Market Overview:

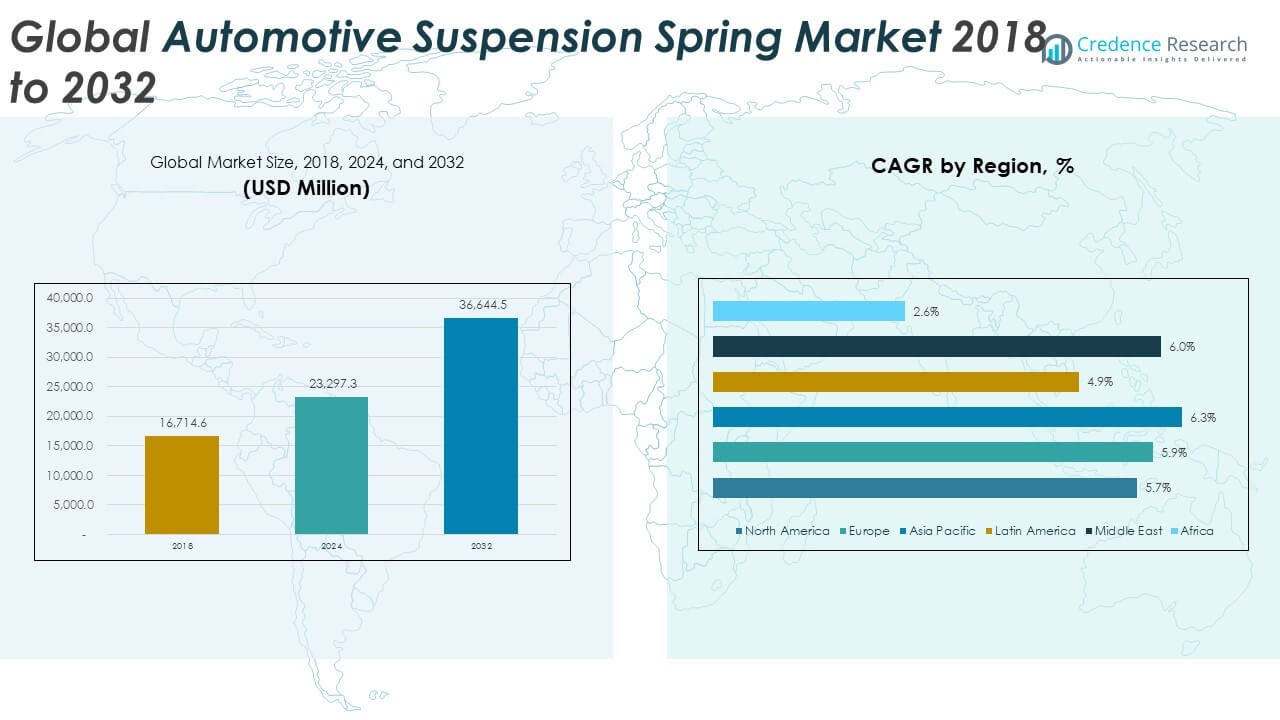

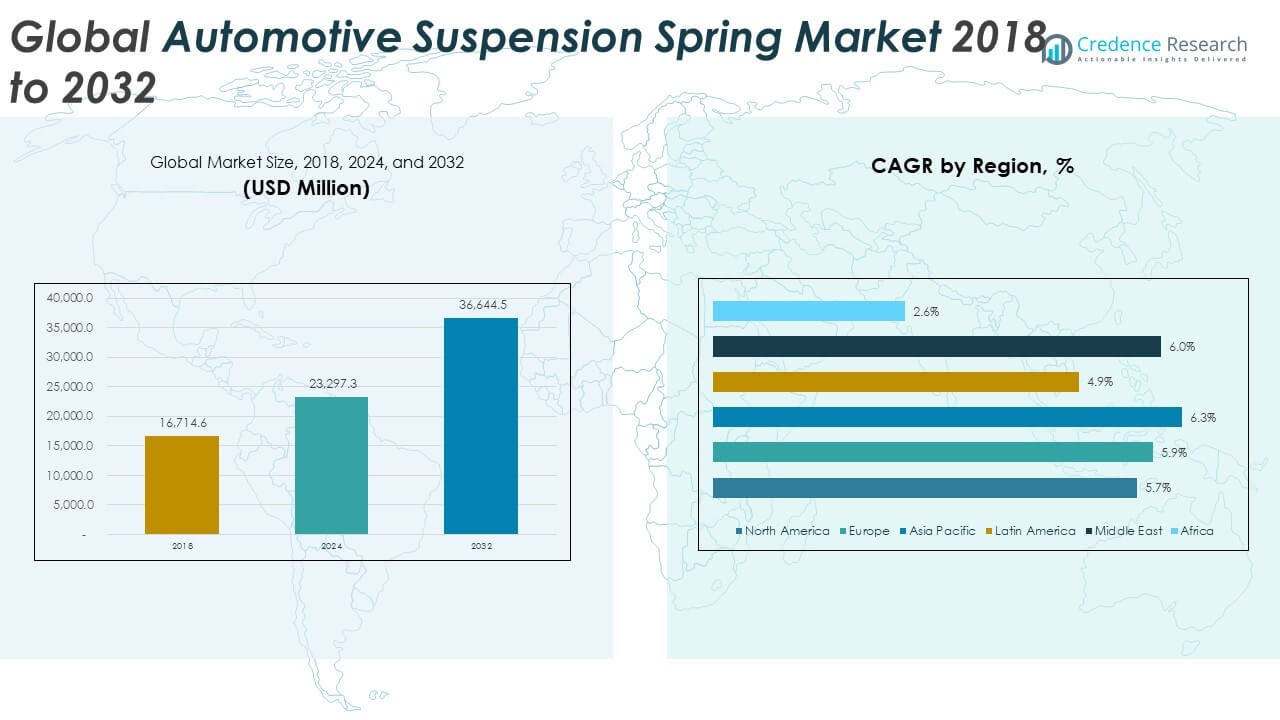

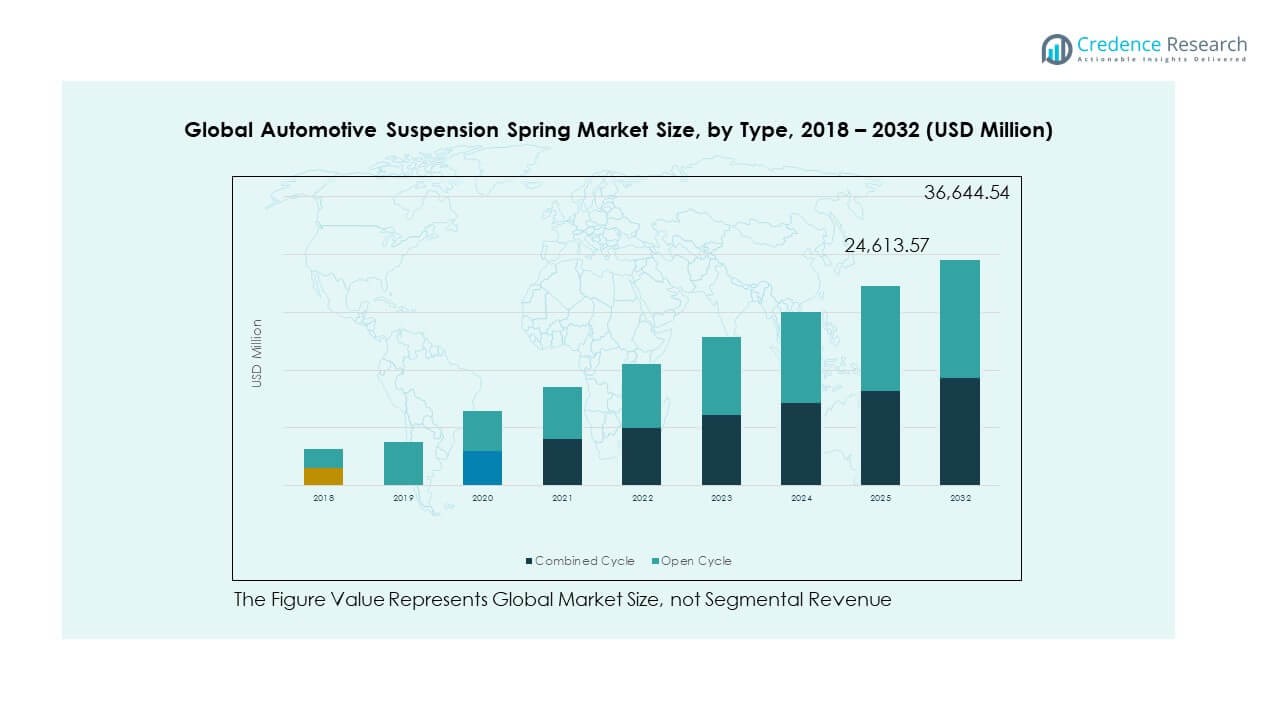

The Global Automotive Suspension Spring Market size was valued at USD 16,714.6 million in 2018 to USD 23,297.3 million in 2024 and is anticipated to reach USD 36,644.5 million by 2032, at a CAGR of 5.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Suspension Spring Market Size 2024 |

USD 23,297.3 Million |

| Automotive Suspension Spring Market, CAGR |

5.85% |

| Automotive Suspension Spring Market Size 2032 |

USD 36,644.5 Million |

The market growth is driven by rising automobile production, increasing consumer preference for enhanced ride comfort, and the growing adoption of advanced suspension technologies in passenger and commercial vehicles. Stringent safety regulations, alongside demand for lightweight materials to improve fuel efficiency, further stimulate the adoption of innovative suspension springs. Additionally, the expansion of the electric vehicle segment contributes significantly to market opportunities.

