Market Overview:

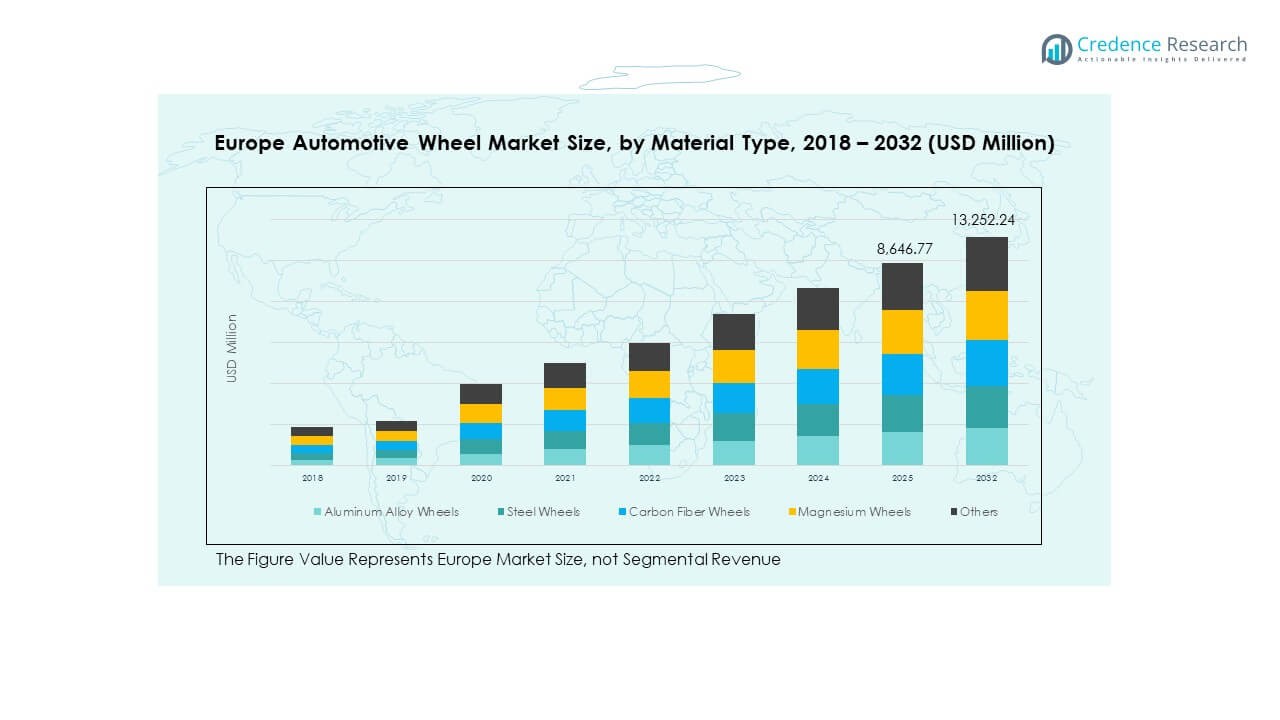

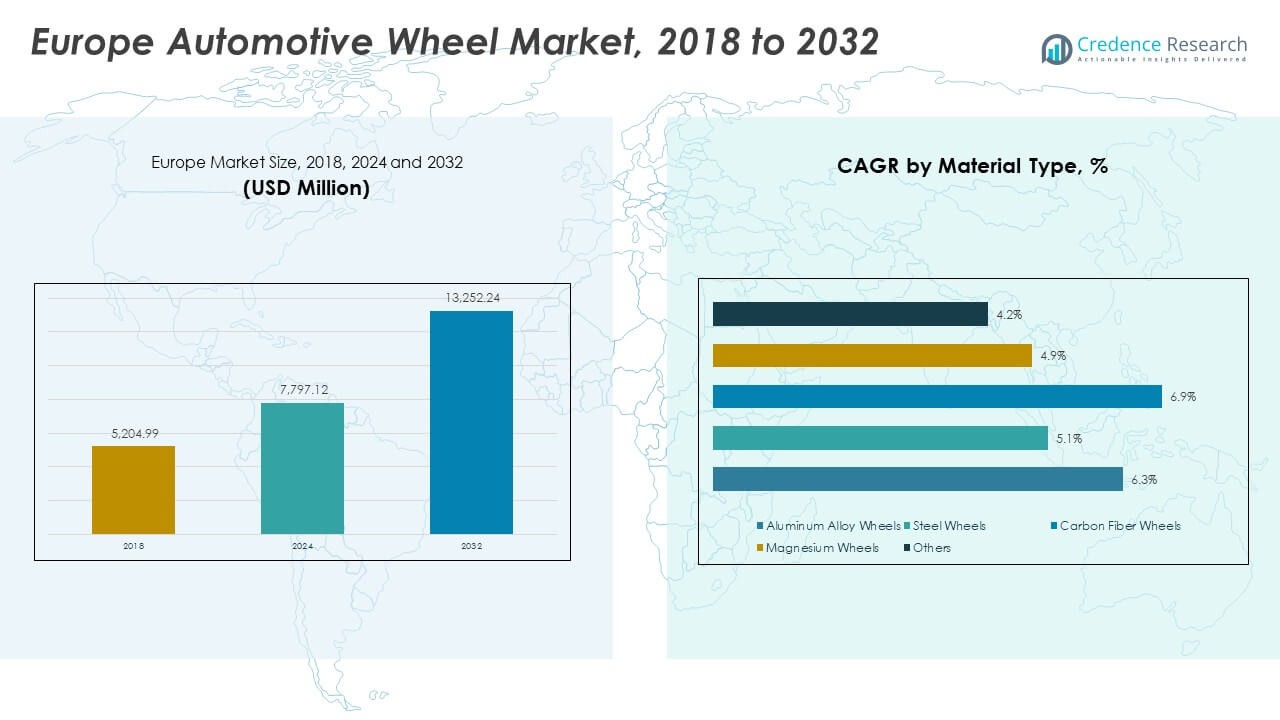

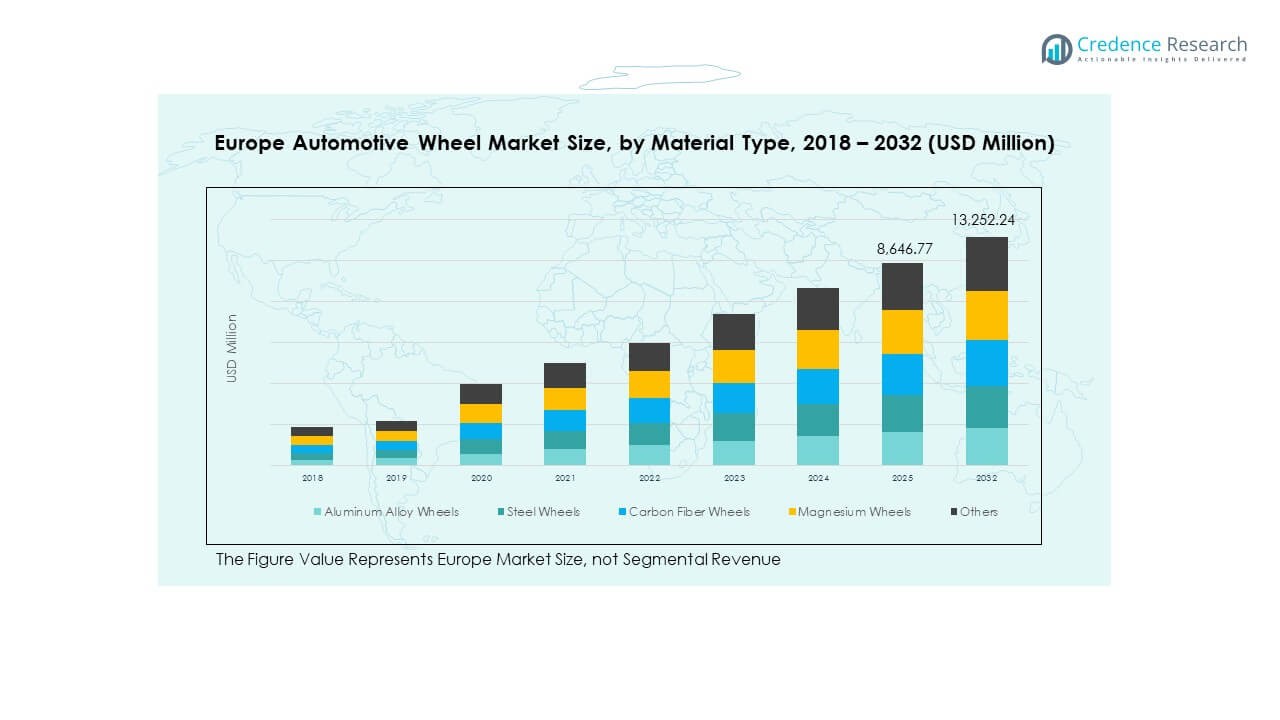

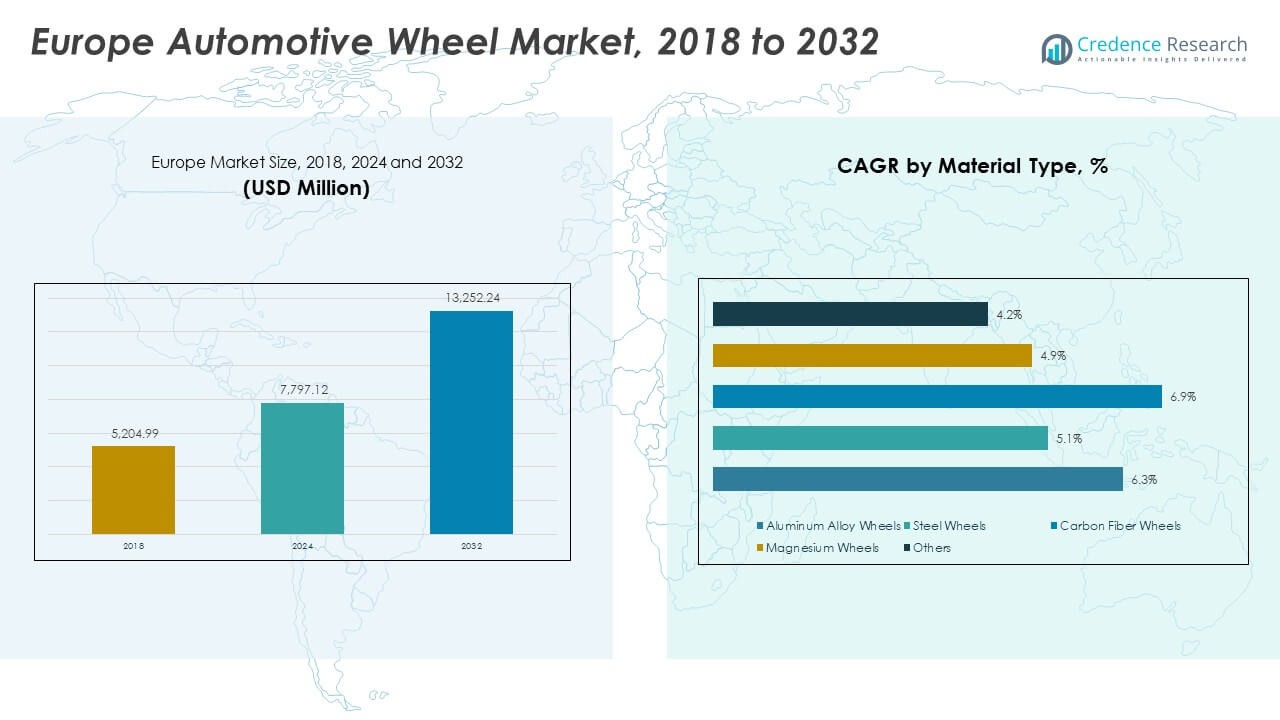

The Europe Automotive Wheel Market size was valued at USD 5,204.99 million in 2018 to USD 7,797.12 million in 2024 and is anticipated to reach USD 13,252.24 million by 2032, at a CAGR of 6.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Automotive Wheel Market Size 2024 |

USD 7,797.12 Million |

| Europe Automotive Wheel Market, CAGR |

6.30% |

| Europe Automotive Wheel Market Size 2032 |

USD 13,252.24 Million |

The market growth is driven by the rising adoption of lightweight materials and advanced wheel designs that enhance vehicle performance and fuel efficiency. Increasing electric vehicle production, demand for customized alloy wheels, and regulatory pressure to reduce carbon emissions are fueling innovation. Automakers are investing in aluminum and carbon fiber wheels to meet efficiency and aesthetic demands across premium and mass-market segments.

Germany leads the European market due to its strong automotive manufacturing base and R&D investment in lightweight materials. The U.K., France, and Italy are emerging markets driven by electric mobility expansion and rising consumer preference for performance-oriented vehicles. Eastern European countries are witnessing steady growth supported by growing auto component exports and local manufacturing investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Automotive Wheel Market was valued at USD 5,204.99 million in 2018, reached USD 7,797.12 million in 2024, and is projected to hit USD 13,252.24 million by 2032, registering a CAGR of 6.30%.

- Western Europe dominates with 56% share, driven by advanced manufacturing bases in Germany, France, and Italy supported by premium vehicle production and R&D strength.

- Eastern Europe holds 27% share due to low-cost manufacturing and growing OEM investments across Poland, Hungary, and the Czech Republic.

- Southern and Northern Europe together account for 17% share and represent the fastest-growing region, propelled by EV adoption, sustainability focus, and aftermarket expansion.

- Aluminum alloy wheels lead with about 46% share, followed by steel wheels at 28%, reflecting strong demand for lightweight, corrosion-resistant, and cost-effective designs.

Market Drivers:

Rising Demand for Lightweight and Fuel-Efficient Vehicles Across Europe

The Europe Automotive Wheel Market benefits from the growing need for lightweight and fuel-efficient vehicles. Automakers focus on weight reduction to improve mileage and cut CO₂ emissions under strict EU regulations. Aluminum and magnesium wheels replace traditional steel, improving performance and durability. The move toward electric vehicles also pushes demand for efficient and aerodynamic wheel designs. Consumers favor alloy wheels that enhance handling and aesthetics, supporting steady growth. Automotive suppliers invest in innovative wheel alloys that combine strength with reduced mass. It continues to evolve with OEM adoption of advanced lightweight materials and smart manufacturing processes.

- For instance, Alcoa Wheels reports weight savings of up to 51% when replacing traditional steel wheels with forged aluminium units, thereby improving efficiency and reducing emissions. Automakers focus on weight reduction to improve mileage and cut CO₂ emissions under strict EU regulations. Aluminium and magnesium wheels replace traditional steel, improving performance and durability.

Growth in Electric Mobility and Vehicle Electrification Programs

Expansion of electric vehicle production strengthens market growth across key European countries. Wheel manufacturers design aerodynamic, low-resistance wheels to extend EV range and improve efficiency. Governments support this transition through incentives for zero-emission vehicles, creating long-term demand. The push toward sustainable materials aligns with the rise of EVs in passenger and commercial fleets. Lightweight aluminum and forged alloys dominate due to their ability to reduce unsprung mass. It encourages automakers to adopt customized EV-compatible wheels optimized for battery performance. Research initiatives in EV integration and battery cooling further enhance the technical scope of wheel production.

- For instance, Ronal Group AG manufactures over 18 million wheels annually and uses forging and flow-forming technologies to support both OEM and aftermarket electric vehicle applications. Wheel manufacturers design aerodynamic, low-resistance wheels, such as the carbon-neutral R70-blue, to extend EV range and improve efficiency. Governments support this transition through incentives for zero-emission vehicles, creating long-term demand.

Strong Focus on Aesthetic Appeal and Vehicle Customization

Growing consumer interest in vehicle aesthetics drives the demand for customized and premium wheel finishes. Automakers and aftermarket players offer a wide variety of alloy designs, surface coatings, and color options. Customers prefer wheels that reflect personal style while maintaining structural strength. The Europe Automotive Wheel Market benefits from the rising trend of personalized luxury vehicles. Paint, chrome, and diamond-cut finishes increase in demand across both OEM and aftermarket channels. It supports a growing niche for high-end wheel design and branding. Evolving lifestyle preferences among younger buyers sustain this trend in urban and performance vehicle categories.

Technological Advancements and Adoption of Smart Manufacturing Systems

Advances in production technologies enhance precision and material utilization in wheel manufacturing. Use of robotics, additive manufacturing, and AI-based quality inspection improves output consistency. Integration of digital twins helps manufacturers monitor fatigue resistance and optimize performance during design. The Europe Automotive Wheel Market witnesses automation across casting, forging, and finishing operations. New surface treatment processes extend product lifespan and protect against corrosion. Automation reduces labor costs and waste while increasing throughput efficiency. It enables suppliers to maintain competitive pricing despite material cost fluctuations and global supply chain challenges.

Market Trends:

Market Trends:

Shift Toward Sustainable and Recyclable Wheel Materials

Manufacturers are increasingly using sustainable materials such as recycled aluminum and bio-based composites. This shift supports Europe’s climate neutrality goals under the Green Deal initiative. Companies invest in closed-loop production systems to reuse scrap material and minimize waste. It improves resource efficiency while reducing carbon footprint during production. Demand for green-certified materials drives partnerships between OEMs and raw material suppliers. Sustainable wheel manufacturing appeals to environmentally conscious consumers and enhances brand image. The trend sets a foundation for long-term competitiveness in a low-emission economy.

