Market Overview

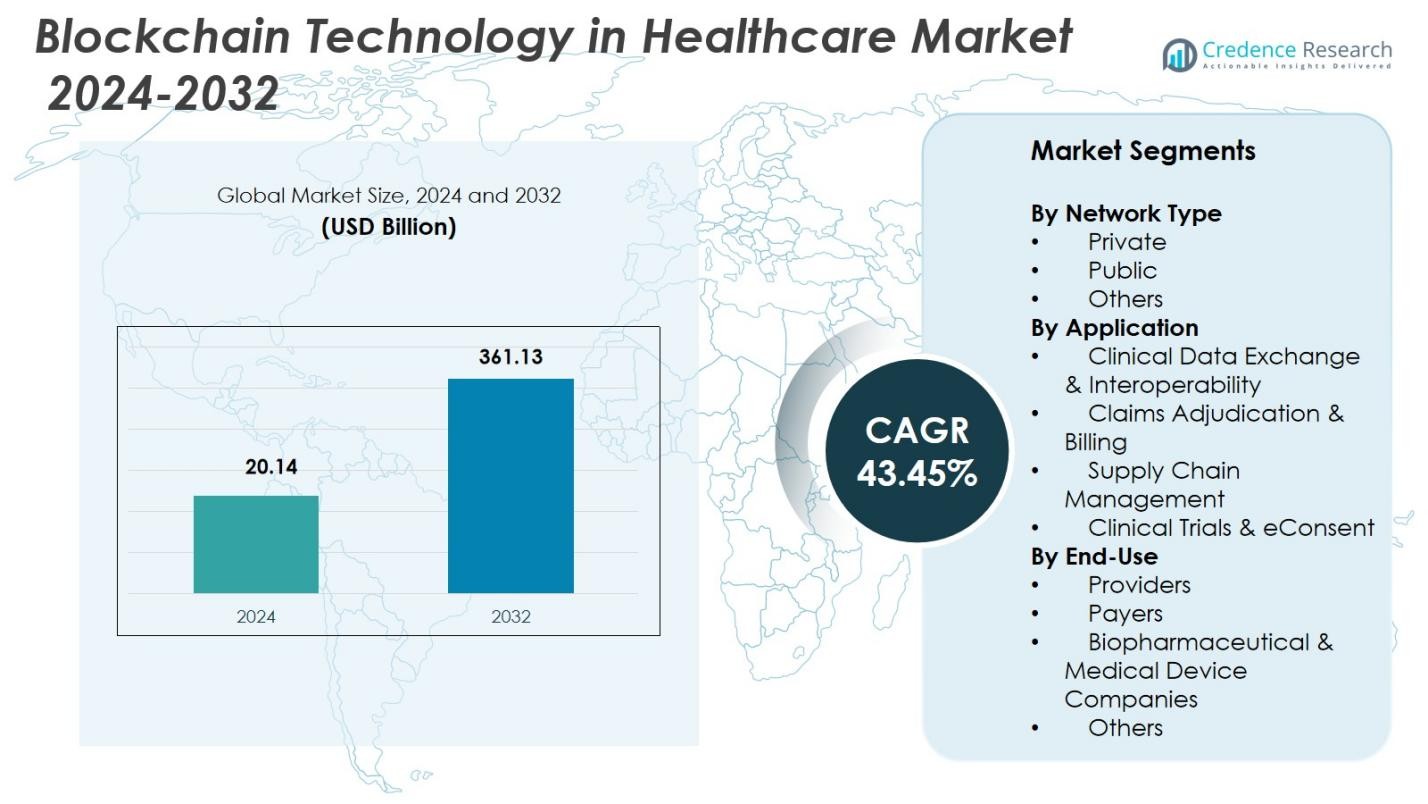

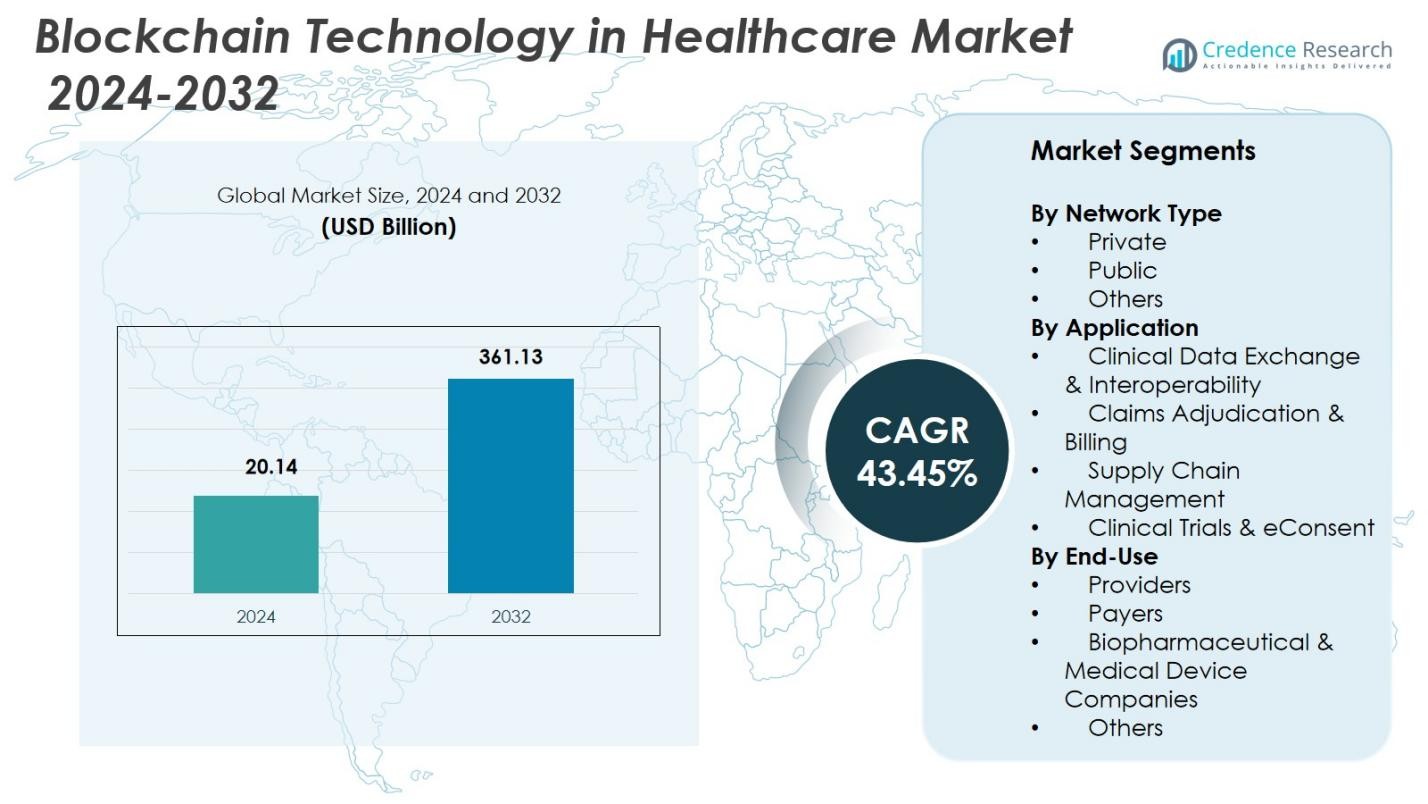

Blockchain Technology in Healthcare Market size was valued at USD 20.14 Billion in 2024 and is anticipated to reach USD 361.13 Billion by 2032, at a CAGR of 43.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blockchain Technology in Healthcare Market Size 2024 |

USD 20.14 Billion |

| Blockchain Technology in Healthcare Market, CAGR |

43.45% |

| Blockchain Technology in Healthcare Market Size 2032 |

USD 361.13 Billion |

Blockchain Technology in Healthcare Market features key players such as IBM, Oracle, Guardtime, Solve.Care, Chronicled, Medicalchain SA, PATIENTORY INC., BurstIQ, Blockpharma, and iSolve LLC, all driving advancements in secure data exchange, supply-chain integrity, and automated claims processing. These companies are strengthening blockchain adoption through product innovation, ecosystem expansion, and integration of decentralized identity, interoperability, and smart contract capabilities. Regionally, North America led the market with a 41.6% share in 2024 due to strong digital health infrastructure and early technological adoption, followed by Europe with 28.4%, supported by strict data governance frameworks and growing cross-border healthcare digitalization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Blockchain Technology in Healthcare Market was valued at USD 20.14 Billion in 2024 and is set to grow at a CAGR of 43.45% through 2032.

- Rising need for secure, interoperable data exchange and increasing adoption of blockchain by biopharma companies for supply-chain traceability are key drivers boosting market expansion.

- Major trends include the growth of decentralized clinical trials, eConsent platforms, and integration of blockchain with AI, IoT, and cloud for enhanced automation and transparency.

- Leading players such as IBM, Oracle, Guardtime, Solve.Care, and Chronicled are expanding their solutions across private networks, which held a 62.4% segment share in 2024.

- North America led the market with a 41.6% share, followed by Europe at 28.4% and Asia-Pacific at 20.7%, driven by strong digital health adoption, regulatory support, and increasing blockchain pilot programs.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Network Type

In the Blockchain Technology in Healthcare Market, the Private blockchain segment dominated with a 62.4% market share in 2024, driven by its enhanced data privacy, controlled access, and suitability for HIPAA-compliant environments. Healthcare providers and payers increasingly prefer private networks to ensure secure patient data exchange and streamline clinical workflows. Public blockchains held 28.6% due to growing interest in decentralized health records, while the Others segment accounted for 9.0%, supported by hybrid architectures. The rising need for tamper-proof, interoperable medical systems continues to accelerate adoption of private blockchain networks across clinical and administrative applications.

- For instance, Guardtime’s KSI blockchain, used by Estonia’s healthcare system to ensure the integrity and confidentiality of electronic health records.

By Application

The Clinical Data Exchange & Interoperability segment led the market with a 38.7% share in 2024, supported by strong demand for secure patient data transfer, real-time record validation, and cross-platform integration. Blockchain’s ability to eliminate data silos and prevent medical record manipulation drives widespread use among hospitals and health IT vendors. Claims Adjudication & Billing represented 26.9% as providers adopt blockchain to combat fraud and settlement delays, while Supply Chain Management held 21.8% due to rising counterfeit-prevention efforts. Clinical Trials & eConsent captured 12.6%, driven by the need for transparent trial documentation.

- For instance, FarmaTrust delivers blockchain with AI for pharmaceutical tracking, enhancing accountability and compliance in global supply chains.

By End-Use

In 2024, Biopharmaceutical & Medical Device Companies dominated the Blockchain Technology in Healthcare Market with a 40.5% market share, propelled by strong reliance on blockchain for supply-chain authentication, research integrity, and regulatory compliance. Providers accounted for 33.1% as hospitals increasingly integrate blockchain to enhance EHR interoperability and secure data access. Payers held 18.7% due to its role in fraud mitigation and automated claims management, while Others represented 7.7%. Growing emphasis on patient data ownership, secure information exchange, and transparent clinical operations continues to accelerate blockchain adoption across all healthcare end-user categories.

Key Growth Drivers

Rising Demand for Secure and Interoperable Health Data Exchange

The Blockchain Technology in Healthcare Market is expanding as healthcare systems prioritize secure, efficient, and interoperable data exchange. Blockchain enables immutable medical records, reduces duplication, and ensures real-time accessibility across providers, payers, and patients. Growing concerns around data breaches and identity theft strengthen the shift toward decentralized architectures. Interoperability mandates from regulators and the increasing adoption of electronic health records further accelerate blockchain integration. These capabilities support seamless care coordination, enhanced clinical decision-making, and greater patient control, making blockchain a critical enabler of next-generation healthcare data infrastructure.

- For instance, Solve.Care launched Care.Chain in March 2023, a Layer-2 decentralized blockchain infrastructure that connects healthcare participants on a peer-to-peer basis for transparent interactions and secure data sharing.

Growing Adoption Across Biopharma for Supply Chain Integrity

Biopharmaceutical and medical device manufacturers increasingly deploy blockchain to ensure supply-chain transparency, product authenticity, and traceability, significantly driving market growth. The technology’s ability to track every transaction—from raw materials to distribution—helps combat counterfeiting, which remains a major challenge in global pharmaceutical trade. Blockchain supports compliance with stringent regulations, enables faster recalls, and enhances visibility across multi-tier networks. As precision medicine, temperature-sensitive shipments, and complex biologics expand, blockchain’s role in ensuring product integrity and operational resilience continues to strengthen within biopharma ecosystems.

- For instance, the MediLedger Project, involving Pfizer and Genentech with wholesalers like McKesson, uses blockchain for package-level tracking of prescription drugs, verifying authenticity in real time to meet the Drug Supply Chain Security Act (DSCSA).

Acceleration of Value-Based Care and Automated Claims Processing

The shift toward value-based healthcare models is fueling widespread adoption of blockchain for billing accuracy, automated adjudication, and fraud reduction. Smart contracts facilitate real-time claims validation, minimize administrative delays, and reduce costs associated with manual processes. Payers and providers benefit from transparent, tamper-proof exchanges that enhance trust and eliminate common disputes. As healthcare systems move toward outcome-driven reimbursements, blockchain supports accurate performance evaluation and ensures verifiable data trails. This alignment with payment modernization significantly boosts blockchain adoption across administrative and financial operations in healthcare.

Key Trends & Opportunities

Expansion of Decentralized Clinical Trials and eConsent Platforms

A major trend in the Blockchain Technology in Healthcare Market is the growing shift toward decentralized clinical trials (DCTs), where blockchain enhances data integrity, patient authentication, and consent management. Sponsors and CROs increasingly adopt blockchain-based eConsent to ensure transparency, time-stamped updates, and compliance with evolving regulatory expectations. As global trials expand to remote regions, blockchain improves participant engagement and guarantees tamper-proof study documentation. This trend unlocks significant opportunities for vendors offering integrated platforms that combine blockchain with wearables, telehealth, and real-time patient monitoring technologies.

- For instance, LabTrace collaborated with King’s College London on an experimental medicine study for Parkinson’s research. They utilized Algorand-based blockchain notarization to authenticate trial data across sites, supporting tamper-proof documentation and multi-stakeholder transparency.

Integration of Blockchain with AI, IoT, and Cloud Ecosystems

The convergence of blockchain with AI, IoT-enabled medical devices, and cloud infrastructures presents one of the strongest growth opportunities. AI benefits from blockchain-secured datasets to improve model accuracy, while IoT devices rely on decentralized networks to protect sensitive patient information. Cloud-based healthcare platforms leverage blockchain for identity management and secure interoperability. These combined technologies enable predictive analytics, automated clinical workflows, and granular data governance. As healthcare’s digital transformation accelerates, integrated blockchain ecosystems will unlock new use cases ranging from remote patient management to smart health contracts.

- For instance, BurstIQ’s platform secures massive patient datasets on blockchain for AI-driven analysis, ensuring HIPAA compliance during data sharing or licensing.

Key Challenges

High Implementation Costs and Integration Complexity

Despite strong potential, the Blockchain Technology in Healthcare Market faces challenges due to high deployment costs and complex integration with legacy IT systems. Many hospitals still operate outdated infrastructure unable to support decentralized architectures. Migrating large patient datasets, ensuring interoperability with EHR vendors, and customizing blockchain applications demand substantial technical resources. Additionally, ongoing maintenance and talent shortages contribute to increased costs. These hurdles often delay adoption, particularly for small and mid-sized healthcare providers with limited budgets and digital transformation capacity.

Regulatory Uncertainty and Data Governance Limitations

Regulatory ambiguity surrounding blockchain use in healthcare continues to impede widespread adoption. Compliance with HIPAA, GDPR, and regional health data laws remains challenging due to the immutable nature of blockchain records. Questions persist regarding data ownership, cross-border information transfer, and the legal standing of smart contracts. Additionally, the inability to modify or delete stored medical information conflicts with patient “right-to-erasure” mandates. These governance issues drive caution among providers and payers, requiring clearer regulatory frameworks and standardized guidelines to support secure and compliant blockchain deployment.

Regional Analysis

North America

North America dominated the Blockchain Technology in Healthcare Market with a 41.6% share in 2024, driven by strong digital health infrastructure, high EHR adoption, and significant investments from healthcare providers, payers, and biopharmaceutical companies. The region benefits from advanced regulatory frameworks, early technology adoption, and active participation from blockchain innovators focusing on data interoperability and supply-chain traceability. Growing incidences of healthcare fraud and rising emphasis on value-based care further accelerate adoption. Ongoing collaborations among hospitals, research institutions, and technology vendors continue to strengthen the region’s leadership in blockchain-enabled healthcare transformation.

Europe

Europe accounted for 28.4% of the Blockchain Technology in Healthcare Market in 2024, supported by strong government-backed digital health initiatives, GDPR-driven data governance priorities, and rising investments in precision medicine. The region’s multi-country healthcare system encourages blockchain adoption to streamline cross-border patient data exchange and clinical research coordination. Pharmaceutical and biotechnology companies increasingly deploy blockchain for compliance, serialization, and anti-counterfeiting. Expanding pilot projects across the U.K., Germany, France, and the Nordics further enhance market penetration. Growing emphasis on security, interoperability, and transparent clinical trials positions Europe as a rapidly advancing blockchain healthcare hub.

Asia-Pacific

Asia-Pacific held a 20.7% share of the Blockchain Technology in Healthcare Market in 2024, driven by rising healthcare digitalization, expanding hospital networks, and increased adoption of blockchain-backed insurance and claims platforms. Countries such as China, Japan, South Korea, and India are investing heavily in healthcare IT modernization, with strong government support for secure patient data management and medical research innovation. Pharmaceutical supply-chain vulnerabilities and the need for traceability fuel further adoption. The presence of a large patient base, growing telehealth usage, and rising medical device manufacturing strengthen the region’s long-term blockchain adoption outlook.

Latin America

Latin America captured a 5.6% share of the Blockchain Technology in Healthcare Market in 2024, supported by growing digital health reforms, expanding insurance coverage, and rising awareness of blockchain’s role in fraud prevention. Countries such as Brazil, Mexico, and Chile are implementing blockchain pilots across patient data exchange, pharmacy management, and claims adjudication. The market benefits from increasing private-sector investments and collaborations with global technology vendors. Despite limited IT infrastructure in some areas, the region is progressing steadily, with blockchain adoption accelerating as healthcare providers seek secure, transparent, and cost-efficient digital solutions.

Middle East & Africa

The Middle East & Africa region accounted for 3.7% of the Blockchain Technology in Healthcare Market in 2024, with growth supported by major government-led digital transformation programs and rising demand for secure medical data management. Countries such as the UAE, Saudi Arabia, and South Africa drive adoption through initiatives focused on smart healthcare, supply-chain transparency, and AI-integrated blockchain solutions. Partnerships between hospitals and technology firms are expanding, improving interoperability and patient identity management. While infrastructure gaps and skill shortages persist in some regions, increasing investments in modern healthcare frameworks continue to fuel market expansion.

Market Segmentations:

By Network Type

By Application

- Clinical Data Exchange & Interoperability

- Claims Adjudication & Billing

- Supply Chain Management

- Clinical Trials & eConsent

By End-Use

- Providers

- Payers

- Biopharmaceutical & Medical Device Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Blockchain Technology in Healthcare Market is characterized by strong participation from key players such as IBM, Oracle, Guardtime, Chronicled, Medicalchain SA, PATIENTORY INC., iSolve LLC, Solve.Care, BurstIQ, and Blockpharma. These companies are actively expanding their portfolios through strategic collaborations, product enhancements, and ecosystem partnerships aimed at strengthening secure data exchange, clinical interoperability, and supply-chain visibility. Vendors increasingly focus on developing scalable platforms tailored for providers, payers, and biopharmaceutical companies, leveraging smart contracts, decentralized identity solutions, and tamper-proof audit trails. The competitive environment is also shaped by rising investments in R&D, regulatory-aligned blockchain frameworks, and integration of AI, IoT, and cloud technologies. Emerging health-tech startups, consortium-led initiatives, and interoperability alliances further intensify competition by accelerating innovation and enabling cross-organizational blockchain networks. Overall, the market continues to evolve rapidly, with companies prioritizing transparency, compliance, and operational efficiency to strengthen their competitive positioning in the global healthcare blockchain ecosystem.

Key Player Analysis

- Solve.Care

- Chronicled

- Medicalchain SA

- Blockpharma

- IBM

- BurstIQ

- PATIENTORY INC.

- Oracle

- iSolve, LLC

- Guardtime

Recent Developments

- In September 2025, Algorand Foundation and Self‑Employed Women’s Association (SEWA) launched a blockchain-based Digital Health Passport to expand women’s access to secure health services in India.

- For instance, Avaneer Health uses blockchain for secure data exchanges and claims processing, backed by partners like Aetna and Cleveland Clinic to streamline provider directories

- In 2024, XRP Healthcare launched the XRPH AI Chatbot, using blockchain-secured data to deliver personalized health guidance, signaling growing convergence of blockchain and AI in healthcare.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Network Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Blockchain adoption in healthcare will accelerate as hospitals prioritize secure and interoperable data exchange.

- Biopharmaceutical companies will increasingly use blockchain to enhance supply-chain transparency and product traceability.

- Smart contracts will gain wider use in automating claims adjudication and reducing administrative burdens.

- Decentralized clinical trial platforms will expand as research organizations seek tamper-proof data validation.

- Blockchain-integrated digital identity solutions will strengthen patient authentication and access control.

- Governments will encourage blockchain adoption through data governance policies and national health IT programs.

- Integration of blockchain with AI, IoT, and cloud systems will unlock advanced analytics and automated workflows.

- Payers will adopt blockchain to reduce fraud, improve reimbursement accuracy, and enhance operational efficiency.

- Hybrid blockchain architectures will emerge to balance scalability, privacy, and regulatory compliance.

- Growing focus on patient-centric healthcare will drive adoption of blockchain-enabled personal health record platforms.

Market Segmentation Analysis:

Market Segmentation Analysis: