| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Electric Vehicle (EV) Hub Motor Market Size 2024 |

USD 268.20 Million |

| Australia Electric Vehicle (EV) Hub Motor Market, CAGR |

12.38% |

| Australia Electric Vehicle (EV) Hub Motor Market Size 2032 |

USD 682.45 Million |

Market Overview

Australia Electric Vehicle (EV) Hub Motor Market size was valued at USD 268.20 million in 2024 and is anticipated to reach USD 682.45 million by 2032, at a CAGR of 12.38% during the forecast period (2024-2032).

The Australia Electric Vehicle (EV) Hub Motor market is experiencing significant growth, driven by increasing government incentives, rising consumer demand for sustainable transportation, and advancements in motor efficiency. Supportive policies, such as tax benefits and subsidies, encourage EV adoption, while the expansion of charging infrastructure enhances market viability. The shift toward compact, lightweight, and energy-efficient hub motors is further fueling demand, as they improve vehicle performance and range. Key trends include the growing integration of smart motor technologies, regenerative braking systems, and enhanced torque control for better drivability. Additionally, increasing investments in R&D to develop high-power-density motors and collaborations between automakers and technology firms are shaping market expansion. The rising popularity of shared mobility and electric two-wheelers is also contributing to the sector’s growth. As sustainability concerns drive innovation, the EV hub motor market in Australia is poised for substantial advancement over the forecast period.

The geographical analysis of the Australia Electric Vehicle (EV) Hub Motor market highlights the increasing adoption of EV technology across major states, including New South Wales, Victoria, Queensland, and Western Australia. Government incentives, expanding charging infrastructure, and growing environmental concerns are driving regional market growth. Urban centers such as Sydney, Melbourne, and Brisbane are witnessing higher EV adoption, while rural areas are gradually embracing electric mobility due to improved infrastructure. Key players in the Australia EV hub motor market include Protean Electric, ZIEHL-ABEGG, Schaeffler Technologies, Bonfiglioli Riduttori S.p.A., ZF Friedrichshafen AG, Elaphe AG, and Siemens AG, among others. These companies are focusing on technological advancements, lightweight materials, and high-efficiency motor solutions to enhance EV performance and driving range. Collaborations between automakers, technology firms, and research institutions are further boosting market expansion, positioning Australia as a growing hub for EV innovation and sustainability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia EV hub motor market was valued at USD 268.20 million in 2024 and is projected to reach USD 682.45 million by 2032, growing at a CAGR of 12.38% during the forecast period.

- Rising adoption of electric two-wheelers, passenger cars, and light commercial vehicles is driving demand for high-efficiency hub motors.

- Advancements in lightweight materials, energy-efficient motor designs, and integration with regenerative braking systems are shaping market trends.

- Leading players such as Protean Electric, ZF Friedrichshafen AG, Siemens AG, and Elaphe AG are investing in research and development to enhance product offerings.

- High initial costs, battery limitations, and limited charging infrastructure pose challenges to widespread market penetration.

- Government incentives, infrastructure development, and increasing fleet electrification initiatives are supporting regional market growth.

- Major demand centers include New South Wales, Victoria, Queensland, and Western Australia, driven by strong EV adoption policies and urban mobility trends.

Report Scope

This report segments the Australia Electric Vehicle (EV) Hub Motor Market as follows:

Market Drivers

Government Support and Favorable Policies

The Australian government is actively promoting electric vehicle (EV) adoption through various incentives, subsidies, and policy frameworks. Financial incentives, such as tax exemptions, rebates on EV purchases, and grants for research and development, are encouraging both manufacturers and consumers to invest in electric mobility. For instance, state-level initiatives like the development of comprehensive EV strategies and infrastructure plans are further accelerating market growth. Infrastructure development initiatives, including expanding public charging networks and integrating renewable energy sources, are also playing a crucial role in fostering EV adoption. These supportive measures are expected to drive demand for EV hub motors, which offer enhanced efficiency and performance benefits compared to conventional propulsion systems.

