Market Overview:

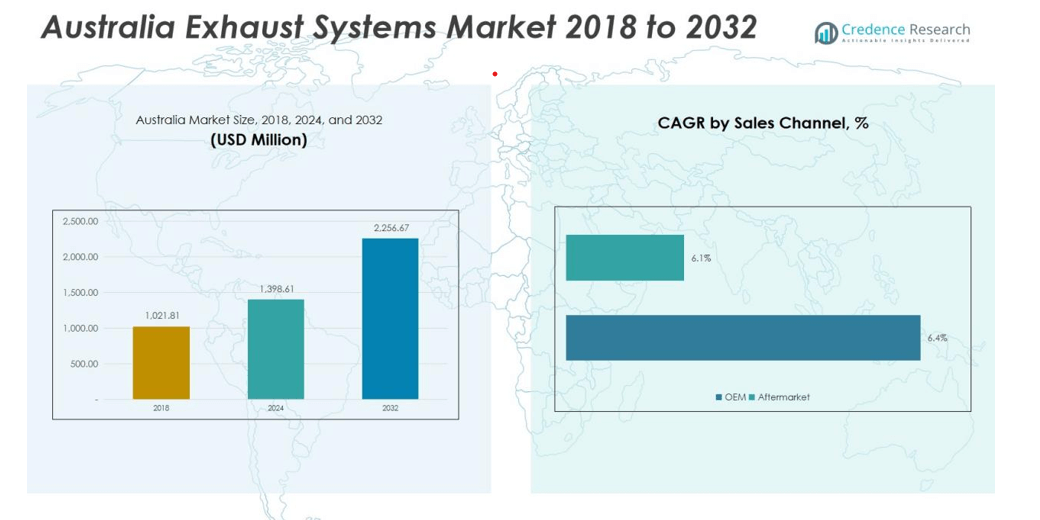

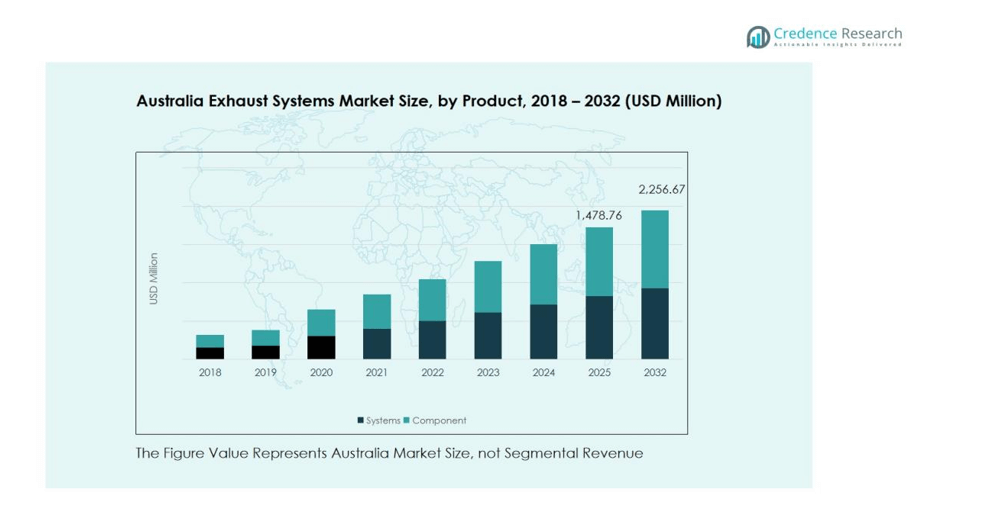

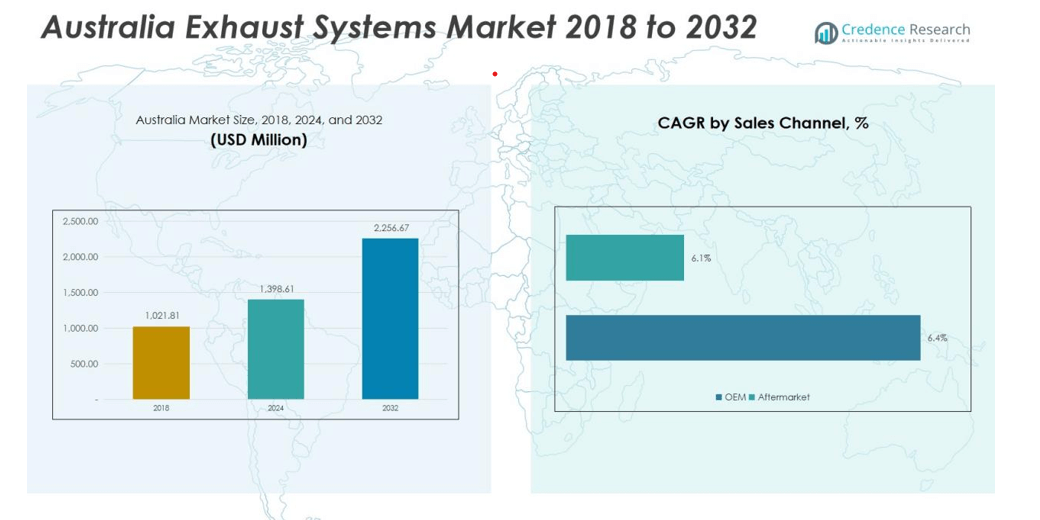

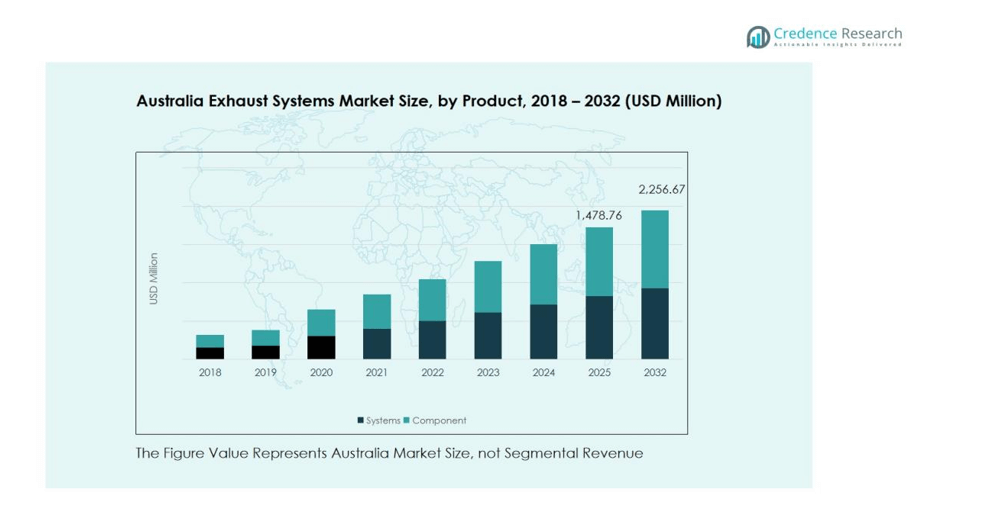

The Australia Exhaust Systems Market size was valued at USD 1,021.81 million in 2018 to USD 1,398.61 million in 2024 and is anticipated to reach USD 2,256.67 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Exhaust Systems Market Size 2024 |

USD 1,398.61 million |

| Australia Exhaust Systems Market, CAGR |

5.8% |

| Australia Exhaust Systems Market Size 2032 |

USD 2,256.67 million |

The market growth is primarily driven by stricter emission norms under Australian Design Rules (ADR) and rising consumer demand for eco-friendly and fuel-efficient vehicles. Continuous innovation by manufacturers in selective catalytic reduction (SCR), diesel particulate filters (DPF), and exhaust gas recirculation (EGR) technologies is enhancing system performance and reducing harmful emissions. Furthermore, the ongoing transition toward hybrid and electric vehicles is encouraging the integration of advanced exhaust thermal management systems.

Regionally, New South Wales and Victoria represent major demand centers due to their high vehicle density and active automotive aftermarket sectors. Queensland and Western Australia are emerging markets supported by expanding logistics and mining vehicle fleets. Increasing investments in sustainable transport infrastructure and stricter environmental compliance standards are further strengthening the exhaust systems market across Australia.

Market Insights:

- The Australia Exhaust Systems Market was valued at USD 1,021.81 million in 2018, reaching USD 1,398.61 million in 2024, and projected to hit USD 2,256.67 million by 2032, registering a CAGR of 5.8%.

- New South Wales holds around 34% of the market, followed by Victoria at 28% and Queensland at 18%, driven by dense vehicle populations, strong aftermarket networks, and strict emission standards.

- Western Australia is the fastest-growing region with a 7% share, supported by expanding logistics, mining fleets, and rising adoption of hybrid and low-emission vehicles.

- By product type, catalytic converters account for nearly 32% of the market share due to their essential role in meeting ADR emission norms.

- Passenger vehicles dominate the vehicle segment with a 55% share, reflecting high urban mobility and replacement demand for efficient, lightweight exhaust systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Regulations Driving Advanced Exhaust Technologies

The Australia Exhaust Systems Market is growing due to the enforcement of strict emission standards under the Australian Design Rules (ADR). These regulations require automakers to reduce harmful gases such as nitrogen oxides and carbon monoxide. Manufacturers are developing selective catalytic reduction (SCR) and diesel particulate filter (DPF) systems to meet compliance. It promotes cleaner combustion and enhanced fuel efficiency across vehicle segments. The shift toward low-emission technologies is encouraging OEMs to invest in continuous exhaust innovation.

- For instance, Hino Australia introduced its 500 Series Standard Cab trucks meeting Japan’s post Post New Long Term (pPNLT) emissions standard equivalent to Euro 6, featuring both SCR and DPR systems that convert nitrogen oxides into nitrogen and water while filtering particulate matter.

Rising Vehicle Production and Expanding Aftermarket Demand

Steady growth in vehicle production and the expanding automotive aftermarket are strengthening the Australia Exhaust Systems Market. High demand for passenger and light commercial vehicles drives replacement and upgrade cycles for exhaust components. Increasing consumer awareness about fuel economy and noise reduction enhances adoption of performance exhaust systems. Local manufacturers and distributors benefit from the need for timely replacements due to harsh road and climate conditions. It creates continuous revenue opportunities for OEMs and service providers.

- For instance, Swift Industries expanded its aftermarket exhaust product portfolio to 19,000 product lines, featuring advanced catalytic converters and Diesel Particulate Filters, positioning the company to serve diverse replacement needs across Australia’s automotive sector

Growing Adoption of Hybrid and Fuel-Efficient Vehicles

Hybrid and fuel-efficient vehicle adoption is reshaping the Australia Exhaust Systems Market. Automakers are integrating compact, lightweight, and thermally optimized exhaust systems to support new powertrains. These designs improve performance while reducing emissions and engine heat. It strengthens compliance with national sustainability goals and supports fuel economy standards. Continuous R&D investment in hybrid-compatible exhaust systems drives competitive differentiation among suppliers.

Technological Advancements and Material Innovation

Advancements in exhaust materials and design innovation are boosting market competitiveness. The use of stainless steel, titanium, and composite alloys improves durability and reduces weight. It enhances corrosion resistance, crucial for Australia’s diverse weather conditions. Automation and precision manufacturing are improving production efficiency and design consistency. The adoption of smart sensors and advanced coatings further increases the performance and lifespan of exhaust systems.

Market Trends:

Increasing Focus on Lightweight Materials and Emission Efficiency

The Australia Exhaust Systems Market is witnessing a strong shift toward lightweight materials to improve efficiency and durability. Manufacturers are replacing conventional steel with stainless steel, titanium, and composite alloys to reduce vehicle weight and fuel consumption. The demand for high-temperature and corrosion-resistant materials is increasing due to Australia’s diverse climate and long-distance driving conditions. It encourages OEMs to integrate advanced thermal coatings and modular designs for extended component life. These innovations support compliance with emission standards while enhancing overall performance and fuel economy.

- For instance, Vandemon Performance in Australia offers titanium exhaust headers for the Suzuki GSX-8S that are approximately 45 percent lighter than stainless steel, dissipating heat twice as fast and featuring superior corrosion resistance without requiring polishing.

Integration of Smart Sensors and Electrified Powertrain Compatibility

Smart exhaust sensors and electronic monitoring systems are emerging as key trends in the Australia Exhaust Systems Market. Automakers are embedding advanced sensors for real-time analysis of temperature, pressure, and gas composition to optimize performance. It supports predictive maintenance and helps meet strict emission monitoring standards. The growing adoption of hybrid and plug-in hybrid vehicles also drives demand for compact exhaust systems compatible with electrified powertrains. Manufacturers are designing adaptive exhaust technologies that regulate sound and heat output efficiently. The trend reflects the industry’s broader move toward intelligent, connected, and sustainable automotive solutions.

- For instance, DENSO developed NTC-type exhaust gas temperature sensors that detect temperature ranges from -40 to 1000 degrees Celsius with response times taking less than 7 seconds to transition from room temperature to 1000 degrees Celsius.

Market Challenges Analysis:

High Cost of Advanced Exhaust Technologies and Material Constraints

The Australia Exhaust Systems Market faces rising costs due to the integration of advanced catalytic converters, sensors, and thermal coatings. These technologies require high-grade materials such as titanium and stainless steel, which increase overall production expenses. It creates pricing pressure for manufacturers and limits affordability for cost-sensitive consumers. Supply chain disruptions and fluctuating raw material prices further challenge consistent output. Local manufacturers struggle to balance quality, compliance, and cost efficiency in a highly regulated environment.

Transition Toward Electric Mobility Reducing Traditional Demand

The growing shift toward electric vehicles (EVs) poses a structural challenge to the Australia Exhaust Systems Market. Battery electric vehicles eliminate the need for conventional exhaust systems, directly impacting long-term demand. It compels suppliers to diversify into hybrid-compatible or alternative thermal management solutions. Limited EV infrastructure currently slows the transition, but government incentives may accelerate adoption. Manufacturers must innovate to stay relevant in a gradually electrifying market landscape.

Market Opportunities:

Expansion of Hybrid Vehicle Segment and Aftermarket Growth

The Australia Exhaust Systems Market offers significant growth opportunities in the hybrid vehicle segment. Automakers are integrating compact exhaust systems optimized for hybrid engines to balance efficiency and emission control. It supports ongoing government initiatives promoting cleaner transport technologies. The growing aftermarket sector also provides revenue potential through replacement parts and performance upgrades. Increasing consumer interest in customized exhaust solutions enhances opportunities for local fabricators and service providers.

Adoption of Smart and Lightweight Exhaust Technologies

Rising demand for smart and lightweight exhaust technologies creates strong prospects for innovation. Manufacturers are investing in digital sensors, real-time emission tracking, and advanced coatings to improve system reliability. It aligns with Australia’s environmental goals and encourages sustainable vehicle manufacturing. The trend toward lightweight materials such as aluminum and titanium allows better fuel efficiency and lower carbon footprints. Expanding R&D capabilities and partnerships with global technology suppliers strengthen future opportunities in performance-driven exhaust systems.

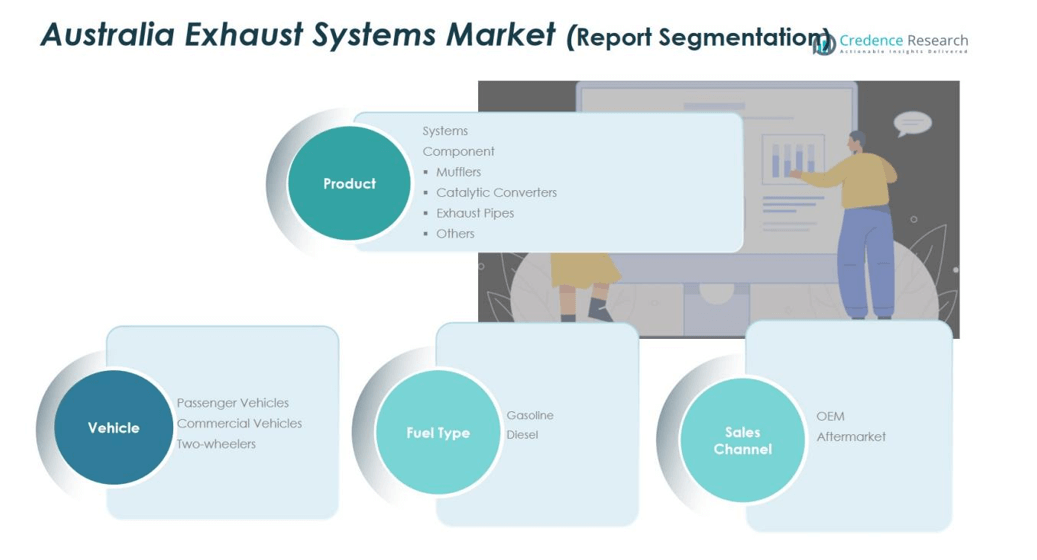

Market Segmentation Analysis:

By Product Type

The Australia Exhaust Systems Market includes systems and components such as mufflers, catalytic converters, exhaust pipes, and other accessories. Catalytic converters hold a significant share due to stricter emission norms and rising environmental awareness. Mufflers also show steady demand for their role in noise reduction and improved engine performance. It benefits from technological advancements and material innovations that enhance exhaust efficiency and durability.

- For instance, Hushpak Engineering custom designed a muffler for CAT 793D haul trucks that reduced noise levels to 122 dB, meeting compliance standards while adding less than 450 kg to the vehicle.

By Vehicle Segment

Passenger vehicles dominate the Australia Exhaust Systems Market, driven by strong consumer demand and expanding urban mobility. The commercial vehicle segment follows, supported by logistics and mining fleet operations requiring durable exhaust systems. Two-wheelers hold a smaller yet growing share, supported by the rise in compact urban transportation. It continues to see innovation focused on lightweight and corrosion-resistant materials suited for long-distance driving.

- For Instance, SC-Project introduced a Rally-S titanium muffler for the Benelli TRK 702 in 2024, achieving a greater than 60% reduction in exhaust weight and a performance uplift of 2.5 hp at 7,900 rpm.

By Fuel Type

Gasoline vehicles account for the largest share of the Australia Exhaust Systems Market due to widespread passenger car usage. Diesel vehicles remain important in commercial and heavy-duty applications, relying on selective catalytic reduction (SCR) and diesel particulate filter (DPF) technologies. It reflects Australia’s focus on emission control and fuel efficiency improvement. The gradual transition toward hybrid vehicles is creating scope for hybrid-compatible exhaust solutions.

Segmentations:

By Product Type Segment:

- Systems

- Components

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Segment:

- Passenger Vehicles

- Commercial Vehicles

- Two-wheelers

By Fuel Type Segment:

By Sales Channel Segment:

Regional Analysis:

New South Wales and Victoria Leading Market Growth through Strong Automotive Base

New South Wales and Victoria dominate the Australia Exhaust Systems Market, supported by dense vehicle populations and a strong automotive service network. These regions record the highest demand for exhaust replacement and performance upgrades due to heavy urban traffic and vehicle aging. It benefits from a well-developed aftermarket and large distribution networks catering to passenger and light commercial vehicles. Stringent emission standards and government initiatives promoting cleaner transportation drive continuous system upgrades. Local manufacturing hubs in these states also support innovation in exhaust materials and assembly technologies.

Queensland and Western Australia Emerging with Rising Fleet and Industrial Activity

Queensland and Western Australia show robust market potential driven by growth in mining, logistics, and commercial fleet operations. Demand for durable exhaust systems is high due to harsh terrain and heavy-duty vehicle usage. It encourages manufacturers to develop high-performance systems with superior corrosion resistance and longer operational life. The growing adoption of hybrid and low-emission vehicles in urban centers further supports regional expansion. Local distributors and service centers are enhancing their capacity to meet aftermarket demand effectively.

South Australia and Tasmania Supporting Growth through Aftermarket and Sustainability Initiatives

South Australia and Tasmania contribute steadily to the Australia Exhaust Systems Market through focused sustainability efforts and growing aftermarket demand. Both regions are emphasizing eco-friendly transport solutions aligned with national emission targets. It promotes the integration of advanced exhaust technologies compatible with hybrid and fuel-efficient vehicles. The expanding presence of authorized service networks ensures timely replacement and maintenance of exhaust systems. Continued investments in regional transport infrastructure are expected to enhance long-term market stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Manta

- Berklee

- MagnaFlow

- Akrapovic

- AP Emissions

- The Axces Group

- BOSAL

- Exhaust Control Industries

- Yutaka Giken Company Limited

- Continental AG

Competitive Analysis:

The Australia Exhaust Systems Market features both global and regional manufacturers competing through innovation and quality. Major players include Manta, Berklee, MagnaFlow, Akrapovic, AP Emissions, The Axces Group, and BOSAL. It is characterized by a mix of local suppliers providing tailored exhaust solutions and international brands offering advanced emission-reduction technologies.

The market competition centers on product performance, noise control, durability, and compliance with emission regulations. Companies are focusing on lightweight materials and precision engineering to meet fuel efficiency standards and sustainability goals. Strategic partnerships with automotive OEMs and aftermarket distributors strengthen distribution networks and brand visibility. Price competitiveness and customization capabilities are key differentiators among domestic producers. Continuous R&D investment supports innovation in catalytic converters, mufflers, and particulate filters, helping companies maintain an edge in the evolving regulatory and performance-driven automotive landscape.

Recent Developments:

- In March 2025, Manta Aircraft announced continued refinement of its hybrid propulsion system and test benches for avionics and system integration, targeting certification of the ANN 6 as a civil passenger aircraft within 3.5 years through the CAAC.

- In June 2025, Akrapovic introduced a titanium exhaust system for the 2025 BMW M5 (G90 sedan and G99 wagon), improving engine output by 7.1 horsepower and reducing overall vehicle weight by 6.1 kilograms while enhancing the vehicle’s sound profile.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle, Fuel Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Australia Exhaust Systems Market will witness strong growth driven by tightening emission norms and fuel efficiency goals.

- Manufacturers will increase the use of lightweight stainless steel, titanium, and composite materials to reduce vehicle weight.

- Demand for hybrid and electric vehicle-compatible exhaust systems will expand as automakers transition toward cleaner technologies.

- It will see more investment in advanced catalytic converter technologies to achieve lower carbon and nitrogen oxide emissions.

- Smart exhaust monitoring systems using sensors and onboard diagnostics will become more common in premium vehicles.

- Aftermarket upgrades and performance exhaust products will attract enthusiasts seeking higher efficiency and enhanced sound.

- Local manufacturers will collaborate with global OEMs to strengthen supply chains and production capabilities.

- Sustainability initiatives will push suppliers to adopt recyclable materials and cleaner production processes.

- Growing infrastructure and logistics sectors will drive steady demand for exhaust systems in commercial vehicles.

- Digital design tools and 3D manufacturing will enable faster product customization and improved thermal management.