Market Overview

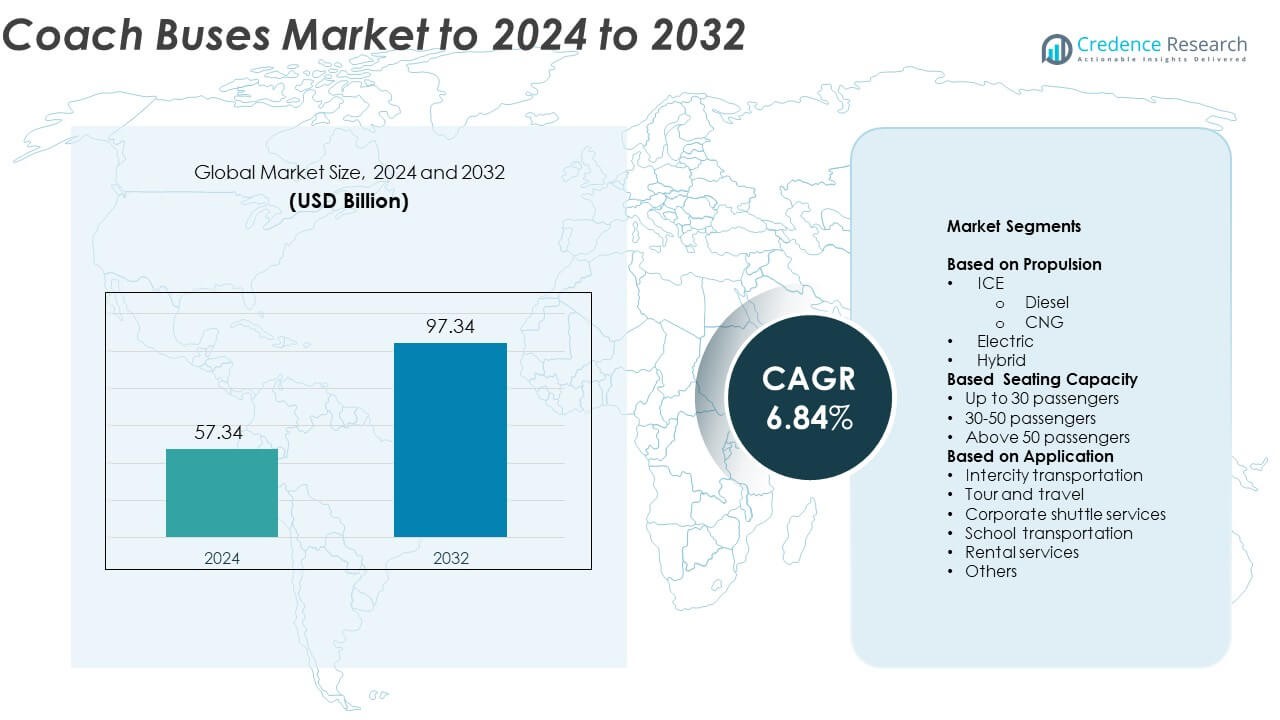

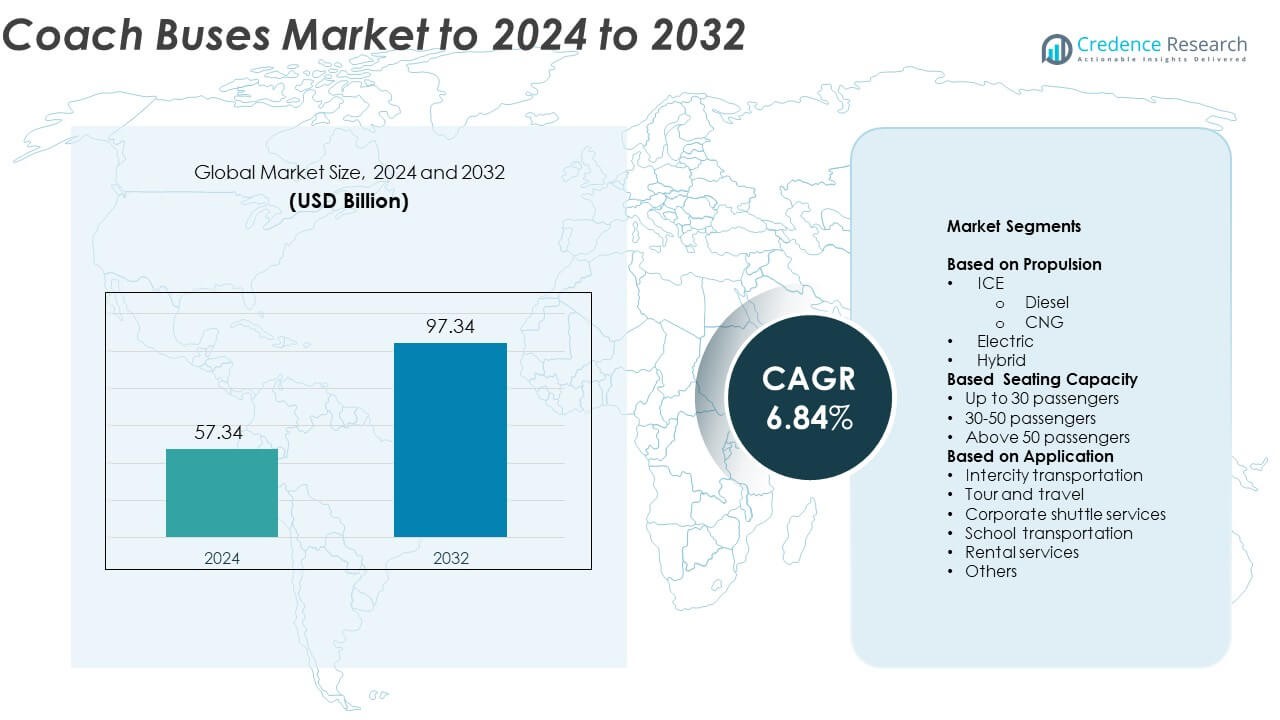

The Coach Buses Market size was valued at USD 57.34 Billion in 2024 and is anticipated to reach USD 97.34 Billion by 2032, at a CAGR of 6.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coach Buses Market Size 2024 |

USD 57.34 Billion |

| Coach Buses Market, CAGR |

6.84% |

| Coach Buses Market Size 2032 |

USD 97.34 Billion |

The coach buses market is led by major players including Volvo Group, BYD Company Limited, MAN Truck & Bus, Alexander Dennis Limited (ADL), Yutong Group Co., Ltd., VDL Groep BV, Scania AB, Zhongtong Bus Holding Co., Ltd., Daimler AG, and Van Hool NV. These companies dominate through strong global distribution networks, continuous innovation, and expansion into electric and hybrid bus segments. Asia Pacific holds the largest market share of about 33.2% in 2024, driven by growing intercity transportation and rapid urbanization. North America follows with around 31.4% share, supported by advanced infrastructure and increasing demand for premium and electric coaches.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The coach buses market was valued at USD 57.34 Billion in 2024 and is projected to reach USD 97.34 Billion by 2032, growing at a CAGR of 6.84%.

- Rising demand for intercity travel, tourism recovery, and sustainable public transport solutions are key drivers boosting market expansion.

- Growing adoption of electric and hybrid propulsion systems, along with telematics integration, defines major trends shaping fleet modernization.

- The market is moderately consolidated, with global manufacturers focusing on innovation, partnerships, and electric model launches to strengthen competitiveness.

