Market Overview:

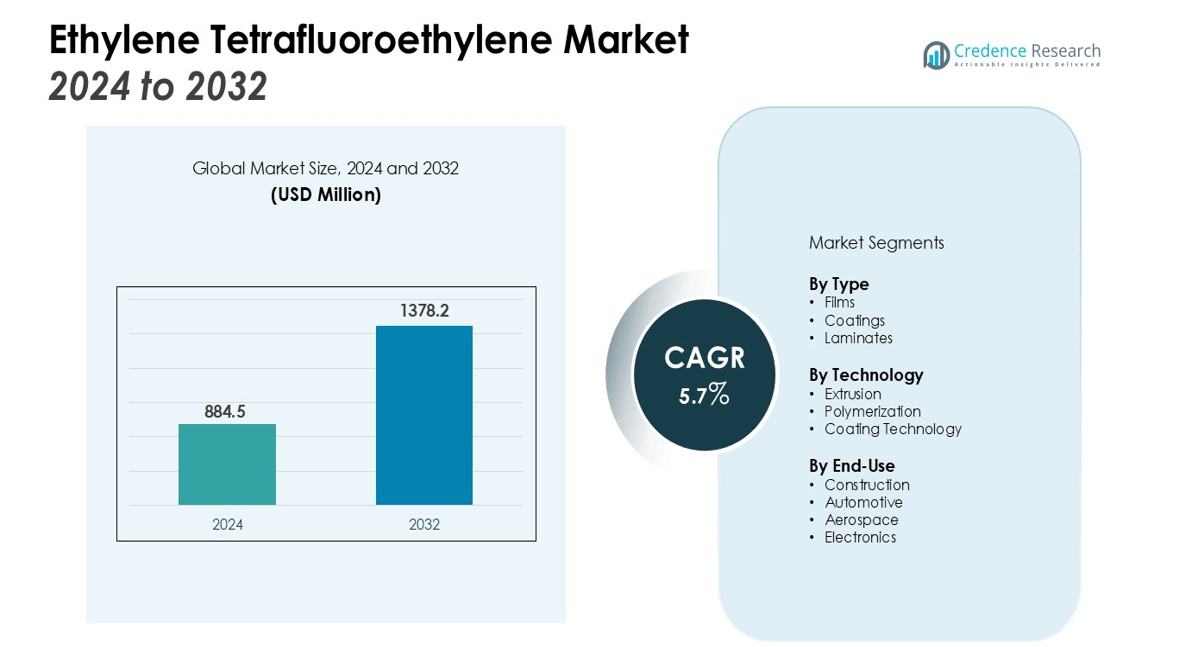

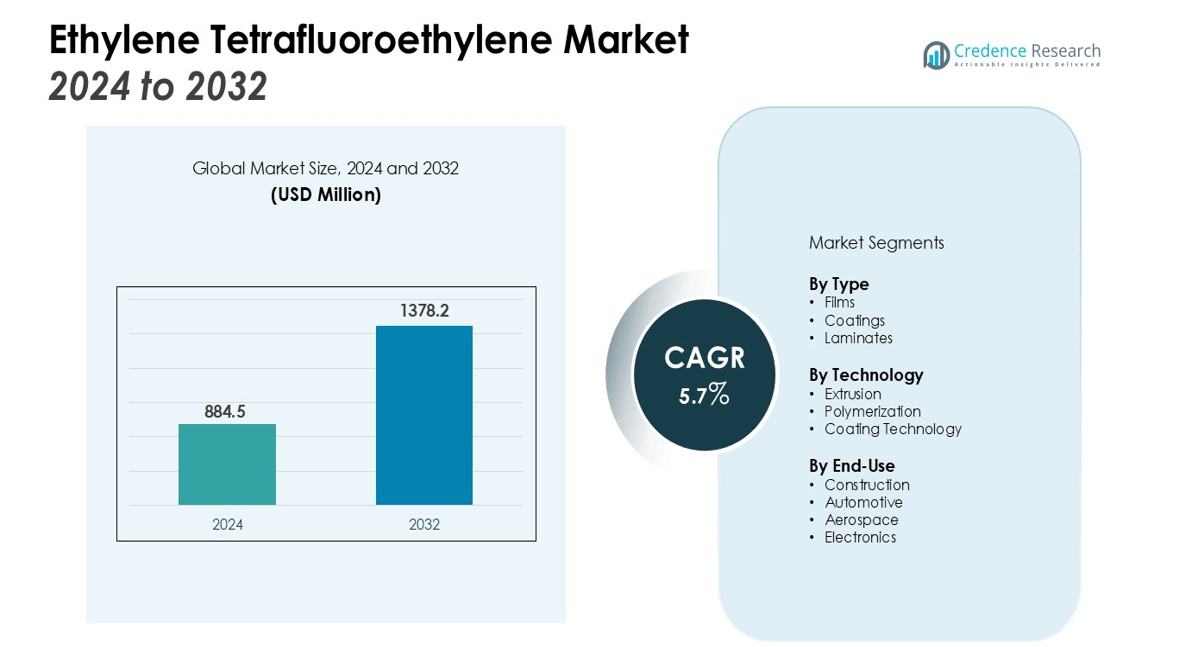

The Ethylene Tetrafluoroethylene Market size was valued at USD 884.5 million in 2024 and is anticipated to reach USD 1378.2 million by 2032, at a CAGR of 5.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethylene Tetrafluoroethylene Market Size 2024 |

USD 884.5 million |

| Ethylene Tetrafluoroethylene Market , CAGR |

5.7% |

| Ethylene Tetrafluoroethylene Market Size 2032 |

USD 1378.2 million |

Key drivers of the ETFE market include its increasing demand in the construction and automotive sectors, where its properties make it ideal for applications such as roofing, facades, and interior components. The growing emphasis on energy-efficient and sustainable construction materials is also propelling ETFE adoption. Additionally, the demand for high-performance coatings and membranes, particularly in the aerospace and electronics sectors, is further contributing to market growth. The rise in technological advancements in fluoropolymer production methods is expected to enhance ETFE’s accessibility and cost-effectiveness. Furthermore, the material’s superior weather resistance and UV stability make it increasingly preferred for long-term outdoor applications.

Regionally, North America and Europe are significant markets for ETFE due to the presence of established industries, stringent regulatory standards, and a strong focus on sustainable building practices. The Asia-Pacific region is expected to experience the highest growth during the forecast period, driven by rapid industrialization and increasing investments in infrastructure, particularly in emerging economies like China and India. This regional shift is further supported by the growing trend of adopting advanced materials for high-performance construction projects.

