Market Overview

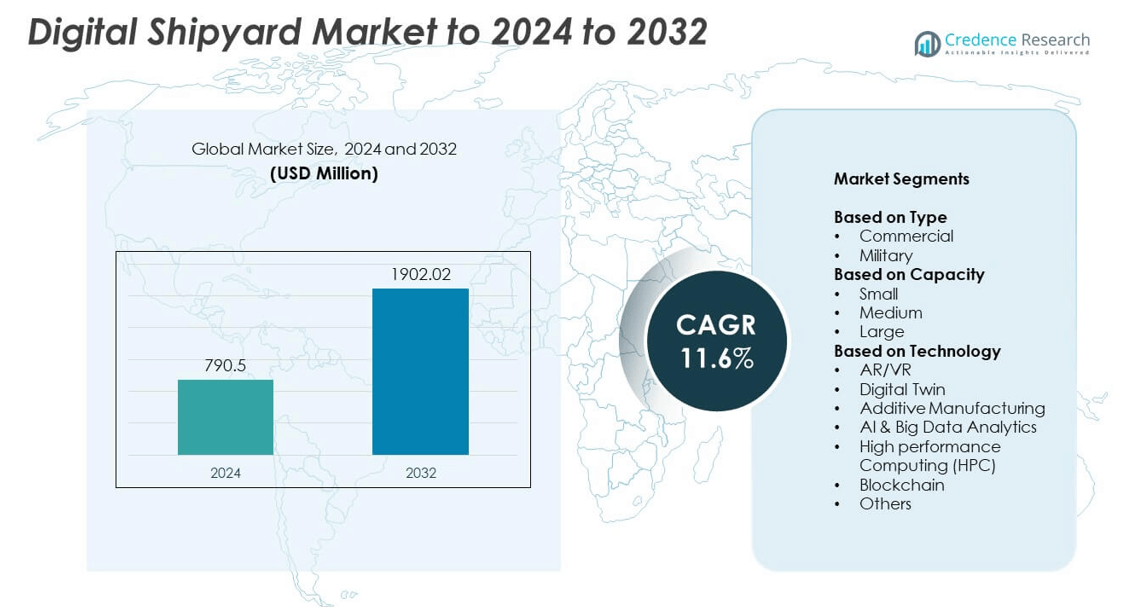

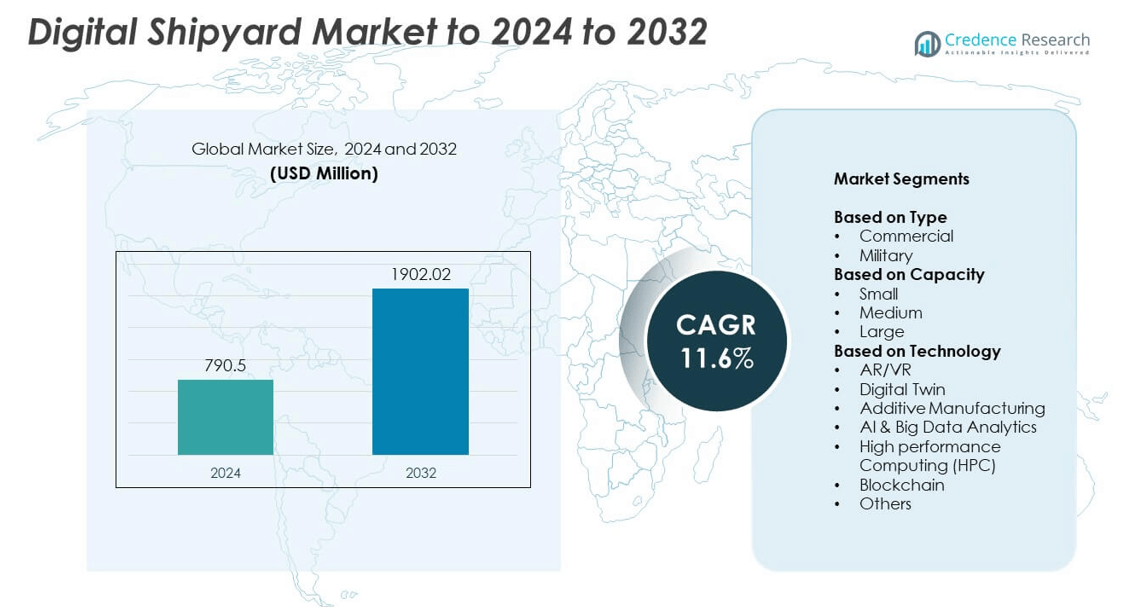

The Digital Shipyard Market size was valued at USD 790.5 million in 2024 and is anticipated to reach USD 1,902.02 million by 2032, at a CAGR of 11.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Shipyard Market Size 2024 |

USD 790.5 million |

| Digital Shipyard Market, CAGR |

11.6% |

| Digital Shipyard Market Size 2032 |

USD 1,902.02 million |

The digital shipyard market is shaped by major players such as Siemens, Accenture, Wärtsilä, Damen Shipyards Group, SAP, BAE Systems, AVEVA Group Limited, Hexagon AB, Dassault Systèmes, and Inmarsat Global Limited. These companies lead innovation through the integration of digital twins, AI analytics, AR/VR, and IoT solutions in ship design, construction, and maintenance. Their strategic collaborations with naval and commercial shipbuilders enhance production efficiency and sustainability. Regionally, North America dominated the market with a 36% share in 2024, driven by advanced naval modernization programs and strong technological infrastructure, followed by Europe and Asia Pacific as rapidly growing hubs for digital transformation in shipbuilding.

Market Insights

- The digital shipyard market was valued at USD 790.5 million in 2024 and is projected to reach USD 1,902.02 million by 2032, growing at a CAGR of 11.6%.

- Market growth is driven by the adoption of digital twin, AI, and automation technologies that enhance ship design accuracy and reduce operational costs.

- Key trends include increasing use of AR/VR for design validation, additive manufacturing for rapid prototyping, and blockchain for secure data management.

- Competition is intensifying as leading players invest in R&D and partnerships to strengthen digital infrastructure and deliver integrated shipyard solutions.

- North America held the largest share of 36% in 2024, followed by Europe at 30% and Asia Pacific at 25%, while the commercial segment led with a 63% share, supported by growing modernization in naval and commercial shipbuilding operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The commercial segment held the dominant share of 63% in 2024, driven by the rapid adoption of digital shipyard solutions across commercial shipbuilding and maintenance operations. Growing demand for smart ship production, predictive maintenance, and lifecycle management is encouraging shipyards to implement digital design and automation platforms. Commercial operators increasingly use digital twins and IoT-enabled monitoring to improve efficiency and reduce operational downtime. The military segment also shows steady growth as defense shipyards modernize fleets through advanced simulation, virtual prototyping, and secure data analytics to optimize naval asset readiness.

- For instance, Samsung Heavy Industries targets 35 new orders annually by 2030, and cites 118 LNG carriers over 25 years old due for replacement, backing its smart-yard push.

By Capacity

Large shipyards accounted for the leading share of 54% in 2024, supported by high investment capacity and broader digital integration needs. These shipyards adopt digital twins, AI-driven inspection tools, and high-performance computing for complex naval and cargo vessel programs. Large-scale operations benefit from centralized data systems for predictive maintenance and design validation. Medium shipyards are also accelerating digital transformation to enhance productivity, while small shipyards adopt modular solutions and cloud-based digital tools to streamline operations with lower capital investment and improved project coordination.

- For instance, Fincantieri runs nine Italian facilities and has launched 7,000+ ships; digital planning cut document transfer from months to days.

By Technology

Digital twin technology dominated the market with a 41% share in 2024, reflecting its growing role in real-time ship design, simulation, and lifecycle management. Shipbuilders increasingly use digital twins to replicate vessel systems and monitor performance under varying conditions, improving operational efficiency and safety. AR/VR and AI-based analytics are also expanding rapidly, supporting immersive design validation and predictive modeling. Additive manufacturing and HPC solutions further accelerate prototyping and data processing, while blockchain technology enhances traceability, cybersecurity, and documentation transparency within digital shipyard ecosystems.

Key Growth Drivers

Rising Adoption of Digital Twin and AI Technologies

Digital twin and AI integration are major growth drivers in the digital shipyard market. These technologies allow shipbuilders to simulate, analyze, and optimize vessel design and performance in real time. AI-driven predictive maintenance reduces downtime and enhances asset reliability. Shipyards also use digital twins for training, design validation, and lifecycle management, resulting in improved efficiency and cost savings. The rising focus on automation and digitalization across maritime operations continues to accelerate adoption among both commercial and defense sectors.

- For instance, HD Hyundai Marine Solutions trials showed 5.3% average fuel savings across 13 routes and 106,000 km using AI route optimization.

Growing Demand for Smart and Sustainable Shipbuilding

The shift toward smart and sustainable shipbuilding practices fuels market expansion. Governments and shipowners emphasize reducing emissions, improving energy efficiency, and complying with environmental regulations. Digital shipyards support this transformation by integrating data analytics, 3D modeling, and IoT systems for real-time monitoring of materials and emissions. Automation enables efficient resource management and reduced waste, aligning shipyards with green technology goals. As sustainability becomes central to maritime operations, digital shipyard solutions emerge as critical tools for achieving cleaner and smarter production.

- For instance, Kongsberg reports equipment installed on 30,000+ vessels, enabling fleet-wide optimization toward lower emissions.

Increasing Naval Modernization Programs

Rising naval modernization initiatives significantly drive demand for digital shipyard technologies. Defense organizations worldwide are upgrading fleets with advanced design and production capabilities. Digital solutions enable faster prototyping, secure collaboration, and precision manufacturing of complex vessels. Governments are investing heavily in digital transformation to enhance operational readiness and security. The integration of AI and HPC further improves decision-making and simulation accuracy, helping naval shipyards meet mission-critical demands while minimizing production time and operational risks.

Key Trends & Opportunities

Integration of Augmented and Virtual Reality (AR/VR)

AR and VR technologies are transforming ship design, training, and maintenance processes. Engineers use virtual simulations to detect design flaws early and improve collaboration among distributed teams. VR-based training environments enhance crew readiness and reduce on-site risks. Shipyards adopting AR tools for remote inspection and digital overlays achieve faster error detection and repair accuracy. The increasing availability of immersive technologies provides significant opportunities for innovation and cost reduction in shipyard operations globally.

- For instance, Keppel Offshore & Marine reported up to 50% reduction in on-site inspection man-hours using 5G AR smart-glasses.

Adoption of Additive Manufacturing for Custom Parts

Additive manufacturing is emerging as a major opportunity for the digital shipyard market. 3D printing allows rapid production of customized components, reducing dependency on supply chains and shortening lead times. Shipyards are leveraging these technologies to fabricate lightweight and durable materials that improve vessel performance. The capability to create on-demand spare parts during maintenance reduces downtime. This trend supports a leaner, more agile manufacturing ecosystem, especially for defense and offshore vessels requiring precise, complex structures.

- For instance, Huntington Ingalls Industries installed 55+ 3D-printed parts at Newport News and planned 200 more by end-2025.

Growing Use of Blockchain for Data Security

Blockchain adoption presents a new growth avenue for secure digital shipyard ecosystems. It ensures traceability of materials, components, and processes while safeguarding sensitive project data. Shipyards use blockchain to verify supplier credentials and maintain transparent documentation throughout production. This reduces risks of data manipulation and counterfeit components. As cybersecurity becomes a top priority, blockchain’s decentralized nature helps enhance trust, compliance, and efficiency across multi-vendor shipbuilding operations.

Key Challenges

High Implementation and Integration Costs

High upfront costs remain a major barrier for widespread adoption of digital shipyard solutions. Implementing technologies like digital twins, HPC, and advanced analytics requires significant investment in infrastructure and training. Many mid-sized and small shipyards struggle with the cost of hardware, software licensing, and integration with legacy systems. Additionally, aligning digital solutions with existing production workflows demands time and technical expertise. These financial and operational hurdles slow down the pace of digital transformation in smaller facilities.

Cybersecurity and Data Privacy Concerns

As shipyards adopt interconnected digital platforms, cybersecurity threats pose a significant challenge. Large-scale data exchange across IoT devices, cloud networks, and AI systems increases vulnerability to breaches. Sensitive defense and commercial project data require advanced protection against unauthorized access. The maritime sector’s reliance on global supply chains further exposes systems to cyber risks. Ensuring compliance with international cybersecurity standards and investing in secure infrastructure remain critical to maintaining operational integrity and trust in digital shipyard ecosystems.

Regional Analysis

North America

North America held the largest share of 36% in the digital shipyard market in 2024. The region’s dominance stems from strong investments in naval modernization and smart shipbuilding programs in the U.S. and Canada. Leading shipyards integrate digital twins, AI, and AR/VR to enhance productivity and reduce lifecycle costs. The U.S. Navy’s digital transformation initiatives and partnerships with defense contractors further strengthen the market. Growing focus on predictive maintenance, cybersecurity, and advanced simulation platforms supports continued adoption, driving the region’s position as a major hub for digital maritime innovation.

