Market Overview

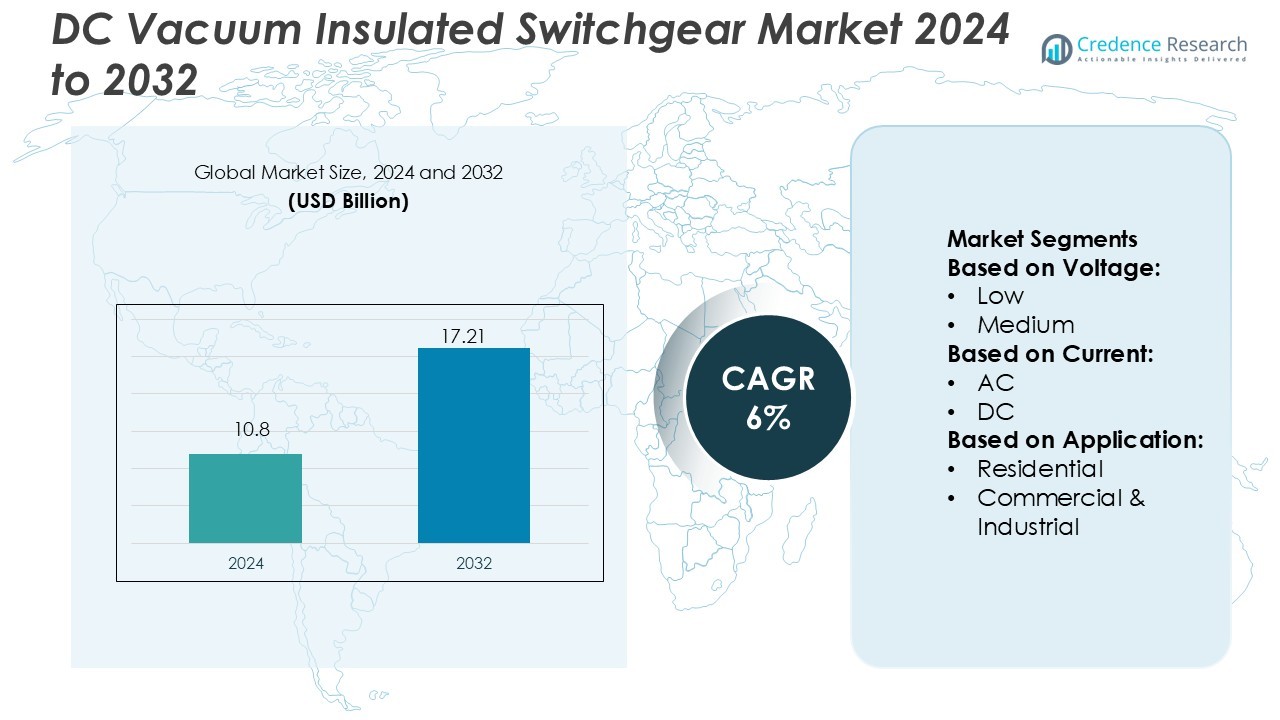

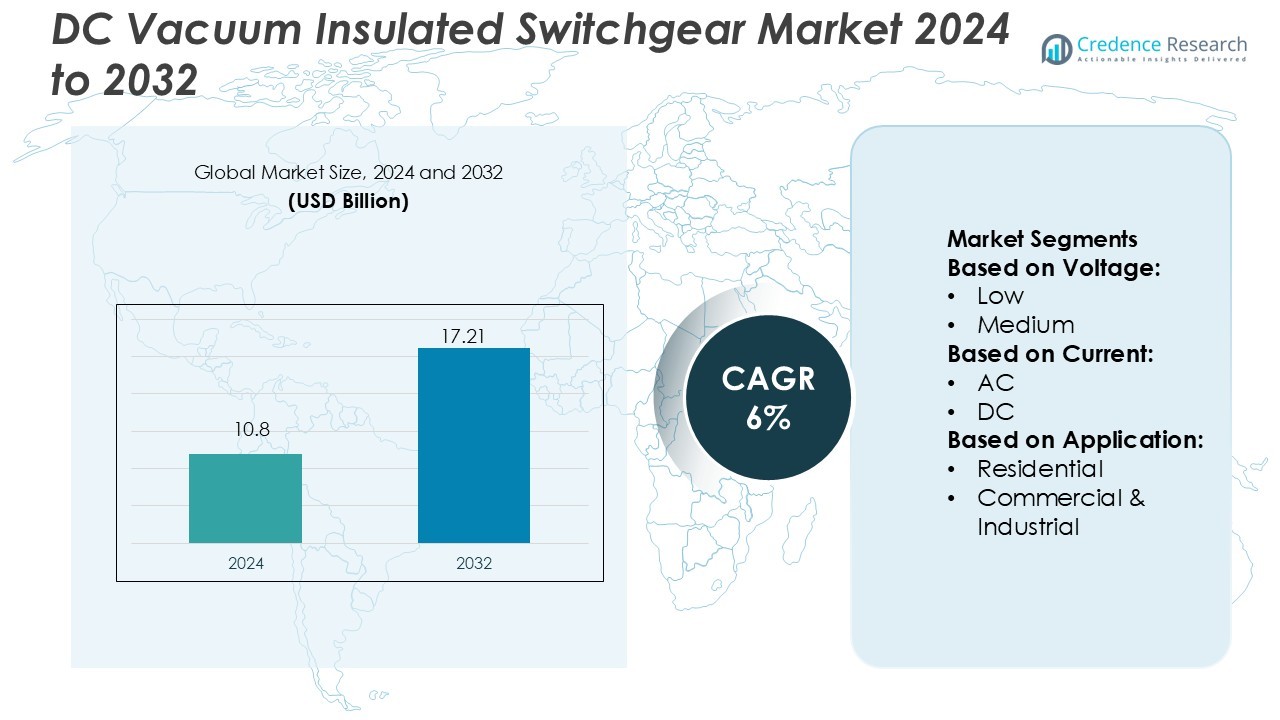

DC Vacuum Insulated Switchgear Market size was valued USD 10.8 billion in 2024 and is anticipated to reach USD 17.21 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Vacuum Insulated Switchgear Market Size 2024 |

USD 10.8 Billion |

| DC Vacuum Insulated Switchgear Market, CAGR |

6% |

| DC Vacuum Insulated Switchgear Market Size 2032 |

USD 17.21 Billion |

The DC Vacuum Insulated Switchgear Market include ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, and Lucy Group. These companies focus on advanced insulation technologies, digital monitoring, and reliable service to stay competitive. The Asia‑Pacific region leads the market with a 46.75% share, driven by rapid industrial growth, infrastructure development, and renewable energy projects in countries like China and India.

Market Insights

- The DC Vacuum Insulated Switchgear Market size was valued USD 10.8 billion in 2024 and is anticipated to reach USD 17.21 billion by 2032, at a CAGR of 6% during the forecast period.

- Growth is driven by rising adoption of renewable energy, smart grids, and urban infrastructure expansion.

- Market trends include integration of digital monitoring, predictive maintenance, and eco-friendly insulation technologies.

- Competition is strong among ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, and Lucy Group, with focus on modular and customizable solutions.

- Regionally, Asia‑Pacific leads with a 46.75% share due to rapid industrial growth and renewable energy projects, followed by Europe and North America with notable adoption in commercial, industrial, and utility sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

The low-voltage segment leads the DC vacuum insulated switchgear market, accounting for the largest share due to strong demand from multiple sectors. Growth is driven by EV charging infrastructure, telecom networks, and industrial automation that require compact, safe, and efficient switchgear solutions. Low-voltage units are preferred for their smaller footprint, lower cost, and simpler installation and maintenance, making them the most widely adopted choice. Medium-voltage systems are gaining traction in industrial microgrids, while high-voltage units remain specialized for large-scale utility applications.

- For instance, Fuji Electric’s VC‑V20A‑1 switchgear is rated at 24 kV and supports currents of 630 A to 2,500 A; its design reduced installation area by 20% compared to the previous model.

By Current

Within the current-based segmentation, AC switchgear dominates the market owing to the extensive use of alternating current in most grids, commercial, and industrial facilities. AC systems benefit from established standards, proven safety measures, and extensive distribution networks, reinforcing their market position. DC switchgear adoption is rising, particularly in renewable energy setups, energy storage systems, and electric vehicle infrastructure. However, AC remains the leading sub-segment due to its large installed base and continued preference by utility and industrial operators for stability and integration ease.

- For instance, Hitachi Energy offers gas‑insulated switchgear (GIS) rated up to 1200 kV AC and 1100 kV DC, demonstrating its broad AC portfolio with clear capability for high‑voltage systems.

By Application

The utility segment holds the largest market share, driven by grid modernization, high-voltage DC transmission projects, and integration of renewable energy sources. Utilities favor vacuum-insulated switchgear for its high reliability, compact design, and reduced maintenance requirements, which enable more efficient substation operation. Commercial and industrial adoption is growing in microgrids, data centers, and manufacturing plants due to space-saving designs and enhanced safety features. Residential adoption is limited but increasing with the expansion of smart home and solar storage solutions.

Key Growth Drivers

Key Growth Drivers

Renewable Energy Integration

The expansion of solar, wind, and other renewable energy sources is a major growth driver for the DC vacuum-insulated switchgear market. These switchgears efficiently handle DC outputs directly from renewable systems, reducing transmission losses and ensuring grid stability. Utilities, commercial operators, and industrial facilities adopt them for their reliability, compact design, and lower maintenance requirements. As countries invest in clean energy infrastructure, demand for vacuum-insulated DC switchgear continues to grow across both new installations and grid upgrade projects, making this driver a key factor for market expansion.

- For instance, ABB’s new vacuum circuit breaker series VD4G‑63 handles short circuits rated up to 63 kA/50 kA and currents from 1,250 A up to 4,000 A, making it suitable for generator protection in power plants.

Electrification of Transport and EV Infrastructure

Rapid growth in electric vehicle adoption and high-power DC charging stations is driving the need for advanced switchgear solutions. Vacuum-insulated DC switchgear provides high safety, reliability, and the ability to handle large currents with minimal maintenance. Charging hubs, fleet depots, and public fast-charging networks increasingly rely on these systems to ensure operational efficiency and safety. The rising focus on reducing vehicle emissions and building EV infrastructure is expected to sustain this demand, positioning electrification of transport as a critical growth driver in the market.

- For instance, Lucy Group’s unit, Lucy Electric, introduced the LEEVI EV Infrastructure platform, designed for modular deployment in charge‑hub applications and rated to support feeder pillars with a current of up to 2,500 A and voltage up to 36 kV.

Grid Modernisation and Urban Applications

Grid modernisation programmes and urban infrastructure projects are contributing significantly to market growth. Utilities are replacing ageing networks and installing compact substations in densely populated areas, where space and safety are crucial. Vacuum-insulated DC switchgear offers a smaller footprint, improved insulation, and higher reliability, making it ideal for urban and space-constrained applications. Smart city initiatives and industrial microgrids further boost adoption, as operators seek efficient and low-maintenance solutions to support modern energy demands and infrastructure upgrades globally.

Key Trends & Opportunities

Digitalisation and Smart Grid Integration

Integration of IoT, sensors, and digital monitoring systems in DC vacuum-insulated switchgear is a growing trend. These smart features allow real-time monitoring, predictive maintenance, and remote control, enhancing system reliability and operational efficiency. Industrial facilities, data centres, and utility operators increasingly adopt digitally enabled switchgear for better fault management, energy optimisation, and grid performance. This trend offers opportunities for manufacturers to develop advanced, connected products that align with smart grid initiatives and energy transition strategies, providing a competitive edge in the market.

- For instance, HMS‑G81 medium‑voltage switchgear is rated for 36 kV and 4,000 A with a breaking capacity of 40 kA/3 s, demonstrating robust performance for hybrid grid applications.

Eco-Friendly and SF₆-Free Solutions

Environmental regulations and sustainability goals are driving demand for eco-friendly switchgear solutions. Vacuum-insulated DC switchgear does not rely on SF₆ gas, making it safer for the environment and compliant with decarbonisation targets. Utilities and industrial end-users prefer these systems for green energy projects, renewable integration, and compliance with low-emission mandates. The emphasis on energy-efficient and environmentally responsible equipment presents significant opportunities for manufacturers to innovate and capture market share in regions focused on sustainability and regulatory adherence.

- For instance, (Green Gas for Grid) portfolio includes a dead‑tank circuit breaker model DT1‑145g 63, rated for 145 kV and interrupting short‑circuit currents up to 63 kA, while offering the same footprint as traditional SF₆ equivalents.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Africa, and Latin America are witnessing rapid electrification and microgrid deployment. These regions require compact, efficient, and low-maintenance switchgear to support new infrastructure projects and renewable energy integration. Vacuum-insulated DC switchgear meets these requirements, providing reliable operation in space-constrained and remote locations. Market players have opportunities to expand their presence in these high-growth regions by targeting utilities, industrial facilities, and renewable projects, driving long-term growth and strengthening global adoption of DC switchgear solutions.

Key Challenges

High Costs and Complex Integration

Despite performance benefits, vacuum-insulated DC switchgear has higher upfront costs compared to conventional solutions. Integration into existing grids, especially in developing regions, can be complex due to technical compatibility issues, longer commissioning times, and training requirements. These factors can slow adoption among utilities and industrial operators, particularly in cost-sensitive projects, posing a challenge for widespread market penetration. Manufacturers must balance performance advantages with affordability to overcome this barrier.

Supply Chain and Material Risks

Production of vacuum-insulated DC switchgear depends on specialized components, high-quality vacuum interrupters, and premium insulating materials. Fluctuations in raw material costs, supply chain disruptions, and global logistics challenges can lead to delays and increased manufacturing expenses. These risks affect profitability, project timelines, and the ability to meet growing demand, presenting a challenge for manufacturers to maintain reliable supply and cost-effective production while scaling operations globally.

Regional Analysis

North America

The North American region holds approximately 20–25% of the global market for DC vacuum‑insulated switchgear. Strong grid modernisation efforts, significant investments in renewable energy and EV infrastructure drive demand. Utility operators in the US and Canada adopt compact, high‑performance switchgear to meet regulatory and efficiency targets. The region benefits from advanced manufacturing capabilities and high per‑capita infrastructure spending, leading to faster adoption compared with other markets.

Europe

Europe accounts for around 18–22% of the global DC vacuum insulated switchgear market share. The region is supported by stringent environmental regulation, growing renewable integration and offshore wind‑HVDC projects. Manufacturers in Germany, France and Scandinavia lead with SF₆‑free vacuum insulation solutions tailored for high reliability. Capacity upgrades and a shift toward decentralised energy assets create solid demand for advanced DC switchgear systems across utilities and industrial applications.

Asia‑Pacific

Asia‑Pacific leads the global market with roughly 30–35% share, making it the largest regional segment. Rapid electrification, renewable expansion and EV charging infrastructure in China, India, Japan and Southeast Asia fuel growth. Urbanisation and increasing deployments of microgrids in space‑constrained cities drive the adoption of compact vacuum‑insulated switchgear. Emerging economies in the region present significant upside potential for suppliers focused on scale and localisation.

Latin America

Latin America holds an estimated 8–10% of the DC vacuum insulated switchgear market. Growth is driven by infrastructure expansion, grid upgrades and renewable energy projects in Brazil, Mexico and Chile. While initial adoption lags compared to developed regions, utilities and industrial users increasingly invest in advanced switchgear to modernise networks and improve reliability in remote or variable‑load environments. The region offers focused opportunities for niche players and partnerships.

Middle East & Africa (MEA)

The MEA region contributes roughly 5–7% of global market share. Demand stems from large‑scale utility projects, solar and wind farms and oil‑gas sector modernisation in Gulf countries and North Africa. The adoption rate is moderated by budget constraints and legacy infrastructure, but international EPCs and government‑backed initiatives drive uptake of vacuum‑insulated DC switchgear in high‑growth segments. The region represents a strategic frontier for long‑term growth.

Market Segmentations:

By Voltage:

By Current:

By Application:

- Residential

- Commercial & Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The DC Vacuum Insulated Switchgear Market players such as Fuji Electric, Hitachi, CG Power and Industrial Solutions, ABB, Lucy Group, HD Hyundai Electric, Eaton, General Electric, Bharat Heavy Electricals, and E + I Engineering. The DC Vacuum Insulated Switchgear Market is highly competitive, driven by rapid technological advancements and growing demand for reliable power distribution. Companies focus on enhancing safety, efficiency, and compactness in their products to meet modern industrial and utility requirements. Innovation in digital monitoring, predictive maintenance, and eco-friendly insulation solutions strengthens operational efficiency and reduces downtime. Modular and customizable designs allow faster installation, easy retrofitting, and adaptability across diverse applications. Increasing adoption in commercial, industrial, and utility sectors encourages continuous product development, while integration of smart sensors enables real-time diagnostics and improved system reliability. The market emphasizes long-term service offerings, lifecycle support, and adherence to international safety standards. Growing investments in renewable energy, urban infrastructure, and grid modernization further expand demand, creating opportunities for innovation and market differentiation. Overall, the market environment drives efficiency, technological excellence, and sustainable growth in high-voltage power distribution systems.

Key Player Analysis

- Fuji Electric

- Hitachi

- CG Power and Industrial Solutions

- ABB

- Lucy Group

- HD Hyundai Electric

- Eaton

- General Electric

- Bharat Heavy Electricals

- E + I Engineering

Recent Developments

- In March 2025, nVent Electric plc announced to enter into a definitive agreement to acquire the enclosures, switchgear, and bus systems businesses of Avail Infrastructure Solutions for an acquisition price of subject to customary adjustments.

- In October 2024, Schneider Electric launched its new Ringmaster AirSeT medium-voltage switchgear in the UK, replacing the potent greenhouse gas sulfur hexafluoride with pure air for insulation. This SF₆-free technology is designed to make electrical grids more sustainable and digitally advanced by allowing for better operational performance and reliability.

- In August 2024, Hitachi Energy Ltd. introduced a switchgear technology aimed at reducing sulfur hexafluoride (SF₆) emissions, which account for 80% of such emissions in the power sector. In response, the company has unveiled the world’s highest-voltage SF₆-free solutions.

- In May 2024, L&T Switchgear, one of India’s leading electrical and automation brands and a pioneer in energy management, unveiled its new brand identity, ‘Lauritz Knudsen Electrical and Automation’. Announces plans to invest Rs 850 cr. over the next 3 years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Voltage, Current, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of renewable energy sources will boost demand for vacuum insulated switchgear.

- Expansion of smart grids will drive integration of digital monitoring features.

- Rising urbanization and industrialization will require compact and reliable power distribution solutions.

- Development of eco-friendly insulation technologies will reduce environmental impact.

- Modular designs will enable faster installation and easier retrofitting in existing infrastructure.

- Predictive maintenance and real-time diagnostics will enhance operational efficiency.

- Growing focus on safety standards will encourage adoption of advanced switchgear solutions.

- Emerging markets will offer new growth opportunities for tailored switchgear applications.

- Technological collaborations and partnerships will accelerate product innovation and diversification.

- Long-term service contracts and lifecycle support will strengthen market presence and customer loyalty.

Key Growth Drivers

Key Growth Drivers