| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Automotive Smart Keys Market Size 2023 |

USD 423.50 Million |

| Canada Automotive Smart Keys Market, CAGR |

8.01% |

| Canada Automotive Smart Keys Market Size 2032 |

USD 847.46 Million |

Market Overview

Canada Automotive Smart Keys Market size was valued at USD 423.50 million in 2023 and is anticipated to reach USD 847.46 million by 2032, at a CAGR of 8.01% during the forecast period (2023-2032).

The Canada Automotive Smart Keys market is driven by the increasing consumer demand for enhanced vehicle security, convenience, and advanced technological integration. Rising adoption of keyless entry and push-start ignition systems across mid-range and premium vehicles is significantly contributing to market growth. Automakers are increasingly incorporating smart key features to improve user experience and differentiate their offerings in a competitive landscape. Additionally, growing concerns over vehicle theft and the rising implementation of advanced anti-theft technologies are fueling the adoption of smart keys. The trend towards connected and autonomous vehicles is further accelerating innovation in smart key functionalities, such as remote access, mobile app integration, and personalized driver settings. Moreover, supportive government regulations promoting automotive safety and technological upgrades are expected to bolster market expansion. As the automotive industry continues to digitize, the integration of smart keys as part of broader IoT ecosystems remains a key trend shaping the future of this market.

The geographical landscape of the Canada automotive smart keys market reflects strong activity across key provinces such as Ontario, Quebec, British Columbia, and regions in Western Canada. These areas, particularly urban centers, are witnessing rapid adoption of smart key technologies due to rising demand for connected vehicles and advanced security features. Ontario and Quebec remain central to vehicle production and innovation, while British Columbia shows strong traction in electric and luxury vehicle adoption, fueling demand for multi-functional smart keys. Key players shaping this market include prominent global and regional automotive technology companies such as Huf Hülsbeck & Fürst GmbH & Co., Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Hyundai Mobis, and Denso Corporation. These firms are actively investing in R&D to deliver cutting-edge smart key solutions that integrate mobile connectivity, biometrics, and enhanced security features, contributing to the evolving landscape of vehicle access technologies in Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada Automotive Smart Keys market was valued at USD 423.50 million in 2023 and is projected to reach USD 847.46 million by 2032, growing at a CAGR of 8.01% during 2023–2032.

- The Global Automotive Smart Keys market was valued at USD 12,499.00 million in 2023 and is projected to reach USD 26,481.41 million by 2032, growing at a CAGR of 8.70% from 2023 to 2032.

- Growing demand for advanced vehicle security and keyless convenience is driving widespread adoption of smart key systems.

- Integration of IoT, mobile apps, and biometric authentication is a rising trend across mid-range and premium vehicle segments.

- Major players such as Continental AG, Huf Hülsbeck & Fürst, Hyundai Mobis, and Denso Corporation are focusing on innovation and partnerships to enhance market presence.

- High costs of implementation and cybersecurity concerns remain key challenges for market expansion, particularly in lower-priced vehicle segments.

- Ontario and Quebec lead in adoption due to automotive manufacturing hubs and strong demand for connected vehicle features.

- British Columbia and Western Canada are emerging markets, driven by EV growth and urban consumer interest in digital solutions.

Report Scope

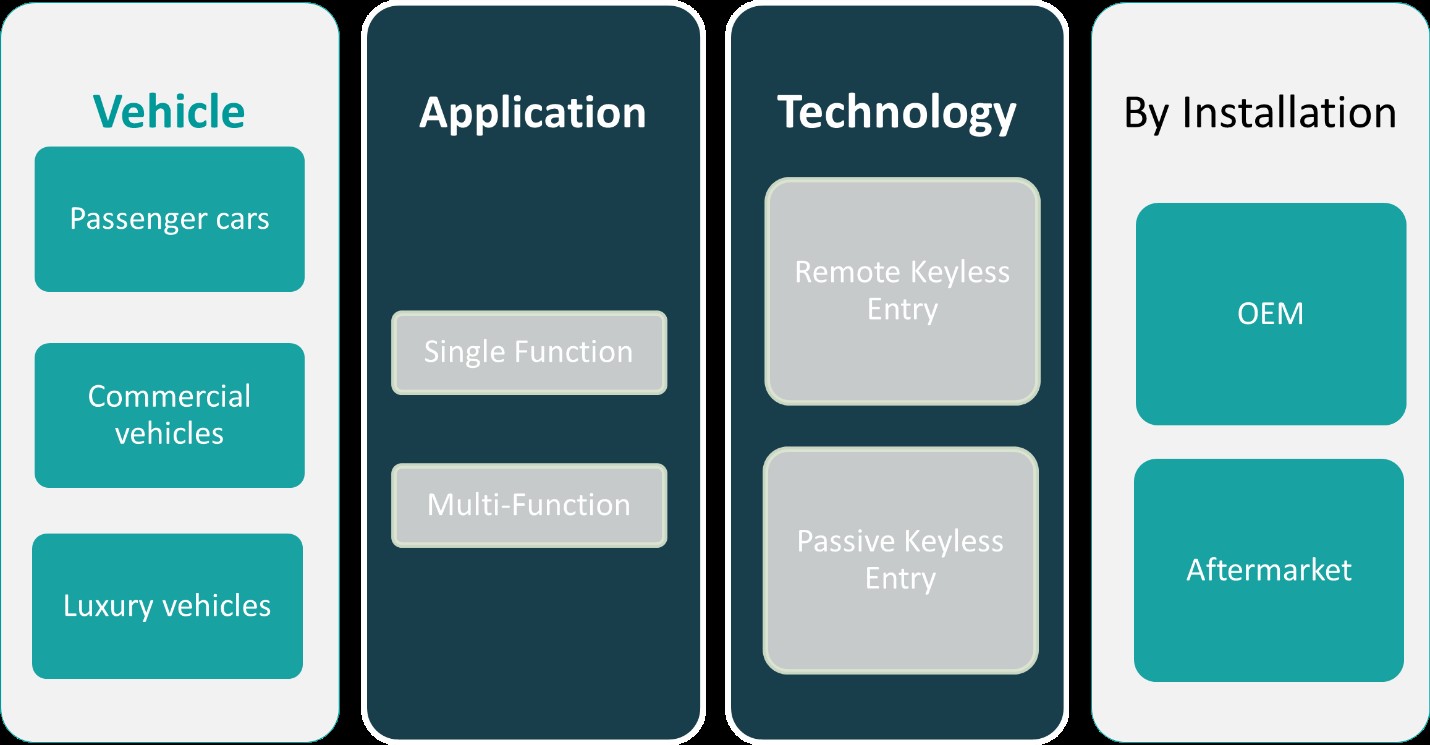

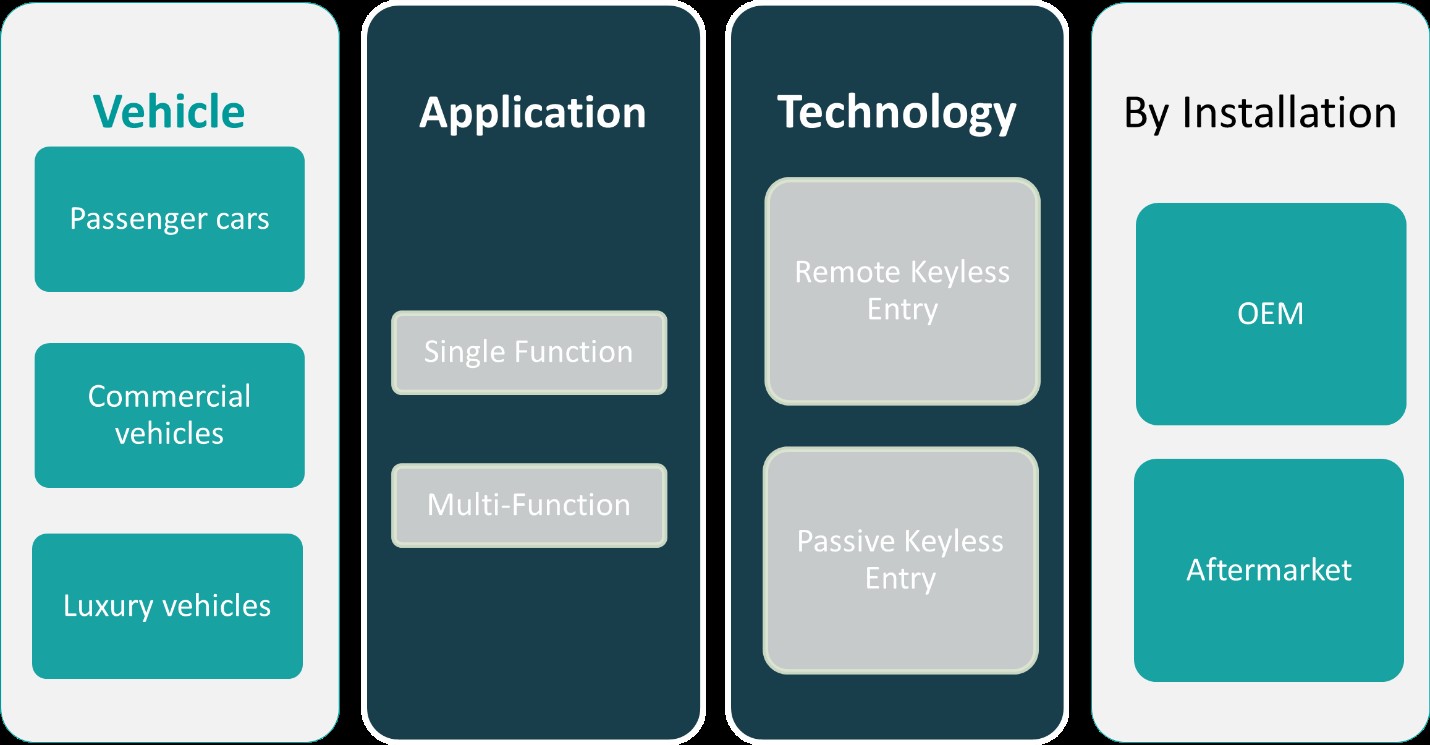

This report segments the Canada Automotive Smart Keys Market as follows:

Market Drivers

Growing Demand for Vehicle Security and Convenience

One of the primary drivers of the Canada automotive smart keys market is the rising demand for enhanced vehicle security and user convenience. For instance, a report by Transport Canada highlights the effectiveness of encrypted radio signals in reducing car theft incidents, particularly in urban areas. Consumers increasingly seek advanced features that allow seamless access to their vehicles without the need for traditional keys. Smart key systems, equipped with encrypted radio signals, provide a higher level of security by significantly reducing the risk of car theft. The added convenience of keyless entry, push-button start, and hands-free trunk access appeals to a wide range of buyers, from tech-savvy younger consumers to older drivers seeking ease of use. As consumer awareness of these benefits increases, demand for vehicles equipped with smart key systems continues to grow, driving market expansion.

Technological Advancements and Digital Integration

The rapid pace of technological innovation in the automotive industry is a significant driver of the smart keys market. For instance, a study by the Canadian Automotive Partnership Council (CAPC) emphasizes the integration of smart keys with IoT platforms, enabling features like remote start and vehicle tracking through smartphones. Automakers are integrating smart keys with broader digital ecosystems, including mobile applications, vehicle infotainment systems, and Internet of Things (IoT) platforms. As vehicles become more connected and autonomous, smart key systems are evolving into multifunctional access and control tools. Additionally, advancements in biometric authentication, such as fingerprint or facial recognition, are being tested for future implementation, enhancing both security and personalization. These innovations make smart keys an integral part of the modern driving experience, further accelerating their adoption across all vehicle segments in Canada.

Rising Adoption Across Vehicle Segments

Another significant driver is the increasing penetration of smart key systems beyond luxury and premium vehicles into mid-range and even entry-level models. Previously considered a high-end feature, smart keys are now becoming standard or optional in a broader array of vehicles as manufacturers strive to meet evolving consumer expectations. This democratization of advanced automotive technology is driven by competitive pressures and the declining cost of smart key components due to economies of scale. As more consumers gain access to smart key features at affordable price points, the Canadian market is witnessing steady growth in adoption rates. The versatility of smart keys in improving not only convenience but also safety, makes them an attractive upgrade for buyers across all demographics.

Supportive Regulatory Environment and Industry Standards

Canada’s regulatory and industry environment also plays a pivotal role in driving the adoption of automotive smart keys. Government initiatives aimed at improving vehicle safety and reducing vehicle-related crimes support the integration of advanced security technologies, including smart key systems. Additionally, industry standards and collaborations among automakers, tech firms, and regulatory bodies ensure compatibility, data security, and user safety. These frameworks encourage innovation while maintaining consumer trust, which is critical for widespread adoption. Moreover, as automakers align with global best practices and technological trends, the Canadian automotive market remains well-positioned to embrace smart key technology as a standard feature in the near future.

Market Trends

Integration of Biometric Authentication

A prominent trend in the Canadian automotive smart keys market is the incorporation of biometric authentication methods, such as fingerprint and facial recognition. For instance, a report by the Biometrics Institute highlights the growing adoption of fingerprint and facial recognition technologies in vehicles, emphasizing their role in enhancing security and personalization. These technologies offer enhanced security and personalization by associating a driver’s unique biometric data with the smart key, ensuring that only authorized individuals can access and operate the vehicle. This aligns with a broader movement towards biometric authentication across various industries, aiming to improve user experiences and bolster security measures.

Advancements in Connectivity and IoT Integration

The rise of the Internet of Things (IoT) has led to the development of smart keys that offer functionalities beyond traditional vehicle access. For instance, a study by the International Energy Agency (IEA) emphasizes the integration of smart keys with IoT platforms, enabling features like remote diagnostics and personalized driver settings. Over-the-air (OTA) software updates further enhance these systems by allowing manufacturers to remotely upgrade vehicle software, improving functionality and security. This trend reflects the automotive industry’s shift towards more connected and autonomous vehicles.

Emergence of Digital and Smartphone-Based Keys

The increasing prevalence of smartphones has paved the way for digital key solutions, allowing drivers to use their mobile devices as virtual keys. This innovation offers enhanced convenience by enabling key sharing among multiple users and integrating with other digital services. Collaborations between automakers and technology companies are accelerating this trend, leading to the development of secure and user-friendly digital key systems. As consumers become more accustomed to digital solutions in their daily lives, the demand for smartphone-based vehicle access is expected to grow.

Focus on Enhanced Vehicle Security Measures

With the rise in vehicle thefts and unauthorized access methods, there is a heightened focus on developing smart keys with advanced security features. Manufacturers are exploring technologies such as blockchain to create tamper-proof systems, while also addressing cybersecurity risks associated with connected vehicles. Ensuring robust security in smart key systems is paramount to maintaining consumer trust and complying with stringent regulatory standards.

Market Challenges Analysis

High Implementation Costs and Integration Complexity

One of the primary challenges hindering the growth of the automotive smart keys market in Canada is the high cost of implementation and system integration. For instance, a report by the Ministry of Statistics and Programme Implementation (MoSPI) highlights the financial burden of adopting advanced components like microcontrollers and encryption modules in emerging markets. For original equipment manufacturers (OEMs), integrating these systems seamlessly with existing vehicle architectures requires substantial investment in R&D and testing. As a result, smart key systems have traditionally been offered in premium and high-end vehicle segments, limiting their penetration in entry-level and budget-friendly models. Although costs are gradually decreasing due to technological advancements and economies of scale, the financial barrier remains a key concern, especially for manufacturers aiming to offer these features across a broader vehicle portfolio.

Cybersecurity Risks and Technological Vulnerabilities

Another critical challenge facing the Canadian automotive smart keys market is the growing concern over cybersecurity and system vulnerabilities. As vehicles become more connected, smart key systems—particularly those integrated with IoT and mobile applications—are increasingly exposed to cyber threats. Unauthorized access, relay attacks, and hacking attempts pose significant risks to both consumer safety and data privacy. Ensuring robust encryption protocols and secure communication channels requires continuous updates and monitoring, which adds to operational complexity. Moreover, consumer trust can be easily undermined by widely publicized breaches or malfunctions, making it imperative for manufacturers to prioritize security in every aspect of smart key design and deployment. As regulatory scrutiny over automotive cybersecurity intensifies, OEMs and technology providers must work collaboratively to ensure compliance while maintaining innovation in smart key solutions.

Market Opportunities

The Canada automotive smart keys market presents strong growth opportunities driven by the increasing consumer shift toward connected, secure, and technology-enabled vehicles. As digital transformation accelerates across the automotive sector, smart key systems are emerging as a crucial differentiator in both mid-range and high-end vehicle offerings. Canadian consumers are progressively valuing convenience and safety, fueling demand for features like keyless entry, remote start, and mobile-integrated vehicle access. This presents an opportunity for automakers and technology providers to develop and offer innovative, user-centric smart key solutions tailored to the evolving expectations of tech-savvy buyers. Additionally, the growing electric vehicle (EV) segment in Canada offers a fertile ground for smart key integration, as EV manufacturers typically prioritize cutting-edge digital features to attract environmentally conscious and digitally inclined consumers.

Furthermore, the rise of shared mobility services and fleet management in Canada opens new avenues for smart key applications. Digital and app-based smart key solutions can enable seamless access and control for car-sharing platforms, rental agencies, and corporate fleets, streamlining vehicle access for multiple users while maintaining high levels of security and control. This trend aligns with the broader push toward digital mobility ecosystems, in which smart keys play a central role. As automotive cybersecurity standards evolve, companies that can deliver secure, scalable, and adaptable smart key technologies stand to benefit significantly. With supportive government policies promoting innovation and smart infrastructure, and an increasingly competitive automotive landscape, Canada offers a compelling market for smart key technology providers seeking to expand their presence and capitalize on future mobility trends.

Market Segmentation Analysis:

By Vehicle:

The Canadian automotive smart keys market is segmented by vehicle type into passenger cars, commercial vehicles, and luxury vehicles, with passenger cars representing the largest share. The growing demand for enhanced convenience and security features among mainstream consumers has driven widespread adoption of smart key technology in this segment. Automakers are increasingly integrating smart keys as standard or optional features in compact and mid-size passenger vehicles to meet rising consumer expectations. Luxury vehicles, which have traditionally led in advanced technology adoption, continue to drive innovation in smart key systems with multi-functionality and biometric integration. On the other hand, the commercial vehicle segment, though relatively slower in adoption, presents untapped potential, particularly as fleet operators begin to recognize the value of digital access systems for operational efficiency, driver management, and security. As smart fleet solutions gain traction, commercial vehicles are expected to emerge as a growing market for smart key applications, particularly within logistics and urban delivery services.

By Application:

Based on application, the market is segmented into single-function and multi-function smart keys, with multi-function keys accounting for a rising share due to increasing consumer demand for connected and feature-rich vehicles. Single-function smart keys, primarily offering keyless entry or ignition start, remain common in lower-end vehicle models and are valued for their simplicity and cost-effectiveness. However, the growing trend toward digital mobility solutions and enhanced in-car experiences is fueling demand for multi-function smart keys. These advanced systems offer a suite of features, including remote start, personalized settings, vehicle tracking, and smartphone connectivity. Canadian consumers, particularly in urban regions, are showing a preference for these integrated solutions, which enhance user convenience and vehicle personalization. As automotive OEMs and technology providers continue to push innovation, multi-function smart keys are expected to dominate the market, offering scalable and customizable features that align with the evolution of connected and autonomous vehicles across the Canadian automotive landscape.

Segments:

Based on Vehicle:

- Passenger cars

- Commercial vehicles

- Luxury vehicles

Based on Application:

- Single Function

- Multi-Function

Based on Technology:

- Remote Keyless Entry

- Passive Keyless Entry

Based on Distribution Channel:

Based on the Geography:

- Ontario

- Quebec

- Western Canada

- British Columbia

- Atlantic Canada

Regional Analysis

Ontario

Ontario holds the largest share in the Canadian automotive smart keys market, accounting for approximately 38% of the total market value. As Canada’s most populous province and the country’s automotive manufacturing hub, Ontario benefits from a well-established automotive ecosystem that includes production facilities for major OEMs and technology suppliers. The high concentration of vehicle sales, coupled with a strong demand for advanced automotive technologies, has positioned Ontario as a leading adopter of smart key systems. Furthermore, the province’s urban centers such as Toronto, Mississauga, and Ottawa have witnessed rapid growth in electric vehicles (EVs) and premium vehicle ownership, further fueling the uptake of smart key solutions. With ongoing investments in smart mobility and connected vehicle infrastructure, Ontario is expected to remain a dominant region in terms of market leadership and innovation in automotive smart technologies.

Quebec

Quebec captures around 24% of the national automotive smart keys market, driven by rising consumer interest in modern vehicle features and sustainable mobility solutions. Montreal and Quebec City, the province’s major urban centers, have shown a growing preference for connected cars, particularly in the passenger and luxury vehicle segments. The province’s bilingual market and environmentally conscious consumers are key factors influencing automakers to equip more vehicles with advanced smart key systems, including remote start and mobile app integration. Additionally, Quebec’s strong support for electric vehicle adoption through government incentives has increased the demand for high-tech vehicles that often come equipped with multi-function smart key features. As consumer awareness and adoption rates continue to rise, Quebec is expected to see steady growth in this segment over the coming years.

Western Canada

Western Canada, comprising Alberta, Saskatchewan, and Manitoba, accounts for approximately 18% of the automotive smart keys market in Canada. While this region traditionally emphasizes utility and performance in vehicle choices, there has been a noticeable shift toward integrated vehicle technologies among urban consumers. The growth of mid-range SUVs and pickup trucks equipped with smart access features is contributing to market expansion in this region. Alberta, in particular, shows potential due to its large vehicle ownership rate and increasing adoption of high-end trucks and commercial vehicles with smart key functionalities. However, economic fluctuations linked to the energy sector and rural market dynamics may moderate the pace of adoption in less urbanized areas.

British Columbia

British Columbia, including the Pacific region, holds an estimated 14% market share and continues to exhibit strong growth potential, especially in the luxury and electric vehicle segments. Vancouver and surrounding areas are experiencing high demand for smart and sustainable vehicle technologies, aligning with the province’s aggressive climate goals and clean transportation initiatives. British Columbia’s forward-thinking consumer base and support for EV infrastructure encourage automakers to introduce vehicles equipped with the latest smart key features. While the region’s smaller population compared to Ontario or Quebec limits overall market size, its high per capita adoption rate of premium and technology-rich vehicles makes it a strategic growth area for automotive smart key providers.

Key Player Analysis

- Huf Hülsbeck & Fürst GmbH & Co.

- Continental AG

- ZF Friedrichshafen AG

- HELLA GmbH & Co. KGaA

- Hyundai Mobis

- Silca Group

- Tokai Rika Co.

- Denso Corporation

- ALPHA Corporation

- Valeo SA

- Ford

Competitive Analysis

The Canada automotive smart keys market is highly competitive, with leading players including Huf Hülsbeck & Fürst GmbH & Co., Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Hyundai Mobis, Silca Group, Tokai Rika Co., Denso Corporation, ALPHA Corporation, Valeo SA, and Ford. These companies are driving innovation through extensive research and development to enhance smart key functionalities such as keyless entry, biometric integration, and smartphone connectivity. Their strategic focus includes partnerships with automakers, technological upgrades, and the expansion of product lines tailored for both luxury and mid-range vehicles. Leading companies in this space are focusing on enhancing smart key functionalities such as remote engine start, proximity detection, personalized vehicle settings, and integration with mobile applications. They are investing heavily in research and development to introduce next-generation solutions that meet rising consumer demand for convenience, security, and connectivity. To gain a competitive edge, market participants are forming strategic partnerships with vehicle manufacturers, expanding their product portfolios, and exploring digital and biometric technologies. Emphasis is also being placed on improving cybersecurity features to address the growing threat of vehicle theft and unauthorized access.

Recent Developments

- In January 2025, Honda Lock, now owned by MinebeaMitsumi, expanded its product line to include advanced keyless entry systems with mobile connectivity and IoT features, aligning with the automotive industry’s trend towards electrification and automation.

- In December 2024, Hyundai Mobis announced plans to expand its card-type smart key to major Hyundai models like the Santa Fe and Tucson. This key uses UWB for enhanced functionality and wireless charging capabilities.

- In April 2024, Continental developed a smart device-based access solution for Mercedes-Benz E-Class cars. This system utilizes ultra-wideband (UWB) technology, transceivers, and intelligent software to enhance security and convenience for luxury vehicles.

- In December 2023, Huf introduced a groundbreaking smart key that combines UWB, BLE, and NFC technologies in compliance with Car Connectivity Consortium (CCC) standards. This innovation enhances anti-theft security and convenience while allowing integration with “Phone as a Key” systems.

Market Concentration & Characteristics

The Canada automotive smart keys market exhibits a moderate to high level of market concentration, characterized by the presence of a few dominant global players with extensive technological expertise and long-standing partnerships with leading automotive manufacturers. These established firms influence the market through their ability to deliver integrated, scalable, and advanced smart key solutions tailored to both luxury and mass-market vehicles. The market is defined by rapid innovation, a strong emphasis on security features, and increasing integration with connected vehicle platforms. As consumer demand grows for enhanced vehicle access and convenience, companies are investing in biometric technologies, smartphone-based systems, and IoT connectivity to differentiate their offerings. Additionally, the market is shaped by regional dynamics, with higher adoption in provinces like Ontario and Quebec due to concentrated vehicle production and urban consumer preferences. Overall, the market reflects a technology-driven, innovation-focused environment with strong competitive pressures and rising expectations for digital mobility solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Application, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Canadian automotive smart keys market is projected to experience steady growth, driven by increasing consumer demand for enhanced vehicle security and convenience features.

- Integration of Internet of Things (IoT) technology is expected to advance, enabling smart keys to offer functionalities such as remote access, vehicle tracking, and real-time diagnostics.

- Adoption of biometric authentication methods, including fingerprint and facial recognition, is anticipated to enhance vehicle security and personalization.

- Expansion of electric and autonomous vehicles in Canada is likely to increase the demand for advanced smart key systems compatible with these technologies.

- Collaborations between automotive manufacturers and technology firms are projected to drive innovation and accelerate the development of sophisticated smart key solutions.

- Emphasis on cybersecurity measures will intensify to protect smart key systems from potential hacking and unauthorized access.

- Growth in shared mobility services and car-sharing platforms is expected to create opportunities for digital and app-based smart key solutions.

- Consumer preference for seamless smartphone integration with vehicle access systems is likely to influence future smart key designs.

- Regulatory developments focusing on vehicle security standards may encourage the adoption of advanced smart key technologies.

- Continuous advancements in materials and design are projected to result in more compact, durable, and aesthetically pleasing smart key devices.