Market Overview:

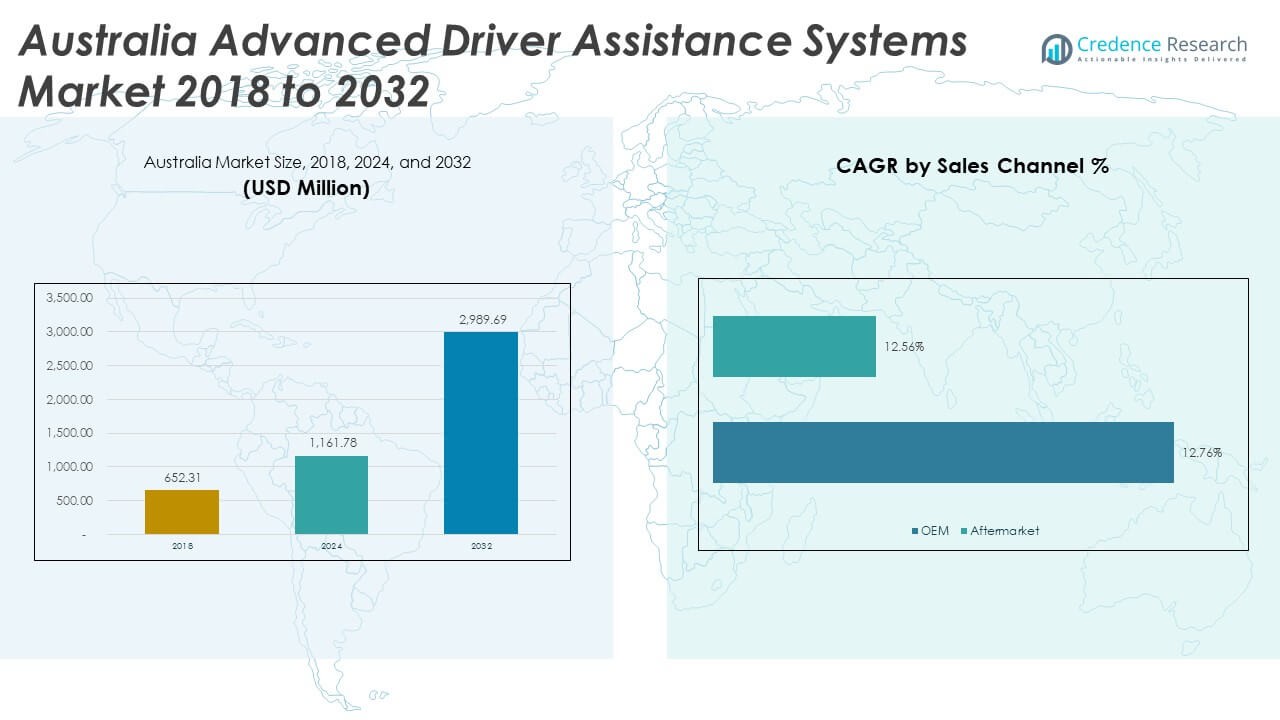

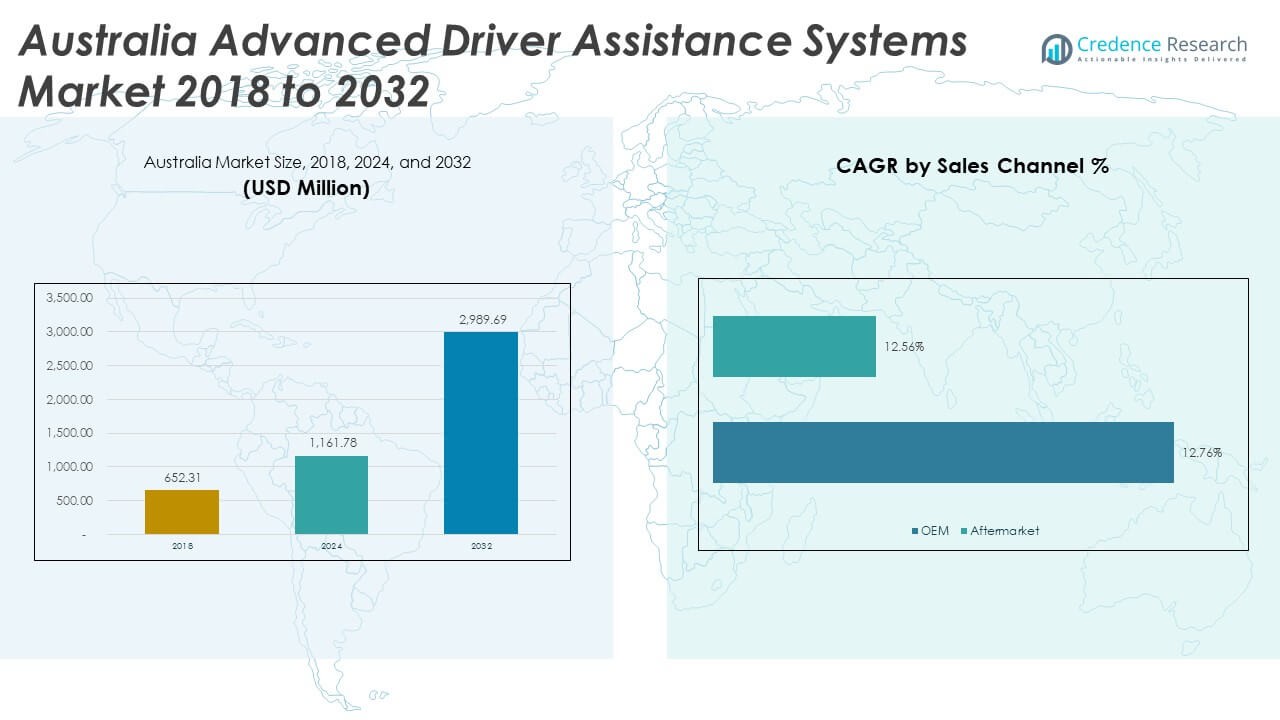

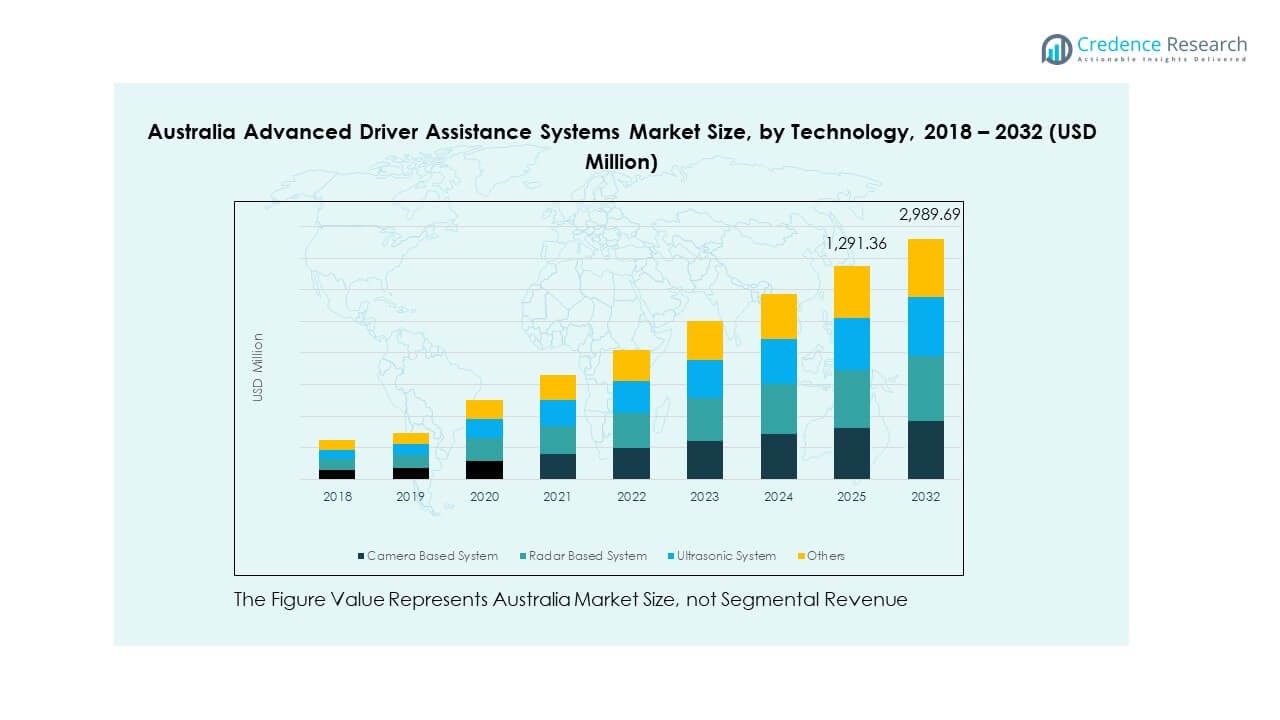

The Australia Advanced Driver Assistance Systems Market size was valued at USD 652.31 million in 2018 to USD 1,161.78 million in 2024 and is anticipated to reach USD 2,989.69 million by 2032, at a CAGR of 12.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Advanced Driver Assistance Systems Market Size 2024 |

USD 1,161.78 Million |

| Australia Advanced Driver Assistance Systems Market, CAGR |

12.54% |

| Australia Advanced Driver Assistance Systems Market Size 2032 |

USD 2,989.69 Million |

Market growth is primarily driven by higher demand for advanced safety and convenience features in modern vehicles. Increasing awareness of road safety, stringent vehicle safety standards, and rising adoption of connected vehicles are fueling industry expansion. OEMs are integrating adaptive cruise control, lane-keeping assist, and blind-spot detection systems to improve driving precision and accident prevention. Expanding electric and hybrid vehicle fleets further support the use of sensor-based automation, improving overall vehicle performance and safety reliability.

New South Wales and Victoria lead adoption due to advanced transport infrastructure and strong vehicle ownership rates. These states benefit from active government support and widespread urban mobility systems. Queensland and Western Australia are emerging growth centers driven by expanding logistics and mining fleets requiring ADAS integration for operational safety. Regional initiatives promoting intelligent transport networks and vehicle connectivity strengthen adoption across passenger and commercial segments, creating a nationwide shift toward safer, technology-driven road systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Advanced Driver Assistance Systems Market was valued at USD 652.31 million in 2018, increased to USD 1,161.78 million in 2024, and is projected to reach USD 2,989.69 million by 2032, registering a CAGR of 12.54%.

- New South Wales leads with 36% share, followed by Victoria with 29% and Queensland with 18%, driven by high vehicle ownership, advanced transport infrastructure, and strong regulatory frameworks promoting vehicle safety adoption.

- Western Australia, holding a 10% share, is the fastest-growing region supported by mining fleet modernization and safety investments in long-distance transport operations.

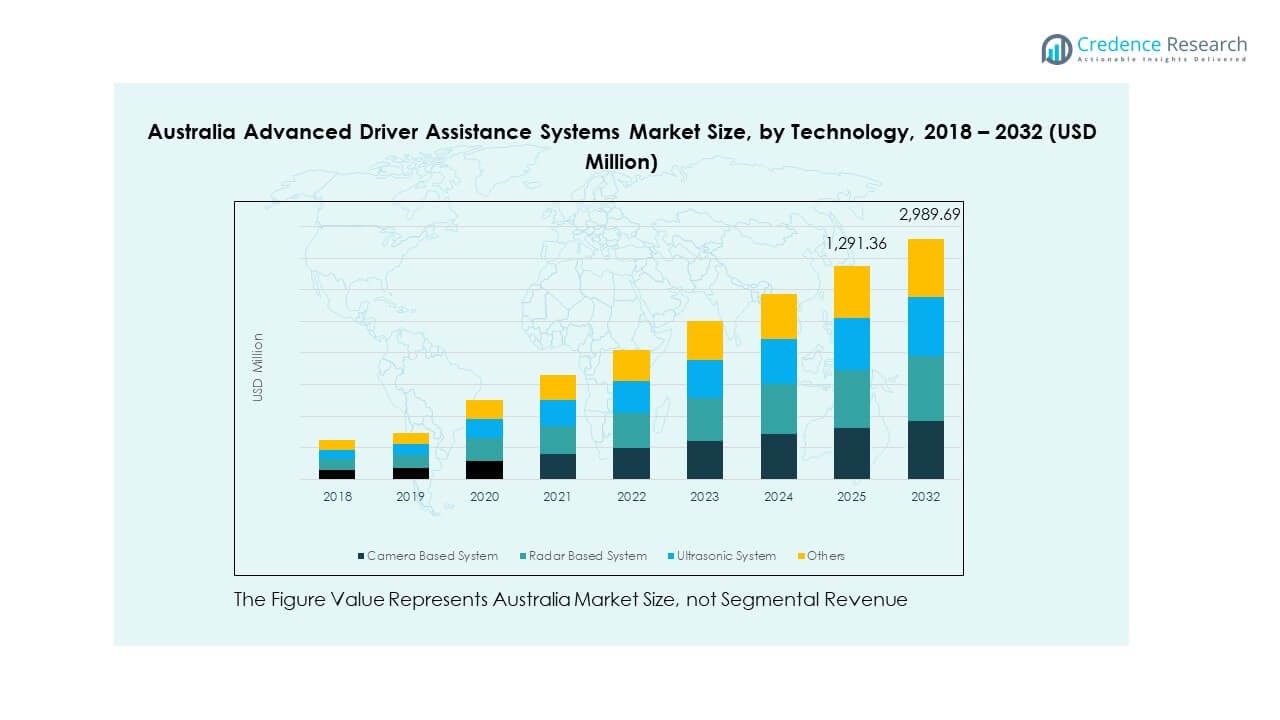

- Camera-based systems account for 38% of the market, dominating due to their role in adaptive cruise control, lane departure warning, and driver monitoring features.

- Radar-based systems follow with 32% share, supported by their precision in collision avoidance, speed monitoring, and integration across commercial and premium vehicle categories.

Market Drivers

Growing Focus On Road Safety And Accident Reduction

Growing focus on road safety drives strong adoption of advanced driver systems. Australia invests in road safety programs and encourages use of collision prevention and lane support features. Rising crash rates in urban corridors push demand for braking, warning, and monitoring systems. Fleet operators in logistics and mining sectors deploy safety tech for driver protection. Rising awareness among private owners increases preference for vehicles with safety suites. Insurance benefits also support integration in new models. The Australia Advanced Driver Assistance Systems Market benefits from mandatory safety norms. It gains momentum from public demand for safer road mobility and efficient hazard response technology.

- For instance, the Australian Government mandated autonomous emergency braking (AEB) systems for all new light vehicles under the Australian Design Rule (ADR) 98/00, requiring compliance for newly introduced models from March 2023 and all vehicles sold from March 2025. This regulatory move covers 222 vehicle models available with AEB and reflects a documented focus on accident reduction through mandated technology adoption.

Rising Adoption Of Connected And Semi-Autonomous Mobility Features

Wider use of navigation and telematics encourages adoption of ADAS capabilities. Carmakers integrate sensors, cameras, radar, and software for automated support functions. IoT connectivity improves data exchange for lane assistance and blind-spot systems. It also enhances driver alerts and emergency intervention modules. Growing penetration of connected cars supports real-time hazard detection. Telecom upgrades strengthen vehicle-to-infrastructure communication. Consumer confidence grows with higher reliability in automated safety response. The Australia Advanced Driver Assistance Systems Market benefits from smart mobility frameworks and real-time data ecosystems.

Increasing Deployment Of Safety Systems Across Commercial Fleets

Commercial fleets prioritize safety systems to meet compliance and improve operational efficiency. Mining, logistics, and construction players use fatigue monitoring and collision warning solutions. It improves driver behavior and reduces downtime linked to incidents. Fleet operators adopt monitoring dashboards for predictive safety alerts. ADAS improves route efficiency and minimizes risk during long-haul transport. Insurance incentives drive installation in fleet vehicles. Higher duty cycles in commercial operations make automated safety support essential. The Australia Advanced Driver Assistance Systems Market sees accelerated uptake in industrial and transport fleets.

Government Safety Standards And Regulatory Visibility

Regulatory bodies promote mandated safety functions in vehicles sold across the country. Programs enforce crash-avoidance technology in premium and mid-range vehicles. Industry guidelines encourage OEMs to introduce advanced braking, lane detection, and pedestrian alerts. Public initiatives create awareness about road risk reduction tools. Import regulations also push foreign vehicle brands to comply with safety benchmarks. Government testing metrics evaluate performance of automation functions. Regulatory focus builds trust among consumers and industry participants. Stakeholders in the Australia Advanced Driver Assistance Systems Market gain clarity and support for structured deployments.

- For instance, the Australian New Car Assessment Program (ANCAP) reported in 2024 that 89.5% of new vehicles sold covering 222 distinct models were equipped with Autonomous Emergency Braking (AEB) technology. ANCAP’s findings, published through official safety assessments and government-linked reports, confirm the widespread integration of mandated driver assistance systems across Australia’s vehicle market.

Market Trends

Rising Integration Of AI-Enhanced Driver Recognition And Cognitive Systems

AI algorithms support driver recognition and fatigue detection to improve vehicle safety. Intelligent camera modules track eye movement, posture, and distraction signals. It enables proactive warnings and emergency braking triggers. Growing trial of gesture-based cabin commands enhances interaction quality. Automakers refine cognitive safety systems through continuous data learning. Platform upgrades reduce false alerts and boost system accuracy. Customers value tailored safety support and behavior-adaptive alerts. The Australia Advanced Driver Assistance Systems Market adopts AI-based human-machine cooperation technologies.

Expansion Of EV And Hybrid Vehicle ADAS Packages

EV and hybrid models include advanced assistance bundles at standard or premium levels. Electric platforms integrate lightweight sensor modules for efficient energy use. It supports automated parking, adaptive lighting, and collision protection systems. EV adoption increases in urban cities, boosting smart safety features. OEMs emphasize digital user experience and remote monitoring tools. Charging infrastructure growth attracts tech-aware consumers. Modern EV designs prioritize full-suite monitoring visibility. The Australia Advanced Driver Assistance Systems Market aligns with sustainable mobility and high-tech platform upgrades.

Development Of High-Resolution Imaging, Radar, and Sensor Fusion

New camera chips deliver clearer object detection in low light and dense traffic. Radar systems achieve better range and accuracy for adaptive cruise control. It also improves performance in rain, fog, and rough terrain. Sensor fusion platforms combine data from vision, radar, and ultrasonic units. Next-generation processors enable real-time threat analysis with low latency. OEMs use compact sensors to maintain clean vehicle styling. High-end and mid-segment vehicles receive premium detection modules. The Australia Advanced Driver Assistance Systems Market strengthens through advanced perception technology.

- For instance, Continental’s ARS540 radar, featured in vehicles such as the Mercedes-Benz S-Class, enables 4D object detection with range, Doppler, azimuth, and elevation measurement. The unit offers a 300-meter detection range, ±0.1° angular accuracy, and a 60 ms update rate. According to Continental’s official technical documentation, the ARS540 radar provides true height perception and supports Level 3 automated driving functions.

Shift Toward Digital Cockpit, Infotainment, and Safety Convergence

Consumers demand integrated cluster displays with ADAS alerts and smart navigation. Vehicles combine infotainment output with lane and collision alerts for improved visibility. It improves reaction time and reduces distraction errors. Voice-assist safety functions and steering-wheel controls enhance user control. AR head-up displays gain adoption in premium models and tech-focused trims. Software-based enhancements reduce reliance on hardware changes. Digital ecosystems support lifetime updates for new functions. The Australia Advanced Driver Assistance Systems Market reflects convergence of safety and connected cockpit design.

- For instance, the Hyundai IONIQ 6 features a 12.3-inch fully digital instrument cluster and infotainment display, along with an augmented reality head-up display that projects key driving, ADAS, and navigation information onto the windshield. Hyundai confirms that its Remote Smart Parking Assist 2 and AR head-up display enhance driver awareness and maneuvering safety by delivering real-time alerts and visual guidance directly within the driver’s line of sight.

Market Challenges Analysis

High System Cost And Complex Installation Requirements

Advanced driver systems include expensive sensors, processors, and calibration tools. Price sensitivity in low-budget vehicle segments limits adoption scale. It becomes difficult for smaller buyers to justify premium costs in entry models. Technical complexity requires skilled workforce for installation and maintenance. Expensive replacement parts increase long-term ownership burden. Strict calibration rules affect aftermarket adoption. OEM adoption rate grows faster than aftermarket penetration. The Australia Advanced Driver Assistance Systems Market faces economic hurdles tied to advanced technology cost.

Limited Infrastructure And Driving Environment Variability

Rural areas and remote routes lack consistent digital infrastructure to support ADAS performance. Road quality variations affect camera and radar accuracy. It leads to challenges in lane detection and road sign recognition. Weather conditions influence performance consistency in some terrains. Lack of standard road markings creates interpretation gaps. Connectivity support differs across regions, reducing feature reliability. Cross-country transport fleets face technology usage limitations. The Australia Advanced Driver Assistance Systems Market navigates infrastructure and regional deployment gaps.

Market Opportunities

Rising Upskilling, Aftermarket Expansion, And Local Manufacturing Push

Local skill development programs enhance ADAS service capability. Training hubs prepare engineers and technicians for calibration and diagnosis work. It encourages aftermarket installations for fleet upgrades and safety retrofits. Government and automotive groups promote localization of supply chains. Supply base growth reduces import dependency over time. EV and hybrid markets attract new ADAS investment. The Australia Advanced Driver Assistance Systems Market benefits from ecosystem strengthening and aftermarket growth.

Emerging Scope In Two-Wheeler And Light Commercial Vehicle Segments

Safety expectations rise for two-wheeler and light utility vehicles. Riders seek accident prevention systems and blind-spot visibility modules. Light commercial fleets adopt driver alerts to protect cargo and personnel. Insurance and fleet policies support expanded technology use. OEMs design compact, affordable safety add-ons. Semi-urban delivery networks demand smart assist functions. It drives new adoption routes for automated safety technologies. The Australia Advanced Driver Assistance Systems Market gains traction in niche mobility formats.

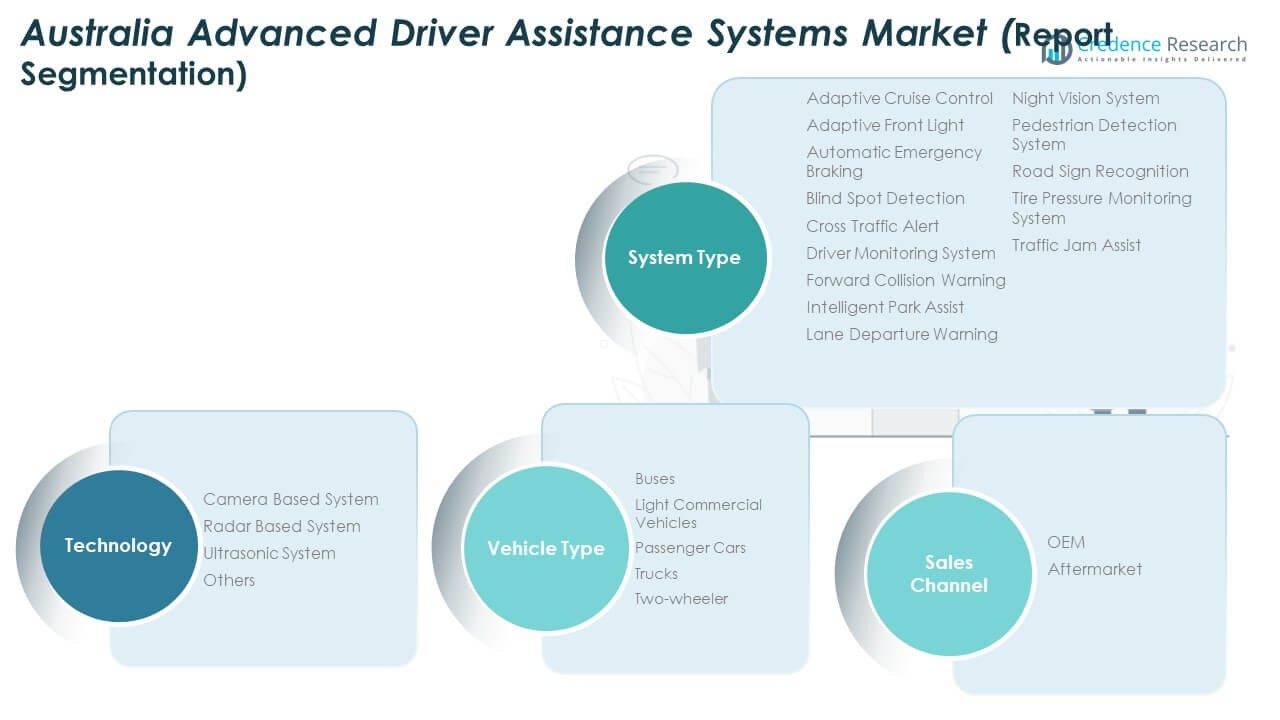

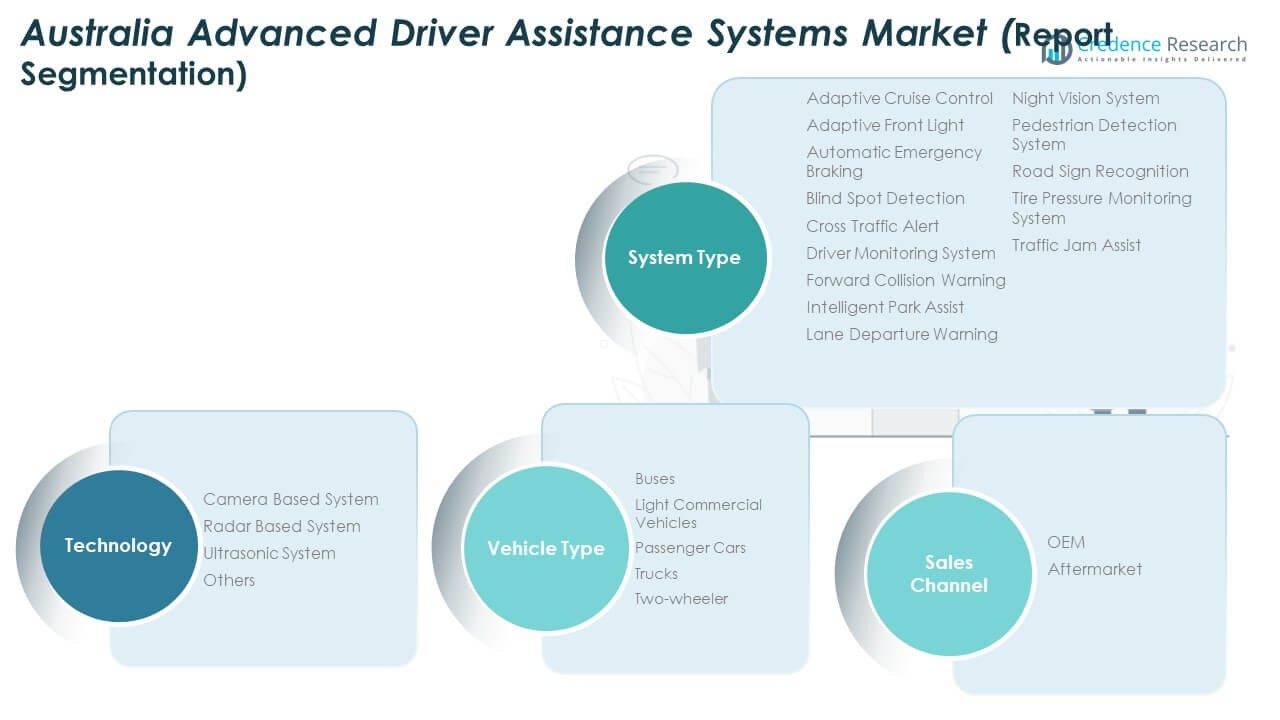

Market Segmentation Analysis

By System Type

Adaptive cruise control, emergency braking, and lane departure systems record high demand in premium and mainstream passenger models. Fleet operators deploy driver monitoring, blind-spot detection, and cross-traffic alerts to improve compliance and reduce incident frequency. Intelligent park assist and pedestrian detection gain acceptance in cities with dense traffic movement. Tire pressure monitoring strengthens reliability and maintenance. Night vision and road sign recognition remain niche but grow in luxury and utility fleets. Traffic jam assist features expand as comfort functions. Forward collision warning systems remain standard in many vehicle categories. The Australia Advanced Driver Assistance Systems Market advances with wider system diversity across safety, comfort, and monitoring features.

- For instance, Mobileye Shield+ systems have been installed on more than 1,000 CDC Victoria and CDC NSW buses under ComfortDelGro Corporation’s safety initiative to reduce at-fault incidents and pedestrian collisions in urban areas. The system uses multi-vision sensors and real-time alerts to assist drivers in detecting vulnerable road users, supporting safer fleet operations across Australian city routes.

By Technology

Camera-based systems hold strong share due to visual clarity and object recognition strength. Radar modules gain traction for cruise control and long-range hazard sensing. Ultrasonic systems support parking and near-object alerts in busy zones. OEMs integrate mixed-sensor fusion for high accuracy and balanced performance. Software calibration improvements enhance reliability across varied Australian terrains. Technology refinement improves night detection and low-light reliability. Consumers value seamless integration with infotainment displays. The Australia Advanced Driver Assistance Systems Market evolves toward hybrid perception stacks.

By Vehicle Type

Passenger vehicles lead adoption with growing safety expectations from buyers. Light commercial vehicles integrate monitoring systems for route safety and fleet compliance. Trucks and buses require fatigue monitoring and collision alerts due to long-distance operations. Two-wheelers begin adoption in urban delivery fleets seeking better rider protection. OEM strategies expand offerings across budget and premium brackets. Public transport and haulage upgrades support safe mobility goals. Industrial fleets in mining regions implement strong safety protocols. The Australia Advanced Driver Assistance Systems Market strengthens across commercial and private vehicle domains.

- For instance, more than 1,000 CDC Victoria and CDC NSW buses operated by ComfortDelGro Corporation Australia were equipped with Mobileye Shield+ ADAS in 2020 to reduce pedestrian and cyclist collisions. This initiative, verified through fleet operator statements and FleetSafe installation records, highlights Australia’s proactive adoption of vision-based driver-assistance systems within public transport networks.

By Sales Channel

OEM channel dominates with factory-installed safety technology in new vehicles. Aftermarket channels grow with demand for fleet upgrades and safety retrofits. Service networks expand to support calibration, diagnostics, and software updates. Certified installers gain relevance with regulatory compliance needs. Fleet operators value bundled safety packages with maintenance programs. Consumer adoption grows for driver monitoring add-ons. Software-based upgrades encourage post-purchase feature enhancement. The Australia Advanced Driver Assistance Systems Market gains volume from OEM leadership and aftermarket expansion.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis

New South Wales and Victoria – Leading Hubs for ADAS Adoption

New South Wales holds the largest share of 36% in the Australia Advanced Driver Assistance Systems Market, followed by Victoria with 29%. These states lead due to strong vehicle ownership rates, advanced infrastructure, and supportive government policies promoting intelligent transport systems. Sydney and Melbourne act as major automotive innovation centers where OEMs collaborate with technology firms for testing and deployment of ADAS technologies. High consumer awareness and demand for luxury and connected vehicles further increase penetration. It benefits from proactive safety regulations and dense urban driving conditions that necessitate automation. Both regions also host a concentration of dealerships offering vehicles with embedded safety systems. These attributes make them consistent revenue contributors in the national ADAS market landscape.

Queensland and Western Australia – Expanding Fleet and Infrastructure Integration

Queensland represents 18% of the national share, driven by rising adoption in logistics and commercial fleets. The state’s expanding highway network and freight industry accelerate demand for driver monitoring and adaptive cruise control technologies. Brisbane’s growing urban density encourages private car owners to choose advanced safety features. Western Australia accounts for 10% share and exhibits rapid growth across mining and transport fleets using fatigue management and collision avoidance tools. Remote operations in the mining belt demand advanced sensing and predictive systems to enhance worker safety. OEM partnerships and local upskilling initiatives support system calibration and maintenance. It demonstrates steady traction through infrastructure expansion and technology acceptance across industrial sectors.

South Australia, Tasmania, and Northern Territory – Emerging Potential Zones

South Australia holds a 5% market share supported by Adelaide’s testing ecosystem for connected and autonomous vehicles. Tasmania contributes 2% due to gradual EV adoption and small-scale fleet modernization. Northern Territory maintains a 1% share, primarily driven by public sector vehicles and logistics fleets in regional areas. These territories focus on improving road safety through targeted investments in camera-based and radar-assisted systems. Industry players explore pilot projects under government road modernization programs. It benefits from national funding aimed at rural connectivity and safety enhancement. Gradual deployment of ADAS-equipped vehicles strengthens adoption across these emerging zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADAS Solutions

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- JLR Corporate

- ZF Friedrichshafen AG

- Kopernikus Automotive

- Valeo SA

- Mobileye

- Allegro MicroSystems

- Safety Tech

- Other Key Players

Competitive Analysis

The Australia Advanced Driver Assistance Systems Market features a competitive environment led by global and regional technology providers. Major players include Robert Bosch GmbH, Continental AG, DENSO Corporation, Valeo SA, and ZF Friedrichshafen AG, each focusing on enhancing sensor accuracy, radar fusion, and AI-based driver monitoring systems. Companies such as Mobileye and Allegro MicroSystems strengthen their presence through vision-based analytics and chip-level innovations. Local entities like ADAS Solutions and Kopernikus Automotive contribute to system integration and testing services. It demonstrates a balanced structure where multinational OEM suppliers dominate core technology, while domestic firms handle adaptation for Australian terrain and compliance. Strategic developments center around collaborations, mergers, and new product introductions focused on semi-autonomous driving support. Continuous investment in R&D and real-world testing sustains leadership and supports faster ADAS penetration across passenger and commercial fleets nationwide.

Recent Developments

- In August 2025, Austroads introduced a new Advanced Driver Assistance Systems (ADAS) Guidance Service designed to help drivers, assessors, licensing regulators, and the broader Australian community adopt vehicle technology safely. This new initiative aims to enhance road user knowledge and ensure the safe use of increasingly prevalent ADAS features in passenger vehicles across Australia.

- In August 2025, GPC Asia Pacific (Repco & NAPA) acquired a majority ownership stake in ADAS Solutions Australia, solidifying its position as the country’s first at-scale, national aftermarket supplier for ADAS calibration services. This partnership began in 2023 and evolved into an acquisition to cater to the rapidly growing demand for ADAS calibration in the collision repair and automotive service sectors across Australia.

- In January 2025, Car ADAS Solutions announced a partnership with Hunter Engineering Company, integrating Hunter’s Ultimate ADAS products and training resources into its offerings. The collaboration aims to promote safe, efficient ADAS calibration and bring OEM-approved equipment to the calibration industry.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Advanced Driver Assistance Systems Market will witness steady integration of AI-based sensing technologies across all vehicle categories.

- OEMs will prioritize full-suite safety solutions covering adaptive lighting, collision warning, and fatigue detection.

- Demand for connected safety platforms will rise with expansion of 5G and vehicle-to-infrastructure communication networks.

- Regulatory mandates will strengthen adoption of standard safety features in new passenger and commercial vehicles.

- Aftermarket installations will gain traction through service networks catering to logistics and fleet modernization.

- Expansion of electric and hybrid vehicle production will accelerate demand for compact and energy-efficient ADAS modules.

- The mining and logistics industries will remain strong growth drivers due to operational safety and fleet management needs.

- Camera and radar fusion technologies will dominate as accuracy and response time continue to improve.

- Domestic assembly and skill development initiatives will enhance local ecosystem capabilities for ADAS calibration and maintenance.

- Continuous innovation in digital cockpit integration will reshape in-vehicle experience, combining safety alerts with infotainment visibility.