Market Overview:

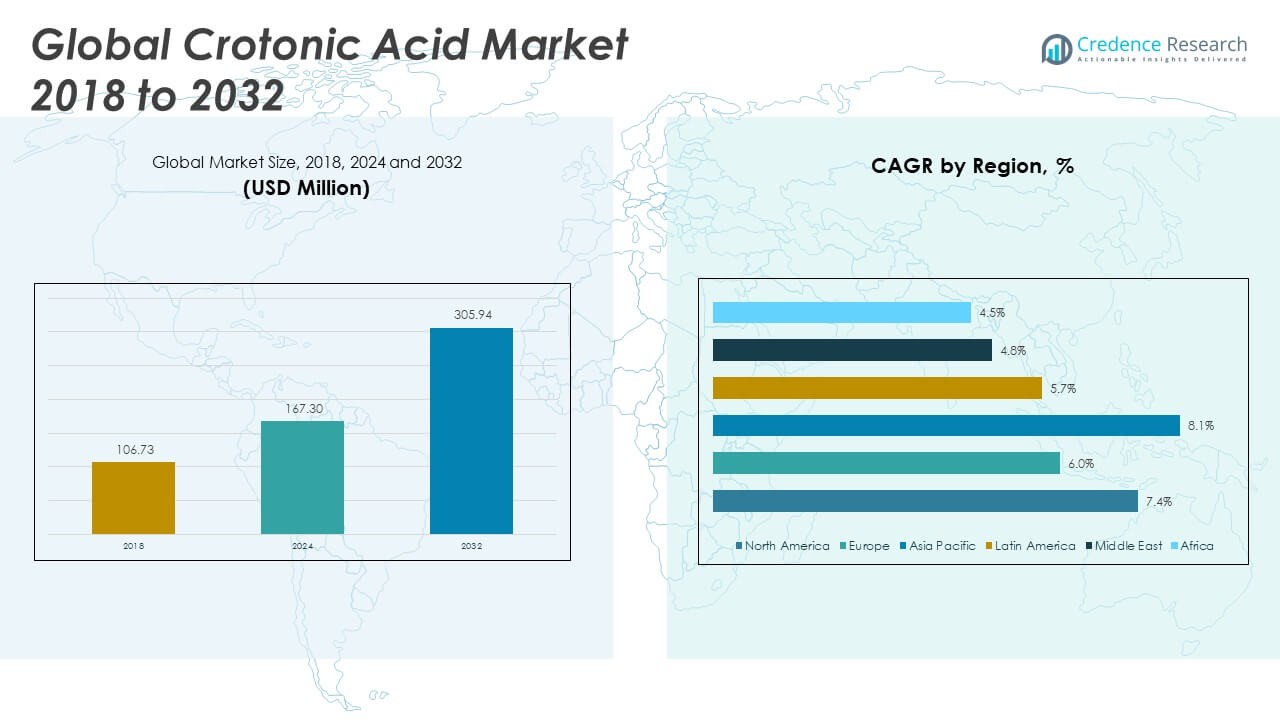

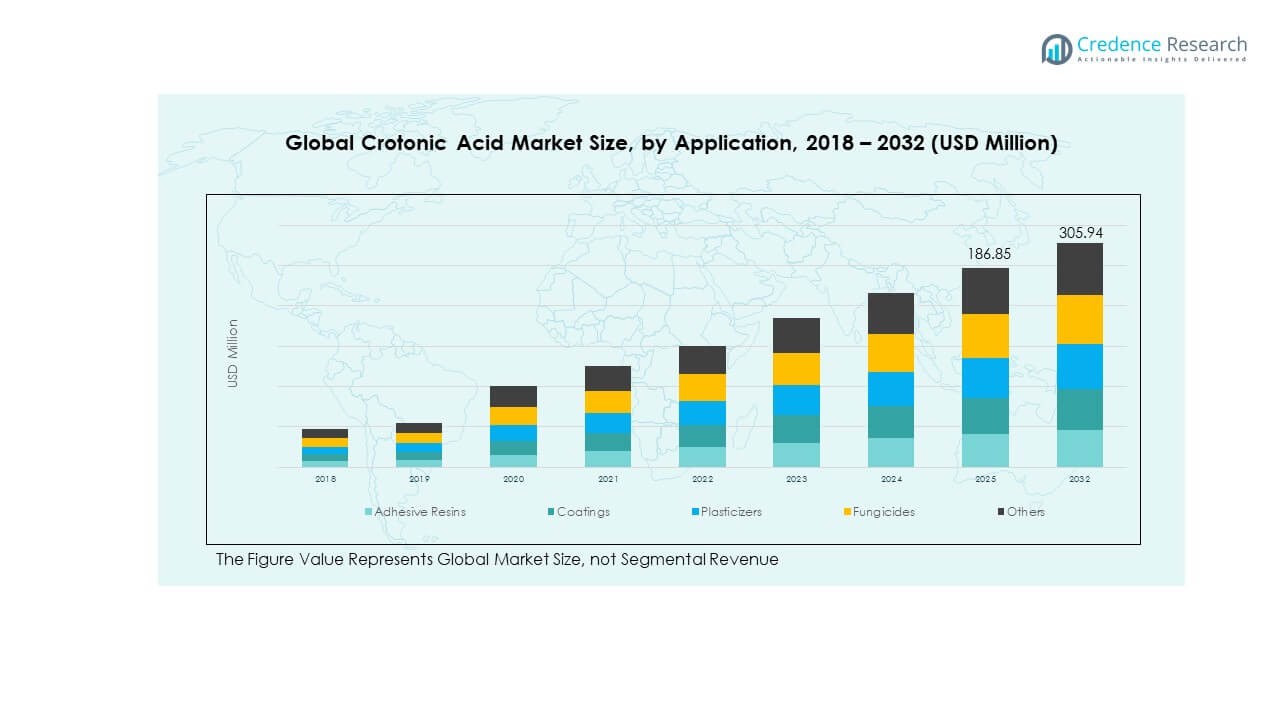

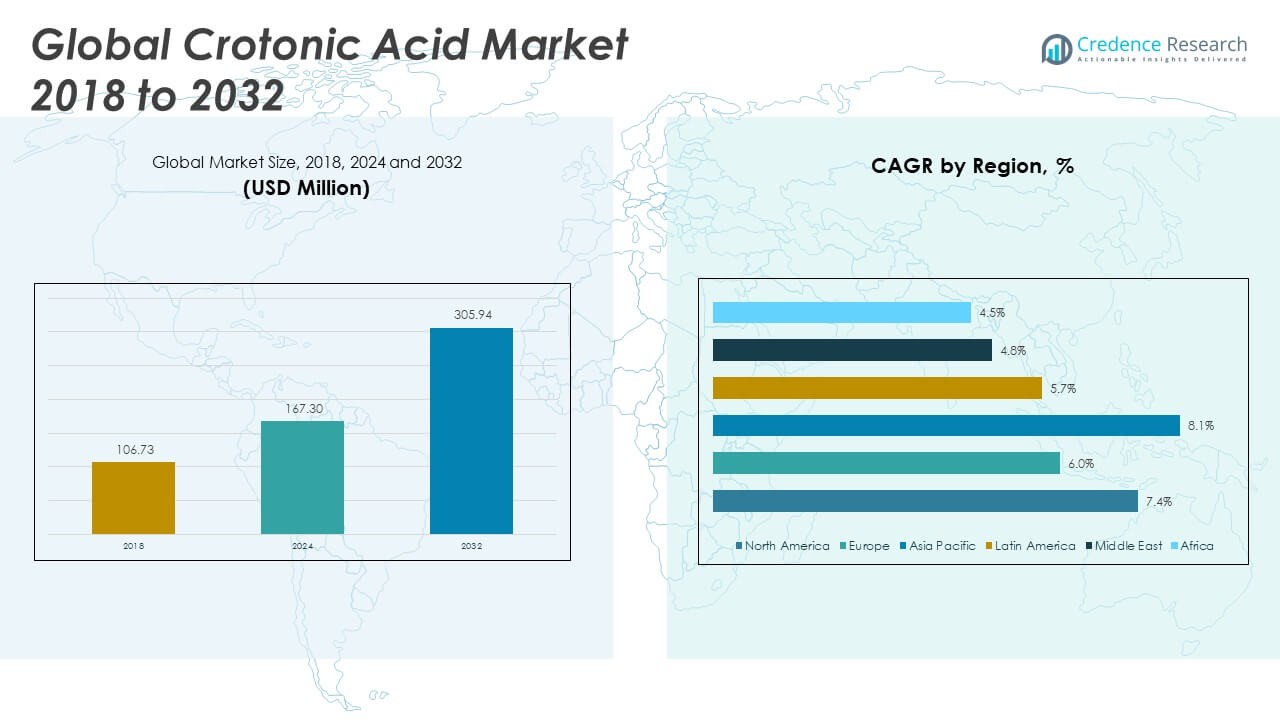