Europe

Europe accounted for 30% of the digital shipyard market in 2024, supported by strong demand from commercial shipbuilders and naval modernization efforts. Countries such as Germany, France, and the U.K. lead in implementing automation and 3D modeling technologies. European shipyards focus on sustainability and compliance with carbon reduction regulations, boosting the use of digital solutions for design optimization and emissions tracking. Collaborative projects between shipbuilders and technology providers promote innovation across the region. Continuous advancements in AI-based systems and high-performance computing strengthen Europe’s competitiveness in the digital maritime ecosystem.

Asia Pacific

Asia Pacific captured 25% of the digital shipyard market in 2024, driven by rapid expansion in shipbuilding industries in China, Japan, and South Korea. The region’s strong manufacturing base and increasing automation investments are accelerating digital adoption. Shipyards leverage AI-driven analytics, digital twins, and additive manufacturing for cost-efficient operations. Governments encourage digital transformation to strengthen maritime exports and defense capabilities. Growing use of smart design tools and virtual prototyping enhances operational efficiency. Asia Pacific’s expanding fleet construction and modernization programs are expected to make it the fastest-growing regional market by 2032.

Rest of the World

The rest of the world represented 9% of the digital shipyard market in 2024, with steady growth led by emerging shipbuilding nations in the Middle East and Latin America. Countries such as Brazil, the UAE, and Saudi Arabia are investing in digital infrastructure to improve naval capabilities and commercial fleet efficiency. Shipyards in these regions are gradually integrating digital twins and AR-based solutions to reduce maintenance costs and optimize production cycles. Although adoption is still in early stages, supportive government policies and increasing technology partnerships are fostering long-term market development.

Market Segmentations:

By Type

By Capacity

By Technology

- AR/VR

- Digital Twin

- Additive Manufacturing

- AI & Big Data Analytics

- High performance Computing (HPC)

- Blockchain

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The digital shipyard market features prominent players such as Siemens, Accenture, Wärtsilä, Damen Shipyards Group, SAP, BAE Systems, AVEVA Group Limited, Hexagon AB, Dassault Systèmes, and Inmarsat Global Limited. These companies focus on integrating advanced technologies like AI, IoT, AR/VR, and digital twin systems to optimize ship design, construction, and lifecycle management. Their solutions improve real-time data exchange, enhance production accuracy, and reduce operational costs. Strategic collaborations with shipbuilders and defense organizations support modernization and automation across naval and commercial sectors. Continuous R&D investments strengthen capabilities in smart manufacturing, predictive maintenance, and cybersecurity. The growing emphasis on sustainability, automation, and system interoperability further drives competitive differentiation. Partnerships with government agencies and technology providers help these companies expand market presence and deliver end-to-end digital solutions tailored to complex shipyard environments.

Key Player Analysis

- Siemens

- Accenture

- Wärtsilä

- Damen Shipyards Group

- SAP

- BAE Systems

- AVEVA Group Limited

- Hexagon AB

- Dassault Systèmes

- Inmarsat Global Limited

Recent Developments

- In June 2025, BAE Systems opened a new digital ship build hall in Glasgow. The facility supports modernized, paper-light production. It forms part of a major yard digitization.

- In April 2025, Accenture launched “Fincantieri Ingenium.” The joint venture accelerates digital transformation for shipyards and ports. It targets cruise and naval programs.

- In May 2024, Inmarsat Maritime, now part of Viasat, Inc., has introduced NexusWave, a fully managed maritime connectivity service that integrates multiple high-speed networks into a single solution, offering unlimited data, global coverage, and secure, resilient communications.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The digital shipyard market will experience strong growth driven by global fleet modernization.

- Adoption of digital twins and AI analytics will expand across both commercial and defense shipyards.

- AR and VR technologies will increasingly support design validation and remote maintenance operations.

- Additive manufacturing will gain traction for faster prototyping and on-demand component production.

- Blockchain integration will improve supply chain transparency and cybersecurity in shipbuilding.

- Cloud-based shipyard management systems will enhance collaboration and data accessibility.

- Sustainability goals will push digital tools that optimize energy use and reduce emissions.

- Investments in high-performance computing will improve simulation accuracy and production speed.

- Predictive maintenance and IoT integration will become standard practices in shipyard operations.

- Regional partnerships and defense programs will continue to accelerate digital transformation in maritime industries.