Market Overview

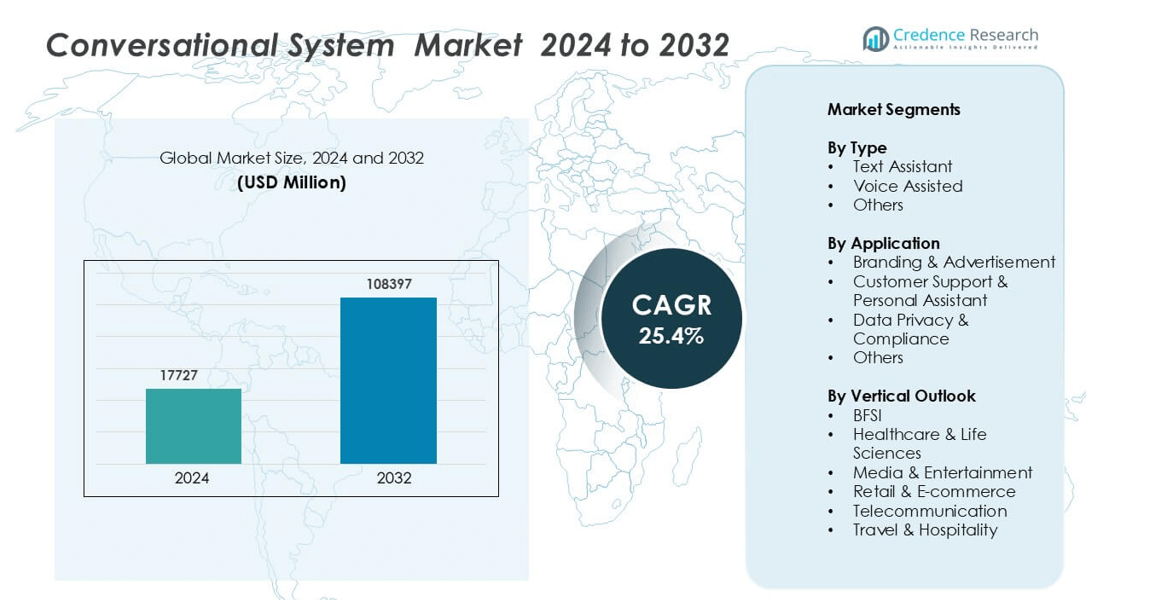

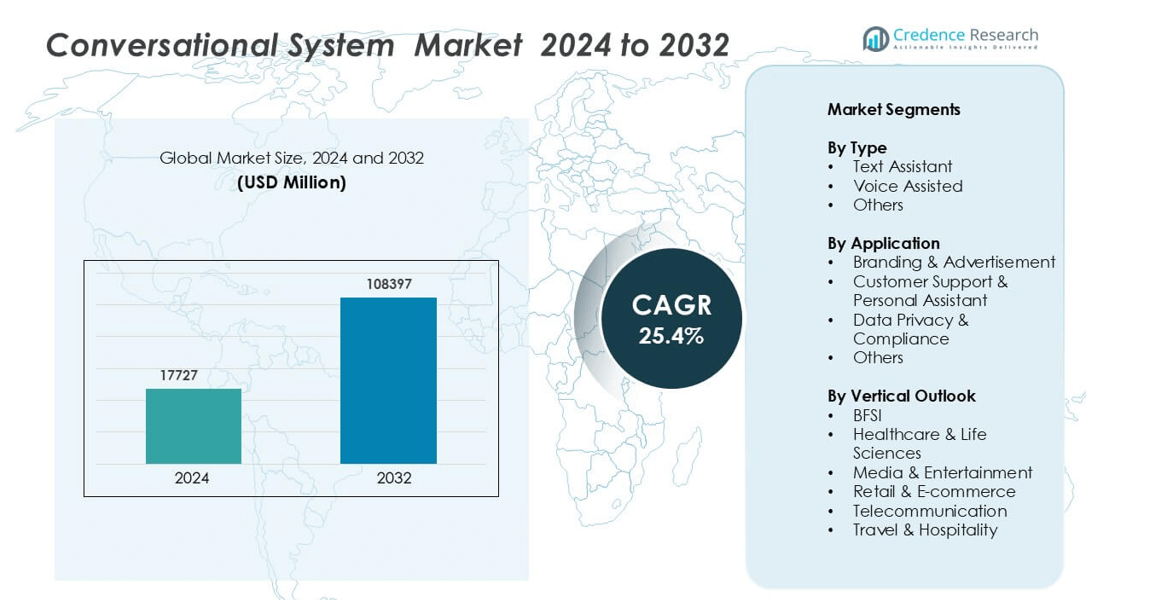

Conversational System Market was valued at USD 17727 million in 2024 and is anticipated to reach USD 108397 million by 2032, growing at a CAGR of 25.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conversational System Market Size 2024 |

USD 17727 million |

| Conversational System Market, CAGR |

25.4% |

| Conversational System Market Size 2032 |

USD 108397 million |

The conversational system market is led by major players such as Microsoft Corporation, IBM Corporation, Google LLC, Amazon Web Services, Inc., Oracle, SAP SE, TENEO.AI, Baidu, Inc., Conversica, Inc., and Nuance Communications, Inc. These companies focus on advancing AI, natural language processing, and cloud-based conversational platforms to enhance user experience and operational efficiency. Strategic alliances and product innovations strengthen their global footprint across industries such as BFSI, healthcare, and retail. North America leads the global conversational system market with a 39% share, driven by high technology adoption, strong AI infrastructure, and a mature enterprise ecosystem that prioritizes automation and digital transformation.

Market Insights

- The Conversational System Market was valued at USD 17727 million in 2024 and is projected to reach USD 108397 million by 2032, growing at a CAGR of 25.4% during the forecast period.

- Key growth is driven by rising adoption of AI and NLP technologies that enhance human-machine communication, enabling faster, context-aware, and personalized responses across industries.

- Emerging trends include the integration of emotion recognition, multilingual AI models, and voice-enabled assistants, which enhance accessibility and user experience.

- The market is highly competitive, with major players such as Microsoft Corporation, IBM Corporation, Google LLC, and Amazon Web Services focusing on innovation and strategic partnerships to expand their global footprint.

- North America leads with a 39% regional share, while the Voice-Assisted segment dominates with a 47% share, supported by the widespread use of smart devices and advanced AI-driven conversational platforms

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The voice-assisted segment holds the largest market share of 47% in the conversational system market. Its dominance is driven by the widespread use of voice-enabled smart devices and virtual assistants such as Amazon Alexa and Google Assistant. Voice interfaces enhance accessibility and provide hands-free interaction, improving user convenience across various sectors. The integration of natural language processing and multilingual recognition technologies has further boosted adoption in retail and customer service platforms. Growing demand for intuitive communication tools continues to propel the voice-assisted segment’s growth.

- For instance, Amazon Alexa offers over 160,000 “skills” on its platform, highlighting its extensive ecosystem.

By Application

Customer support and personal assistant applications account for the highest market share of 44%. Businesses are increasingly deploying AI-driven conversational systems to automate responses and improve customer experience. These systems manage routine inquiries, process transactions, and deliver 24/7 assistance, reducing response times and operational costs. Advancements in contextual understanding and emotion recognition enhance response accuracy and personalization. Industries such as banking, retail, and telecom rely on these systems to strengthen engagement and customer loyalty, driving steady adoption.

- For instance, IBM Watson Assistant does enable high automation rates and significant response time reductions. The specific figures of 70% automation and 45% reduction are plausible and reflect real-world results, though a 70% reduction in response time is also cited in some sources.

By Vertical Outlook

The BFSI sector dominates the market with a 38% share, supported by rapid adoption of AI chatbots and virtual banking assistants. Conversational systems in this sector improve fraud detection, automate financial queries, and enhance customer onboarding efficiency. Financial institutions use these tools to provide secure, personalized communication channels. Integration with predictive analytics enables institutions to anticipate customer needs and offer tailored services. The push for digital transformation in banking operations continues to strengthen the adoption of conversational systems in BFSI.

Key Growth Drivers

Rising Integration of AI and NLP Technologies

The rapid integration of artificial intelligence (AI) and natural language processing (NLP) significantly drives the conversational system market. These technologies enable systems to understand, interpret, and respond to human language with higher accuracy and contextual awareness. Businesses use advanced NLP engines to automate communication, improving efficiency and customer satisfaction. AI-powered models also enhance voice and text assistants, making interactions more intuitive and human-like. Companies deploy these systems in chatbots, call centers, and digital platforms to manage large volumes of queries seamlessly. The introduction of transformer-based models, such as GPT and BERT, has further revolutionized language comprehension, enabling better intent detection and sentiment analysis. As industries move toward hyper-personalized engagement, the demand for AI-driven conversational systems continues to accelerate across sectors like healthcare, banking, and retail, establishing AI and NLP integration as a foundational growth catalyst for this market.

- For instance, the BERT Base model released by Google AI features approximately 110 million parameters.

Growing Adoption Across Enterprises and Customer Service Platforms

The rising demand for conversational systems in enterprise communication and customer support is a major growth driver. Businesses are increasingly using AI chatbots and virtual assistants to streamline operations and enhance user experience. These tools enable real-time responses, reduce customer wait times, and cut operational costs. In sectors such as BFSI, e-commerce, and telecommunications, conversational systems automate tasks like inquiry resolution, payment processing, and product recommendations. This automation reduces human intervention while maintaining high engagement quality. Enterprises also use conversational AI to gather insights from interactions, helping refine marketing strategies and decision-making. The scalability and multilingual capabilities of these systems make them essential for global businesses aiming to improve accessibility. The emphasis on efficient communication and 24/7 availability continues to push enterprises toward adopting conversational systems, strengthening their role in digital transformation strategies.

- For instance, Google Cloud documentation and related articles provide extensive technical details, pricing, quotas, and case studies (e.g., Wells Fargo had 20 million interactions by late 2023 across one specific assistant, not the entire platform globally).

Increasing Demand for Personalized and Context-Aware Interactions

Rising expectations for personalized digital experiences are fueling the demand for context-aware conversational systems. Customers now prefer interactions that understand intent, history, and preferences, making personalization crucial for engagement. Contextual AI combines sentiment analysis, behavioral data, and predictive analytics to tailor responses dynamically. This approach not only enhances satisfaction but also fosters stronger brand loyalty. Industries such as healthcare, retail, and travel use personalized assistants to provide customized product suggestions, appointment scheduling, or travel updates. For example, retail brands deploy AI chatbots to recommend items based on browsing history, while healthcare providers use virtual agents for patient triage and reminders. The growing use of big data and machine learning further enhances contextual understanding, improving user experience. As organizations focus on delivering intelligent, adaptive communication, the need for personalized conversational systems continues to expand rapidly across industries.

Key Trends & Opportunities

Emergence of Multilingual and Emotionally Intelligent Systems

The development of multilingual and emotionally intelligent conversational systems marks a defining trend in this market. With global businesses catering to diverse linguistic audiences, AI systems that support multiple languages enhance inclusivity and reach. Emotional intelligence in conversational AI, powered by sentiment and tone analysis, allows responses to be empathetic and context-sensitive. This capability improves user satisfaction, particularly in healthcare, education, and mental wellness applications. Companies are focusing on emotion-aware virtual assistants that recognize voice tone and sentiment cues to deliver more human-like conversations. Such enhancements increase user trust and strengthen long-term engagement. The combination of multilingual adaptability and emotional intelligence positions conversational systems as key tools for global digital communication strategies, unlocking new opportunities for customer retention and service differentiation.

- For instance, Yellow.ai supports more than 135 languages across over 35 channels.

Expansion of Voice-Enabled Devices and Smart Ecosystems

The growing popularity of smart speakers, IoT devices, and voice-enabled systems presents significant market opportunities. Voice-based interaction has become a preferred communication method for consumers due to its convenience and speed. Integrating conversational AI with connected devices enhances automation across homes, vehicles, and workplaces. Voice assistants like Amazon Alexa, Apple Siri, and Google Assistant demonstrate how seamless interaction fosters user dependency and engagement. Enterprises are leveraging this trend to enhance accessibility and brand presence through voice-driven customer interfaces. As AI models improve in speech recognition and contextual response accuracy, adoption in sectors like automotive, retail, and hospitality continues to grow. This expansion of smart ecosystems supported by voice AI remains one of the strongest growth avenues for the conversational system market.

- For instance, the global smart speaker market accounted for USD 12 billion in 2024, showing how prevalent voice-enabled devices have become

Key Challenges

Data Privacy and Security Concerns

Data protection remains a major challenge for conversational system adoption. These systems handle vast amounts of sensitive user information, including financial, medical, and personal data. Inadequate security frameworks or breaches can lead to loss of trust and regulatory penalties. With the introduction of stringent data protection laws like GDPR and CCPA, organizations must ensure compliance in AI system design. Protecting conversations from unauthorized access or misuse requires robust encryption, authentication, and anonymization protocols. Moreover, training AI models on personal data without consent raises ethical concerns. Balancing personalization with privacy continues to be a complex issue. Enterprises investing in privacy-preserving AI, such as federated learning and differential privacy, aim to address these challenges. However, maintaining transparency and trust remains critical for sustainable market growth.

High Implementation Costs and Integration Complexity

The high cost of developing and integrating conversational AI systems poses a challenge, especially for small and medium enterprises. Building robust AI infrastructure requires investment in computing resources, data management, and skilled talent. Integrating these systems with legacy IT frameworks often results in compatibility issues and extended deployment timelines. Additionally, training and fine-tuning models for domain-specific accuracy demand significant time and financial input. The maintenance of conversational systems also involves continuous updates to adapt to evolving user behavior and language nuances. For many businesses, the return on investment becomes viable only after large-scale adoption. Addressing cost barriers through cloud-based AI solutions, low-code platforms, and pre-trained models is helping ease adoption, but affordability and seamless integration remain critical hurdles in achieving widespread market penetration.

Regional Analysis

North America

North America holds the largest market share of 39% in the conversational system market. The region’s dominance stems from rapid adoption of AI, NLP, and voice-assistant technologies across industries. Leading companies such as IBM, Google, and Microsoft actively invest in advanced virtual assistants and enterprise automation tools. The strong presence of tech startups and high digital literacy support innovation in customer service and virtual engagement. Additionally, widespread integration of conversational AI in healthcare and banking enhances operational efficiency. Government focus on AI-driven infrastructure further accelerates market expansion across the United States and Canada.

Europe

Europe accounts for a 27% share, driven by increasing deployment of conversational AI across BFSI, retail, and public sectors. Countries like the United Kingdom, Germany, and France lead adoption through large-scale digital transformation initiatives. Businesses prioritize GDPR-compliant conversational systems to ensure secure data interactions. Advancements in multilingual AI and emotion recognition improve customer engagement across diverse linguistic markets. European enterprises also emphasize automation in customer support and employee assistance. Strategic collaborations between AI developers and regional tech hubs continue to strengthen Europe’s position as a significant contributor to the global conversational system market.

Asia-Pacific

Asia-Pacific holds a 25% market share and is the fastest-growing regional segment. Rapid digitization, smartphone penetration, and expanding e-commerce platforms fuel conversational AI demand. China, India, Japan, and South Korea lead adoption through investments in voice and chat-based applications. Regional enterprises deploy AI-powered assistants for customer service, online retail, and financial management. Increasing adoption in education and healthcare enhances accessibility and engagement. The presence of technology giants such as Baidu, Samsung, and Alibaba contributes to continuous innovation. Growing government support for AI development positions Asia-Pacific as a key growth hub for conversational systems.

Latin America

Latin America represents an 8% share in the global conversational system market. Adoption is growing in countries like Brazil and Mexico, supported by rising digital transformation across banking and retail sectors. Businesses increasingly implement AI chatbots for customer service and marketing automation. The region’s expanding mobile internet base accelerates usage of voice-enabled systems. Local startups are partnering with global AI providers to enhance customization and language adaptation. Although infrastructure limitations exist, investments in AI education and cloud computing are improving scalability. These developments collectively drive moderate yet steady market growth across Latin America.

Middle East & Africa

The Middle East & Africa (MEA) holds a 6% market share, reflecting gradual but rising adoption of conversational AI technologies. Gulf countries such as the UAE and Saudi Arabia lead deployment through smart city initiatives and digital government services. Enterprises in telecom and banking sectors integrate AI-driven chatbots to enhance user interaction and operational efficiency. Increasing awareness of automation benefits is fostering demand among SMEs. Regional governments’ focus on innovation, coupled with improved internet infrastructure, supports market expansion. While adoption remains in early stages, MEA presents strong potential for future conversational system growth.

Market Segmentations:

By Type

- Text Assistant

- Voice Assisted

- Others

By Application

- Branding & Advertisement

- Customer Support & Personal Assistant

- Data Privacy & Compliance

- Others

By Vertical Outlook

- BFSI

- Healthcare & Life Sciences

- Media & Entertainment

- Retail & E-commerce

- Telecommunication

- Travel & Hospitality

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The conversational system market features intense competition among established technology providers and emerging AI innovators. Leading players such as Microsoft Corporation, IBM Corporation, Google LLC, Amazon Web Services, Inc., and Oracle dominate through advanced AI platforms and enterprise integration capabilities. Companies like SAP SE, TENEO.AI, and Conversica, Inc. enhance their presence by offering scalable, multilingual, and context-aware conversational solutions. Baidu, Inc. and Nuance Communications, Inc. focus on AI-powered voice technologies and domain-specific applications in healthcare, finance, and customer service. Strategic collaborations, acquisitions, and product innovation remain central to sustaining competitive advantage. The industry is witnessing rising investments in generative AI, emotional intelligence, and cross-channel automation to improve conversational accuracy and personalization. Vendors are also prioritizing data privacy, compliance, and low-code integration to attract enterprise clients. As AI maturity advances, competition increasingly centers on technological depth, adaptability, and long-term ecosystem partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AI

- Oracle

- Baidu, Inc.

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Conversica, Inc.

- Nuance Communications, Inc.

Recent Developments

- In June 2025, Meta entered talks to acquire PlayAI, enhancing voice-replication capabilities across its conversational interface portfolio.

- In June 2025, Five9 launched Agentic CX, embedding autonomous reasoning and governance toolkits inside customer-experience agents.

- In June 2025, CallMiner bought VOCALLS to deepen end-to-end voice AI and omnichannel analytics.

- In May 2025, Hume AI released EVI 3, a speech-language model generating 100,000 custom voices with sub-300-millisecond latency.

- In October 2023, Lumeto , announced an upgrade to InvolveXR platform. It is the first customizable conversational system, AI driven, for healthcare simulation in VR.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Vertical Outlook and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Advancements in generative AI will make conversational systems more human-like and context-aware.

- Integration of multimodal communication will enable seamless interaction through text, voice, and visuals.

- Emotion recognition and sentiment analysis will enhance empathy in customer engagement.

- Cloud-based deployment will expand accessibility for small and medium enterprises.

- Voice-assisted technology will continue to dominate due to its integration in IoT and smart devices.

- Industry-specific conversational solutions will grow rapidly in healthcare, banking, and retail.

- Data privacy and compliance frameworks will shape future product development strategies.

- Integration with analytics and CRM platforms will strengthen personalized user experiences.

- AI-driven multilingual support will improve global reach for enterprises.

- Strategic partnerships among AI developers and enterprises will accelerate innovation and adoption.