Market Overview

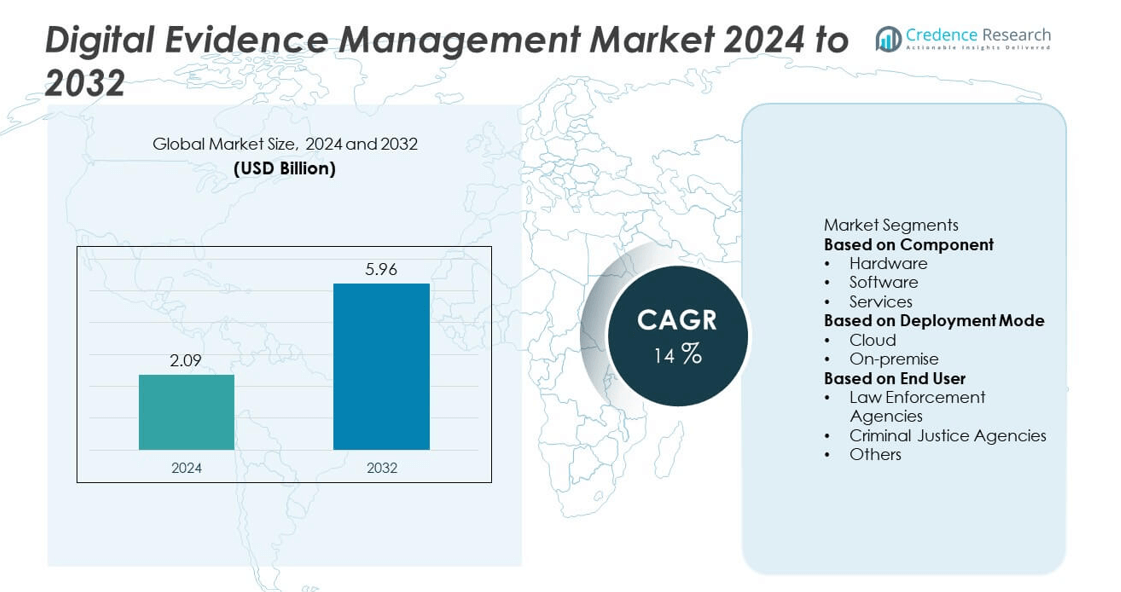

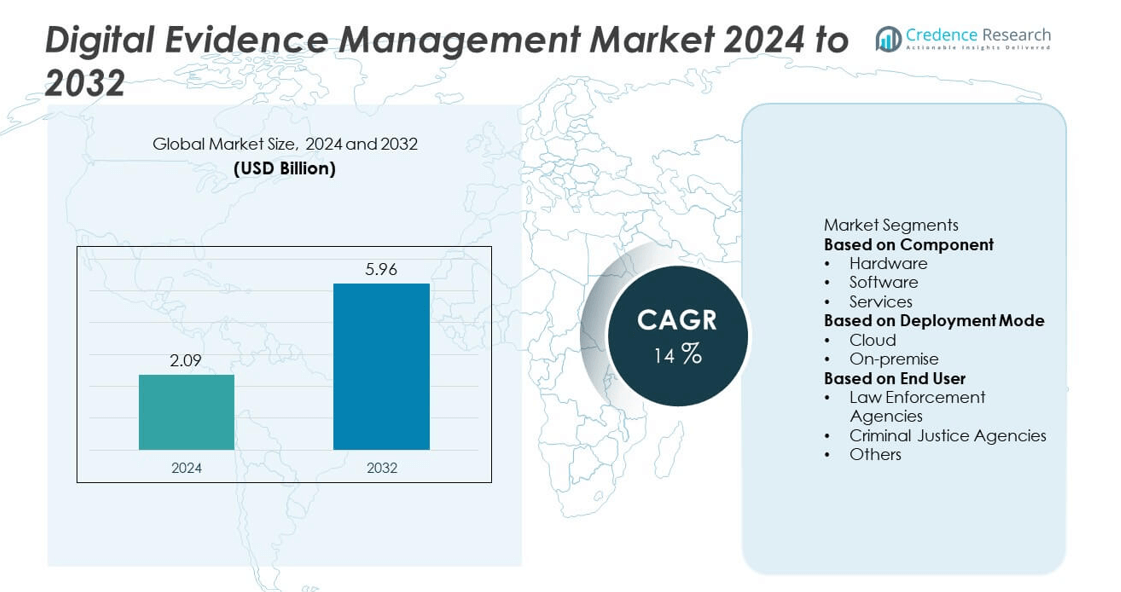

The global digital evidence management market was valued at USD 2.09 billion in 2024 and is projected to reach USD 5.96 billion by 2032, growing at a CAGR of 14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Evidence Management Market Size 2024 |

USD 2.09 billion |

| Digital Evidence Management Market, CAGR |

14% |

| Digital Evidence Management Market Size 2032 |

USD 5.96 billion |

The digital evidence management market is led by major players such as Guardify, Oracle Corporation, Digital Ally, Inc., IBM Corporation, Motorola Solutions, OpenText Corporation, Hitachi, Ltd., NICE Ltd., Cellebrite, and Axon Enterprise, Inc. These companies dominate the market through advanced AI-enabled solutions, secure cloud platforms, and strong partnerships with law enforcement and judicial agencies. North America emerged as the leading region with a 38% share in 2024, driven by high adoption of body-worn cameras and robust digital infrastructure. Europe followed with a 29% share, supported by strict data protection regulations and investments in smart policing, while Asia-Pacific, holding a 25% share, is expanding rapidly due to growing digitalization and public safety modernization initiatives.

Market Insights

- The digital evidence management market was valued at USD 2.09 billion in 2024 and is projected to reach USD 5.96 billion by 2032, growing at a CAGR of 14% during the forecast period.

- Rising adoption of body-worn cameras, digital forensics tools, and cloud-based systems is driving demand for secure and centralized digital evidence management across law enforcement and judicial agencies.

- Market trends include the integration of artificial intelligence, blockchain verification, and analytics tools to enhance data accuracy, case efficiency, and real-time evidence processing.

- The market is moderately competitive, with key players such as Axon Enterprise, IBM Corporation, Oracle Corporation, and Motorola Solutions focusing on AI-driven, cloud-based, and interoperable platforms to strengthen global reach.

- North America led with a 38% share in 2024, followed by Europe at 29% and Asia-Pacific at 25%, while the software segment dominated with a 48% share due to its critical role in secure evidence analysis and management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment dominated the digital evidence management market in 2024 with a 48% share, driven by the increasing adoption of advanced data analytics, case management, and automated evidence tracking platforms. Software solutions enable seamless integration of video, audio, and document evidence, improving efficiency and accuracy in investigations. The demand for centralized, cloud-compatible systems that allow secure sharing and storage of digital evidence is rising rapidly among law enforcement and judicial agencies. Continuous innovations in AI-based analytics and data encryption technologies further strengthen software adoption across public safety operations.

- For instance, Axon Enterprise’s AI-powered Auto-Tagging system, which is part of Axon Evidence, automates the extraction of metadata from video, audio, and image files. This technology helps to improve efficiency for law enforcement agencies by reducing manual data entry and human error.

By Deployment Mode

The cloud deployment segment held a 57% share of the market in 2024, fueled by its scalability, cost efficiency, and real-time accessibility. Cloud-based digital evidence management systems allow agencies to store and share large volumes of data without investing in expensive on-site infrastructure. The growing trend of digital transformation in public safety and the need for remote collaboration among law enforcement units are driving adoption. Strong cybersecurity frameworks and compliance with data protection standards have made cloud solutions the preferred choice for managing sensitive criminal evidence.

- For instance, OpenText Corporation’s eDiscovery Cloud processes massive volumes of data through ISO 27001-certified data centers, enabling secure, scalable digital evidence storage for global law enforcement agencies.

By End User

The law enforcement agencies segment accounted for a 61% share of the market in 2024, supported by the widespread use of body-worn cameras, surveillance systems, and digital forensics tools. Police departments and investigation units are adopting digital evidence platforms to manage increasing volumes of video and image data efficiently. These solutions streamline evidence collection, storage, and sharing, ensuring transparency and integrity in legal proceedings. The growing emphasis on accountability, coupled with government funding for digital policing initiatives, continues to drive strong adoption among law enforcement agencies worldwide.

Key Growth Drivers

Rising Adoption of Body-Worn Cameras and Surveillance Systems

The increasing use of body-worn cameras, CCTV systems, and dashcams by law enforcement agencies is driving the demand for efficient digital evidence management systems. These devices generate massive volumes of video data that require secure storage, retrieval, and sharing. Governments are mandating the deployment of digital video recording for transparency and accountability in policing. As a result, agencies are adopting advanced digital evidence platforms to streamline operations, improve case accuracy, and ensure the authenticity of data in judicial proceedings.

- For instance, the Motorola Solutions WatchGuard platform utilizes a flexible, scalable software solution like Evidence Library to manage video evidence from police body-worn and in-car systems, enabling high-volume data transfer and secure analytics integration across jurisdictions. The system uses multi-resolution technology to manage storage costs, with options for on-premises or cloud-hosted solutions.

Growing Need for Secure and Centralized Evidence Storage

The surge in digital crime and electronic data collection has highlighted the importance of centralized storage systems. Law enforcement and judicial bodies require unified platforms to securely manage video, audio, and document evidence across departments. Digital evidence management systems offer encryption, access control, and audit trails to maintain data integrity and chain of custody. Increasing cybersecurity concerns and strict data protection regulations are further accelerating adoption of secure, cloud-based evidence repositories.

- For instance, NICE Ltd.’s Evidencentral Cloud manages over 240 million digital evidence items and utilizes robust AES-256 encryption to secure data. It provides end-to-end management of digital evidence, including automated collection, analysis, sharing, and storage for public safety and justice agencies.

Government Initiatives Supporting Digital Transformation in Law Enforcement

Governments across various regions are investing in digital modernization programs to enhance public safety and judicial transparency. Initiatives promoting smart policing, data sharing, and integrated criminal justice systems are boosting market growth. Funding support for AI-driven evidence management and cloud adoption is strengthening system capabilities. Law enforcement agencies are increasingly deploying digital platforms to meet compliance requirements, improve inter-agency coordination, and streamline evidence submission processes for faster investigations and legal outcomes.

Key Trends and Opportunities

Integration of Artificial Intelligence and Analytics

Artificial intelligence is transforming digital evidence management by automating data classification, facial recognition, and metadata tagging. AI algorithms can analyze large video datasets quickly, improving investigative efficiency and accuracy. Predictive analytics help agencies identify patterns and detect anomalies in real time. The integration of AI and machine learning with digital evidence platforms offers opportunities to reduce manual workload and enhance case-solving speed. This trend is expected to continue as agencies seek smarter, data-driven solutions for digital investigations.

- For instance, IBM Corporation’s Watson AI platform enables automated image recognition and video analysis for commercial uses like enhancing customer engagement, managing inventory, and fraud detection.

Expansion of Cloud-Based and Interoperable Platforms

The growing shift toward cloud-based infrastructure offers scalability, cost savings, and remote accessibility for evidence management. Cloud platforms enable real-time collaboration between law enforcement, forensic teams, and legal entities. Interoperability between multiple data sources—such as surveillance systems, mobile devices, and digital records—enhances case connectivity and transparency. Vendors are focusing on developing open, secure, and compliant architectures to facilitate seamless data exchange, positioning cloud deployment as a key growth opportunity in the coming years.

- For instance, Oracle Cloud Infrastructure (OCI) offers robust security, enables interoperability with other clouds like Microsoft Azure and AWS through direct interconnects, and provides features that support compliance with various regulatory frameworks, including those relevant for law enforcement.

Key Challenges

Data Security and Privacy Concerns

Digital evidence often contains highly sensitive information, making data breaches a critical concern. Agencies must comply with strict regulations such as GDPR and CJIS for data handling and storage. Unauthorized access or tampering can compromise investigations and public trust. Ensuring end-to-end encryption, multi-factor authentication, and controlled access remains a major challenge for vendors and agencies. Continuous investment in advanced cybersecurity frameworks is necessary to maintain evidence integrity and regulatory compliance.

Integration Complexity and Lack of Technical Expertise

Implementing digital evidence management systems across diverse departments and legacy infrastructures can be complex. Many agencies lack the technical expertise required to operate advanced AI and cloud-based platforms efficiently. Integration with existing record management systems, databases, and hardware often poses compatibility issues. High initial setup costs and training requirements further limit adoption in smaller jurisdictions. Simplifying deployment and improving user training will be crucial to overcoming these operational challenges.

Regional Analysis

North America

North America held a 38% share of the digital evidence management market in 2024, driven by high adoption of body-worn cameras, surveillance systems, and advanced forensic technologies. The United States leads due to substantial government funding for law enforcement modernization and digital transformation. Agencies are increasingly investing in AI-enabled cloud platforms for efficient evidence handling and compliance with legal standards. Canada is also witnessing growth through initiatives supporting digital policing and secure data storage. The region’s mature infrastructure and strong cybersecurity frameworks continue to support sustained market expansion.

Europe

Europe accounted for a 29% share of the digital evidence management market in 2024, supported by strict data protection laws and rising use of digital forensics in criminal investigations. The United Kingdom, Germany, and France are key contributors, emphasizing secure, GDPR-compliant cloud solutions. Law enforcement agencies are adopting integrated platforms for video, audio, and document management to improve transparency and operational efficiency. Government-backed investments in smart policing technologies and cross-border data sharing initiatives are further driving adoption. The region’s growing focus on accountability and data integrity strengthens its market position.

Asia-Pacific

Asia-Pacific captured a 25% share of the digital evidence management market in 2024, fueled by rapid digitalization, growing law enforcement modernization, and increasing cybercrime cases. Countries such as China, India, and Japan are investing in advanced surveillance infrastructure and evidence analysis tools. Rising adoption of body-worn cameras and mobile-based incident recording is enhancing data collection efficiency. The growing implementation of cloud-based solutions and AI-driven evidence processing platforms supports scalability and cost efficiency. Expanding government initiatives for smart policing and judicial reforms continue to drive regional market growth.

Latin America

Latin America held a 5% share of the digital evidence management market in 2024, driven by efforts to modernize public safety and justice systems. Brazil and Mexico are leading markets, focusing on integrating digital evidence solutions for crime prevention and investigation. The rise in organized crime and cyber threats has increased demand for secure, centralized evidence platforms. Governments are collaborating with technology providers to enhance digital record-keeping and streamline case management. Although infrastructure challenges persist, growing investment in law enforcement technology is steadily expanding market adoption across the region.

Middle East and Africa

The Middle East and Africa region accounted for a 3% share of the digital evidence management market in 2024, supported by increasing digital transformation in policing and judicial sectors. The United Arab Emirates and Saudi Arabia are investing in AI-based surveillance and cloud-based evidence management systems under national smart governance initiatives. South Africa and Kenya are also adopting digital tools to enhance forensic analysis and transparency. Growing emphasis on public safety, coupled with efforts to strengthen legal infrastructure, is promoting gradual market growth despite limited technological readiness in some areas.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Deployment Mode

By End User

- Law Enforcement Agencies

- Criminal Justice Agencies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the digital evidence management market includes key players such as Guardify, Oracle Corporation, Digital Ally, Inc., IBM Corporation, Motorola Solutions, OpenText Corporation, Hitachi, Ltd., NICE Ltd., Cellebrite, and Axon Enterprise, Inc. These companies lead the market through robust product portfolios, technological innovations, and strong partnerships with law enforcement and government agencies. The competition is centered on offering cloud-based, AI-driven, and scalable evidence management solutions that ensure security, compliance, and interoperability. Major players are investing in advanced analytics, blockchain verification, and automation to enhance data integrity and streamline workflows. Strategic collaborations, mergers, and acquisitions are further strengthening their market positions. Continuous advancements in digital forensics, cybersecurity integration, and mobile evidence capture solutions are enabling these companies to expand their global footprint and cater to the increasing demand for secure, efficient, and centralized digital evidence management systems.

Key Player Analysis

- Guardify

- Oracle Corporation

- Digital Ally, Inc.

- IBM Corporation

- Motorola Solutions

- OpenText Corporation

- Hitachi, Ltd.

- NICE Ltd.

- Cellebrite

- Axon Enterprise, Inc.

Recent Developments

- In August 2025, Axon Enterprise, Inc. unveiled a redesigned Axon Evidence interface with improved search, media player, and admin experience.

- In July 2025, NICE Ltd. announced that its AI-powered platform Evidencentral now supports over 37 million active criminal cases and over 240 million evidence items.

- In 2025, Axon Enterprise, Inc. reported Q2 2025 that its Software & Services revenue rose 39% year-over-year, driven by increased adoption of premium digital evidence management solutions.

- In June 2024, Cellebrite released Digital Intelligence Platform 2024.2, enhancing mobile forensics and cloud capabilities

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with the growing adoption of cloud-based evidence management platforms.

- Integration of artificial intelligence and analytics will enhance evidence classification and case resolution speed.

- Blockchain technology will play a key role in ensuring evidence authenticity and tamper-proof storage.

- Governments will increase investments in digital policing and forensic modernization programs.

- Partnerships between technology providers and law enforcement agencies will strengthen solution reliability and reach.

- The demand for interoperable and scalable systems will rise with expanding data volumes.

- Cybersecurity and data privacy compliance will remain central to product innovation.

- Mobile-based evidence capture and real-time sharing will gain traction among field officers.

- Vendors will focus on developing cost-efficient solutions for smaller law enforcement agencies.

- Asia-Pacific will emerge as a high-growth region due to rapid digital transformation and rising adoption of smart policing technologies.