| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Electronics MarketSize 2024 |

USD 2,61,809.88 million |

| Automotive Electronics Market, CAGR |

7.54% |

| Automotive Electronics Market Size 2032 |

USD 4,66,225.40 million |

Market Overview:

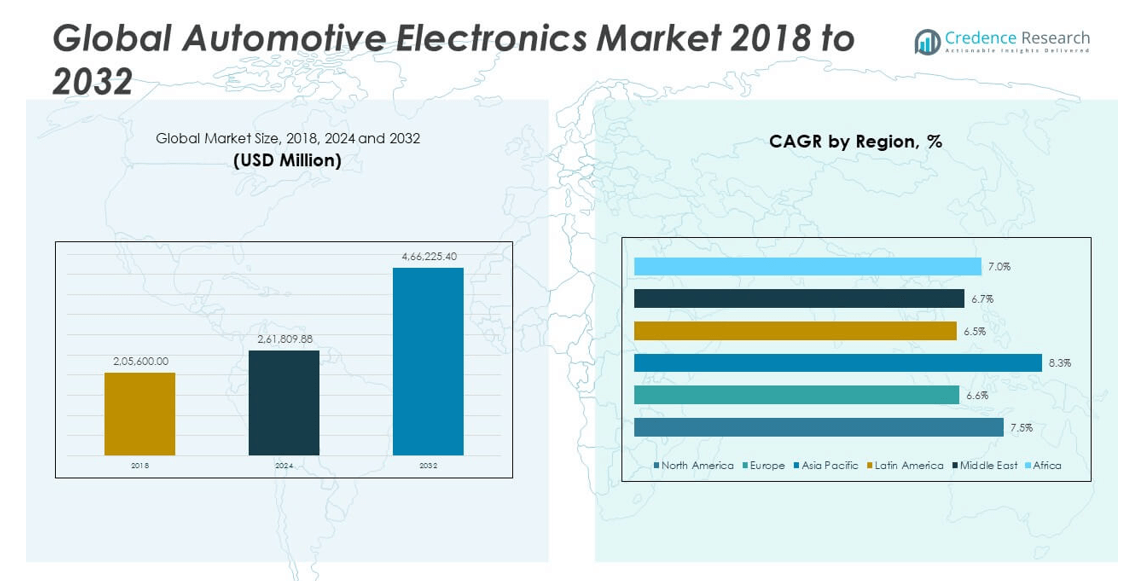

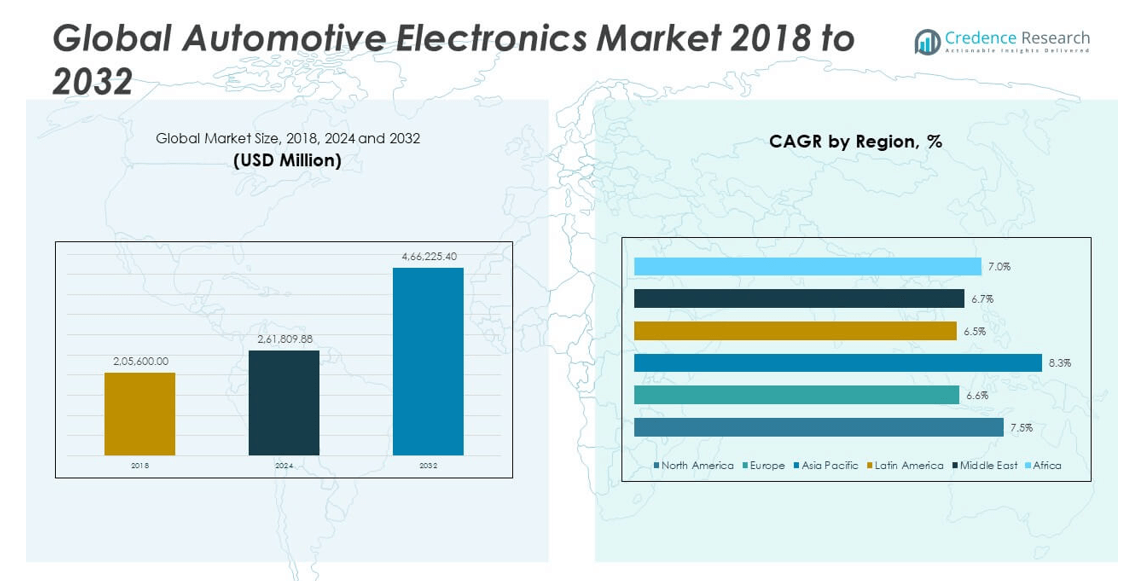

The Global Automotive Electronics Market size was valued at USD 2,05,600.00 million in 2018 to USD 2,61,809.88 million in 2024 and is anticipated to reach USD 4,66,225.40 million by 2032, at a CAGR of 7.54% during the forecast period.

Several key drivers are accelerating the market’s growth trajectory. The increasing adoption of advanced driver assistance systems (ADAS), driven by stringent safety regulations and consumer demand for safer driving experiences, is a major contributor. Governments across North America, Europe, and Asia are mandating the integration of safety features such as automatic emergency braking, lane departure warning, and blind spot detection—creating a growing need for sensor-based electronics and control units. Simultaneously, the surge in electric vehicle (EV) adoption is boosting demand for power electronics, including battery management systems, inverters, and onboard chargers. In addition, rising consumer expectations for in-vehicle connectivity, digital dashboards, and infotainment platforms are pushing OEMs to embed high-performance electronics and over-the-air update capabilities. Other contributing factors include the rise of autonomous driving technologies, growing investment in automotive software, and environmental regulations that favor the development of smart, energy-efficient vehicles.

Regionally, Asia-Pacific dominates the global automotive electronics market, accounting for the largest revenue share, driven by high vehicle production volumes, rapid EV adoption, and favorable government policies. China, in particular, leads in electric vehicle manufacturing and is rapidly expanding its domestic semiconductor capabilities. India is also witnessing growth due to rising automotive production and policy support for local electronics manufacturing. North America is the second-largest market, fueled by technological advancements, rising demand for electric and autonomous vehicles, and government incentives supporting clean mobility. The U.S. market is particularly strong, with robust R&D investment and the presence of leading automakers and technology companies. Europe follows closely, shaped by the EU’s ambitious climate targets and zero-emission mandates. Countries like Germany, France, and the UK are investing heavily in next-generation vehicle platforms that integrate safety, efficiency, and connectivity. Meanwhile, Latin America and the Middle East & Africa represent emerging markets where growing urbanization, rising income levels, and policy shifts are expected to gradually boost demand for automotive electronics, particularly in the areas of basic safety and infotainment systems.

Market Insights:

- The Global Automotive Electronics Market was valued at USD 2,05,600 million in 2018, reached USD 2,61,809.88 million in 2024, and is projected to reach USD 4,66,225.40 million by 2032, growing at a CAGR of 7.54%.

- Mandatory safety regulations across regions are accelerating the integration of electronic systems like ADAS, lane-keeping assist, and emergency braking into vehicles, significantly boosting market demand.

- Rising EV adoption in China, Europe, and North America is driving the need for advanced powertrain electronics such as battery management systems, traction inverters, and onboard chargers.

- Consumer expectations for connected in-car experiences are pushing automakers to invest in infotainment, digital dashboards, voice control, and OTA update capabilities.

- Telematics and connectivity are emerging as major growth drivers, with 5G and V2X technologies enabling predictive maintenance, real-time communication, and vehicle data monetization.

- The market faces production bottlenecks due to ongoing semiconductor shortages and supply chain disruptions, creating pressure on OEMs to diversify and localize component sourcing.

- High integration complexity, long validation cycles, and elevated R&D costs are limiting market entry for smaller firms, particularly in the context of electrified and autonomous vehicle platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Mandatory Safety Regulations and Government Policies Accelerate Electronic Integration:

Governments worldwide are enforcing stringent vehicle safety standards that require the integration of advanced electronic systems. Features like electronic stability control, anti-lock braking systems, and lane-keeping assist have become essential for regulatory compliance. The Global Automotive Electronics Market is experiencing strong growth due to the push for safer mobility. It benefits from increasing adoption of driver-assistance systems driven by both legislation and consumer demand. Automakers must continuously upgrade their electronic architectures to meet evolving compliance requirements. Regulatory bodies in Europe, North America, and Asia are promoting intelligent transportation, creating long-term demand for safety electronics.

- For instance, Continental has collaborated with NOVOSENSE Microelectronics to co-develop sensor ICs with functional safety for global automotive platforms, with products covering applications from high-reliability airbag triggers to battery pack monitoring systems, demonstrating their compliance with global safety standards.Autoliv, specializing in safety systems, shipped over 70 million airbags and 170 million seatbelts in a single year to fulfill global regulations.

Rise in Electrification Demands Complex Powertrain Electronics:

Electric vehicles (EVs) require significantly more electronic content than internal combustion engine (ICE) vehicles. Battery management systems, traction inverters, and charging interfaces all rely on advanced electronics for optimal performance. The Global Automotive Electronics Market gains substantial momentum from the rapid global shift toward electrification. It sees consistent investment from OEMs and tier-1 suppliers to enhance vehicle efficiency, safety, and range through better electronics. Growth in EV production in China, Europe, and the U.S. amplifies demand for high-voltage power electronics. EV-specific platforms are emerging with integrated electronics that support scalable designs across models.

- For instance, Tesla’s Model 3 introduced a quasi-centralized architecture, reducing wiring harness length from 3 kilometers in earlier models to just 1.5 kilometers, boosting efficiency and supporting higher electronic complexity for EVs.Bosch Mobility supplies high-voltage battery management systems and inverters for multiple OEMs, providing integral electronic powertrain components across leading EV models globally.

Consumer Preference for Digital In-Car Experience Drives Infotainment Demand:

Modern consumers expect vehicles to deliver seamless digital experiences with intuitive human-machine interfaces. Touchscreen control panels, voice assistants, real-time navigation, and app integration are now baseline expectations. The Global Automotive Electronics Market expands in response to the surge in infotainment and connectivity solutions. It supports the shift toward software-defined vehicles, enabling continuous improvements via over-the-air updates. Automakers are collaborating with tech companies to deliver user-centric designs. These partnerships elevate demand for high-bandwidth electronics, memory modules, and cloud-based integration systems.

Telematics and Connectivity Solutions Create New Demand Frontiers:

Vehicle connectivity plays a pivotal role in fleet optimization, predictive maintenance, and data monetization strategies. Telematics solutions, such as GPS tracking and remote diagnostics, rely on robust electronic platforms. The Global Automotive Electronics Market benefits from the integration of 5G and vehicle-to-everything (V2X) communications. It enables vehicles to interact with infrastructure, networks, and other vehicles in real time. This evolution enhances traffic management, accident reduction, and driver convenience. Connectivity is no longer optional but a foundational requirement in new vehicle architectures.

Market Trends:

Shift Toward Centralized and Scalable Electronic Architectures:

Automakers are consolidating vehicle control functions into fewer but more powerful domain controllers. This trend improves computing efficiency, reduces wiring complexity, and enhances software scalability. The Global Automotive Electronics Market is witnessing a transition from distributed ECUs to zonal or centralized architectures. It supports modular design strategies and facilitates software upgrades across platforms. Centralization also improves cybersecurity management and data synchronization. OEMs are redesigning vehicle platforms to support this long-term structural change.

- For instance, Volkswagen’s MEB E3 architecture in the ID.3 and ID.4 integrates three primary domain controllers—vehicle control, intelligent driving, and intelligent cockpit—enabling segmented management and facilitating software/service upgrades across models.

