Market Overview

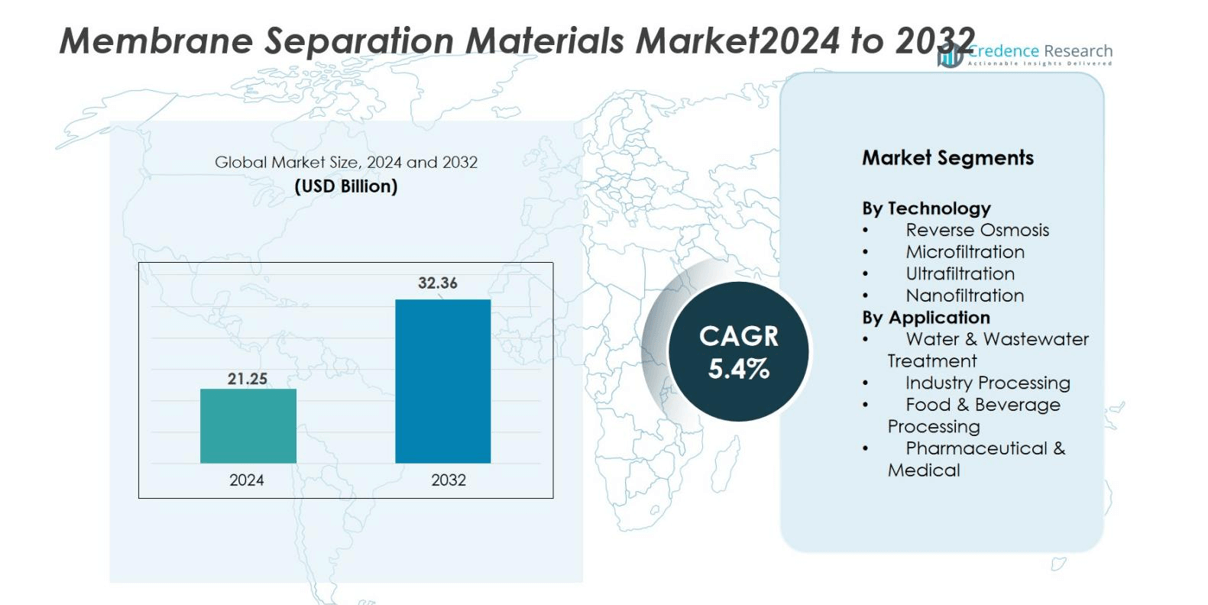

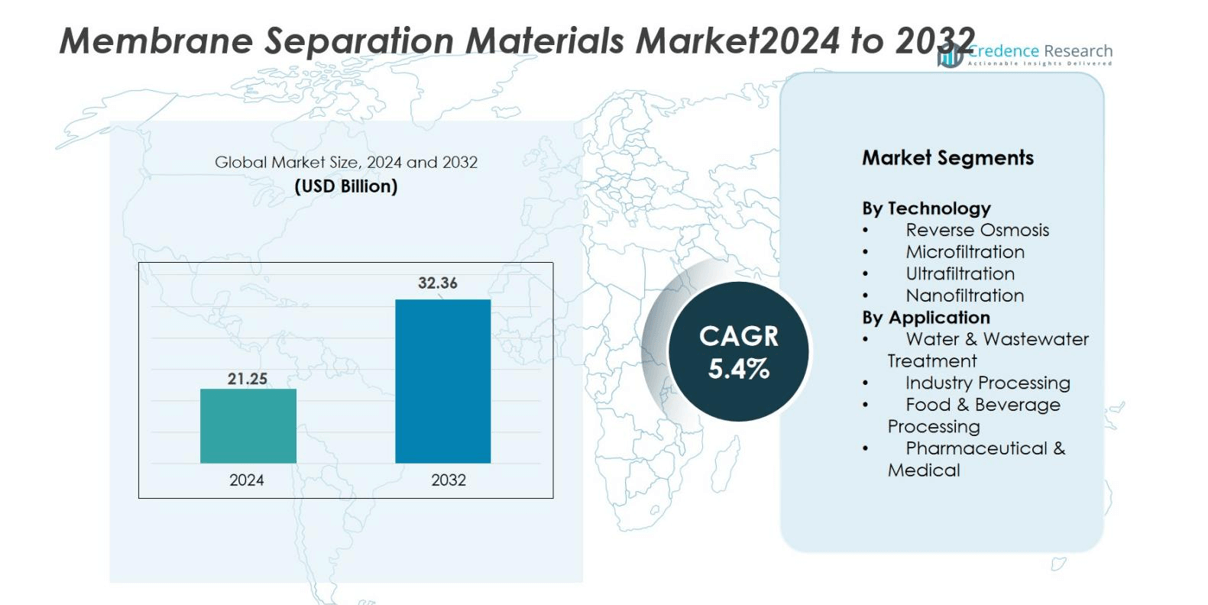

Membrane Separation Materials market size was valued USD 21.25 Billion in 2024 and is anticipated to reach USD 32.36 Billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Membrane Separation Materials Market Size 2024 |

USD 21.25 Billion |

| Membrane Separation Materials Market, CAGR |

5.4% |

| Membrane Separation Materials Market Size 2032 |

USD 32.36 Billion |

The Membrane Separation Materials market is led by major players such as Merck KGaA, Dow, Nitto Denko Corporation, 3M, Air Products and Chemicals, Inc., GEA Group Aktiengesellschaft, Evoqua Water Technologies LLC, Lenntech B.V., applied membranes, inc., and H2O Innovation. These companies focus on developing durable, high-selectivity membranes for water purification, industrial processing, and pharmaceutical applications. North America dominates the global market with a 32% share, supported by advanced infrastructure and strong regulatory frameworks. Asia-Pacific follows closely with 34% share, driven by industrial growth, urbanization, and large-scale investments in desalination and wastewater treatment projects across China, India, and Japan.

Market Insights

- The Membrane Separation Materials market was valued at USD 21.25 billion in 2024 and is projected to reach USD 32.36 billion by 2032, growing at a CAGR of 5.4%.

- Demand rises due to expanding water and wastewater treatment projects, supported by strict environmental regulations and industrial recycling needs.

- Reverse osmosis holds the largest segment share of 42%, while Asia-Pacific leads regionally with 34% share, followed by North America at 32%.

- Major players such as Merck KGaA, Dow, 3M, and Nitto Denko Corporation compete through innovations in energy-efficient and anti-fouling membranes.

- High operational costs and fouling challenges restrain smaller facilities, but increasing government funding and desalination investments in Asia-Pacific and the Middle East continue to boost long-term adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Technology

Reverse osmosis dominates the technology segment with 42% share, driven by its ability to remove dissolved salts, bacteria, and organic contaminants with high precision. Its adoption increases across desalination plants, municipal water systems, and industrial utilities. Ultrafiltration shows strong growth due to its effectiveness in pretreatment and wastewater clarification. Microfiltration supports beverage, dairy, and pharmaceutical operations by filtering suspended solids and microorganisms. Nanofiltration gains attention for partial desalination and selective ion removal in industrial settings. The increasing need for sustainable and energy-efficient purification technologies supports continuous advancement in membrane materials.

- For instance, the Sorek Desalination Plant in Israel utilizes advanced reverse osmosis membranes to produce 165 million gallons of fresh water daily, serving 1.5 million people with high energy efficiency.

By Application

Water and wastewater treatment leads the application segment with 55% share, supported by growing urbanization, industrial discharge, and government initiatives for clean water access. Membrane systems replace chemical-based methods in municipal and industrial filtration, offering low energy use and high efficiency. Industrial processing follows, utilizing membranes for gas separation, solvent recovery, and effluent treatment. The food and beverage industry uses microfiltration and ultrafiltration for juice clarification and dairy concentration. Pharmaceutical and medical applications rely on high-purity membranes for sterile filtration, supporting product quality and compliance with safety standards.

- For instance, Fluence Corporation has developed membrane aerated biofilm reactors (MABR) offering high nutrient removal with low energy usage, proven effective in full-scale pilots in China and California.

Key Growth Drivers

Rising Demand for Clean and Potable Water

The market grows rapidly because many regions face water scarcity and depend on advanced filtration systems to meet drinking water standards. Reverse osmosis and ultrafiltration units help remove dissolved solids, microorganisms, and organic pollutants, supporting municipal supply and desalination projects. Population growth, urbanization, and industrial discharge increase pressure on available freshwater sources, pushing governments to invest in membrane-based purification. Many cities upgrade aging infrastructure with automated membrane plants to reduce waste and chemical consumption. Strict public health rules drive adoption in both developed and developing economies.

- For instance, Newater manufactures commercial reverse osmosis systems with capacities up to 20,000 gallons per day, designed to reduce energy use and wastewater while providing high-quality potable water for municipal and commercial applications.

Growth in Industrial Wastewater Recycling

Industrial plants adopt membrane technologies to lower freshwater use, meet discharge limits, and recover valuable materials from effluent streams. Refineries, chemical manufacturing, pharmaceuticals, food processing, and power plants rely on microfiltration and nanofiltration to separate oil, solids, salts, and contaminants before reuse or safe release. Environmental authorities enforce strict penalties for pollution, encouraging industries to upgrade treatment facilities. Membrane systems work well with zero liquid discharge strategies and produce consistent effluent quality with less manual handling.

- For instance, the aerospace multinational in Hungary implemented nanofiltration membranes supplied by NX Filtration to treat its industrial wastewater, ensuring effective removal of contaminants with stable flux performance.

Advancements in High-Performance Membrane Materials

Next-generation membrane materials improve durability, fouling resistance, and filtration precision, making separation systems more efficient for harsh industrial conditions. Manufacturers develop thin-film composites, ceramic membranes, and functional polymers that can handle high salinity, strong chemicals, and extreme temperatures. Anti-fouling coatings reduce downtime and cleaning costs, extending service life and lowering operational expenses. Research organizations and companies work on selective ion transport and energy-efficient desalination processes, which help utilities reduce energy consumption. Smart monitoring technology and membrane surface modification boost overall plant performance.

- For instance, Hydro Air Research Italia utilizes ceramic membranes made from high-purity alumina and zirconia, which exhibit exceptional chemical resistance and long lifetimes, enabling their use in extreme pH conditions and high-temperature applications prone to heavy fouling.

Key Trends & Opportunities

Expansion of Desalination and Water Reuse Projects

Desalination becomes a major opportunity as coastal nations invest in membrane-based seawater treatment to supply clean water to urban and industrial sectors. Large-scale plants use reverse osmosis due to lower operating costs and higher recovery rates compared with thermal technologies. Water-stressed regions in Middle East, Asia-Pacific, and parts of North America expand reuse networks where treated wastewater returns for irrigation, industrial use, or even potable supply. Policies encouraging circular water management create long-term contracts for membrane suppliers. Innovation in energy recovery devices and membrane cleaning systems improves sustainability and lifecycle performance, driving higher adoption.

- For instance, Aquatech supplied a membrane desalination solution to the 68,180 m3/day Ghalilah plant in the UAE, effectively managing biofouling and operational costs in seawater reverse osmosis (SWRO) systems.

Shift Toward Energy-Efficient and Low-Maintenance Systems

Energy use and fouling are major concerns for operators, and suppliers introduce new solutions that reduce consumption and cleaning frequency. Lightweight polymeric membranes, improved module design, and automated backwashing systems enhance throughput while reducing downtime. Compact, containerized membrane units gain traction for remote communities, small industries, and emergency uses. Integration with IoT sensors enables real-time monitoring of pressure, flow, and salt rejection, helping operators detect failures and optimize processes. These developments create opportunities for premium materials with longer service life and minimal operational cost, strengthening market competitiveness.

- For instance, Veolia’s ZeeWeed 500 Membrane Bioreactor combines biological treatment with ultrafiltration in a compact, energy-efficient design, featuring fibers with 60 times greater strength and membrane lifespans exceeding 15 years.

Key Challenges

High Operational and Maintenance Costs

While membranes deliver reliable output, fouling, scaling, and chemical cleaning increase maintenance efforts. Plants often require skilled staff to monitor performance, handle consumables, and manage pretreatment. Energy usage in high-pressure desalination remains a concern for budget-constrained municipalities and small companies. Replacement of damaged or worn membranes can impact overall costs, especially for large facilities. These expenses slow adoption in emerging economies with limited funding. Manufacturers respond with improved surface coatings, low-pressure membranes, and energy recovery systems, but upfront investment still acts as a barrier for many potential users.

Complexity in Handling Industrial Effluents

Industrial wastewater contains chemicals, oils, organics, and heavy metals that cause rapid membrane degradation and clogging if pretreatment is insufficient. Highly variable water quality in sectors such as mining, textiles, and petrochemicals complicates system design and durability. Operators face challenges selecting the right membrane type, pretreatment chemicals, and cleaning cycles to maintain consistent output. Improper maintenance leads to reduced lifespan and higher operational risk. Although research in advanced membrane materials continues, managing aggressive contaminants remains a key hurdle that requires high investment, technical expertise, and continuous monitoring.

Regional Analysis

North America

North America holds 32% share of the Membrane Separation Materials market, driven by strong municipal water treatment infrastructure and strict regulatory standards. The United States invests in desalination, wastewater recycling, and industrial effluent treatment to manage water scarcity in several states. Food processing and pharmaceuticals create steady demand for microfiltration and ultrafiltration systems. The region also benefits from early adoption of advanced polymer membranes and energy-efficient reverse osmosis technologies. Manufacturers expand product portfolios through R&D and partnerships with utilities. Replacement demand remains high due to aging facilities and tightening environmental regulations.

Europe

Europe accounts for 27% share of the market, supported by sustainability goals, strict discharge limits, and advanced industrial wastewater management systems. Countries such as Germany, the Netherlands, and France deploy membrane filtration across food, beverage, and chemical processing industries. Water reuse and zero liquid discharge projects gain attention due to rising environmental awareness and circular economy policies. The region invests heavily in anti-fouling materials, ceramic membranes, and automated monitoring systems to reduce maintenance costs. Strong government funding and technology innovation encourage long-term adoption across municipal and industrial sectors.

Asia-Pacific

Asia-Pacific leads the global market with 34% share, fueled by rapid industrialization, population growth, and urban water demand. China, India, Japan, and South Korea expand desalination, wastewater recycling, and industrial treatment plants to handle pollution and water shortages. Manufacturing, electronics, textiles, and petrochemicals create strong demand for nanofiltration and ultrafiltration materials. Government regulations push industries toward membrane-based purification to meet stricter discharge norms. Rising investment in low-cost polymer membranes supports large-scale installations. Growing infrastructure development and industrial expansion position the region as the fastest-growing market for membrane technologies.

Middle East & Africa

Middle East & Africa holds 5% share, but demand rises due to heavy reliance on desalination for municipal and industrial water supply. Countries in the Gulf invest in large seawater reverse osmosis facilities to manage extreme freshwater scarcity. Industrial zones use membrane systems for effluent treatment and reuse, supporting sustainability goals. Research in low-energy desalination technologies gains momentum to cut operating costs. Africa experiences slow but steady adoption as governments modernize water infrastructure and public-private partnerships grow in wastewater treatment projects. The region shows long-term potential with expanding urban populations and tourism hubs.

Latin America

Latin America captures 2% share, driven by water treatment needs in agriculture, food processing, and mining industries. Countries including Brazil, Chile, and Mexico adopt ultrafiltration and reverse osmosis systems to support industrial wastewater management and safe municipal supply. Mining regions rely on membranes for removing metals, minerals, and suspended solids before reuse or discharge. Economic constraints slow adoption, but foreign investment and infrastructure upgrades support gradual growth. Sustainability rules and rising urbanization encourage modernization of old filtration units. The market sees increasing interest in low-maintenance and energy-efficient membrane materials across small and medium industries.

Market Segmentations:

By Technology

- Reverse Osmosis

- Microfiltration

- Ultrafiltration

- Nanofiltration

By Application

- Water & Wastewater Treatment

- Industry Processing

- Food & Beverage Processing

- Pharmaceutical & Medical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Membrane Separation Materials market features a moderately consolidated structure with several global manufacturers competing through product innovation, regional expansion, and strategic collaborations. Major players include Merck KGaA, 3M, Nitto Denko Corporation, GEA Group Aktiengesellschaft, Dow, and Air Products and Chemicals, Inc. These companies invest heavily in R&D to develop high-performance membranes with enhanced permeability, fouling resistance, and mechanical stability. Partnerships with industrial water treatment firms and municipal utilities strengthen market positioning. Key competitors focus on sustainable materials, smart monitoring systems, and energy-efficient processes to meet regulatory and environmental standards. Continuous upgrades in polymer chemistry, nanocomposite coatings, and ceramic membrane technologies provide a strong edge in high-demand industries such as pharmaceuticals, power generation, and food processing. Expansion into emerging economies, particularly in Asia-Pacific, further drives competition and market consolidation through acquisitions and joint ventures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, Qatar Free Zones Authority (QFZ) and Evonik signed a Memorandum of Understanding (MoU) to explore investment opportunities in sustainable energy solutions, with Evonik’s advanced smart materials, including gas separation membranes, playing a pivotal role in the collaboration.

- In April 2024, Mitsubishi Heavy Industries, Ltd. (MHI) and NGK INSULATORS, LTD. (NGK) announced a partnership to develop a hydrogen purification system utilizing membrane separation technology.

- In October 2023, Koch Separation Solutions underwent a corporate rebranding, becoming Kovalus Separation Solutions following its acquisition by an affiliate of Sun Capital Partners Inc

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced filtration materials will rise due to stricter water quality regulations.

- Reverse osmosis technology will continue to dominate with wider industrial and municipal use.

- Asia-Pacific will remain the fastest-growing region supported by rapid industrialization.

- Manufacturers will invest more in anti-fouling and high-durability membrane coatings.

- Integration of IoT and AI will enhance process monitoring and performance efficiency.

- Desalination and wastewater recycling projects will expand in the Middle East and coastal nations.

- Collaboration between public utilities and private companies will increase technology deployment.

- Development of bio-based and recyclable membrane materials will gain momentum.

- Operational cost reduction through low-energy membrane systems will become a major focus.

- Continuous R&D in nanofiltration and hybrid membrane systems will create new market opportunities.