Regionally, Asia Pacific dominates the market, supported by strong automotive manufacturing bases in China, Japan, and India. Europe follows, with its focus on premium vehicles and stringent safety standards that drive advanced suspension adoption. North America remains a steady market due to demand for SUVs and pickup trucks, while emerging regions such as Latin America and the Middle East show growth potential as vehicle ownership rises and infrastructure development progresses.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Automotive Suspension Spring Market was valued at USD 16,714.6 million in 2018, reached USD 23,297.3 million in 2024, and is projected to hit USD 36,644.5 million by 2032, growing at a CAGR of 5.85%.

- Asia Pacific leads with a 32.7% share in 2024, followed by North America at 27.4% and Europe at 23.9%, driven by strong automotive production, premium vehicle demand, and advanced manufacturing hubs.

- Asia Pacific is the fastest-growing region with a CAGR of 6.3%, supported by rising middle-class populations, infrastructure growth, and strong EV adoption in China and India.

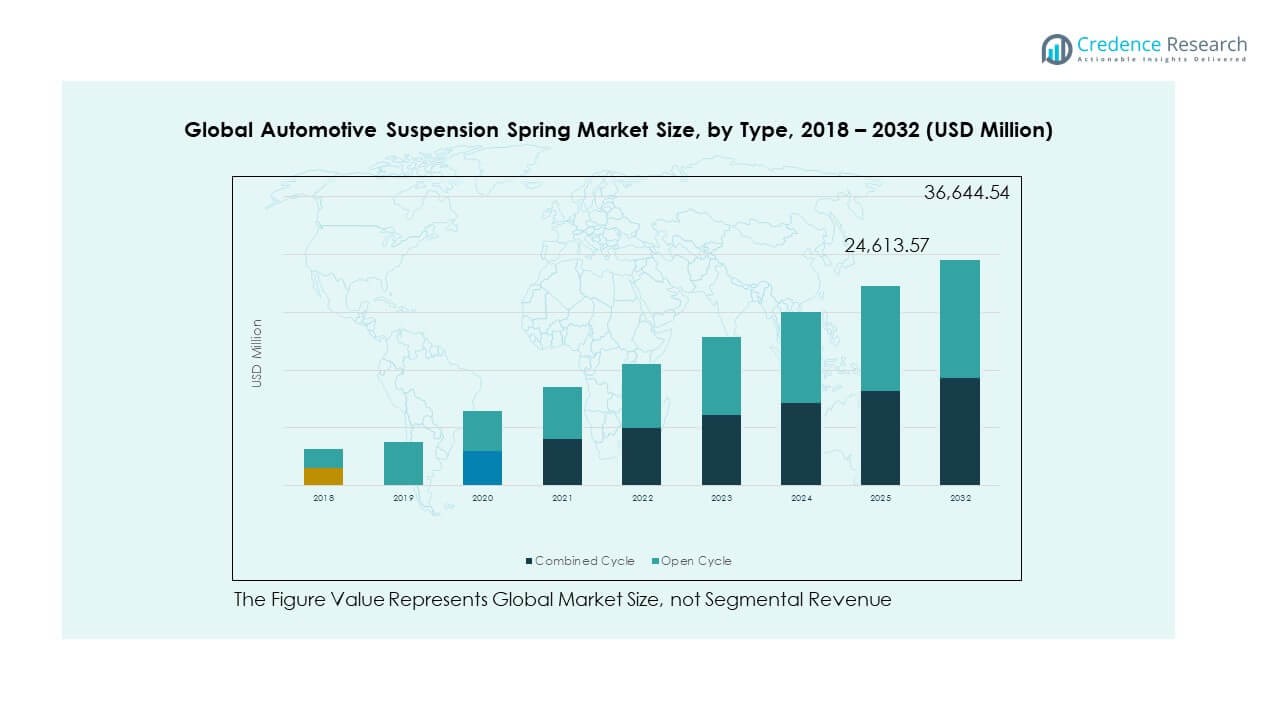

- Segment distribution shows combined cycle suspension springs accounting for 56% of the 2024 market share, reflecting broad application across passenger and commercial vehicles.

- Open cycle suspension springs represent 44% of the 2024 share, supported by steady demand in specific applications where cost efficiency and durability remain priorities.

Market Drivers:

Rising Global Automobile Production and Vehicle Demand Shaping Growth

The Global Automotive Suspension Spring Market benefits from continuous expansion in automobile production across developed and developing nations. Rising disposable incomes increase demand for passenger cars with improved comfort and safety. It gains momentum from growth in commercial vehicle sales supporting logistics and infrastructure sectors. OEMs adopt advanced suspension systems to differentiate models and attract consumers. Stringent safety norms encourage integration of reliable suspension designs to improve ride quality. Lightweight material adoption helps enhance vehicle efficiency and reduces emissions. It positions suspension springs as essential in meeting global environmental and efficiency targets.

Consumer Focus on Ride Comfort and Vehicle Performance Influencing Adoption

Consumers demand smoother driving experiences with emphasis on stability and comfort. The Global Automotive Suspension Spring Market adapts to these expectations by integrating modern suspension technologies in vehicles. Luxury car segments highlight advanced spring systems as value-adding features. Compact and mid-size cars also increasingly integrate high-performance springs to meet urban road challenges. It supports competitive differentiation for manufacturers catering to premium and mass market segments. Strong aftersales and replacement demand sustain market growth across geographies. It reflects a balance between consumer requirements, regulatory compliance, and innovation strategies.

- For example, Elka Suspension introduced a composite spring prototype at the King of the Hammers 2023 off-road race, where it achieved up to 14 pounds of weight reduction by lowering unsprung mass, demonstrating clear efficiency gains in UTV applications.

Rapid Expansion of Electric Vehicles Creating New Application Needs

The rise of electric vehicles introduces distinct suspension requirements due to battery weight distribution. The Global Automotive Suspension Spring Market evolves by developing tailored spring solutions for EV platforms. It supports optimization of range and driving comfort in EV adoption. Government incentives and emission reduction policies accelerate EV sales worldwide. Manufacturers redesign suspension systems to align with lightweight chassis designs. High investment in EV supply chains further strengthens demand for advanced springs. It ensures technology upgrades align with industry transformation. The EV shift secures growth avenues and long-term market relevance.

Technological Advancements and Lightweight Materials Strengthening Market Position

Innovations in suspension spring materials, such as composites and high-strength alloys, drive efficiency. The Global Automotive Suspension Spring Market gains competitive edge through weight reduction without compromising durability. It enhances fuel economy and lowers emissions in compliance with global standards. High investments in R&D expand material capabilities and manufacturing processes. OEM partnerships with suppliers enable cost-effective and sustainable product integration. Replacement demand in aftermarket channels sustains revenue streams alongside OEM supply. It showcases adaptability to both evolving vehicle platforms and sustainability expectations. Advanced material strategies reinforce the market’s growth outlook.

- For example, composite spring materials, such as carbon fiber-reinforced polymer (CFRP) springs, offer weight reductions up to 30%compared to conventional steel springs, improving handling and ride comfort.

Market Trends:

Integration of Smart Suspension Technologies Enhancing Performance and Safety

Digitalization in automotive design increases adoption of smart suspension systems. The Global Automotive Suspension Spring Market aligns with trends integrating electronic control for improved performance. It enhances driving stability by adjusting springs in real time. Consumer preference for connected features extends into suspension optimization. Premium brands highlight smart suspension as part of advanced driver assistance systems. It positions spring technology as a key enabler of intelligent mobility solutions. Rising adoption supports demand for innovative suppliers in the competitive ecosystem.

- For example, in December 2023, Marelli introduced its Fully Active Electromechanical Suspension System featuring four electronically controlled actuators that adjust each wheel’s suspension in real time. The system processes sensor data within 5 milliseconds and achieves up to 80 % energy efficiency over passive or semi-active systems through oil-free design and energy recovery.

Customization and Personalization in Suspension Systems Driving Consumer Interest

Automakers introduce customizable suspension solutions for different driving conditions. The Global Automotive Suspension Spring Market adapts to this demand by offering modular options. It allows consumers to select between comfort, sport, or mixed modes. Premium and mid-range vehicles highlight adjustable suspension systems to attract diverse buyers. Off-road vehicles integrate specialized spring technologies for terrain adaptability. It reflects a shift towards consumer-centric innovation across vehicle categories. Mass personalization enhances consumer engagement and strengthens brand loyalty. The trend drives continuous refinement in suspension engineering.

- For instance, Porsche’s independent suspension system allows each wheel to move vertically and independently, providing enhanced traction and comfort by significantly reducing vibration transfer. This technology involves highly patented innovations that maintain optimal road surface contact individually for each wheel, enabling tailored handling and ride profiles based on user preference and terrain.

Growing Role of Sustainability and Eco-Friendly Production Practices

Sustainability influences manufacturing and material sourcing strategies for springs. The Global Automotive Suspension Spring Market responds by adopting recyclable and energy-efficient materials. It reflects increasing pressure from governments and consumers for eco-friendly designs. Manufacturing facilities shift to low-carbon operations to align with green regulations. Eco-certifications create differentiation for suppliers in competitive environments. It extends market acceptance by aligning with industry sustainability roadmaps. Growth in circular economy practices strengthens long-term supplier strategies. It establishes alignment with broader automotive industry sustainability commitments.

Expansion of Aftermarket and Replacement Demand Driving Business Growth

Replacement demand contributes significantly to revenue generation across regions. The Global Automotive Suspension Spring Market benefits from aging vehicle fleets in mature markets. It supports strong aftermarket channels supplying both OEM and independent workshops. Consumers replace suspension components to maintain safety and ride quality. Expanding e-commerce platforms simplify access to suspension parts globally. It encourages small and mid-size suppliers to capture larger consumer bases. Regional distribution partnerships strengthen service delivery for fast replacement needs. It ensures aftermarket remains a vital contributor to market expansion.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions Impacting Growth

The Global Automotive Suspension Spring Market faces challenges from fluctuating steel and alloy prices. It creates cost pressures for manufacturers dependent on large volumes of raw materials. Supply chain disruptions from geopolitical tensions and logistic delays worsen volatility. Production delays reduce responsiveness to rising vehicle demand. Market participants balance between affordability and maintaining product durability. Supplier dependence on limited regions raises vulnerability to shortages. It forces companies to diversify procurement strategies and invest in resilient supply chains. Adapting to these dynamics remains critical for sustaining competitiveness.

Intense Competition and Technological Complexity Restraining Smaller Participants

High competition among global and regional players creates pressure on margins. The Global Automotive Suspension Spring Market experiences rapid shifts in technology adoption. It challenges smaller manufacturers with limited R&D capacity to compete effectively. Premium OEMs demand advanced features that require significant investment. Smaller participants often struggle to meet complex standards and certifications. It leads to consolidation trends where larger players acquire niche firms. Rising consumer expectations for quality and customization intensify this challenge further. Sustaining profitability under these competitive conditions requires strategic collaboration and innovation.

Market Opportunities:

Expansion of Emerging Economies and Rising Vehicle Ownership Creating Demand

Emerging markets present vast growth opportunities driven by rising vehicle ownership. The Global Automotive Suspension Spring Market leverages increasing demand from Asia, Latin America, and Africa. It benefits from government support for automotive sector expansion. Rising infrastructure investment further boosts commercial vehicle adoption. Growing middle-class populations demand affordable yet reliable vehicles. It strengthens OEM presence in high-potential regions. Increasing replacement and aftermarket needs expand opportunities for local suppliers.

Development of Advanced EV and Lightweight Suspension Systems Supporting Innovation

Advancements in EV platforms create opportunities for tailored suspension spring designs. The Global Automotive Suspension Spring Market responds by focusing on lightweight and durable materials. It benefits from EV manufacturers emphasizing comfort and efficiency. Innovation in composites and advanced alloys supports cost-effective solutions. Strategic alliances between OEMs and suppliers accelerate new product integration. It strengthens competitive positioning for global and regional players. Adoption of green practices further increases opportunities across industries.

Market Segmentation Analysis:

