CHAPTER NO. 1 : GENESIS OF THE MARKET

1.1 Market Prelude – Introduction & Scope

1.2 The Big Picture – Objectives & Vision

1.3 Strategic Edge – Unique Value Proposition

1.4 Stakeholder Compass – Key Beneficiaries

CHAPTER NO. 2 : EXECUTIVE LENS

2.1 Pulse of the Industry – Market Snapshot

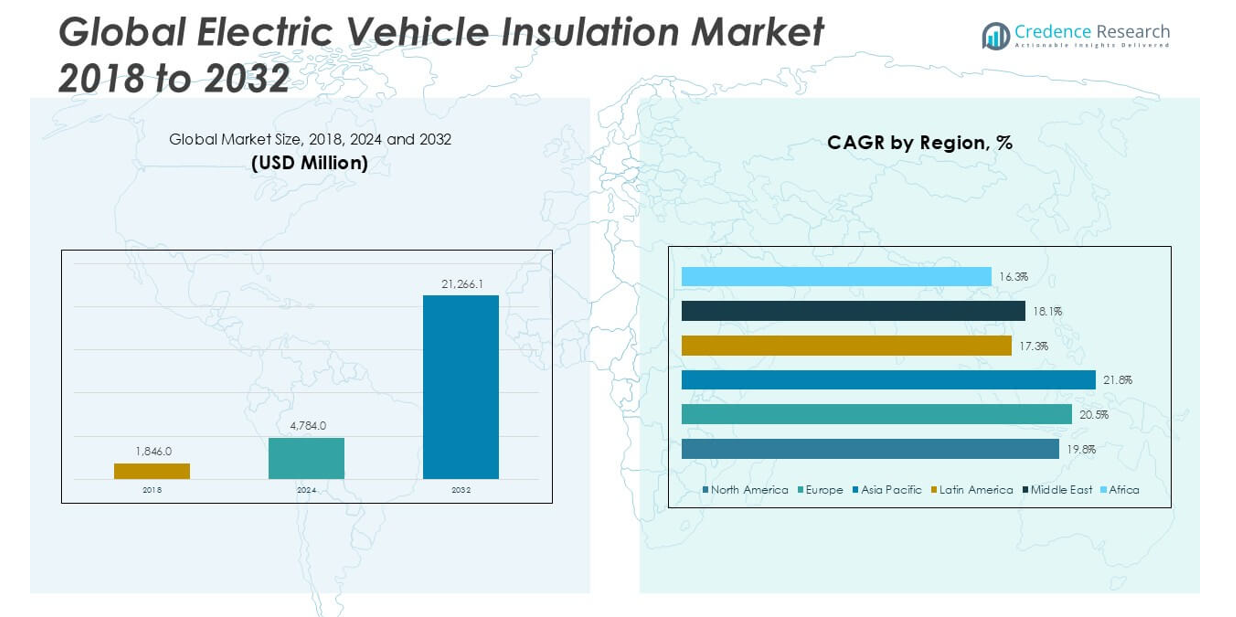

2.2 Growth Arc – Revenue Projections (USD Million)

2.3. Premium Insights – Based on Primary Interviews

CHAPTER NO. 3 : ELECTRIC VEHICLE INSULATION MARKET FORCES & INDUSTRY PULSE

3.1 Foundations of Change – Market Overview

3.2 Catalysts of Expansion – Key Market Drivers

3.2.1 Momentum Boosters – Growth Triggers

3.2.2 Innovation Fuel – Disruptive Technologies

3.3 Headwinds & Crosswinds – Market Restraints

3.3.1 Regulatory Tides – Compliance Challenges

3.3.2 Economic Frictions – Inflationary Pressures

3.4 Untapped Horizons – Growth Potential & Opportunities

3.5 Strategic Navigation – Industry Frameworks

3.5.1 Market Equilibrium – Porter’s Five Forces

3.5.2 Ecosystem Dynamics – Value Chain Analysis

3.5.3 Macro Forces – PESTEL Breakdown

3.6 Price Trend Analysis

3.6.1 Regional Price Trend

3.6.2 Price Trend by product

CHAPTER NO. 4 : KEY INVESTMENT EPICENTER

4.1 Regional Goldmines – High-Growth Geographies

4.2 Product Frontiers – Lucrative Product Categories

4.3 Vehicle Type Sweet Spots – Emerging Demand Segments

CHAPTER NO. 5: REVENUE TRAJECTORY & WEALTH MAPPING

5.1 Momentum Metrics – Forecast & Growth Curves

5.2 Regional Revenue Footprint – Market Share Insights

5.3 Segmental Wealth Flow – Product Type & Vehicle Type Revenue

CHAPTER NO. 6 : TRADE & COMMERCE ANALYSIS

6.1. Import Analysis by Region

6.1.1. Global Electric Vehicle Insulation Market Import Volume By Region

6.2. Export Analysis by Region

6.2.1. Global Electric Vehicle Insulation Market Export Volume By Region

CHAPTER NO. 7 : COMPETITION ANALYSIS

7.1. Company Market Share Analysis

7.1.1. Global Electric Vehicle Insulation Market: Company Market Share

7.1. Global Electric Vehicle Insulation Market Company Volume Market Share

7.2. Global Electric Vehicle Insulation Market Company Revenue Market Share

7.3. Strategic Developments

7.3.1. Acquisitions & Mergers

7.3.2. New Product Launch

7.3.3. Regional Expansion

7.4. Competitive Dashboard

7.5. Company Assessment Metrics, 2024

CHAPTER NO. 8 : ELECTRIC VEHICLE INSULATION MARKET – BY PRODUCT TYPE SEGMENT ANALYSIS

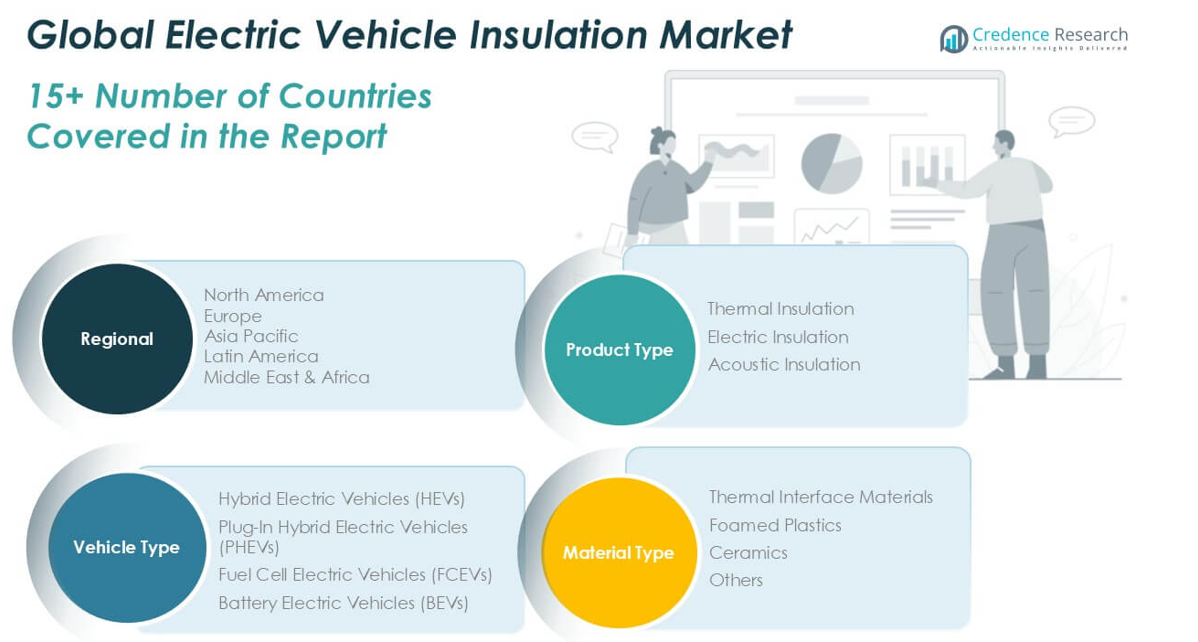

8.1. Electric Vehicle Insulation Market Overview by Product Type Segment

8.1.1. Electric Vehicle Insulation Market Volume Share By Product Type

8.1.2. Electric Vehicle Insulation Market Revenue Share By Product Type

8.2. Thermal Insulation

8.3. Electric Insulation

8.4. Acoustic Insulation

CHAPTER NO. 9 : ELECTRIC VEHICLE INSULATION MARKET – BY VEHICLE TYPE SEGMENT ANALYSIS

9.1. Electric Vehicle Insulation Market Overview by Vehicle Type Segment

