| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Off The Road Tire Market Size 2024 |

USD 513.21 Million |

| Brazil Off The Road Tire Market, CAGR |

3.99% |

| Brazil Off The Road Tire Market Size 2032 |

USD 730.54 Million |

Market Overview:

Brazil Off The Road Tire Market size was valued at USD 513.21 million in 2023 and is anticipated to reach USD 730.54 million by 2032, at a CAGR of 3.99% during the forecast period (2023-2032).

The growth of the Brazil Off-the-Road (OTR) tire market is driven by several key factors. Infrastructure development is a major contributor, with large-scale projects such as roads, highways, and urban expansion increasing the demand for heavy machinery, which in turn drives the need for durable OTR tires. Additionally, Brazil’s mining sector plays a significant role, as the country’s vast mineral resources require robust mining operations. These operations rely heavily on specialized OTR tires to withstand challenging terrains and heavy loads. The agricultural sector also contributes to the market growth, as the mechanization of farming practices increases the demand for OTR tires for various agricultural machinery. Furthermore, the expansion of the commercial transportation sector, including logistics and freight services, boosts the utilization of OTR tires in vehicles operating in off-road conditions.

Regionally, Brazil’s OTR tire market is influenced by the economic activities and geographic characteristics of its various regions. The Southeast region, as Brazil’s industrial hub, drives a large portion of the demand due to its concentration of mining and manufacturing activities, which rely on heavy-duty machinery. In the South region, agricultural activities significantly contribute to the demand for OTR tires, as mechanized farming continues to modernize. Meanwhile, the Northeast and Central-West regions are seeing increasing demand due to expanding infrastructure projects and agricultural growth, both of which require specialized OTR tires for construction and farming machinery. This regional diversity presents opportunities for stakeholders to target specific market needs based on the dominant industries in each area.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Brazil Off the Road Tire market size was valued at USD 513.21 million in 2023 and is anticipated to reach USD 730.54 million by 2032, at a CAGR of 3.99% during the forecast period (2023-2032).

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Brazil’s mining sector, with its vast natural resources, significantly contributes to the demand for specialized OTR tires needed for heavy-duty mining machinery.

- The agricultural sector’s mechanization is increasing the demand for OTR tires, as modern farming practices rely on specialized machinery such as tractors and harvesters.

- The growing commercial transportation and logistics sectors are further driving OTR tire demand, especially in vehicles operating in challenging off-road conditions.

- The Southeast region leads the market, with its concentration of industrial activities such as mining and manufacturing that require durable OTR tires.

- The South region’s agricultural activities continue to boost OTR tire demand, especially with the increasing mechanization of farming equipment.

- The Brazil OTR tire market faces challenges like high costs, supply chain complexities, and stringent environmental regulations, but these also present opportunities for innovation.

Market Drivers:

Infrastructure Development and Urbanization

One of the primary drivers of the Brazil Off-the-Road (OTR) tire market is the ongoing infrastructure development and urbanization across the country. Brazil has been investing heavily in large-scale infrastructure projects, including roads, highways, bridges, and urban developments. For instance, a prime example of Brazil’s infrastructure boom is the BR-153/080/414/GO/TO Highway Duplication project, which involves duplicating 850.7 km of highway between Anápolis in Goiás and Aliança in Tocantins. As cities expand and rural areas see increased connectivity, the demand for heavy-duty construction machinery is growing. These projects require specialized equipment such as bulldozers, excavators, and graders, all of which are reliant on high-performance OTR tires. The expansion of infrastructure not only increases the volume of construction activity but also requires durable and reliable tires that can withstand the challenging conditions of off-road environments, propelling the demand for OTR tires in Brazil.

Mining Sector Expansion

Brazil’s rich natural resources and large-scale mining activities are another significant driver of the OTR tire market. The country is home to some of the world’s largest reserves of iron ore, gold, and other minerals, making the mining industry a critical economic sector. Mining operations are often located in remote areas, requiring specialized machinery equipped with durable OTR tires to navigate tough terrains, such as rocky, uneven ground and mining pits. The ongoing growth of the mining sector, supported by global demand for minerals, continues to drive the need for OTR tires designed to meet the heavy-duty requirements of this industry. Furthermore, as Brazil remains a key player in global mining, the continuous investment in expanding mining capacities further increases the demand for tires that can perform in extreme environments.

Agricultural Mechanization

The agricultural sector in Brazil is also a major contributor to the growth of the OTR tire market. Agriculture is one of the country’s primary industries, with vast areas of land dedicated to the cultivation of crops such as soybeans, sugarcane, and coffee. As the industry continues to modernize, there is a growing trend toward the mechanization of farming practices, which requires the use of specialized machinery like tractors, harvesters, and plows. These machines rely on OTR tires for their ability to handle the rough terrains and heavy loads typically associated with agricultural operations. The increasing adoption of modern farming equipment and technologies is directly fueling the demand for OTR tires in Brazil’s agricultural sector, ensuring both efficiency and productivity in crop production.

Rising Demand in Commercial Transportation and Logistics

In addition to the construction, mining, and agricultural sectors, the commercial transportation and logistics industries are contributing to the growth of the OTR tire market in Brazil. With the country’s vast size and the increasing need for transportation across long distances, the demand for heavy-duty vehicles capable of traversing off-road environments has surged. Trucks and other commercial vehicles that operate in challenging conditions, such as unpaved roads or remote regions, require durable OTR tires to maintain operational efficiency and safety. This demand is further amplified by the expansion of logistics networks to support Brazil’s growing e-commerce sector. For instance, the construction of a specialized port terminal for grains and fertilizers at the Port of Santos a joint venture between Rumo and DP World in March 2024 aims to boost annual capacity by 12.5 million tons, requiring heavy-duty vehicles and equipment with reliable OTR tires for efficient cargo movement. The increasing need for robust tires that can handle various off-road conditions is driving market growth in this sector, ensuring the continued need for specialized OTR tire solutions.

Market Trends:

Shift Toward Sustainable and Eco-friendly Tires

A growing trend in the Brazil Off-the-Road (OTR) tire market is the increasing demand for sustainable and eco-friendly tire solutions. As environmental concerns become more prominent, the tire manufacturing industry is responding with innovations aimed at reducing the environmental impact of OTR tires. This includes the development of tires made from renewable or recyclable materials, as well as advancements in tire longevity, which reduce the frequency of replacements and, in turn, the environmental footprint. For instance, Trelleborg Tires, a global leader in agricultural tires, has supported Brazilian agribusiness for over 30 years by introducing advanced tire solutions made with recycled and natural materials, as well as optimized tread designs that enhance crop yields and promote sustainable practices. Brazil, being one of the largest agricultural and industrial hubs in Latin America, is seeing a rise in the adoption of green technologies across various sectors, including mining, construction, and agriculture. Manufacturers are focusing on producing high-performance tires that not only meet the durability requirements of these industries but also align with environmental sustainability goals. This trend is expected to gain momentum as both local and global stakeholders prioritize eco-conscious solutions.

Technological Advancements in Tire Design

Technological innovation is another key trend shaping the Brazil OTR tire market. Advances in tire design and materials are improving the overall performance, safety, and efficiency of OTR tires. The introduction of tires with better wear resistance, enhanced traction, and optimized load-bearing capabilities is contributing to the market’s growth. For instance, Trelleborg’s TM1 ECO POWER tire, launched in April 2024, exemplifies advancements in sustainable tire engineering, offering enhanced durability and fuel efficiency for agricultural applications. Tires are now being designed with advanced tread patterns and more durable rubber compounds, making them better suited for the demanding environments of mining, construction, and agriculture. Additionally, manufacturers are incorporating intelligent technologies into tire systems, such as sensors that monitor tire pressure, temperature, and wear. These innovations not only improve the longevity and performance of OTR tires but also offer valuable data for maintenance and operations, enhancing overall fleet management and cost efficiency.

Growing Focus on Remote Monitoring and Fleet Management

As industries become more digitalized, there is an increasing focus on remote monitoring and fleet management solutions in the Brazil OTR tire market. The use of data analytics, Internet of Things (IoT) devices, and cloud-based platforms is enabling companies to optimize their tire management strategies. By remotely tracking tire performance and wear, businesses in sectors such as mining and agriculture can reduce downtime, improve operational efficiency, and enhance safety. Remote monitoring systems can also provide real-time alerts for maintenance needs, allowing for proactive repairs and replacements. This trend is particularly important in remote regions of Brazil, where access to maintenance services can be limited. As digitalization continues to grow, the integration of smart tire management systems is expected to play an increasingly important role in the market.

Expansion of the Rental and Leasing Market

Another notable trend in the Brazil OTR tire market is the expansion of the rental and leasing market for heavy machinery. As industries face financial pressure and the need for cost efficiency, many companies are opting to lease or rent heavy-duty equipment, including machinery that requires OTR tires. This shift is particularly prevalent in the construction and mining sectors, where project-based operations make it more cost-effective to rent equipment rather than invest in purchasing new machinery. This trend is creating a more dynamic demand for OTR tires, as rental companies require tires that offer high performance and durability. The leasing model also encourages the use of tires that are optimized for various conditions and can be easily replaced or upgraded as needed. This growing rental market is expected to continue influencing the OTR tire industry, shaping demand patterns and driving innovation in tire solutions.

Market Challenges Analysis:

High Cost of OTR Tires

One of the primary restraints in the Brazil Off-the-Road (OTR) tire market is the high cost associated with purchasing and maintaining OTR tires. These tires are designed for heavy-duty machinery and extreme conditions, requiring specialized materials and manufacturing processes that contribute to their high price. For industries such as mining, agriculture, and construction, the upfront cost of OTR tires can be significant, which may deter smaller operators from investing in the latest tire technology. Additionally, the cost of maintenance and periodic replacements adds to the overall financial burden, further limiting the market growth for certain companies, especially in economically challenging times.

Supply Chain and Logistics Challenges

Another challenge faced by the Brazil OTR tire market is the complexity of the supply chain and logistics. Brazil’s vast geography and the remote locations of many mining and agricultural operations make the distribution of OTR tires a difficult task. The transportation of heavy-duty tires to these areas, combined with fluctuating transportation costs, can lead to delays and increased costs for manufacturers and end-users. These logistical challenges are compounded by the lack of adequate infrastructure in certain regions, which further impedes timely and efficient delivery. The supply chain disruptions, as seen during the COVID-19 pandemic, have also highlighted the vulnerability of the market to global supply chain fluctuations.

Environmental Regulations and Compliance

Stringent environmental regulations are another restraint for the Brazil OTR tire market. As governments continue to impose stricter environmental laws regarding the disposal and recycling of tires, manufacturers face pressure to develop sustainable tire solutions. While there is a growing trend toward eco-friendly tires, transitioning to greener alternatives involves significant investment in research and development. For instance, Brazilian regulations such as Resolution Conama No. 416 require manufacturers and importers of new tires weighing more than 2 kg to collect and properly dispose of unusable tires within the country. Additionally, the lack of widespread recycling facilities for OTR tires in Brazil adds to the challenges in managing tire disposal and reducing the environmental impact. The increasing pressure for compliance with environmental standards presents both a challenge and an opportunity for innovation in the sector.

Market Opportunities:

The Brazil Off-the-Road (OTR) tire market presents significant opportunities for growth driven by the expanding demand across several key sectors, including mining, agriculture, and infrastructure. With Brazil being a major player in the global mining industry, there is a continuous need for high-performance tires that can withstand the harsh environments of mining sites. As mining operations grow and evolve, especially in remote areas, the demand for durable and reliable OTR tires is expected to increase. Additionally, Brazil’s agricultural sector, one of the largest in the world, is embracing mechanization at an accelerating rate, further boosting the need for specialized tires. This trend creates a strong opportunity for manufacturers to cater to the evolving demands of these industries by providing tires that meet the specific needs of heavy-duty machinery used in farming and mining operations.

Furthermore, the growing trend toward sustainability and eco-friendly solutions offers a notable opportunity for innovation in the Brazilian OTR tire market. As environmental regulations become more stringent, there is a rising demand for tires made from renewable materials and those designed for longer lifespans, which reduce waste and frequency of replacements. Manufacturers who focus on developing eco-friendly, high-performance tires are well-positioned to capture a growing market segment. Additionally, the digitalization of fleet management and remote tire monitoring systems presents a promising opportunity to enhance tire performance and maintenance, providing further growth potential in Brazil’s OTR tire market.

Market Segmentation Analysis:

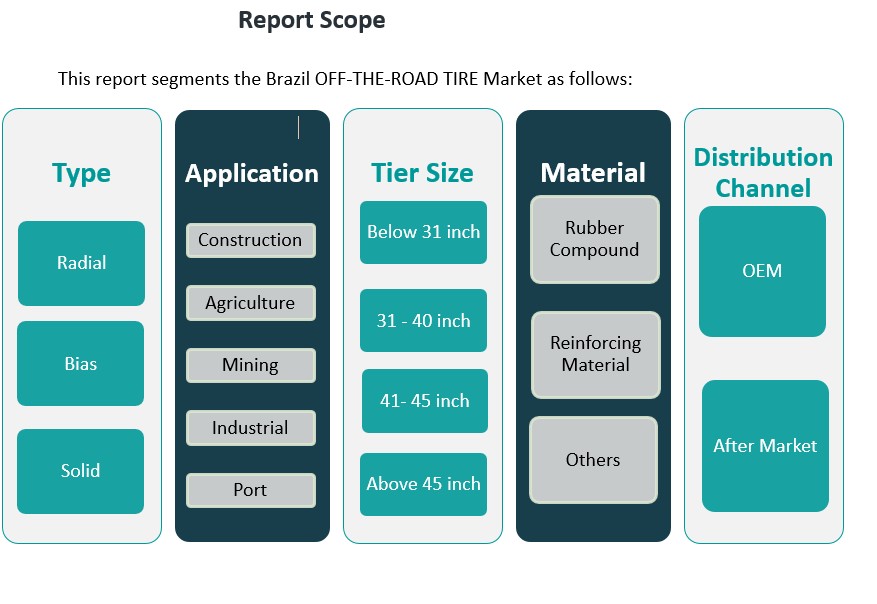

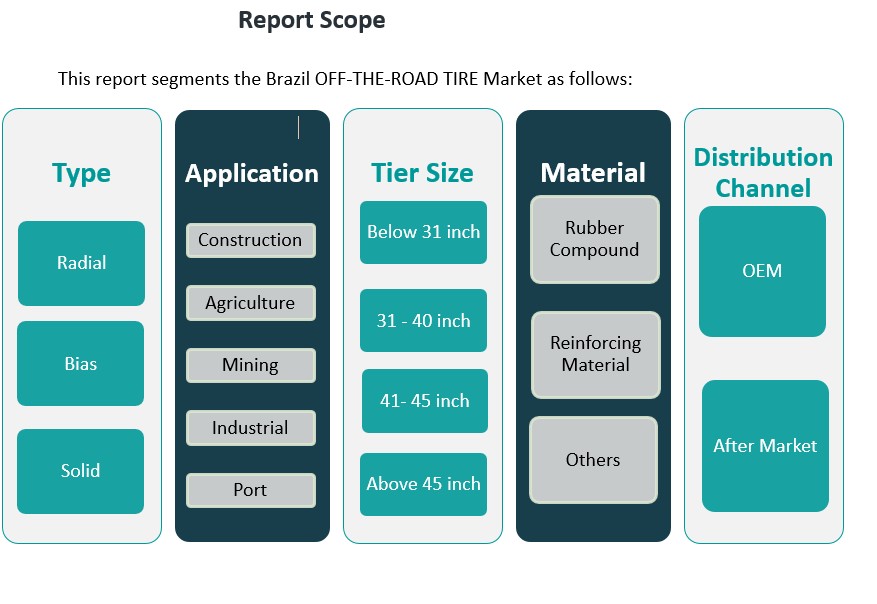

The Brazil Off-the-Road (OTR) tire market is segmented by type, application, tire size, material, and distribution channel, each contributing to the market’s growth in distinct ways.

By Type Segment

The OTR tire market in Brazil is primarily divided into radial, bias, and solid tires. Radial tires are the most popular due to their superior durability, enhanced fuel efficiency, and better load-bearing capacity, making them suitable for a range of applications. Bias tires, while less common, still hold a significant share due to their cost-effectiveness in some sectors. Solid tires, known for their durability and resistance to punctures, are widely used in industrial applications where frequent tire replacements are a challenge.

By Application Segment

The market is driven by the demand across various sectors, including construction, agriculture, mining, industrial, and port applications. The mining sector holds a large share due to Brazil’s significant mining activities, requiring robust tires for heavy machinery. Agriculture follows as mechanization in farming continues to increase, driving the need for specialized tires. The construction and industrial sectors also represent substantial opportunities for OTR tire manufacturers, especially with ongoing infrastructure development in the country. The port segment, fueled by Brazil’s export-driven economy, is another critical application.

By Tire Size Segment

Tire sizes in the OTR market are segmented into below 31 inches, 31-40 inches, 41-45 inches, and above 45 inches. Larger tires (above 45 inches) are primarily used in mining and heavy industrial applications, while smaller tires are suitable for agriculture and construction equipment.

By Material Segment

The material segment consists of rubber compounds, reinforcing materials, and other materials, with rubber compounds being the most significant due to their impact on tire durability and performance.

By Distribution Channel Segment

The distribution channels are segmented into OEM and aftermarket. OEM accounts for a significant share due to large-scale equipment purchases, while the aftermarket segment remains crucial as it caters to replacement tires for ongoing operations across various sectors.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Brazil Off-the-Road (OTR) tire market exhibits significant regional variation, driven by the diverse economic activities, industrial sectors, and geographical conditions across the country. The demand for OTR tires is largely concentrated in regions with robust mining, agriculture, and infrastructure development, each contributing to the overall market in different ways.

Southeast Region

The Southeast region holds the largest market share in the Brazil OTR tire market, accounting for approximately 40% of the total demand. This region includes the economic hub of São Paulo, which is home to a large proportion of Brazil’s industrial activities, including construction, mining, and manufacturing. The demand for OTR tires in this region is driven by infrastructure projects and the extensive mining operations in states like Minas Gerais. Furthermore, the presence of significant agricultural activities in areas like Espírito Santo further contributes to the need for specialized OTR tires.

South Region

The South region holds around 25% of the market share, with a strong emphasis on agriculture. This region is known for its vast agricultural lands, particularly for crops like soybeans, corn, and wheat. As mechanization in agriculture continues to rise, there is an increasing demand for OTR tires, especially in the farming sector. The construction industry in the region also adds to the demand for OTR tires, particularly in the expanding infrastructure projects aimed at improving transportation and logistics.

Northeast Region

The Northeast region contributes approximately 15% to the overall OTR tire market. While the region has a relatively smaller share compared to the Southeast and South, it is rapidly developing, particularly in sectors like agriculture and infrastructure. The expansion of infrastructure projects in states like Bahia and Pernambuco, combined with the growing adoption of mechanized farming, is fueling the demand for OTR tires. Mining activities in this region also contribute to the market, although at a smaller scale compared to the Southeast.

Central-West Region

The Central-West region accounts for around 10% of the market share. This region is characterized by extensive agricultural activities, particularly in the cultivation of soybeans, sugarcane, and cotton. The increasing mechanization of farming operations is a key driver for OTR tire demand in the region. Additionally, the development of transport infrastructure projects and logistics networks contributes to market growth.

North Region

The North region has the smallest market share, at around 10%. This is largely due to its relatively low industrial activities compared to other regions. However, the region’s mining and agricultural sectors are slowly driving the demand for OTR tires, particularly in areas like Pará and Amazonas, where mineral extraction and large-scale farming are expanding.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Sumitomo Rubber do Brasil

Competitive Analysis:

The Brazil Off-the-Road (OTR) tire market is highly competitive, with a mix of global and regional players vying for market share. Leading multinational tire manufacturers, such as Michelin, Bridgestone, Goodyear, and Continental, dominate the market with their extensive product offerings and strong brand recognition. These companies benefit from their ability to provide innovative, high-performance tires designed for various industries, including mining, agriculture, and construction. Their robust distribution networks and advanced technology enable them to maintain a significant presence in Brazil. Regional players are also gaining traction, leveraging their understanding of local market dynamics and providing cost-effective solutions tailored to specific sector needs. These companies focus on offering durable tires at competitive prices to cater to Brazil’s growing demand for OTR tires, particularly in agriculture and infrastructure. The competitive landscape is marked by ongoing innovations in tire technology and increasing pressure to provide sustainable, eco-friendly solutions.

Recent Developments:

- In July 2024, Trelleborg Tires and John Deere announced a significant partnership in Brazil, marking a strategic collaboration for the distribution of Trelleborg’s advanced agricultural tires through John Deere dealerships. This move is designed to strengthen Trelleborg’s presence in the Brazilian market and provide farmers with access to high-performance, patented tire technologies that offer superior stability, self-cleaning, enhanced traction, and very high flexion (VF) construction.

- In April 2024, Trelleborg launched its most sustainable tire to date in Brazil, the TM1 ECO POWER. This product introduction demonstrates Trelleborg’s focus on sustainable innovation in response to the growing demand for eco-friendly farming solutions. The TM1 ECO POWER tire is engineered for reduced environmental impact without compromising durability or performance, catering to the needs of modern, high-powered agricultural equipment.

- Linglong Tire made headlines in October 2024 by announcing a global strategic partnership with Real Madrid, aiming to boost its international brand presence. Additionally, at the 2024 SEMA Show in November, Linglong unveiled 20 new products, including six new off-road tread patterns and innovative, sustainable tire technologies. These efforts underscore Linglong’s ambition to strengthen its position in the global OTR tire market, including Brazil.

Market Concentration & Characteristics:

The Brazil Off-the-Road (OTR) tire market exhibits moderate concentration, with several key global players dominating the landscape. Major multinational tire manufacturers, including Michelin, Bridgestone, Goodyear, and Continental, hold a significant share of the market due to their extensive product portfolios, strong brand equity, and advanced technological capabilities. These companies offer a wide range of high-performance tires for various applications, such as mining, construction, and agriculture. Despite the dominance of these large players, the market also features regional companies that cater to specific local needs and offer cost-effective alternatives. These regional firms tend to focus on competitive pricing and custom solutions tailored to the unique demands of Brazil’s agricultural and infrastructure sectors. The market is characterized by innovation, with ongoing efforts to develop more durable, eco-friendly, and efficient tire solutions to meet the diverse requirements of industries operating in challenging off-road environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Brazil OTR tire market is poised for steady growth, driven by various sector demands.

- Infrastructure development will continue to increase the need for durable tires in construction.

- Expanding mining operations in Brazil will support the demand for specialized OTR tires.

- The rise in agricultural mechanization will boost tire requirements for farming machinery.

- Ongoing innovations in tire technology will enhance durability and performance in off-road environments.

- Eco-friendly tire solutions will gain traction as sustainability becomes a key market focus.

- The demand for larger tires will grow as heavy-duty machinery usage increases across industries.

- The adoption of remote tire monitoring systems will become more prevalent for fleet management.

- The Southeast and South regions will maintain a dominant role in market growth due to industrial and agricultural activity.

- The aftermarket sector will remain vital, with increasing demand for reliable replacement tires.