Market Overview

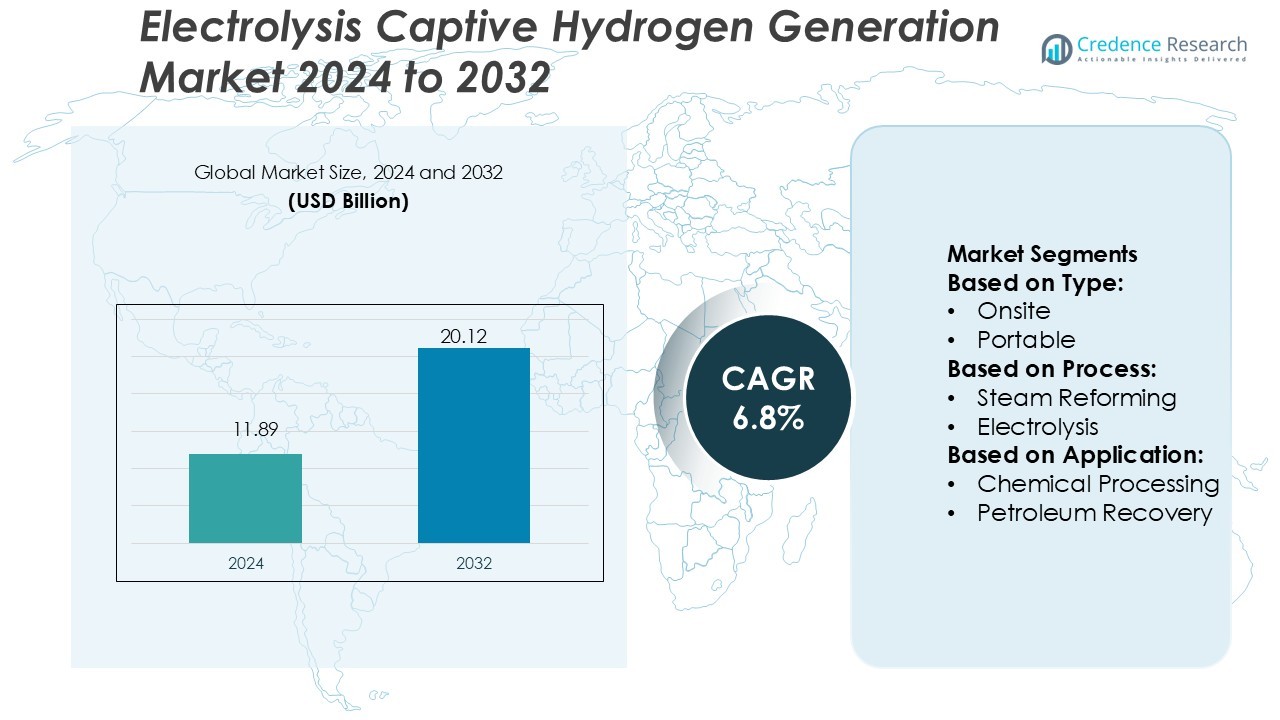

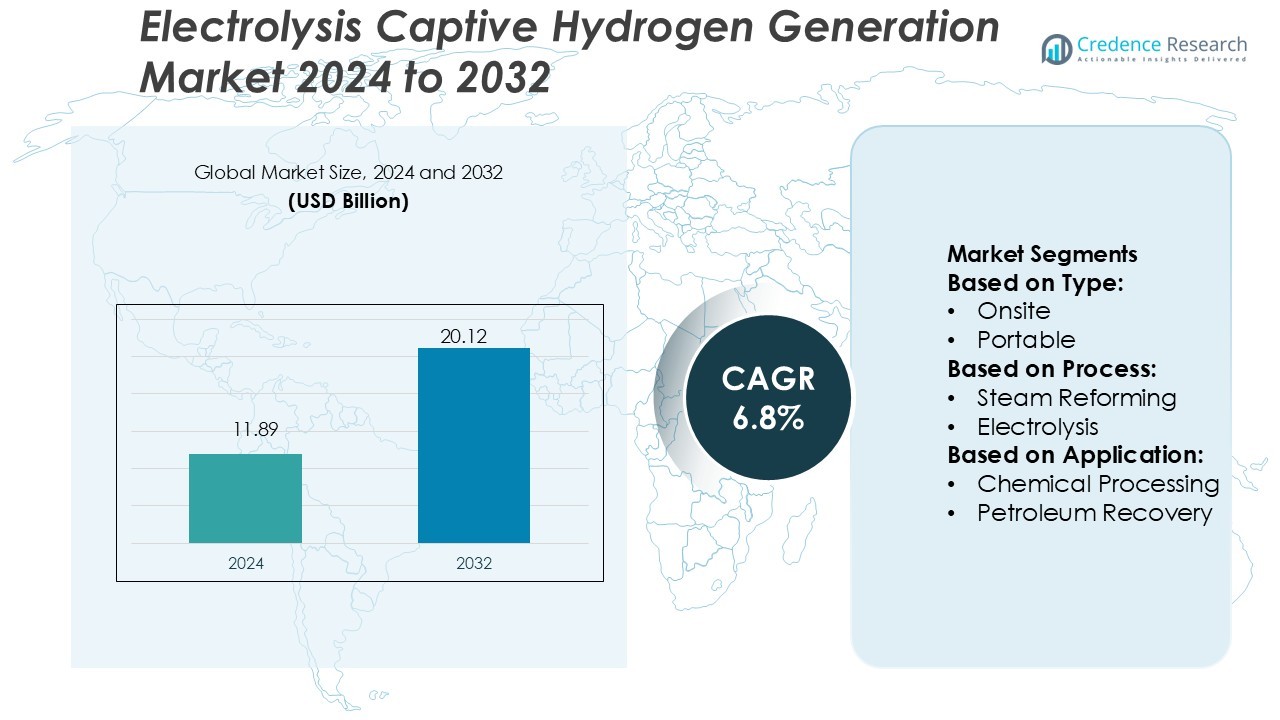

Electrolysis Captive Hydrogen Generation Market size was valued USD 11.89 billion in 2024 and is anticipated to reach USD 20.12 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrolysis Captive Hydrogen Generation Market Size 2024 |

USD 11.89 Billion |

| Electrolysis Captive Hydrogen Generation Market, CAGR |

6.8% |

| Electrolysis Captive Hydrogen Generation Market Size 2032 |

USD 20.12 Billion |

The Electrolysis Captive Hydrogen Generation Market is driven by leading players such as Air Liquide International S.A., Air Products and Chemicals, Inc., Linde Plc, Hydrogenics Corporation, Iwatani Corporation, Messer, Matheson Tri-Gas, Inc., SOL Group, INOX Air Products Ltd., and Tokyo Gas Chemicals Co., Ltd. These companies focus on scaling electrolyzer capacity, enhancing energy efficiency, and integrating renewable power sources into hydrogen production systems. Strategic collaborations and government-supported projects have accelerated technology deployment across industries. North America leads the market with a 32% share, supported by advanced hydrogen infrastructure, favorable policy frameworks, and significant investments in green hydrogen projects. Continuous innovation and infrastructure expansion maintain the region’s dominance in global electrolysis-based hydrogen generation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electrolysis Captive Hydrogen Generation Market was valued at USD 11.89 billion in 2024 and is projected to reach USD 20.12 billion by 2032, growing at a CAGR of 6.8%.

- Rising investments in green hydrogen and expanding industrial decarbonization initiatives are key growth drivers for the market.

- The market is witnessing strong trends in renewable-powered electrolysis systems and modular electrolyzer designs that enhance scalability and operational efficiency.

- High installation costs and limited hydrogen storage infrastructure remain major restraints affecting market penetration in developing regions.

- North America leads with a 32% share, driven by advanced renewable integration and government incentives, while Electrolysis technology dominates with the largest segment share due to its clean, efficient, and zero-emission hydrogen production process.

Market Segmentation Analysis:

By Type

The Onsite segment dominates the Electrolysis Captive Hydrogen Generation Market with a significant market share, supported by its ability to produce hydrogen directly at industrial sites. It minimizes transport costs and ensures a consistent supply for continuous operations. Onsite systems are widely deployed in refineries, chemical plants, and energy storage facilities due to scalability and operational efficiency. The Portable segment is expanding, driven by mobile power generation and temporary project applications. The increasing preference for decentralized hydrogen production and cost-effective onsite installations continues to fuel this segment’s growth momentum globally.

