Market Overview

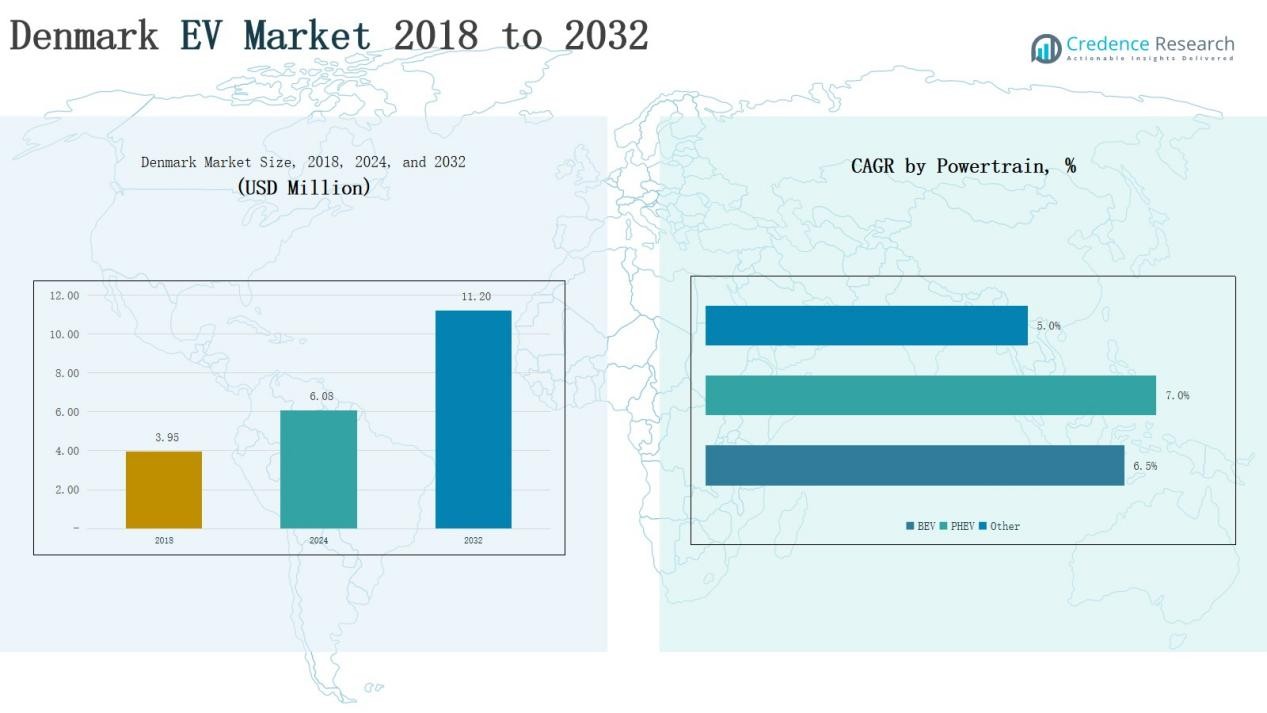

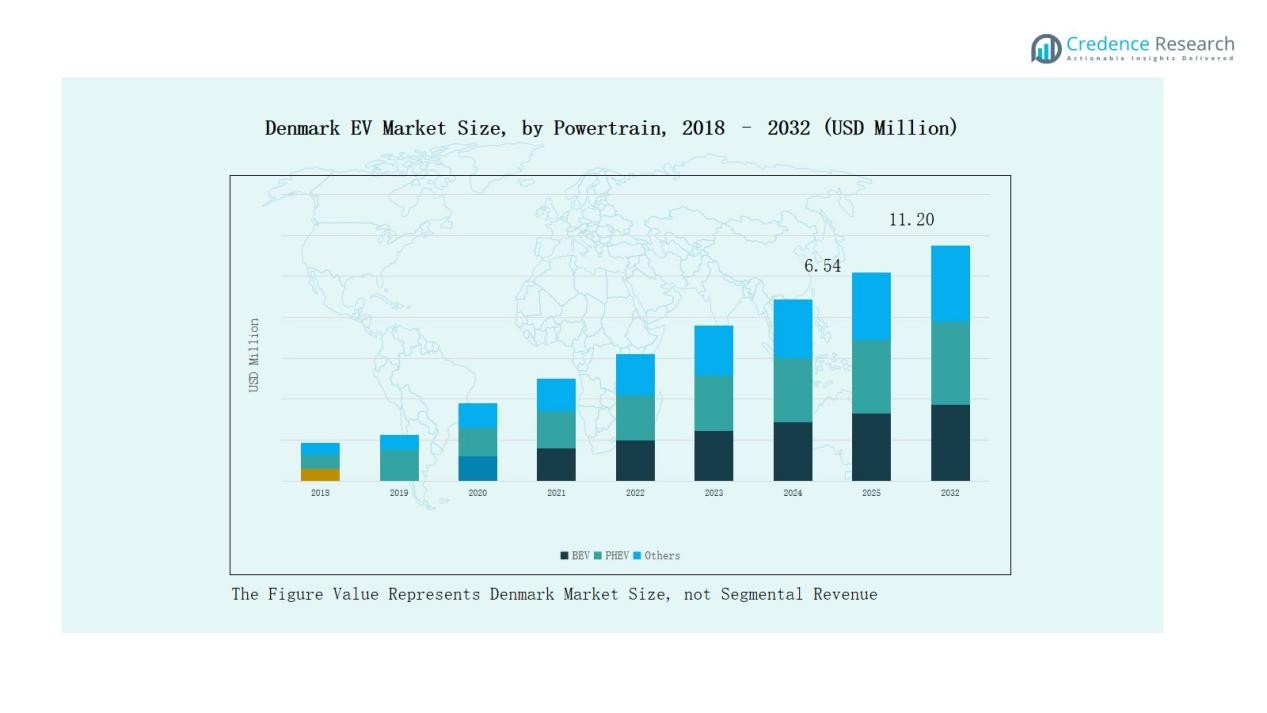

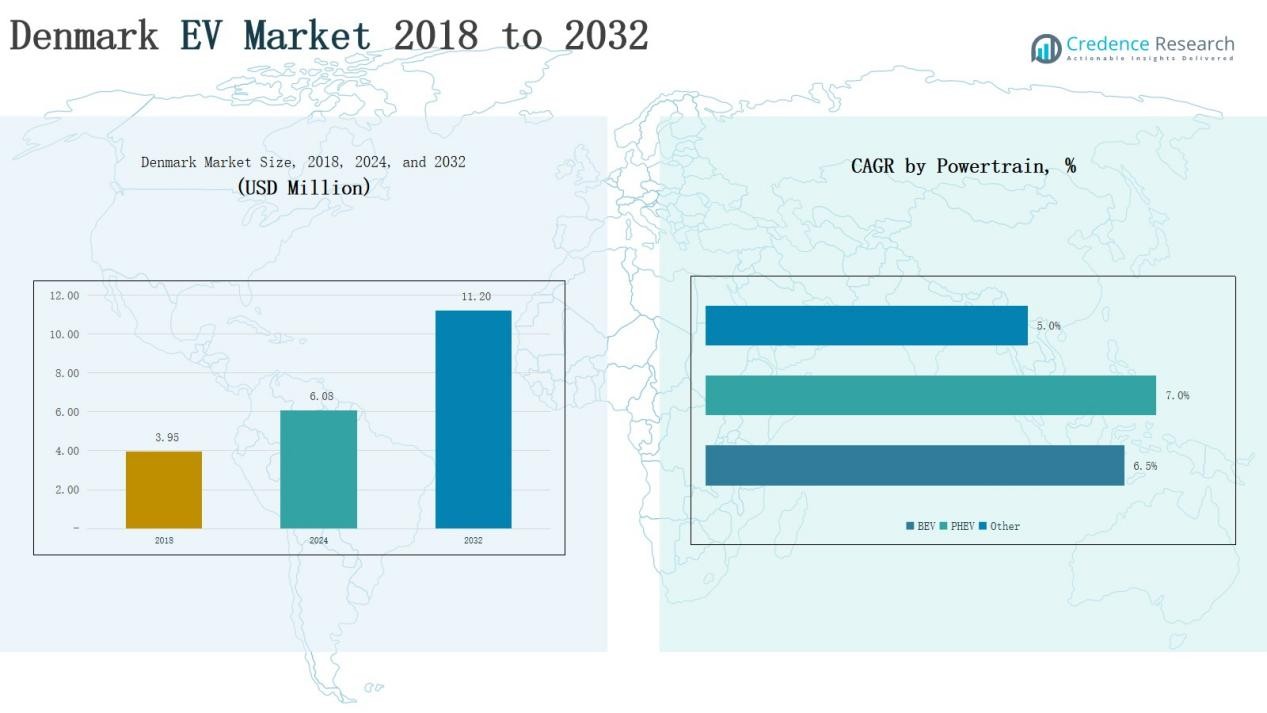

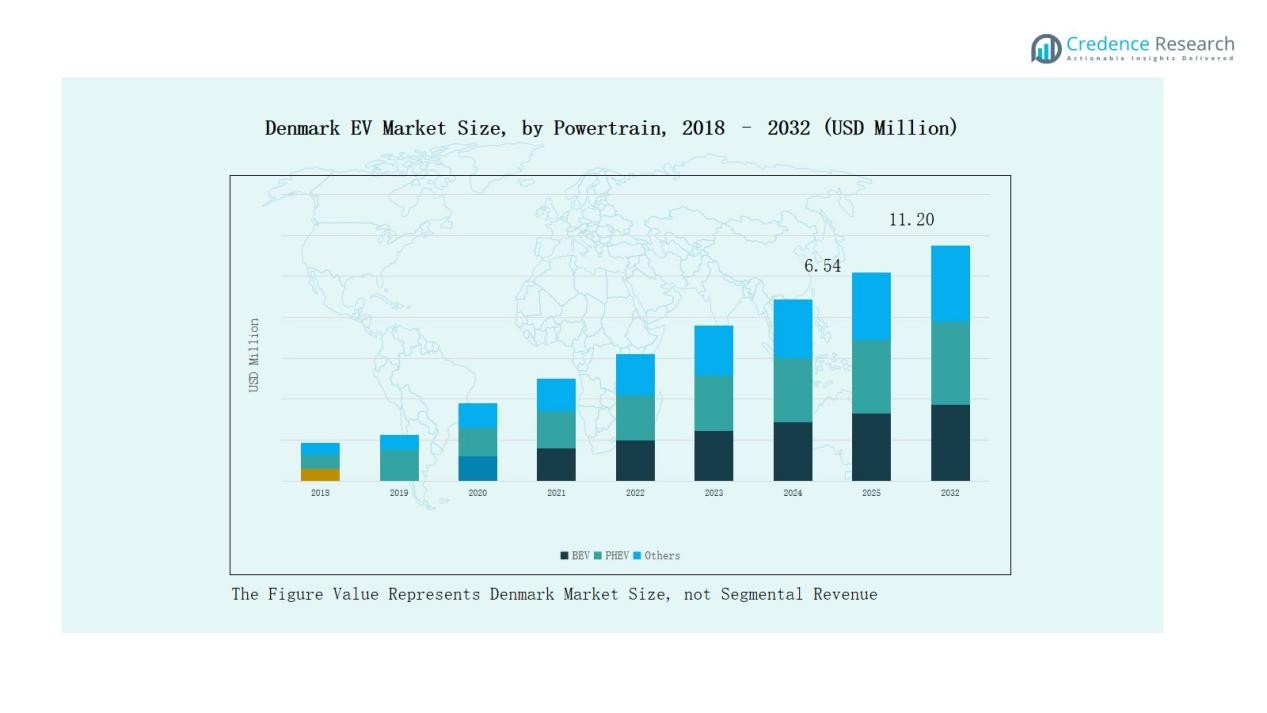

Denmark Electric Vehicle (EV) Market size was valued at USD 3.95 million in 2018 to USD 6.08 million in 2024 and is anticipated to reach USD 11.20 million by 2032, at a CAGR of 7.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Denmark Electric Vehicle (EV) Market Size 2024 |

USD 6.08 Million |

| Denmark Electric Vehicle (EV) Market, CAGR |

7.73% |

| Denmark Electric Vehicle (EV) Market Size 2032 |

USD 11.20 Million |

The Denmark EV Market is shaped by leading automakers including Volkswagen, Tesla, BMW, Mercedes-Benz, Volvo, Audi, Skoda, Nissan, and Geely Holding, each competing through diverse EV portfolios, strong brand positioning, and continuous investment in charging infrastructure partnerships. These players focus on expanding BEV and PHEV offerings to meet rising consumer demand and corporate fleet requirements. Competitive intensity is reinforced by strategic collaborations, sustainability-driven initiatives, and innovation in battery technologies. Among regions, Copenhagen and Zealand emerged as the clear leader, capturing 33% market share in 2024, supported by strict emission targets, high charging station density, and strong consumer adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Denmark EV Market grew from USD 3.95 million in 2018 to USD 6.08 million in 2024 and is expected to reach USD 11.20 million by 2032 at a CAGR of 7.73%.

- Battery Electric Vehicles led with 68% share in 2024, while Plug-in Hybrid Electric Vehicles held 24% and other alternatives contributed 8%.

- Private Buyers dominated with 71% share in 2024, while Corporate Buyers accounted for 29% and continue to expand through fleet electrification strategies.

- Copenhagen and Zealand led regional adoption with 33% share in 2024, followed by Central Denmark at 27%, Southern Denmark at 22%, and Northern Denmark at 18%.

- Key players such as Volkswagen, Tesla, BMW, Mercedes-Benz, Volvo, Audi, Skoda, Nissan, and Geely Holding strengthen competition through innovation, infrastructure partnerships, and diverse EV portfolios.

Market Segment Insights

By Powertrain

Battery Electric Vehicles (BEVs) dominate the Denmark EV Market, holding 68% market share in 2024. Their growth is supported by strong government subsidies, extensive charging infrastructure, and rising consumer preference for zero-emission mobility. Plug-in Hybrid Electric Vehicles (PHEVs) accounted for 24% share, driven by buyers seeking flexibility for both short electric commutes and longer fuel-based travel. The remaining 8% share came from other options, including fuel cell EVs and mild hybrids, which attract niche buyers focused on alternative technologies.

- For instance, Tesla delivered over 4,200 new BEVs in Denmark, with the Model Y becoming the country’s best-selling car according to the Danish Car Importers Association.

By End User

Private Buyers lead the Denmark EV Market with 71% market share in 2024, as households increasingly adopt EVs to reduce fuel expenses and comply with green mobility policies. Strong incentives on vehicle purchase and registration tax exemptions further support this dominance. Corporate Buyers captured 29% share, with fleet operators and companies adopting EVs to align with sustainability goals and lower operational costs. Their share is expected to grow steadily as businesses transition to climate-neutral fleets under regulatory pressure.

- For instance, Hyundai Motor Denmark announced that private customers accounted for the majority of its IONIQ 5 sales, supported by national incentives and zero registration tax policies.

Key Growth Drivers

Government Incentives and Policy Support

The Denmark EV Market benefits from extensive government policies promoting clean mobility. Subsidies, tax exemptions, and reduced registration fees make EVs more affordable for consumers. Strict carbon emission reduction targets drive households and businesses to adopt EVs rapidly. Public investments in nationwide charging infrastructure further reinforce confidence in electric mobility. These measures strengthen BEV dominance and accelerate the transition away from fossil fuel vehicles. Policy-driven demand ensures consistent market expansion over the forecast period.

- For instance, the Skoda Enyaq iV, Volkswagen ID.4, and Tesla Model Y were top-selling BEVs, demonstrating how manufacturer offerings aligned with policy incentives boosted EV adoption.

Expanding Charging Infrastructure

Robust expansion of charging infrastructure serves as a critical growth driver for the Denmark EV Market. Fast-charging networks across urban and rural areas make EV adoption more convenient for consumers. Partnerships between government and private operators are enabling high-capacity charging points in highways, workplaces, and residential areas. The growing density of charging stations reduces range anxiety, boosting consumer trust in BEVs. This infrastructural backbone is essential to meet rising demand from both private buyers and corporate fleets.

- For instance, ABB partnered with energy group EWII to deploy 1,350 chargers at Copenhagen Airport, transforming it into Denmark’s largest EV charging hub and serving over 80,000 daily travelers.

Rising Consumer Preference for Sustainability

Sustainability-focused consumers strongly influence the Denmark EV Market. Increasing awareness of climate change, air pollution, and fuel dependency motivates households to switch to EVs. Younger demographics, particularly urban residents, view EVs as a lifestyle choice reflecting environmental responsibility. The availability of affordable EV models across passenger car segments enhances accessibility. Corporate fleets also prefer EVs to meet sustainability reporting standards and improve brand image. Growing consumer confidence in EV performance and declining battery costs amplify long-term adoption momentum.

Key Trends & Opportunities

Shift Toward Fleet Electrification

The Denmark EV Market is experiencing a shift toward corporate fleet electrification. Businesses are increasingly replacing fuel-powered fleets with BEVs and PHEVs to comply with EU carbon targets. Logistics operators, ride-hailing services, and rental providers adopt EVs for cost savings and brand positioning. This creates opportunities for automakers and charging service providers to offer fleet-specific solutions. Government-backed incentives for fleet conversion further strengthen this trend, positioning corporate adoption as a significant growth opportunity.

- For instance, Movia, Denmark’s largest public transport operator, reached 50% electrification of its bus fleet by adding 66 new electric buses, cutting annual CO₂ emissions by 3,100 tonnes and covering over 51 million emission-free kilometers yearly.

Technological Advancements in EV Batteries

Battery innovation creates major opportunities for the Denmark EV Market. Improved energy density, faster charging, and declining battery costs expand EV affordability and usability. Solid-state batteries under development promise longer ranges and enhanced safety, boosting consumer confidence. Automakers in Denmark are collaborating with global suppliers to integrate next-generation batteries into models. This trend enhances vehicle performance, addresses range limitations, and supports broader adoption. Advancements in recycling technologies also present opportunities to secure a sustainable battery supply chain.

- For instance, Northvolt inaugurated its recycling plant Revolt Ett in Sweden, capable of recovering 125,000 tonnes of battery materials per year, helping secure a sustainable supply chain for European EV manufacturers, including those in Denmark.

Key Challenges

High Upfront Costs of EVs

Despite subsidies, high upfront vehicle costs remain a challenge in the Denmark EV Market. EV models often carry higher purchase prices than conventional cars, limiting accessibility for price-sensitive buyers. Small households may hesitate to invest in EVs despite long-term fuel savings. Although battery costs are declining, affordability remains a significant barrier. This challenge particularly impacts rural buyers with lower income levels. Overcoming high initial costs requires continued government incentives and broader availability of low-cost EV models.

Charging Infrastructure Gaps in Rural Areas

Urban Denmark enjoys strong charging infrastructure, but rural regions still face accessibility gaps. Limited charging points create range anxiety among buyers outside major cities. This uneven distribution of infrastructure slows adoption in suburban and remote areas. Long travel distances in rural communities further highlight the need for reliable fast-charging stations. Addressing these disparities requires targeted public and private investment. Without balanced infrastructure growth, adoption will remain concentrated in urban centers, limiting overall market expansion.

Dependence on Global Supply Chains

The Denmark EV Market depends heavily on global supply chains for batteries and components. Disruptions in raw material sourcing, particularly lithium, cobalt, and nickel, create price volatility and supply risks. Dependence on foreign manufacturing, primarily from Asia, raises vulnerability to geopolitical tensions and logistics disruptions. These factors threaten timely vehicle deliveries and price stability. Building regional supply partnerships and investing in recycling systems are critical to reducing reliance on external suppliers and ensuring long-term resilience.

Regional Analysis

Northern Denmark

Northern Denmark accounted for 18% market share in 2024, supported by regional policies encouraging clean mobility adoption. The presence of renewable energy projects aligns with EV growth and reinforces consumer trust in sustainable transport. Charging networks in urban hubs such as Aalborg help address range concerns for private and corporate buyers. The Denmark EV Market in this region is driven by government fleet transition programs and rising interest from logistics operators. It continues to benefit from infrastructure expansion and local incentives, making it a vital growth area.

Central Denmark

Central Denmark held 27% market share in 2024, positioning it as one of the strongest regions for EV adoption. Aarhus, the second-largest city, leads demand with its smart city initiatives and strong corporate presence. It supports a mix of BEVs and PHEVs, appealing to both households and fleet operators. The Denmark EV Market in Central Denmark benefits from investments in public charging stations, workplace charging facilities, and regional mobility programs. It remains attractive for automakers and service providers aiming to expand their consumer base.

Southern Denmark

Southern Denmark contributed 22% market share in 2024, led by transport corridors that connect Denmark to Germany. The region’s adoption of EVs is supported by cross-border traffic electrification and government-backed sustainability projects. It plays a strategic role in logistics and commercial fleets adopting PHEVs and BEVs. The Denmark EV Market in Southern Denmark benefits from charging hubs located along highways and urban centers. Rising awareness among private buyers adds further momentum to the region’s market performance.

Copenhagen and Zealand

Copenhagen and Zealand dominated with 33% market share in 2024, making it the largest contributor to EV adoption in the country. Copenhagen, Denmark’s capital, sets the pace with strict emission targets and widespread use of EV-friendly urban infrastructure. Strong charging station density and high household incomes support BEV preference in the region. The Denmark EV Market here is also boosted by corporate electrification projects and public transport modernization. It continues to lead demand with sustainable mobility initiatives and advanced technology integration.

Market Segmentations:

By Powertrain

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Others (Fuel Cell EVs, Mild Hybrids, etc.)

By End User

- Private Buyers

- Corporate Buyers

By Region

- Northern

- Central

- Southern

- Copenhagen and Zealand

Competitive Landscape

The Denmark EV Market is highly competitive, shaped by global automakers, regional players, and emerging startups. Leading companies such as Volkswagen, Tesla, BMW, Mercedes-Benz, and Volvo dominate the market through extensive product portfolios and continuous innovation in BEV and PHEV models. Strong presence of Audi, Skoda, and Nissan adds further intensity, with each brand targeting specific consumer segments through differentiated designs and pricing strategies. It is driven by aggressive investments in charging infrastructure partnerships, battery technology upgrades, and fleet electrification solutions. Government policies supporting tax exemptions and incentives create opportunities for new entrants and accelerate rivalry among established brands. Corporate buyers increasingly favor brands with strong service networks and proven sustainability performance, pushing manufacturers to compete beyond vehicle offerings. Strategic collaborations, localized marketing, and aftersales services remain crucial factors that define competitive positioning in Denmark’s evolving EV landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Volkswagen

- BMW AG

- Mercedes-Benz

- Tesla

- Volvo

- Audi

- Skoda

- Nissan Motor Co., Ltd.

- Geely Holding

- Other

Recent Developments

- In July 2025, Danish energy company OK partnered with Techniche EV to deploy a maintenance platform across 4,100 public charging stations to enhance uptime.

- In May 2025, Clever and PowerGo formed a partnership, granting Clever One customers free access to PowerGo’s EV charging network across Denmark.

- In March 2025, Changan Automobile introduced its electric SUV model Deepal S07 in Denmark among other European markets, supported by expanded sales and service networks.

- In June 2025, PowerGo added over 300 new charging points across Danish municipalities Ikast-Brande, Haderslev, Varde, and Vejen to strengthen the public EV charging network.

Report Coverage

The research report offers an in-depth analysis based on Powertrain, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Denmark will witness stronger adoption of BEVs supported by charging infrastructure expansion.

- Corporate fleets will accelerate electrification to align with sustainability and emission targets.

- Government incentives will continue to drive household adoption of electric vehicles.

- PHEVs will maintain relevance among buyers seeking dual fuel flexibility.

- Technological improvements in battery efficiency will enhance range and reduce charging times.

- Urban regions like Copenhagen will remain the strongest hubs for EV penetration.

- Rural adoption will increase as investments improve charging availability outside major cities.

- Automakers will expand affordable EV models to capture price-sensitive consumer groups.

- Partnerships between energy companies and automakers will strengthen the charging ecosystem.

- The competitive landscape will intensify as global and regional brands expand product portfolios.