Market Overview:

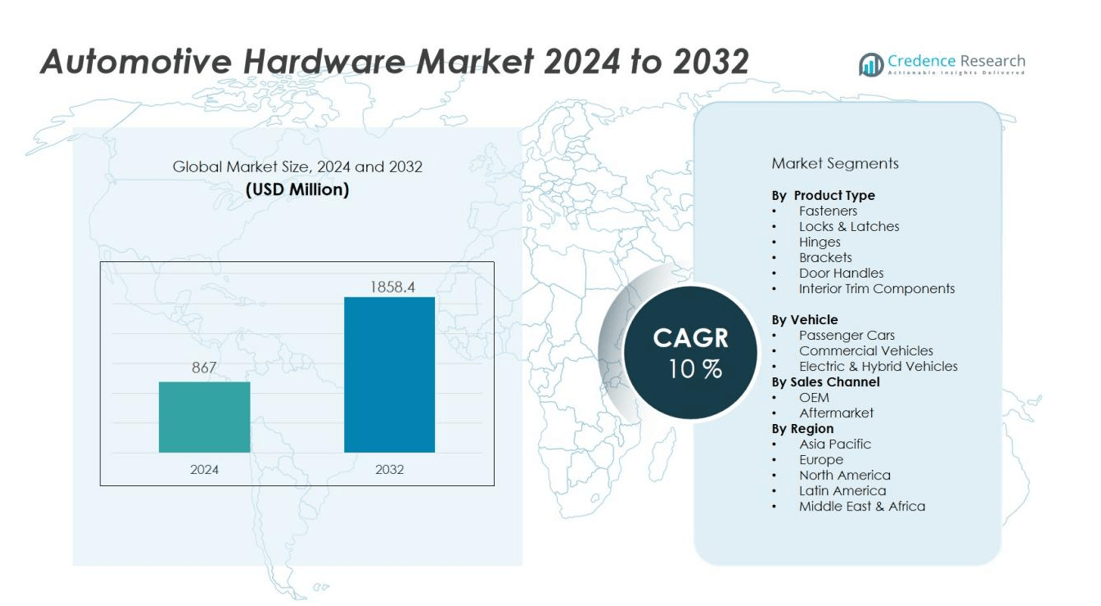

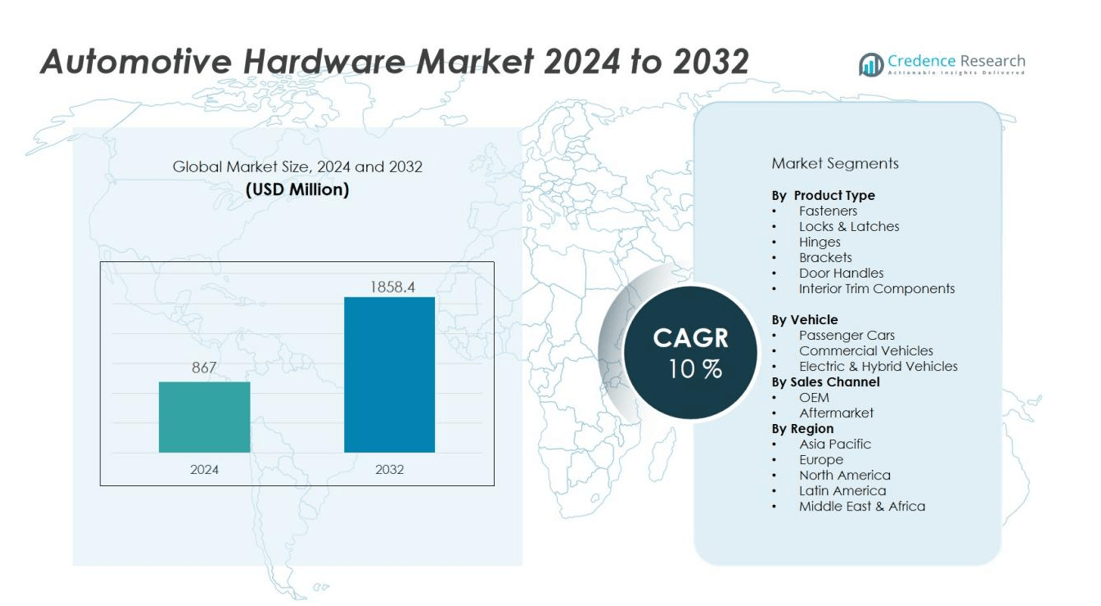

The automotive hardware market size was valued at USD 867 million in 2024 and is anticipated to reach USD 1858.4 million by 2032, at a CAGR of 10 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Hardware Market Size 2024 |

USD 867 million |

| Automotive Hardware Market, CAGR |

10% |

| Automotive Hardware Market Size 2032 |

USD 1858.4 million |

Key drivers include the ongoing expansion of the automotive industry, especially in emerging economies, coupled with stringent safety and quality standards imposed by regulatory bodies. The shift toward electric vehicles and smart automotive systems further stimulates demand for specialized hardware that supports advanced functionalities and enhanced vehicle safety. OEMs and suppliers are investing in innovative product development, focusing on corrosion resistance, weight reduction, and cost efficiency to gain competitive advantage.

Regionally, Asia Pacific dominates the automotive hardware market, accounting for the largest share due to robust manufacturing activity in China, India, and Japan. North America and Europe follow, supported by established automotive sectors and continuous technological advancements. Emerging markets in Latin America and the Middle East present additional growth opportunities, fueled by rising automotive production and infrastructure development.

Market Insights:

- The automotive hardware market was valued at USD 867 million in 2024 and will reach USD 1,858.4 million by 2032.

- Expansion of automotive manufacturing in emerging economies drives robust demand for high-performance hardware.

- Stringent global safety and quality regulations push manufacturers to invest in durable, corrosion-resistant, and efficient components.

- The shift toward electric vehicles and smart systems fuels the need for lightweight and advanced automotive hardware.

- Supply chain disruptions and raw material price volatility challenge manufacturers, prompting focus on sourcing and cost management.

- Asia Pacific leads with a 46% market share, while North America and Europe benefit from innovation, strong supply chains, and sustainability initiatives.

- Rising complexity in vehicle design and compliance requirements fosters continuous R&D, helping companies maintain a competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Vehicle Production Fuels Hardware Demand:

Automotive production continues to rise, particularly in emerging economies with growing middle-class populations and increasing urbanization. The automotive hardware market benefits from expanded manufacturing activity, higher vehicle sales, and an uptrend in both passenger and commercial vehicle production. OEMs require reliable, high-performance hardware components to meet output targets and quality benchmarks. This steady rise in production volume directly drives demand for advanced and cost-effective automotive hardware.

- Volkswagen Group produced 9.31 million vehicles globally in 2023, representing a 6.8% increase from the prior year and demonstrating a 2.5% rise in productivity, including its Chinese joint ventures.

Stringent Safety and Regulatory Standards Shape Product Requirements:

Governments and industry regulators worldwide impose strict safety and performance standards on vehicles. The automotive hardware market responds by investing in hardware components that meet crashworthiness, durability, and quality regulations. Compliance with these standards prompts manufacturers to develop products with enhanced material strength, corrosion resistance, and longer service life. Safety-focused innovation supports hardware adoption across all vehicle segments.

- For instance, Mercedes-Benz integrated more than 100 vehicle safety functions—including advanced driver-assistance systems—that help their cars consistently achieve a top 5-star rating in Euro NCAP crash tests.

Advancement in Vehicle Technologies and Electrification:

Growth in electric vehicles and adoption of smart technologies require specialized hardware solutions. The automotive hardware market sees rising demand for lightweight, robust, and multi-functional components to support advanced features in electric and connected vehicles. Automakers seek products that facilitate modular assembly, reduce vehicle weight, and integrate seamlessly with electronic systems. This trend propels ongoing development of next-generation automotive hardware.

Sustained Investment in R&D and Product Innovation:

Companies prioritize research and development to deliver differentiated hardware solutions tailored to modern automotive needs. The automotive hardware market evolves through continuous innovation in materials, design, and manufacturing processes. Firms focus on products that provide superior performance, cost efficiency, and adaptability to changing vehicle platforms. R&D initiatives support long-term growth and help maintain competitive positioning in a dynamic automotive landscape.

Market Trends:

Growing Emphasis on Lightweight Materials and Sustainable Manufacturing:

Automotive manufacturers prioritize lightweight materials and sustainable practices to meet fuel efficiency targets and environmental regulations. The automotive hardware market experiences strong demand for hardware components made from advanced alloys, high-strength plastics, and composite materials. Companies develop corrosion-resistant and recyclable hardware that aligns with sustainability goals and supports vehicle weight reduction strategies. This trend drives adoption of innovative fastening and structural solutions, enabling improved energy efficiency and lower emissions. Manufacturers adopt greener production processes and promote the use of recycled materials across their product portfolios.

- For instance, Ford achieved a weight reduction of up to 700 pounds in its best-selling F-150 model by introducing an aluminum-intensive body in 2015, directly improving fuel economy while maintaining truck durability and safety performance.

Integration of Smart Features and Customization in Automotive Hardware:

The trend toward smart vehicles leads to greater integration of electronic and sensor-based hardware solutions. The automotive hardware market responds with development of intelligent locking systems, anti-theft devices, and components supporting connected vehicle technologies. Automakers also seek greater customization options, requiring flexible and modular hardware that adapts to varied vehicle models and user preferences. Demand rises for hardware that supports safety, comfort, and advanced infotainment features. These innovations drive the evolution of hardware design, positioning it as a critical enabler of next-generation vehicle functionality.

- For instance, Panasonic’s Cirrus 2.0 platform supports V2X (vehicle-to-everything) systems for state departments and commercial fleets, managing V2X operations across hundreds of infrastructure devices to improve safety and roadway efficiency.

Market Challenges Analysis:

Supply Chain Disruptions and Volatility in Raw Material Prices:

Automotive hardware manufacturers face ongoing supply chain disruptions and unpredictable raw material prices. The automotive hardware market feels the impact of global events, trade restrictions, and logistics bottlenecks that delay the delivery of essential components. Companies must navigate shortages of key materials such as steel, aluminum, and specialty plastics. Price volatility increases production costs and pressures margins for both OEMs and suppliers. Firms invest in diversified sourcing strategies and inventory management to address these uncertainties.

Rising Complexity of Design and Compliance Requirements:

Modern vehicles demand hardware that supports advanced safety, connectivity, and comfort features, increasing the complexity of design specifications. The automotive hardware market responds to evolving technical requirements while ensuring compliance with rigorous international standards. Manufacturers must balance innovation with strict quality control, leading to higher development costs and longer lead times. Integration of new materials and smart features challenges traditional manufacturing processes. Companies that adapt quickly to these demands maintain their competitive edge in the market.

Market Opportunities:

Expansion of Electric and Autonomous Vehicle Segments:

Growth in electric and autonomous vehicles opens new opportunities for hardware manufacturers. The automotive hardware market benefits from demand for specialized connectors, brackets, and advanced fastening systems that support high-voltage battery modules, sensors, and autonomous driving components. OEMs seek lightweight and durable hardware to maximize efficiency and ensure safety in next-generation vehicles. Companies that invest in R&D for application-specific solutions will capture a greater share of emerging segments. Collaboration with technology firms and mobility startups can further drive innovation and business expansion.

Rising Demand for Aftermarket and Customization Solutions:

The automotive hardware market gains opportunities from the expanding aftermarket and rising consumer preference for vehicle customization. Owners and fleet operators seek hardware upgrades that enhance security, performance, and aesthetics. Suppliers can leverage digital platforms and e-commerce channels to reach wider customer bases. Product lines that focus on retrofit applications, modular systems, and easy-to-install solutions hold significant growth potential. Firms that offer tailored products for diverse vehicle types and regional needs will position themselves favorably in the evolving automotive landscape.

Market Segmentation Analysis:

By Product:

The automotive hardware market covers a diverse range of components, including fasteners, locks, hinges, brackets, door handles, and interior trim parts. Fasteners represent the largest product segment due to their universal application across vehicle types and critical role in structural integrity. Demand for lightweight and corrosion-resistant products continues to rise, driving innovation in material selection and design. Hardware supporting advanced safety and electronic features gains traction, reflecting the industry’s transition toward connected and autonomous vehicles.

- For instance, the adoption of Nylon SHIELD coating enables steel fasteners to pass a 15-year corrosion resistance simulation, outperforming industry standards for mixed-material joints like steel-to-magnesium.

By Vehicle:

Passenger vehicles account for the largest share of the automotive hardware market, supported by steady global production and rising consumer demand for comfort and safety enhancements. Commercial vehicles—such as trucks, buses, and vans—create substantial opportunities for specialized and heavy-duty hardware, particularly in logistics, public transport, and construction sectors. The emergence of electric and hybrid vehicles propels demand for hardware solutions that integrate with high-voltage systems and lightweight structures.

- Ford’s connected telematics solutions now offer video dashcams and predictive maintenance for all commercial vans and trucks, with over 700 Ford Commercial Vehicle Centers supporting these technologies in 2025.

By Sales Channel:

OEMs dominate sales channels in the automotive hardware market, supplying parts directly to automakers for assembly in new vehicles. The aftermarket segment shows strong growth, driven by rising vehicle parc, maintenance requirements, and consumer interest in customization. Companies leverage e-commerce platforms and distributor networks to reach end-users and expand market access. The balance between OEM and aftermarket channels sustains competitive dynamics and continuous product development.

Segmentations:

By Product:

- Fasteners

- Locks & Latches

- Hinges

- Brackets

- Door Handles

- Interior Trim Components

By Vehicle:

- Passenger Cars

- Commercial Vehicles

- Electric & Hybrid Vehicles

By Sales Channel:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific :

Asia Pacific commands a 46% share of the global automotive hardware market, driven by robust vehicle production in China, Japan, South Korea, and India. Rapid industrialization, rising disposable incomes, and expanding automotive manufacturing hubs fuel hardware demand. Governments in the region support local production through investment incentives and favorable trade policies. Major OEMs and suppliers establish manufacturing facilities to capitalize on cost advantages and skilled labor availability. The region also leads in the adoption of advanced materials and sustainable manufacturing practices. Continuous investment in research and technology development strengthens Asia Pacific’s leadership position.

North America :

North America accounts for a 27% share of the automotive hardware market, supported by established automotive sectors in the United States, Canada, and Mexico. The region benefits from high R&D spending, stringent safety standards, and a well-developed supply chain network. Companies focus on innovation, particularly for electric vehicles, autonomous driving technologies, and connected car features. Government policies encourage domestic production and the integration of advanced manufacturing processes. North America’s market structure enables quick adoption of new materials and product solutions that enhance vehicle performance and safety.

Europe:

Europe captures a 20% share of the automotive hardware market, led by Germany, France, Italy, and the United Kingdom. Automakers and suppliers in the region emphasize sustainability, energy efficiency, and compliance with strict emission regulations. European companies invest in lightweight and recyclable hardware solutions to meet evolving environmental standards. The region’s strong engineering expertise supports development of high-performance hardware for premium and electric vehicles. Europe’s collaborative innovation ecosystem accelerates product development and helps maintain a competitive edge on the global stage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DSpace GmbH

- Continental AG

- Magna International Inc.

- Typhoon HIL, Inc.

- PHINIA Inc. (Delphi Automotive PLC)

- IPG Automotive GmbH

- AURORA FLIGHT SCIENCES

- Robert Bosch GmbH

- ANSYS, Inc.

- Softing Automotive Electronics GmbH

Competitive Analysis:

The automotive hardware market features a mix of global leaders and specialized technology firms, driving innovation and competition. Key players include DSpace GmbH, Continental AG, Magna International Inc., Typhoon HIL, Inc., PHINIA Inc. (Delphi Automotive PLC), IPG Automotive GmbH, and AURORA FLIGHT SCIENCE. Companies focus on product differentiation, advanced materials, and digital integration to meet evolving vehicle requirements. Continental AG and Magna International Inc. leverage broad portfolios and global reach to secure OEM contracts. Technology-driven firms like DSpace GmbH and Typhoon HIL, Inc. excel in simulation, testing, and integration services for next-generation vehicles. The automotive hardware market requires strong R&D capabilities, supply chain agility, and strategic alliances to maintain competitive advantage. Continuous investment in safety, connectivity, and sustainability supports long-term growth and market leadership.

Recent Developments:

- In January 2025, dSPACE GmbH announced a partnership with Stellantis to accelerate cloud-based vehicle development, integrating dSPACE’s simulation solutions into Stellantis’ engineering processes for enhanced software innovation and development cycles.

- In September 2024, Continental AG launched two new versions of its ContiConnect tire management platform—ContiConnect Lite and ContiConnect Pro—at the IAA Transportation event in Hanover, aiming to reduce fleet costs and enhance sustainability.

- In June 2025, Typhoon HIL, Inc. entered into a collaboration with Infineon to provide innovative tools for automotive engineering teams, concentrating on real-time HIL platform

Market Concentration & Characteristics:

The automotive hardware market demonstrates moderate concentration, with several global and regional players holding significant shares. Leading companies focus on strategic partnerships, mergers, and acquisitions to strengthen their market presence and expand product portfolios. The market features a mix of large multinational firms and specialized local suppliers, fostering competitive dynamics and ongoing innovation. Product differentiation, technological advancement, and adherence to quality standards define the market’s key characteristics. OEMs and suppliers prioritize reliability, durability, and cost efficiency when selecting hardware components. The automotive hardware market evolves in response to changing vehicle technologies and regulatory requirements, driving continuous investment in R&D and process optimization.

Report Coverage:

The research report offers an in-depth analysis based on Product, Vehicle, Sales Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Investments in advanced materials will drive development of lightweight, high‑strength components for future vehicle platforms, meeting efficiency and safety targets.

- Suppliers will integrate smart functionalities into hardware designs, enabling seamless compatibility with electronic systems and automated features.

- Modular and scalable hardware solutions will gain traction, allowing OEMs to streamline assembly and customize vehicle variants.

- Tier‑1 and Tier‑2 suppliers will expand digital manufacturing capabilities and automation to reduce costs and improve lead times.

- Flexible production strategies will help companies respond quickly to shifting demand and supply disruptions.

- Collaborative partnerships between hardware providers and technology firms will foster innovation in hardware that supports electric and autonomous vehicles.

- Circular economy practices will influence hardware design, leading to increased use of recyclable materials and closed‑loop manufacturing.

- Aftermarket demand will grow for retrofit and upgrade hardware, targeting vehicle personalization and performance enhancements.

- Regional suppliers in emerging markets will expand their footprint, driven by rising domestic vehicle production and favorable trade policies.

- Continuous investment in R&D will optimize product durability, integration, and cost efficiency, reinforcing competitive advantage for adaptable hardware providers.