- For instance, Constellium SE’s C-TEC research centre has developed high-strength automotive aluminium alloys and holds over 600 patent families in lightweight structural components. This shift supports Europe’s climate neutrality goals under the Green Deal initiative. Companies invest in closed-loop production systems to reuse scrap material and minimise waste.

Integration of Smart and Sensor-Enabled Wheel Technologies

Integration of sensors into wheels enhances real-time data tracking for temperature, tire pressure, and load distribution. These smart systems improve safety, efficiency, and predictive maintenance in connected vehicles. The Europe Automotive Wheel Market benefits from the growth of intelligent mobility solutions. Manufacturers collaborate with electronics firms to embed IoT-based components into wheel assemblies. Such integration supports fleet management and advanced driver-assistance systems. It also helps detect early signs of wear and improve performance monitoring. Demand for smart wheels grows as vehicles transition toward higher automation levels.

- For instance, NIRA Dynamics AB’s Tire Pressure Indicator (TPI) system has been installed in over 110 million vehicles and supports indirect wheel-based monitoring without additional physical sensors. These smart systems improve safety, efficiency, and predictive maintenance in connected vehicles. The Europe Automotive Wheel Market benefits from the growth of intelligent mobility solutions.

Increasing Popularity of Premium and Performance Vehicle Segments

Luxury and sports car manufacturers increasingly rely on forged and precision-engineered alloy wheels. Premium vehicles emphasize aesthetics, performance, and brand exclusivity, encouraging innovation in wheel design. The market gains traction from rising disposable incomes and consumer interest in high-end mobility. Advanced wheel coatings enhance corrosion resistance and maintain a distinctive finish. It reinforces manufacturer focus on craftsmanship and precision detailing. The Europe Automotive Wheel Market continues to expand through the luxury aftermarket segment. Demand for performance upgrades sustains wheel innovation among boutique and mainstream brands alike.

Adoption of Hybrid Manufacturing and Advanced Design Technologies

The use of hybrid manufacturing methods combines casting, forging, and machining for enhanced performance. These techniques optimize material flow, density, and impact resistance in finished products. Adoption of computer-aided design (CAD) and simulation tools ensures structural integrity and lightweight balance. 3D printing supports prototyping and customization for low-volume production lines. It helps suppliers reduce development time while maintaining accuracy. The Europe Automotive Wheel Market evolves toward digital design environments that streamline innovation cycles. Continuous R&D efforts enhance flexibility, allowing faster adaptation to evolving consumer preferences.

Market Challenges Analysis:

Volatility in Raw Material Costs and Supply Chain Disruptions

Fluctuating prices of aluminum, magnesium, and other alloying metals create uncertainty in production planning. High energy costs in Europe increase operational expenses and pressure profit margins. Supply chain interruptions due to geopolitical tensions disrupt raw material sourcing. The Europe Automotive Wheel Market faces constraints from limited availability of specialized alloys. Logistics delays affect just-in-time delivery models critical for OEM operations. Manufacturers must balance cost control with maintaining product quality and performance standards. It pushes the need for diversified supplier networks and localized manufacturing strategies to reduce risk.

Stringent Environmental and Safety Regulations Affecting Design Flexibility

EU emission and recycling standards impose strict requirements on wheel materials and coatings. Compliance with REACH and Euro 7 standards limits the use of certain surface chemicals. Manufacturers must redesign processes to meet durability and sustainability benchmarks. Testing protocols for impact resistance and fatigue life add to time and development costs. The Europe Automotive Wheel Market encounters challenges adapting to evolving safety regulations. Restrictions on volatile organic compounds affect finishing and painting technologies. It compels the industry to invest heavily in R&D to balance safety, design freedom, and environmental compliance.

Market Opportunities:

Expansion of Electric and Autonomous Vehicle Segments in Europe

The growing electric and autonomous vehicle markets create new opportunities for wheel manufacturers. Lightweight aerodynamic wheels support higher energy efficiency and longer driving range. Automakers demand designs that integrate seamlessly with regenerative braking and low-noise requirements. The Europe Automotive Wheel Market benefits from collaborations between OEMs and technology providers. It allows development of advanced wheel systems tailored for next-generation EVs and automated fleets. Demand for quiet, durable, and energy-optimized wheels continues to accelerate with the mobility transition.

Emergence of Aftermarket Customization and Premium Wheel Upgrades

The expanding aftermarket for performance and aesthetic upgrades creates new revenue streams. Consumers seek stylish and personalized wheels that complement modern vehicle designs. Growth in online retailing and customization services supports this segment. The Europe Automotive Wheel Market gains from rising disposable incomes and enthusiasm for visual enhancement. It fosters innovation in modular design, finishes, and 3D-printed accessories. Increasing use of digital configurators simplifies selection and encourages premium purchases. Manufacturers offering flexible customization options strengthen brand loyalty and expand their market reach.

Market Segmentation Analysis:

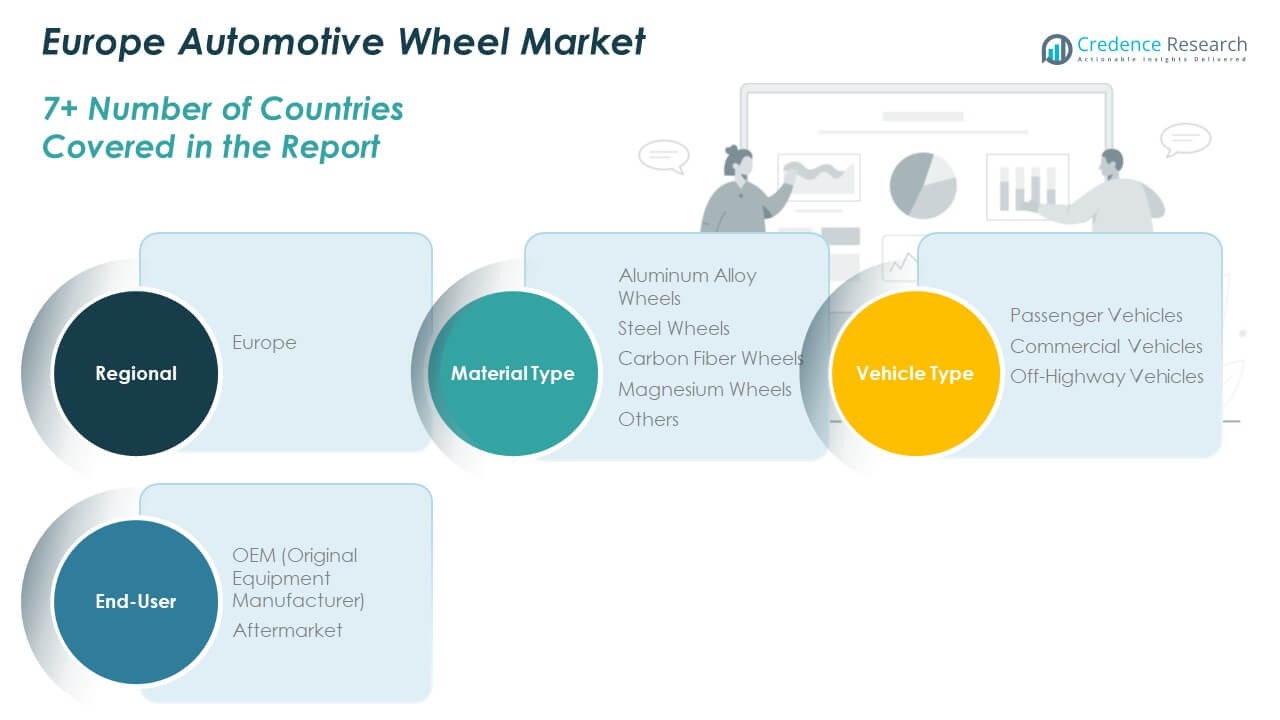

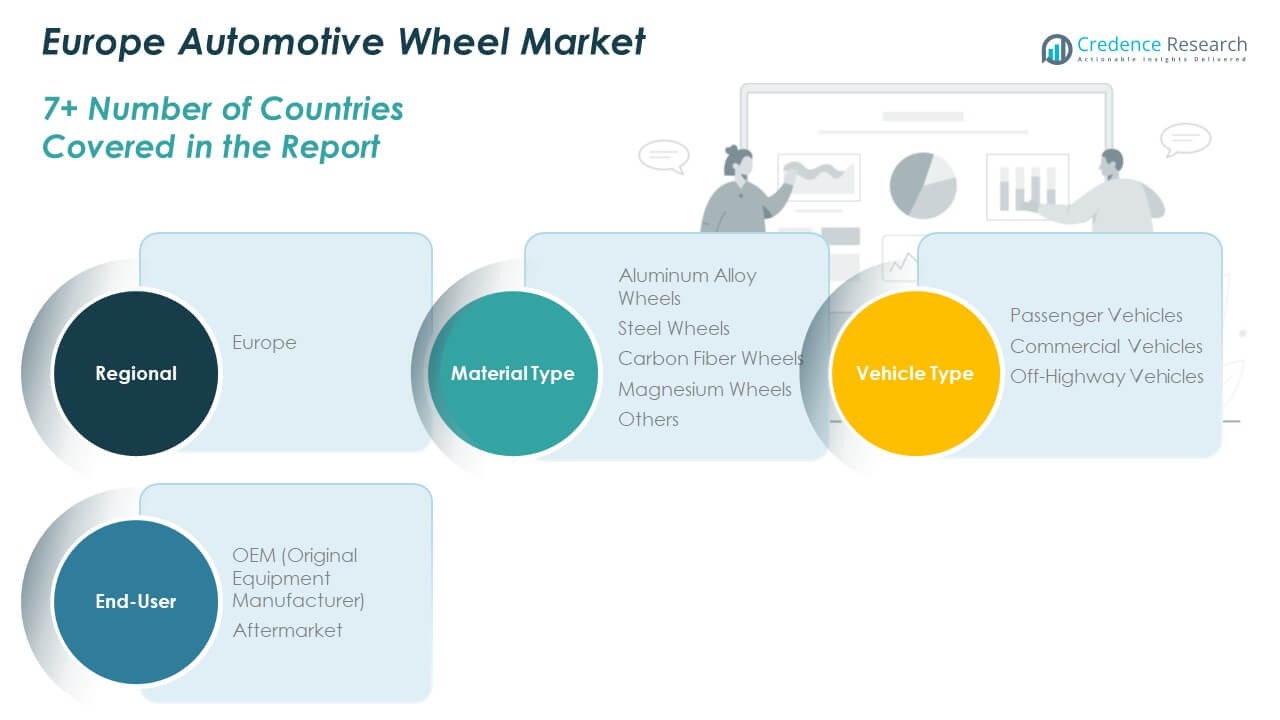

By Material Type

The Europe Automotive Wheel Market is segmented by material type into aluminum alloy, steel, carbon fiber, magnesium, and others. Aluminum alloy wheels dominate due to their lightweight structure, corrosion resistance, and contribution to fuel efficiency. Steel wheels maintain steady demand in heavy-duty and commercial vehicles for their durability and affordability. Carbon fiber wheels gain traction in premium and sports segments because of their superior strength-to-weight ratio. Magnesium wheels appeal to performance-focused consumers for enhanced acceleration and reduced inertia. It continues evolving with innovations in hybrid composite materials designed for sustainability and recyclability.

- For instance, Carbon Revolution Ltd. developed 23-inch and 24-inch carbon-fibre wheels achieving approximately 45 % weight savings compared with aluminium equivalents. Magnesium wheels appeal to performance-focused consumers for enhanced acceleration and reduced inertia.

By Vehicle Type

The market is segmented by vehicle type into passenger vehicles, commercial vehicles, and off-highway vehicles. Passenger vehicles lead the segment, supported by higher production volumes and consumer preference for enhanced aesthetics and comfort. Commercial vehicles rely on robust steel and forged alloy wheels to meet the demands of logistics and transportation sectors. Off-highway vehicles, including agricultural and construction machinery, utilize reinforced wheels for performance under extreme conditions. It experiences growing diversification as automakers introduce vehicle-specific wheel designs optimized for energy efficiency and performance.

- For instance, OEM steel wheels for off-highway use are made in spun or pressed formats exceeding 54-inch diameters for heavy-duty farm machinery. It experiences growing diversification as automakers introduce vehicle-specific wheel designs optimised for energy efficiency and performance.

By End User

The market is classified by end user into OEM and aftermarket categories. OEMs dominate due to strong collaborations with automakers and the integration of advanced wheel technologies during vehicle assembly. The aftermarket segment grows rapidly with increasing demand for replacement and customization options. Consumers seek personalized finishes and lightweight upgrades that enhance vehicle performance. It benefits from online retail channels and the rising popularity of customization culture across Europe.

Segmentation:

By Material Type

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Off-Highway Vehicles

By End User

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Region

- Europe

- United Kingdom (UK)

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe – Established Manufacturing Base and Premium Demand

Western Europe holds the dominant share of 56% in the Europe Automotive Wheel Market. Germany leads production with a strong automotive manufacturing network supported by BMW, Volkswagen, and Mercedes-Benz. The region emphasizes advanced wheel technologies and high-quality materials for performance and electric vehicles. France and Italy contribute significantly through luxury and sports car segments, where design precision drives wheel innovation. The aftermarket in the United Kingdom shows steady expansion due to consumer interest in customization and alloy upgrades. It maintains its leadership with continuous R&D investments, advanced forging technologies, and compliance with EU emission standards.

Eastern Europe – Expanding Industrial Footprint and Cost-Effective Manufacturing

Eastern Europe accounts for around 27% market share, supported by low production costs and skilled labor availability. Poland, the Czech Republic, and Hungary attract automotive wheel investments due to government incentives and supplier networks. Local plants serve both regional demand and export requirements for Western Europe. The market benefits from proximity to major European automakers, ensuring efficient logistics and supply chain operations. Rising demand for commercial and passenger vehicles increases OEM wheel production. It continues to emerge as a preferred hub for aluminum wheel casting and steel wheel manufacturing under expanding trade partnerships.

Southern and Northern Europe – Niche Growth Through Electrification and Aftermarket Expansion

Southern and Northern Europe together represent 17% of the total market share, focusing on specialty wheel production and electric vehicle integration. Spain and Italy support growing adoption of lightweight alloy wheels through expanding EV assembly plants. Scandinavian countries such as Sweden and Norway lead in sustainable automotive initiatives, encouraging demand for recyclable materials. The aftermarket in these regions benefits from premium vehicle sales and increased spending on performance wheels. Collaboration between regional suppliers and global brands enhances product diversification and availability. It demonstrates strong growth potential driven by electrification, design innovation, and circular economy strategies.

Key Player Analysis:

- Maxion Wheels

- Accuride Corporation

- Superior Industries International, Inc.

- American Eagle Wheels

- Alcoa Wheels

- MHT Luxury Wheels

- Wheel Pros

- Brixton Forged

- RTX Wheels

- Enkei

Competitive Analysis:

The Europe Automotive Wheel Market is highly competitive, with strong participation from both global and regional manufacturers. Companies focus on advanced materials, lightweight designs, and digital manufacturing processes to enhance efficiency and sustainability. Leading players such as Maxion Wheels, Accuride Corporation, and Superior Industries International compete through innovation, strategic partnerships, and expansion of OEM contracts. The industry shows consolidation trends as firms invest in automation and smart inspection systems to improve quality. It emphasizes customization, corrosion resistance, and advanced surface coatings to meet evolving design standards and consumer expectations.

Recent Developments:

- Enkei established a strategic distribution partnership in the Philippines in August 2025, with Wheel Gallery officially appointed as the Enkei wheel distributor by YHI Philippines, a subsidiary of YHI International Limited. The partnership encompasses Enkei’s complete lineup, including Racing Series, Tuning Series, Performance Series, and Truck & SUV wheel models.

- American Eagle Wheels ventured into lifestyle collaborations beyond traditional automotive wheel manufacturing, debuting a limited-edition partnership with Tru Kolors by Travis Kelce in August 2025. This diversification strategy represents the company’s expansion into broader consumer markets while maintaining its core wheel business operations.

- Superior Industries International, Inc. received shareholder approval in September 2025 for its acquisition by a group of term loan investors led by Oaktree Capital Management. The acquisition was initially announced on July 9, 2025, with all required regulatory approvals obtained by September 15, 2025, and the transaction anticipated to close on or before September 30, 2025. Superior Industries, with annual revenues of $1.16 billion, continues manufacturing aluminum wheels for the automotive industry while navigating significant capital structure challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on material type, vehicle type, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of lightweight alloys will redefine production efficiency and performance standards.

- Integration of smart wheel sensors will enhance vehicle safety and diagnostics.

- Electric mobility expansion will create demand for aerodynamic and low-resistance wheels.

- Recyclable materials will gain prominence to align with EU sustainability goals.

- Aftermarket customization will grow with digital design and e-commerce platforms.

- Automation and AI-driven quality control will improve precision and reduce costs.

- Strategic collaborations between OEMs and suppliers will accelerate design innovation.

- Carbon fiber and hybrid composites will enter mainstream use in premium segments.

- Regional manufacturing hubs in Eastern Europe will strengthen supply chain resilience.

- Continuous R&D investment will sustain competitiveness in a transitioning mobility ecosystem.

Market Trends:

Market Trends: