Market Overview

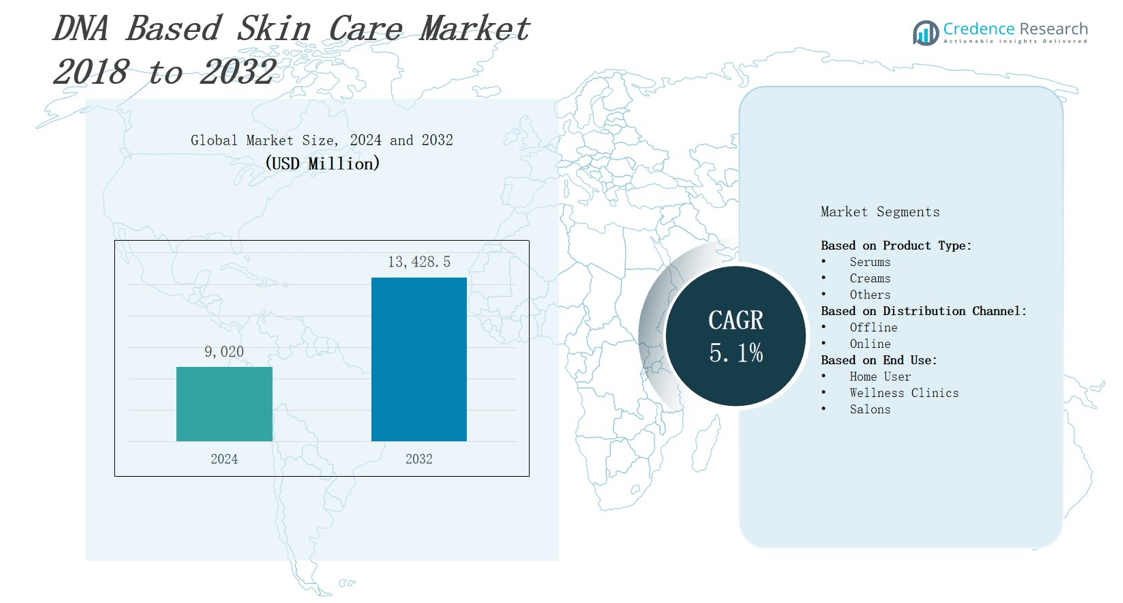

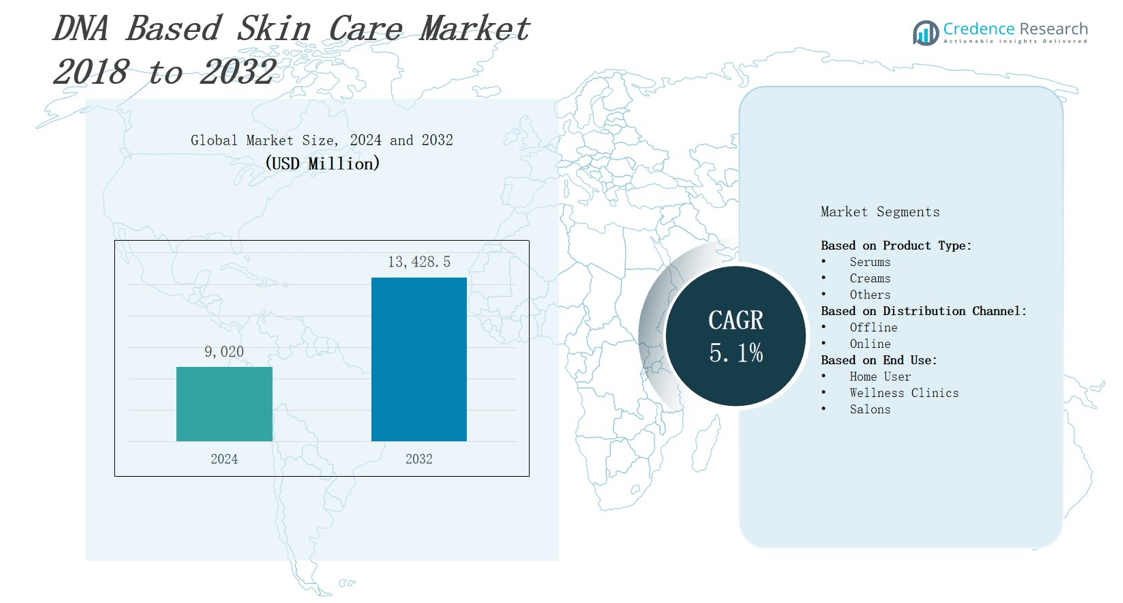

In 2024, the dna based skin care market was valued at USD 9,020 million and is projected to grow to USD 13,428.5 million by 2032 at a CAGR of 5.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DNA-Based Skin Care Market Size 2024 |

USD 9,020 million |

| DNA-Based Skin Care Market, CAGR |

5.1% |

| DNA-Based Skin Care Market Size 2032 |

USD 13,428.5 million |

Rising consumer demand for personalization drives the dna based skin care market, as brands leverage genomic insights to tailor formulations. Technological advances in DNA sequencing and analytics empower companies to deliver targeted treatments and improve efficacy. Growing awareness of skin health and preventive care motivates adoption of genetically informed products. Partnerships between biotech firms and cosmetic manufacturers accelerate innovation and expand product portfolios. At-home genetic testing kits and AI-powered platforms enhance customer engagement, streamline customization processes. Sustainability concerns prompt development of novel clean ingredients. Market players invest in robust research collaborations and digital platforms to differentiate offerings and seize opportunities.

North America dominates with 35% share, driven by advanced healthcare infrastructure and high consumer demand. Europe follows at 25% thanks to robust R&D and established cosmetic brands. Asia Pacific holds 20% fueled by rising incomes and digital adoption. Latin America and Middle East & Africa each account for 10%, supported by growing wellness awareness. The dna based skin care market features key players such as SkinGenie Pvt Ltd, DNA Skin Institute, ALLÉL, Anake, Targeted DNA, Jinomz, dnaskin, SKINSHIFT, LifeNome Inc., SkinDNA, Genetic Beauty, and Evergreen Health Solutions Ltd.

Market Insights

- DNA based skin care market reached USD 9,020 million in 2024 and will hit USD 13,428.5 million by 2032 at 5.1 % CAGR.

- Genomic personalization drives the dna based skin care market by delivering targeted treatments for aging, sensitivity, and pigmentation.

- Faster DNA sequencing and AI analytics enable precise formulations via matching genetic variants with optimal active‑ingredient concentrations.

- Biotech‑cosmetic partnerships co‑develop serums and masks, backed by clinical trials that validate product claims and efficacy.

- At‑home genetic kits and AI‑powered platforms streamline customization, boost engagement, and expand direct‑to‑consumer channels.

- Focus on sustainability pushes brands to use botanical extracts, biodegradable carriers, and eco‑friendly packaging in formulations.

- North America leads with 35 % share, Europe follows at 25 %, Asia Pacific holds 20 %, Latin America and MEA each secure 10 %; key players include SkinGenie, DNA Skin Institute, ALLÉL.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Genomic Personalization Drives Consumer Engagement

Brands in the dna based skin care market leverage genetic analysis to tailor products to individual skin profiles. It empowers researchers to identify unique biomarkers and select active compounds with precision. Consumers gain confidence when products respond specifically to their DNA data. It supports targeted treatments for concerns like aging, sensitivity, and pigmentation. Companies highlight personalized benefits through scientific validation. This approach drives higher satisfaction and repeat purchases across demographics.

- For instance, Anake tests more than 15 genetic markers through a DNA kit and combines this data with advanced skin imaging technology to create customized skincare routines.

Technological Innovation Enhances Precision Formulations

Advances in sequencing speed and cost reduction accelerate progress in the dna based skin care market. It enables rapid interpretation of complex genetic data by AI platforms. Firms develop software that matches genetic variants with optimal ingredient concentrations. It reduces development cycles and optimizes efficacy. Bioinformatics tools analyze millions of data points to predict skin responses. This integration of technology and science fosters robust solution pipelines. Researchers refine outcomes continually.

- For instance, L’Oréal uses integrated omics data analysis—combining genomic, epigenetic, proteomic, and metabolomic information—to predict skincare treatment efficacy and tailor formulations to individual responses, improving outcomes.

Industry Collaborations Accelerate Product Development

Biotech firms partner with cosmetic companies to innovate within the dna based skin care market. Joint ventures combine genomic expertise and formulation capabilities. It supports co development of novel serums and masks. Academic institutions supply validation through clinical trials that strengthen product claims. Investors fund strategic alliances to drive rapid commercialization. It fosters shared risk and resource allocation. Collaborative platforms unite cross functional teams to streamline regulatory approval process.

Consumer Awareness Fuels Market Adoption

Consumer interest in preventive health drives demand within the dna based skin care market. Educated buyers research genetic reports before purchasing. It promotes transparency when brands publish testing methods and clinical data. Social media channels showcase personalized success stories and reviews. It elevates trust and broadens reach. Health influencers collaborate with companies to highlight targeted regimens. This momentum spurs mainstream retailers to stock DNA premium informed products alongside traditional lines.

Market Trends

Data-Driven Consumer Insights Shape Demand

Brands collect consumer genetics data to tailor skin care. The dna based skin care market responds to demand for personalized regimens. It uses insights from DNA tests to match active compounds to individual concerns. Companies maintain transparent reporting on methodology and outcomes. It fosters trust through published clinical results. Influencer feedback and social proof increase peer awareness. This trend promotes adoption in premium and mainstream segments.

- For instance, Anake uses an end-to-end DNA testing kit analyzing over 15 genetic markers combined with advanced skin imaging technology to formulate bespoke skincare routines, providing transparency through expert consultations and clinical validation.

AI-Powered Analysis Optimizes Formulations

Genetic algorithms process complex variant data to guide ingredient selection. The dna based skin care market benefits from machine learning platforms that validate efficacy predictions. It employs software to integrate genomic markers with dermatological research. Firms shorten development timelines and reduce trial costs. It ensures precise concentration of antioxidants and peptides in formulations. Regulatory bodies review validation protocols to maintain safety. This trend drives robust product pipelines.

- For instance, L’Oréal uses integrated omics data—including genomic, epigenetic, proteomic, and metabolomic markers—to predict treatment efficacy, enabling tailored product development that improves outcomes by identifying biomarkers related to success or failure of treatments.

At‑Home Testing Kits Expand Accessibility

Home DNA kits provide user friendly sample collection and rapid results. The dna based skin care market relies on direct‑to‑consumer channels to broaden reach. It connects customers with tailored treatment plans through digital portals. Dermatologists offer hybrid consultations that merge genetic reports with skin imaging. It reduces barriers that once limited personalized care. Retail partnerships integrate testing services into beauty stores. This approach boosts market penetration globally.

Sustainability Focus Influences Product Design

Biodegradable carriers and eco‑safe ingredients gain preference in the dna based skin care market. It encourages brands to swap synthetic polymers for botanical extracts and bio resin. Companies invest in renewable supply chains and transparent sourcing policies. It supports carbon neutrality goals and improves brand reputation. Consumer surveys emphasize clean‑label claims and minimal packaging waste. It drives competitive differentiation among premium offerings. This trend aligns product design with environmental values.

Market Challenges Analysis

Stringent Regulatory Requirements and Data Privacy Concerns

Brands in the dna based skin care market face stringent regulatory requirements that vary across regions. It demands robust compliance frameworks and lengthy approval cycles. Companies must secure consumer consent for genetic data collection and follow strict privacy laws. Regulators review test accuracy and product claims before granting market access. It increases development costs and delays product launches. Firms invest in legal teams to navigate evolving policies. Consumers expect transparency in data handling and secure storage practices. It forces organizations to implement advanced encryption systems, conduct regular audits under costly schedules, and enforce vendor oversight to secure third‑party data and maintain stakeholder confidence. Cross‑border genetic data transfers encounter additional restrictions that inhibit global research collaborations.

High Development Costs and Consumer Skepticism

High development costs challenge broader adoption in the dna based skin care market. It requires investment in sequencing equipment and bioinformatics infrastructure. Personalized formulations involve expensive clinical validation and specialized ingredients. Companies negotiate pricing strategies to balance affordability and profit margins. It forces brands to deliver clear value propositions to justify premium pricing. Consumers often doubt genetic tests’ accuracy and real benefits. Firms launch education campaigns to build trust and clarify scientific basis. It demands partnerships with specialized testing labs and ongoing method validation to maintain quality. Companies experiment with scalable manufacturing processes to reduce per‑unit costs. Investors monitor ROI and push for streamlined workflows to improve margin potential.

Market Opportunities

Bioinformatic Platform Integration Fuels Customized Solutions

Companies integrate bioinformatics platforms to enhance product precision. It allows real‑time analysis of genetic markers and skin phenotype. Firms in the dna based skin care market partner with biotech and AI startups. They develop targeted serums and treatment protocols. Subscription models deliver customized product deliveries. Investors fund R&D collaborations that leverage genomic databases. Brands differentiate through diagnostic apps that recommend regimens. It supports multi‑omics data integration to refine personalization further. Teams explore partnerships with academic consortia to access broader genotype‑phenotype correlations.

Emerging Markets and Hybrid Wellness Models Expand Reach

Firms in the dna based skin care market expand into Asia and Latin America to access new consumer segments. It aligns with rising health consciousness and digital adoption. Teledermatology services embed genetic profiling in virtual consultations. Brands offer hybrid wellness programs that merge DNA insights with lifestyle coaching. Retailers deploy in‑store kiosks for on‑the‑spot genetic testing. They broaden distribution channels beyond online direct sales. Partnerships with healthcare providers strengthen credibility and reach. It supports mobile sampling units that improve community engagement and collect diverse genomic data to tailor products for underserved populations.

Market Segmentation Analysis:

By Product Type

Serums capture significant revenue in the dna based skin care market due to their high potency and rapid absorption. It targets cellular repair through concentrated active compounds. Creams maintain hydration and deliver DNA‑specific peptides to support barrier function. Others include masks and gels that complement core formulations and address niche concerns. Brands allocate R&D budgets to refine serum textures and optimize cream stability. It drives differentiation through unique delivery mechanisms.

- For example, EpigenCare’s SKINTELLI test offers a direct-to-consumer DNA test that measures gene activity related to skin aging, moisture, pigmentation, and repair through epigenetic mechanisms.

By Distribution Channel

Offline retail channels maintain strong influence in the dna based skin care market through hands‑on consultations and sample testing. It supports brand engagement via in‑store staff training and educational displays. Online platforms gain traction when they offer personalized quizzes and direct‑to‑consumer genetic kits. E‑commerce sites integrate secure data portals to share results and recommend products. Brands expand partnerships with select retailers and digital marketplaces. It enhances user convenience and broadens geographic reach.

- For instance, SkinDNA offers in-clinic genetic testing for skin concerns such as UV damage and sensitivity, supported by trained staff who guide product selection, driving significant offline sales.

By End Use

Home users drive demand in the dna based skin care market through purchase of genetic test kits and tailored regimens for daily care. It allows individuals to address concerns such as sensitivity and premature aging. Wellness clinics adopt professional‑grade DNA analysis tools to guide advanced treatments. Salons incorporate genetic reports to customize facials and skin therapies. Brands develop training programs for clinicians to apply test insights. It elevates treatment precision and client satisfaction.

Segments:

Based on Product Type:

Based on Distribution Channel:

Based on End Use:

- Home User

- Wellness Clinics

- Salons

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America secures the largest share at 35% in the dna based skin care market. It leverages advanced healthcare networks and high consumer awareness. It fosters partnerships with clinics and technology providers. Europe holds 25%, Asia Pacific 20%, Latin America 10%, Middle East & Africa 10%. It drives innovation through regulatory support and dedicated funding. It supports direct‑to‑consumer models alongside offline consultations. It commits to clinical validation to strengthen consumer trust.

Europe

Europe claims a 25% share in the dna based skin care market due to robust R&D investments. It emphasizes genomic research centers and academic collaborations. It enforces strict data privacy and regulatory guidelines that shape product development. North America holds 35%, Asia Pacific 20%, Latin America 10%, Middle East & Africa 10%. It features leading cosmetic brands that integrate genetic insights. It adapts formulations to local skin types through clinical trials. It expands distribution via specialist retailers and digital platforms.

Asia Pacific

Asia Pacific accounts for 20% share in the dna based skin care market driven by income growth and digital adoption. It benefits from mobile genetic test services and expanding teledermatology. It offers hybrid wellness packages that merge DNA reports with lifestyle advice. North America holds 35%, Europe 25%, Latin America 10%, Middle East & Africa 10%. It attracts foreign investment in personalized beauty ventures. It supports local startups developing cost‑effective sequencing solutions. It anticipates further growth through e‑commerce expansion and regional partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SkinGenie Pvt Ltd. (India)

- DNA Skin Institute (USA)

- ALLÉL (Sweden)

- Anake (Singapore)

- Targeted DNA (USA)

- Jinomz (Turkey)

- dnaskin (USA)

- SKINSHIFT (USA)

- LifeNome Inc. (USA)

- SkinDNA (Australia)

- Genetic Beauty (USA)

- Evergreen Health Solutions Ltd. (UK)

Competitive Analysis

Leading firms differentiate through proprietary genomic platforms that analyze individual DNA profiles to recommend precise skin treatments. It emphasizes partnerships with clinical dermatologists and research institutions to validate efficacy. Companies such as SkinGenie Pvt Ltd. and DNA Skin Institute secure exclusive variant databases to protect intellectual property and enhance product pipelines. Firms invest in AI tools that integrate genetic data with skin assessments to propose tailored serums and creams. They expand distribution through direct‑to‑consumer portals and premium offline kiosks. Brands publish clinical trial results and secure regulatory clearances to strengthen credibility. They adopt subscription models to ensure repeat engagement and gather longitudinal data. It pressures new entrants to demonstrate clear scientific value and rapid innovation to compete effectively.

Recent Developments

- In April 2023, MapMyGenome introduced BeautyMap™, India’s first DNA‑based test that delivers tailored skin and hair care recommendations alongside genetic counseling.

- In September 2024, Beiersdorf unveiled the Eucerin Hyaluron‑Filler Epigenetic Serum with its proprietary “Age Clock” technology to assess and target biological skin aging.

- In October 2024, SkinBB launched a skincare metaverse that leverages AI and virtual consultations to offer personalized regimen guidance in an interactive digital space.

- In March 2025, L’Oréal Groupe partnered with TruDiagnostic to study epigenomic markers and beauty indicators for longevity‑focused DNA‑based skincare solutions.

Market Concentration & Characteristics

The dna based skin care market shows a moderate concentration with a handful of specialized biotech and beauty companies controlling major genomic platforms and distribution channels. It features leading firms that hold proprietary DNA databases and advanced bioinformatic tools, securing high entry barriers. Mid‑tier brands collaborate through licensing agreements and white‑label offerings to access genetic insights. It supports strategic partnerships with research institutions to refine product pipelines and validate efficacy. Distribution channels split between direct‑to‑consumer digital portals and selective offline kiosks. Clinical dermatologists endorse high‑end formulations while home testing kits drive consumer engagement. It demands rigorous regulatory compliance and data privacy standards, which create cost hurdles for newcomers. Investors target established players with proven accuracy and strong brand recognition. It encourages niche startups to innovate around sustainable ingredients and specialized clinical services. This structure balances innovation with barriers, shaping a dynamic yet controlled market environment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brands will collaborate with biotech firms to integrate advanced genomic profiling into personalized skincare solutions.

- Teledermatology providers will embed genetic reports in virtual consultations and deliver targeted skincare recommendations.

- Direct-to-consumer platforms will introduce subscription services deliver customized treatment regimens based on individual DNA profiles.

- Retailers will install in‑store kiosks enabling consumers to access genetic tests for personalized skincare solutions.

- AI platforms refine ingredient selection by correlating genomic markers with efficacy data to optimize formulations.

- Wearable sensors integrate skin metrics with DNA insights to provide real‑time guidance for skincare routines.

- Wellness clinics will adopt integrated genetic profiling tools to customize treatments and enhance clinical outcomes.

- Sustainability will drive brands to adopt ingredients and recyclable packaging for DNA‑based skin care products.

- Regulatory agencies will define protocols for genetic accuracy and data privacy to ensure consumer protection.

- Emerging markets will adopt genetic testing services and virtual consultations to deliver personalized skincare guidance.