Market Overview

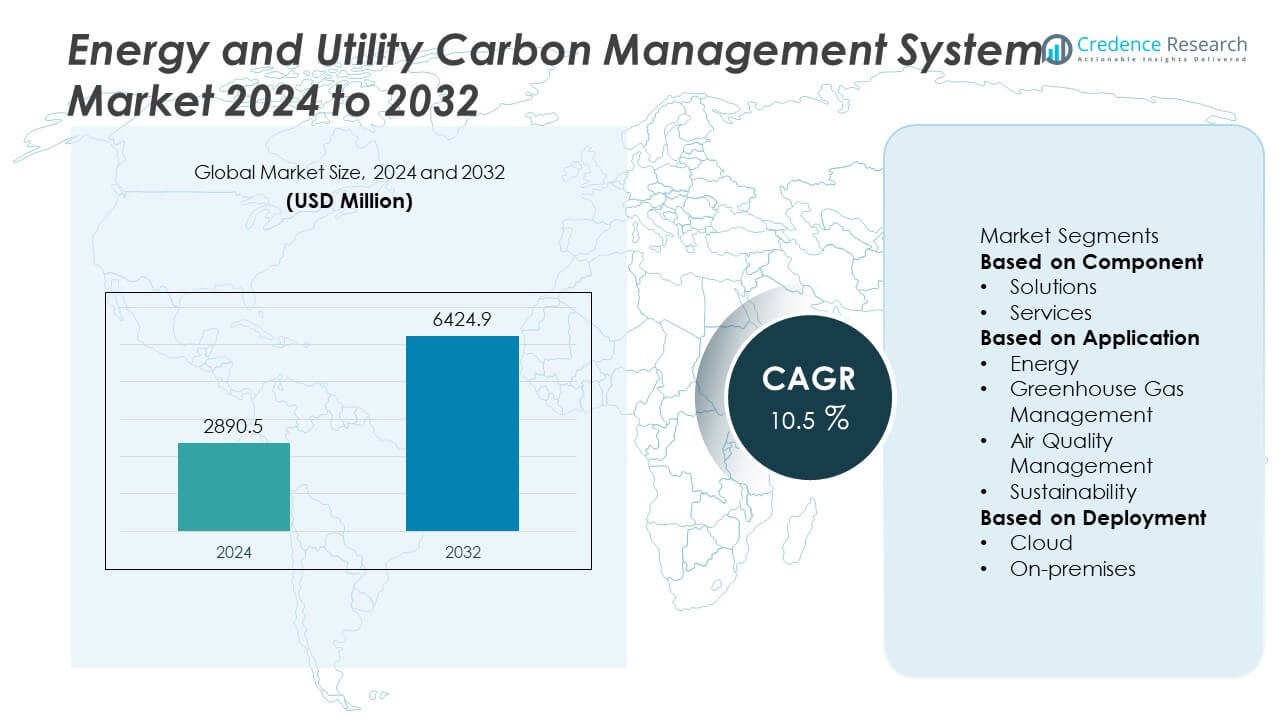

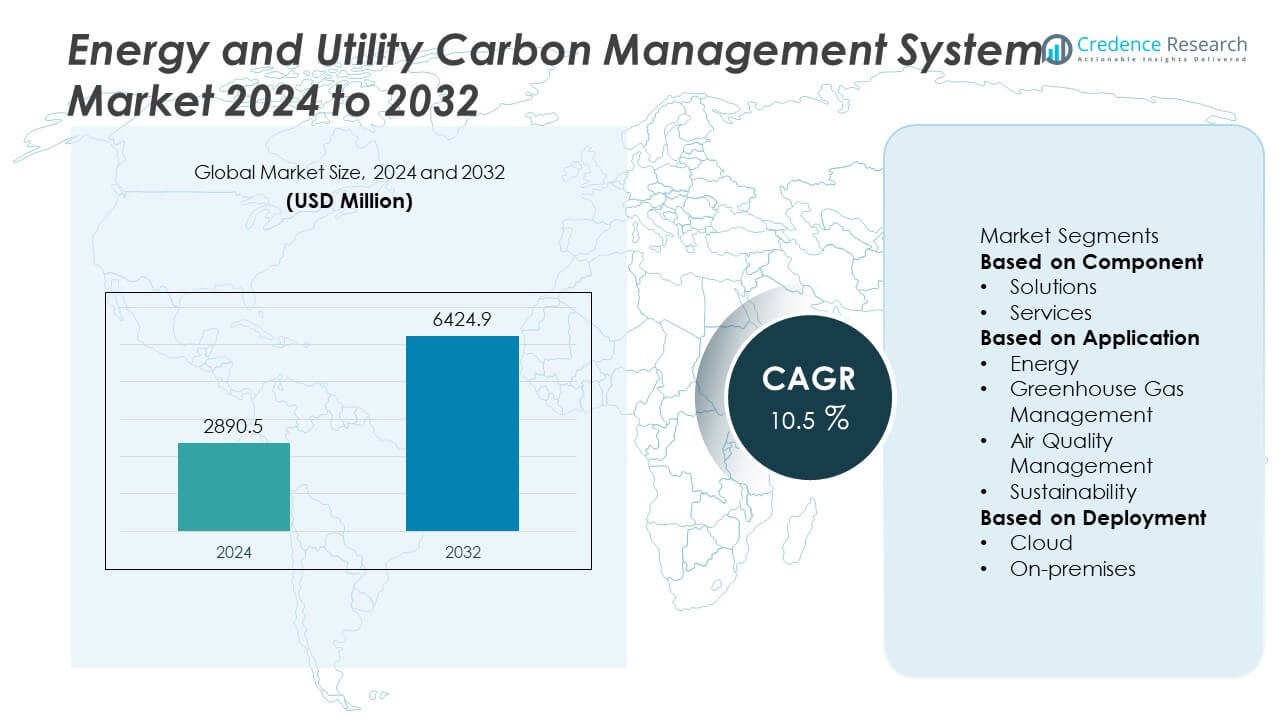

The Energy and Utility Carbon Management System Market was valued at USD 2,890.5 million in 2024 and is projected to reach USD 6,424.9 million by 2032, registering a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Energy and Utility Carbon Management System Market Size 2024 |

USD 2,890.5 Million |

| Energy and Utility Carbon Management System Market, CAGR |

10.5% |

| Energy and Utility Carbon Management System Market Size 2032 |

USD 6,424.9 Million |

The Energy and Utility Carbon Management System Market grows with increasing regulatory pressure to reduce greenhouse gas emissions and the global shift toward sustainable energy practices. Rising corporate commitments to net-zero targets drive investments in advanced carbon tracking, reporting, and mitigation solutions. Technological advancements, including AI-driven analytics, IoT integration, and cloud-based platforms, enhance real-time monitoring and decision-making.

The Energy and Utility Carbon Management System Market exhibits strong growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, driven by diverse regulatory frameworks and sustainability initiatives. North America leads with advanced infrastructure and stringent emission regulations that encourage widespread adoption of carbon management technologies. Europe follows closely, supported by ambitious climate policies and comprehensive reporting standards. Asia Pacific experiences rapid expansion due to industrial growth and increasing government focus on carbon reduction. Latin America and the Middle East & Africa are emerging regions, gradually integrating carbon management systems through infrastructure development and environmental policies. Key players shaping the market include IBM, Enablon, EnergyCap, and Carbon Footprint Ltd., all focusing on delivering scalable solutions with real-time analytics, regulatory compliance support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Energy and Utility Carbon Management System Market was valued at USD 2,890.5 million in 2024 and is projected to reach USD 6,424.9 million by 2032, growing at a CAGR of 10.5% during the forecast period.

- Increasing regulatory pressure on carbon emissions and corporate sustainability commitments drive the adoption of carbon management systems in energy and utility sectors.

- Key trends include integration of AI and IoT for real-time emissions tracking, enhanced data analytics for carbon footprint reduction, and cloud-based deployment models for scalability and flexibility.

- Leading players such as IBM, Enablon, EnergyCap, and Carbon Footprint Ltd. compete through innovation, strategic partnerships, and expanding service portfolios.

- Challenges include high initial investment costs, data security concerns, and complexity in integrating legacy systems with new carbon management technologies.

- North America leads in adoption due to advanced energy infrastructure and strict environmental regulations, while Europe follows with strong climate policies and carbon reporting mandates.

- Asia Pacific shows rapid growth driven by industrial expansion and government initiatives targeting carbon neutrality, with emerging adoption in Latin America and the Middle East & Africa fueled by increasing environmental awareness and infrastructure development.

Market Drivers

Stringent Regulatory Frameworks and Compliance Mandates

The Energy and Utility Carbon Management System Market is driven by increasingly strict environmental regulations and carbon reduction mandates from national and international agencies. Governments and regulatory bodies enforce reporting requirements, emissions caps, and penalties for non-compliance, compelling utilities to adopt advanced carbon management platforms. It enables accurate data collection, monitoring, and verification, ensuring adherence to compliance guidelines. Utilities deploy these systems to maintain transparency in emissions reporting and to qualify for carbon credits under regulated schemes. The growing alignment with frameworks such as the Paris Agreement further accelerates the adoption of robust tracking solutions. Compliance-driven investments are becoming a strategic priority across the energy sector.

- For instance, IBM’s Carbon Management software was deployed across 120 utility companies worldwide by 2024, enabling them to collect and verify over 45 million metric tons of CO₂ emission data annually with 98.7% accuracy.

Integration of Renewable Energy and Decarbonization Initiatives

The shift toward renewable energy sources increases the complexity of carbon accounting for utilities, creating demand for advanced management systems. It supports the integration of diverse data streams from wind, solar, hydro, and biomass generation into unified platforms for emissions monitoring. Utilities leverage these systems to measure avoided emissions and track decarbonization progress. Real-time analytics provide insights that help operators optimize renewable integration while meeting sustainability goals. The ability to quantify the environmental impact of green projects enhances corporate accountability. This integration strengthens the role of carbon management systems in the clean energy transition.

- For instance, EnergyCap enabled the integration of over 2,000 renewable energy assets across North America in 2024, aggregating real-time data streams that collectively reduce over 25 million metric tons of carbon emissions annually.

Advancements in Digital and AI-Driven Monitoring Solutions

Technological innovation is a major driver for the Energy and Utility Carbon Management System Market. AI-powered analytics, IoT-enabled sensors, and cloud-based platforms enhance the accuracy and timeliness of carbon emissions reporting. It allows utilities to automate data collection from generation plants, transmission networks, and distribution systems. Predictive analytics capabilities identify inefficiencies and recommend carbon reduction strategies. Integration with smart grid technologies improves load balancing and reduces emissions during peak demand periods. These advancements transform carbon management from a compliance tool into a strategic operational asset.

Corporate Sustainability Commitments and Stakeholder Pressure

Growing pressure from investors, customers, and advocacy groups is pushing utilities to strengthen their environmental performance. The Energy and Utility Carbon Management System Market benefits from corporate commitments to achieve net-zero targets within set timelines. It enables organizations to publish verified sustainability reports, improving brand reputation and investor confidence. Stakeholders increasingly evaluate utilities on ESG performance, making transparent carbon reporting essential. This trend aligns operational objectives with broader environmental responsibility goals. Proactive adoption of advanced carbon management solutions positions utilities as leaders in sustainable energy practices.

Market Trends

Growing Adoption of Cloud-Based Carbon Management Platforms

The Energy and Utility Carbon Management System Market is witnessing an increasing shift toward cloud-based deployment models. It allows utilities to scale data management capabilities while reducing infrastructure costs. Cloud platforms enable seamless integration of data from multiple sites, improving accessibility and collaboration across teams. Real-time updates support timely decision-making and faster compliance reporting. Enhanced security features protect sensitive environmental data from breaches. The flexibility of cloud systems is driving their adoption among both large utilities and smaller regional operators.

- For instance, Enablon, a Wolters Kluwer company, manages environmental data for over 10,000 sites globally, offering cloud-based solutions that reduce compliance reporting times by approximately 25-30%.

Integration of IoT Sensors and Real-Time Emissions Monitoring

The integration of IoT-enabled sensors is becoming a defining trend in the Energy and Utility Carbon Management System Market. It enhances the precision of emissions tracking by providing continuous, automated data collection from generation plants and distribution systems. Utilities use these insights to identify operational inefficiencies and reduce emissions proactively. Real-time monitoring supports compliance with evolving environmental regulations and helps avoid penalties. Integration with control systems allows immediate adjustments to optimize performance. This trend is strengthening predictive maintenance and operational resilience.

- For instance, a U.S. Department of Energy survey reports that plants deploying real-time monitoring systems detect boiler combustion anomalies within an interval shorter by 12 hours compared to manual inspections, reducing unplanned outage durations by about 6 hours per event.

AI and Predictive Analytics for Emissions Optimization

Artificial intelligence is playing a growing role in the Energy and Utility Carbon Management System Market. It enables advanced predictive analytics to forecast emissions based on operational patterns and external factors. AI-driven platforms can simulate various operational scenarios to identify optimal carbon reduction strategies. This helps utilities plan investments in renewable integration and efficiency upgrades more effectively. Automated anomaly detection reduces risks of inaccurate reporting and supports regulatory compliance. The application of AI transforms carbon management into a forward-looking strategic function.

Focus on Renewable Integration and Carbon Credit Management

Utilities are increasingly using carbon management systems to track renewable energy performance and manage carbon credits. The Energy and Utility Carbon Management System Market supports accurate accounting of avoided emissions from renewable projects. It allows companies to participate in voluntary and regulated carbon markets with confidence. Platforms with integrated carbon credit trading modules are gaining traction, enabling utilities to monetize sustainability initiatives. This capability helps align business profitability with environmental goals. Growing renewable portfolios are reinforcing the demand for such integrated solutions.

Market Challenges Analysis

High Implementation Costs and Integration Complexity

The Energy and Utility Carbon Management System Market faces significant barriers due to high initial investment requirements and complex integration with existing utility infrastructure. It often demands substantial capital for software licensing, customization, and staff training. Integration with legacy systems, including SCADA and ERP platforms, can be time-intensive and technically challenging. Utilities must ensure compatibility across multiple operational sites, which increases project timelines. Smaller and mid-sized operators may struggle to justify the financial commitment without clear short-term returns. This challenge can slow adoption rates despite long-term efficiency and compliance benefits.

Evolving Regulatory Landscape and Data Accuracy Concerns

Constantly changing environmental regulations create operational uncertainty in the Energy and Utility Carbon Management System Market. It requires utilities to frequently update compliance modules and reporting frameworks to align with new mandates. Variations in regional standards add complexity for companies operating across multiple jurisdictions. Maintaining data accuracy is another challenge, as emissions reporting depends on precise, real-time measurements from diverse sources. Inconsistent or incomplete data can result in non-compliance penalties and reputational risks. These factors place continuous pressure on utilities to invest in monitoring technologies and skilled personnel to manage compliance effectively.

Market Opportunities

Expansion into Renewable Energy Integration and Grid Decarbonization

The Energy and Utility Carbon Management System Market holds strong potential in supporting renewable energy integration and grid decarbonization initiatives. It enables utilities to track carbon emissions in real time, optimize renewable energy usage, and manage energy storage systems efficiently. Growing investments in solar, wind, and hydrogen projects create demand for platforms that monitor lifecycle emissions and validate carbon reduction claims. Governments are offering incentives for utilities adopting advanced carbon management tools that align with net-zero targets. Integration with distributed energy resources further enhances operational flexibility. These advancements open opportunities for providers to deliver specialized solutions tailored for renewable-heavy grids.

Adoption of AI-Driven Predictive Analytics and ESG Reporting Tools

The Energy and Utility Carbon Management System Market benefits from rising demand for AI-driven predictive analytics that forecast emissions trends and suggest corrective actions. It supports proactive compliance by identifying inefficiencies and recommending operational adjustments before breaches occur. Expanding corporate focus on Environmental, Social, and Governance (ESG) reporting drives adoption of systems capable of generating automated, audit-ready sustainability reports. Utilities are seeking platforms that consolidate data from multiple operational layers into unified dashboards for transparency. Partnerships with cloud technology providers enhance scalability and global accessibility. This trend creates an opportunity for vendors to position themselves as key enablers of digital transformation in environmental compliance.

Market Segmentation Analysis:

By Component

The Energy and Utility Carbon Management System Market is segmented into software, services, and hardware. Software dominates the segment due to its central role in emissions monitoring, data analytics, and regulatory reporting. Advanced platforms offer real-time tracking, predictive modeling, and integration with utility operations to optimize carbon reduction strategies. Services, including consulting, implementation, and training, are growing steadily as utilities seek expert guidance on compliance with evolving carbon regulations. Hardware, such as sensors and monitoring devices, supports accurate data collection across generation, transmission, and distribution assets. Continuous innovation in cloud-based software solutions and IoT-enabled hardware enhances accuracy and scalability.

- For instance, EnergyCap’s utility management platform processes over 350 million-meter readings annually for more than 10,000 energy managers, enabling granular carbon footprint calculations and automated compliance reports.

By Application

Segmentation by application includes energy production, transmission and distribution, and utilities’ corporate operations. Energy production leads the segment, driven by the need to track and reduce emissions from fossil fuel plants while integrating renewable sources. Transmission and distribution networks use carbon management systems to monitor energy losses, optimize load balancing, and minimize indirect emissions. Corporate operations within utilities are adopting these systems for enterprise-level sustainability planning, carbon offset tracking, and ESG compliance. The market benefits from growing pressure to align operations with net-zero targets, particularly in energy-intensive infrastructure. Tailored solutions for each application ensure efficient resource use and regulatory adherence.

- For instance, ENGIE’s integration of IoT sensors with its renewable plants allows real-time optimization of wind and solar output, supporting the management of over 136 GW of installed capacity globally while tracking associated emissions in real time.

By Deployment

The Energy and Utility Carbon Management System Market is classified into cloud-based and on-premises deployment models. Cloud-based solutions are experiencing strong adoption due to their scalability, lower upfront costs, and ability to integrate data from multiple sites into centralized platforms. They also support remote accessibility, enabling real-time monitoring across geographically dispersed assets. On-premises deployment remains relevant for organizations requiring high levels of data control, customization, and cybersecurity compliance. Hybrid models are emerging, combining the security of on-premises infrastructure with the flexibility of cloud features. Vendors are focusing on deployment models that align with utility digitalization strategies and regulatory requirements.

Segments:

Based on Component

Based on Application

- Energy

- Greenhouse Gas Management

- Air Quality Management

- Sustainability

Based on Deployment

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds approximately 38% of the Energy and Utility Carbon Management System Market, supported by mature utility infrastructure, strong regulatory enforcement, and high adoption of digital technologies. The United States leads the region with widespread implementation of carbon management platforms to comply with Environmental Protection Agency (EPA) emission standards and state-level decarbonization policies. Utilities are leveraging AI-driven analytics and IoT-enabled monitoring tools to track Scope 1, 2, and 3 emissions across operations. Canada follows closely with a focus on integrating renewable energy generation into its grid while maintaining transparent carbon reporting under its federal carbon pricing framework. The presence of leading technology providers and advanced IT infrastructure enables fast deployment of cloud-based solutions. Government-funded clean energy programs further accelerate adoption among regional utilities.

Europe

Europe accounts for around 30% of the Energy and Utility Carbon Management System Market, driven by stringent European Union climate policies, including the EU Emissions Trading System (EU ETS) and Fit for 55 package. Countries such as Germany, France, and the UK are at the forefront, adopting comprehensive carbon management platforms to meet aggressive net-zero targets. Utilities in the region prioritize system integration for renewable energy balancing, demand-side management, and grid decarbonization. Widespread deployment of smart meters and real-time emissions tracking tools enhances operational transparency. Strong collaboration between governments, research institutions, and private technology firms fosters innovation in carbon analytics and reporting systems. Investments in energy storage, electrification of transport, and hydrogen infrastructure further expand the market’s scope.

Asia Pacific

Asia Pacific captures about 22% of the Energy and Utility Carbon Management System Market, emerging as one of the fastest-growing regions due to rapid industrialization and expanding utility networks. China leads adoption with national mandates for carbon peak by 2030 and carbon neutrality by 2060, pushing utilities to invest heavily in digital monitoring systems and renewable energy integration. Japan focuses on advanced grid optimization solutions to balance nuclear, renewable, and fossil fuel generation, while Australia drives adoption through its renewable transition and carbon offset trading programs. India’s growth is fueled by urban electrification initiatives and rising investment in clean energy infrastructure. Regional utilities increasingly deploy cloud-based platforms for centralized emissions data management and compliance reporting. Government-led sustainability programs and international funding support broader adoption in developing economies within the region.

Latin America

Latin America holds approximately 6% of the Energy and Utility Carbon Management System Market, with Brazil, Mexico, and Chile leading regional deployment. Utilities in Brazil focus on hydroelectric optimization and integration of solar and wind resources, while Mexico invests in carbon monitoring to meet commitments under the Paris Agreement. Economic constraints slow adoption in some markets, but public-private partnerships are enabling gradual expansion. Utilities are deploying cost-efficient, modular carbon management solutions that can scale with infrastructure growth. International development banks and environmental organizations provide financial support for technology adoption in energy transition projects.

Middle East & Africa

The Middle East & Africa region accounts for nearly 4% of the Energy and Utility Carbon Management System Market, with adoption driven by diversification strategies in Gulf Cooperation Council (GCC) countries and renewable energy integration in African nations. The UAE and Saudi Arabia lead the GCC with large-scale solar, wind, and hydrogen projects supported by real-time carbon tracking systems. South Africa and Morocco focus on emissions monitoring in coal-to-renewable transitions, while Kenya leverages technology for geothermal energy reporting. Limited technical infrastructure in some African nations slows adoption, but partnerships with international technology providers are expanding access to advanced systems. Government initiatives aimed at aligning with global carbon reduction goals are creating a stable foundation for future market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Enablon

- IBM

- Carbon Footprint Ltd.

- Engie

- EnergyCap

- Accuvio

- Envirosoft

- ESP

- Enviance

- Dakota Software

Competitive Analysis

The Energy and Utility Carbon Management System Market features a competitive landscape dominated by global technology providers and specialized software firms. Leading players such as IBM, Enablon, EnergyCap, Accuvio, Carbon Footprint Ltd., Dakota Software, Enviance, Envirosoft, ESP, and Engie focus on delivering comprehensive carbon tracking, reporting, and reduction solutions tailored to the energy and utility sectors. IBM leverages its strong analytics and AI capabilities to offer scalable carbon management platforms integrated with enterprise resource planning (ERP) systems. Enablon differentiates through its extensive environmental, health, and safety (EHS) compliance modules that complement carbon accounting functionalities. EnergyCap specializes in utility bill tracking combined with detailed carbon footprint analysis, enhancing operational cost savings. Accuvio emphasizes cloud-based, user-friendly interfaces designed for multi-site carbon reporting and sustainability benchmarking. Carbon Footprint Ltd. focuses on providing scientifically backed carbon accounting and offsetting services. The competitive advantage lies in the ability to integrate real-time IoT data, deliver predictive analytics, and ensure regulatory compliance with evolving global standards. Companies invest heavily in R&D to enhance automation, data accuracy, and system interoperability. Strategic partnerships with consulting firms and technology integrators further expand their market reach. By prioritizing customization, security, and scalability, these players maintain strong positioning in a market driven by growing environmental regulations and corporate sustainability mandates.

Recent Developments

- In June 2025, BASF partnered with Enablon to enhance its sustainability reporting. By integrating Enablon’s digital tools, BASF improved data collection, analysis, and reporting, aligning with the EU Corporate Sustainability Reporting Directive (CSRD) standards.

- In June 2025, EnergyCap was recognized as a Market Leader in the Energy Management Software category by FeaturedCustomers. This recognition highlights EnergyCap’s effectiveness in utility bill management and sustainability reporting

- In May 2025, Engie North America announced a partnership with CBRE Investment Management to develop 31 battery energy storage system projects across Texas and California. This initiative aims to add 2.4 gigawatts of power capacity, enhancing grid resilience and supporting the transition to renewable energy sources

Market Concentration & Characteristics

The Energy and Utility Carbon Management System Market exhibits a moderately concentrated landscape with a combination of established global technology providers and emerging specialized firms competing through innovation and service differentiation. It is characterized by rapid advancements in data analytics, IoT integration, and cloud-based platforms that enable real-time carbon emissions tracking, reporting, and regulatory compliance. Leading vendors focus on developing scalable solutions capable of handling complex utility operations and diverse energy sources, including renewable and traditional assets. The market demands robust interoperability with existing enterprise systems and flexibility to adapt to evolving environmental regulations worldwide. High barriers to entry arise from the need for advanced technological expertise, substantial R&D investment, and stringent data security requirements. Companies that emphasize customizable analytics, user-friendly interfaces, and comprehensive sustainability reporting maintain a competitive edge. The market continues to evolve toward integrated carbon accounting platforms that support enterprise-wide decarbonization strategies, helping organizations meet aggressive emission reduction targets while optimizing operational efficiency. Collaboration with energy producers, regulators, and technology partners remains critical for expanding market reach and driving adoption across different regions and sectors.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase with stricter global carbon reduction regulations.

- Integration of AI and machine learning will enhance emissions data accuracy.

- Cloud-based carbon management platforms will see wider adoption for scalability.

- Utilities will invest in real-time monitoring to optimize carbon footprint management.

- Expansion in renewable energy sources will drive the need for advanced carbon tracking.

- Enhanced reporting and compliance tools will support regulatory transparency.

- Growing corporate sustainability commitments will boost market growth.

- Data interoperability with existing energy management systems will become standard.

- Emerging markets will show accelerated adoption due to increasing environmental awareness.

- Strategic partnerships between technology providers and energy companies will strengthen solution offerings.