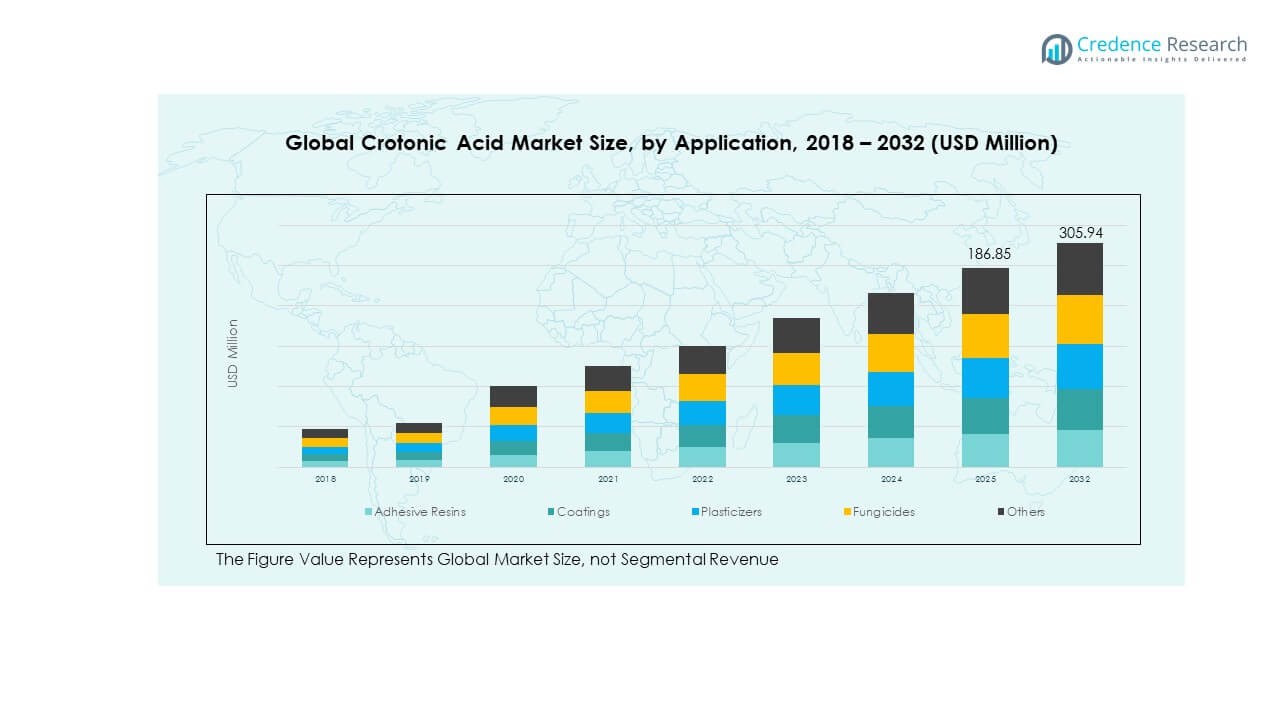

The Global Crotonic Acid Market size was valued at USD 106.73 million in 2018 to USD 167.30 million in 2024 and is anticipated to reach USD 305.94 million by 2032, at a CAGR of 7.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crotonic Acid Market Size 2024 |

USD 167.30 Million |

| Crotonic Acid Market, CAGR |

7.30% |

| Crotonic Acid Market Size 2032 |

USD 305.94 Million |

The market is witnessing strong momentum due to its expanding applications in adhesives, coatings, and resins, where it enhances performance and durability. Rising demand for specialty polymers and copolymers is further boosting adoption. It benefits from increasing usage in hot-melt adhesives, paints, and varnishes across construction and automotive industries. Moreover, its role as a chemical intermediate in manufacturing plasticizers, fungicides, and other specialty chemicals strengthens market demand.

Regionally, North America and Europe lead the market due to established chemical industries, advanced manufacturing capabilities, and consistent demand for adhesives and coatings. Asia-Pacific is emerging as a high-growth region, supported by expanding construction, automotive, and packaging sectors in China and India. Latin America shows steady uptake, driven by industrial growth, while the Middle East and Africa are gradually adopting crotonic acid applications in construction and chemicals. This geographic spread highlights the market’s global penetration with clear regional growth dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Crotonic Acid Market was valued at USD 106.73 million in 2018, reached USD 167.30 million in 2024, and is projected to hit USD 305.94 million by 2032, registering a CAGR of 7.30% during the forecast period.

- Asia Pacific commanded the largest regional share of 46.2% in 2024, followed by North America at 27.3% and Europe at 17.4%, reflecting their strong industrial bases and diversified end-use demand.

- Asia Pacific remains the fastest-growing region, supported by rapid industrialization, strong packaging and automotive demand, and expanding pharmaceutical industries in China and India, reinforcing its global dominance.

- Adhesive resins represented the largest segment in 2024, accounting for 35% of the Global Crotonic Acid Market, driven by high usage in packaging, construction, and automotive sectors.

- Coatings contributed 28% share in 2024, reflecting steady demand across construction, automotive finishing, and industrial protective applications.

Market Drivers

Expanding Demand from Adhesives and Coatings Sector

The Global Crotonic Acid Market gains momentum from its growing use in adhesives, sealants, and coatings, where it improves bonding strength and enhances durability. It serves as a critical ingredient in hot-melt adhesives that are widely applied in packaging, construction, and automotive industries. Manufacturers value its reactivity in polymer formulations, enabling high-performance products. The rising demand for water-resistant and heat-resistant coatings also strengthens its role. It supports the development of specialty coatings for industrial and consumer applications. End-users increasingly favor crotonic acid due to its ability to improve adhesion on varied surfaces. It directly influences product life cycle performance in diverse sectors. Its application in paints and varnishes reinforces its position in construction and protective finishes.

- For example, A U.S. patent (US2855374A), assigned to Rohm & Haas Company, demonstrates that incorporating 3% crotonic acid into polyvinyl acetate emulsions increased joint rupture force to 1.3 kg/cm², producing a glassy, elastic, and strongly adherent adhesive film.

Rising Usage in Polymer and Copolymer Manufacturing

The Global Crotonic Acid Market is strongly supported by its role in polymer and copolymer production, where it enhances strength, flexibility, and chemical resistance. It finds use in specialty polymers required for advanced packaging and engineering plastics. The automotive industry benefits from these polymers in lightweight, durable materials. Demand for efficient plastics with thermal and mechanical stability supports this growth. It also enables new grades of copolymers designed for targeted industrial applications. Chemical firms expand capacity to meet the growing polymer industry demand. Its utility extends to the synthesis of specialty intermediates, further diversifying its market scope. Continuous advancements in material science amplify the adoption of crotonic acid in polymer chemistry.

Growing Role in Chemical Intermediates and Industrial Applications

The Global Crotonic Acid Market expands with its application as a chemical intermediate for plasticizers, fungicides, and specialty chemicals. It enables efficient production routes for downstream derivatives with high market demand. Agrochemical producers utilize it in fungicide manufacturing to address crop protection needs. It also supports industrial processes where reactive intermediates are essential. Rising need for intermediates in pharmaceuticals and specialty polymers adds to its significance. It strengthens industrial efficiency by facilitating versatile reactions. Demand in diversified chemical applications drives its consistent adoption. Its presence in multiple industrial value chains reinforces its importance in the global chemical economy.

- For example, Poly(vinyl acetate-co-crotonic acid) copolymers are documented in U.S. Patent US2855374A and related filings, where crotonic acid functions as a comonomer with vinyl acetate to enhance flexibility, water resistance, and adhesion. These copolymers are applied in protective coatings, adhesives, and varnishes, demonstrating the industrial significance of crotonic acid.

Increasing Construction and Automotive Sector Utilization

The Global Crotonic Acid Market benefits from the expanding construction and automotive sectors, where adhesives, coatings, and resins play a central role. It helps enhance product reliability in construction materials, ensuring long-lasting performance. Automotive producers employ it in advanced coatings and specialty resins to achieve superior finishes and protective layers. Growing demand for vehicles with high-quality surface durability drives adoption. Construction activities in emerging economies strengthen consumption patterns. It contributes to energy-efficient building designs through its role in protective coatings. Manufacturers focus on its capacity to deliver performance under challenging environmental conditions. Its broad compatibility with existing formulations makes it an attractive solution in both industries.

Market Trends

Rising Focus on Bio-Based and Sustainable Alternatives

The Global Crotonic Acid Market reflects a strong trend toward bio-based and renewable alternatives, aligning with global sustainability goals. Producers invest in developing green synthesis routes to reduce dependency on petrochemical sources. The transition to eco-friendly solutions enhances the market’s attractiveness among environmentally conscious buyers. It positions crotonic acid as part of circular economy initiatives. Industries highlight its potential role in biodegradable polymer development. Sustainability-driven policies across regions further push companies toward cleaner production methods. Its integration into eco-friendly formulations supports long-term market stability. The trend underscores an industry-wide shift toward responsible chemical sourcing.

- For example, researchers developed a method to upcycle wastewater treatment sludge into bio-based crotonic acid, which replaced fossil-derived crotonic acid in copolymer formulations. This route cut the carbon footprint from 13.9 kg CO₂ to 7.75 kg CO₂ per kg of crotonic acid, while matching thermal and compositional performance.

Integration with Advanced Manufacturing Technologies

The Global Crotonic Acid Market experiences growth from integration with advanced manufacturing technologies, including automation and digital monitoring systems. Producers adopt modern process controls to ensure consistency and efficiency in crotonic acid output. It benefits from innovations that reduce production costs and environmental footprints. Continuous improvement in synthesis processes enhances purity and quality standards. Digitalization of supply chains increases transparency and responsiveness. Manufacturers align production with global regulatory frameworks through precision-based technologies. Automation also facilitates large-scale output with reduced resource consumption. The trend highlights technology’s influence on competitiveness within the market.

- For example, a study demonstrated an eco-friendly thermolytic distillation process converting PHB into bio-based crotonic acid with yields up to 92%, laying the groundwork for a drop-in renewable production route

Expansion into Specialty Coatings and High-Value Applications

The Global Crotonic Acid Market shows a trend of expansion into specialty coatings and high-value industrial uses, driven by end-user demand for tailored solutions. It finds growing relevance in niche protective coatings for aerospace, marine, and defense sectors. Such coatings provide long-term durability and chemical resistance. End-users prioritize crotonic acid-based formulations for advanced performance. Manufacturers explore customized solutions to cater to diverse industrial needs. This trend enhances the value proposition of crotonic acid beyond conventional applications. New formulations strengthen its role in protective industries. Its adoption in high-value applications supports diversification of revenue streams.