9.1.1. Electric Vehicle Insulation Market Volume Share By Vehicle Type

9.1.2. Electric Vehicle Insulation Market Revenue Share By Vehicle Type

9.2. Hybrid Electric Vehicles (HEVs)

9.3. Plug-In Hybrid Electric Vehicles (PHEVs)

9.4. Fuel Cell Electric Vehicles (FCEVs)

9.5. Battery Electric Vehicles (BEVs)

CHAPTER NO. 10 : ELECTRIC VEHICLE INSULATION MARKET – BY MATERIAL TYPE SEGMENT ANALYSIS

10.1. Electric Vehicle Insulation Market Overview by Material Type Segment

10.1.1. Electric Vehicle Insulation Market Volume Share By Material Type

10.1.2. Electric Vehicle Insulation Market Revenue Share By Material Type

10.2. Thermal Interface Materials

10.3. Foamed Plastics

10.4. Ceramics

10.5. Others

CHAPTER NO. 11 : ELECTRIC VEHICLE INSULATION MARKET – REGIONAL ANALYSIS

11.1. Electric Vehicle Insulation Market Overview by Region Segment

11.1.1. Global Electric Vehicle Insulation Market Volume Share By Region

11.1.2. Global Electric Vehicle Insulation Market Revenue Share By Region

11.1.3. Regions

11.1.4. Global Electric Vehicle Insulation Market Volume By Region

11.1.5. Global Electric Vehicle Insulation Market Revenue By Region

11.1.6. Product Type

11.1.7. Global Electric Vehicle Insulation Market Volume By Product Type

11.1.8. Global Electric Vehicle Insulation Market Revenue By Product Type

11.1.9. Vehicle Type

11.1.10. Global Electric Vehicle Insulation Market Volume By Vehicle Type

11.1.11. Global Electric Vehicle Insulation Market Revenue By Vehicle Type

11.1.12. Material Type

11.1.13. Global Electric Vehicle Insulation Market Volume By Material Type

11.1.14. Global Electric Vehicle Insulation Market Revenue By Material Type

CHAPTER NO. 12 : NORTH AMERICA ELECTRIC VEHICLE INSULATION MARKET – COUNTRY ANALYSIS

12.1. North America Electric Vehicle Insulation Market Overview by Country Segment

12.1.1. North America Electric Vehicle Insulation Market Volume Share By Region

12.1.2. North America Electric Vehicle Insulation Market Revenue Share By Region

12.2. North America

12.2.1. North America Electric Vehicle Insulation Market Volume By Country

12.2.2. North America Electric Vehicle Insulation Market Revenue By Country

12.2.3. Product Type

12.2.4. North America Electric Vehicle Insulation Market Volume By Product Type

12.2.5. North America Electric Vehicle Insulation Market Revenue By Product Type

12.2.6. Vehicle Type

12.2.7. North America Electric Vehicle Insulation Market Volume By Vehicle Type

12.2.8. North America Electric Vehicle Insulation Market Revenue By Vehicle Type

12.2.9. Material Type

12.2.10. North America Electric Vehicle Insulation Market Volume By Material Type

12.2.11. North America Electric Vehicle Insulation Market Revenue By Material Type

12.3. U.S.

12.4. Canada

12.5. Mexico

CHAPTER NO. 13 : EUROPE ELECTRIC VEHICLE INSULATION MARKET – COUNTRY ANALYSIS

13.1. Europe Electric Vehicle Insulation Market Overview by Country Segment

