Market Overview

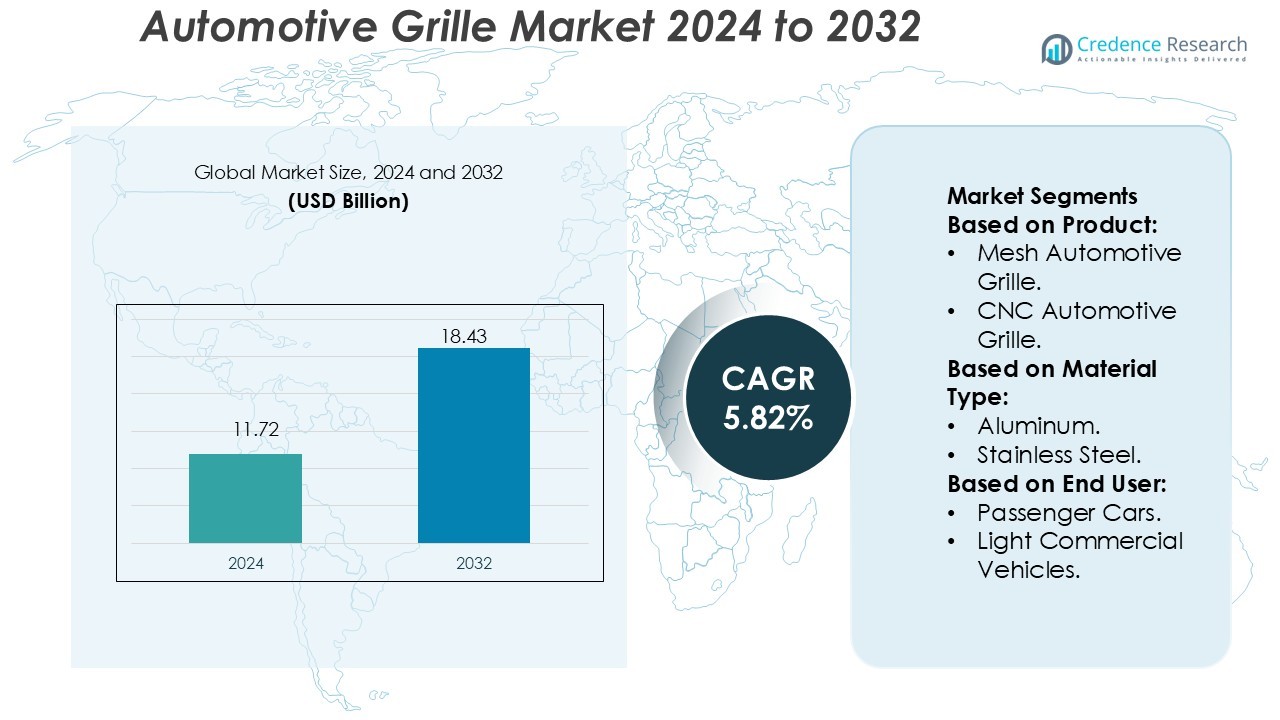

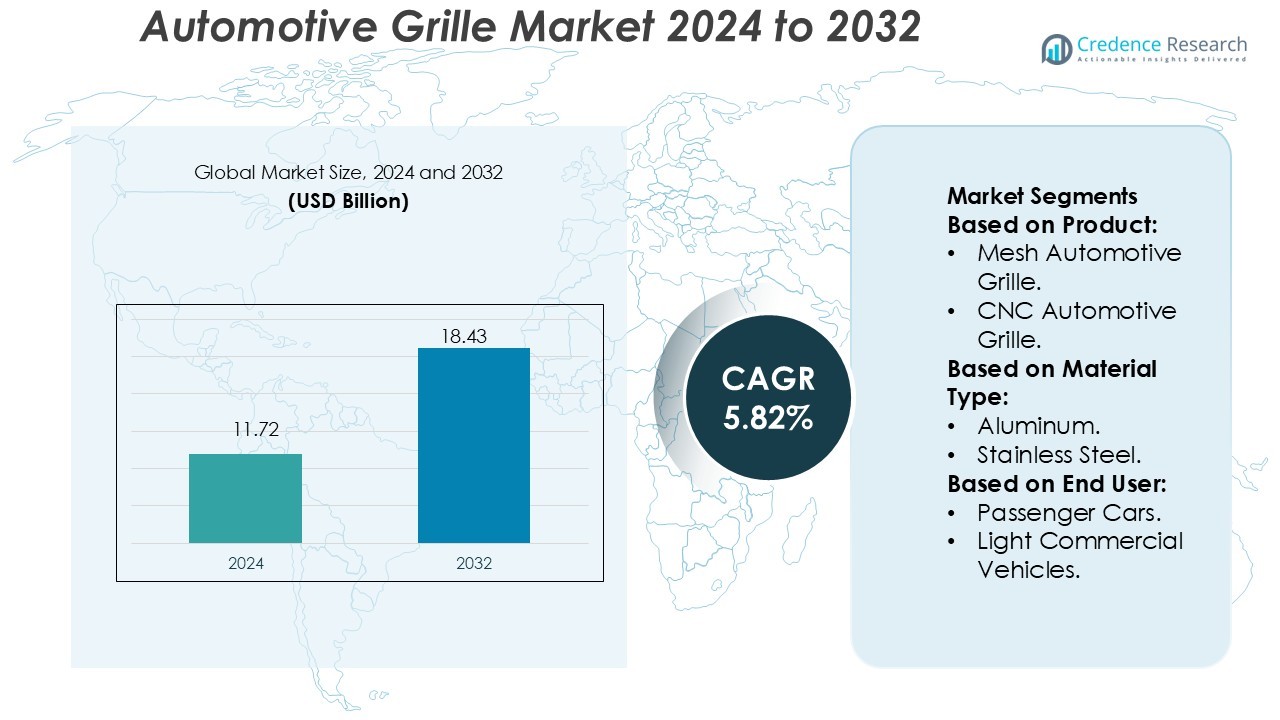

Automotive Grille Market size was valued USD 11.72 billion in 2024 and is anticipated to reach USD 18.43 billion by 2032, at a CAGR of 5.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Grille Market Size 2024 |

USD 11.72 Billion |

| Automotive Grille Market, CAGR |

5.82% |

| Automotive Grille Market Size 2032 |

USD 18.43 Billion |

The Automotive Grille Market is driven by leading manufacturers such as Tata Motors, Mahindra & Mahindra Ltd., Hyundai Motor India, MARUTI SUZUKI INDIA LIMITED, Honda Motor Co., Ltd., Mercedes-Benz Group AG, Bajaj Auto Ltd., ASHOK LEYLAND, EICHER MOTORS LIMITED, and Piaggio & C. SpA. These companies focus on advanced grille technologies that enhance vehicle aerodynamics, aesthetics, and brand identity. Innovations in lightweight materials, smart airflow systems, and illuminated grille designs are shaping competitive differentiation. Asia-Pacific leads the market with a 33% share, supported by high vehicle production in India, China, and Japan. Expanding electric vehicle manufacturing and consumer preference for stylish, efficient designs further strengthen the region’s dominance in the global automotive grille industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Grille Market was valued at USD 11.72 billion in 2024 and is projected to reach USD 18.43 billion by 2032, growing at a CAGR of 5.82% during the forecast period.

- Rising vehicle production and consumer demand for stylish, aerodynamic designs are major growth drivers boosting grille innovation.

- The market is witnessing strong trends in lightweight materials, smart airflow systems, and illuminated grille technologies enhancing performance and aesthetics.

- High production costs and regulatory requirements for recyclability and safety remain key restraints affecting smaller manufacturers.

- Asia-Pacific leads with a 33% share, driven by robust automotive manufacturing in India, China, and Japan, while Mesh Grilles dominate the product segment due to their superior airflow efficiency and visual appeal.

Market Segmentation Analysis:

By Product

The Mesh Automotive Grille segment dominates the market with the largest share due to its widespread use in passenger and commercial vehicles. Its lightweight design, high airflow efficiency, and aesthetic appeal make it a preferred choice for modern vehicles. Automakers integrate mesh grilles to enhance engine cooling and improve aerodynamic performance. CNC and billet grilles follow, catering to premium and performance car models that emphasize durability and customized styling. The rising adoption of advanced manufacturing technologies supports innovation and design flexibility in grille production across major vehicle segments.

- For instance, Mercedes‑Benz Group AG has introduced a new “iconic grille” for its upcoming electric GLC model featuring 942 individually backlit LED dots arranged in a smoked-glass lattice structure, transforming the front fascia into an illuminated digital graphic.

By Material Type

The ABS Plastic segment holds the dominant market share, driven by its lightweight nature, cost-effectiveness, and high resistance to impact and corrosion. It is extensively used in passenger cars and light commercial vehicles to improve fuel efficiency and vehicle design flexibility. Aluminum and stainless-steel grilles occupy notable shares in luxury and heavy-duty vehicles due to superior strength and heat resistance. The increasing use of recyclable and thermoplastic composites further enhances production sustainability and aligns with automakers’ lightweighting strategies for improved vehicle performance.

- For instance, Fuji Electric’s ALPHA7 series servo drive achieves an “industry-leading” speed and frequency response of 3.2 kHz, enabling ultra-high-speed control and reducing tact time.The system uses a 24-bit fine-resolution incremental/absolute (INC/ABS) encoder, providing significantly improved control precision for demanding applications.

By End-User

The Passenger Cars segment leads the Automotive Grille Market with the highest share, supported by global growth in automobile production and consumer demand for enhanced aesthetics. Automakers focus on integrating stylish, aerodynamic grilles to differentiate vehicle designs and optimize engine ventilation. Light commercial vehicles follow closely, benefiting from rising logistics and urban transport demand. Heavy commercial vehicles maintain steady growth with emphasis on durability and heat management. The surge in electric and hybrid vehicle adoption also influences grille designs, emphasizing both functionality and brand identity.

Key Growth Drivers

Increasing Vehicle Production and Customization Demand

Rising global automobile production and growing consumer interest in vehicle personalization drive demand for automotive grilles. Manufacturers are focusing on grille designs that enhance aesthetics, brand identity, and engine airflow efficiency. The availability of customizable grille options in premium and mid-range vehicles further supports market growth. Automakers integrate unique front-end designs to differentiate models and attract customers. Expanding aftermarket sales for custom grilles also contribute to revenue, particularly in markets emphasizing vehicle modification and performance enhancement.

- For instance, The Control Techniques Unidrive M700 series has a heavy-duty peak rating of 200% (or twice the continuous current) for 3 seconds. This means a drive with a 20A continuous rating would indeed have a 40A peak current rating.

Advancements in Lightweight Materials and Manufacturing Technologies

Continuous innovation in material science, including the use of ABS plastics, carbon fiber, and aluminum, strengthens grille performance and reduces vehicle weight. Advanced manufacturing processes such as 3D printing, CNC machining, and precision molding improve design accuracy and production efficiency. These technologies enable manufacturers to produce complex grille patterns that enhance airflow and durability. The focus on lightweighting to improve fuel efficiency and comply with emission regulations boosts adoption of advanced material-based grilles across all vehicle categories.

- For instance, Beckhoff’s AM8064-wLyz variant (with ‘L’ as the winding code), the motor delivers. A standstill torque of 35.4 Nm. A peak torque of 148 Nm. A rated speed of 1,500 rpm (revolutions per minute).

Expansion of Electric and Hybrid Vehicles

The rapid expansion of electric and hybrid vehicle production is reshaping grille designs to meet new performance needs. While EVs require less airflow, manufacturers use grilles for cooling battery systems and improving aerodynamics. Automakers are developing closed and active grille shutters to optimize airflow and energy efficiency. Companies like Tesla and BMW employ innovative front fascia designs that combine aesthetics with thermal management. The integration of smart grille technologies in EVs supports better performance, vehicle safety, and energy optimization, driving long-term market growth.

Key Trends & Opportunities

Adoption of Smart and Active Airflow Grilles

Automotive OEMs are increasingly integrating smart grille systems that regulate airflow based on engine temperature and driving conditions. Active grille shutters improve fuel efficiency by reducing aerodynamic drag and maintaining optimal engine temperatures. These systems are now standard in many mid- to high-end vehicles. As connected vehicle technologies advance, smart grilles with embedded sensors and actuators will enhance vehicle performance and sustainability, presenting strong growth opportunities for grille manufacturers focused on innovation and intelligent control systems.

- For instance, Delta’s ASDA-B2 servo drive supports a 17-bit encoder (160,000 pulses per revolution) and a command input rate of up to 4 Mbps for high-precision positioning.

Growing Focus on Aesthetic and Brand Differentiation

Automotive grilles have evolved from functional components to key design elements that define brand identity. Companies are investing in distinctive grille patterns, finishes, and lighting features to create a signature look. For instance, luxury brands like Lexus and BMW emphasize bold grille designs as brand hallmarks. Rising consumer interest in premium aesthetics and vehicle personalization drives manufacturers to introduce customizable and illuminated grilles. This trend fuels competition and innovation in grille styling and materials, aligning with evolving consumer preferences.

- For instance, Danfoss’ VLT AutomationDrive FC 302 includes an Integrated Motion Controller (IMC) that performs high-precision positioning and synchronization tasks without requiring extra hardware (e.g. encoder modules).

Key Challenges

High Manufacturing and Design Costs

Developing advanced grilles with premium materials, smart sensors, and active control mechanisms involves significant R&D and production costs. High tooling and mold fabrication expenses increase the overall manufacturing budget, particularly for low-volume models. Smaller suppliers face difficulties in adopting automation and precision design technologies due to limited capital resources. Maintaining quality standards while controlling costs remains a major challenge for manufacturers, especially as automakers demand more innovative and cost-effective grille solutions across diverse vehicle lines.

Stringent Environmental and Safety Regulations

Compliance with environmental and vehicle safety standards poses a key challenge for grille manufacturers. Regulations promoting lightweight materials and recyclability require redesigning production processes and material sourcing. Additionally, pedestrian safety standards influence grille structure and placement, limiting design flexibility. Manufacturers must balance aesthetic appeal with impact absorption capabilities to meet regional safety norms. Adapting to these evolving regulations increases operational complexity and raises development costs, particularly in markets with strict automotive component testing and certification requirements.

Regional Analysis

North America

North America holds a 31% share of the Automotive Grille Market, driven by high vehicle production and strong demand for SUVs and pickup trucks. The United States dominates regional sales, with leading automakers integrating advanced grille designs for improved aerodynamics and aesthetics. The rise in electric vehicle production has spurred innovation in active air-flap grilles and lightweight materials. Manufacturers focus on combining functionality with brand identity, using stainless steel and ABS plastic materials. Growing customization trends and a robust aftermarket sector continue to strengthen the region’s competitive position in grille manufacturing and design.

Europe

Europe accounts for a 29% share of the global market, supported by premium car production and a strong focus on vehicle aesthetics and sustainability. Germany, the UK, and France lead the market, with manufacturers adopting innovative grille technologies for electric and hybrid vehicles. Stringent emission and safety regulations drive the use of lightweight, recyclable materials. Automakers like BMW, Audi, and Mercedes-Benz prioritize grille designs as a brand-defining element. Continuous investment in aerodynamic efficiency and smart grille systems reinforces Europe’s position as a hub for automotive design innovation and advanced engineering.

Asia-Pacific

Asia-Pacific dominates the Automotive Grille Market with a 33% share, driven by expanding automobile production in China, Japan, India, and South Korea. Rising disposable incomes and rapid urbanization boost passenger car sales, increasing grille demand. The region benefits from strong supply chains and cost-effective manufacturing capabilities. Automakers are focusing on using high-strength plastics and aluminum to reduce vehicle weight and improve fuel efficiency. The shift toward electric vehicles and compact designs encourages new grille technologies tailored for energy efficiency and aesthetic appeal. Asia-Pacific remains the fastest-growing market due to strong OEM presence and production scalability.

Latin America

Latin America captures a 4% share of the global market, supported by increasing vehicle assembly operations and expanding aftermarket customization. Brazil and Mexico lead regional growth, focusing on cost-effective grille designs for passenger and commercial vehicles. Local manufacturers are adopting polymer-based materials to balance durability and affordability. The growing trend of vehicle personalization among younger consumers further stimulates demand. Despite economic challenges, investments in automotive component manufacturing and rising exports to North America are enhancing the region’s market potential for automotive grilles.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, with growing demand for luxury and commercial vehicles fueling steady expansion. The UAE, Saudi Arabia, and South Africa are key contributors, emphasizing premium vehicle imports and localized assembly. Harsh climatic conditions drive the adoption of corrosion-resistant materials such as stainless steel and coated aluminum. Expanding automotive service networks and aftermarket sales also support market growth. Increasing adoption of SUVs and premium sedans, coupled with gradual industrial diversification, continues to strengthen regional demand for durable and high-performance automotive grille systems.

Market Segmentations:

By Product:

- Mesh Automotive Grille.

- CNC Automotive Grille.

By Material Type:

By End User:

- Passenger Cars.

- Light Commercial Vehicles.

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Grille Market features major players such as Piaggio & C. SpA, EICHER MOTORS LIMITED, Mercedes-Benz Group AG, Bajaj Auto Ltd., Tata Motors, Mahindra & Mahindra Ltd., Honda Motor Co., Ltd., ASHOK LEYLAND, MARUTI SUZUKI INDIA LIMITED, and Hyundai Motor India. The Automotive Grille Market is defined by rapid innovation, material advancement, and strong emphasis on vehicle aesthetics. Manufacturers are focusing on developing lightweight, durable, and aerodynamic grille systems that enhance both design and functionality. Integration of smart and active airflow technologies is becoming common, improving engine cooling and fuel efficiency. Companies are investing in sustainable materials like ABS plastics and aluminum to meet emission standards and reduce vehicle weight. Growing consumer demand for customized vehicle designs further intensifies competition, encouraging continuous product upgrades and strategic collaborations across the automotive value chain.

Key Player Analysis

- Piaggio & C. SpA

- EICHER MOTORS LIMITED

- Mercedes-Benz Group AG

- Bajaj Auto Ltd.

- Tata Motors

- Mahindra & Mahindra Ltd.

- Honda Motor Co., Ltd.

- ASHOK LEYLAND

- MARUTI SUZUKI INDIA LIMITED

- Hyundai Motor India

Recent Developments

- In May 2025, Tata Motors has launched the All-New Altroz in India at a starting price of around positioning it as a premium hatchback with a bold design, luxurious interiors, and advanced features. The vehicle now includes segment-first features such as flush door handles, Infinity LED tail lamps, Luminate LED headlamps with DRLs, and a 3D front grille.

- In March 2025, Mercedes-Benz has launched the Mercedes-Maybach SL 680 Monogram Series in India at an ex-showroom price of Deliveries are expected to begin in Q1 2026, with customer consultations starting immediately.

- In June 2024, Melexis launched the MLX81123, a new LED driver IC that miniaturizes its LIN RGB family by offering smaller SOIC8 and DFN-8 3mm x 3mm packages. This miniaturization allows for more ambient lighting applications in vehicles by overcoming previous space constraints, building on the success of its predecessor, the MLX81113.

- In March 2024, Semilux International Ltd. announced the initiation of a research and development (R&D) program in collaboration with researchers and academics from Taiwanese universities to develop a cutting-edge solid-state LiDAR module for automotive applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Material Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lightweight and aerodynamic grille designs will continue to increase.

- Electric and hybrid vehicles will drive innovation in closed and smart grille systems.

- Use of sustainable and recyclable materials will become a key manufacturing focus.

- Integration of active air-flap technologies will improve vehicle efficiency and cooling.

- Customization and aesthetic differentiation will strengthen aftermarket grille demand.

- 3D printing and CNC machining will enhance design precision and production speed.

- Automakers will invest more in illuminated and sensor-integrated grille technologies.

- Premium vehicle sales will boost adoption of advanced grille styling and finishes.

- Collaboration between OEMs and suppliers will accelerate innovation in grille components.

- Regulatory focus on emission reduction will influence grille material and structural design choices.