Rising Globalization of Supply Chains and Market Reach

The Global Crotonic Acid Market continues to benefit from globalization of supply chains and international trade networks. Producers expand their geographic presence to capture growing demand in emerging economies. It creates opportunities for regional players to partner with multinational firms. Global distribution channels improve accessibility of crotonic acid in developing regions. Companies emphasize localized supply models to reduce logistical complexities. The trend supports competitive pricing strategies and supply security. Multinational expansion enhances regional penetration and customer outreach. Its broader availability across continents strengthens its global footprint. The trend underscores how market expansion strategies reshape competitive landscapes.

Market Challenges Analysis

Price Volatility and Raw Material Supply Constraints

The Global Crotonic Acid Market faces challenges linked to raw material price fluctuations and supply uncertainties. Feedstock availability impacts production stability and cost structures. Producers must manage risks associated with volatile petrochemical supply chains. Rising costs of inputs reduce profit margins for manufacturers. It creates barriers for smaller companies seeking market entry. Supply chain disruptions from geopolitical tensions and trade restrictions add further complexity. These dynamics limit the capacity of producers to maintain consistent output. Long-term dependence on fluctuating resources poses sustainability challenges for the industry.

Regulatory Compliance and Environmental Considerations

The Global Crotonic Acid Market encounters significant pressure from stringent environmental regulations and compliance requirements. Governments enforce tighter rules regarding emissions and chemical safety. Producers must invest heavily in cleaner production technologies to meet these standards. It raises operational costs and affects pricing strategies. Failure to comply risks legal actions and market restrictions. Complex international regulations create challenges for exporters and global suppliers. Environmental concerns regarding petrochemical-based production intensify scrutiny. Manufacturers are compelled to adopt sustainable practices, which require substantial capital investment. Compliance obligations reshape the strategic priorities of industry players.

Market Opportunities

Emerging Applications in High-Performance Materials

The Global Crotonic Acid Market offers opportunities through its adoption in high-performance materials, especially in specialty polymers and coatings. It supports advanced material development for automotive, construction, and aerospace sectors. Producers explore innovative applications in lightweight polymers and energy-efficient coatings. It strengthens the material science industry by enabling versatile solutions. Growing interest in next-generation polymers provides fertile ground for expansion. Specialty applications enhance product differentiation and profitability. Market players can capitalize on innovation-driven opportunities.

Growing Potential in Asia-Pacific and Emerging Economies

The Global Crotonic Acid Market finds growth prospects in Asia-Pacific and other emerging economies with rapid industrialization. Expanding construction, automotive, and packaging industries in China and India create strong demand. It benefits from supportive government policies encouraging chemical sector growth. Local players gain opportunities to partner with international firms. Emerging economies focus on infrastructure and industrial investments, expanding consumption patterns. The rising presence of manufacturing hubs enhances regional adoption. It opens pathways for long-term market penetration.

Market Segmentation Analysis:

The Global Crotonic Acid Market is segmented

By application

Into adhesive resins, coatings, plasticizers, fungicides, and others. Adhesive resins represent a significant share, driven by strong demand in packaging, construction, and automotive industries, where it improves bonding strength and durability. Coatings emerge as another important segment, supported by requirements for heat resistance, chemical stability, and protective finishes across industrial and consumer products. Plasticizers create consistent demand, particularly in flexible polymer and resin production. Fungicides add agricultural relevance, with crotonic acid serving as a vital chemical intermediate in crop protection. The “others” category includes specialty chemicals and intermediates, reflecting its diverse utility in industrial processes.

- For example, WeylChem International lists crotonic acid as part of its fine chemicals portfolio, supplying it for use in adhesives, coatings, and resin formulations in industrial applications.

By end-use industry

The Global Crotonic Acid Market includes paint and coatings, pharmaceutical, chemical, and others. Paint and coatings hold a leading share due to rising construction activities and automotive finishing needs across developed and emerging economies. The pharmaceutical sector shows steady adoption, where crotonic acid supports synthesis of intermediates and active ingredients. Chemical industries utilize it in specialty polymers, resins, and downstream derivatives, ensuring consistent demand. The “others” segment reflects usage in niche industries exploring new performance materials and customized formulations. It demonstrates broad cross-industry relevance, with demand patterns shaped by industrialization, technological advancements, and material innovation across global markets.

- For example, Tianjin Jinhui Fine Chemical Co., Ltd. includes crotonic acid in its product portfolio as an intermediate for pharmaceuticals, agrochemicals, and resin applications, positioning it as a versatile raw material for chemical synthesis.

Segmentation:

By Application

- Adhesive Resins

- Coatings

- Plasticizers

- Fungicides

- Others

By End-Use Industry

- Paint & Coatings

- Pharmaceutical

- Chemical

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Crotonic Acid Market size was valued at USD 29.71 million in 2018 to USD 45.81 million in 2024 and is anticipated to reach USD 84.14 million by 2032, at a CAGR of 7.4% during the forecast period. It accounts for 27.3% of the global market share in 2024, supported by well-established chemical industries and robust adoption across adhesives, coatings, and resins. The U.S. leads demand, driven by advancements in automotive and construction sectors where crotonic acid finds consistent application. Canada and Mexico contribute to regional growth through packaging and manufacturing expansions. Regulatory frameworks promote innovation in eco-friendly coatings and resins, enhancing demand for crotonic acid-based formulations. Investment in R&D strengthens competitive positioning of major players in the region. End-user industries prioritize durable adhesives and protective coatings, sustaining strong consumption. Its role in high-value polymers further solidifies regional growth dynamics.

Europe

The Europe Global Crotonic Acid Market size was valued at USD 19.69 million in 2018 to USD 29.15 million in 2024 and is anticipated to reach USD 48.41 million by 2032, at a CAGR of 6.0% during the forecast period. It holds a 17.4% market share in 2024, led by Germany, France, and the UK with high consumption in coatings and specialty chemicals. European industries adopt crotonic acid in advanced material applications aligned with sustainability goals. Demand from pharmaceuticals and agriculture supports wider utilization across niche markets. Regional players emphasize renewable chemical processes, encouraging bio-based product development. Paint and coatings industries expand through infrastructural upgrades, further boosting market adoption. Stringent EU regulations on environmental safety push manufacturers to adopt cleaner technologies. Its integration into eco-friendly coatings underscores Europe’s strategic direction.

Asia Pacific

The Asia Pacific Global Crotonic Acid Market size was valued at USD 47.63 million in 2018 to USD 77.35 million in 2024 and is anticipated to reach USD 149.92 million by 2032, at a CAGR of 8.1% during the forecast period. It represents 46.2% of the global market share in 2024, emerging as the fastest-growing region driven by rapid industrialization. China dominates production and consumption, backed by large-scale construction, automotive, and packaging industries. India and Southeast Asia contribute significantly with rising chemical and pharmaceutical sectors. Japan and South Korea invest in advanced polymer applications, fueling additional demand. Regional players strengthen their position by scaling manufacturing capabilities and forming global partnerships. Government initiatives promoting industrial expansion further enhance adoption of crotonic acid. Its demand profile reflects Asia Pacific’s role as the epicenter of global chemical growth.

Latin America

The Latin America Global Crotonic Acid Market size was valued at USD 5.14 million in 2018 to USD 7.95 million in 2024 and is anticipated to reach USD 12.90 million by 2032, at a CAGR of 5.7% during the forecast period. It accounts for 4.7% of the market share in 2024, with Brazil leading regional adoption supported by growing construction and packaging industries. Argentina and Mexico demonstrate steady demand across coatings and adhesives. Industrial growth in infrastructure development contributes to rising consumption. The region benefits from gradual expansion in pharmaceuticals and chemical intermediates. Local manufacturers expand capacity to address regional supply gaps. Trade integration with North America and Europe enhances distribution channels. Its market growth reflects steady progress, driven by industrial diversification across Latin America.

Middle East

The Middle East Global Crotonic Acid Market size was valued at USD 2.80 million in 2018 to USD 3.99 million in 2024 and is anticipated to reach USD 6.07 million by 2032, at a CAGR of 4.8% during the forecast period. It represents 2.4% of the global market share in 2024, with GCC countries leading adoption. Demand stems from construction projects and coatings for infrastructure development. Israel and Turkey add to consumption through chemical intermediates and resins. Regional industries seek durable coatings suitable for harsh climatic conditions, supporting steady adoption. Investment in manufacturing hubs diversifies demand sources. Export opportunities to Africa and Asia strengthen market dynamics. Its expansion is gradual, supported by infrastructure-led growth across the Middle East.

Africa

The Africa Global Crotonic Acid Market size was valued at USD 1.77 million in 2018 to USD 3.05 million in 2024 and is anticipated to reach USD 4.51 million by 2032, at a CAGR of 4.5% during the forecast period. It holds 1.8% of the market share in 2024, reflecting a developing but promising regional demand pattern. South Africa drives market adoption through construction and automotive activities. Egypt adds to growth with rising chemical and industrial manufacturing. Infrastructure investments fuel requirements for adhesives and coatings, gradually strengthening demand. Limited local production creates reliance on imports from Asia and Europe. Governments promote industrialization, creating opportunities for regional market expansion. It demonstrates steady progress supported by rising construction and industrial activities across key African economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Eastman Chemical Company

- SABIC

- Lanxess AG

- Celanese Corporation

- Acme Synthetic Chemicals

- Evonik Industries AG

- Alfa Aesar (Thermo Fisher Scientific)

- Tokyo Chemical Industry Co., Ltd.

- ChemDiv, Inc.

Competitive Analysis:

The Global Crotonic Acid Market is defined by the presence of multinational chemical companies and regional producers competing across applications and geographies. Leading players such as BASF SE, Eastman Chemical Company, SABIC, Lanxess AG, and Celanese Corporation emphasize research, product diversification, and strategic partnerships to strengthen market positions. Companies expand capacity, focus on eco-friendly synthesis, and explore bio-based derivatives to align with evolving industry demands. Regional players like Acme Synthetic Chemicals and Tokyo Chemical Industry Co., Ltd. target niche markets with customized offerings. Evonik Industries AG and Alfa Aesar leverage strong distribution networks to enhance global reach. It reflects an industry where innovation, quality consistency, and cost efficiency shape competitive dynamics. Strategic mergers, product launches, and regional expansions remain central to sustaining growth and market share.

Recent Developments:

- In July 2025, BASF SE completed the acquisition of DOMO Chemicals’ 49% share in the Alsachimie joint venture, making BASF the sole owner of the production facility for key polyamide 6.6 precursors at Chalampé, France. This strategic purchase enhances BASF’s upstream integration and reinforces its position in the European nylon value chain.

Market Concentration & Characteristics:

The Global Crotonic Acid Market demonstrates moderate concentration, with global chemical leaders holding significant shares alongside specialized regional firms. It is characterized by steady demand from adhesives, coatings, and chemical intermediates, with Asia Pacific emerging as the fastest-growing region. Market players focus on securing feedstock supply, developing sustainable production methods, and strengthening value chain integration. It reflects a competitive environment where scale, technical expertise, and regulatory compliance influence long-term positioning and profitability. Continuous innovation in application development further defines market characteristics, ensuring its relevance across diverse industries.

Report Coverage:

The research report offers an in-depth analysis based on Application and End Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Crotonic Acid Market will expand with growing adoption in high-performance adhesives across packaging and construction sectors.

- Demand will rise from coatings applications, supported by automotive and industrial finishing requirements.

- Pharmaceutical and specialty chemical industries will strengthen usage in intermediates and synthesis processes.

- Sustainability initiatives will encourage development of bio-based crotonic acid production technologies.

- Asia Pacific will remain the key growth hub, driven by industrialization and manufacturing expansion.

- North America and Europe will focus on advanced applications, particularly in eco-friendly coatings and polymers.

- Market players will pursue capacity expansions and partnerships to ensure supply chain resilience.

- Regulatory frameworks will push companies toward cleaner, low-emission production processes.

- Investment in R&D will drive innovation in specialty polymers and copolymer formulations.

- Competitive strategies will center on differentiation through quality, efficiency, and sustainable solutions.