Market Overview

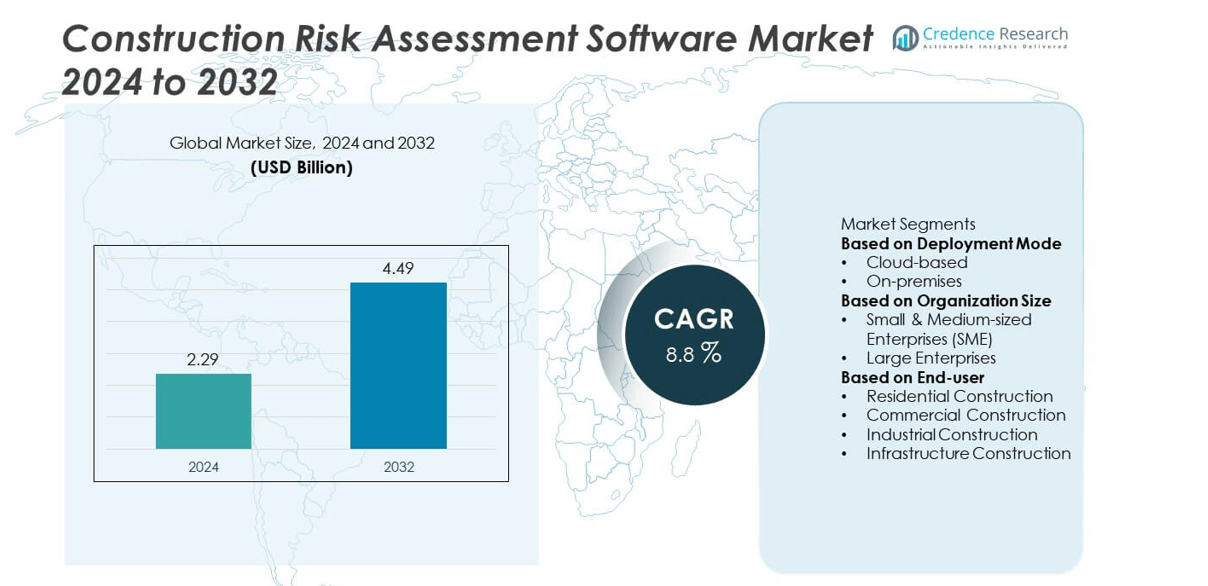

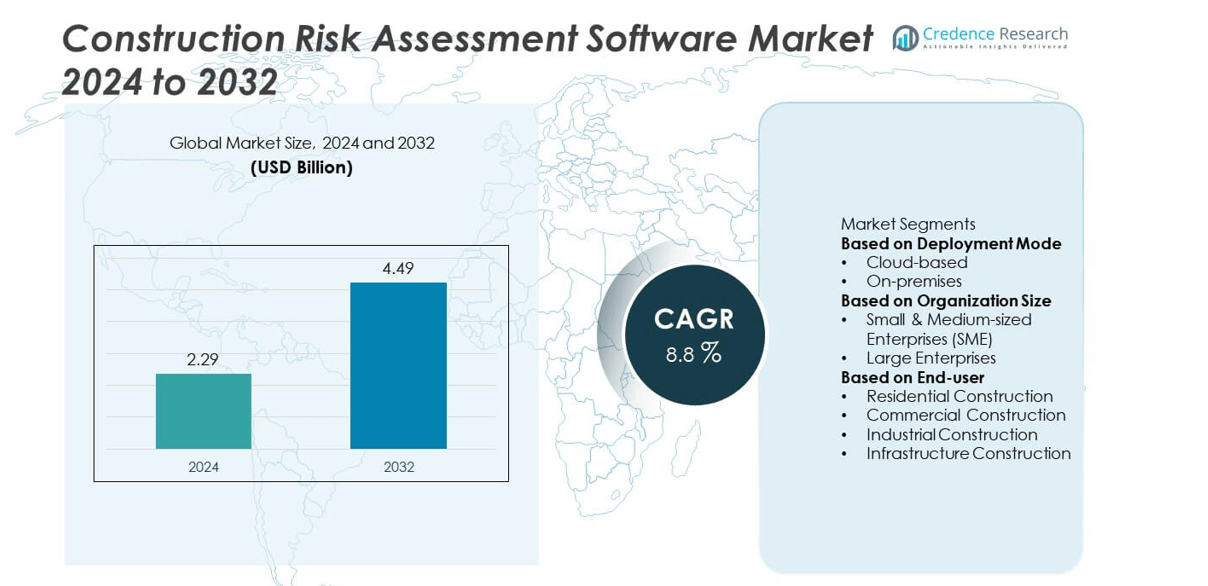

The Construction Risk Assessment Software market was valued at USD 2.29 billion in 2024 and is projected to reach USD 4.49 billion by 2032, growing at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Risk Assessment Software Market Size 2024 |

USD 2.29 billion |

| Construction Risk Assessment Software Market, CAGR |

8.8% |

| Construction Risk Assessment Software Market Size 2032 |

USD 4.49 billion |

The Construction Risk Assessment Software market is led by major players such as Trimble Inc., Procore Technologies, Inc., Autodesk, Inc., Buildertrend Solutions, Inc., Oracle Corporation, Bentley Systems, Incorporated, Raken, Inc., PlanGrid, Viewpoint, Inc., and CMiC Global. These companies dominate through innovation in cloud-based platforms, predictive analytics, and integrated project management tools that enhance safety, compliance, and cost efficiency. North America led the global market with a 32% share in 2024, driven by advanced digital adoption and strict regulatory standards. Europe followed with 28%, supported by strong infrastructure modernization initiatives, while Asia-Pacific, holding 30%, grew rapidly due to large-scale construction projects and increasing cloud-based software adoption.

Market Insights

- The Construction Risk Assessment Software market was valued at USD 2.29 billion in 2024 and is projected to reach USD 4.49 billion by 2032, growing at a CAGR of 8.8% during the forecast period.

- Market growth is driven by the rising need for digital risk management solutions that improve safety, compliance, and cost control in complex construction projects.

- Key trends include the integration of cloud-based platforms, AI-driven analytics, and Building Information Modeling (BIM) for real-time risk monitoring and predictive insights.

- The market is moderately competitive, with leading players such as Trimble Inc., Autodesk, and Procore Technologies focusing on AI-based automation, mobile accessibility, and strategic partnerships to expand their presence.

- North America leads with a 32% share, followed by Europe with 28% and Asia-Pacific with 30%, while the cloud-based deployment segment dominates with a 63% share due to scalability and real-time collaboration advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Mode

The cloud-based segment dominated the construction risk assessment software market in 2024, accounting for around 63% of the total share. Its dominance is driven by rising demand for scalable, real-time, and cost-efficient solutions that support remote project monitoring and collaboration. Cloud platforms enable seamless data sharing across multiple stakeholders, improving transparency and decision-making in large construction projects. The increasing use of AI and predictive analytics in cloud environments enhances risk identification accuracy. In contrast, on-premises solutions continue to serve organizations requiring higher data control and customized security infrastructure.

- For instance, Autodesk Inc.’s Construction Cloud platform utilizes AI-driven analytics, such as its Construction IQ feature, to analyze project data and identify high-risk areas impacting cost, schedule, quality, and safety.

By Organization Size

The large enterprises segment held a 57% market share in 2024, fueled by widespread adoption of advanced project management systems and digital safety platforms. Large construction companies increasingly invest in risk assessment software to manage complex, multi-site operations efficiently. The need for compliance with safety standards and contractual regulations further drives adoption. These enterprises benefit from integrated risk dashboards and automation tools that reduce financial losses and schedule delays. Small and medium-sized enterprises are also showing rapid growth, supported by affordable cloud-based subscription models that minimize upfront investment.

- For instance, Oracle’s Primavera Cloud offers risk management features with capabilities such as quantitative risk analysis, including Monte Carlo simulations, to help forecast cost and schedule outcomes for projects.

By End-user

The infrastructure construction segment led the market with a 42% share in 2024, driven by rising global investments in transportation, energy, and urban development projects. Large-scale public and private infrastructure initiatives demand robust risk assessment tools to manage cost overruns, site safety, and environmental compliance. Governments and contractors increasingly deploy predictive risk analytics to improve project reliability and safety outcomes. The commercial and industrial construction segments also show steady adoption, particularly for large facilities, logistics hubs, and office projects requiring continuous safety monitoring and regulatory compliance.

Key Growth Drivers

Increasing Focus on Construction Safety and Compliance

Growing emphasis on safety compliance and workforce protection is a major driver for the construction risk assessment software market. Governments and regulatory agencies are enforcing stricter construction safety standards, pushing companies to adopt digital risk management tools. These platforms help identify hazards, track safety incidents, and ensure compliance with environmental and labor laws. The software also reduces manual reporting and enhances transparency across construction sites, minimizing costly accidents and project disruptions. This rising digital safety culture continues to strengthen market adoption worldwide.

- For instance, Procore Technologies Inc.’s Quality & Safety software helps users log and manage incidents, observations, and other safety data across active projects.