- For instance, Tokyo Gas Chemicals Co., Ltd. installed an AEM water-electrolysis system consisting of 30 modules in a single container with a total hydrogen output capacity of 15 Nm³/h, enabling hydrogen production at the refueling station site.

By Process

The Electrolysis segment leads the market, accounting for the largest share owing to its clean and renewable production process. Electrolysis systems enable hydrogen generation using water and renewable electricity, offering zero carbon emissions. Rapid advancements in electrolyzer technologies such as PEM and alkaline systems enhance efficiency and output. The Steam Reforming process remains widely used in heavy industries for cost-effective large-scale hydrogen supply, while the Others category includes hybrid and thermochemical methods. Increasing investments in renewable hydrogen infrastructure strengthen the dominance of electrolysis in the global market.

- For instance, Messer Group GmbH announced a green-hydrogen plant in Germany with a nominal output of 10 MW and a production capacity of up to 180 kg of hydrogen per hour, powered entirely via electrolysis.

By Application

The Chemical Processing segment holds the largest market share, driven by high hydrogen demand in ammonia, methanol, and fertilizer production. Industries rely on consistent, high-purity hydrogen for efficient chemical synthesis and lower emissions. Refinery applications follow closely, using captive hydrogen to desulfurize fuels and enhance refining efficiency. Fuel Cells represent a rapidly expanding segment as clean energy initiatives grow, while Petroleum Recovery applications focus on hydrogen injection for enhanced oil recovery. The shift toward decarbonized industrial operations continues to support strong demand from the chemical and energy sectors.

Key Growth Drivers

Rising Demand for Green Hydrogen in Industrial Applications

The growing focus on decarbonization across industries drives the adoption of electrolysis-based hydrogen generation. Green hydrogen produced through water electrolysis supports zero-emission energy goals and replaces fossil-fuel-derived hydrogen in refining, chemical, and steel manufacturing processes. Governments and corporations are investing in electrolyzer installations powered by renewable energy. Increasing integration of solar and wind-based electrolysis units in industrial zones enhances operational sustainability and energy independence, positioning green hydrogen as a key enabler of the global clean energy transition.

- For instance, Air Products and Chemicals, Inc. has committed to install an electrolyser system exceeding 2 GW capacity at its NEOM Green Hydrogen Complex, enabling production of large-scale hydrogen for ammonia synthesis.

Supportive Government Policies and Incentives

Government-led initiatives promoting renewable hydrogen are accelerating electrolysis adoption. Financial incentives, subsidies, and carbon credit schemes encourage industries to deploy onsite electrolysis systems. Policy frameworks such as the EU Hydrogen Strategy and U.S. Inflation Reduction Act provide direct support for hydrogen infrastructure development. These programs enhance cost competitiveness and boost large-scale production capabilities. Such measures, combined with growing regulatory pressure to reduce emissions, strengthen investor confidence and foster continuous expansion of the electrolysis captive hydrogen generation market globally.

- For instance, Linde Plc is constructing a 24-megawatt PEM electrolyzer at the Herøya site that will produce around 10,000 kg of hydrogen per day and save approximately 41,000 tons of CO₂ annually.

Technological Advancements in Electrolyzer Efficiency

Innovations in proton exchange membrane (PEM), solid oxide, and alkaline electrolyzers are improving hydrogen production efficiency and reducing operational costs. Modern systems now achieve energy efficiencies above 80% with faster start-up and response times. Manufacturers focus on modular designs that allow scalability for both industrial and distributed applications. The use of AI-based monitoring and digital twins enhances system reliability and predictive maintenance. Continuous R&D investment in high-performance materials and automation technologies drives the long-term competitiveness of electrolysis-based captive hydrogen generation.

Key Trends & Opportunities

Expansion of Renewable-Powered Electrolysis Plants

Integration of renewable energy sources such as solar and wind with electrolysis systems is a defining market trend. These hybrid setups allow continuous green hydrogen production with lower carbon intensity. Companies are developing large-scale electrolysis facilities directly linked to renewable power grids to ensure cost-effective operation. This trend supports decarbonization in hard-to-abate sectors such as chemicals, transport, and heavy manufacturing, providing a major growth opportunity for technology providers and energy developers alike.

- For instance, Matheson Tri-Gas, Inc. has secured a long-term hydrogen supply contract for a facility with a nameplate capacity exceeding 30 mmscfd (million standard cubic feet per day) and includes the capability to process renewable hydrocarbons in its feedstock design.

Rising Adoption of Modular and Containerized Systems

Modular electrolysis units are gaining traction for their flexibility, lower installation costs, and ease of deployment. Containerized hydrogen systems enable scalable solutions suited for remote locations and small industrial users. Their plug-and-play design simplifies integration with renewable power sources, reducing setup time by up to 30%. Growing demand from distributed generation sites and microgrids positions modular systems as a critical enabler of decentralized hydrogen infrastructure development.

- For instance, INOX Air Products Ltd. commissioned a green hydrogen facility at its float-glass partner site in Rajasthan with an annual production capacity of 190 tonnes, beginning with an initial phase delivering 95 tonnes per annum via solar-powered electrolysis.

Emergence of Strategic Partnerships and Joint Ventures

Collaborations between technology developers, energy utilities, and industrial users are accelerating innovation and project execution. Joint ventures enable cost sharing, technology transfer, and rapid scaling of hydrogen production capacity. Partnerships between electrolyzer manufacturers and renewable energy companies are emerging to ensure consistent power supply and system optimization. These alliances enhance project feasibility and market penetration, creating favorable conditions for sustained growth across global hydrogen value chains.

Key Challenges

High Capital and Operational Costs

Despite technological progress, electrolysis systems remain capital-intensive due to high equipment and installation costs. The price of electrolyzers, along with maintenance and energy expenses, continues to challenge small and medium-scale users. Electricity accounts for over 70% of total production costs, making affordable renewable power access crucial. Ongoing innovation in system design and government-backed cost-reduction programs are key to improving overall project viability and accelerating market adoption.

Limited Infrastructure and Hydrogen Storage Capacity

Inadequate hydrogen storage and transport infrastructure restrict large-scale implementation of captive electrolysis projects. The absence of standardized refueling networks and pipeline systems increases logistical complexity. Additionally, current storage technologies face safety and efficiency constraints for high-pressure or cryogenic hydrogen. To address this, stakeholders are investing in advanced storage materials, compression technologies, and localized hydrogen hubs to strengthen supply chain reliability and support continuous operations in industrial and mobility sectors.

Regional Analysis

North America

North America holds a 32% share of the Electrolysis Captive Hydrogen Generation Market, led by the United States and Canada. Strong government incentives, including funding under the U.S. Inflation Reduction Act, drive large-scale green hydrogen projects. The region’s robust renewable energy infrastructure supports integration of electrolysis systems into industrial and transportation sectors. Major players are establishing production hubs for clean hydrogen to decarbonize refineries and chemical plants. Increasing private investments, supportive regulations, and advancements in PEM electrolyzer technology reinforce North America’s leadership in sustainable hydrogen production.

Europe

Europe accounts for a 30% share of the global market, driven by aggressive decarbonization goals and strong policy frameworks. The European Union’s Hydrogen Strategy and funding through the Horizon Europe program have accelerated electrolyzer installations across Germany, France, and the Netherlands. The region prioritizes renewable integration, with several projects exceeding 100 MW capacity. Collaborations between industrial players and energy companies foster innovation in large-scale electrolysis systems. With its commitment to net-zero targets by 2050, Europe continues to be a global frontrunner in green hydrogen production and infrastructure development.

Asia-Pacific

Asia-Pacific captures a 28% share and represents the fastest-growing region in the Electrolysis Captive Hydrogen Generation Market. China, Japan, South Korea, and India are investing heavily in domestic hydrogen ecosystems to reduce carbon emissions and enhance energy security. Government programs promoting renewable energy utilization and fuel cell technology are driving installations of electrolysis units. China alone accounts for more than half of Asia’s installed electrolyzer capacity. Rapid industrialization, rising energy demand, and large-scale renewable power generation make Asia-Pacific a key region for future hydrogen growth and technology innovation.

Latin America

Latin America holds a 6% market share, supported by abundant renewable resources and emerging clean energy initiatives. Chile and Brazil are leading regional efforts to develop green hydrogen export hubs powered by solar and wind energy. Electrolysis projects in coastal areas are gaining attention for their potential to supply hydrogen for local refineries and chemical plants. Public-private partnerships and foreign investments are accelerating project development. The region’s strategic focus on decarbonizing mining and transportation sectors continues to create opportunities for electrolysis-based captive hydrogen generation.

Middle East & Africa

The Middle East & Africa region represents a 4% share of the global market, showing rising interest in large-scale hydrogen generation. Countries such as Saudi Arabia, the UAE, and South Africa are integrating electrolysis technology into national energy transition plans. Projects like NEOM’s green hydrogen plant highlight the region’s capacity for renewable-powered hydrogen production. Growing solar potential, government-backed initiatives, and international partnerships attract significant investments. Although infrastructure challenges remain, ongoing projects indicate strong momentum toward positioning the region as a major hydrogen export hub.

Market Segmentations:

By Type:

By Process:

- Steam Reforming

- Electrolysis

By Application:

- Chemical Processing

- Petroleum Recovery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electrolysis Captive Hydrogen Generation Market features major players such as Tokyo Gas Chemicals Co., Ltd., Messer, Air Products and Chemicals, Inc., Linde Plc, Matheson Tri-Gas, Inc., INOX Air Products Ltd., SOL Group, Iwatani Corporation, Hydrogenics Corporation, and Air Liquide International S.A. The Electrolysis Captive Hydrogen Generation Market is marked by rapid technological progress, strategic alliances, and expanding project portfolios. Companies are investing in high-efficiency electrolyzers, digital process optimization, and renewable integration to enhance hydrogen production performance. Partnerships between energy providers, industrial users, and technology developers are accelerating large-scale green hydrogen deployments worldwide. Growing emphasis on modular system design and localized production supports flexibility and cost efficiency. Continuous R&D efforts aimed at reducing operational costs and improving energy conversion efficiency are shaping the long-term competitiveness of the electrolysis-based hydrogen generation industry.

Key Player Analysis

- Tokyo Gas Chemicals Co., Ltd.

- Messer

- Air Products and Chemicals, Inc.

- Linde Plc

- Matheson Tri-Gas, Inc.

- INOX Air Products Ltd.

- SOL Group

- Iwatani Corporation

- Hydrogenics Corporation

- Air Liquide International S.A.

Recent Developments

- In May 2025, Hitachi Energy partnered with Stena Line, Power Cell Group, Linde Gas, and the Port of Gothenburg to launch HyFlex, a system that provides clean, zero-emission power to ships at berth using hydrogen fuel cell technology. This collaboration aims to reduce port emissions by replacing diesel generators with this sustainable alternative, which offers a cleaner and quieter power supply for vessels.

- In April 2025, HYDGEN, a company specializing in hydrogen electrolyzer technology, and the University of North Bengal (NBU) formalized a research collaboration agreement. This partnership is focused on developing low-cost electrocatalysts to make green hydrogen production more cost-effective and accessible.

- In July 2024, Mangalore Refinery and Petrochemicals Limited (MRPL) announced a new 500 TPA green hydrogen production unit at its refinery, which will use water electrolysis and be integrated with its existing hydrogen supply for captive use.

- In June 2024, Yara International inaugurated its renewable hydrogen plant in Herøya, Norway, a facility it claims is Europe’s largest electrolysis plant. The plant uses renewable electricity to produce green hydrogen, which is then converted into ammonia, a key component in fertilizers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for green hydrogen will rise with growing industrial decarbonization efforts.

- Governments will increase incentives and funding for large-scale electrolysis projects.

- Technological advancements will improve electrolyzer efficiency and reduce energy losses.

- Integration with renewable energy sources will strengthen hydrogen sustainability.

- Modular and containerized electrolysis systems will gain popularity for distributed generation.

- Strategic partnerships between energy firms and technology developers will expand project pipelines.

- Hydrogen storage and transport infrastructure will advance to support stable supply chains.

- Rising fuel cell adoption in transport will create new demand for onsite hydrogen generation.

- Expansion of regional hydrogen hubs will enhance production scalability and cost optimization.

- Continuous R&D in materials and automation will drive long-term competitiveness in the market.