Market Insights:

- The global Ethylene Tetrafluoroethylene (ETFE) market was valued at USD 884.5 million in 2024 and is projected to reach USD 1378.2 million by 2032, growing at a CAGR of 5.7%.

- The growing demand for energy-efficient construction materials drives ETFE adoption, especially in roofing, facades, and interior components.

- The automotive sector boosts ETFE use due to its durability and resistance, particularly in fuel systems, seals, and trims.

- Technological advancements in fluoropolymer production are reducing ETFE manufacturing costs and expanding its applications.

- High production costs and raw material scarcity limit ETFE adoption, particularly in price-sensitive markets.

- ETFE faces competition from alternative materials like polycarbonate and polyethylene, which are more cost-effective.

- North America holds 35% of the market share, with Europe and Asia-Pacific following, with Asia expected to see the highest growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable and Energy-Efficient Construction Materials

The increasing focus on sustainability in the construction industry is a significant driver for the Ethylene Tetrafluoroethylene (ETFE) market. With its excellent thermal properties and lightweight nature, ETFE is increasingly being used in architectural applications such as roofing and facades. Its energy-efficient characteristics help reduce energy consumption in buildings, contributing to green construction practices. This demand is driven by stricter building codes, environmental regulations, and a growing preference for eco-friendly materials in urban development.