The Global Automotive Suspension Spring Market is segmented

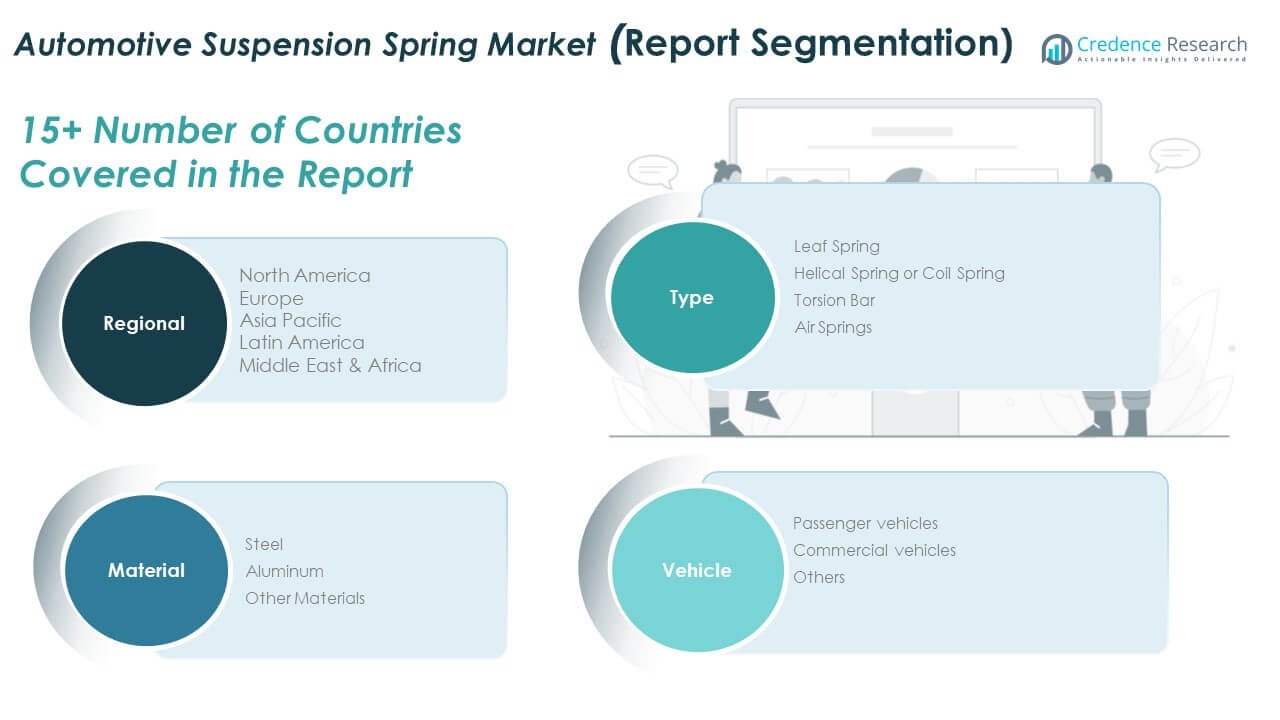

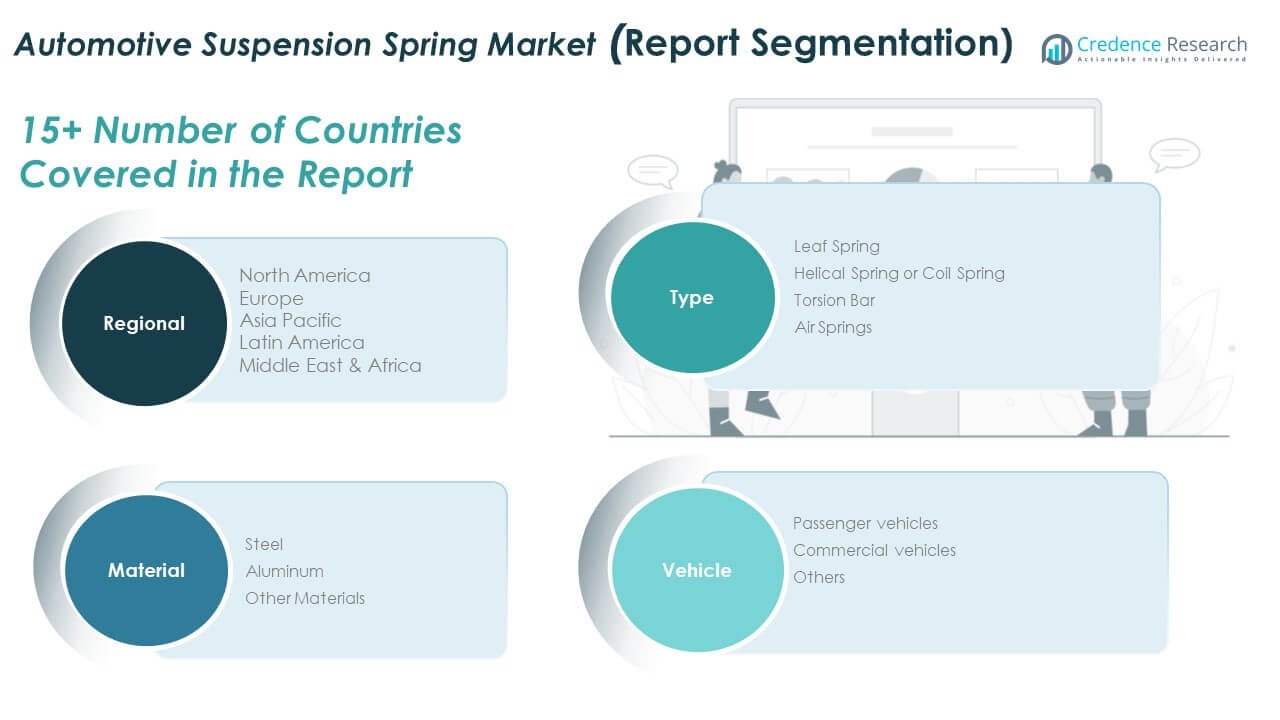

By Type

Into leaf spring, helical spring or coil spring, torsion bar, and air springs. Leaf springs remain widely used in heavy commercial vehicles due to durability and cost efficiency. Helical or coil springs dominate passenger vehicles because of their superior ride comfort and compact design. Torsion bars support applications where space efficiency and load-bearing strength are required. Air springs gain traction in premium vehicles and buses, offering improved stability and comfort for long-distance travel.

- For instance, IFC Composites supplies glass fiber reinforced composite leaf springs for Daimler’s 40-ton trucks, offering a weight reduction of approximately 400 kg compared to steel counterparts, while maintaining robust load capacity and durability required for heavy trucks.

By Material

The market is divided into steel, aluminum, and other materials. Steel continues to hold the largest share due to strength, availability, and cost advantages. Aluminum is gaining attention for lightweight applications, aligning with global fuel efficiency and emission reduction goals. Other advanced materials, including composites, are under development to balance performance with sustainability. It demonstrates clear movement toward material innovation supporting both OEM and aftermarket demand.

- For example, spring steel grades like 1095 and 6150 are commonly used for automotive suspension springs, valued for their high yield strength and excellent fatigue resistance essential for withstanding repeated cyclic loads

By Vehicle

The market covers passenger vehicles, commercial vehicles, and others. Passenger vehicles lead the segment, supported by rising consumer demand for comfort and safety. Commercial vehicles drive significant demand for durable and load-bearing springs in logistics and construction industries. The “others” segment, including specialty vehicles, reflects niche adoption influenced by custom suspension requirements. It highlights diverse applications across mobility platforms and reinforces the growth outlook of the Global Automotive Suspension Spring Market.

Segmentation:

By Type

- Leaf Spring

- Helical Spring or Coil Spring

- Torsion Bar

- Air Springs

By Material

- Steel

- Aluminum

- Other Materials

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Automotive Suspension Spring Market size was valued at USD 4,616.57 million in 2018 to USD 6,382.79 million in 2024 and is anticipated to reach USD 9,930.67 million by 2032, at a CAGR of 5.7% during the forecast period. North America accounts for 27.4% share of the global market in 2024. The region benefits from strong demand for SUVs, pickup trucks, and premium passenger vehicles. The Global Automotive Suspension Spring Market here is shaped by consumer preference for comfort and durability. It reflects consistent replacement demand driven by aging vehicle fleets in the United States. Stringent safety and performance regulations drive adoption of advanced spring technologies. OEMs and aftermarket suppliers both maintain strong footprints. It highlights steady growth supported by high disposable incomes and a mature automotive sector.

Europe

The Europe Global Automotive Suspension Spring Market size was valued at USD 3,974.73 million in 2018 to USD 5,562.06 million in 2024 and is anticipated to reach USD 8,794.69 million by 2032, at a CAGR of 5.9% during the forecast period. Europe contributes 23.9% share of the global market in 2024. The region emphasizes premium and luxury vehicle production, boosting demand for advanced spring technologies. The Global Automotive Suspension Spring Market is influenced by strict emission norms and sustainability targets. It encourages adoption of lightweight materials such as aluminum and composites. Germany, the UK, and France lead due to their established automotive hubs. Replacement demand across Western Europe sustains aftermarket growth. It underlines the region’s position as a hub for innovation in suspension technologies.

Asia Pacific

The Asia Pacific Global Automotive Suspension Spring Market size was valued at USD 5,330.29 million in 2018 to USD 7,629.19 million in 2024 and is anticipated to reach USD 12,418.83 million by 2032, at a CAGR of 6.3% during the forecast period. Asia Pacific holds 32.7% share of the global market in 2024. Strong vehicle production bases in China, Japan, India, and South Korea drive growth. The Global Automotive Suspension Spring Market in this region benefits from rising middle-class populations demanding passenger vehicles. It is supported by rapid urbanization and infrastructure development fueling commercial vehicle adoption. Local suppliers strengthen competitive pricing and aftermarket presence. EV growth in China further expands opportunities for specialized suspension systems. It positions Asia Pacific as the leading growth engine globally.

Latin America

The Latin America Global Automotive Suspension Spring Market size was valued at USD 1,633.02 million in 2018 to USD 2,166.31 million in 2024 and is anticipated to reach USD 3,177.08 million by 2032, at a CAGR of 4.9% during the forecast period. Latin America accounts for 9.3% share of the global market in 2024. Brazil and Mexico dominate due to their established automotive assembly plants. The Global Automotive Suspension Spring Market here grows through rising demand for cost-efficient vehicles. It reflects opportunities in aftermarket channels supported by replacement needs. Economic fluctuations present challenges but also highlight resilience in key markets. Expanding road infrastructure supports commercial vehicle sales. It shows stable growth potential tied to regional automotive expansion.