Integration of Artificial Intelligence into Vehicle Electronics:

Artificial intelligence is reshaping how electronic systems process data and make decisions in real time. AI enables features such as adaptive cruise control, intelligent parking assistance, and driver monitoring. The Global Automotive Electronics Market is evolving with embedded AI capabilities across ADAS, infotainment, and energy management systems. It unlocks predictive functionalities and enhances responsiveness to dynamic environments. Automakers use AI to personalize in-cabin experiences based on driver behavior and preferences. AI-driven systems are becoming central to future mobility innovations.

- For instance, Mercedes-Benz rolled out its updated MBUX AI-powered Voice Assistant to over three million vehicles by December 2024, supporting natural language interfaces and AI-driven in-car features for enhanced user experience.

Growth of Cybersecurity Features in Automotive Software Ecosystems:

The digitization of vehicles exposes them to increasing cybersecurity risks from unauthorized access and remote manipulation. Secure hardware modules and encrypted communication protocols are gaining attention across the value chain. The Global Automotive Electronics Market is adapting to the demand for embedded cybersecurity in both hardware and software components. It now prioritizes compliance with international regulations like WP.29 and ISO/SAE 21434. Cyber resilience is becoming a core requirement for all new vehicle platforms. Automakers are investing in layered security approaches to protect users and infrastructure.

Expansion of Electronics Content in Two-Wheelers and Light Commercial Vehicles:

Electronic integration is no longer limited to high-end passenger cars or SUVs. Two-wheelers and light commercial vehicles are adopting ABS, GPS tracking, and digital instrument clusters. The Global Automotive Electronics Market is broadening with strong uptake in low- and mid-income economies. It supports local manufacturers targeting urban logistics and commuter transportation. Governments in countries like India, Vietnam, and Brazil are enforcing safety mandates across all vehicle categories. Cost-effective electronics tailored to mass markets are gaining share.

Market Challenges Analysis:

Supply Chain Instability and Semiconductor Dependency Constrain Production Capabilities:

The automotive industry remains heavily reliant on a limited number of suppliers for semiconductors and critical electronic components. Disruptions triggered by geopolitical tensions, raw material shortages, and factory shutdowns continue to expose vulnerabilities across the supply chain. The Global Automotive Electronics Market faces persistent risks from these imbalances, especially during periods of demand spikes or logistic bottlenecks. It struggles to maintain production continuity when component lead times extend or inventory backlogs accumulate. Automakers must compete with other high-tech industries for microcontrollers, power ICs, and sensors. This structural dependency limits the pace at which companies can scale production, diversify sourcing, or localize manufacturing.

Complex Integration and High Development Costs Impede Smaller Players:

Automotive electronics require precision engineering, safety validation, and software compatibility across diverse vehicle platforms. Each new feature or module must meet strict performance, compliance, and reliability standards, raising R&D and testing expenditures. The Global Automotive Electronics Market experiences mounting cost pressure as OEMs transition toward connected, autonomous, and electrified platforms. It presents a significant entry barrier for smaller companies lacking the resources to manage hardware-software integration or long certification cycles. Legacy system constraints further slow innovation by restricting compatibility with next-generation components. These challenges can delay time-to-market and reduce the flexibility needed to respond to evolving customer and regulatory demands.

Market Opportunities:

Expansion of Vehicle Electrification Creates Long-Term Growth Avenues:

The shift toward electric mobility presents significant opportunities for electronic system integration across battery management, power conversion, and thermal control. Governments worldwide are investing in charging infrastructure and offering incentives to accelerate EV adoption. The Global Automotive Electronics Market can capitalize on this momentum by supplying advanced electronics that enhance vehicle efficiency, range, and safety. It supports the development of modular EV platforms that require scalable and interoperable electronic components. Demand is rising for lightweight, energy-efficient systems that reduce power loss and optimize load distribution. Suppliers that offer compact, integrated solutions will gain competitive advantages in both OEM and aftermarket segments.

Growth in Software-Defined Vehicles and Connected Services Unlocks Recurring Revenue:

Automakers are adopting software-defined architectures that allow real-time updates, personalized interfaces, and feature monetization. The Global Automotive Electronics Market stands to benefit from this shift through increased demand for high-performance processors, memory modules, and secure connectivity solutions. It enables service-based models where consumers pay for upgrades, diagnostics, or subscriptions. This trend fosters a new ecosystem of hardware and software co-development between automotive and tech firms. Opportunities are growing for electronics providers to embed analytics, cybersecurity, and remote service capabilities into their systems. Market participants that align products with cloud connectivity and digital mobility solutions will access new, recurring revenue streams.

Market Segmentation Analysis:

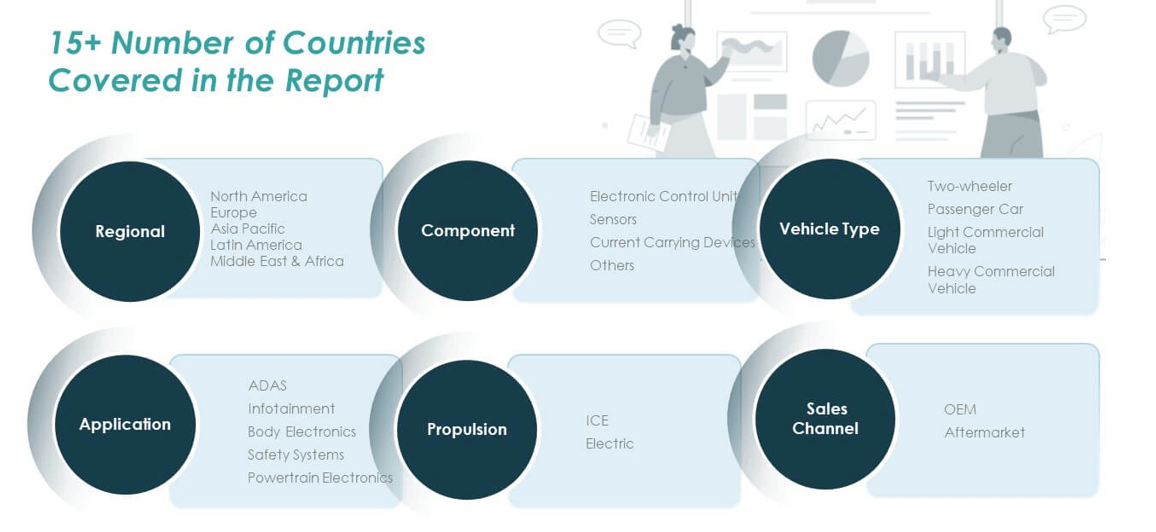

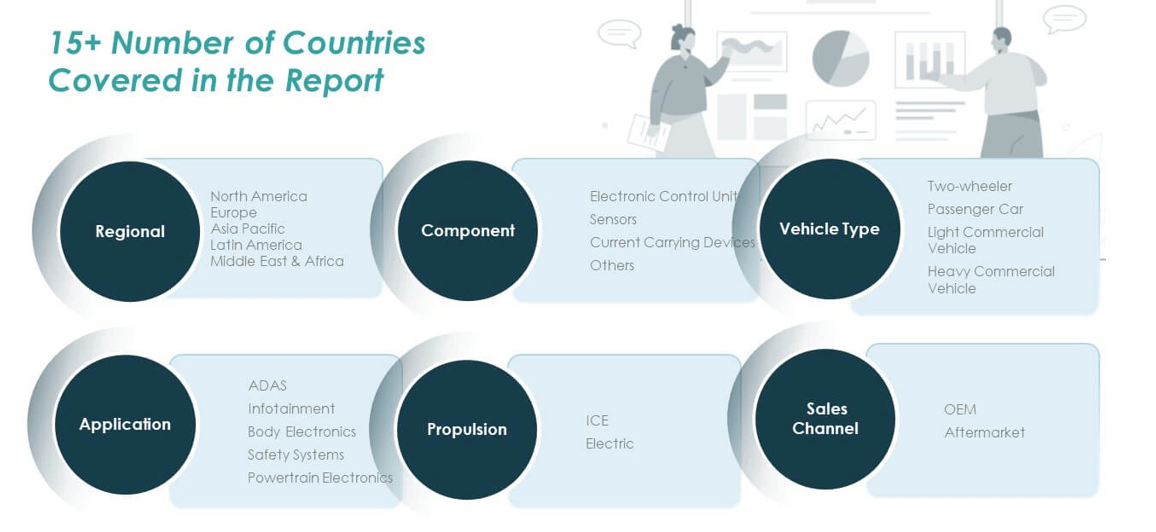

By Component

The Global Automotive Electronics Market includes four primary component segments: Electronic Control Units (ECUs), sensors, current carrying devices, and others. ECUs lead the segment due to their function in coordinating key vehicle operations, including engine performance, braking, and infotainment. Sensors are expanding rapidly, supported by demand for environmental detection and driver-assistance features. Current carrying devices, such as fuses and connectors, play a critical role in power distribution and safety. The “others” category includes lighting electronics, displays, and embedded systems.

- For instance, Bosch is the world’s top MEMS sensor supplier, producing more than 18 billion sensors since 1995 today, the company manufactures over four million MEMS sensors daily, serving automotive and other sectors.

By Application

Key application areas are ADAS, infotainment, body electronics, safety systems, and powertrain electronics. ADAS dominates in growth due to safety mandates and consumer interest in semi-autonomous driving. Infotainment systems continue to advance with touchscreens, voice controls, and smartphone integration. Body electronics, which cover climate control and lighting, support comfort and customization. Safety systems remain essential across vehicle classes. Powertrain electronics are vital for both ICE and EV models, controlling engine performance, emissions, and energy efficiency.

- For instance, Veoneer has delivered more than 4 million camera sensors and over 33 million radar sensors for ADAS, contributing to the integration of advanced safety features by premium global automakers.

By Vehicle Type

This segment includes two-wheelers, passenger cars, light commercial vehicles, and heavy commercial vehicles. Passenger cars lead the segment by volume and value, driven by rising integration of advanced electronics. Light commercial vehicles follow, supported by logistics growth and fleet upgrades. Heavy commercial vehicles use electronics for engine control and safety. Two-wheelers are adopting digital displays, ABS, and tracking systems in emerging markets.

By Propulsion

The propulsion segment is divided into ICE and electric vehicles. ICE vehicles still hold a majority share but face slower growth. Electric vehicles are rapidly expanding due to regulatory incentives and global electrification strategies. It supports increased demand for battery management, inverters, and onboard chargers.

By Sales Channel

Sales are segmented into OEM and aftermarket. OEMs dominate with pre-installed systems embedded during manufacturing. The aftermarket segment is growing through demand for upgrades, diagnostics, and connected features in existing vehicles. It offers new revenue potential across both developed and emerging markets.

Segmentation:

By Component

- Electronic Control Unit (ECU)

- Sensors

- Current Carrying Devices

- Others

By Application

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

By Vehicle Type

- Two-Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Propulsion

- ICE (Internal Combustion Engine)

- Electric

By Sales Channel

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North

The North America Automotive Electronics Market size was valued at USD 46,383.36 million in 2018, reached USD 57,910.78 million in 2024, and is projected to reach USD 102,564.93 million by 2032, at a CAGR of 7.5% during the forecast period. North America holds approximately 21% of the Global Automotive Electronics Market. The region benefits from a strong base of automotive innovation, early adoption of electric and hybrid vehicles, and growing demand for safety and connectivity features. The United States drives most of the regional growth through regulatory initiatives, investments in autonomous mobility, and active collaboration between automakers and tech companies. OEMs are advancing telematics, over-the-air updates, and driver-assistance technologies. The region’s emphasis on research and smart infrastructure supports long-term expansion in vehicle electronics integration.

Europe

The Europe Automotive Electronics Market was valued at USD 43,792.80 million in 2018, reached USD 53,087.89 million in 2024, and is expected to hit USD 88,001.28 million by 2032, growing at a CAGR of 6.6%. Europe accounts for 19% of the Global Automotive Electronics Market, supported by its strong regulatory framework and technology-driven manufacturing base. Germany, France, and the UK lead regional adoption of EV electronics, cybersecurity platforms, and ADAS. Strict emissions targets and EU-wide electrification policies are compelling OEMs to implement smart, energy-efficient electronics. The region plays a central role in developing software-defined vehicles and embedded AI solutions. Strategic alliances between automakers and chip manufacturers are enabling scalable innovation in electronic modules across all vehicle classes.

Asia Pacific

The Asia Pacific Automotive Electronics Market stood at USD 84,953.92 million in 2018, rose to USD 111,019.38 million in 2024, and is projected to reach USD 208,924.37 million by 2032, registering a CAGR of 8.3%. Asia Pacific dominates the Global Automotive Electronics Market with over 45% share, led by China, Japan, South Korea, and India. China spearheads electric vehicle production and battery innovation, while Japan and South Korea contribute high-end sensor, camera, and ECU technologies. India shows strong growth potential through rising digitization and increasing two-wheeler electrification. OEMs across the region are integrating infotainment, safety, and ADAS features across low- and mid-tier models. Government incentives and localized manufacturing have further strengthened the region’s leadership in the global value chain.

Latin America

The Latin America Automotive Electronics Market was valued at USD 12,808.88 million in 2018, increased to USD 16,151.05 million in 2024, and is anticipated to reach USD 26,654.10 million by 2032, expanding at a CAGR of 6.5%. Latin America contributes approximately 6% to the Global Automotive Electronics Market, with Brazil and Mexico as the primary hubs. The region is advancing through rising production of passenger vehicles and light commercial fleets. Automakers are adopting digital clusters, navigation systems, and base-level ADAS to meet urban and regional demand. Trade agreements and economic recovery are fueling interest in building local supply chains. Urban fleet electrification and emission compliance are creating new opportunities for electronics suppliers targeting mid-range and economy segments.

Middle East

The Middle East Automotive Electronics Market was valued at USD 11,924.80 million in 2018, grew to USD 14,554.93 million in 2024, and is forecast to reach USD 24,292.91 million by 2032, at a CAGR of 6.7%. The region represents about 5% of the Global Automotive Electronics Market and is gaining traction through premium vehicle demand and national smart city initiatives. Saudi Arabia and the UAE are promoting EVs and connected mobility, supported by infrastructure for V2X and digital services. OEMs are rolling out models with advanced infotainment and enhanced safety tailored to regional preferences. Government-backed pilot projects are helping integrate EV charging and telematics systems. The market is slowly diversifying to include mid-range offerings equipped with essential electronics.

Africa

The Africa Automotive Electronics Market was valued at USD 5,736.24 million in 2018, increased to USD 9,085.86 million in 2024, and is projected to reach USD 15,787.81 million by 2032, growing at a CAGR of 7.0%. Africa holds the smallest share—approximately 4%—of the Global Automotive Electronics Market but presents long-term growth potential. Rising urbanization, road safety needs, and growing demand for basic electronics such as anti-theft systems, GPS tracking, and infotainment are driving early adoption. South Africa, Nigeria, and Egypt lead regional progress through consumer demand and OEM interest. Local assembly and supply chain development are expanding in response to cost-sensitive vehicle segments. The market is expected to grow steadily through the integration of foundational electronic systems across mass-market vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Continental AG

- DENSO Corporation

- Hella GmbH & Co. Kgaa

- Hitachi Automotive Systems, Ltd.

- Infineon Technologies AG

- Robert Bosch GmbH

- Valeo Inc.

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG

Competitive Analysis:

The Global Automotive Electronics Market features intense competition among leading OEMs, tier-1 suppliers, and technology firms. Key players such as Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, and Panasonic Corporation dominate the landscape through strong product portfolios and global manufacturing capabilities. It is witnessing increased collaboration between automakers and software providers to develop integrated electronic architectures for electric and autonomous vehicles. Companies are focusing on in-house chip development and strategic acquisitions to overcome semiconductor shortages and strengthen vertical integration. Innovation centers around ADAS modules, EV power electronics, infotainment systems, and cybersecurity platforms. Market participants are investing in scalable, software-defined vehicle platforms to gain long-term customer retention and cost advantages. Startups and niche firms face high entry barriers due to certification demands and complex integration requirements. Competitive differentiation relies on the ability to deliver safety, efficiency, and connectivity while maintaining compliance with evolving global regulations.

Recent Developments:

- In Valeo Inc., July 2025 marked the debut of next-generation vehicle technologies at IAA Mobility, focused on software-defined vehicle (SDV) platforms, advanced driver assistance systems (ADAS), electrified mobility, and innovative smart lighting. Noteworthy is the launch of Valeo Ineez™, a new AC charging station with full connectivity and Vehicle-to-Grid (V2G) features, as well as advanced thermal management and eAxle hybridization systems aimed at improving energy efficiency, safety, and driver experience for global automakers.

- In Infineon Technologies AG, June 2025 brought the announcement of a strategic partnership with IDEMIA Secure Transactions to advance digital car access solutions using secure embedded software and cryptography, strengthening security and convenience for connected vehicles. Moreover, in May 2025, Infineon entered a formal collaboration with Visteon to develop advanced power conversion systems for next-generation electric vehicles, leveraging wide bandgap semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) to improve efficiency and reliability in EV drivetrain modules.

- In Visteon Corporation, May 2025 witnessed the company forming a strategic partnership with Infineon Technologies AG to co-develop next-generation EV powertrain systems. The collaboration leverages cutting-edge semiconductor technologies to significantly enhance energy efficiency and reduce system costs in upcoming vehicle models, including advanced battery junction boxes, DC-DC converters, and on-board chargers.

Market Concentration & Characteristics:

The Global Automotive Electronics Market is moderately concentrated, with a few dominant players controlling significant market share across multiple product segments. It is characterized by high capital intensity, long development cycles, and stringent regulatory requirements. The market favors established firms with advanced R&D capabilities, global supply chains, and strategic partnerships with automakers. Innovation, scale, and reliability drive competitive advantage, especially in areas such as ADAS, power electronics, and in-vehicle connectivity. The market exhibits high entry barriers due to complex integration demands and certification standards. It is also shaped by rapid technological evolution and growing dependence on semiconductor components.

Report Coverage:

The research report offers an in-depth analysis based on component, application, vehicle type, propulsion, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Integration of AI in vehicle electronics will enhance real-time decision-making and personalized driving experiences.

- Demand for domain and zonal architectures will rise to support centralized vehicle control and software-defined features.

- Growth in EV production will accelerate the need for high-voltage power electronics and thermal management systems.

- Expansion of 5G infrastructure will support faster, more reliable V2X communication and cloud-based vehicle services.

- Regulatory mandates will continue to drive adoption of safety-critical electronics such as ADAS and electronic braking systems.

- Increased consumer focus on digital lifestyles will push OEMs to offer advanced infotainment and connectivity platforms.

- Semiconductor innovation and local chip manufacturing will become essential to mitigate supply chain risks.

- Cybersecurity solutions will gain importance due to rising threats in connected and autonomous vehicles.

- Sustainability trends will influence the design of energy-efficient and recyclable electronic components.

- Partnerships between automakers and tech firms will intensify to accelerate innovation in embedded automotive software.