Market Overview

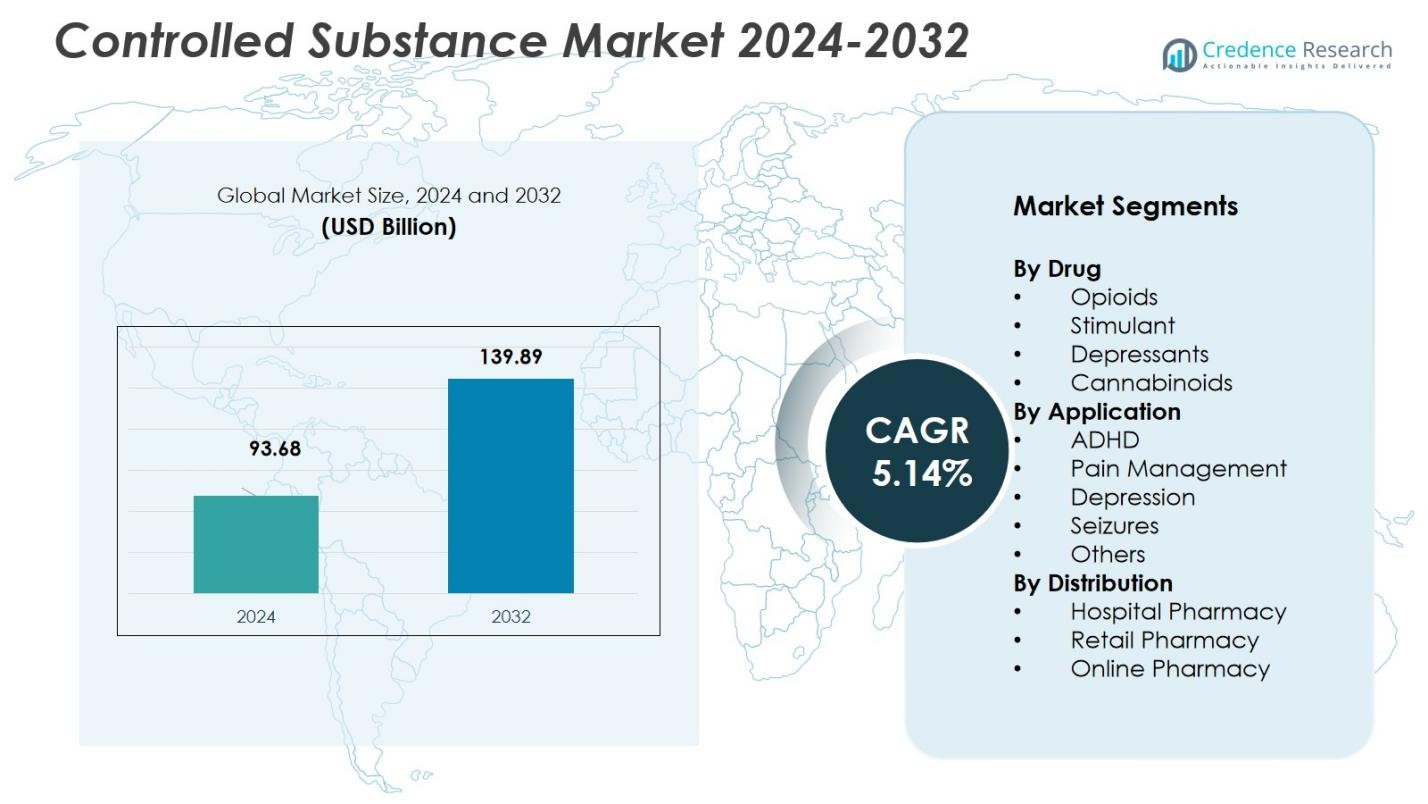

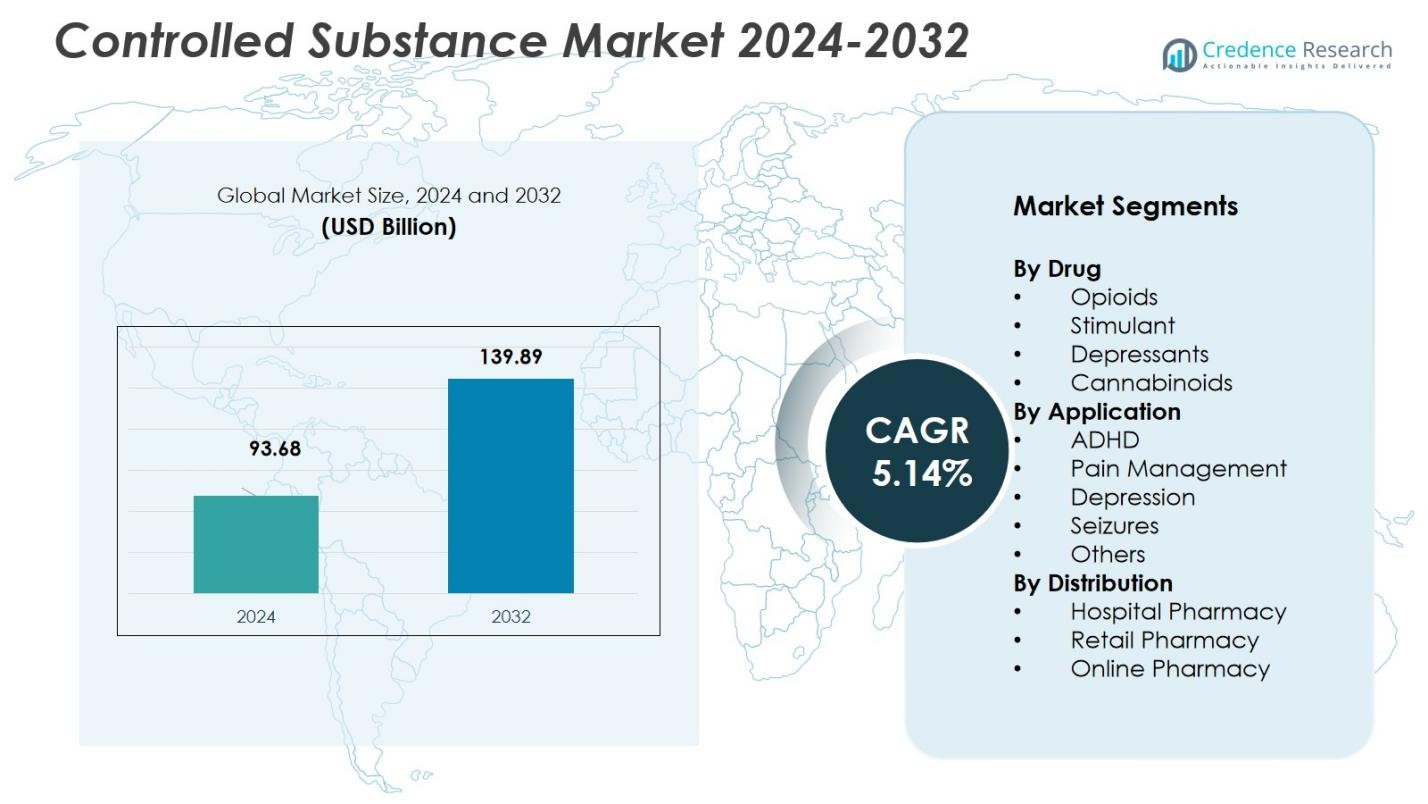

The Controlled Substance Market size was valued at USD 93.68 Billion in 2024 and is anticipated to reach USD 139.89 Billion by 2032, at a CAGR of 5.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Controlled Substance Market Size 2024 |

USD 93.68 Billion |

| Controlled Substance Market, CAGR |

5.14% |

| Controlled Substance Market Size 2032 |

USD 139.89 Billion |

The Controlled Substance Market is primarily dominated by key players such as Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, AbbVie Inc., and Novartis AG. These companies lead the market with their extensive portfolios of controlled medications, particularly in pain management and neurological treatments. Pfizer and Merck, with their focus on opioid analgesics and CNS medications, hold significant market shares, while AbbVie and Novartis contribute to the market’s expansion through their innovation in alternative pain relief and mental health solutions. North America holds the largest market share at 42.5% in 2024, driven by high demand for opioids and advanced healthcare infrastructure. Europe follows with 29.8% of the market share, supported by strong regulatory frameworks and increasing demand for pain and mental health treatments. The Asia-Pacific region, although smaller, is growing rapidly, with a market share of 15.2%, spurred by rising healthcare investments and awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Controlled Substance Market was valued at USD 93.68 Billion in 2024 and is projected to grow at a CAGR of 5.14%, reaching USD 139.89 Billion by 2032.

