| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Baby & Infant Toys Market Size 2024 |

14,984.63 million |

| Baby & Infant Toys Market, CAGR |

4.42% |

| Baby & Infant Toys Market, Size 2032 |

USD 21,182.46 million |

Market Overview

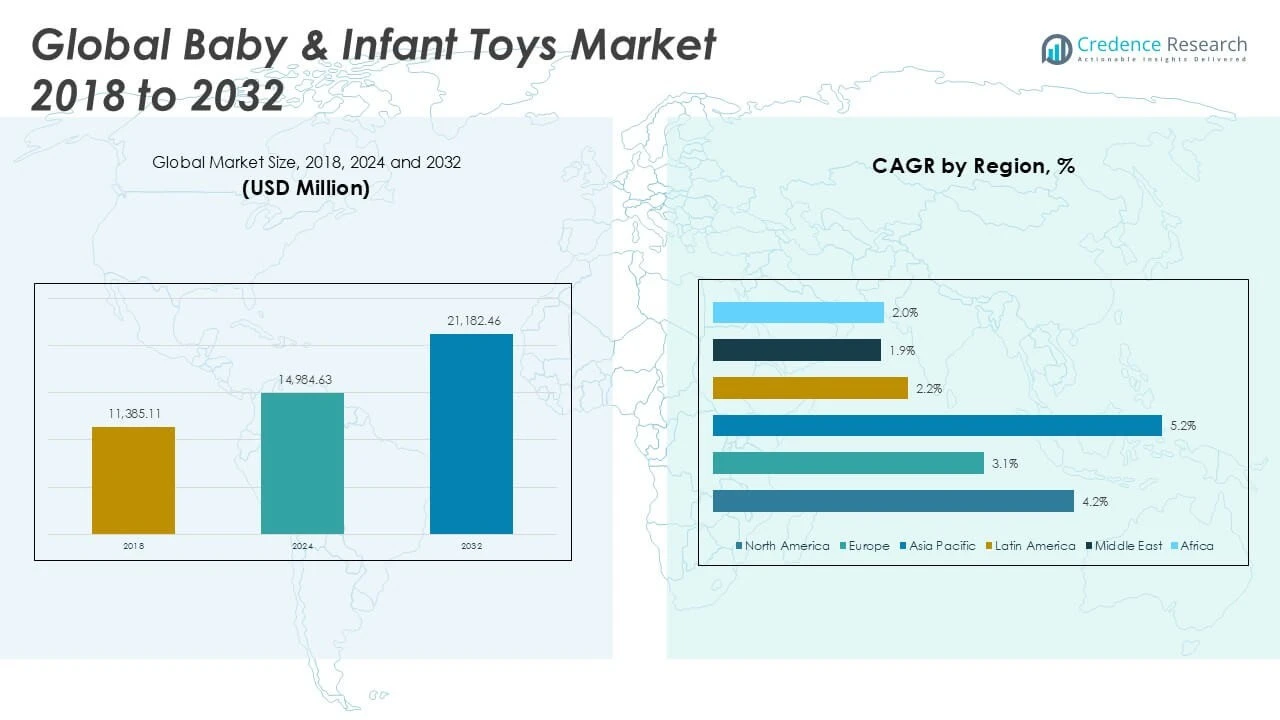

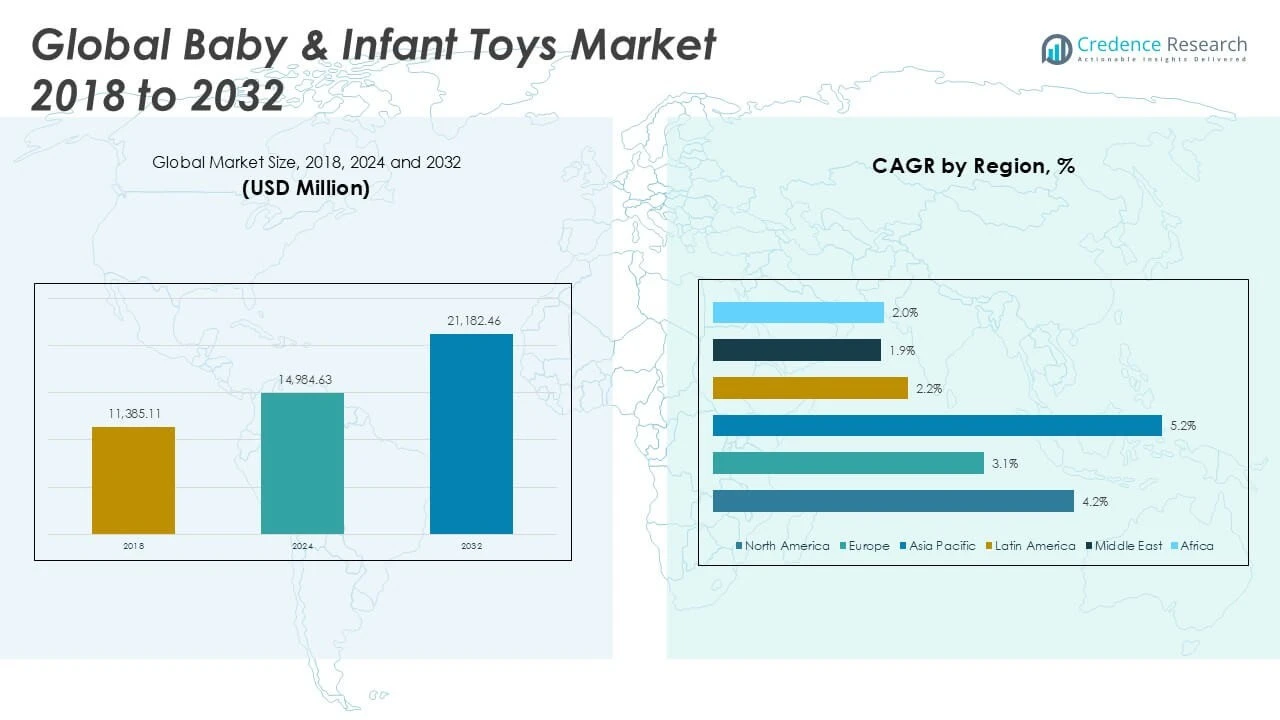

Baby & Infant Toys Market size was valued at USD 11,385.11 million in 2018 to USD 14,984.63 million in 2024 and is anticipated to reach USD 21,182.46 million by 2032, at a CAGR of 4.42% during the forecast period.

The Baby & Infant Toys Market gains momentum from rising birth rates, increasing parental awareness of early childhood development, and higher disposable incomes among young families. Parents seek educational and sensory-stimulating toys that support cognitive and motor skill growth, driving demand for innovative products designed for safety and learning. Manufacturers respond by introducing eco-friendly, non-toxic, and smart toys, incorporating features such as interactive sounds, lights, and mobile connectivity to enhance engagement. Trends indicate a preference for gender-neutral designs and sustainable materials, aligning with broader shifts toward responsible consumption. E-commerce platforms and targeted digital marketing expand access to a wider range of toys, while collaborations with healthcare professionals and child development experts reinforce product credibility. These factors, combined with continuous product innovation and evolving consumer preferences, position the Baby & Infant Toys Market for sustained growth and diversification across global regions.

The Baby & Infant Toys Market shows robust growth across key global regions, led by North America, Europe, and Asia Pacific. North America stands out for its strong focus on innovative, high-quality, and safety-certified products, supported by established retail infrastructure and high consumer awareness. Europe follows closely, driven by demand for eco-friendly and educational toys, with parents showing strong preferences for sustainability and developmental value. Asia Pacific emerges as a high-potential market due to increasing birth rates, rising disposable incomes, and expanding access to international brands through e-commerce. Prominent players shaping the industry include Mattel Inc., Hasbro Inc., The LEGO Group, and VTech Holdings Limited, each leveraging product innovation, strategic partnerships, and diverse portfolios to maintain leadership and respond to evolving consumer preferences in these dynamic regions.

Market Insights

- The Baby & Infant Toys Market was valued at USD 14,984.63 million in 2024 and is projected to reach USD 21,182.46 million by 2032, registering a CAGR of 4.42% during the forecast period.

- Rising parental awareness of early childhood development and increased disposable incomes fuel steady demand for educational, interactive, and safe toys.

- Manufacturers introduce eco-friendly, sustainable, and gender-neutral toys to align with evolving consumer values and regulatory standards.

- Digital marketing, influencer partnerships, and omnichannel retail strategies expand brand reach and enhance consumer engagement across regions.

- Intense competition and the prevalence of low-cost, unbranded alternatives present ongoing challenges for established brands to maintain quality and profitability.

- North America and Europe remain leaders in product innovation and premium offerings, while Asia Pacific displays rapid market growth driven by high birth rates and urbanization.

- The market navigates challenges such as stringent safety regulations, price sensitivity, and the need to balance innovation with affordability in a competitive global landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Parental Focus on Early Childhood Development

The Baby & Infant Toys Market benefits significantly from heightened parental awareness regarding the importance of early childhood development. Parents increasingly seek toys that promote cognitive, sensory, and motor skill advancement in infants. They look for products that encourage exploration, creativity, and learning through play. Educational toys, sensory playsets, and activity gyms gain traction, driven by endorsements from child development specialists and pediatricians. The trend towards early skill-building supports steady demand for a variety of developmental toys. This focus not only sustains the market’s growth but also drives manufacturers to invest in research and product design tailored to early learning outcomes.

- For instance, Indian parents are increasingly investing in toys that stimulate cognitive, motor, and social skills, with educational toys accounting for approximately 30% of total toy sales.

Expansion of Disposable Incomes Among Young Families

Increasing disposable incomes, particularly in emerging economies, serve as a major growth driver for the Baby & Infant Toys Market. Young families are more willing to invest in high-quality, branded, and premium toys for their infants. This financial flexibility leads to higher adoption rates for educational, interactive, and tech-enabled products. The market responds with diverse offerings across different price ranges, catering to both value-conscious and luxury-seeking customers. Retailers and manufacturers expand their product portfolios to address varying purchasing capacities. The availability of premium and innovative toys stimulates repeat purchases and enhances overall market value.

Emphasis on Product Safety and Regulatory Compliance

The Baby & Infant Toys Market places strong emphasis on product safety, non-toxic materials, and adherence to international quality standards. Parents prioritize toys that comply with safety certifications and regulatory requirements, ensuring the well-being of their children. Manufacturers invest in rigorous testing, certifications, and transparent labeling to build consumer trust. The adoption of eco-friendly and sustainable materials aligns with growing environmental concerns, further enhancing brand reputation. Companies that prioritize safety and sustainability strengthen their competitive position and appeal to a broader customer base. This focus on compliance and transparency shapes product development and marketing strategies industry-wide.

- For instance, the global baby toys market is witnessing a growing emphasis on eco-friendly and sustainable products, with parents seeking toys made from safe, non-toxic materials.

Technological Advancements and Product Innovation

Technological progress fuels ongoing innovation within the Baby & Infant Toys Market. Companies introduce smart toys featuring interactive sounds, lights, and mobile connectivity to enhance engagement and learning. The integration of artificial intelligence and sensor technology provides personalized and adaptive play experiences for infants. Product designers develop multifunctional toys that address developmental milestones, convenience, and entertainment. These innovations help brands differentiate themselves in a crowded market and appeal to tech-savvy parents. Digital marketing and e-commerce platforms further amplify the reach of innovative products. The continuous cycle of technological advancement supports sustained market growth and dynamic consumer engagement.

Market Trends

Rise of Eco-Friendly and Sustainable Products

The Baby & Infant Toys Market reflects a significant shift toward eco-friendly and sustainable product offerings. Manufacturers introduce toys made from natural, biodegradable, and non-toxic materials, aligning with consumer demand for responsible consumption. Parents prefer brands that demonstrate a commitment to environmental stewardship and child safety. Certifications and transparent supply chains enhance consumer trust and set new benchmarks for quality. The adoption of recyclable packaging further distinguishes brands in a crowded marketplace. This trend supports the overall reputation of the industry and appeals to environmentally conscious families seeking safe and sustainable choices.

- For instance, Playmobil has transformed 90% of its toddler range to plant-based materials, while its Wiltopia range incorporates 80% recycled and bio-based materials.

Integration of Smart Technology and Interactive Features

The Baby & Infant Toys Market integrates advanced technologies, leading to a surge in smart and interactive toys. Companies invest in products equipped with sensors, interactive sounds, lights, and mobile app connectivity, offering a more engaging play experience. These smart toys provide personalized responses and adaptive learning, keeping infants entertained and fostering developmental progress. Parents value products that blend traditional play with educational technology. The expansion of the Internet of Things (IoT) in toys enables real-time feedback and monitoring, further driving market differentiation. This focus on innovation creates opportunities for premium pricing and brand loyalty.

Growth of Gender-Neutral and Inclusive Toy Designs

Toy manufacturers in the Baby & Infant Toys Market shift toward gender-neutral and inclusive product designs. Brands move away from traditional gender-based color schemes and themes, introducing toys that encourage open-ended play for all children. Parents support these inclusive options, recognizing their role in promoting creativity and self-expression. Marketing strategies highlight diversity and equality, resonating with modern family values. This trend influences product development, packaging, and in-store displays across retail channels. Gender-neutral toys expand the customer base and strengthen the market’s adaptability to evolving social attitudes.

- For instance, modern toy companies are moving away from traditional gender-based color schemes and themes, introducing toys that encourage open-ended play for all children.

Expansion of Omnichannel Retail and Digital Marketing

The Baby & Infant Toys Market sees strong growth in omnichannel retailing, combining online and offline sales strategies. E-commerce platforms provide convenience and access to a broad range of products, supported by targeted digital marketing campaigns. Influencer collaborations and social media promotions help brands reach tech-savvy parents and younger families. Brick-and-mortar stores maintain relevance by offering experiential retail and personalized service. The integration of virtual product demonstrations and online reviews influences purchasing decisions and increases consumer confidence. Omnichannel strategies ensure brands remain visible and accessible in a highly competitive environment.

Market Challenges Analysis

Stringent Regulatory Requirements and Product Safety Concerns

The Baby & Infant Toys Market faces significant challenges from strict regulatory standards and growing parental concerns about product safety. Global regulations demand rigorous testing, certification, and compliance with evolving safety norms, which increases operational costs for manufacturers. Companies must adapt quickly to changes in material standards, chemical restrictions, and labeling requirements. Recalls due to non-compliance or product defects can damage brand reputation and erode consumer trust. The market must invest in ongoing research and development to ensure that toys meet safety benchmarks across different regions. Navigating diverse regulatory environments presents complexity for international brands and may slow product launches or market expansion.

- For instance, global toy safety regulations, including the European Union’s Toy Safety Directive and the U.S. Consumer Product Safety Improvement Act, mandate rigorous testing and certification to ensure compliance with evolving safety norms.

Price Sensitivity and Competition from Unbranded Products

The Baby & Infant Toys Market encounters strong price sensitivity, particularly in developing regions where consumers prioritize affordability. The presence of low-cost, unbranded, or counterfeit products creates intense competition for established brands. These alternatives often bypass strict safety checks, putting infants at risk and undermining consumer confidence in the market. Leading brands must balance innovation and quality with cost efficiency to remain competitive without sacrificing product standards. Economic downturns and fluctuations in raw material prices further pressure margins. The challenge to offer high-value products at accessible price points persists across all segments of the industry.

Market Opportunities

Expansion into Emerging Markets and New Demographics

The Baby & Infant Toys Market holds strong growth opportunities through strategic expansion into emerging markets and the targeting of new consumer segments. Rising birth rates and increasing disposable incomes in Asia Pacific, Latin America, and parts of Africa create robust demand for safe, innovative, and affordable toys. Companies can develop region-specific products and localized marketing campaigns to engage young families and address unique cultural preferences. Partnerships with local retailers and e-commerce platforms support broader distribution and brand recognition. The market’s ability to adapt its portfolio for varying price points and developmental needs positions it well to capture new growth in these dynamic regions. Proactive outreach to untapped demographic groups, such as working parents and grandparents, expands the consumer base further.

Innovation in Smart Toys and Sustainability Initiatives

The Baby & Infant Toys Market offers substantial potential for brands that invest in product innovation and sustainability. Companies can leverage advancements in sensor technology, artificial intelligence, and mobile connectivity to develop smart toys that deliver personalized, educational experiences. These innovations attract tech-savvy parents seeking tools to support early development. Brands that embrace sustainable materials, recyclable packaging, and ethical sourcing differentiate themselves in a competitive landscape and build long-term trust with environmentally conscious consumers. Collaborations with child development experts and healthcare professionals enhance product credibility and drive adoption. This focus on technology and sustainability ensures continued relevance and market leadership.

Market Segmentation Analysis:

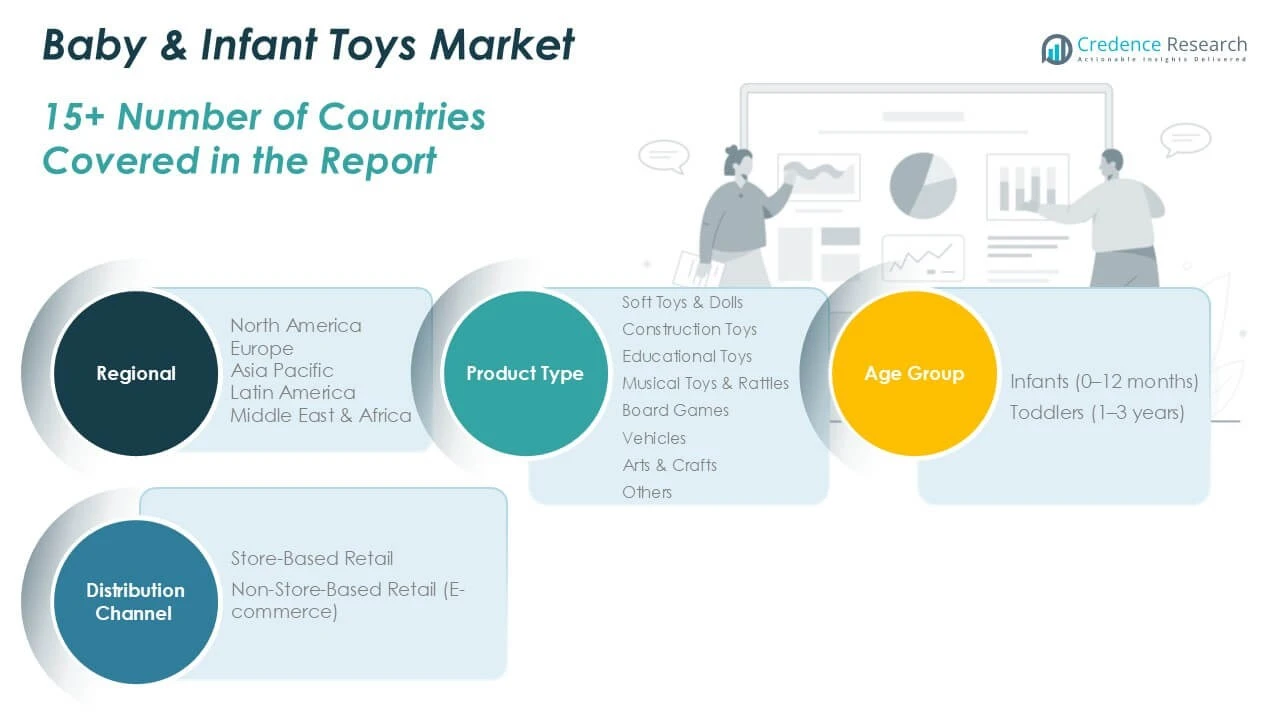

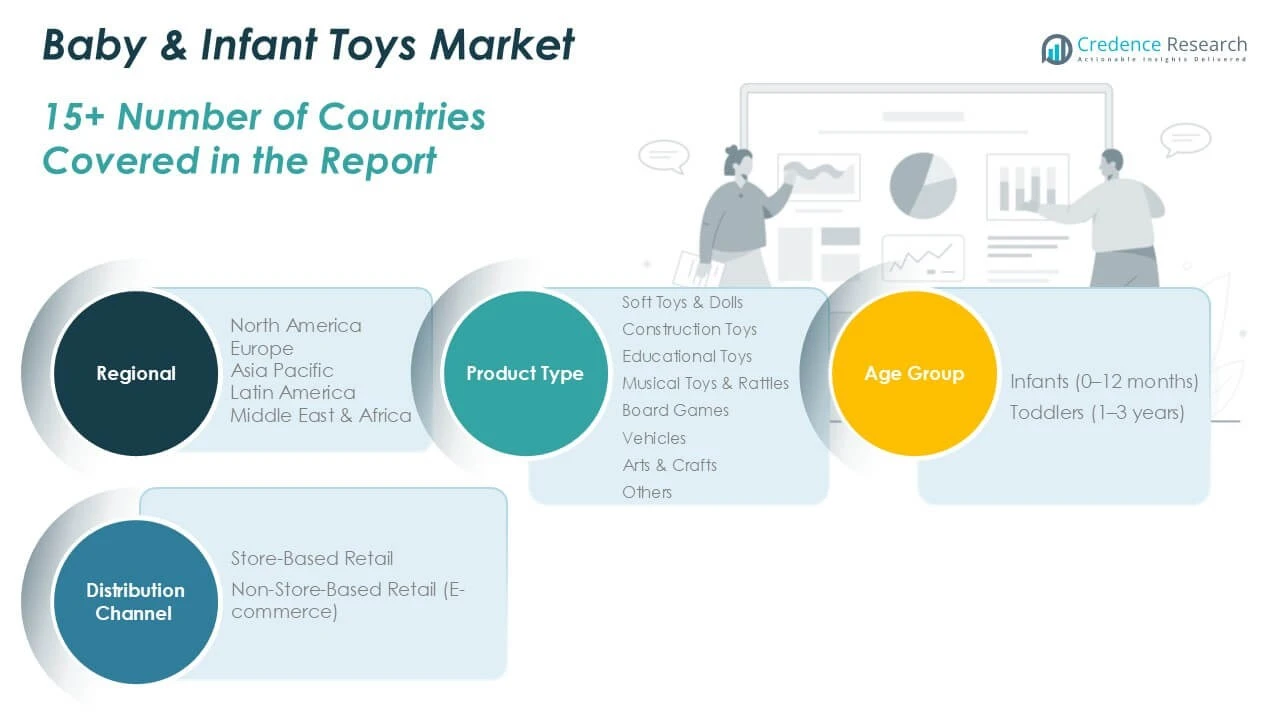

By Product Type:

The Baby & Infant Toys Market presents a comprehensive segment structure that enables brands to address diverse consumer preferences, developmental stages, and purchasing behaviors. By product type, the market includes soft toys and dolls, construction toys, educational toys, musical toys and rattles, board games, vehicles, arts and crafts, and others. Soft toys and dolls remain a staple due to their perceived safety and comforting attributes, particularly favored by parents for newborns and infants. Construction toys and educational toys see rising demand as families and early learning centers emphasize cognitive development, problem-solving, and creativity from an early age. Musical toys and rattles stimulate sensory perception and auditory skills in infants, while board games and vehicle toys foster group play, coordination, and imaginative thinking, appealing more to toddlers. Arts and crafts products encourage fine motor skill development and creative expression, supporting holistic early childhood growth.

By Age Group:

Segmentation by age group further refines the market, focusing on infants (0–12 months) and toddlers (1–3 years). The infant segment values toys that support basic sensory development, safety, and soothing, prompting a preference for simple, soft, and non-toxic materials. For toddlers, the emphasis shifts to toys that enable interactive, skill-building experiences, such as construction sets, educational puzzles, and beginner board games, reflecting the rapid development of physical and cognitive abilities during this stage.

By Distribution Channel:

Distribution channels are another crucial aspect of the Baby & Infant Toys Market. Store-based retail, including specialty toy shops, supermarkets, and department stores, retains a strong foothold by offering immediate product access and personalized service. However, non-store-based retail especially e-commerce has expanded swiftly, providing greater product variety, convenience, and the ability to compare prices and read reviews online. E-commerce platforms cater to modern shopping preferences and extend market reach to consumers in both urban and rural areas. This well-defined segmentation strategy allows the Baby & Infant Toys Market to adapt its product innovation, marketing, and distribution approaches, driving sustained growth and market relevance across regions and consumer groups.

Segments:

Based on Product Type:

- Soft Toys & Dolls

- Construction Toys

- Educational Toys

- Musical Toys & Rattles

- Board Games

- Vehicles

- Arts & Crafts

- Others

Based on Age Group:

- Infants (0–12 months)

- Toddlers (1–3 years)

Based on Distribution Channel:

- Store-Based Retail

- Non-Store-Based Retail (E-commerce)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Baby & Infant Toys Market

North America Baby & Infant Toys Market grew from USD 4,236.14 million in 2018 to USD 5,507.48 million in 2024 and is projected to reach USD 7,810.87 million by 2032, reflecting a CAGR of 4.2%. North America accounts for around 33% of the global market share in 2024. The United States leads the region, followed by Canada and Mexico, supported by high consumer spending and strong awareness of developmental benefits associated with infant toys. A mature retail landscape, coupled with high adoption of premium and tech-integrated products, drives consistent demand. E-commerce channels and specialty stores make a wide product range accessible to parents. Strict safety standards and an emphasis on educational value shape brand strategies and consumer choices.

Europe Baby & Infant Toys Market

Europe Baby & Infant Toys Market grew from USD 2,607.81 million in 2018 to USD 3,279.04 million in 2024 and is expected to reach USD 4,296.37 million by 2032, growing at a CAGR of 3.1%. Europe holds a 20% market share in 2024. Key countries such as Germany, the UK, France, and Italy drive regional demand, supported by a focus on sustainability and regulatory compliance. The market benefits from a strong tradition of educational and wooden toys. Retailers expand offerings of organic and eco-friendly products, appealing to environmentally conscious families. Cross-border e-commerce and local manufacturing support growth across both Western and Eastern Europe.

Asia Pacific Baby & Infant Toys Market

Asia Pacific Baby & Infant Toys Market grew from USD 3,513.13 million in 2018 to USD 4,865.62 million in 2024 and is projected to reach USD 7,463.58 million by 2032, reflecting a CAGR of 5.2%. Asia Pacific commands the largest regional share at 29% in 2024. China, Japan, India, South Korea, and Australia are major markets, fueled by rising birth rates, growing disposable incomes, and increasing urbanization. Regional brands focus on innovation, affordability, and safety, appealing to diverse consumer needs. E-commerce and mobile shopping drive rapid growth, while local and international players expand their presence through strategic partnerships.

Latin America Baby & Infant Toys Market

Latin America Baby & Infant Toys Market grew from USD 462.61 million in 2018 to USD 600.07 million in 2024 and is set to reach USD 734.73 million by 2032, at a CAGR of 2.2%. Latin America accounts for 4% of the global market share in 2024. Brazil, Argentina, Chile, and Colombia represent the region’s largest markets, supported by expanding middle classes and a cultural emphasis on family care. Retailers introduce a wider range of developmental and affordable toys. E-commerce penetration is rising, enabling brands to reach underserved communities and boost market visibility. Local adaptations and seasonal marketing drive consumer engagement.

Middle East Baby & Infant Toys Market

Middle East Baby & Infant Toys Market grew from USD 322.63 million in 2018 to USD 388.57 million in 2024 and is projected to reach USD 464.55 million by 2032, registering a CAGR of 1.9%. The Middle East represents about 2% of the global market in 2024. Key countries include the UAE, Saudi Arabia, and Israel, where population growth, rising incomes, and growing awareness of child development drive demand. Brands focus on premium, certified-safe, and culturally tailored products to meet regional preferences. Retailers expand in urban centers and invest in online channels for broader reach. Educational campaigns and partnerships with healthcare providers support ongoing market development.

Africa Baby & Infant Toys Market

Africa Baby & Infant Toys Market grew from USD 242.79 million in 2018 to USD 343.85 million in 2024 and is projected to reach USD 412.35 million by 2032, reflecting a CAGR of 2.0%. Africa holds 2% of the global market in 2024. Nigeria, South Africa, and Egypt are leading countries, driven by high birth rates, urbanization, and increasing consumer awareness. International brands collaborate with local partners to enhance affordability and distribution. Retail infrastructure improvements and government initiatives supporting early childhood development are key growth drivers. The market continues to expand as economic conditions and access to quality products improve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mattel Inc.