Advancements in Hub Motor Technology

Continuous innovation in hub motor technology is significantly boosting market growth by improving energy efficiency, power density, and vehicle performance. The development of lightweight, compact, and high-torque hub motors has enhanced the driving experience by optimizing power output while minimizing energy consumption. Advanced materials, such as rare-earth magnets and high-temperature-resistant coatings, are improving motor durability and efficiency. Additionally, the integration of smart control systems, regenerative braking, and real-time monitoring features is further increasing the adoption of hub motors in electric vehicles. These advancements not only improve range and acceleration but also contribute to reduced maintenance costs, making EVs more appealing to consumers. As technological breakthroughs continue, the demand for high-performance hub motors is expected to rise in Australia’s growing EV market.

Growing Consumer Demand for Electric Vehicles

Consumer preference for sustainable and cost-effective transportation solutions is a key driver for the EV hub motor market in Australia. Rising awareness of climate change, coupled with increasing fuel prices, is pushing consumers toward EVs as a viable alternative to internal combustion engine (ICE) vehicles. Additionally, the cost benefits of EV ownership, including lower maintenance and charging expenses compared to traditional fuel-powered vehicles, are attracting more buyers. The expansion of EV model availability, particularly in the two-wheeler and light commercial vehicle segments, is further fueling demand for hub motors. Consumers are also seeking improved driving experiences, with hub motors providing benefits such as enhanced acceleration, noise reduction, and greater control. This shift in consumer behavior is expected to support long-term market growth for EV hub motors.

Expansion of Shared Mobility and Last-Mile Delivery Services

The increasing adoption of shared mobility solutions, including electric scooters, e-bikes, and ride-hailing EV fleets, is accelerating demand for hub motors in Australia. The rise of urbanization and changing commuting patterns are driving investments in sustainable and affordable transportation options. For example, companies are investing heavily in fleet electrification to reduce operational costs and meet environmental sustainability goals. Additionally, the booming e-commerce sector is pushing logistics providers to transition to electric last-mile delivery vehicles, which rely heavily on efficient and high-performance hub motors. Companies are prioritizing fleet electrification to reduce operational costs and meet environmental sustainability goals, further strengthening market expansion. As shared and commercial electric mobility gains traction, the demand for reliable and high-efficiency hub motors will continue to grow in Australia’s evolving transportation landscape.

Market Trends

Integration of Smart and Connected Hub Motors

The Australian EV hub motor market is witnessing a significant shift toward smart and connected technologies, enhancing vehicle efficiency and performance. Advanced hub motors now feature integrated sensors, IoT connectivity, and AI-driven predictive maintenance to optimize energy consumption and provide real-time diagnostics. For instance, the South Australian government’s initiatives in smart charging and electric vehicle integration are setting a precedent for how smart technologies can enhance EV efficiency and user experience. These innovations enable better torque control, improved regenerative braking, and adaptive power management, leading to increased vehicle range and safety. Automakers and technology firms are investing in intelligent hub motor solutions to enhance user experience and drive market differentiation. The growing adoption of connected mobility solutions is expected to further accelerate the demand for smart hub motors in Australia’s EV landscape.

Expansion of Two-Wheeler and Micro-Mobility Segments

The increasing adoption of electric two-wheelers, e-bikes, and micro-mobility solutions is driving demand for hub motors in Australia. Urban congestion, rising fuel costs, and consumer preference for cost-effective and eco-friendly transportation options are fueling the growth of small electric vehicles. For instance, local governments are investing in infrastructure to support sustainable urban mobility, such as dedicated cycling lanes and improved parking facilities, which encourages the use of e-bikes and other micro-mobility solutions. The government’s push for sustainable urban mobility solutions is further supporting this trend, with incentives for e-scooters and shared mobility programs. Hub motors are particularly well-suited for two-wheelers and micro-mobility vehicles due to their compact design, efficiency, and ease of integration. With growing interest in last-mile delivery solutions and personal electric transport, the hub motor market is poised for substantial growth in this segment.

Rise in Lightweight and High-Efficiency Motor Designs

The focus on lightweight materials and high-efficiency designs is transforming the EV hub motor market in Australia. Manufacturers are developing compact, low-weight motors with higher power density, allowing for better energy efficiency and extended battery life. Innovations such as rare-earth magnet alternatives, high-performance cooling systems, and improved insulation technologies are enhancing the durability and performance of hub motors. These advancements contribute to lower energy losses and reduced overall vehicle weight, making EVs more efficient and competitive against traditional internal combustion engine (ICE) vehicles. As automakers strive for better efficiency-to-weight ratios, demand for high-performance hub motors is expected to rise.