Middle East

The Middle East Global Automotive Suspension Spring Market size was valued at USD 798.96 million in 2018 to USD 1,124.59 million in 2024 and is anticipated to reach USD 1,791.92 million by 2032, at a CAGR of 6.0% during the forecast period. The region represents 4.8% share of the global market in 2024. Demand is fueled by SUVs, luxury cars, and commercial fleets in GCC countries. The Global Automotive Suspension Spring Market in the Middle East benefits from high consumer spending power. It reflects growing emphasis on durable and reliable spring systems for harsh driving conditions. Infrastructure investments increase commercial fleet adoption. Replacement demand strengthens aftermarket sales across urban hubs. It highlights consistent expansion supported by both OEM sales and service demand.

Africa

The Africa Global Automotive Suspension Spring Market size was valued at USD 361.04 million in 2018 to USD 432.33 million in 2024 and is anticipated to reach USD 531.35 million by 2032, at a CAGR of 2.6% during the forecast period. Africa contributes 1.9% share of the global market in 2024. Growth is modest compared to other regions due to limited automotive manufacturing bases. The Global Automotive Suspension Spring Market here depends largely on imports and aftermarket sales. It shows opportunities in South Africa and Egypt where automotive sectors are expanding. Rising vehicle ownership supports gradual demand for suspension components. Infrastructure growth improves commercial vehicle adoption. It signals steady but slow-paced development with long-term potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kilen

- Sogefi SpA

- H&R Special Springs

- Mubea

- MW Industries Inc.

- Dendoff Springs

- Bellamy & East

- Springcoil

- Emco

- HSW-Zaklad Sprezynownia

- Hendrickson

- Other Key Players

Competitive Analysis:

The Global Automotive Suspension Spring Market is characterized by strong competition among global and regional manufacturers. Leading companies such as Kilen, Sogefi SpA, H&R Special Springs, Mubea, and MW Industries focus on innovation, product quality, and global distribution networks. It demonstrates consolidation trends where larger players expand portfolios through acquisitions and partnerships. Smaller firms emphasize niche markets and aftermarket services to remain competitive. OEM partnerships with spring manufacturers strengthen supply chains and ensure technology integration in new vehicle platforms. It reflects increasing demand for lightweight materials and customized suspension solutions. Companies invest in research and development to align with evolving standards and sustainability goals. The competitive landscape highlights continuous innovation and strategic alignment to maintain market share in dynamic automotive sectors.

Recent Developments:

- In 2025, H&R Special Springs launched multiple designs of lowering springs specifically tailored for the 2025 Honda Civic models equipped with Adaptive Damper System (ADS). These springs range from subtle sport springs lowering the vehicle by 0.25 to 0.75 inches to aggressive race springs with a drop of up to 2.5 inches, all covered under a Limited Lifetime Warranty, enhancing control, handling, and stance for daily-driven vehicles and performance enthusiasts.

- In November 2024, MidOcean Partners acquired Arnott Industries. The private equity firm expanded its footprint in the automotive aftermarket by purchasing Arnott, a leading designer and manufacturer of air suspension systems and components. The acquisition positions Arnott for growth across North American and European aftermarket platforms

- In October 2024, Brembo completed its acquisition of Öhlins Racing for USD 405 million. Brembo, known for high-performance braking systems, acquired the Swedish suspension technology company Öhlins, marking its largest-ever acquisition. The deal, aimed to close in early 2025, seeks to enhance Brembo’s intelligent vehicle solutions by integrating advanced mechatronic suspension technologies developed by Öhlins.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material and Vehicle. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for electric vehicles will create new opportunities for innovation in suspension spring design, as manufacturers adapt to unique weight distribution and efficiency requirements.

- Lightweight material adoption will expand steadily, helping automakers meet stricter fuel efficiency standards and global emission reduction targets while maintaining durability.

- Aftermarket growth will accelerate in developed economies, supported by aging vehicle fleets that require consistent replacement of suspension components.

- Premium vehicles will continue integrating advanced suspension spring systems, highlighting the growing consumer preference for comfort, safety, and high-performance driving experiences.

- Emerging markets will witness strong expansion in demand, driven by increasing vehicle ownership and infrastructure development, particularly across Asia, Latin America, and Africa.

- Smart suspension technologies will gain traction in high-end passenger and commercial vehicles, enabling real-time adjustments and improving safety and ride quality.

- Strategic alliances between OEMs and suppliers will shape competitive advantages, ensuring stronger supply chains and efficient product integration.

- Sustainability goals will push manufacturers to adopt recyclable and eco-friendly materials, aligning with industry-wide green mobility initiatives.

- Regional players will strengthen aftermarket channels with cost-effective solutions, enhancing accessibility for budget-conscious consumers.

- Continuous R&D investment will support innovation, allowing companies to differentiate products, maintain market relevance, and secure long-term growth.