- Rising prevalence of chronic pain, neurological disorders and mental‑health conditions worldwide continues to drive demand, especially for opioids and CNS‑active substances, boosting overall market growth.

- Innovations in drug formulations and delivery systems including safer analgesics and extended‑release CNS drugs support increased adoption and broader therapeutic use.

- The opioid sub‑segment held 36.3% share by drug class in 2024, while Pain Management accounted for 41.8% share by application, underscoring their dominance in treatment patterns.

- North America led the regional market with 42.5% share in 2024, followed by Europe with 29.8%, and Asia‑Pacific emerging strongly, reflecting rising healthcare investment and expanding access across regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Drug

The Opioids sub-segment dominates the Controlled Substance Market under the drug-type classification, capturing 36.3% of the market share in 2024. This dominance is primarily driven by the widespread use of opioids for moderate-to-severe pain relief, particularly for chronic pain, post-operative recovery, and cancer-related pain. Despite increasing regulatory scrutiny and concerns over misuse, the persistent global burden of chronic pain and rising cancer rates continue to drive demand for opioids, solidifying their position as the largest drug sub-segment in the market.

- For instance, oxycodone, a key opioid analgesic, is expected to capture 37.5% of the opioid analgesics market by 2025, largely due to its extensive use in treating moderate to severe pain, including post-surgical and cancer-related pain.

By Application

The Pain Management sub-segment holds the largest share in the application segment, accounting for 41.8% of the market in 2024. This dominance is fueled by the increasing global prevalence of chronic pain conditions, such as back pain, arthritis, and cancer-related pain, which require effective and potent analgesics. The growing geriatric population and the rising incidence of non-communicable diseases contribute to the sustained demand for pain management therapies, particularly opioids and other controlled substances used in pain relief, reinforcing the leadership of this sub-segment.

- For instance, Mallinckrodt’s Ofirmev (IV acetaminophen) has seen increased adoption in hospitals for acute pain management, supported by documented clinical efficacy.

By Distribution

Retail Pharmacy leads the distribution channels for controlled substances, holding a market share of 47.2% in 2024. This is attributed to the accessibility, convenience, and widespread geographic presence of retail pharmacies, which are increasingly seen as primary points of access for prescription medications. Additionally, regulatory frameworks in many regions permit retail pharmacies to dispense controlled substances, coupled with growing outpatient care and patient preference for convenience, further fueling the retail pharmacy channel’s dominance in controlled substance distribution.

Key Growth Drivers

Rising Prevalence of Chronic Pain and Neurological Disorders

The increasing global incidence of chronic pain conditions (such as arthritis, cancer‑related pain, musculoskeletal disorders) and neurological disorders drives large-scale demand for controlled substances, especially analgesics and CNS‑acting drugs. The growing geriatric population and longer life expectancy exacerbate this burden, prompting more frequent long-term prescriptions. This sustained need for effective pain management and chronic disease care underpins robust growth in the controlled substance market.

- For instance, the FDA approved Journavx (suzetrigine), a novel pain medication that selectively blocks sodium channels in pain-sensing nerves, offering effectiveness comparable to Vicodin but without addiction risk.

Advancements in Pharmaceutical R&D and Drug Formulations

Ongoing innovation in pharmaceutical research has led to the development of newer, more effective, and safer formulations of controlled substances including improved opioid analgesics, extended‑release stimulants, and CNS medications. These innovations satisfy both medical demand for better efficacy and regulatory requirements for safety, thus enabling broader adoption of controlled medications for pain, neurology, and palliative care.

- For instance, Cara Therapeutics developed CR845, a peripherally restricted κ-opioid receptor agonist tetrapeptide that limits access to the central nervous system. Phase 2 trials showed it reduced postoperative pain after laparoscopic hysterectomy and bunionectomy, with good tolerability over two weeks in osteoarthritis patients.

Expansion of Healthcare Infrastructure and Rising Healthcare Expenditure

Expanding healthcare infrastructure—particularly in emerging markets—and growing investments in healthcare expenditure support greater access to controlled substances via hospitals, clinics, and pharmacies. As healthcare systems scale and invest more in chronic disease management, pain clinics, mental health services, and neurology care, demand for controlled prescriptions increases accordingly. This structural expansion underpins long-term growth of the controlled substance market.

Key Trends & Opportunities

Shift toward Wider Acceptance of Controlled Drugs for CNS & Palliative Care

There is growing acceptance globally for using controlled substances in treating neurological disorders, mental health conditions, and palliative care beyond traditional pain relief. This broader therapeutic scope opens new avenues for market expansion, especially as more regions recognize the importance of controlled medications for depression, anxiety, ADHD, and seizure management. Increased regulatory clarity and medical endorsement further support this trend.

- For instance, the Australian National Core Community Palliative Care Medicines List includes clonazepam oral drops for managing anxiety and seizures in terminal illness, highlighting its clinical usefulness and ease of administration under government subsidy programs.

Rising Adoption of Digital Prescription Monitoring and Telemedicine

The increasing use of digital prescription‑monitoring systems and telemedicine services is streamlining prescription, dispensing, and patient access to controlled substances. This reduces administrative hurdles, improves compliance, and expands reach — especially in regions with limited physical infrastructure. As telehealth adoption grows, controlled-substance distribution could become more efficient and scalable, unlocking growth potential in underpenetrated markets.

- For instance, HealthSnap offers a telemedicine-integrated platform that monitors chronic conditions via connected devices, supporting prescription adherence for controlled medications. It automates billing and EHR interoperability for over 80 systems, enabling remote oversight without additional staff.

Key Challenges

Regulatory Scrutiny, Risk of Misuse, and Social Concerns

Controlled substances remain heavily regulated due to risks of addiction, misuse, and diversion into illicit channels. Regulatory barriers tight controls on production, prescription, dispensing, and distribution can limit market growth, slow approval of new formulations, and constrain adoption, especially in markets with stringent oversight. Concerns around abuse and overdose hinder broader liberalization of access.

Competition from Alternative Therapies and Non‑Controlled Treatments

Growing interest in non-pharmacological pain management (e.g., physiotherapy, behavioral therapy, minimally invasive interventions) and non‑controlled medications reduces reliance on controlled substances. Additionally, the development of non-addictive analgesics and CNS drugs presents competition. Such alternatives may reduce long-term demand growth for traditional controlled therapies, particularly as regulatory dashboards and public health initiatives promote safer options.

Regional Analysis

North America

North America holds the largest share of the Controlled Substance Market, accounting for 42.5% in 2024. The region’s dominance is driven by the high demand for pain management therapies, particularly opioids, and the growing prevalence of neurological disorders. The United States is the major contributor, supported by advanced healthcare infrastructure and a high number of chronic pain patients. However, strict regulatory policies, particularly around opioid prescriptions, present challenges to growth. Despite these, the presence of major pharmaceutical companies and increasing investments in R&D keep North America at the forefront of the market.

Europe

Europe holds a substantial share of 29.8% of the Controlled Substance Market. The region’s growth is driven by increasing incidences of chronic pain, neurological disorders, and mental health issues, leading to a growing need for controlled substances. The regulatory environment in Europe is stringent, especially in the European Union, but supportive policies for pain management and mental health treatments ensure steady market growth. Germany, the UK, and France are key contributors in the region. Increased government spending on healthcare, especially in pain and mental health care, further strengthens Europe’s position in the global market.

Asia-Pacific

Asia-Pacific is experiencing rapid growth in the Controlled Substance Market, with a market share of 15.2% in 2024. This growth is attributed to rising healthcare expenditure, particularly in China, India, and Japan, where there is a high burden of chronic diseases, neurological disorders, and mental health conditions. The region’s growing awareness of pain management and mental health treatment is contributing to increasing adoption of controlled substances. Regulatory frameworks are evolving, and while challenges related to misuse remain, the expansion of healthcare infrastructure is fueling future market growth, making the region an attractive investment destination.

Latin America

Latin America holds a market share of 7.5% in the Controlled Substance Market. The demand for controlled substances in the region is driven by the rising prevalence of chronic pain conditions and increasing access to healthcare services. Countries like Brazil and Mexico are key contributors due to their large populations and expanding healthcare infrastructure. However, challenges related to limited healthcare access in rural areas and regulatory constraints around drug prescriptions limit growth potential. Despite these challenges, the growing adoption of pain management and mental health treatments presents opportunities for market expansion in the region.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for 5.0% of the Controlled Substance Market. The demand for controlled substances is relatively low compared to other regions, but the market is gradually expanding due to improving healthcare systems, increasing awareness of pain management, and rising incidence of chronic diseases. The UAE, Saudi Arabia, and South Africa are key markets in the region. High regulatory control, limited access to medications in some countries, and the challenges of misuse prevention remain hurdles. However, as healthcare infrastructure improves and access increases, MEA presents untapped growth potential in the coming years.

Market Segmentations:

By Drug

- Opioids

- Stimulant

- Depressants

- Cannabinoids

By Application

- ADHD

- Pain Management

- Depression

- Seizures

- Others

By Distribution

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Controlled Substance Market is highly influenced by major players such as Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, AbbVie Inc., and Novartis AG, which dominate the market through their extensive portfolios of analgesics, CNS medications, and treatment options for mental health conditions. These companies focus on innovation in drug development and improving patient access through various distribution channels. Strategic partnerships, acquisitions, and mergers play a critical role in enhancing their market presence. For example, partnerships between pharmaceutical companies and healthcare providers for pain management and mental health treatment help expand their product offerings. However, regulatory scrutiny, safety concerns, and the risk of misuse and addiction continue to challenge these players. To maintain a competitive edge, companies are investing in R&D for non-addictive controlled substances and novel drug delivery systems. The growing shift towards digital health solutions and telemedicine also provides an opportunity for companies to enhance their distribution and accessibility.

Key Player Analysis

- Pfizer Inc.

- Merck & Co., Inc.

- Novartis AG

- Purdue Pharma L.P.

- AstraZeneca

- AbbVie Inc

- F. Hoffmann-La Roche Ltd

- Johnson & Johnson

- Grünenthal

- UPM Pharmaceuticals

Recent Developments

- In May 2025, Senores Pharmaceuticals acquired the USFDA‑approved ANDA for Tramadol Tablets from APDM Pharmaceuticals, gaining rights to produce a controlled‑substance opioid analgesic for severe pain management.

- In January 2025, Vertex Pharmaceuticals secured FDA approval for JOURNAVX (active ingredient: suzetrigine), the first non‑opioid acute‑pain medication approved in decades, offering a potential alternative to traditional opioids for moderate‑to‑severe pain.

- In March 2025, Protega Pharmaceuticals partnered with Wellgistics Health to expand access to ROXYBOND (oxycodone), an FDA‑approved Schedule II opioid, aiming to improve distribution while promoting abuse‑deterrent usage guidelines.

- In August 2025, Supernus Pharmaceuticals announced a tender offer to acquire Sage Therapeutics, a move expected to strengthen its CNS‑drug portfolio and broader presence in medications affecting controlled substance demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug, Application, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for controlled substances will continue to rise due to the increasing prevalence of chronic pain, neurological disorders, and mental health conditions.

- Innovations in drug formulations and drug delivery systems will drive market growth, with a focus on reducing addiction risks and improving efficacy.

- Regulatory pressures will intensify, leading to stricter controls on the production and distribution of controlled substances, particularly opioids.

- The adoption of digital health solutions, including telemedicine and e-prescriptions, will enhance the accessibility and distribution of controlled medications.

- The shift toward non-addictive alternatives and the development of safer controlled substances will create new market opportunities.

- The growing geriatric population will further fuel demand for pain management and neurological treatments.

- Increased healthcare expenditure in emerging markets will expand access to controlled substances and drive regional market growth.

- Personalized medicine approaches will become more prevalent, offering tailored treatment options for patients requiring controlled substances.

- Pharmaceutical companies will continue to invest heavily in R&D to develop breakthrough therapies in the controlled substance space.

- The market will face challenges related to misuse, necessitating advancements in monitoring systems and responsible prescribing practices.

Market Segmentation Analysis:

Market Segmentation Analysis: