Market Overview

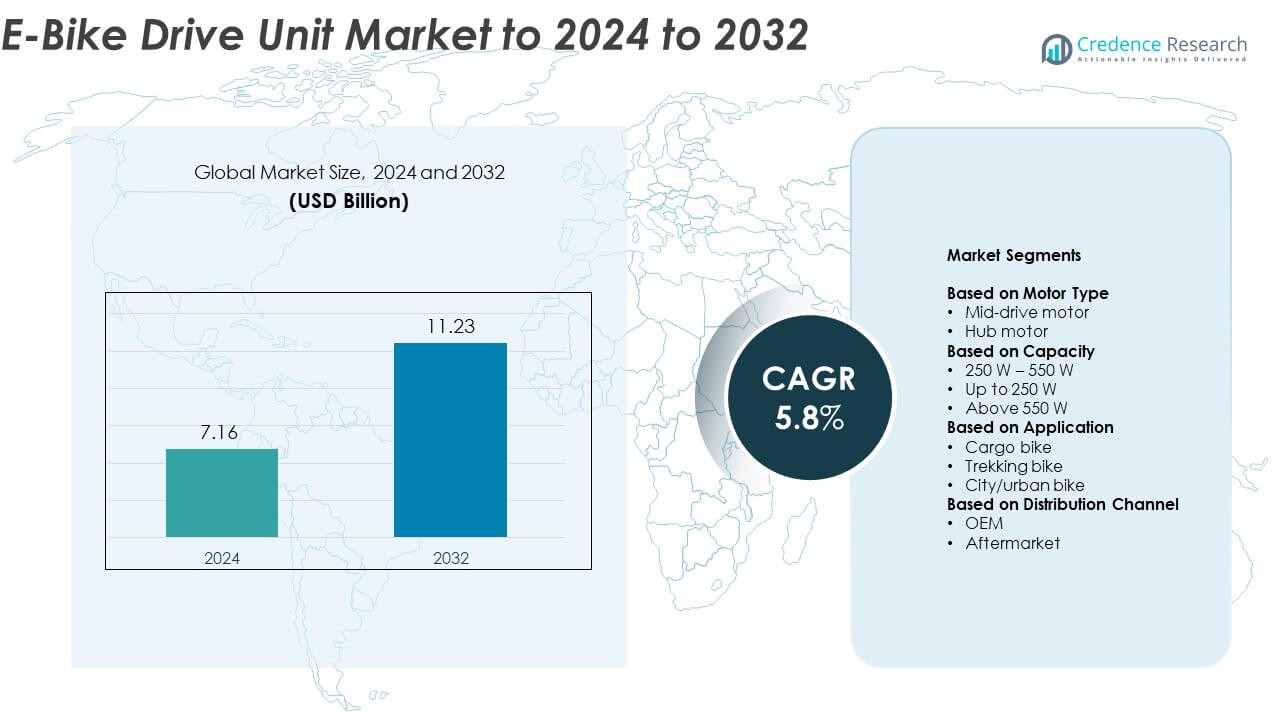

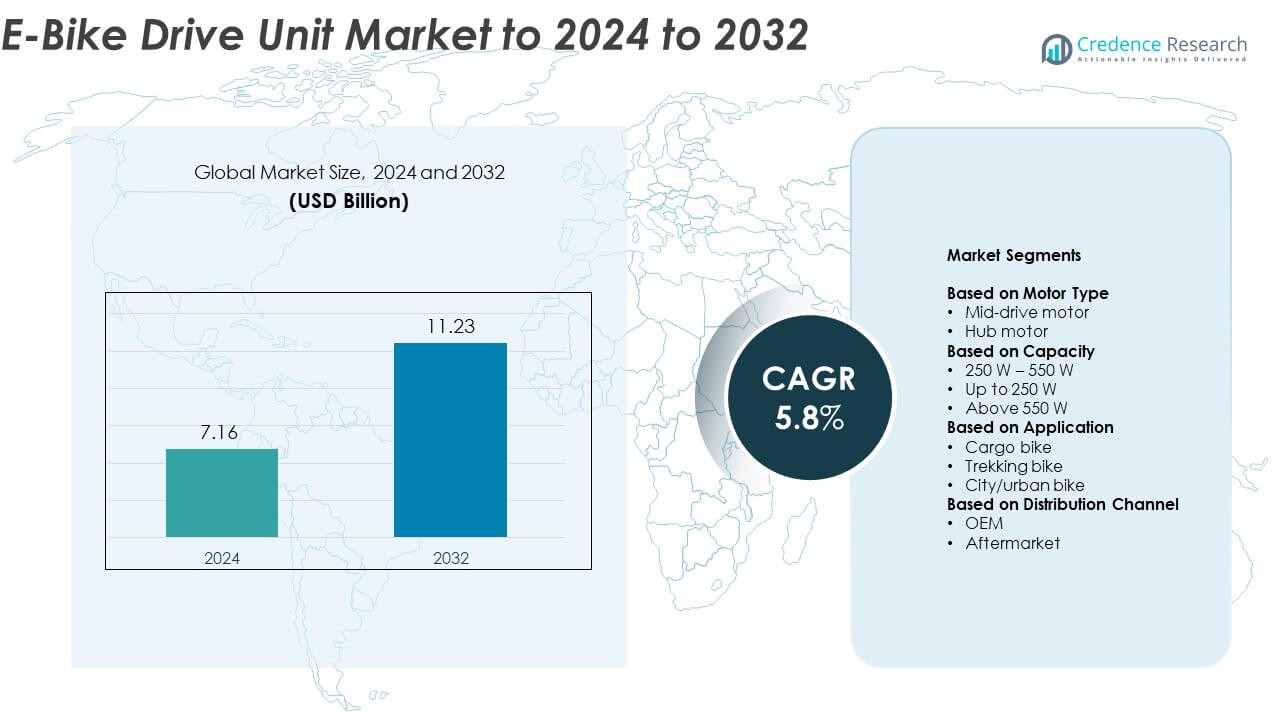

The E-Bike Drive Unit market size was valued at USD 7.16 Billion in 2024 and is anticipated to reach USD 11.23 Billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-Bike Drive Unit Market Size 2024 |

USD 7.16 Billion |

| E-Bike Drive Unit Market, CAGR |

5.8% |

| E-Bike Drive Unit Market Size 2032 |

USD 11.23 Billion |

The E-Bike Drive Unit market is led by major players including Robert Bosch, Shimano Inc., Yamaha, Panasonic, Bafang, Mahle GmbH, Bros, Dapu Motors, Suzhou Xiongda, and TDCM. These companies dominate through advanced motor technologies, extensive OEM collaborations, and strong product reliability. Europe remains the leading region, accounting for approximately 39.7% share in 2024, driven by widespread adoption of sustainable mobility and strong cycling infrastructure. Asia-Pacific follows with 31.4% share, supported by large-scale manufacturing and rising urban e-bike use. North America holds 21.6% share, driven by growing interest in eco-friendly transportation and premium electric bike models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The E-Bike Drive Unit market was valued at USD 7.16 Billion in 2024 and is projected to reach USD 11.23 Billion by 2032, growing at a CAGR of 5.8%.

- Growing demand for eco-friendly and cost-efficient transportation is driving market growth, supported by government incentives promoting electric mobility.

- Advancements in mid-drive motor technology and integration of smart connectivity features are shaping future trends in the market.

- The market is competitive with leading manufacturers focusing on innovation, torque optimization, and partnerships with OEMs to enhance product offerings.

- Europe leads with a 39.7% share in 2024, followed by Asia-Pacific with 31.4% and North America with 21.6%, while the mid-drive motor segment holds the dominant 61.3% share.

Market Segmentation Analysis:

By Motor Type

The mid-drive motor segment dominates the E-Bike Drive Unit market, accounting for nearly 61.3% share in 2024. This dominance is driven by its superior weight distribution, higher torque output, and improved energy efficiency compared to hub motors. Mid-drive systems enhance climbing performance and ride stability, making them ideal for trekking and performance-oriented e-bikes. Growing adoption among premium e-bike manufacturers and increasing consumer preference for smooth power delivery further reinforce the leadership of mid-drive motors in both developed and emerging markets.

- For instance, Bosch Performance Line CX (current generation) delivers 85 Nm of torque at approximately 2.8 kg of weight.

By Capacity

The 250 W – 550 W segment leads the market with approximately 47.5% share in 2024. This range offers a balanced blend of power and efficiency suitable for urban commuting and moderate off-road rides. Manufacturers prefer this category due to compliance with global e-bike regulations and optimized energy consumption. Rising demand for versatile models capable of handling varied terrains without compromising battery life supports the dominance of this capacity range. Technological upgrades in mid-range motors continue to boost their efficiency and popularity.

- For instance, Shimano EP8 is rated 250 W and outputs 85 Nm.

By Application

City or urban bikes hold the largest share of about 52.8% in 2024, reflecting the growing use of e-bikes for daily commuting and short-distance travel. Rising urban congestion and the push for eco-friendly mobility solutions have accelerated adoption in metropolitan areas. These bikes offer compact designs, efficient motors, and cost-effective operation, aligning with sustainability initiatives. Governments across Europe and Asia are supporting urban e-bike use through subsidies and infrastructure improvements, further driving demand in this segment.

Key Growth Drivers

Rising Demand for Sustainable Urban Mobility

The global shift toward eco-friendly transportation is a primary growth driver for the E-Bike Drive Unit market. Increasing environmental awareness, coupled with government incentives for electric mobility, has accelerated e-bike adoption in urban areas. Cities worldwide are expanding cycling infrastructure, making e-bikes a preferred choice for short-distance commuting. The surge in fuel prices and carbon emission concerns further strengthen the demand for efficient and clean mobility solutions, positioning e-bike drive units as a vital component of the green transport transition.

- For instance, the TQ-HPR50 system weighs 3,900 g in total (motor at approximately 1,850 g and 360 Wh battery at approximately 1,830 g) and delivers 50 Nm of torque.

Technological Advancements in Motor Efficiency

Ongoing innovation in motor design, such as torque sensors and integrated smart control systems, is boosting market growth. Modern drive units now offer enhanced torque output, longer battery life, and improved connectivity features for riders. Lightweight materials and advanced cooling mechanisms are improving performance and durability. These innovations enable smoother power delivery and better riding experience, encouraging adoption across both premium and mid-range e-bike categories. Manufacturers continue to focus on intelligent drive units for adaptive riding conditions.

- For instance, Brose Drive S Mag produces 90 Nm of torque and has a unit weight of approximately 2,900 g (2.9 kg) due to its innovative magnesium casing.

Expansion of E-Bike Infrastructure and OEM Collaborations

The rapid development of e-bike infrastructure and collaborations between motor manufacturers and OEMs are accelerating market expansion. Governments are investing in dedicated bike lanes, charging points, and urban mobility programs that support e-bike usage. OEM partnerships help integrate customized drive units into specific e-bike models, ensuring superior performance and standardization. The availability of extensive dealer networks and after-sales services also enhances consumer confidence, leading to sustained market growth across Asia-Pacific and Europe.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

Smart e-bike systems equipped with GPS tracking, mobile connectivity, and IoT-based analytics are emerging as a major trend. Integration of drive units with digital platforms allows performance monitoring, predictive maintenance, and real-time diagnostics. These advancements enhance user experience and safety while supporting fleet operators in managing electric bike-sharing systems efficiently. Growing adoption of app-connected e-bikes is expected to create new opportunities for drive unit manufacturers focusing on data-driven, intelligent mobility solutions.

- For instance, the updated MAHLE X20 system features a motor that delivers a comparable performance to a mid-drive system with 65 Nm of equivalent torque, while its actual torque output at the wheel is approximately 27 Nm.

Rising Popularity of High-Torque Mid-Drive Systems

High-torque mid-drive units are gaining popularity among performance and cargo bike users. Their ability to deliver superior climbing power and balanced weight distribution enhances stability and efficiency. Manufacturers are leveraging this trend to introduce compact yet powerful mid-drive motors catering to diverse applications, from trekking to logistics. As consumer preference shifts toward premium riding experiences, this trend presents strong opportunities for drive unit producers focusing on precision engineering and adaptive torque control systems.

- For instance, The Bafang M620 (G510) is a high-power mid-drive motor that typically reaches a maximum torque of 160 Nm (some official documentation specifies up to 170 Nm), offers continuous rated power outputs of 750 W or 1000 W, and the bare motor unit weighs approximately 6.7 kg.

Key Challenges

High Cost of Advanced Drive Systems

The premium pricing of high-performance drive units remains a key challenge for widespread market penetration. Advanced systems featuring integrated sensors, smart controls, and lightweight materials increase overall e-bike costs, limiting adoption in developing economies. Cost-sensitive markets often prefer low-end hub motors, reducing revenue potential for high-end manufacturers. Balancing affordability with innovation remains a major concern, pushing producers to optimize production and supply chain efficiency while maintaining competitive quality standards.

Limited Battery Range and Power Management Issues

Battery capacity constraints and energy efficiency challenges affect the performance of e-bike drive units. High torque demand in uphill or cargo applications can drain batteries faster, leading to shorter travel ranges. Despite improvements in lithium-ion technology, range anxiety remains prevalent among users. Manufacturers are focusing on energy optimization algorithms and regenerative braking systems to overcome these limitations. However, ensuring consistent performance across varying terrains and weather conditions continues to be a major technical hurdle.

Regional Analysis

North America

North America accounts for around 21.6% share of the E-Bike Drive Unit market in 2024. The region benefits from rising health awareness, sustainable commuting preferences, and increasing adoption of electric mobility solutions. The United States leads due to strong demand for high-performance and cargo e-bikes, supported by favorable city-level electrification initiatives. Canada is also witnessing notable growth with expanding e-bike infrastructure and incentive programs. Continuous investment by OEMs in lightweight and efficient mid-drive motors supports regional expansion, while aftermarket upgrades further enhance market opportunities across metropolitan areas.

Europe

Europe dominates the E-Bike Drive Unit market with approximately 39.7% share in 2024, driven by strong environmental policies and advanced cycling infrastructure. Countries such as Germany, the Netherlands, and France lead due to widespread e-bike adoption for daily commuting. The region’s focus on sustainable mobility and emission reduction under EU Green Deal initiatives continues to support market expansion. European manufacturers are at the forefront of developing innovative mid-drive systems with enhanced torque and efficiency. Rising urban congestion and government-backed subsidy programs further stimulate sales of premium e-bikes across the continent.

Asia-Pacific

Asia-Pacific holds about 31.4% share of the global market, making it one of the fastest-growing regions. China dominates production and consumption due to strong local manufacturing capabilities and high population density in urban centers. Japan and South Korea are experiencing rapid adoption of compact and smart-connected e-bikes, supported by strong OEM networks. Government support for electric mobility and growing environmental awareness further boost demand. Continuous technological advancements and cost-effective motor designs strengthen the region’s position as a key manufacturing and export hub for e-bike drive units.

Latin America

Latin America represents nearly 4.3% share of the E-Bike Drive Unit market in 2024. The region is witnessing steady growth due to urbanization and increasing awareness of eco-friendly commuting solutions. Brazil, Mexico, and Chile are the leading markets, supported by improving cycling infrastructure and rising interest in electric two-wheelers. Limited purchasing power remains a challenge, yet affordable hub motor solutions are expanding accessibility. Market players are focusing on expanding distribution networks and introducing locally assembled models, which is expected to enhance regional adoption in the coming years.

Middle East & Africa

The Middle East & Africa accounts for around 3.0% share of the market in 2024. Growth is supported by increasing urbanization, rising fuel costs, and the gradual shift toward sustainable transport systems. Countries like the UAE and South Africa are leading adoption through smart city projects and green mobility initiatives. The market remains in a nascent stage but shows strong potential with expanding cycling infrastructure and tourism-related demand. Global manufacturers are exploring partnerships with local assemblers to establish a foothold and address rising interest in e-mobility solutions.

Market Segmentations:

By Motor Type

- Mid-drive motor

- Hub motor

By Capacity

- 250 W – 550 W

- Up to 250 W

- Above 550 W

By Application

- Cargo bike

- Trekking bike

- City/urban bike

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the E-Bike Drive Unit market features prominent players such as Robert Bosch, Shimano Inc., Yamaha, Panasonic, Bafang, Mahle GmbH, Bros, Dapu Motors, Suzhou Xiongda, and TDCM. The market is characterized by continuous innovation, strategic partnerships, and technological advancement in motor design, efficiency, and connectivity. Leading manufacturers are emphasizing smart systems integration, lightweight construction, and enhanced torque performance to cater to diverse e-bike categories. Increasing investment in research and development supports the creation of compact and energy-efficient drive units tailored to different applications such as city, trekking, and cargo e-bikes. Companies are also expanding their global presence through collaborations with OEMs to strengthen product customization and supply reliability. The growing demand for connected e-mobility solutions and regulatory support for sustainable transport are expected to intensify competition, encouraging firms to focus on performance optimization and digital features to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Bafang launched the H730 hub motor featuring a 3-speed automatic gearbox that shifts gears based on riding speed without rider input.

- In 2024, Bosch eBike Systems unveiled new features, including AI-powered navigation and expanded eShift solutions for advanced gear-shifting, as part of their smart system updates for Model Year 2025.

- In 2024, Yamaha Motor’s manufacturing subsidiary in France launched local production of the lightweight and powerful PW-S2 drive units for the European market to streamline logistics and reduce lead times.

Report Coverage

The research report offers an in-depth analysis based on Motor Type, Capacity, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mid-drive motors will continue to grow due to superior efficiency and control.

- Smart connectivity and IoT integration will enhance performance monitoring and maintenance.

- Lightweight and compact motor designs will gain popularity among urban commuters.

- OEM collaborations will increase to deliver customized and integrated drive unit solutions.

- Battery efficiency improvements will extend riding range and reduce charging frequency.

- Government incentives will support e-bike adoption across major urban centers worldwide.

- Advancements in torque sensor technology will improve riding comfort and safety.

- Asia-Pacific will remain a major manufacturing and export hub for drive units.

- The aftermarket segment will expand with growing demand for motor upgrades and replacements.

- Sustainability and emission reduction goals will continue to drive innovation in electric mobility.