- Hasbro Inc.

- The LEGO Group

- VTech Holdings Limited

- Melissa & Doug

- Spin Master Corp.

- Chicco (Artsana Group)

- Playgro

- Bright Starts

- Infantino LLC

- MGA Entertainment

- Bandai Namco Holdings Inc.

- LeapFrog Enterprises Inc.

- Baby Einstein

Competitive Analysis

The Baby & Infant Toys Market features strong competition among leading players, including Mattel Inc., Hasbro Inc., The LEGO Group, VTech Holdings Limited, Melissa & Doug, Spin Master Corp., Chicco (Artsana Group), Playgro, Bright Starts, Infantino LLC, MGA Entertainment, Bandai Namco Holdings Inc., LeapFrog Enterprises Inc., and Baby Einstein. These companies compete on innovation, brand recognition, safety standards, and portfolio diversity to capture and retain consumer loyalty. Market leaders consistently invest in research and development to introduce new educational, interactive, and eco-friendly products that appeal to modern parents and caregivers. Strategic collaborations with licensing partners and child development experts enhance their credibility and product offerings. Strategic partnerships with licensors and child development experts help firms enrich their product lines and enhance market credibility. Companies leverage omnichannel distribution, combining in-store experiences with strong e-commerce strategies to expand reach and improve customer engagement. Intense competition pushes all players to focus on quality, value, and innovation, ensuring the market remains responsive to changing family needs and regulatory requirements

Recent Developments

- In January 2023, the beloved baby boutique, which shut its doors in 2018, is reopening under new management. A new brick-and-mortar location will soon be opening in the American Dream mall in New Jersey.

- In July 2022, in order to develop and promote items that encourage kids and collectors to embrace their inner explorers of space, Mattel, Inc. recently announced that it had reached a multi-year agreement with SpaceX. Under its renowned Matchbox brand, Mattel will start releasing toys in 2023 that are inspired by SpaceX. Parallel to this, Mattel Creations, the company’s platform for cooperation and direct sales to consumers, will begin to feature collectibles inspired by space exploration.

Market Concentration & Characteristics

The Baby & Infant Toys Market demonstrates moderate to high market concentration, with a blend of global giants and specialized regional brands shaping the industry landscape. It features strong emphasis on safety, quality, and developmental value, driving manufacturers to comply with stringent regulatory standards and invest in continuous innovation. The market includes a wide variety of products, ranging from traditional soft toys to technologically advanced and educational toys, catering to different age groups and parental expectations. Established brands leverage expansive distribution networks, digital marketing, and collaborations with child development experts to maintain competitive advantage and consumer trust. The market’s characteristics include rapid product turnover, frequent launches of new and themed toys, and growing adoption of eco-friendly materials. E-commerce growth supports broader access and diversity in product offerings, while brick-and-mortar retail remains important for experiential shopping and immediate product availability

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily through 2032, driven by increasing demand for both physical and digital card games.

- Digital transformation will continue to shape the industry, with mobile and online platforms expanding access and enhancing user engagement.

- Collectible and themed card games will gain popularity, attracting both traditional players and new audiences seeking unique gaming experiences.

- Sustainability initiatives, such as eco-friendly materials and packaging, will become more prominent, aligning with consumer preferences for environmentally responsible products.

- Educational and skill-based card games will see increased adoption in schools and learning centers, supporting cognitive development and collaborative learning.

- Emerging markets in Asia Pacific, Latin America, and Africa will offer significant growth opportunities due to rising disposable incomes and expanding urban populations.

- Integration of augmented reality (AR) and virtual reality (VR) technologies will enhance gameplay, providing immersive experiences that blend physical and digital elements.

- Esports and competitive card gaming will expand, with tournaments and online competitions fostering community engagement and brand loyalty.

- Strategic partnerships with entertainment franchises will drive the development of new card game themes, appealing to fans of movies, comics, and video games.

- Omnichannel distribution strategies, combining offline retail and online platforms, will ensure broad product accessibility and cater to diverse consumer preferences.