- Asia Pacific leads with a 33.2% share, followed by North America at 31.4% and Europe at 28.7%, while the 30–50 passenger segment dominates with 53.4% share globally.

Market Segmentation Analysis:

By Propulsion

The internal combustion engine (ICE) segment dominates the coach buses market, accounting for around 68.7% share in 2024. Diesel-powered coaches remain the preferred choice due to their cost-effectiveness, durability, and widespread refueling infrastructure. However, CNG variants are rapidly gaining popularity as fleet operators prioritize lower emissions and operating costs. Meanwhile, electric coaches are expanding their footprint with advancements in battery capacity and government incentives for clean mobility. Growing adoption of hybrid coaches by private and intercity operators also supports the market’s gradual transition toward sustainable propulsion technologies.

- For instance, Volvo Buses lists BZL Electric battery capacity up to 470 kWh.

By Seating Capacity

The 30-50 passenger segment leads the global coach buses market with about 53.4% share in 2024. This capacity range offers the ideal balance between comfort, efficiency, and cost, making it popular among intercity transport and tourism operators. Increasing demand for medium-capacity coaches for airport transfers, corporate shuttles, and charter services further fuels the segment’s growth. Operators prefer these models for their flexible configuration options and lower maintenance costs. Meanwhile, large-capacity buses above 50 passengers are witnessing steady adoption for long-distance routes and high-volume commuter services.

- For instance, the Mercedes-Benz Tourrider offers standard 56-seat configurations. The coach is powered by a Mercedes-Benz OM471 engine, which has an output of 450 hp (336 kW), developed for the North American market.

By Application

Intercity transportation holds the dominant share of nearly 41.6% in the coach buses market in 2024. Its leadership is driven by growing public preference for cost-effective and comfortable long-distance travel options. Expanding regional connectivity networks and government investments in road infrastructure enhance fleet deployment. The tour and travel segment follows closely, supported by the post-pandemic revival of tourism and rising demand for luxury coaches. Corporate shuttle and school transportation services are also expanding as organizations and institutions adopt dedicated mobility solutions to ensure safety and punctuality.

Key Growth Drivers

Rising Demand for Intercity and Long-Distance Travel

The increasing preference for affordable and comfortable long-distance transportation drives the coach buses market. Growing intercity connectivity and highway development projects across regions support higher fleet utilization. Operators are expanding premium and sleeper coach services to meet evolving passenger comfort expectations. Additionally, urban migration and tourism growth continue to boost intercity bus demand, especially in developing economies where road networks remain the primary mode of regional travel.

- For instance, National Express recorded airport route growth: +50% Manchester, +37% Birmingham, +21% Bristol (Jan–Jun 2024 vs 2023).

Shift Toward Sustainable Mobility Solutions

The transition to low-emission and electric buses is a key growth catalyst. Governments worldwide are implementing policies and subsidies encouraging fleet electrification to reduce carbon footprints. Advancements in battery technology and the establishment of charging infrastructure enhance operational efficiency. Major manufacturers are introducing hybrid and fully electric coach models to align with emission norms, positioning the market toward sustainable growth.

- For instance, BYD won a single U.S. order for 130 battery-electric buses from LADOT.

Expansion in Tourism and Corporate Travel

Tourism recovery and corporate mobility programs are fueling coach bus demand globally. Tour operators are increasingly investing in modern, air-conditioned coaches with advanced safety features. Corporate shuttle services are also growing as companies focus on employee convenience and sustainability. Expanding leisure travel and event-based transportation further strengthen market expansion, especially in regions with robust tourism infrastructure and rising disposable incomes.

Key Trends & Opportunities

Integration of Advanced Telematics and Safety Systems

The adoption of telematics and smart monitoring systems is reshaping fleet management. Features such as GPS tracking, driver behavior analysis, and predictive maintenance reduce operational costs and improve safety. Manufacturers are equipping buses with advanced driver-assistance systems, enhancing reliability and passenger security. These digital innovations are creating new opportunities for connected fleet solutions across public and private transportation networks.

- For instance, Abellio London cut on-board bus casualties by 60% after fitting Mobileye collision-avoidance systems.

Growth of Electrified and Autonomous Coaches

The rise of electric and semi-autonomous coaches marks a major technological shift. Continuous investment in electric drivetrains and autonomous navigation improves efficiency and lowers emissions. Pilot programs in Europe and Asia are testing self-driving long-haul coaches, signaling future mobility trends. As charging networks expand, electrified models will gain wider commercial adoption, unlocking growth opportunities for eco-friendly mass transport.

- For instance, Yutong completed a 1,272-km full-scenario test of its IC12E battery-electric intercity bus in July 2025.

Key Challenges

High Initial Investment and Infrastructure Costs

The transition toward electric and hybrid coaches faces hurdles due to high acquisition and setup costs. Charging infrastructure development remains limited in many regions, especially in rural and intercity routes. Operators hesitate to shift from conventional diesel fleets due to uncertain return on investment. These financial and logistical challenges slow down adoption, particularly for small and mid-sized fleet owners.

Stringent Emission and Safety Regulations

Regulatory compliance poses a significant challenge for manufacturers and operators. Stricter emission standards and safety mandates increase production complexity and costs. Adhering to these evolving requirements demands continuous technological upgrades and investment in cleaner propulsion systems. Delays in meeting regional regulations can affect market competitiveness and hinder timely product rollouts across international markets.

Regional Analysis

North America

North America holds around 31.4% share of the global coach buses market in 2024. Growth is driven by increasing adoption of intercity and charter coach services across the United States and Canada. The region benefits from advanced road infrastructure, high tourism activity, and strong demand for luxury and electric coaches. Government initiatives supporting emission-free transportation and replacement of aging fleets also promote market expansion. Key manufacturers focus on integrating telematics and autonomous technologies to enhance passenger safety and operational efficiency, further strengthening the regional market outlook.

Europe

Europe accounts for about 28.7% share of the coach buses market in 2024, supported by stringent emission norms and widespread adoption of electric and hybrid models. Countries such as Germany, France, and the United Kingdom lead in deploying sustainable intercity and tourism coaches. The market benefits from growing investments in charging infrastructure and passenger comfort features. Increased cross-border travel and tourism revival post-pandemic continue to boost demand for modern, energy-efficient fleets, while regulatory frameworks such as Euro VI standards accelerate innovation in clean propulsion technologies.

Asia Pacific

Asia Pacific dominates the global coach buses market with around 33.2% share in 2024. Rapid urbanization, rising tourism, and expanding intercity transportation networks are key growth drivers. China, Japan, and India are major contributors, with local manufacturers introducing cost-effective and electric models to meet growing passenger volumes. Government policies encouraging clean mobility and improved road connectivity further stimulate demand. Increasing fleet modernization and the popularity of corporate and school transportation services continue to enhance market prospects across emerging economies in the region.

Latin America

Latin America captures nearly 4.1% share of the global coach buses market in 2024. Growth is fueled by rising investments in intercity connectivity and the tourism sector across Brazil, Mexico, and Argentina. Operators are upgrading fleets with advanced safety systems and low-emission vehicles to comply with regional sustainability goals. The expanding middle-class population and increasing demand for affordable long-distance travel further support market penetration. However, limited electrification infrastructure and economic fluctuations in key economies slightly restrain faster adoption of electric and hybrid coaches in the region.

Middle East & Africa

The Middle East and Africa region holds around 2.6% share in the coach buses market in 2024. Growing tourism, urban transport projects, and investments in public mobility infrastructure drive demand. The Gulf countries are witnessing increasing adoption of luxury and air-conditioned coaches for intercity and tourism applications. Africa’s market is gradually developing as governments enhance road connectivity and prioritize safe mass transportation systems. However, high import costs and limited manufacturing capabilities present challenges, though rising regional collaborations and fleet modernization programs offer promising future opportunities.

Market Segmentations:

By Propulsion

By Seating Capacity

- Up to 30 passengers

- 30-50 passengers

- Above 50 passengers

By Application

- Intercity transportation

- Tour and travel

- Corporate shuttle services

- School transportation

- Rental services

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the coach buses market features prominent players such as Volvo Group, BYD Company Limited, MAN Truck & Bus, Alexander Dennis Limited (ADL), Yutong Group Co., Ltd., VDL Groep BV, Scania AB, Zhongtong Bus Holding Co., Ltd., Daimler AG, and Van Hool NV. The market is characterized by continuous innovation, strategic alliances, and investments in sustainable mobility solutions. Companies are focusing on expanding their product portfolios with electric and hybrid models to align with global emission targets. Growing emphasis on autonomous driving technologies, advanced safety features, and telematics integration enhances operational efficiency and passenger comfort. Partnerships between manufacturers and transport operators are strengthening service networks and fleet maintenance programs. Competitive differentiation increasingly depends on energy efficiency, design flexibility, and aftersales support. Moreover, R&D initiatives targeting improved battery systems and digital fleet management platforms are expected to define the next phase of competition in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Volvo Group

- BYD Company Limited

- MAN Truck & Bus

- Alexander Dennis Limited (ADL)

- Yutong Group Co., Ltd.

- VDL Groep BV

- Scania AB

- Zhongtong Bus Holding Co., Ltd.

- Daimler AG

- Van Hool NV

Recent Developments

- In 2025, Alexander Dennis (ADL) expanded its stock bus range to include electric models such as the Enviro100EV, alongside the Enviro200 and Enviro400, all with updated specifications to improve the driver and passenger experience and information accessibility

- In 2025, BYD Company Limited: Unveiled a new e-bus platform (1,000-V, CTC) and the C11, supporting large battery packs suitable for intercity use.

- In 2025, Scania launched its first high-floor battery-electric platform, enabling it to produce zero-emission coaches for urban and long-distance travel.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Seating Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of electric and hybrid coach buses will accelerate with improved battery efficiency.

- Autonomous driving technologies will reshape fleet operations and reduce human error.

- Increasing demand for luxury intercity and tourism coaches will drive premium segment growth.

- Governments will expand incentives and subsidies for zero-emission fleet transitions.

- Integration of telematics and AI-based fleet monitoring will enhance safety and performance.

- Urbanization and infrastructure development will boost intercity and shuttle transportation demand.

- Fleet modernization initiatives will replace aging diesel models with cleaner alternatives.

- Expansion of smart charging infrastructure will support large-scale electric coach deployment.

- Collaboration between manufacturers and mobility operators will increase customized fleet solutions.

- Rising corporate and institutional travel needs will strengthen demand for mid-capacity coaches.