- For instance, the iCon Innovation Centre in Daventry utilizes Texlon® ETFE cushions with a U-value of 1.96 W/m²K, offering superior insulation and reducing the need for artificial heating and cooling, which supports sustainable building design.

Rising Applications in the Automotive Industry

The automotive sector is another key driver for the growth of the ETFE market. ETFE is utilized in various automotive applications due to its durability, resistance to heat, and chemical stability. It is commonly used for components such as fuel systems, seals, and interior trims. The growing emphasis on vehicle lightweighting to enhance fuel efficiency and reduce emissions further propels the adoption of ETFE in automotive manufacturing.

- For instance, Radix Wire & Cable manufactures ETFE insulated automotive wires that can operate continuously at 150°C, ensuring electrical component reliability under high temperatures.

Technological Advancements in Fluoropolymer Production

Technological advancements in fluoropolymer production processes have made ETFE more accessible and cost-effective. New production methods have improved the efficiency of ETFE manufacturing, reducing the overall production costs. This has enabled wider adoption across industries, including aerospace, electronics, and telecommunications. As a high-performance polymer, ETFE offers significant advantages in terms of longevity and resistance to harsh environments, making it an ideal choice for a variety of demanding applications.

Expanding Use in Aerospace and Electronics Sectors

The aerospace and electronics industries are increasingly turning to ETFE due to its superior properties such as chemical resistance and high tensile strength. In aerospace, it is used in cable insulation and protective coatings, while in electronics, it is applied to improve the performance of components exposed to high temperatures and moisture. The growing reliance on ETFE in these sectors reflects the material’s ability to meet stringent safety and performance standards.

Market Trends:

Increasing Adoption of ETFE in Eco-Friendly and Smart Building Projects

The Ethylene Tetrafluoroethylene (ETFE) market is witnessing a significant shift towards the material’s use in eco-friendly and smart buildings. Its ability to provide high levels of insulation while allowing natural light penetration makes it a popular choice for energy-efficient structures. Architects and engineers are increasingly using ETFE for facades, roofs, and atriums due to its transparency and excellent thermal insulation properties. As building designs become more innovative and sustainable, ETFE is becoming a go-to solution for smart, energy-efficient buildings that align with green building certifications such as LEED and BREEAM. This trend reflects a broader move towards sustainability, where materials like ETFE are key to meeting modern construction demands while reducing the carbon footprint of buildings.

- For instance, the National Aquatics Center (Water Cube) in Beijing uses 100,000 square meters of Texlon® ETFE covering its roof and façade, creating the largest ETFE structure in the world while providing exceptional thermal performance combined with structural innovation.

Growth of ETFE Applications in Emerging Markets

Emerging markets, particularly in the Asia-Pacific region, are driving a growing demand for ETFE in construction and industrial applications. Rapid urbanization and infrastructure development in countries like China and India have led to an increased need for lightweight, durable, and cost-effective materials. ETFE is gaining prominence in these markets for its versatility in architectural design and performance in harsh environmental conditions. With an expanding middle class and higher disposable incomes, there is greater demand for advanced, modern building solutions that incorporate high-performance materials like ETFE. As industries continue to evolve and invest in infrastructure, the market for ETFE is expected to grow significantly in these regions.

- For instance, the G-Park Business Center in Xi’an, China, features an ETFE air pillow roof with a total area of 15,000 square meters, which is the largest ETFE membrane canopy in western China, combining durability with aesthetic transparency.

Market Challenges Analysis:

High Production Costs and Limited Availability

One of the significant challenges in the Ethylene Tetrafluoroethylene (ETFE) market is the high production cost of the material. ETFE’s manufacturing process is complex, requiring advanced technology and specialized equipment, which contributes to its relatively high price compared to other polymers. This limits its widespread use in price-sensitive markets, especially in developing regions where cost efficiency is crucial. The limited availability of raw materials also affects the supply chain, further driving up costs. Consequently, these factors may restrict the growth of ETFE applications in some industries, despite its superior performance characteristics.

Market Competition from Alternative Materials

The Ethylene Tetrafluoroethylene market faces competition from alternative materials with similar properties, such as polycarbonate, polyethylene, and other fluoropolymers. These materials are often more cost-effective and easier to produce, which makes them attractive options for manufacturers and builders. While ETFE offers significant advantages in terms of performance, its higher cost and more complex production process can be a deterrent for industries looking to reduce material expenses. This competition from cheaper alternatives poses a challenge to the broader adoption of ETFE, particularly in sectors with tight budget constraints.

Market Opportunities:

Growing Demand for Sustainable Infrastructure and Green Building Solutions

The Ethylene Tetrafluoroethylene (ETFE) market presents significant opportunities in the growing demand for sustainable infrastructure and green building solutions. As global construction trends shift toward eco-friendly materials, ETFE’s energy-efficient and durable properties make it an ideal choice for projects aiming for green certifications. Its ability to reduce energy consumption while allowing natural light penetration aligns with the increasing emphasis on sustainability in the construction sector. As cities and businesses strive to meet stricter environmental regulations and sustainability goals, the adoption of ETFE in building designs is expected to rise, offering substantial market potential.

Expansion in Emerging Economies and Industrial Applications

Emerging economies, particularly in the Asia-Pacific region, present a notable growth opportunity for the Ethylene Tetrafluoroethylene market. Rapid urbanization and infrastructure development in countries like China and India are driving the demand for advanced construction materials. ETFE’s versatility and ability to withstand harsh environmental conditions make it a valuable material for a wide range of applications beyond construction, including automotive, aerospace, and electronics. As industries in these regions expand and modernize, the need for high-performance materials such as ETFE will continue to increase, opening new avenues for growth in diverse sectors.

Market Segmentation Analysis:

By Type

The Ethylene Tetrafluoroethylene (ETFE) market is primarily segmented into films, coatings, and laminates. ETFE films hold the largest share, driven by their application in architectural designs such as facades and roofs due to their lightweight, durable, and transparent properties. Coatings are increasingly popular in industries like automotive and electronics, offering high chemical resistance and thermal stability, while laminates are gaining traction in specialized applications requiring additional strength and resistance.

- For instance, AGC’s Fluon® ETFE film with a thickness of 0.2 millimeters is used for the roof of Forsyth Barr Stadium in New Zealand, covering 20,000 square meters and providing long-term weather resistance and light transmission.

By Technology

Technological advancements in fluoropolymer production have significantly impacted the ETFE market. Key innovations in extrusion and polymerization techniques have enhanced manufacturing efficiency, reduced costs, and expanded the range of ETFE products. These technological improvements make ETFE more accessible to various industries, contributing to its broader adoption in construction, aerospace, automotive, and electronics sectors. The increased use of advanced processing methods ensures higher product quality and performance in demanding applications.

- For instance, AGC Chemicals developed a surfactant-free fluoropolymer manufacturing process reducing fluorinated byproducts to below 25 parts per billion, targeting industrial-scale production by 2030.

By End-Use

The construction industry leads the ETFE market, utilizing the material in roofing, facades, and other architectural elements due to its excellent thermal insulation and energy efficiency properties. The automotive sector follows closely, using ETFE for components like fuel systems and seals, thanks to its heat and chemical resistance. The aerospace sector also benefits from ETFE, particularly for cable insulation and protective coatings in high-performance environments. The electronics industry is expanding its use of ETFE for cable insulation and protective applications, capitalizing on its superior mechanical and thermal properties.

Segmentations:

By Type:

By Technology:

- Extrusion

- Polymerization

- Coating Technology

By End-Use:

- Construction

- Automotive

- Aerospace

- Electronics

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America Market Overview

North America accounted for 35% of the global Ethylene Tetrafluoroethylene (ETFE) market in 2024. The region’s mature construction sector and increasing demand for sustainable building solutions drive ETFE adoption. Strong regulatory frameworks and a focus on energy-efficient, green buildings propel its use in architectural applications such as roofing and facades. The material’s durability and performance in harsh climates make it particularly suitable for the region’s construction needs. In addition, ETFE’s growing applications in aerospace and automotive sectors support its continued market presence in North America.

Europe Market Overview

Europe held a 30% share of the global ETFE market in 2024, with high adoption driven by stringent environmental regulations and the region’s commitment to sustainable construction practices. The growing integration of ETFE in green building projects, including facades and roofs, aligns with Europe’s emphasis on reducing carbon footprints and promoting energy-efficient designs. Key markets such as Germany, France, and the U.K. lead the way in adopting ETFE due to their advanced infrastructure and regulatory support for eco-friendly materials. Technological innovations in ETFE production further bolster the material’s presence in Europe.

Asia-Pacific Market Overview

Asia-Pacific is poised to grow the fastest, accounting for 25% of the global ETFE market in 2024. The rapid urbanization and infrastructure development in countries like China and India are significant drivers of this growth. ETFE’s lightweight and energy-efficient properties make it a preferred material for large-scale construction projects. As the region focuses on sustainable urban planning and modernizing infrastructure, ETFE’s applications in both commercial and residential developments are expanding. Additionally, the industrial demand for ETFE in aerospace and automotive sectors further fuels its market growth in Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M

- VECTOR FOILTEC

- AGC Chemicals Americas, Inc.

- The Chemours Company

- SABIC

- Toefco Engineered Coating Systems, Inc.

- Solvay

- Ensingerm Daikin Industries Ltd

- Shandong Hengyi New Material Technology Co., Ltd

- Saint-Gobain

Competitive Analysis:

The Ethylene Tetrafluoroethylene (ETFE) market is highly competitive, with leading players such as 3M, Chemours, and Daikin Industries dominating through continuous product innovation and technological advancements. These companies focus on improving production efficiency and reducing costs, enabling them to offer cost-effective ETFE solutions across industries like construction, automotive, and aerospace. Smaller regional players, particularly in Asia-Pacific, are capitalizing on niche applications and the growing demand for sustainable materials. Competitive strategies, including mergers, acquisitions, and partnerships, are essential for expanding market share and enhancing product offerings. The market’s dynamic nature and the need for high-performance materials drive ongoing competition among established and emerging players.

Recent Developments:

- In May 2025, The Chemours Company announced a strategic agreement with DataVolt to advance liquid cooling solutions for data centers, aiming for energy-efficient two-phase immersion cooling commercialization.

- In May 2025, Chemours partnered with Navin Fluorine International to manufacture Opteon™ two-phase immersion cooling fluids, supporting product commercialization plans.

- In August 2025, SABIC announced second-quarter 2025 financial results with adjusted net income of SAR 0.5 billion, progressing on a one million metric ton capacity MTBE project at its Petrokemya affiliate with EPC phase over 95% complete and pilot commissioning expected in Q3 2025.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Ethylene Tetrafluoroethylene (ETFE) is expected to grow as industries prioritize sustainability and energy-efficient materials.

- Increased adoption of ETFE in green building projects will drive its use in roofing, facades, and energy-efficient construction.

- Technological advancements in ETFE production processes will lead to lower costs, making the material more accessible across various sectors.

- The automotive industry will continue to fuel ETFE growth, especially with increasing demand for lightweight, durable components.

- Aerospace and electronics sectors will increasingly adopt ETFE for its superior thermal stability and chemical resistance.

- Asia-Pacific will be a key growth region, driven by rapid urbanization, industrialization, and investments in infrastructure projects.

- The demand for ETFE in emerging markets will rise as construction standards improve and sustainable building materials gain traction.

- ETFE’s applications in the automotive sector are expected to expand as manufacturers focus on lightweighting for improved fuel efficiency and reduced emissions.

- Increasing focus on smart cities and sustainable urban planning will enhance the demand for high-performance materials like ETFE.

- As environmental regulations tighten globally, the market for ETFE will expand, supported by its eco-friendly characteristics and long-term durability.