Market Overview

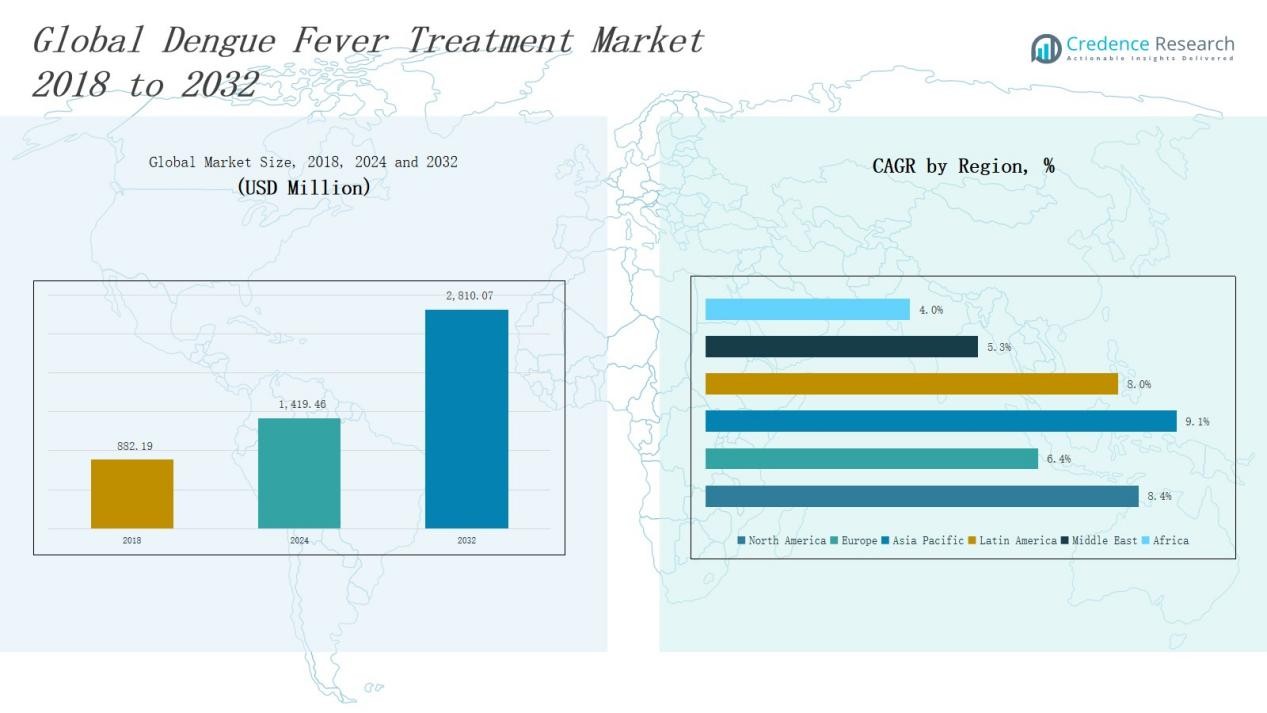

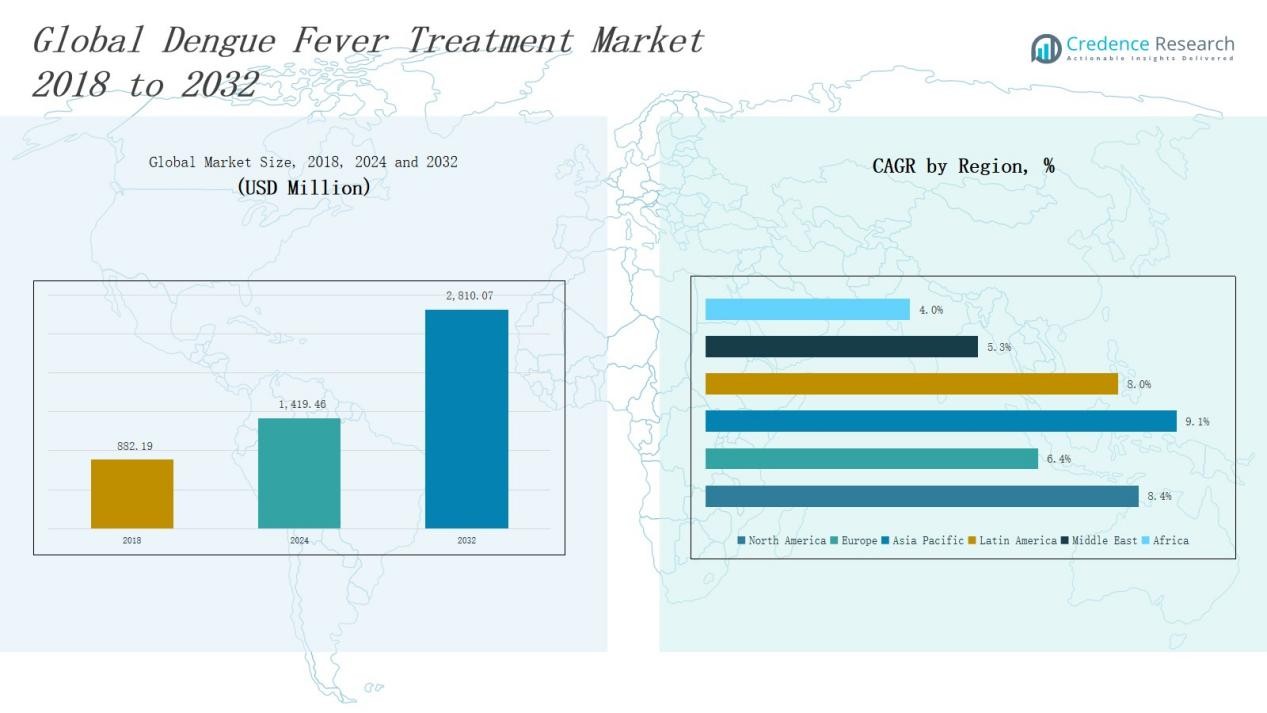

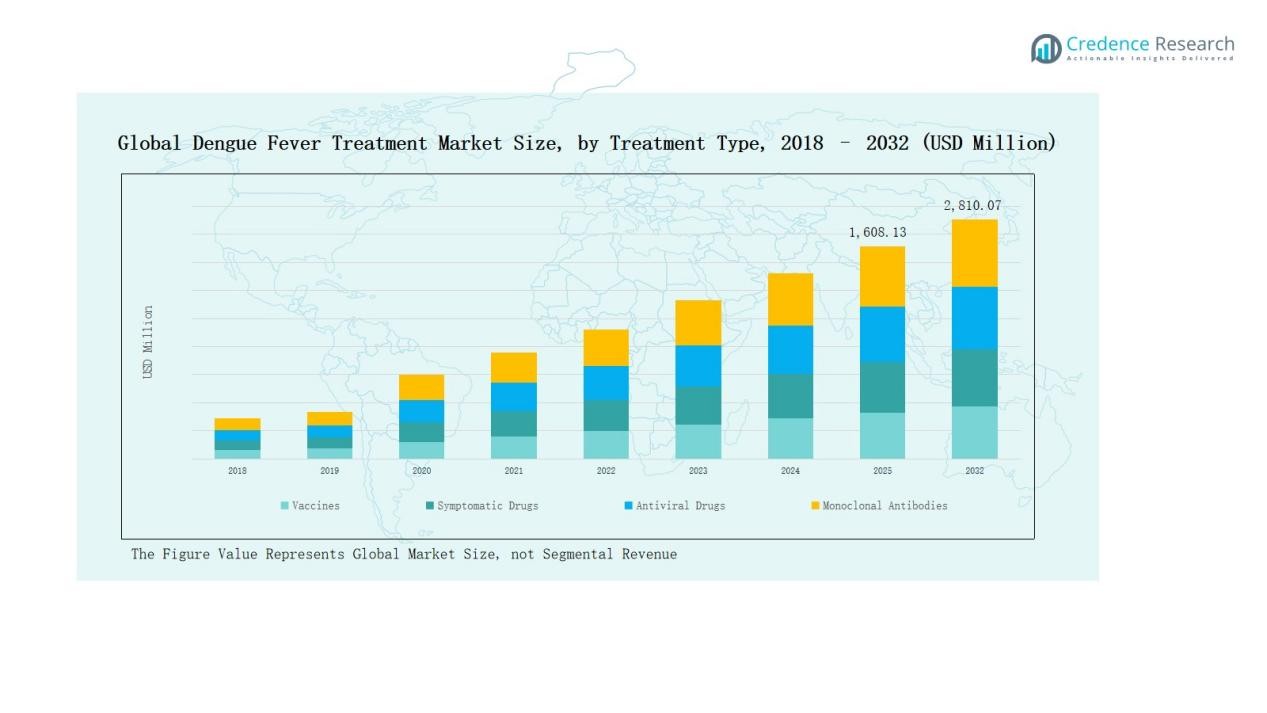

Dengue Fever Treatment Market size was valued at USD 882.19 million in 2018 to USD 1,419.46 million in 2024 and is anticipated to reach USD 2,810.07 million by 2032, at a CAGR of 8.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dengue Fever Treatment Market Size 2024 |

USD 1,419.46 Million |

| Dengue Fever Treatment Market, CAGR |

8.30% |

| Dengue Fever Treatment Market Size 2032 |

USD 2,810.07 Million |

The Dengue Fever Treatment Market is shaped by leading players such as Takeda Pharmaceutical, Sanofi, Pfizer, GlaxoSmithKline, Johnson & Johnson, Abbott Laboratories, Teva Pharmaceuticals, Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, Cipla, Serum Institute of India, Bharat Biotech, Panacea Biotec, and Instituto Butantan. These companies strengthen their positions through vaccine innovations, development of monoclonal antibodies, and affordable symptomatic drug portfolios. Strategic collaborations with global health agencies and government partnerships enhance their market penetration, particularly in endemic regions. Asia Pacific emerged as the leading region with a 46% share in 2024, driven by high dengue prevalence, large-scale immunization initiatives, and significant investments in advanced therapies and preventive solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dengue Fever Treatment Market grew from USD 882.19 million in 2018 to USD 1,419.46 million in 2024 and is expected to reach USD 2,810.07 million by 2032.

- Asia Pacific led with 46% share in 2024, driven by high endemicity, large-scale vaccination programs, and rapid healthcare expansion across India, Indonesia, and the Philippines.

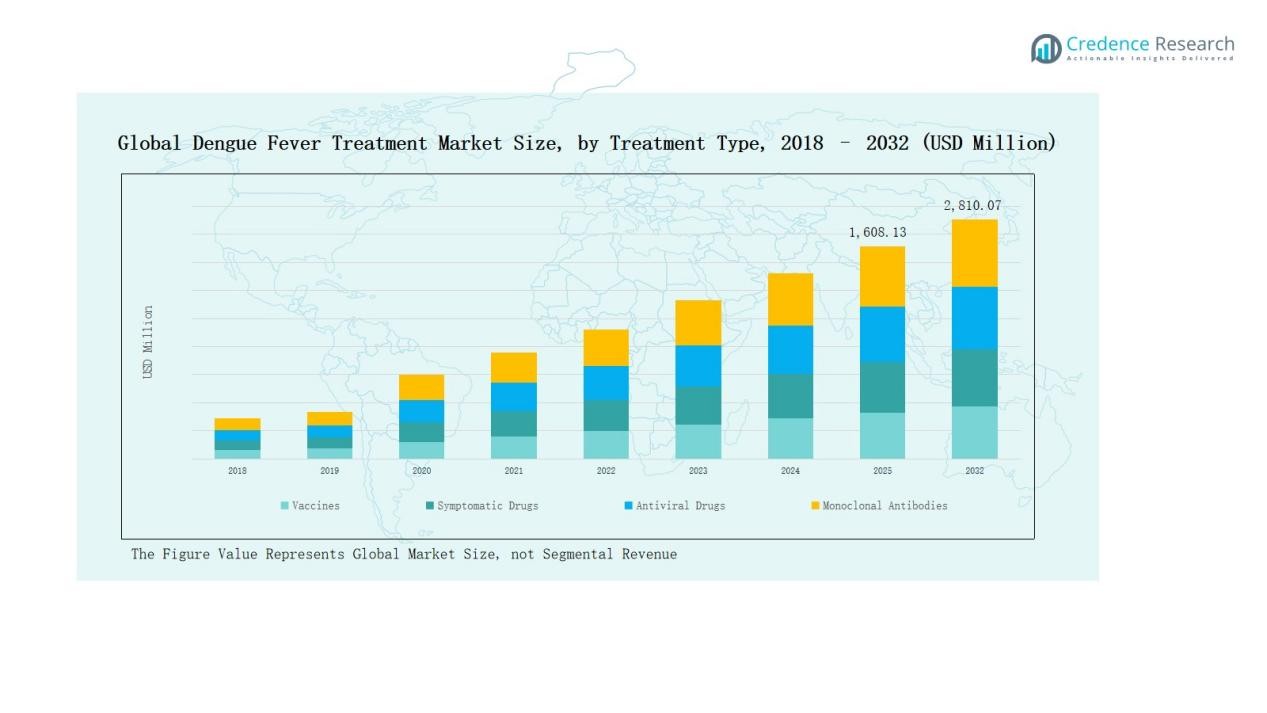

- By treatment type, vaccines dominated with 38% share in 2024, followed by symptomatic drugs at 32%, highlighting their critical role in preventive and supportive care.

- By route of administration, parenteral treatments held 61% share in 2024, reflecting the hospital-based delivery of vaccines, antivirals, and monoclonal antibodies.

- Hospitals accounted for the highest end-user share at 54% in 2024, due to the need for inpatient care, intravenous therapy, and monitoring in severe dengue cases.

Market Segment Insights

By Treatment Type

Vaccines accounted for the largest share of the dengue fever treatment market with 38% in 2024. Their dominance is driven by growing adoption in endemic regions and government immunization initiatives. Symptomatic drugs held 32% share, supported by high patient reliance on pain relievers and antipyretics for immediate relief. Antiviral drugs represented 20% share, boosted by increasing R&D efforts to develop targeted therapies. Monoclonal antibodies captured 10% share, benefiting from recent clinical approvals that provide longer-term protection.

- For instance, Dengvaxia was approved and integrated into national vaccination campaigns in countries like Brazil and the Philippines, the program was suspended and eventually banned in the Philippines due to safety risks in non-infected people.

By Route of Administration

Parenteral (injectable) treatments dominated the segment with 61% share in 2024. Their leadership stems from the necessity of hospital-based administration of vaccines, antivirals, and monoclonal antibodies. Oral treatments followed with 39% share, primarily driven by symptomatic drugs such as analgesics and fluid replacement therapies. The oral route continues to expand due to convenience, lower cost, and wider availability in outpatient and home healthcare settings.

- For instance, by May 2024, Qdenga was approved in approximately 40 countries, not just “over 20”. Countries include Indonesia, Brazil, Thailand, Argentina, and members of the European Union.

By End User

Hospitals held the dominant position with 54% share in 2024, attributed to the need for inpatient care, intravenous drug administration, and critical monitoring in severe dengue cases. Specialty clinics accounted for 28% share, as they provide tailored treatments and follow-up services for dengue management. Home healthcare represented 18% share, supported by rising patient preference for oral symptomatic drugs and cost-effective care outside hospitals. Growing awareness and telehealth integration are expected to enhance adoption of home-based care in the coming years.

Key Growth Drivers

Rising Global Burden of Dengue

The increasing incidence of dengue cases worldwide serves as the strongest growth driver. According to WHO, nearly 390 million infections occur annually, intensifying the need for effective treatments. Governments in high-burden countries are expanding vector-control programs and allocating funds to strengthen treatment facilities. Hospitals and clinics report rising patient admissions during seasonal outbreaks, increasing reliance on both symptomatic and advanced therapies. This growing disease prevalence is pushing pharmaceutical companies to accelerate development of vaccines, antivirals, and supportive care solutions.

- For instance, Takeda Pharmaceutical’s dengue vaccine, Qdenga, demonstrated 80.2% efficacy in Phase III trials across 8 countries, leading to its regulatory approval in Europe in December 2022

Advancements in Vaccine Development

Innovations in dengue vaccines are transforming the treatment landscape. Takeda’s Dengvaxia and Qdenga have gained approval across several regions, expanding patient access. The vaccines reduce hospitalization risk and severe dengue cases, driving higher demand in endemic regions. Public health agencies in Asia-Pacific and Latin America actively promote vaccination programs. Clinical pipelines for next-generation vaccines show promising outcomes, ensuring wider adoption over the next decade. The ability of vaccines to offer long-term prevention strengthens their role as a cornerstone in market expansion.

Government Support and Funding Initiatives

Robust government initiatives play a critical role in advancing dengue treatment availability. National immunization programs in countries like Brazil, Philippines, and India include dengue vaccines as part of public health policies. Funding support also extends to vector control measures, clinical trials, and procurement of medical supplies during outbreaks. Organizations such as UNICEF and WHO partner with governments to ensure affordable treatment access. These combined efforts not only boost awareness but also improve healthcare infrastructure, which directly accelerates treatment adoption across hospitals and community centers.

- For instance, Brazil’s Ministry of Health launched a nationwide dengue control campaign in 2023 that distributed over 600,000 Wolbachia-infected mosquitoes to reduce dengue transmission.

Key Trends & Opportunities

Monoclonal Antibody Therapies

The rise of monoclonal antibodies offers new opportunities in dengue management. These therapies provide targeted immune protection, reducing viral load and disease severity. Recent clinical trials highlight efficacy against multiple dengue strains, making them a promising segment for long-term treatment strategies. Growing pharmaceutical partnerships and accelerated regulatory approvals are pushing these therapies into mainstream adoption. High acceptance among patients with severe infections and supportive reimbursement policies are expected to position monoclonal antibodies as a major future growth driver in the market.

- For instance, Janssen Pharmaceuticals (Johnson & Johnson) partnered with the National Institute of Allergy and Infectious Diseases (NIAID) to evaluate its mAb combination therapy, including antibodies JNJ-1802 and JNJ-1954, which showed a greater than 90% reduction in viral RNA in non-human primate models within 48 hours of administration.

Expansion of Home Healthcare and Telemedicine

Home healthcare adoption is growing as patients prefer cost-effective treatment outside hospitals. Oral symptomatic drugs, fluid replacement, and remote monitoring technologies are supporting this transition. Telemedicine platforms enable patients to consult physicians for early symptom management, reducing hospitalization pressure. This trend is especially evident in Asia-Pacific, where digital health adoption is rapidly increasing. Pharmaceutical companies and digital health providers are collaborating to integrate telehealth tools with dengue care solutions. The expansion of this model represents a strong opportunity for widening access to treatment.

- For instance, Takeda’s tetravalent dengue vaccine candidate, TAK-003, is based on a live, attenuated dengue serotype 2 virus that provides cross-neutralizing activity against all four dengue serotypes. Phase 3 data from a 4.5-year study showed a cumulative vaccine efficacy of 84.1% against hospitalized dengue.

Key Challenges

Limited Antiviral Options

The absence of widely approved, effective antiviral drugs remains a major hurdle. While research is ongoing, most treatments remain symptomatic, leaving patients reliant on supportive care. This limitation increases hospitalization duration and recovery times. Uncertainty in clinical trial outcomes also discourages large-scale investments from pharmaceutical companies. Without breakthrough therapies, reliance on vaccines and symptomatic drugs continues, slowing innovation. Developing effective antivirals that cover all dengue serotypes is a critical need for strengthening the treatment market’s long-term growth potential.

Vaccine Safety Concerns and Acceptance

Safety concerns around dengue vaccines have created barriers to adoption. Previous controversies, such as limited efficacy in seronegative patients, have raised public skepticism. Despite advancements, some regions remain hesitant to include vaccines in mass immunization programs. Negative public perception affects uptake rates and slows revenue growth for manufacturers. Addressing safety profiles through transparent clinical data and public education campaigns is essential to restore trust. Without higher acceptance, the full preventive potential of vaccines may not be realized, limiting overall market progress.

High Treatment Costs in Developing Regions

Affordability continues to challenge access in low- and middle-income countries, where dengue is most prevalent. Vaccines, monoclonal antibodies, and advanced therapies often remain priced beyond the reach of average households. Weak reimbursement systems and uneven healthcare funding further worsen disparities in treatment availability. Many patients rely on low-cost symptomatic drugs, which provide only temporary relief. Unless manufacturers and governments collaborate on cost-reduction measures, equitable access will remain limited. This cost challenge directly affects both patient outcomes and market penetration in developing regions.

Regional Analysis

North America

North America accounted for 22% of the global dengue fever treatment market in 2024, with revenue of USD 229.68 million. The region is projected to reach USD 458.07 million by 2032, growing at a CAGR of 8.4%. Strong healthcare infrastructure, high awareness levels, and adoption of advanced therapies such as monoclonal antibodies drive market growth. The U.S. leads regional demand with expanded vaccine approvals and government-led awareness campaigns. Increasing cross-border travel also amplifies the need for preventive and therapeutic solutions, strengthening North America’s role in the global landscape.

Europe

Europe represented 17% of the market share in 2024, valued at USD 177.44 million, and is projected to reach USD 306.32 million by 2032 at a CAGR of 6.4%. The region benefits from structured healthcare systems and rising incidence of travel-related dengue cases. Countries like France, Spain, and Italy report higher adoption of vaccines and supportive care. Government efforts to monitor vector-borne diseases and collaborations with pharmaceutical companies are expanding access to advanced treatments. However, slower adoption compared to Asia-Pacific reflects reliance on preventive measures and relatively lower prevalence rates.

Asia Pacific

Asia Pacific dominated the market with the largest 46% share in 2024, generating USD 615.47 million and expected to reach USD 1,296.09 million by 2032 at a CAGR of 9.1%. The region’s dominance stems from high endemicity in countries such as India, Indonesia, and the Philippines, which account for a majority of global dengue cases. Large-scale vaccination programs, government investments, and a surge in R&D for antivirals strengthen market growth. Rapid healthcare expansion and growing awareness further drive treatment adoption. Asia Pacific remains the most critical region for future market expansion due to its significant disease burden.

Latin America

Latin America held 26% of the global market share in 2024, valued at USD 350.42 million, and is projected to reach USD 678.66 million by 2032 at a CAGR of 8.0%. Brazil and Argentina lead regional demand, supported by widespread dengue prevalence and government immunization initiatives. The high adoption of vaccines and symptomatic drugs highlights the region’s urgent need for effective solutions. Seasonal outbreaks and large-scale awareness campaigns boost demand across hospitals and clinics. Latin America’s strong disease burden ensures it remains a vital market for pharmaceutical companies expanding treatment portfolios.

Middle East

The Middle East accounted for 2% share in 2024, valued at USD 28.45 million, with projections reaching USD 45.08 million by 2032 at a CAGR of 5.3%. Although the disease burden is lower compared to Asia and Latin America, rising travel-related cases and imported infections drive demand. Countries in the GCC are investing in vaccines and advanced therapies as precautionary measures. Growing public health initiatives and collaborations with international pharmaceutical firms support gradual market expansion. However, limited endemic presence keeps market size relatively modest.

Africa

Africa captured 1% of the market share in 2024, valued at USD 18.00 million, and is projected to reach USD 25.85 million by 2032 at a CAGR of 4.0%. Dengue remains underreported in many African nations due to weak surveillance systems and limited diagnostic infrastructure. However, rising outbreaks in regions like East Africa are creating awareness and increasing demand for symptomatic care. Access challenges, affordability issues, and fragmented healthcare systems constrain growth. International collaborations and government-backed vaccination efforts are expected to improve treatment adoption gradually across the region.

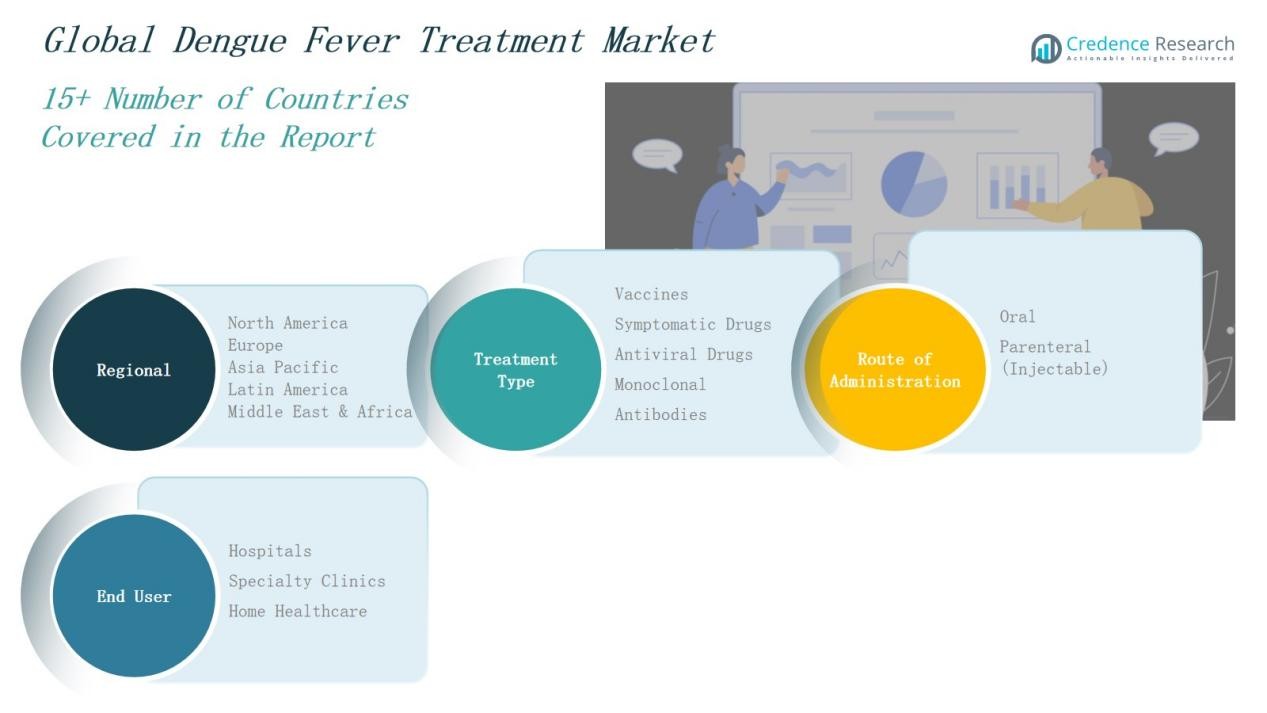

Market Segmentations:

By Treatment Type

- Vaccines

- Symptomatic Drugs

- Antiviral Drugs

- Monoclonal Antibodies

By Route of Administration

- Oral

- Parenteral (Injectable)

By End User

- Hospitals

- Specialty Clinics

- Home Healthcare

By Region

- North America:S., Canada, Mexico

- Europe:UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific:China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America:Brazil, Argentina, Rest of Latin America

- Middle East:GCC Countries, Israel, Turkey, Rest of Middle East

- Africa:South Africa, Egypt, Rest of Africa

Competitive Landscape

The dengue fever treatment market is moderately consolidated, with global and regional players competing through product innovation, vaccine approvals, and strategic collaborations. Leading companies such as Takeda Pharmaceutical, Sanofi, Pfizer, and GlaxoSmithKline dominate with strong vaccine portfolios and global distribution networks. Their market strength is reinforced by continuous R&D investment, clinical trials for advanced antivirals, and regulatory approvals across endemic regions. Generic drug manufacturers including Sun Pharmaceutical, Teva, and Dr. Reddy’s Laboratories play a vital role by supplying affordable symptomatic drugs widely used in hospitals and home healthcare. Emerging biopharma firms are focusing on monoclonal antibodies and next-generation antivirals, supported by funding from governments and international health agencies. Strategic partnerships, such as collaborations with the WHO and UNICEF for vaccine distribution, strengthen market penetration in Asia-Pacific and Latin America. Competition is also intensifying through pricing strategies, expansion into developing regions, and technology-driven innovations in diagnostics and treatment delivery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Takeda Pharmaceutical Company

- Sanofi (Sanofi Pasteur)

- Pfizer

- GlaxoSmithKline (GSK)

- Johnson & Johnson (Janssen)

- Abbott Laboratories

- Teva Pharmaceuticals

- Viatris (Mylan)

- Sun Pharmaceutical Industries

- Perrigo Company

- Fresenius Kabi

- Baxter International

- Braun Melsungen AG

- Reddy’s Laboratories

- Cipla

- Aurobindo Pharma

- Lupin

- Zydus Lifesciences

- Serum Institute of India

- Bharat Biotech

- Panacea Biotec

- Biological E.

- Instituto Butantan

Recent Developments

- In June 2025, the Serum Institute of India partnered with DNDi to advance a monoclonal antibody treatment targeting all four dengue virus serotypes, moving into Phase III clinical trials across India, Brazil, and other endemic regions.

- In August 2024, Panacea Biotec, in collaboration with ICMR, initiated a Phase III trial for its dengue vaccine candidate DengiAll in India.

- In February 2024, Takeda Pharmaceutical announced a manufacturing partnership with Biological E. Ltd., scaling production capacity for QDENGA (TAK-003) to 50 million doses annually, with a target of 100 million by 2030.

Report Coverage

The research report offers an in-depth analysis based on Tretament Type, Route of Administration, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dengue vaccines will continue to expand in endemic regions.

- Pharmaceutical companies will accelerate development of effective antiviral therapies.

- Monoclonal antibodies will gain wider acceptance for severe case management.

- Governments will strengthen immunization programs to reduce hospitalization rates.

- Digital health and telemedicine will improve access to early diagnosis and treatment.

- Home healthcare solutions will see rising adoption for mild and moderate cases.

- Public–private partnerships will drive faster distribution of vaccines and therapies.

- Research collaborations will focus on next-generation multivalent vaccines.

- Awareness campaigns will enhance preventive care and early intervention practices.

- Market players will expand presence in Asia-Pacific and Latin America to meet rising demand.