| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Assembly Line Robots Market Size 2024 |

USD 19,505.35 Million |

| Assembly Line Robots Market, CAGR |

10.14% |

| Assembly Line Robots Market Size 2032 |

USD 42,086.53 Million |

Market Overview

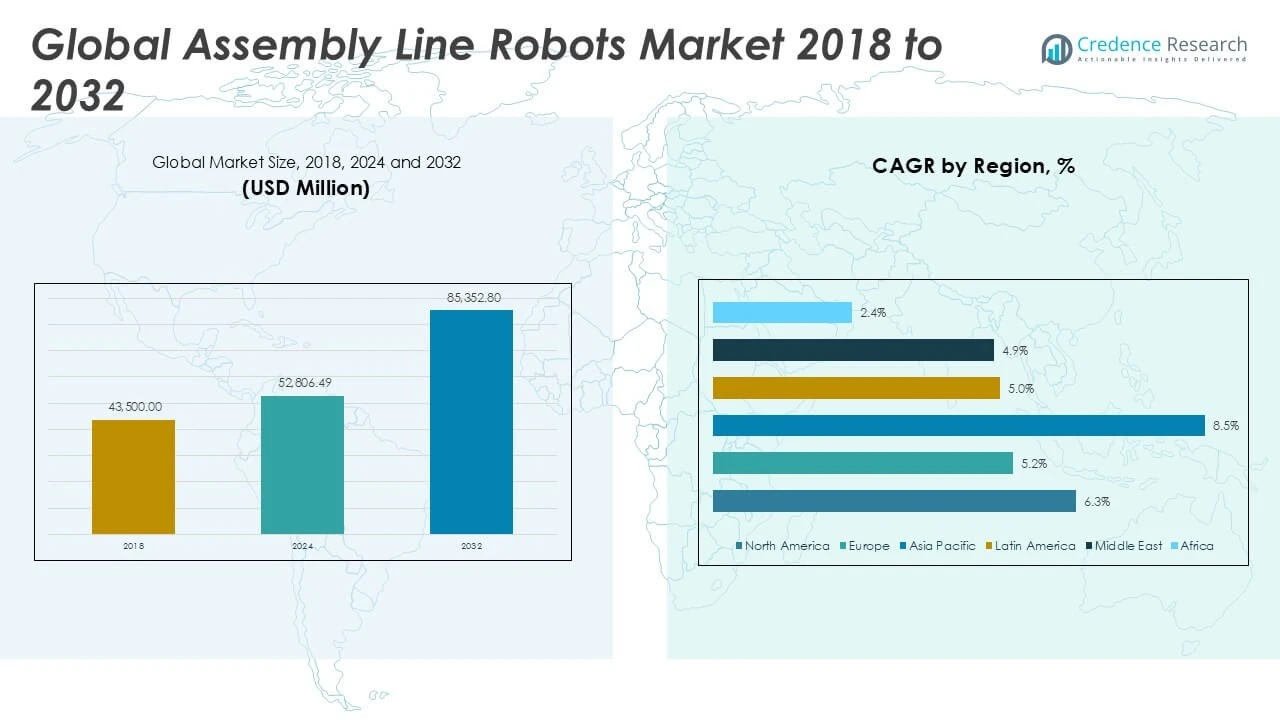

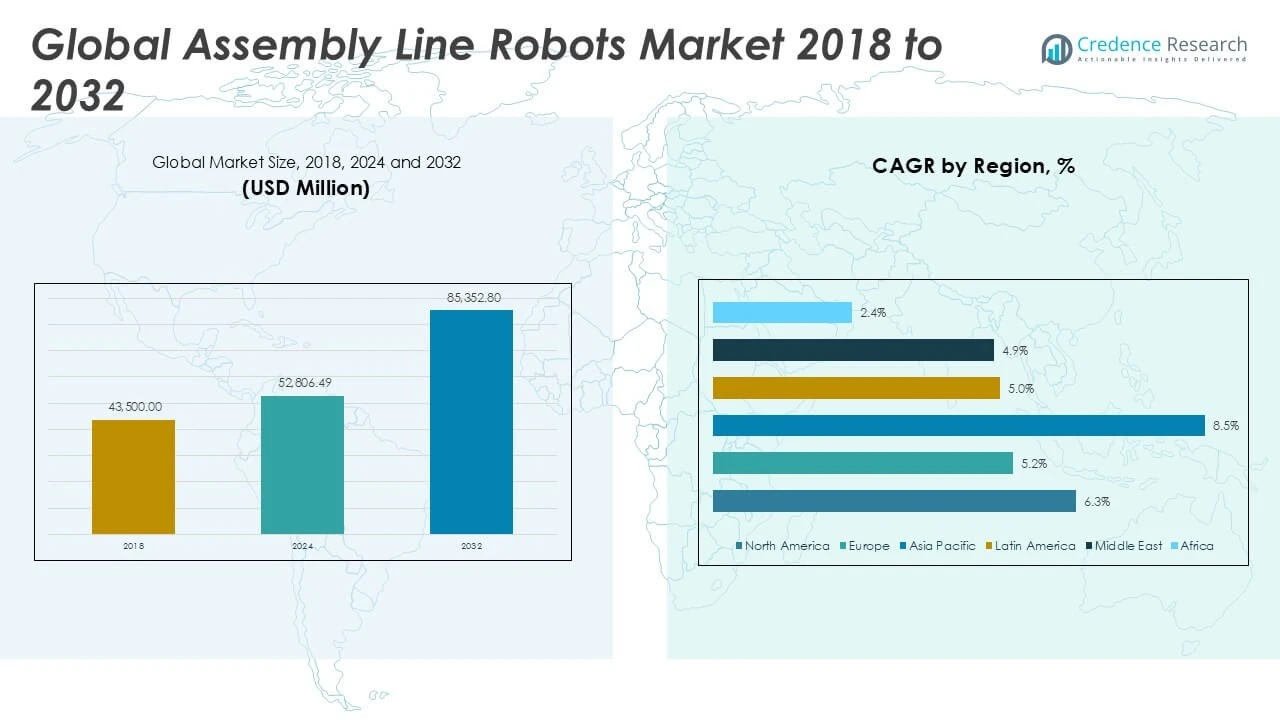

The Global Assembly Line Robots Market is projected to grow from USD 19,505.35 million in 2024 to an estimated USD 42,086.53 million by 2032, with a compound annual growth rate (CAGR) of 10.14% from 2025 to 2032.

Key drivers fueling the market include the increasing need for high-speed production with minimal human intervention and the rising labor costs in manufacturing hubs. Trends such as the deployment of collaborative robots (cobots), advancements in AI and machine learning for adaptive automation, and the integration of vision and motion control systems are significantly shaping the future of assembly line robotics. Moreover, small and medium-sized enterprises (SMEs) are increasingly embracing robotic automation, supported by cost-effective, compact robotic solutions.

Regionally, Asia Pacific dominates the global market due to the robust manufacturing infrastructure in countries such as China, Japan, and South Korea, alongside supportive government policies for industrial automation. North America and Europe are also key contributors, driven by strong automotive and electronics sectors. Prominent market players include ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Mitsubishi Electric Corporation, all of whom are continuously innovating to meet evolving industrial demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Assembly Line Robots Market is projected to grow from USD 19,505.35 million in 2024 to USD 42,086.53 million by 2032, registering a CAGR of 10.14% from 2025 to 2032.

- Automation demand across manufacturing sectors is the primary driver, boosting adoption of advanced robotic systems to increase productivity and accuracy.

- Rising labor costs and the need for high-speed, error-free production are accelerating robotic integration in industries such as automotive, electronics, and consumer goods.

- Market growth is challenged by high initial investment and integration complexities, particularly for small and medium-sized enterprises.

- Cybersecurity concerns and a shortage of skilled technicians for robot maintenance also hinder widespread adoption.

- Asia Pacific dominates the global market with strong contributions from China, Japan, and South Korea, supported by government incentives and manufacturing scale.

- North America and Europe remain key regions, driven by advanced industrial infrastructure and demand for smart factory solutions.

Market Drivers

Rising Demand for Automation in Manufacturing Processes

The Global Assembly Line Robots Market is gaining momentum due to the expanding need for automation in manufacturing. Industries aim to increase efficiency, accuracy, and production volume while reducing labor costs. Automated assembly lines enhance quality control and minimize human error. This shift enables manufacturers to meet growing demand across sectors such as automotive, electronics, and consumer goods. Companies are transitioning from manual labor to robotics to remain competitive in global markets. It supports faster turnaround times and ensures consistency in production cycles.

For instance, over 57,000 automated assembly systems were deployed globally in 2024, reflecting the increasing demand for robotics in manufacturing

Labor Shortages and High Operational Costs Driving Robot Adoption

Labor shortages and rising operational costs are pushing manufacturers to invest in robotic automation. In many regions, skilled labor is becoming scarce, increasing dependency on intelligent machines. The Global Assembly Line Robots Market addresses these workforce challenges by offering efficient, continuous operations. Robotics reduce reliance on manual labor, optimize shift operations, and cut down on long-term expenses. Employers seek solutions that ensure higher uptime and consistent throughput. It allows facilities to manage peak production periods without increasing headcount.

For instance, approximately 40% of warehouse operators reported labor shortages in 2024, driving increased adoption of robotic automation

Integration of AI and Machine Vision Systems Enhancing Capabilities

Artificial intelligence and machine vision are elevating the functionality of assembly line robots. Robots now execute complex tasks with improved accuracy and adaptability. The Global Assembly Line Robots Market is evolving through innovations that allow robots to detect faults, make real-time decisions, and adjust operations autonomously. These capabilities increase production speed and enhance product quality. Manufacturers gain from reduced downtime and better diagnostics. It supports flexible production lines that can adjust to product variation.

Supportive Government Policies and Industry 4.0 Adoption

Governments worldwide are promoting smart manufacturing through subsidies and policy frameworks. Industry 4.0 initiatives are accelerating the digital transformation of production lines. The Global Assembly Line Robots Market benefits from such support, encouraging enterprises to modernize infrastructure. Regulatory bodies provide tax incentives and funding for automation upgrades. These measures help small and medium-sized enterprises deploy robotics efficiently. It promotes widespread adoption of advanced assembly line technologies.

Market Trends

Growing Deployment of Collaborative Robots in Assembly Lines

The Global Assembly Line Robots Market is witnessing increased demand for collaborative robots (cobots) that work safely alongside human operators. These robots support high-precision tasks while ensuring safety in shared workspaces. Their flexibility and ease of programming make them ideal for dynamic manufacturing environments. Industries value their ability to improve productivity without overhauling existing production setups. Cobots reduce the need for fencing or protective barriers, which saves floor space and cost. It enables smaller firms to adopt automation in incremental steps.

For instance, the number of cobots deployed in automotive assembly lines worldwide surpassed 75,000 units in 2024, reflecting their growing adoption in precision tasks.

Increased Use of Vision Systems and Real-Time Sensing Technologies

Advanced vision systems and real-time sensors are transforming robotic performance on assembly lines. Robots now perform quality inspections, object recognition, and alignment with greater accuracy. The Global Assembly Line Robots Market is shifting towards machines that adapt to changing inputs and make autonomous decisions. These technologies reduce errors and material wastage, improving overall production efficiency. Smart sensors help identify bottlenecks and support predictive maintenance. It strengthens the reliability of robotic systems in continuous operations.

For instance, manufacturers in the electronics sector implemented over 12,500 vision-based robotic systems in 2024 to improve quality control and reduce defects.

Rising Trend of Modular and Scalable Robotic Solutions

Manufacturers are moving towards modular robotic systems that scale with production needs. Modular robots allow easy upgrades, part replacements, and integration with existing machinery. The Global Assembly Line Robots Market supports this trend through adaptable configurations that suit varied industries. Companies prefer flexible systems to accommodate changing product lines without major redesigns. Standardized components help reduce lead times and simplify maintenance. It supports cost-effective automation strategies for both large enterprises and SMEs.

Integration of Digital Twins and Industrial IoT in Robot Control

Digital twin technology and industrial IoT are gaining traction in the robotic automation landscape. These tools allow manufacturers to simulate, monitor, and optimize robot performance virtually. The Global Assembly Line Robots Market is embracing these technologies to enhance operational transparency and control. Real-time data insights help adjust production parameters and prevent system failures. This integration streamlines decision-making across the production lifecycle. It creates a connected ecosystem that drives smarter and more agile manufacturing.

Market Challenges

High Initial Investment and Integration Complexity Restrain Adoption

The Global Assembly Line Robots Market faces resistance due to the high upfront cost of robotic systems and infrastructure upgrades. Small and medium enterprises often lack the capital needed to invest in advanced automation. Integration of robots with existing assembly lines requires significant customization, which increases implementation time and costs. Companies must also train personnel to manage and maintain these systems, adding to the financial burden. Complex installation processes can disrupt production workflows during the transition phase. It creates hesitation among manufacturers considering automation for the first time.

For instance, the global assembly automation market was estimated to involve over 57,000 million units of robotic systems in 2024, reflecting the increasing adoption of automation in manufacturing

Cybersecurity and Data Privacy Concerns in Connected Robotics

Increasing use of connected robots and data-driven systems raises concerns around cybersecurity and data integrity. The Global Assembly Line Robots Market must address the risk of cyberattacks that could halt operations or compromise proprietary information. Manufacturing facilities rely on real-time data from IoT sensors and digital platforms, which require secure communication protocols. Lack of robust cybersecurity frameworks can delay adoption, especially in critical sectors. Companies also face compliance issues with data protection regulations. It forces manufacturers to invest in parallel IT security upgrades, raising total project costs.

Market Opportunities

Adoption by Small and Medium Enterprises Unlocks New Growth Potential

The Global Assembly Line Robots Market is set to gain from increasing adoption among small and medium enterprises (SMEs). With the rise of compact, cost-effective, and easy-to-program robotic systems, SMEs can now automate processes previously reliant on manual labor. This shift enables these businesses to enhance productivity, reduce operational errors, and stay competitive in cost-sensitive environments. Lower barriers to entry and simplified integration solutions are making robotics accessible beyond large manufacturers. Governments and industry bodies are also supporting SME automation through grants and digital transformation programs. It creates a promising environment for market expansion across diverse sectors.

Expanding Applications in Emerging and Non-Traditional Industries

The market holds significant opportunities in sectors such as food and beverage, textiles, and logistics, where robotic deployment remains relatively low. Demand for automation in packaging, handling, and quality inspection is rising in these industries. The Global Assembly Line Robots Market can capitalize on this shift by offering tailored solutions that meet specific operational needs. Innovations in end-effectors, mobility, and safety features support adaptation in dynamic, labor-intensive environments. Companies entering these untapped segments stand to benefit from first-mover advantages. It positions the market for broader adoption and long-term growth across emerging verticals.

Market Segmentation Analysis

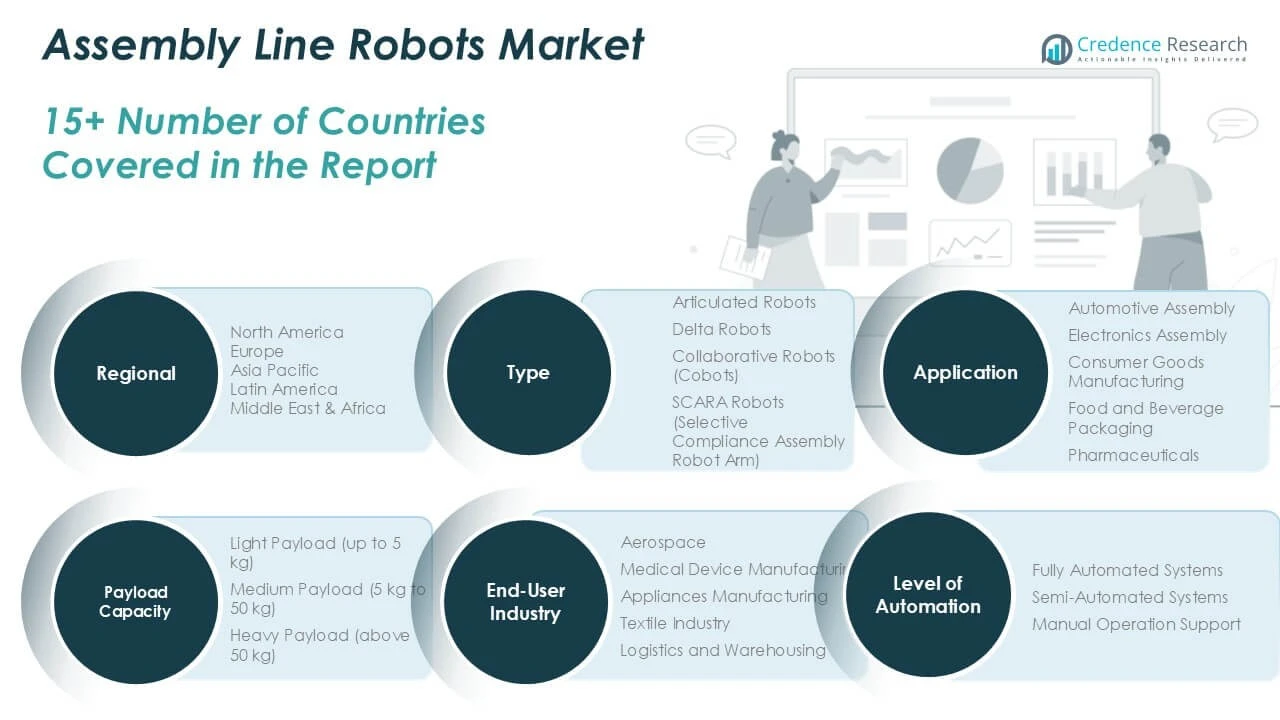

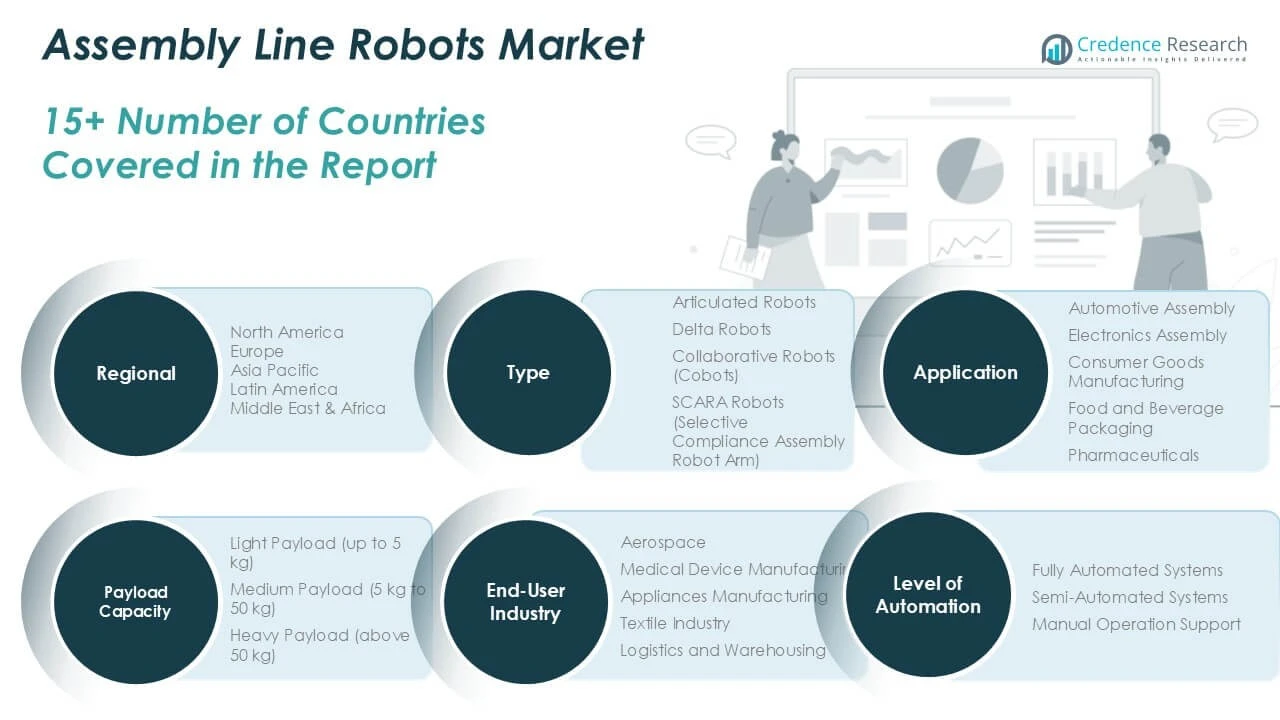

By Type

The Global Assembly Line Robots Market includes articulated robots, delta robots, collaborative robots (cobots), and SCARA robots. Articulated robots dominate the market due to their flexibility and ability to perform complex tasks across multiple axes. Delta robots are preferred for high-speed pick-and-place applications, especially in electronics and food industries. Cobots are gaining traction for their safe operation in shared human-robot environments, making them suitable for small and mid-sized enterprises. SCARA robots offer precision and speed for selective compliance tasks, especially in confined spaces. It supports varied industrial needs with type-specific advantages in productivity and efficiency.

By Application

The market spans key applications such as automotive assembly, electronics assembly, consumer goods manufacturing, food and beverage packaging, and pharmaceuticals. Automotive assembly leads due to high-volume repetitive tasks requiring precision and strength. Electronics assembly benefits from robots’ ability to handle delicate components efficiently. Consumer goods and food sectors deploy robots for packaging and repetitive handling. In pharmaceuticals, robots maintain hygiene and reduce contamination risks. The Global Assembly Line Robots Market serves these applications with tailored automation solutions that enhance throughput and product quality.

By Payload Capacity

Assembly line robots are segmented into light (up to 5 kg), medium (5–50 kg), and heavy (above 50 kg) payload categories. Light payload robots are ideal for delicate assembly tasks in electronics and medical devices. Medium payload robots support versatile operations in automotive and consumer goods manufacturing. Heavy payload robots are essential for large part handling and high-force applications. It meets diverse operational requirements across industries by matching robotic strength to task complexity.

By Level of Automation

The market features fully automated systems, semi-automated systems, and manual operation support. Fully automated systems dominate due to their ability to operate with minimal human intervention, improving production speed and consistency. Semi-automated systems offer a balance between automation and human input, often used in variable production environments. Manual operation support enhances human efficiency without full automation. The Global Assembly Line Robots Market aligns automation levels to operational scale and complexity.

By End-user Industry

End-user industries include aerospace, medical device manufacturing, appliances manufacturing, textile, and logistics and warehousing. Aerospace and medical sectors demand high precision and compliance with safety standards, favoring advanced robotic systems. Appliance and textile industries leverage robots for repetitive and labor-intensive tasks. Logistics and warehousing use robots for order fulfillment, packaging, and material handling. It addresses industry-specific demands by improving efficiency, safety, and scalability.

Segments

Based on Type

- Articulated Robots

- Delta Robots

- Collaborative Robots (Cobots)

- SCARA Robots (Selective Compliance Assembly Robot Arm)

Based on Application

- Automotive Assembly

- Electronics Assembly

- Consumer Goods Manufacturing

- Food and Beverage Packaging

- Pharmaceuticals

Based on Payload Capacity

- Light Payload (up to 5 kg)

- Medium Payload (5 kg to 50 kg)

- Heavy Payload (above 50 kg)

Based on Level of Automation

- Fully Automated Systems

- Semi-Automated Systems

- Manual Operation Support

Based on End-user Industry

- Aerospace

- Medical Device Manufacturing

- Appliances Manufacturing

- Textile Industry

- Logistics and Warehousing

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Assembly Line Robots Market

North America holds the largest share in the Global Assembly Line Robots Market, accounting for 36.2% of the total market in 2024. It is projected to grow from USD 7,063.36 million in 2024 to USD 15,292.28 million by 2032, registering a CAGR of 10.2%. The region’s dominance stems from the early adoption of industrial automation in sectors like automotive and aerospace. The U.S. leads the regional market, supported by strong investments in robotics R\&D and integration of AI in manufacturing. Canada also contributes significantly with its expanding electronics and medical device manufacturing industries. It continues to support growth through skilled labor availability and advanced infrastructure.

Europe Assembly Line Robots Market

Europe represents 27.4% of the global market in 2024, with a valuation of USD 5,340.03 million, expected to reach USD 10,848.76 million by 2032 at a CAGR of 9.3%. Germany, France, and Italy drive the regional demand with strong industrial bases and high automation levels. The automotive sector, especially in Germany, remains the key user of robotic assembly lines. Policies promoting Industry 4.0 and workforce safety influence investments in robotics. The Assembly Line Robots Market in Europe benefits from government incentives and industrial digitization programs. It maintains a strong focus on technological advancement and sustainability.

Asia Pacific Assembly Line Robots Market

Asia Pacific holds a 24.3% share of the global market in 2024, growing from USD 4,734.72 million to USD 11,641.49 million by 2032, with the highest CAGR of 12.1%. China, Japan, and South Korea dominate regional demand due to large-scale manufacturing and rapid industrial automation. China leads in robot installation volume, supported by national policies favoring smart manufacturing. Japan and South Korea invest heavily in robotics innovation, particularly in electronics and automotive sectors. The region’s competitive labor dynamics and export-oriented economies fuel automation. It is positioned as a major hub for both production and consumption of robotic systems.

Latin America Assembly Line Robots Market

Latin America contributes 4.2% to the global market in 2024 and is projected to grow from USD 817.08 million to USD 1,537.42 million by 2032, at a CAGR of 8.3%. Brazil and Mexico lead the region with investments in automotive manufacturing and electronics assembly. Rising labor costs and the need for production efficiency are key drivers for automation. Government support and foreign direct investment in industrial infrastructure are encouraging adoption. The Assembly Line Robots Market in Latin America is gradually expanding, supported by regional demand for productivity and quality control. It sees steady growth despite economic volatility in select markets.

Middle East Assembly Line Robots Market

The Middle East accounts for 4.1% of the global market in 2024 and is set to increase from USD 795.69 million to USD 1,548.51 million by 2032, at a CAGR of 8.7%. The UAE and Saudi Arabia are leading adopters, leveraging robotics in logistics, manufacturing, and infrastructure projects. Industrial diversification under national development plans fuels automation initiatives. Robotics in the region also supports the rise of smart factories and clean energy manufacturing. The Assembly Line Robots Market benefits from policy-driven transformation and investments in high-tech industrial parks. It continues to evolve in response to regional modernization strategies.

Africa Assembly Line Robots Market

Africa holds the smallest share at 3.9% of the global market in 2024, expected to grow from USD 754.47 million to USD 1,218.07 million by 2032, registering a CAGR of 5.3%. South Africa leads regional adoption, with growing interest in manufacturing automation across textiles and consumer goods. Limited infrastructure and high import dependency constrain faster growth. However, international partnerships and technology transfer initiatives are promoting robotics uptake. The Assembly Line Robots Market in Africa shows potential through expanding industrial zones and vocational training programs. It gradually builds capacity for automation in response to evolving manufacturing needs.