Rapid Adoption of Cloud-Based and AI-Driven Platforms

The shift toward cloud-based construction management tools is accelerating due to improved accessibility, scalability, and cost-efficiency. Cloud deployment enables real-time collaboration between engineers, contractors, and safety officers, ensuring timely risk identification and response. The integration of AI and predictive analytics allows early detection of potential failures and cost overruns. These intelligent systems enhance decision-making accuracy and operational efficiency. As construction firms prioritize data-driven project planning, demand for AI-enabled risk assessment software continues to grow, particularly in large infrastructure and commercial projects.

- For instance, Bentley Systems Inc. integrated its iTwin AI Analytics with infrastructure digital twins to analyze data from ongoing transportation and energy projects, enabling early risk detection and helping to reduce asset maintenance downtime.

Rising Infrastructure Development and Urbanization

Expanding infrastructure projects worldwide are significantly driving demand for construction risk assessment solutions. Rapid urbanization in emerging economies has led to large-scale investments in transportation, utilities, and housing. These complex projects involve multiple contractors, timelines, and compliance requirements, increasing the need for automated risk monitoring. Digital risk tools enable project managers to mitigate financial, environmental, and operational uncertainties. Government-led smart city initiatives and public-private partnerships further contribute to software adoption, as they require robust platforms to ensure safety, quality control, and project transparency.

Key Trends & Opportunities

Integration of BIM and IoT for Real-Time Risk Monitoring

The integration of Building Information Modeling (BIM) and IoT technologies is transforming construction risk assessment. IoT sensors collect real-time data on site conditions, equipment performance, and worker safety, while BIM provides a digital twin of the project for visualization and planning. Combined, these tools allow predictive risk management and faster response to on-site issues. Software providers are leveraging this synergy to create comprehensive risk analytics platforms, offering construction firms greater control over project outcomes and operational efficiency across complex builds.

- For instance, Trimble Inc. utilizes its WorksOS platform to connect various IoT-enabled devices, linking field telemetry with 3D BIM models for real-time grading, productivity, and safety insights, enabling more informed decision-making across construction projects.

Growing Demand for Predictive Analytics and Automation

Predictive analytics is emerging as a key trend in construction risk management, helping organizations foresee and prevent potential project failures. Automated tools assess historical and live data to identify high-risk areas in cost, safety, and scheduling. This data-driven approach enhances planning accuracy and reduces delays. Construction firms increasingly invest in automation to streamline risk documentation, reporting, and compliance tracking. The trend supports proactive decision-making and aligns with the industry’s transition toward digital transformation and smarter construction practices.

- For instance, CMiC has leveraged AI-enabled workflows within its construction ERP platforms like NEXUS and CONSTRUCT, which process real-time project data to automate processes, enhance analytics, improve risk management, and generate reports for client projects.

Key Challenges

High Implementation Costs and Integration Complexity

While risk assessment software offers long-term benefits, the initial implementation cost remains a major barrier, particularly for small and medium enterprises. Integrating these platforms with existing project management and ERP systems requires technical expertise and time. Customization for specific construction environments also increases setup costs. Limited IT infrastructure in developing regions further slows adoption. To address this, vendors are introducing flexible subscription-based pricing and simplified integration modules, yet cost sensitivity and technological readiness continue to restrict market penetration.

Data Security and Privacy Concerns

As construction firms increasingly adopt cloud and connected software platforms, data security has become a major concern. Sensitive project information, including financial records, safety reports, and client data, is at risk of cyber threats and unauthorized access. Compliance with global data protection regulations such as GDPR adds further complexity. Ensuring secure data transmission, storage, and access control is essential to maintain client trust. Software providers are investing in encryption, multi-factor authentication, and secure cloud environments to mitigate these challenges and support safe digital adoption.

Regional Analysis

North America

North America held a 32% market share in 2024, driven by widespread adoption of digital construction management tools and strong regulatory focus on safety compliance. The United States leads the region, supported by large-scale infrastructure investments and rapid integration of cloud and AI technologies in construction operations. Construction firms increasingly use risk assessment software to enhance project efficiency, meet OSHA standards, and minimize financial losses. Growing adoption of predictive analytics and mobile-based safety applications continues to strengthen North America’s dominance in the global construction risk assessment software market.

Europe

Europe accounted for 28% of the market share in 2024, supported by strict construction safety regulations and the rapid digitalization of project management systems. Countries such as Germany, the United Kingdom, and France are at the forefront of adopting risk management software to ensure compliance with environmental and labor safety standards. The region’s strong focus on sustainable infrastructure and smart construction practices drives steady growth. European firms are investing in integrated software solutions that combine BIM, IoT, and AI capabilities to improve risk visibility and enhance operational resilience across construction sites.

Asia-Pacific

Asia-Pacific dominated the market with a 30% share in 2024, fueled by massive infrastructure development and rapid urbanization across China, India, Japan, and South Korea. Governments are heavily investing in smart city projects, transportation networks, and renewable energy infrastructure, creating strong demand for risk assessment solutions. The growing adoption of cloud-based platforms among regional contractors enables efficient project tracking and regulatory compliance. Increasing awareness of digital safety management and labor risk prevention further supports regional growth. Asia-Pacific is expected to remain the fastest-growing region throughout the forecast period.

Latin America

Latin America captured a 6% market share in 2024, with Brazil and Mexico leading regional adoption. The market is expanding due to growing construction activity in residential, industrial, and infrastructure sectors. Companies are gradually shifting from manual monitoring to automated risk assessment tools to enhance project transparency and worker safety. The implementation of government-backed infrastructure programs is further boosting adoption. However, limited digital infrastructure and high software costs continue to restrict market penetration. The region offers emerging opportunities for vendors introducing cost-effective, cloud-based risk management solutions tailored to local needs.

Middle East & Africa

The Middle East and Africa region accounted for 4% of the market share in 2024, supported by the expansion of large-scale construction and infrastructure projects. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are increasingly using risk assessment software to manage complex, high-value developments. Smart city initiatives like NEOM and Vision 2030 are accelerating digital adoption. However, dependency on imported technology and limited awareness among smaller contractors remain challenges. International software providers are focusing on partnerships with regional firms to deliver localized, cloud-enabled solutions and strengthen their presence.

Market Segmentations:

By Deployment Mode

By Organization Size

- Small & Medium-sized Enterprises (SME)

- Large Enterprises

By End-user

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Risk Assessment Software market includes key players such as Trimble Inc., Procore Technologies, Inc., Autodesk, Inc., Buildertrend Solutions, Inc., Oracle Corporation, Bentley Systems, Incorporated, Raken, Inc., PlanGrid, Viewpoint, Inc., and CMiC Global. These companies compete by offering advanced digital solutions that enhance safety management, cost control, and operational efficiency across construction projects. Leading players focus on integrating AI, predictive analytics, and cloud-based technologies to deliver real-time risk monitoring and compliance tools. Strategic partnerships with contractors, engineering firms, and infrastructure developers strengthen their market presence. North American and European providers dominate enterprise-grade solutions, while emerging vendors target affordable, modular platforms for small and mid-sized firms. Continuous investment in automation, mobile integration, and data-driven insights is intensifying competition. Innovation, scalability, and interoperability remain key differentiators shaping long-term leadership in the global construction risk assessment software market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trimble Inc.

- Procore Technologies, Inc.

- Autodesk, Inc.

- Buildertrend Solutions, Inc.

- Oracle Corporation

- Bentley Systems, Incorporated

- Raken, Inc.

- PlanGrid

- Viewpoint, Inc.

- CMiC Global

Recent Developments

- In May 2025, Trimble Inc. released Trimble Materials, a procurement and materials management module that helps contractors mitigate risk and manage cost overruns through integrated purchasing workflows.

- In February 2025, Procore Technologies, Inc. launched its Procore Analytics Risk Report, consolidating risk registers, probability matrices, and budget risk elements into a unified report across Procore tools.

- In June 2024, At Innovation Summit 2024, Procore Technologies unveiled new advancements aimed at enhancing collaboration in construction. The company introduced Procore Copilot AI, which integrates with Microsoft Teams to provide project data and summaries through conversational queries.

- In March 2024, Autodesk Construction Cloud introduced over 45 product updates aimed at enhancing its platform. Autodesk Build now offers enhanced integrations with AutoCAD and advanced reporting options

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Organization Size, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with increasing digital transformation in the construction industry.

- Cloud-based deployment will remain the preferred model due to its scalability and collaboration benefits.

- Integration of AI and predictive analytics will enhance real-time risk identification and prevention.

- Demand for mobile-friendly and user-centric platforms will rise among contractors and project managers.

- Adoption of Building Information Modeling (BIM) will strengthen data-driven risk assessment capabilities.

- Small and medium-sized enterprises will increasingly adopt affordable, subscription-based solutions.

- Partnerships between software providers and construction firms will drive innovation and customized solutions.

- Data security and compliance management features will become critical for large infrastructure projects.

- Asia-Pacific will experience the fastest growth due to rapid urbanization and large-scale infrastructure development.

- Continuous R&D in automation and smart analytics will define long-term competitiveness and software advancement.