Increasing Adoption of All-Wheel Drive (AWD) EVs

Australia’s EV market is experiencing a growing preference for all-wheel drive (AWD) electric vehicles, leveraging hub motor technology for improved performance. AWD EVs equipped with individual hub motors in each wheel offer enhanced traction, better acceleration, and improved handling in diverse road conditions. This trend is particularly prominent in SUVs and off-road electric vehicles, where consumers seek high power efficiency and superior driving dynamics. Automakers are capitalizing on this demand by introducing multi-motor configurations that enhance both performance and safety. As AWD EVs gain traction among Australian consumers, the integration of hub motors in high-performance and utility vehicles is expected to contribute to the market’s expansion.

Market Challenges Analysis

High Initial Costs and Supply Chain Constraints

The adoption of EV hub motors in Australia faces challenges due to high initial costs and supply chain limitations. The manufacturing of hub motors involves advanced materials, precision engineering, and rare-earth magnets, all of which contribute to higher production expenses. For instance, the reliance on imported components can lead to supply chain vulnerabilities, as seen in recent disruptions affecting global automotive production. Additionally, the dependency on imported components and global supply chains makes Australia vulnerable to price fluctuations and material shortages. Supply chain disruptions, particularly in semiconductor chips and battery materials, further hinder production and delay EV rollouts. These cost-related barriers make it difficult for manufacturers to offer affordable EV options, potentially slowing market penetration. To overcome these challenges, companies must invest in localized production, alternative motor designs, and supply chain diversification to ensure long-term growth.

Limited Charging Infrastructure and Consumer Awareness

Despite government efforts to promote EV adoption, insufficient charging infrastructure and low consumer awareness remain key obstacles to the growth of hub motors in Australia. Many regions, particularly rural and suburban areas, still lack adequate fast-charging stations, limiting the feasibility of EV ownership. Consumers also express concerns about battery range, maintenance, and long-term reliability, leading to hesitation in transitioning from traditional internal combustion engine vehicles. Additionally, a lack of technical knowledge and after-sales support for hub motor technology further slows adoption. Expanding charging networks, conducting consumer education programs, and offering financial incentives are essential steps to address these barriers. Strengthening public-private partnerships will also play a crucial role in accelerating the development of EV infrastructure and fostering confidence in hub motor-powered electric vehicles.

Market Opportunities

Australia’s electric vehicle (EV) hub motor market presents significant opportunities driven by increasing government support, technological advancements, and rising consumer adoption of electric mobility. The expansion of incentives, tax benefits, and charging infrastructure investments is creating a favorable environment for EV manufacturers and suppliers. As the country moves toward achieving its net-zero emissions goals, the demand for energy-efficient transportation solutions is expected to rise, accelerating the adoption of hub motor technology. Additionally, ongoing advancements in lightweight materials, high-power density motors, and smart control systems are enhancing vehicle performance and efficiency, making hub motors an attractive choice for automakers. The development of cost-effective, high-efficiency motor solutions tailored to various vehicle segments, including electric two-wheelers, passenger cars, and commercial fleets, will further drive market expansion.

The growing emphasis on shared mobility, last-mile delivery, and fleet electrification offers a lucrative opportunity for hub motor manufacturers. The increasing adoption of electric scooters, e-bikes, and ride-sharing EVs is fueling demand for compact and high-torque hub motors that improve operational efficiency. Furthermore, the push for localized production and supply chain diversification can reduce dependency on imports, fostering domestic manufacturing growth. Partnerships between automakers, technology firms, and research institutions will play a crucial role in advancing hub motor innovations and ensuring long-term market growth. As consumer awareness of EV benefits, cost savings, and sustainability continues to increase, the demand for advanced hub motor solutions is expected to surge, creating a robust and expanding market in Australia.

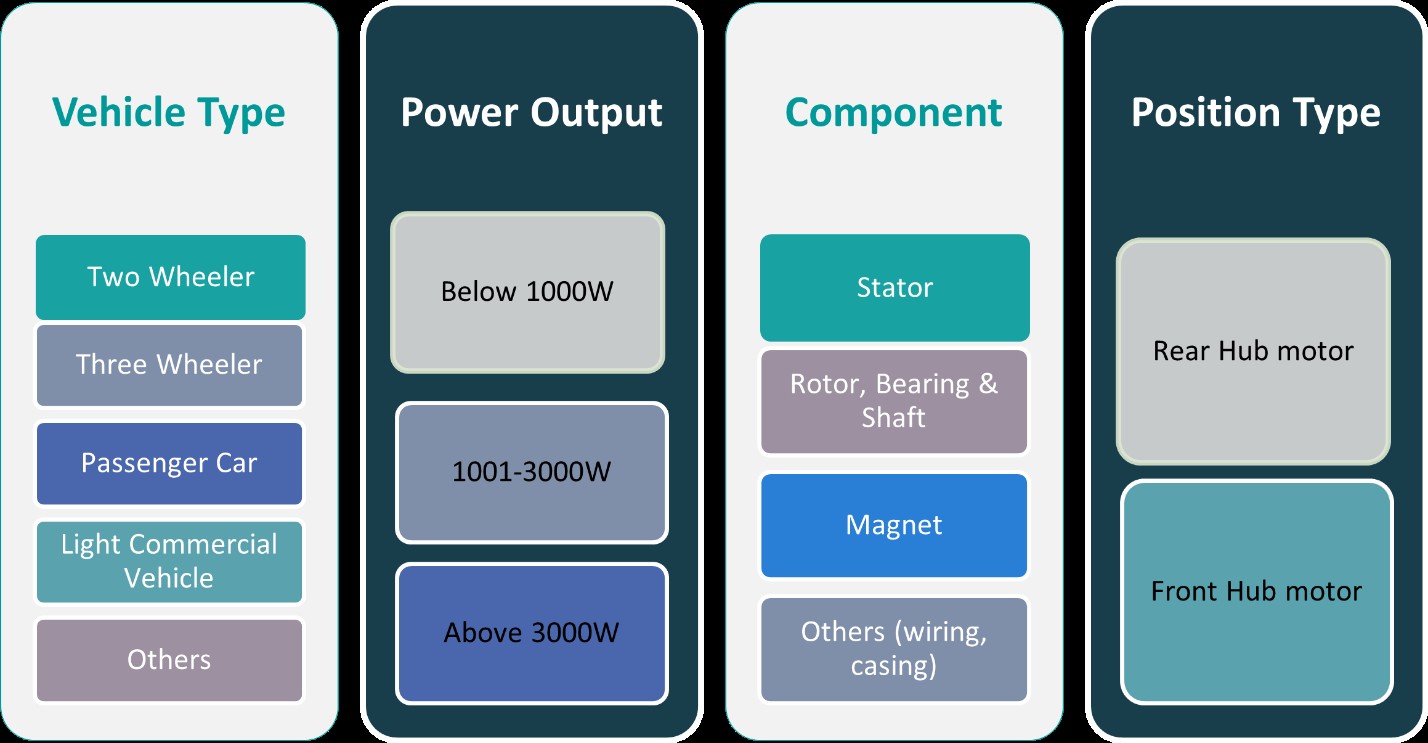

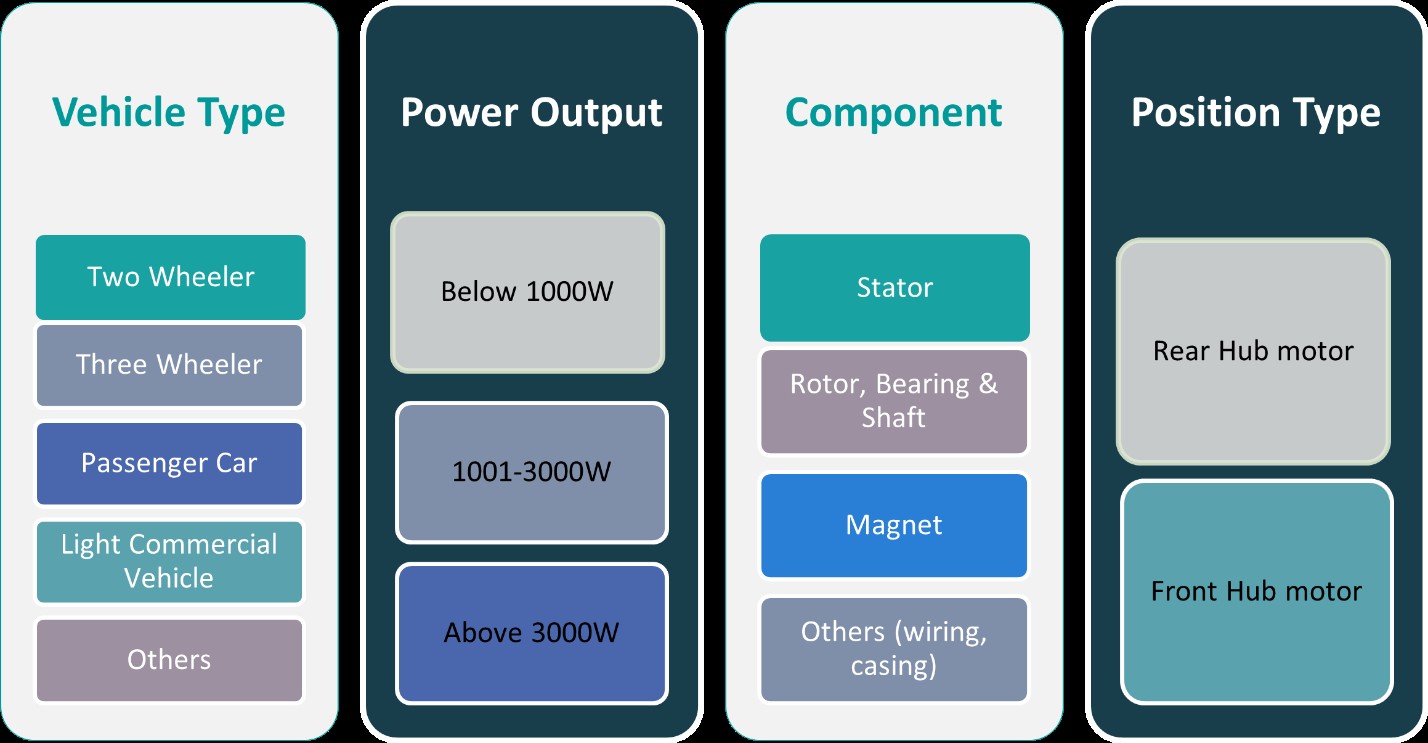

Market Segmentation Analysis:

By Vehicle Type:

The Australia EV hub motor market is segmented based on vehicle type, including two-wheelers, three-wheelers, passenger cars, light commercial vehicles (LCVs), and others. The two-wheeler segment holds a substantial market share, driven by the increasing adoption of electric scooters and e-bikes for personal mobility and last-mile delivery solutions. The affordability, ease of use, and government incentives supporting electric two-wheelers contribute to their growing demand. The three-wheeler segment is also expanding, particularly in urban areas, as businesses seek cost-effective and eco-friendly transportation options for small-scale logistics and passenger commuting. Passenger cars account for a significant portion of the market due to rising consumer preference for zero-emission vehicles and improvements in charging infrastructure. Additionally, light commercial vehicles (LCVs) are witnessing increased adoption, especially in the logistics and e-commerce sectors, where fleet operators prioritize fuel cost savings and sustainability. The others category, which includes electric buses and specialty vehicles, is gaining traction as public and private sectors invest in electrified transport solutions to reduce carbon emissions.

By Power Output:

Based on power output, the Australia EV hub motor market is segmented into below 1000W, 1001-3000W, and above 3000W. The below 1000W segment primarily serves electric two-wheelers and e-bikes, where energy efficiency and lightweight design are key factors. These motors support urban commuting and personal transportation needs while ensuring affordability. The 1001-3000W segment caters to a broad range of vehicles, including three-wheelers and small passenger EVs, where moderate power and torque balance efficiency with performance. This category is witnessing steady growth due to increased demand for shared mobility solutions and low-cost electric vehicles. The above 3000W segment dominates the passenger car and LCV segments, offering high performance, torque, and acceleration for larger electric vehicles. Automakers are focusing on high-power hub motors to improve battery efficiency and driving range, making them a preferred choice for high-performance EVs. With technological advancements, the demand for powerful and efficient hub motors is expected to rise across all vehicle categories.

Segments:

Based on Vehicle Type:

- Two-Wheeler

- Three-Wheeler

- Passenger Car

- Light Commercial Vehicle

- Others

Based on Power Output:

- Below 1000W

- 1001-3000W

- Above 3000W

Based on Component:

- Stator

- Rotor, Bearing & Shaft

- Magnet

- Others (wiring, casing)

Based on Position Type:

- Rear Hub Motor

- Front Hub Motor

Based on the Geography:

- New South Wales

- Victoria

- Queensland

- Western Australia (WA)

- South Australia

Regional Analysis

New South Wales

New South Wales (NSW) dominates the Australia EV hub motor market, accounting for 33% of the total market share. The state’s leadership is driven by strong government policies, extensive EV infrastructure, and high consumer adoption rates. Sydney and other major urban centers have witnessed a surge in EV sales, supported by rebates, tax exemptions, and growing charging networks. The NSW government’s Net Zero Plan and initiatives such as the Electric Vehicle Strategy 2021 are accelerating EV adoption, directly boosting demand for hub motors. Public and private investments in smart mobility solutions and sustainable transport are further strengthening the market. The growing preference for electric two-wheelers and shared mobility solutions also contributes to the increased adoption of hub motors, particularly in urban areas where congestion and sustainability concerns are prominent.

Victoria

Victoria holds a 28% market share in the Australian EV hub motor sector, making it the second-largest regional market. The state’s commitment to decarbonization and investments in EV charging infrastructure are key growth drivers. Melbourne’s urban centers are witnessing increased demand for electric passenger vehicles and commercial fleets, supporting the adoption of high-power hub motors. The Victorian government’s Zero Emissions Vehicle (ZEV) Roadmap aims to have 50% of new car sales as EVs by 2030, further fueling market expansion. Additionally, incentives such as discounted registration fees, rebates for EV purchases, and charging infrastructure grants are attracting both consumers and businesses. The growing presence of EV manufacturing facilities and research centers in Victoria also supports local innovation and production of advanced hub motor technologies, ensuring sustained market growth.

Queensland

Queensland holds an 19% share of the Australia EV hub motor market, with rapid growth driven by government incentives, expanding EV infrastructure, and increased fleet electrification. The Queensland Electric Super Highway (QESH) has significantly improved charging accessibility, making EVs more viable for long-distance travel. Brisbane and other metropolitan areas are experiencing a rise in electric two-wheelers and passenger cars, increasing the demand for hub motors across different power segments. Additionally, Queensland’s strong push toward sustainable transport solutions and renewable energy integration is fostering greater interest in electric commercial vehicles and fleet electrification. The state’s climate and geography make hub motor-powered vehicles an attractive option for urban and suburban commuting, further contributing to market expansion.

Western Australia

Western Australia (WA) is an emerging player in the EV hub motor market, accounting for 11% of the total market share. The state’s vast geography and dependence on mining and industrial sectors have resulted in slower EV adoption compared to eastern states. However, WA is witnessing gradual growth in EV sales, supported by incentives, growing charging networks, and increased awareness of sustainability benefits. Perth and surrounding urban areas are seeing a rise in electric two-wheelers and passenger EVs, primarily driven by fuel cost savings and environmental concerns. The WA government’s investment in hydrogen and renewable energy-powered vehicles is also expected to create new opportunities for advanced hub motor technologies, particularly in commercial and industrial vehicle applications.

Key Player Analysis

- Protean Electric

- ZIEHL-ABEGG

- Schaeffler Technologies

- Bonfiglioli Riduttori S.p.A.

- ZF Friedrichshafen AG

- Elaphe AG

- Evans Electric

- TM4

- Siemens AG

- Kolektor

- Printed Motor Works

- NSK Ltd.

- NTN Corporation

- GEM Motors d.o.o.

- Magnetic Systems Technology

- e-Traction B.V.

- Hyundai Mobis

- YASA Limited

- ECOmove GmbH

- Tajima Motor Corporation

Competitive Analysis

The Australia Electric Vehicle (EV) Hub Motor market is highly competitive, with key players focusing on technological advancements, strategic collaborations, and product innovation to strengthen their market presence. Leading companies such as Protean Electric, ZF Friedrichshafen AG, Siemens AG, Elaphe AG, Schaeffler Technologies, NSK Ltd., and NTN Corporation are actively investing in R&D to enhance motor efficiency, reduce weight, and improve power output. These firms are also working on integrating smart technologies such as AI-driven motor control systems and advanced thermal management solutions to improve performance and extend battery life. Strategic partnerships with automotive manufacturers and fleet operators are a key growth strategy, allowing companies to expand their product adoption across two-wheelers, passenger cars, and commercial vehicles. Additionally, some players are exploring local manufacturing and assembly units to reduce costs and ensure supply chain stability. With increasing demand for high-efficiency and cost-effective hub motors, market players are expected to continue innovation and expansion efforts to maintain a competitive edge.

Recent Developments

- In May 2024, Bajaj Auto intended to introduce a mass-market electric scooter under the Chetak brand, increasing its retail presence three times over the next three to four months.

- In April 2024, VinFast, the electric vehicle arm of Vietnamese conglomerate Vingroup, will begin selling its VF DrgnFly electric bike in the U.S. The bike, a 750W rear hub motor, offers a smooth riding experience and a top speed of up to 45 km/h.

- In February 2024, Kabira Mobility, located in Verna, Goa, introduced two electric motorcycles in India, the KM3000 and KM4000, featuring an aluminium core hub motor powertrain, telescopic forks, monoshock, disc brakes, 17-inch wheels, and modular battery pack.

- In February 2024, BYD, auto manufacturing conglomerate based in Shenzhen, China, plans to establish an electric vehicle factory in Mexico, aiming to establish an export hub to the U.S., leveraging Mexico’s automaking sector’s close integration with the U.S.

- In October 2023, GEM Motor signed a strategic partnership agreement with Stilride to develop a specialized advanced electric drive. Stilride presented an electric scooter that will be available to Swedish customers in an exclusive limited series in spring 2024 and will be powered by an innovative GEM in-wheel drive G2.6.

Market Concentration & Characteristics

The Australia Electric Vehicle (EV) Hub Motor market exhibits a moderate to high market concentration, with a few dominant players holding a significant share due to their technological expertise, strong distribution networks, and strategic partnerships. Companies such as Protean Electric, ZF Friedrichshafen AG, Siemens AG, and Elaphe AG are leading the market with continuous innovation in motor efficiency, lightweight materials, and advanced integration solutions. The market is characterized by rapid technological advancements, increasing regulatory support, and rising consumer preference for energy-efficient vehicles. Strong government incentives and expanding EV infrastructure are encouraging new entrants, yet high R&D costs and stringent performance standards pose entry barriers. Competition is driven by product differentiation, cost efficiency, and sustainability initiatives, with established players focusing on customization and localized production to gain a competitive edge. As EV adoption grows, the market is expected to witness increased investments and further consolidation among key players.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Power Output, Component, Position Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia EV hub motor market is expected to witness significant growth due to increasing EV adoption across all vehicle segments.

- Advancements in motor efficiency, lightweight materials, and integration with smart technologies will drive innovation.

- Government incentives, tax benefits, and infrastructure expansion will support market expansion and boost consumer adoption.

- Growing demand for sustainable and high-performance EVs will push manufacturers to develop cost-effective and energy-efficient hub motors.

- Key players will continue investing in R&D and strategic partnerships to enhance product offerings and expand market reach.

- The shift towards electric two-wheelers and light commercial vehicles will create new growth opportunities.

- Urban centers will experience faster EV adoption, while rural areas will gradually expand their electric mobility infrastructure.

- Supply chain localization and domestic manufacturing will help reduce costs and improve market stability.

- Increasing collaborations between automotive companies and technology firms will drive advancements in motor design.

- The market will see continued consolidation, with established players strengthening their positions through mergers, acquisitions, and joint ventures.