Key players

- FANUC Corporation

- Kawasaki Heavy Industries

- Yaskawa

- Acieta LLC

- Dobot

- Universal Robots

- KRANENDONK

- OnRobot

- ABB

- KUKA

Competitive Analysis

The Global Assembly Line Robots Market features strong competition among established automation leaders and emerging robotic solution providers. FANUC Corporation, ABB, and KUKA dominate with expansive product portfolios, global reach, and continuous R\&D investment. Kawasaki Heavy Industries and Yaskawa maintain a solid presence through high-performance industrial robots and long-term customer relationships. Universal Robots and OnRobot are gaining ground in the collaborative robot segment, targeting small and medium enterprises. Companies like Dobot and KRANENDONK focus on niche applications and integration capabilities, offering tailored automation solutions. The market rewards innovation, energy efficiency, and seamless system integration. It drives players to differentiate through software enhancement, AI-enabled platforms, and modular designs.

Recent Developments

- In April 2025, Acieta announced its participation in Automate 2025, scheduled for May 12–15 at Huntington Place in Detroit, MI. At Booth #1300, Acieta plans to showcase its latest robotic automation solutions, including real-time quality assurance technologies like in-line 3D non-contact analysis, aiming to enhance manufacturing efficiency and product quality. The company will also host conference sessions, such as “Precision Redefined: Elevating Manufacturing Standards with In-Line 3D Non-Contact Analysis,” presented by Scott Robbins and Jeff Frey, focusing on modern metrology’s role in quality assurance.

- In April 2025, Universal Robots and MiR announced their joint participation at Automate 2025, held from May 12–15 in Detroit, MI. Occupying the largest exhibition area at booths #4023 and #3623, they showcased integrated automation solutions across automotive, electronics manufacturing, and logistics sectors.

- In April 2025, ABB announced plans to spin off its entire Robotics division, aiming to establish it as an independent, publicly traded company by the second quarter of 2026. The proposal will be presented to shareholders at ABB’s Annual General Meeting in early 2026. If approved, ABB shareholders will receive shares in the new entity, tentatively named “ABB Robotics,” through a dividend in-kind proportional to their existing holdings.

Market Concentration and Characteristics

The Global Assembly Line Robots Market is moderately concentrated, with a few dominant players controlling a significant share of the market. Key manufacturers such as FANUC, ABB, and KUKA lead through their global presence, advanced product lines, and consistent innovation. The market features high entry barriers due to capital-intensive R&D and complex integration requirements. It is characterized by rapid technological advancement, demand for application-specific customization, and growing preference for collaborative and modular systems. Buyers emphasize reliability, precision, and adaptability, driving suppliers to prioritize quality and service. It continues to evolve with trends in AI integration, digital twin technology, and smart factory deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Payload Capacity, Level of Automation, End-user Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global Assembly Line Robots Market will expand significantly in emerging economies, driven by industrialization and rising labor costs. Countries in Asia Pacific, Latin America, and Africa are expected to adopt robotic solutions at a faster pace.

- Collaborative robots will gain more traction due to their safety, ease of integration, and ability to work alongside humans. Their deployment will increase across small and mid-sized enterprises seeking affordable automation.

- AI integration will enhance the decision-making capabilities of assembly line robots. Future systems will be more adaptive, enabling real-time adjustments to production variables and improving process efficiency.

- Manufacturers will prioritize modular robotic systems to achieve flexibility and scalability. These systems will allow for easier upgrades and reconfiguration to meet changing production needs.

- The market will see rising adoption of predictive maintenance features enabled by IoT and sensor technologies. These tools will minimize unplanned downtime and extend the operational life of robotic systems.

- Assembly line robots will support high-mix, low-volume manufacturing models with quick reprogramming and adaptable tooling. This shift will cater to consumer demand for personalized and diversified products.

- Robotic manufacturers will design systems that consume less power and support sustainable production practices. The market will align with global environmental goals and regulatory frameworks.

- Future robots will feature advanced HRI technologies for intuitive operation and seamless human collaboration. Touchscreen controls, gesture recognition, and voice commands will become more common.

- The use of assembly line robots will extend into sectors such as agriculture, food processing, and textiles. These industries will adopt robotics to improve productivity and meet compliance requirements.

- Firms will boost R\&D spending to develop application-specific robots tailored to unique industrial needs. The market will reward companies that offer high customization and post-deployment support.