13.1.1. Europe Electric Vehicle Insulation Market Volume Share By Region

13.1.2. Europe Electric Vehicle Insulation Market Revenue Share By Region

13.2. Europe

13.2.1. Europe Electric Vehicle Insulation Market Volume By Country

13.2.2. Europe Electric Vehicle Insulation Market Revenue By Country

13.2.3. Product Type

13.2.4. Europe Electric Vehicle Insulation Market Volume By Product Type

13.2.5. Europe Electric Vehicle Insulation Market Revenue By Product Type

13.2.6. Vehicle Type

13.2.7. Europe Electric Vehicle Insulation Market Volume By Vehicle Type

13.2.8. Europe Electric Vehicle Insulation Market Revenue By Vehicle Type

13.2.9. Material Type

13.2.10. Europe Electric Vehicle Insulation Market Volume By Material Type

13.2.11. Europe Electric Vehicle Insulation Market Revenue By Material Type

13.3. UK

13.4. France

13.5. Germany

13.6. Italy

13.7. Spain

13.8. Russia

13.9. Rest of Europe

CHAPTER NO. 14 : ASIA PACIFIC ELECTRIC VEHICLE INSULATION MARKET – COUNTRY ANALYSIS

14.1. Asia Pacific Electric Vehicle Insulation Market Overview by Country Segment

14.1.1. Asia Pacific Electric Vehicle Insulation Market Volume Share By Region

14.1.2. Asia Pacific Electric Vehicle Insulation Market Revenue Share By Region

14.2. Asia Pacific

14.2.1. Asia Pacific Electric Vehicle Insulation Market Volume By Country

14.2.2. Asia Pacific Electric Vehicle Insulation Market Revenue By Country

14.2.3. Product Type

14.2.4. Asia Pacific Electric Vehicle Insulation Market Volume By Product Type

14.2.5. Asia Pacific Electric Vehicle Insulation Market Revenue By Product Type

14.2.6. Vehicle Type

14.2.7. Asia Pacific Electric Vehicle Insulation Market Volume By Vehicle Type

14.2.8. Asia Pacific Electric Vehicle Insulation Market Revenue By Vehicle Type

14.2.9. Material Type

14.2.10. Asia Pacific Electric Vehicle Insulation Market Volume By Material Type

14.2.11. Asia Pacific Electric Vehicle Insulation Market Revenue By Material Type

14.3. China

14.4. Japan

14.5. South Korea

14.6. India

14.7. Australia

14.8. Southeast Asia

14.9. Rest of Asia Pacific

CHAPTER NO. 15 : LATIN AMERICA ELECTRIC VEHICLE INSULATION MARKET – COUNTRY ANALYSIS

15.1. Latin America Electric Vehicle Insulation Market Overview by Country Segment

15.1.1. Latin America Electric Vehicle Insulation Market Volume Share By Region

15.1.2. Latin America Electric Vehicle Insulation Market Revenue Share By Region

15.2. Latin America

15.2.1. Latin America Electric Vehicle Insulation Market Volume By Country

15.2.2. Latin America Electric Vehicle Insulation Market Revenue By Country

15.2.3. Product Type

15.2.4. Latin America Electric Vehicle Insulation Market Volume By Product Type

15.2.5. Latin America Electric Vehicle Insulation Market Revenue By Product Type

15.2.6. Vehicle Type

15.2.7. Latin America Electric Vehicle Insulation Market Volume By Vehicle Type

15.2.8. Latin America Electric Vehicle Insulation Market Revenue By Vehicle Type

15.2.9. Material Type

15.2.10. Latin America Electric Vehicle Insulation Market Volume By Material Type

15.2.11. Latin America Electric Vehicle Insulation Market Revenue By Material Type

15.3. Brazil

15.4. Argentina

15.5. Rest of Latin America

CHAPTER NO. 16 : MIDDLE EAST ELECTRIC VEHICLE INSULATION MARKET – COUNTRY ANALYSIS

16.1. Middle East Electric Vehicle Insulation Market Overview by Country Segment

16.1.1. Middle East Electric Vehicle Insulation Market Volume Share By Region

16.1.2. Middle East Electric Vehicle Insulation Market Revenue Share By Region

16.2. Middle East

16.2.1. Middle East Electric Vehicle Insulation Market Volume By Country

16.2.2. Middle East Electric Vehicle Insulation Market Revenue By Country

16.2.3. Product Type

16.2.4. Middle East Electric Vehicle Insulation Market Volume By Product Type

16.2.5. Middle East Electric Vehicle Insulation Market Revenue By Product Type

16.2.6. Vehicle Type

16.2.7. Middle East Electric Vehicle Insulation Market Volume By Vehicle Type

16.2.8. Middle East Electric Vehicle Insulation Market Revenue By Vehicle Type

16.2.9. Material Type

16.2.10. Middle East Electric Vehicle Insulation Market Volume By Material Type

16.2.11. Middle East Electric Vehicle Insulation Market Revenue By Material Type

16.3. GCC Countries

16.4. Israel

16.5. Turkey

16.6. Rest of Middle East

CHAPTER NO. 17 : AFRICA ELECTRIC VEHICLE INSULATION MARKET – COUNTRY ANALYSIS

17.1. Africa Electric Vehicle Insulation Market Overview by Country Segment

17.1.1. Africa Electric Vehicle Insulation Market Volume Share By Region

17.1.2. Africa Electric Vehicle Insulation Market Revenue Share By Region

17.2. Africa

17.2.1. Africa Electric Vehicle Insulation Market Volume By Country

17.2.2. Africa Electric Vehicle Insulation Market Revenue By Country

17.2.3. Product Type

17.2.4. Africa Electric Vehicle Insulation Market Volume By Product Type

17.2.5. Africa Electric Vehicle Insulation Market Revenue By Product Type

17.2.6. Vehicle Type

17.2.7. Africa Electric Vehicle Insulation Market Volume By Vehicle Type

17.2.8. Africa Electric Vehicle Insulation Market Revenue By Vehicle Type

17.2.9. Material Type

17.2.10. Africa Electric Vehicle Insulation Market Volume By Material Type

17.2.11. Africa Electric Vehicle Insulation Market Revenue By Material Type

17.3. South Africa

17.4. Egypt

17.5. Rest of Africa

CHAPTER NO. 18 : COMPANY PROFILES

18.1. 3M

18.1.1. Company Overview

18.1.2. Product Portfolio

18.1.3. Financial Overview

18.1.4. Recent Developments

18.1.5. Growth Strategy

18.1.6. SWOT Analysis

18.2. Elkem ASA

18.3. DuPont

18.4. Saint-Gobain

18.5. Zotefoams plc

18.6. BASF SE

18.7. Rogers Corporation

18.8. Parker Hannifin Corporation

18.9. Morgan Advanced Materials

18.10. Pyrophobic Systems Ltd.

18.11. Autoneum

18.12. Adler Pelzer Group

18.13. Sika AG

18.14. Covestro AG