Market Overview:

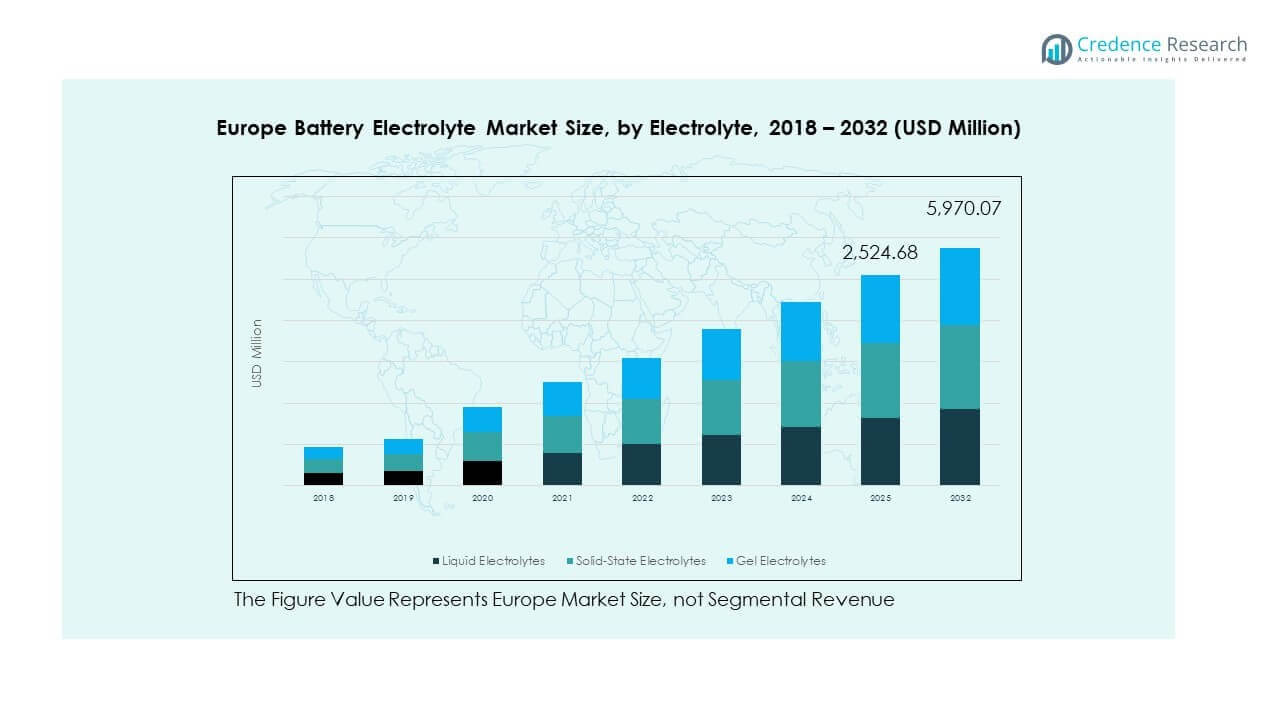

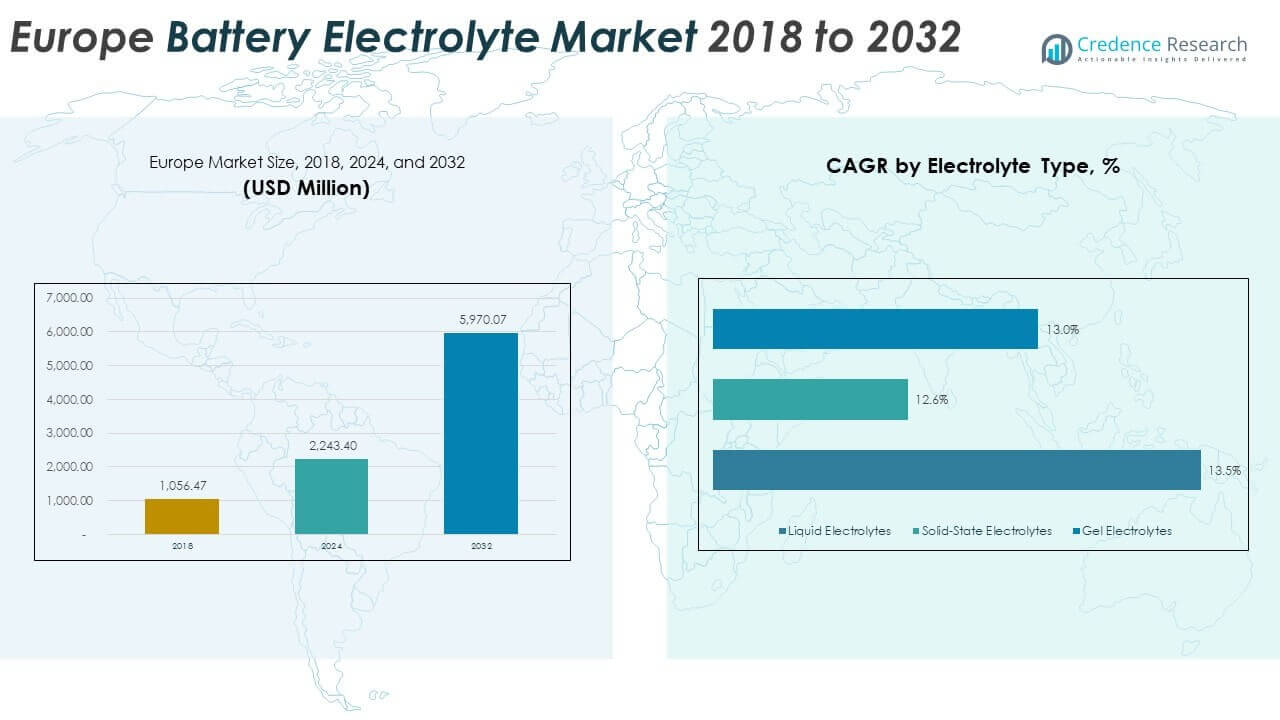

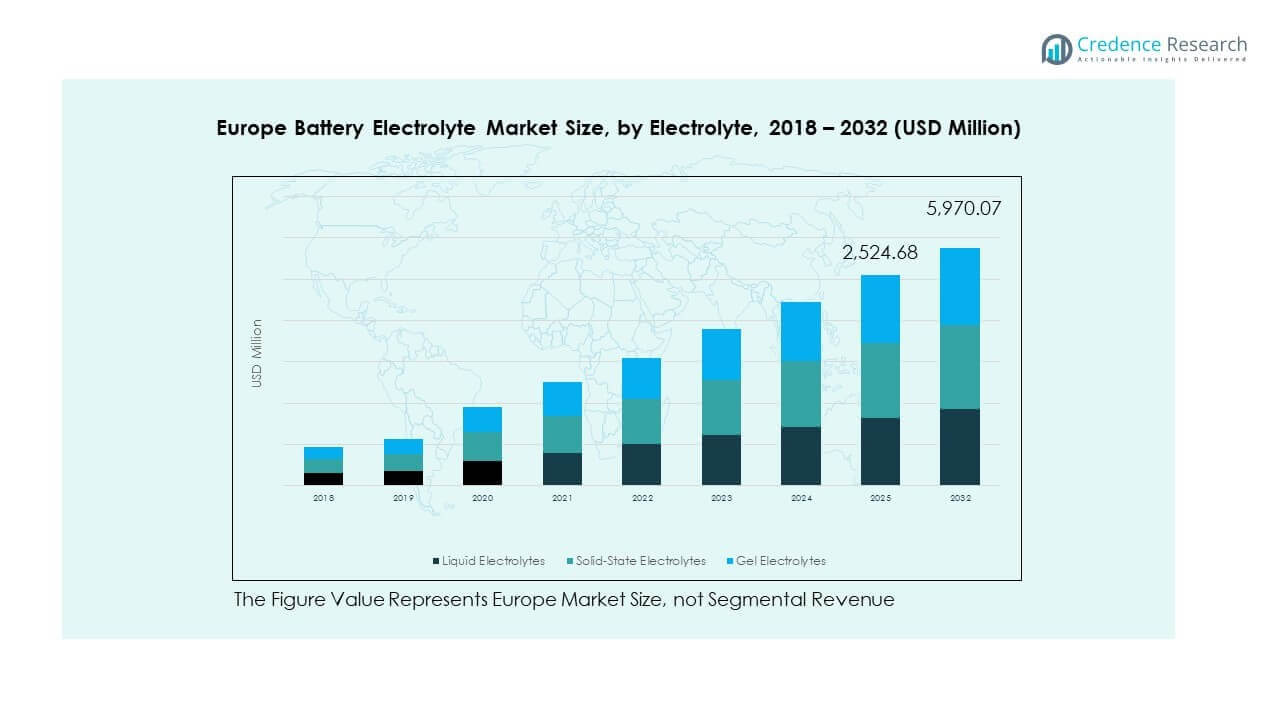

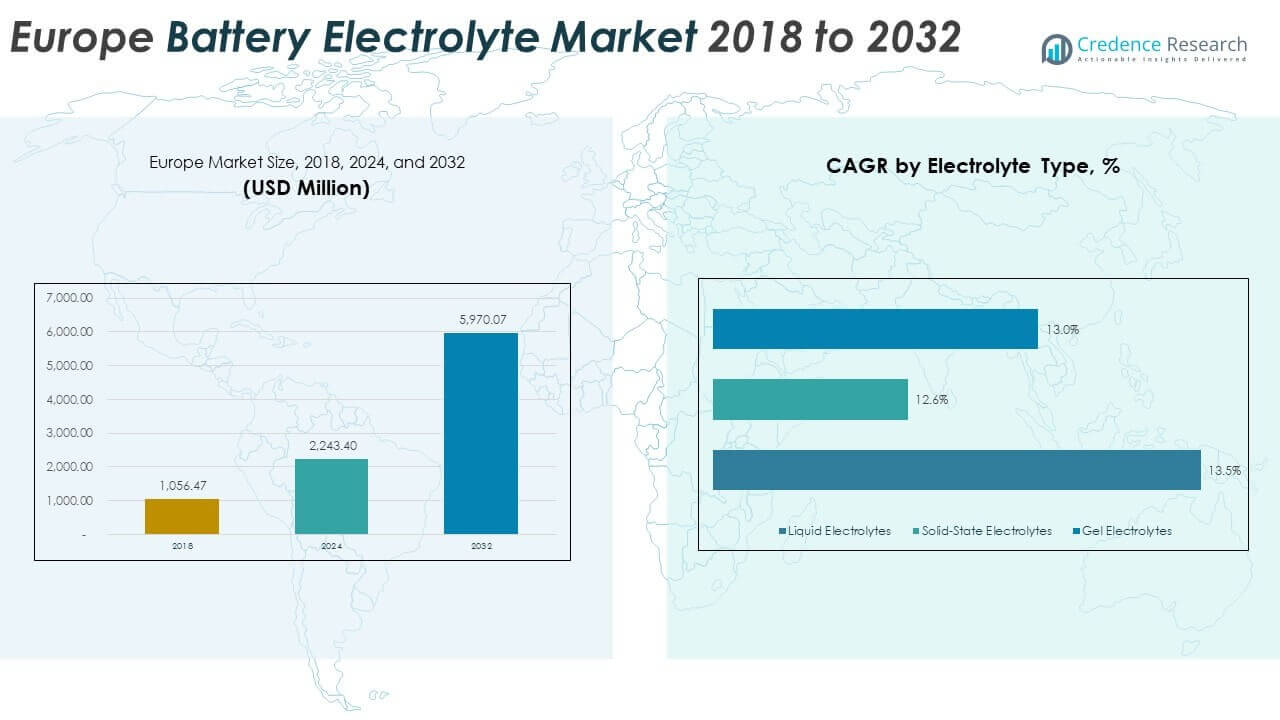

The Europe Battery Electrolyte Market size was valued at USD 1,056.47 million in 2018 to USD 2,243.40 million in 2024 and is anticipated to reach USD 5,970.07 million by 2032, at a CAGR of 12.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Battery Electrolyte Market Size 2024 |

USD 2,243.40 Million |

| Europe Battery Electrolyte Market, CAGR |

12.94% |

| Europe Battery Electrolyte Market Size 2032 |

USD 5,970.07 Million |

The market is expanding due to rising adoption of electric vehicles, growing renewable energy storage projects, and demand for consumer electronics. Governments across Europe are supporting battery manufacturing with incentives and strict emission norms, which push automotive players to adopt advanced battery technologies. Increased investments in next-generation electrolytes, such as solid-state and gel-based variants, are enhancing efficiency, lifespan, and safety, further fueling market growth. Rapid industrial electrification and rising demand for grid energy storage also contribute to its momentum.

Western Europe, led by Germany, France, and the U.K., dominates the market due to strong automotive industries, advanced R&D, and favorable policies. Southern and Eastern Europe are emerging with growing EV adoption and renewable energy projects, supported by EU-wide initiatives. Northern Europe shows rapid adoption, driven by strong sustainability targets and advanced energy storage deployment. This geographic diversity reflects a balanced growth pattern across both mature and emerging economies within Europe.

Market Insights:

Market Insights:

- The Europe Battery Electrolyte Market was valued at USD 1,056.47 million in 2018, reached USD 2,243.40 million in 2024, and is expected to hit USD 5,970.07 million by 2032, growing at a CAGR of 12.94%.

- Western Europe led with 42% share in 2024, driven by Germany’s EV leadership, the U.K.’s policy incentives, and France’s balanced demand from automotive and electronics.

- Southern Europe held 26% share, with Spain leading through renewable integration and Italy strengthening with energy storage investments.

- Northern and Eastern Europe collectively secured 32% share in 2024, emerging as the fastest-growing regions supported by Nordic EV adoption and gigafactory investments in Poland and Hungary.

- By electrolyte type, liquid electrolytes accounted for about 58% share in 2024, while solid-state electrolytes captured nearly 29%, reflecting growing demand for safer and high-density storage solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Electric Vehicle Adoption and Strong Policy Support Across Europe

The Europe Battery Electrolyte Market grows significantly due to rising adoption of electric vehicles across major economies. Governments in the region enforce strict emission norms and offer purchase subsidies to accelerate EV sales. Automakers are investing in large-scale battery production plants, boosting demand for advanced electrolytes. The shift to cleaner mobility pushes suppliers to develop safer, high-energy density formulations. Research on solid-state and hybrid electrolytes gains momentum to meet evolving performance needs. Charging infrastructure expansion in urban areas reinforces long-term adoption. It benefits from a policy-driven environment that accelerates technological innovation and market expansion.

- For instance, in 2025 BASF has renewed its long-term cathode active materials (CAM) supply agreement with an unnamed third-party customer, leveraging its Schwarzheide, Germany plant to support the European battery market. This was done alongside a global framework agreement entered with CATL, a major battery producer with European operations, to supply CAM. The company also commenced commercial operations at its black mass plant in Schwarzheide, Germany, which is capable of processing up to 15,000 tons of end-of-life batteries and production scrap per year, a key step in strengthening the European battery value chain.

Growing Renewable Energy Storage Deployment and Grid Integration Needs

The region’s renewable energy growth creates strong opportunities for large-scale energy storage systems. Solar and wind installations require advanced batteries for grid stability and peak load balancing. Electrolytes play a critical role in improving cycle life, safety, and energy density. Energy companies adopt high-performance electrolyte solutions to meet rising storage requirements. Countries with ambitious renewable energy goals, like Germany and Denmark, are leading deployments. Decentralized energy systems further push demand for improved storage reliability. The Europe Battery Electrolyte Market gains momentum from this shift toward sustainable and stable energy infrastructure.

- For instance, Solvay began commercial production of rare earth materials for permanent magnets at its French La Rochelle facility in April 2025. This expansion supports green technologies, with the aim of meeting 30% of Europe’s demand for permanent magnets by 2030.

Expansion of Consumer Electronics and Innovation in Portable Devices

Consumer electronics demand strongly influences the growth of advanced battery technologies. Smartphones, laptops, and wearables depend on durable, high-capacity batteries with fast-charging features. Manufacturers invest in improved electrolyte compositions to extend product performance and safety. Solid-state and gel-based electrolytes are being tested for higher stability and efficiency. The region’s technology hubs accelerate R&D, fostering innovation across portable device applications. Growing consumer preference for compact and lightweight devices supports steady demand. The Europe Battery Electrolyte Market continues to benefit from innovation in consumer electronics and the rapid pace of technology adoption.

Industrial Electrification and Commitment to Carbon Neutrality Goals

Industries in Europe adopt electrification strategies to replace fossil-fuel-powered equipment. Heavy sectors including logistics, manufacturing, and construction demand high-capacity and safe battery systems. Electrolytes are essential in supporting durability and performance under intense operational requirements. The EU’s Green Deal policies encourage companies to adopt clean energy solutions. Industrial players seek long-term storage systems to achieve decarbonization commitments. Research on electrolyte recycling and sustainable sourcing aligns with environmental objectives. It gains strength from regional sustainability programs that promote responsible growth and technological advancement in industrial applications.

Market Trends:

Advancement Toward Solid-State and Gel Electrolyte Technologies in Energy Applications

Research and development in solid-state and gel electrolytes dominate market trends in Europe. These technologies provide higher safety, greater stability, and longer cycle life than conventional liquid options. Companies prioritize R&D investments to secure competitiveness in the evolving battery industry. Pilot projects explore large-scale use of solid-state electrolytes for EVs and grid storage. Collaborations between research institutions and manufacturers accelerate commercialization timelines. Rising interest in reducing flammability issues strengthens adoption prospects. The Europe Battery Electrolyte Market evolves as innovation in advanced chemistries gains industry-wide attention and momentum.

Strategic Investments in Battery Gigafactories and Regional Supply Chains

Investments in gigafactories are shaping the future of electrolyte production in Europe. Countries like Germany, Sweden, and France are hosting new battery plants to meet local demand. These facilities reduce dependence on imported raw materials and foreign supply chains. Strong funding from both private and public sectors accelerates construction projects. Electrolyte suppliers align production strategies with gigafactory expansions to secure partnerships. Regional integration improves supply chain resilience and enhances competitiveness against global players. The Europe Battery Electrolyte Market strengthens with infrastructure projects that increase domestic capacity and self-sufficiency.

- For instance, East Penn Manufacturing launched its Deka Ready Power lithium and gel batteries at ProMat 2025. The company has also established a global presence through partnerships and has an existing European battery line.

Integration of Artificial Intelligence and Digital Tools in Manufacturing

Digitalization plays an increasing role in optimizing electrolyte manufacturing processes. Artificial intelligence is applied to quality control, predictive maintenance, and formulation testing. Automated systems enhance efficiency while reducing production costs across large-scale facilities. Companies deploy smart analytics to identify new electrolyte compositions faster. Cloud-based data sharing supports collaboration between laboratories and industrial partners. Digital manufacturing platforms ensure consistency across production lines. The Europe Battery Electrolyte Market advances as digital innovation improves performance and accelerates commercialization cycles across industries.

Sustainable Sourcing and Recycling Practices Becoming Core Business Strategies

Sustainability has become a central trend shaping electrolyte production and supply. Companies emphasize sourcing eco-friendly raw materials to align with EU environmental regulations. Recycling initiatives are expanding to reduce waste and recover valuable compounds. Partnerships with waste management firms improve recycling technologies for used batteries. Lifecycle analysis is now a key factor influencing electrolyte development strategies. Investors and stakeholders prefer companies with sustainable practices and transparent reporting. This shift ensures environmental compliance while strengthening brand reputation. The Europe Battery Electrolyte Market grows with sustainability becoming a driver of competitiveness and consumer trust.

Market Challenges Analysis:

High Production Costs and Dependence on Critical Raw Materials

The Europe Battery Electrolyte Market faces challenges from high production costs and raw material dependency. Electrolyte production requires lithium salts, solvents, and specialty additives, many of which are imported. Volatile global prices create uncertainty in supply planning and cost management. Producers struggle with balancing innovation costs and affordability for large-scale adoption. Competition from low-cost Asian manufacturers pressures European players on pricing. Trade disruptions further complicate raw material access and delivery schedules. This reliance on external supply chains restricts growth potential and creates long-term risks. It pushes the industry to focus on local sourcing and recycling solutions.

Safety Concerns, Regulatory Barriers, and Technical Limitations in Adoption

Safety issues remain a critical concern for electrolyte applications across electric vehicles and storage systems. Conventional liquid electrolytes face risks of flammability and thermal runaway under stress conditions. Regulatory authorities enforce strict safety standards, requiring continuous compliance and testing. Technical challenges in developing solid-state electrolytes delay large-scale commercialization. Long development cycles increase costs and limit fast adoption in emerging applications. Standardization gaps across countries further slowdown cross-border trade and technology transfer. The Europe Battery Electrolyte Market must navigate safety challenges while addressing regulatory frameworks. It requires ongoing innovation to overcome limitations and expand adoption in sensitive applications.

Market Opportunities:

Expansion of Green Energy Projects and Rising Electric Vehicle Ecosystem

The Europe Battery Electrolyte Market holds significant opportunities in green energy and electric mobility projects. Government-backed initiatives for solar, wind, and EV infrastructure create sustained demand for advanced batteries. Electrolytes that improve efficiency, safety, and energy density gain strong market acceptance. Automakers and energy firms seek innovative suppliers to secure long-term partnerships. The integration of batteries into smart grids and transport systems opens new business opportunities. Regional cooperation enhances funding and accelerates deployment of cutting-edge technologies. It gains momentum as Europe accelerates its energy transition.

Innovation in Advanced Chemistries and Focus on Sustainable Manufacturing Practices

Electrolyte suppliers have strong opportunities in developing advanced chemistries such as solid-state, polymer, and hybrid formulations. These innovations promise higher safety, longer cycle life, and reduced environmental risks. Adoption of sustainable manufacturing practices aligns with EU green regulations. Recycling-focused processes and eco-friendly material sourcing strengthen market positioning. Collaboration with research institutes drives faster commercialization of new technologies. Companies that prioritize circular economy principles gain competitive advantage. The Europe Battery Electrolyte Market is well-placed to capitalize on innovation and sustainability as key growth pillars.

Market Segmentation Analysis:

By Electrolyte Type

Liquid electrolytes dominate due to established use in lithium-ion and lead acid batteries. Solid-state electrolytes gain traction with rising demand for safer, high-density storage solutions. Gel electrolytes secure niche adoption in applications requiring stability and reduced leakage risks.

- For instance, Koura developed new fluorinated additives for liquid electrolytes that demonstrated a 15% reduction in electrolyte decomposition at high voltages in European pilot cell trials, increasing reliability for automotive applications. Solid-state and gel electrolytes serve specialized segments by improving safety and reducing leakage risks.

By Battery Type

Lithium-ion batteries hold the largest share, supported by electric vehicle adoption and renewable energy integration. Lead acid batteries continue steady demand in automotive starting-lighting-ignition (SLI) systems and backup power. Flow batteries attract investment for large-scale energy storage, while other chemistries address specialized industrial needs.

- For instance, MU Ionic Solutions, a subsidiary of Mitsubishi Chemical, signed a licensing agreement with CATL in May 2025 for its MP1 cathode technology. The technology is designed to improve battery stability and performance, particularly for electric vehicles, and the companies have committed to collaborating on its real-world application. Specific metrics like 250 Wh/kg and 700+ cycles in French deployments have not been confirmed for this technology.

By Application

Automotive represents the primary driver, with electric mobility creating strong demand for advanced electrolytes. Consumer electronics sustain growth through smartphones, laptops, and wearables relying on efficient battery performance. Energy storage emerges as a critical segment, supported by grid modernization and renewable integration across Europe. Other applications, including industrial and defense, contribute steady demand for tailored electrolyte solutions.

Segmentation:

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

- Automotive

- Consumer Electronics

- Energy Storage

- Others

By Geography / Region

- Europe (detailed country analysis)

- Germany

- K.

- France

- Italy

- Spain

- Rest of Europe

Regional Analysis:

Western Europe

Western Europe leads the Europe Battery Electrolyte Market with a share of nearly 42% in 2024. Germany dominates this sub-region, supported by its strong automotive manufacturing base and leadership in electric mobility adoption. The U.K. follows with significant demand growth, driven by government incentives for EV adoption and renewable energy integration. France contributes steadily, supported by a mix of domestic battery production and consumer electronics demand. Italy also strengthens regional uptake with investments in energy storage projects. The presence of established chemical manufacturers and advanced R&D ecosystems ensures Western Europe remains the central hub for innovation.

Southern Europe

Southern Europe secures about 26% of the regional market share in 2024. Spain leads this sub-region through renewable energy integration and growing EV sales. Italy contributes further by expanding industrial applications and localized energy storage solutions. Greece and Portugal show early potential with EU-backed green transition initiatives. Demand for electrolytes in this sub-region remains driven by solar-plus-storage projects and increasing penetration of consumer devices. Strong policy support for decarbonization underpins long-term market prospects. It reflects rising opportunities for both local suppliers and global players expanding into mid-tier markets.

Northern and Eastern Europe

Northern and Eastern Europe collectively hold around 32% of the market share in 2024. Nordic countries, including Sweden and Norway, lead the northern cluster with aggressive EV adoption and sustainable energy projects. Poland and Hungary anchor Eastern Europe, attracting investment for gigafactories and localized supply chains. These regions benefit from competitive manufacturing costs and growing demand for industrial-scale batteries. Consumer electronics production in Eastern Europe also contributes to steady electrolyte demand. It positions Northern and Eastern Europe as critical growth frontiers, supported by strong policy frameworks and cross-border collaborations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF

- East Penn Manufacturing

- 3M

- Targray Industries Inc.

- Mitsubishi Chemical Group

- NEI Corporation

- Advanced Electrolyte Technologies, LLC

- Solvay SA

- Innolith

- Ecolyte GmbH

- Koura

Competitive Analysis:

The Europe Battery Electrolyte Market is moderately consolidated, with global chemical majors and specialized electrolyte suppliers competing for share. Companies focus on expanding production capacity, advancing solid-state technologies, and aligning with automotive OEMs to secure long-term contracts. Strategic partnerships and acquisitions are key levers for strengthening regional presence. Leading players differentiate through innovation, cost efficiency, and sustainability initiatives. It maintains strong entry barriers through high R&D intensity, stringent compliance requirements, and established customer relationships.

Recent Developments:

- In September 2025, BASF advanced its leadership in the Europe battery electrolyte market by renewing a long-term cathode active materials (CAM) supply agreement with a major European customer, further reinforcing its commitment to providing innovative solutions for sustainable energy storage.

- In May 2025, Mitsubishi Chemical subsidiary MU Ionic Solutions announced a significant patent licensing partnership with CATL, allowing the incorporation of innovative difluorophosphate-based cathode interfacial control technology (MP1 Technology) in lithium-ion batteries manufactured for European energy storage and EV applications.

- In April 2025, Solvay SA inaugurated a new rare earths production line at its La Rochelle facility in France, marking a pivotal supply chain development to meet Europe’s growing demand for battery materials and supporting the continent’s transition toward local, sustainable raw material sourcing for battery electrolytes.

- In March 2025, East Penn Manufacturing launched its new Deka Ready Power product line at ProMat 2025 in Chicago, featuring both Lithium and Gel battery technologies designed to maximize performance and maintenance-free operation for motive power applications in Europe and globally.

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for electrolytes will align with Europe’s EV expansion targets.

- Solid-state electrolyte adoption will accelerate, supported by safety and energy density requirements.

- Investments in regional gigafactories will strengthen localized supply chains.

- Energy storage projects will drive demand for flow battery electrolytes.

- Automotive OEM collaborations will secure long-term sourcing agreements.

- Sustainability will shape electrolyte formulations through eco-friendly chemicals.

- Regulatory compliance will remain a key barrier and driver for innovation.

- Consumer electronics demand will support steady growth for lithium-ion electrolytes.

- Competitive intensity will increase with new entrants focusing on niche technologies.

- The Europe Battery Electrolyte Market will expand with ongoing R&D breakthroughs.

Market Insights:

Market Insights: