| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Off The Road Tire Market Size 2023 |

USD 2,214.68 Million |

| China Off The Road Tire Market, CAGR |

6.43% |

| China Off The Road Tire Market Size 2032 |

USD 3883.45 Million |

Market Overview:

China Off-the-Road Tire Market size was valued at USD 2,214.68 million in 2023 and is anticipated to reach USD 3883.45 million by 2032, at a CAGR of 6.43% during the forecast period (2023-2032).

The growth of the China Off-the-Road (OTR) tire market is driven by several key factors. The country’s extensive infrastructure development, including large-scale urbanization and transportation projects, necessitates the use of durable OTR tires for construction and heavy machinery. Additionally, the mining and agricultural sectors in China are expanding, increasing the demand for specialized tires capable of handling tough terrains. Technological advancements in tire design, such as enhanced tread patterns and improved materials, have contributed to better performance and longer-lasting products, further stimulating market growth. Moreover, China’s prominent position as a global manufacturer and exporter of OTR tires has bolstered the industry, with increasing exports to emerging markets in Latin America, Africa, and Asia.

China leads the Asia-Pacific region, accounting for over 60% of the global Off-the-Road (OTR) tire market share in 2023. The country’s dominance in the OTR tire market is attributed to its large industrial base, including key sectors like construction, mining, and agriculture, which require heavy-duty vehicles and specialized tires. Additionally, China’s ongoing infrastructure projects, including roads, bridges, and ports, continue to drive demand for OTR tires. The government’s push for innovation and sustainability in manufacturing, alongside increased export opportunities, ensures China’s strong position in both the regional and global OTR tire markets. The market’s growth is further supported by increasing investments in technological advancements and manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The China Off-the-Road (OTR) tire market was valued at USD 2,214.68 million in 2023 and is projected to reach USD 3,883.45 million by 2032, growing at a CAGR of 6.43% during the forecast period.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Key growth drivers include extensive infrastructure development, with large-scale urbanization and transportation projects fueling demand for durable OTR tires used in construction and heavy machinery.

- The mining and agricultural sectors are expanding rapidly, increasing the need for specialized OTR tires designed to handle rugged and tough terrains, significantly contributing to market growth.

- Technological advancements in tire design, including enhanced tread patterns and better materials, are improving performance, durability, and fuel efficiency, further boosting the OTR tire market.

- China’s strong export position enhances market growth as the country increasingly meets demand for OTR tires in international markets, particularly in Latin America, Africa, and Asia.

- The high initial cost of premium OTR tires remains a restraint for smaller businesses, limiting the adoption of high-performance tires in cost-sensitive sectors like agriculture and small-scale mining.

- Supply chain disruptions, including price fluctuations of raw materials and geopolitical tensions, challenge OTR tire production and manufacturing timelines, creating uncertainty in the market.

Market Drivers:

Infrastructure Development

Infrastructure development is one of the primary drivers of the China Off-the-Road (OTR) tire market. The country’s rapid urbanization and expansive infrastructure projects, including the construction of roads, highways, ports, and bridges, demand heavy machinery that requires durable and specialized tires. These projects, which are part of China’s long-term development strategy, significantly increase the need for OTR tires designed to perform in demanding environments. As urban centers continue to expand and new transportation networks are built, the demand for OTR tires for construction vehicles and equipment will continue to rise, boosting the market’s growth. This factor is critical to China’s growing market for heavy-duty and off-road vehicles, which form the backbone of large-scale infrastructure efforts.

Mining and Agricultural Growth

The mining and agricultural sectors in China are major contributors to the growing demand for OTR tires. China is a leading global producer of raw materials, and its mining industry is a key sector driving the economy. For instance, China’s mining sector, with 173 found minerals and 163 proven deposits, ranks third globally and is a major driver of OTR tire demand for construction and mining equipment. As the demand for metals, minerals, and energy increases both domestically and internationally, mining operations expand, requiring heavy machinery such as trucks, excavators, and loaders equipped with OTR tires. Furthermore, China’s vast agricultural industry, which is central to the nation’s economy, also drives the need for OTR tires for various farming machinery. The rise in mechanization within agriculture for tasks like harvesting and plowing increases demand for tires that can withstand harsh working conditions, contributing significantly to the OTR tire market’s growth.

Technological Advancements in Tire Design

Technological advancements in tire design and materials play a pivotal role in the expansion of the OTR tire market in China. Tire manufacturers are continuously innovating to develop tires that offer enhanced durability, better traction, and improved fuel efficiency, making them more suitable for demanding off-road environments. Innovations such as better tread patterns, advanced rubber compounds, and tire reinforcement materials help improve tire performance and extend their lifespan. These technological improvements meet the specific needs of sectors such as construction, mining, and agriculture, where machinery and equipment face rugged terrains and harsh conditions. As tire manufacturers in China continue to prioritize technological innovation, the market is expected to witness a steady increase in demand for high-performance OTR tires.

Global Export Demand

China’s position as a major global supplier of OTR tires is another key driver fueling market growth. The country’s established manufacturing infrastructure and expertise in tire production enable it to meet the rising demand for OTR tires in international markets. For instance, from January to October 2022, China exported 6,216,900 OTR tires, with an export value of USD 1.071 billion, up 50.10% year-on-year. Regions such as Latin America, Africa, and Asia-Pacific are experiencing an increasing demand for heavy-duty vehicles and agricultural machinery, which in turn boosts the demand for OTR tires. As global trade continues to expand, China’s role as a major exporter of OTR tires strengthens, contributing to its market dominance. Moreover, Chinese tire manufacturers are leveraging their cost-effectiveness and manufacturing capabilities to penetrate emerging markets, which further supports the growth of the domestic OTR tire market. The increasing global focus on infrastructure development, coupled with the demand for durable and cost-efficient tires, ensures sustained growth for the OTR tire market in China.

Market Trends:

Shift Towards Radial Tires

One of the significant trends in the China Off-the-Road (OTR) tire market is the increasing adoption of radial tires over bias tires. Radial tires are becoming the preferred choice for heavy-duty machinery and off-road vehicles due to their superior performance and durability. Compared to bias tires, radial tires offer better fuel efficiency, enhanced load distribution, and longer tread life. These advantages make radial tires more suitable for demanding applications in construction, mining, and agriculture. For instance, companies like Zhongce Rubber have actively expanded their production of agricultural radial tires, increasing output by 80,000 units at their Tianjin facility in 2023, and are investing in projects to further enhance high-end radial tire manufacturing capabilities. The shift towards radial tires is particularly prominent in the mining sector, where the need for tires that can withstand high pressure and extreme conditions is critical. This trend is expected to continue as manufacturers focus on improving the overall performance and cost-effectiveness of radial OTR tires.

Rise in Eco-friendly Tire Solutions

The growing emphasis on sustainability is another key trend influencing the China OTR tire market. As environmental concerns become increasingly important across industries, manufacturers are focusing on producing eco-friendly tire solutions. This includes the use of sustainable materials such as natural rubber and the development of recyclable tire designs. In addition, manufacturers are investing in the development of tires that consume less energy and reduce emissions. The Chinese government’s regulatory push for greener technologies is further driving this trend, encouraging the production and adoption of environmentally friendly OTR tires. As industries in China become more environmentally conscious, the demand for these sustainable tire solutions is expected to rise.

Integration of Smart Tire Technologies

The integration of smart technologies into OTR tires is another trend that is gaining momentum in China. Smart tires equipped with sensors that monitor tire pressure, temperature, and wear are becoming more common in the market. These technologies allow for real-time monitoring of tire performance, which helps prevent downtime and reduces maintenance costs. In the construction and mining sectors, where equipment reliability is critical, smart tire technologies enhance operational efficiency by providing early warnings about potential tire failures. This trend is aligned with China’s broader push towards digital transformation and automation, as industries seek to optimize their operations and reduce operational risks.

Growth in Aftermarket Services

The aftermarket services segment is also witnessing considerable growth within the China OTR tire market. As OTR tires are subject to wear and tear from heavy-duty use, the demand for tire repair, maintenance, and replacement services is increasing. The availability of specialized services, including tire retreading and reconditioning, is expanding as a result. Tire retreading, in particular, is gaining popularity as a cost-effective and sustainable solution for extending the life of tires, especially in industries with high tire usage like mining and construction. Companies are also offering value-added services such as tire management systems that help track tire usage and performance, further driving the growth of the aftermarket segment. For instance, Chinese manufacturers, including Qingdao Wangyu, have developed a diverse range of OTR and agricultural radial tires, and offer value-added services such as tire management systems to help track tire usage and performance. This trend reflects the growing importance of tire maintenance and management in reducing total operating costs for businesses in China.

Market Challenges Analysis:

High Initial Costs

One of the key restraints in the China Off-the-Road (OTR) tire market is the high initial cost associated with purchasing premium OTR tires. The durable and high-performance nature of these tires often comes with a significant price tag, which can be a barrier for smaller businesses and operators in cost-sensitive industries. While the long-term benefits of these tires—such as extended durability and reduced maintenance costs—make them a worthwhile investment, the upfront cost remains a concern for many companies, particularly in sectors like agriculture and small-scale mining. This financial burden may limit the adoption of premium OTR tires among smaller businesses that are unable to justify the higher initial expenditure.

Supply Chain Disruptions

The OTR tire market in China also faces challenges related to supply chain disruptions. Raw materials required for tire production, such as rubber and steel, are subject to price fluctuations and availability constraints. These disruptions can lead to delays in manufacturing and increased costs for producers, which in turn affect the overall market. Moreover, geopolitical tensions and trade policies can further exacerbate supply chain instability, particularly in the case of tire exports. These factors create an uncertain business environment for OTR tire manufacturers, forcing them to adjust pricing strategies and manufacturing timelines to accommodate market fluctuations.

Intense Competition

The China OTR tire market is highly competitive, with numerous domestic and international players vying for market share. This intense competition places pressure on manufacturers to maintain cost competitiveness while meeting the growing demand for high-performance products. Companies that cannot differentiate their products through technological innovation or offer significant value-added services may struggle to maintain profitability. Smaller players, in particular, may find it difficult to compete with larger, well-established tire manufacturers that have better access to resources, distribution networks, and brand recognition.

Regulatory Compliance

Stringent regulations regarding environmental standards and product safety are additional challenges faced by the OTR tire market in China. For instance, the Certification and Accreditation Administration (CNCA) announced updated mandatory product certification standards for motor vehicle tires (GB 9743-2024 for passenger car tires and GB 9744-2024 for truck tires), which will be enforced starting May 1, 2025. Manufacturers must adhere to government policies on sustainability, emissions, and tire disposal, which can increase operational costs. Compliance with these regulations requires significant investment in research and development, as well as upgrades to manufacturing facilities. For smaller companies or those that lack the financial capacity to invest in such improvements, regulatory compliance can be a significant hurdle to market participation.

Market Opportunities:

The China Off-the-Road (OTR) tire market presents substantial opportunities, particularly in emerging sectors such as renewable energy and electric vehicles (EVs). As China accelerates its transition to renewable energy, the demand for OTR tires in wind turbine construction and maintenance is expected to rise. Heavy machinery used in the construction of wind farms requires specialized tires that can withstand challenging terrains and heavy loads. Additionally, the growth of the electric vehicle market, including electric mining vehicles, presents a new avenue for OTR tire manufacturers to explore. As more industries adopt electric technology, tires designed for these applications—offering energy efficiency and durability—will become increasingly essential. This shift creates an opportunity for manufacturers to innovate and provide tailored solutions for these evolving sectors.

Another promising opportunity lies in the aftermarket and retreading services segment of the China OTR tire market. As tires undergo wear and tear, especially in industries like mining and construction, the demand for tire retreading and maintenance services is growing. Retreading provides a cost-effective solution for extending the lifespan of tires, which is particularly appealing in sectors with high operational costs. Additionally, tire management systems that help track performance and optimize tire usage are gaining traction. Manufacturers can tap into this opportunity by offering value-added services that enhance the overall customer experience and reduce total cost of ownership. The expanding aftermarket services segment represents a steady growth opportunity for OTR tire manufacturers and service providers in China.

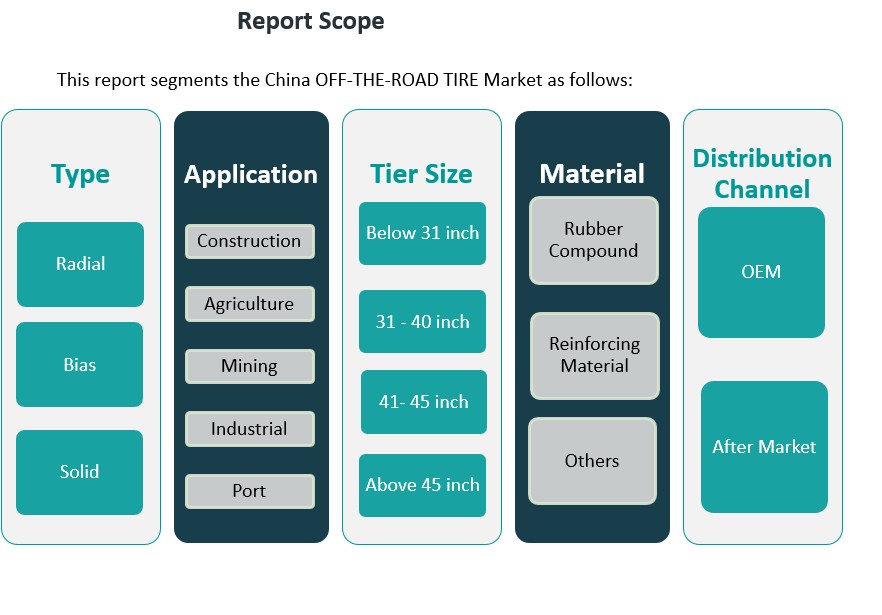

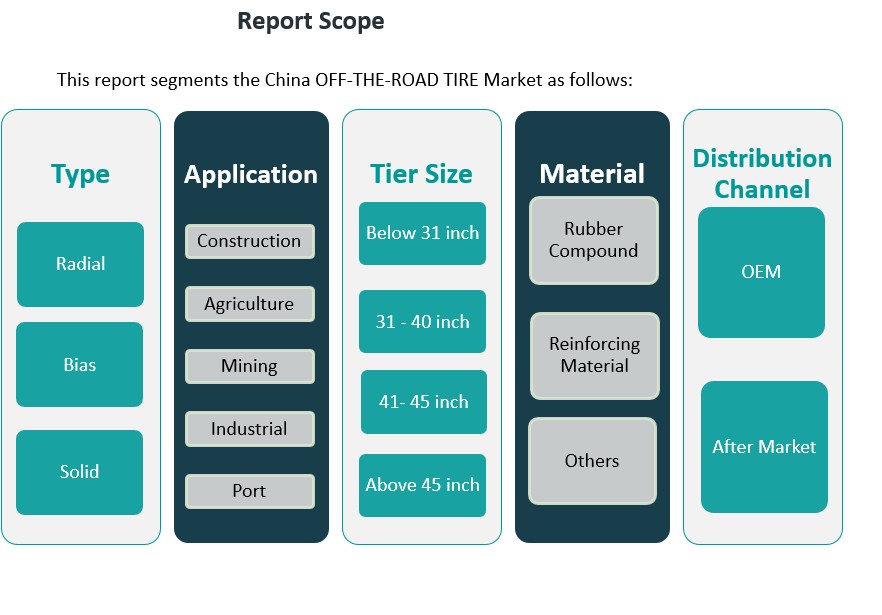

Market Segmentation Analysis:

The China Off-the-Road (OTR) tire market is segmented into various categories, each catering to specific industries and applications.

By Type, the market is primarily divided into radial, bias, and solid tires. Radial tires are gaining significant market share due to their superior performance, enhanced durability, and fuel efficiency, making them ideal for heavy-duty machinery in construction, mining, and agriculture. Bias tires, while still in use, are being gradually replaced by radial tires. Solid tires are increasingly popular in industrial and port applications for their longevity and ability to perform in harsh environments.

By Application, the OTR tire market is segmented into construction, agriculture, mining, industrial, and port applications. Construction and mining are the largest contributors, driven by ongoing infrastructure development and mining operations in China. The Agriculture sector also demands high-quality OTR tires for machinery that handles various tasks, from plowing to harvesting. The industrial and port sectors are growing steadily, particularly with the rise in e-commerce and the need for efficient logistics.

By Tire Size segmentation includes categories such as below 31 inches, 31-40 inches, 41-45 inches, and above 45 inches. Larger tire sizes are predominantly used in heavy machinery and mining operations, where durability and load-bearing capacity are crucial.

By Material segment consists of rubber compounds, reinforcing materials, and others, with rubber compounds being the primary material used for tire manufacturing due to their durability and performance characteristics.

By Distribution Channel segment is divided into OEM and aftermarket, with aftermarket services growing rapidly as more companies seek retreading and maintenance solutions to optimize operational costs

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The China Off-the-Road (OTR) tire market is dominated by strong regional demand driven by various industrial and infrastructure activities. The market exhibits substantial growth across several key regions, each contributing differently to the overall market dynamics. As the largest economy in Asia and a global leader in infrastructure development, China remains the primary hub for OTR tire consumption.

Eastern China holds the largest share of the OTR tire market, accounting for approximately 40% of the total market share. This region is the industrial powerhouse of China, with major urban centers like Shanghai, Hangzhou, and Suzhou driving demand for construction machinery and mining operations. The extensive infrastructure development projects in Eastern China, including the construction of highways, ports, and urban expansion, significantly contribute to the demand for heavy-duty OTR tires. Additionally, the region’s advanced manufacturing capabilities and concentration of logistics operations support strong growth in the industrial and port sectors, further increasing the need for high-performance tires.

Northern China, including cities like Beijing and Tianjin, accounts for about 25% of the OTR tire market. This region’s strong presence in agriculture and mining contributes heavily to the demand for specialized OTR tires. As China’s agricultural heartland, Northern China relies on durable tires for farming machinery, including tractors and harvesters. Additionally, mining operations in Inner Mongolia drive the demand for tires in this region, particularly for heavy machinery used in coal and mineral extraction.

Southern China represents roughly 20% of the market, with key cities like Guangzhou, Shenzhen, and Hong Kong acting as major commercial and industrial centers. The region is a significant player in the port and logistics sectors, where specialized OTR tires are essential for cargo handling equipment and industrial vehicles. The growth in e-commerce and logistics infrastructure further fuels the demand for OTR tires in this region.

Western China, comprising regions such as Sichuan and Xinjiang, contributes about 10% to the overall market share. Although less industrialized than the eastern and northern regions, Western China’s demand for OTR tires is rising due to increased mining activities, particularly in areas rich in natural resources like oil and gas. The region’s tire market growth is also supported by expanding agricultural machinery usage and infrastructure projects in the more remote areas.

The Southwest and Central China regions represent smaller but growing shares of the market, approximately 5%, as urbanization and infrastructure development expand. These regions are seeing a steady rise in demand for OTR tires for construction, agriculture, and industrial applications.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Longmarch Tyre

- Sailun Group

Competitive Analysis:

The China Off-the-Road (OTR) tire market is highly competitive, with several key domestic and international players vying for market share. Major global tire manufacturers, including Michelin, Bridgestone, and Goodyear, dominate the market, offering a wide range of high-performance OTR tires. These companies leverage advanced technologies, extensive distribution networks, and strong brand recognition to maintain their market position. Local manufacturers, such as Triangle Tire and Doublestar Tire, have also gained significant traction by offering cost-effective solutions tailored to the domestic market. These players are increasingly focusing on improving tire durability and performance through innovation and technological advancements. Additionally, local manufacturers are benefiting from China’s robust manufacturing base, allowing them to produce high volumes at competitive prices. The market is also witnessing the emergence of niche players that specialize in tire retreading and aftermarket services, providing added value through tire management solutions.

Recent Developments:

- In March 2024, The Goodyear Tire & Rubber Company introduced the RL-5K OTR tire, designed specifically for heavy-duty loaders and wheel dozers. This new product features a three-star load capacity rating, enhancing durability and performance for demanding operations and showcasing Goodyear’s commitment to advancing OTR tire technology with a focus on efficiency, durability, and operational performance.

- In December 2023, JK Tyre & Industries Ltd, a leading tire manufacturer, unveiled 11 new OTR tires at the CII EXCON event in Bengaluru. Among these, the JK Tyre 18.00-25 40PR Port Champion Plus stands out, as it is engineered for reach stackers and features deep treads, a precise pattern, and a heavy rubber center. This design ensures superior durability, high mileage, and exceptional steering performance, reinforcing JK Tyre’s position as an innovator in the OTR segment.

- On February 29, 2024, Titan International completed the acquisition of Carlstar Group LLC for approximately $296 million. Carlstar operates manufacturing facilities in the U.S. and China, and this deal is expected to immediately enhance Titan’s earnings and operating margins. The acquisition positions Titan as a “one-stop shop” in the specialty wheel and tire space, diversifying its product range and customer relationships, especially in off-highway and specialty tire segments.

Market Concentration & Characteristics:

The China Off-the-Road (OTR) tire market is moderately concentrated, with a mix of global and local players dominating the market. Leading international tire manufacturers such as Michelin, Bridgestone, and Goodyear hold a significant share, benefiting from strong brand recognition, technological expertise, and extensive distribution networks. However, local companies like Triangle Tire and Doublestar Tire have gained substantial market presence by offering cost-competitive products tailored to domestic needs. The market is characterized by high competition and continuous innovation, with companies investing in advanced tire technologies, such as radial tires and smart tire solutions. Demand is driven by the construction, mining, agriculture, and industrial sectors, all requiring specialized, durable tires. The market also features a growing aftermarket segment, with services such as tire retreading and maintenance gaining importance. The dynamic nature of the market reflects ongoing technological advancements and shifting customer preferences for cost-effective and high-performance solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The China Off-the-Road (OTR) tire market will continue to grow due to ongoing infrastructure development and urbanization projects.

- Increasing demand for durable, high-performance tires will be driven by the expansion of mining and agricultural activities.

- Radial tires will dominate the market, as industries prioritize performance, fuel efficiency, and longevity.

- Technological advancements, including smart tire solutions, will enhance operational efficiency and safety across sectors.

- The shift toward eco-friendly tire materials and sustainable production practices will be a key market trend.

- The aftermarket segment will experience growth as companies focus on tire retreading and maintenance services.

- The rise of electric and autonomous vehicles in construction and mining sectors will create new opportunities for specialized OTR tires.

- Regional expansion in Western and Central China will contribute to increased demand for OTR tires in less industrialized areas.

- Competitive pressures will drive continuous innovation, with local manufacturers increasingly adopting advanced tire technologies.

- Strong export demand, particularly to emerging markets in Asia and Latin America, will sustain China’s leadership in the global OTR tire market.