Market Overview

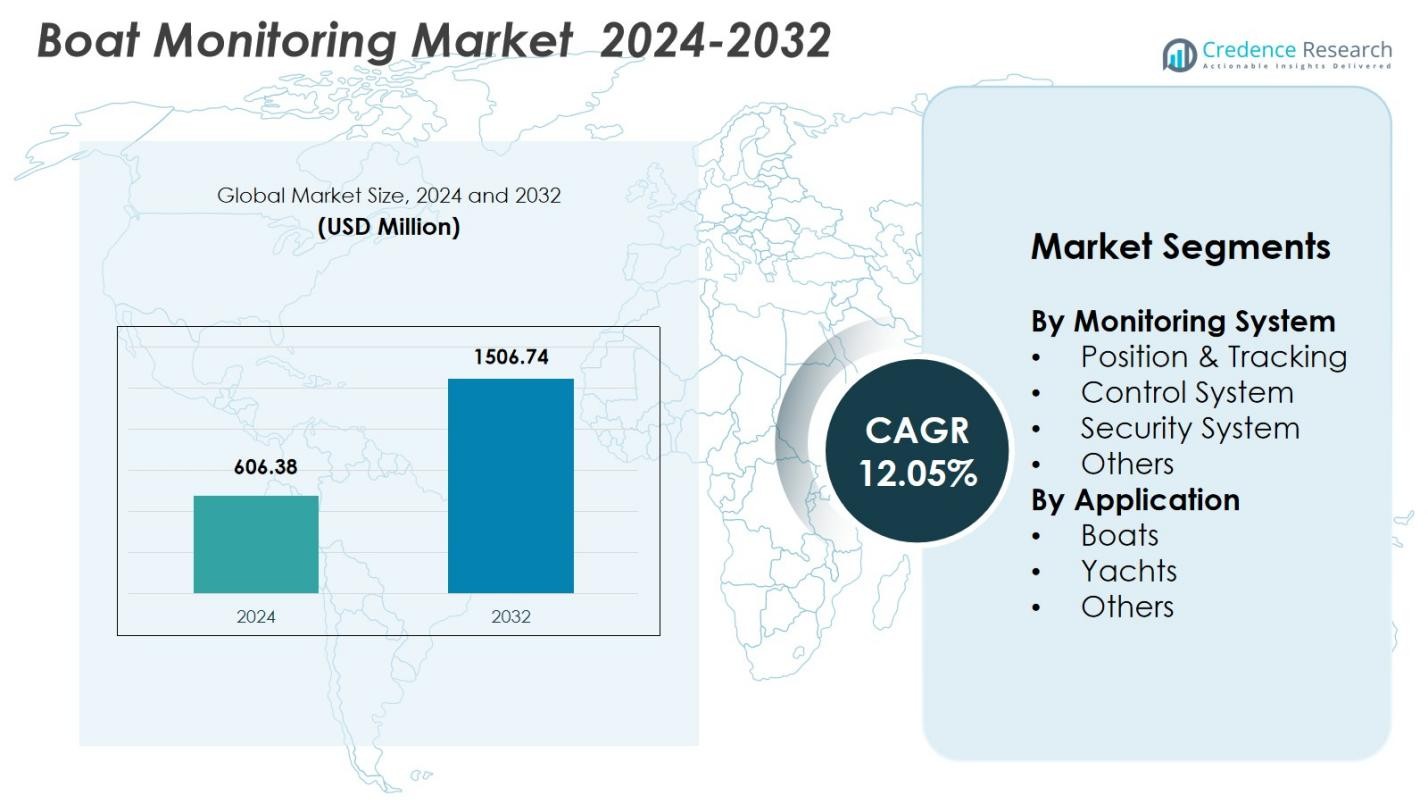

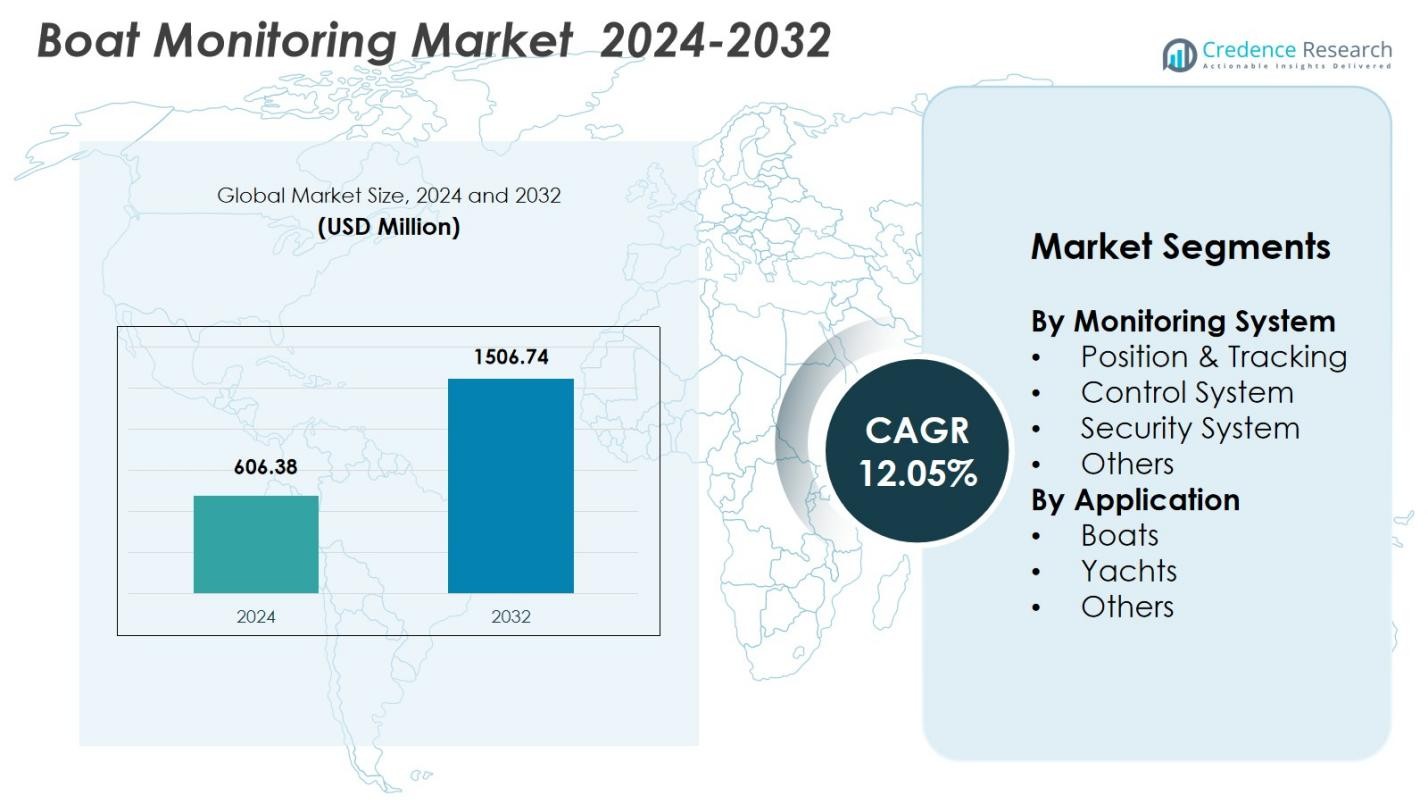

Boat Monitoring Market size was valued at USD 606.38 Million in 2024 and is anticipated to reach USD 1506.74 Million by 2032, at a CAGR of 12.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blockchain Technology in Healthcare Market Size 2024 |

USD 606.38 Million |

| Blockchain Technology in Healthcare Market, CAGR |

12.05% |

| Blockchain Technology in Healthcare Market Size 2032 |

USD 1506.74 Million |

Boat Monitoring Market is shaped by leading players such as Seas of Solutions, Garmin, Smart Switch, Navis Elektronika, Monnit, Yamaha, Azimut-Benetti Group, GOST, Brunswick Corporation, and Groupe Beneteau, each contributing to advancements in tracking systems, security technologies, and remote diagnostics. These companies focus on enhancing real-time visibility, vessel safety, and predictive maintenance through IoT-enabled and sensor-integrated platforms. North America emerged as the leading region in 2024 with a 38.4% share, driven by strong adoption of smart marine solutions and a high concentration of recreational boating activities. Europe followed with a 27.6% share, supported by established yacht manufacturing hubs and increasing digitalization across marinas and fleet operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Boat Monitoring Market was valued at USD 606.38 Million in 2024 and is projected to reach USD 1506.74 Million by 2032, growing at a CAGR of 12.05%.

- Market drivers include rising adoption of IoT-enabled tracking, growing emphasis on vessel safety, and increasing recreational boating and yacht ownership.

- Key trends highlight rapid integration of AI-driven diagnostics, predictive maintenance tools, and multi-sensor monitoring platforms, enhancing real-time vessel visibility and performance insights.

- Leading companies such as Seas of Solutions, Garmin, Smart Switch, Navis Elektronika, Monnit, Yamaha, GOST, Brunswick Corporation, and Groupe Beneteau focus on advanced tracking, security, and remote management technologies; Position & Tracking dominated the segment with a 42.6% share in 2024.

- Regional analysis shows North America leading with a 38.4% share, followed by Europe at 27.6% and Asia Pacific at 21.9%, driven by strong recreational marine activity and growing adoption of smart marine systems across key coastal markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Monitoring System

In the Boat Monitoring Market, the Position & Tracking segment led the market in 2024 with a 42.6% share, driven by rising demand for real-time vessel visibility, geofencing alerts, and advanced navigation safety. Fleet operators, yacht owners, and rental service providers increasingly rely on GPS-enabled platforms to monitor location, optimize routes, and reduce theft risks. The Control System segment continues to grow as boaters adopt remote engine diagnostics and automation tools, while Security Systems gain traction due to heightened safety awareness. Other monitoring categories expand with integrated IoT solutions that enhance onboard connectivity and performance management.

- For instance, Siren Marine’s Connected Boat platform, now backed by Yamaha Marine, provides real-time tracking, geofencing, and remote switching through its mobile app for fleet and individual vessels.

By Application

Within the Boat Monitoring Market, the Boats segment dominated the application category in 2024 with a 57.3% share, supported by increasing adoption of telematics, GPS tracking, and remote diagnostics across leisure, commercial, and fishing vessels. Rising emphasis on operational safety, reduced maintenance downtime, and compliance with maritime regulations accelerates system integration in smaller and mid-sized boats. The Yachts segment benefits from premium features such as multi-sensor security, route optimization, and smart control systems tailored for luxury fleets. Other vessels, including patrol and research crafts, continue adopting monitoring technologies to improve mission reliability and operational efficiency.

- For instance, Siren Marine’s Siren 3 Pro Hub, now under Yamaha Marine, supports wired and wireless sensors for aftermarket installation on commercial vessels, enabling remote tracking of location and systems.

Key Growth Drivers

Increasing Adoption of Connected and Smart Marine Technologies

The Boat Monitoring Market is expanding as boat owners, fleet managers, and recreational users increasingly adopt connected marine technologies for real-time insights and enhanced operational safety. IoT-enabled sensors, satellite connectivity, and cloud-based dashboards support continuous vessel tracking, engine diagnostics, and predictive maintenance. Growing demand for digital control systems and automated alerts strengthens the role of smart monitoring in preventing breakdowns and improving performance. As manufacturers integrate advanced telemetry into boats and yachts, connected systems become essential for optimizing navigation, reducing risks, and ensuring seamless on-water experiences.

- For instance, Starlink’s low Earth orbit satellite technology delivers low-latency connectivity for vessels, enabling real-time fleet monitoring and remote maintenance through high-speed data transmission even in offshore areas.

Rising Focus on Safety, Security, and Theft Prevention

Heightened emphasis on maritime safety and asset protection significantly drives demand for advanced monitoring solutions. Boat owners increasingly rely on geofencing, intrusion detection, remote locking, and emergency alert capabilities to mitigate theft, unauthorized access, and safety hazards. Insurance companies promote monitoring systems by offering premium benefits for enhanced security compliance. Growing incidents of vessel theft and navigation-related risks strengthen the adoption of GPS-enabled tracking and multi-sensor security platforms. This shift toward proactive safety management accelerates market growth across recreational, commercial, and luxury marine segments.

- For instance, MotionInfo’s AWARE Network uses real-time AIS tracking and automated alerts to protect high-risk marine zones, detecting vessel activity in restricted areas and sending proactive warnings to prevent damage to critical infrastructure.

Expansion of Recreational Boating and Yacht Ownership

Rapid growth in recreational boating, sport fishing, and luxury yacht ownership fuels widespread adoption of monitoring technologies. Rising disposable income, marine tourism expansion, and interest in leisure boating increase the number of digitally equipped vessels. Owners seek remote control capabilities, maintenance automation, and real-time vessel performance insights to improve convenience and reliability. Marinas and charter operators integrate monitoring platforms to optimize fleet operations and customer safety. As recreational boating continues to expand worldwide, demand for advanced boat monitoring systems grows proportionally.

Key Trends & Opportunities

Integration of AI, Predictive Analytics, and Automation

Artificial intelligence and predictive analytics are transforming the Boat Monitoring Market by enabling smarter insights, early fault detection, and automated decision-making. AI-driven algorithms analyze engine health, battery performance, location patterns, and environmental conditions to predict issues before failures occur. Automation features, including smart route optimization, fuel management, and real-time diagnostics, present major opportunities for tech vendors. As digital twins and intelligent marine systems gain prominence, AI-enabled platforms create new value propositions for both recreational and commercial vessel applications.

- For instance, Maersk Line uses AI systems with onboard sensors to monitor engine health across its fleet, enabling proactive interventions.

Growth of IoT-Enabled Multi-Sensor Platforms and Remote Management

A major trend shaping the market is the adoption of integrated IoT platforms that combine tracking, diagnostics, security, and environmental monitoring into unified solutions. Demand for remote monitoring continues to rise among fleet operators, yacht owners, and rental services seeking centralized control and reduced operational downtime. Improved cellular, satellite, and Wi-Fi connectivity expands opportunities for cloud-based dashboards and app-controlled systems. These connected platforms enable seamless monitoring from anywhere, supporting smarter maintenance planning, safety compliance, and enhanced user experience across diverse vessel categories.

- For instance, Teltonika offers telematics solutions for charter yachts, delivering real-time location monitoring, theft prevention via geofencing and immobilizers, and remote diagnostics with instant alerts for incidents like equipment failures.

Key Challenges

High Installation Costs and Limited Adoption in Older Vessels

Despite strong demand, high installation and integration costs remain a major challenge, particularly for older boats lacking modern electrical interfaces. Advanced sensors, GPS units, and cloud subscriptions increase upfront expenses, discouraging small boat owners and cost-sensitive operators. Retrofitting older vessels often requires structural modifications and compatibility adjustments, raising complexity and total ownership cost. This cost barrier slows adoption in developing regions and among entry-level boaters, limiting overall market penetration and slowing modernization across traditional fleets.

Connectivity Limitations in Remote Marine Environments

Reliable connectivity remains a persistent challenge in open waters and remote marine zones where cellular networks are weak or unavailable. Monitoring systems relying on real-time GPS, cloud data, and remote alerts face disruptions, affecting tracking accuracy and system performance. Satellite-based solutions offer better coverage but significantly increase operational costs. Inconsistent communication infrastructure restricts system reliability for long-distance voyages, commercial fishing operations, and offshore activities. These connectivity gaps hinder seamless monitoring and reduce the effectiveness of advanced smart marine technologies.

Regional Analysis

North America

North America held the largest share in the Boat Monitoring Market in 2024, accounting for 38.4% of the global revenue, driven by strong adoption of smart marine technologies, high recreational boating activity, and a well-established yacht ownership base. The U.S. leads the region with widespread integration of GPS tracking, remote diagnostics, and multi-sensor security systems across leisure and commercial vessels. Growing marine tourism, advanced connectivity infrastructure, and supportive insurance incentives further boost uptake. Continuous innovation by regional marine electronics manufacturers strengthens market expansion across lakeside, coastal, and offshore boating segments.

Europe

Europe captured 27.6% of the Boat Monitoring Market in 2024, supported by robust demand from countries such as Italy, France, the U.K., and the Netherlands, where yacht manufacturing and premium boating culture are well-established. The region benefits from strong maritime regulations promoting vessel safety, navigation compliance, and remote monitoring adoption. Increasing electrification of boats, rising marina infrastructure investments, and growing charter fleet operations fuel market growth. Advanced onboard digitalization and high consumer preference for connected marine systems position Europe as a major hub for technologically sophisticated monitoring platforms.

Asia Pacific

Asia Pacific accounted for 21.9% of the Boat Monitoring Market in 2024, driven by expanding coastal tourism, rising recreational boating participation, and strong economic growth in China, Japan, Australia, and Southeast Asia. Demand for monitoring technologies increases as governments strengthen maritime safety standards and commercial fleets adopt advanced navigation and security systems. Growing yacht purchases among high-net-worth individuals and rising marine infrastructure developments contribute to market expansion. Improved connectivity and rapid adoption of IoT-enabled marine solutions further accelerate system penetration across both commercial and leisure marine segments.

Latin America

Latin America represented 7.8% of the Boat Monitoring Market in 2024, supported by growing marine tourism, rising boating activity in Brazil, Mexico, and Chile, and increasing adoption of safety and security technologies. Monitoring systems gain traction as vessel owners prioritize theft prevention and remote tracking due to rising maritime security concerns. Expanding fishing and charter industries create additional demand for real-time diagnostics and location monitoring. Despite infrastructure limitations, the region’s growing interest in connected marine solutions and government initiatives to strengthen maritime safety drive steady market adoption.

Middle East & Africa

The Middle East & Africa region held a 4.3% share of the Boat Monitoring Market in 2024, driven by increasing yacht ownership, coastal development projects, and a rising focus on marine tourism in the UAE, Saudi Arabia, and South Africa. Luxury marinas and charter services accelerate demand for advanced security, tracking, and vessel management systems. Adoption grows among commercial vessels, fishing fleets, and port authorities seeking improved operational visibility. Although connectivity gaps persist in remote waters, ongoing investments in digital marine infrastructure support gradual expansion of monitoring technologies across the region.

Market Segmentations:

By Monitoring System

- Position & Tracking

- Control System

- Security System

- Others

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Boat Monitoring Market features key players such as Seas of Solutions, Garmin, Smart Switch, Navis Elektronika, Monnit, Yamaha, Azimut-Benetti Group, GOST, Brunswick Corporation, and Groupe Beneteau, each contributing to technological advancements and product diversification. The market is shaped by continuous innovation in IoT-enabled tracking systems, multi-sensor security platforms, engine diagnostics, and cloud-based monitoring dashboards. Leading players focus on enhancing real-time visibility, predictive maintenance, and integrated control features to improve vessel efficiency and safety. Strategic initiatives, including product launches, partnerships, and software enhancements, strengthen their global presence. Manufacturers increasingly incorporate AI-driven analytics, satellite connectivity, and mobile app integration to differentiate offerings amid rising customer expectations for smarter, more intuitive monitoring systems. As recreational boating expands and maritime safety regulations intensify, competition accelerates, pushing companies to invest in R&D, expand service networks, and deliver more seamless, connected marine experiences across boats, fleets, and luxury yachts.

Key Player Analysis

- Seas of Solutions

- Garmin

- Smart Switch

- Navis Elektronika

- Monnit

- Yamaha

- Azimut-Benetti Group

- GOST (Global Ocean Security Technologies)

- Brunswick Corporation

- Groupe Beneteau

Recent Developments

- In October 2025, Garmin launched its new OnBoard system offering wireless man-overboard detection and engine-cutoff integration with its chartplotters, improving boating safety and vessel control.

- In September 2023, GOST also partnered with Boat Fix to offer 24/7 alarm monitoring and live customer support for boat owners using GOST’s satellite-tracking systems.

- In June 2023, Seas of Solutions unveiled three new marine-safety and monitoring products including a compact voyage data recorder and upgraded EPIRB devices at the Seawork exhibition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Monitoring System, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Boat Monitoring Market will experience rising adoption of AI-driven diagnostics and predictive maintenance tools.

- IoT-enabled multi-sensor platforms will become standard across recreational, commercial, and luxury vessels.

- Real-time tracking and geofencing solutions will gain stronger demand for enhanced vessel security.

- Satellite connectivity advancements will expand monitoring reliability in remote marine regions.

- Cloud-based dashboards and mobile apps will play a central role in remote vessel management.

- Integration of digital twins will support advanced performance modeling and route optimization.

- Growth in recreational boating and yacht ownership will drive widespread system upgrades.

- Insurance providers will increasingly incentivize monitoring systems to reduce risk exposures.

- Hybrid energy and electric boat ecosystems will accelerate the adoption of smart onboard monitoring.

- Rising maritime safety regulations will push owners and fleets to integrate advanced monitoring technologies.

Market Segmentation Analysis:

Market Segmentation Analysis: