Market Overview:

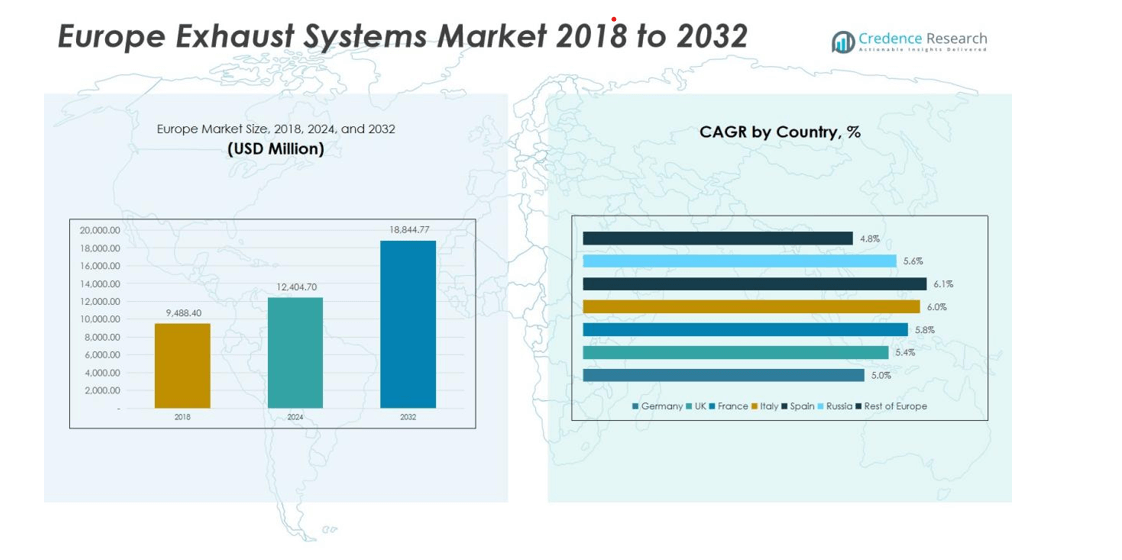

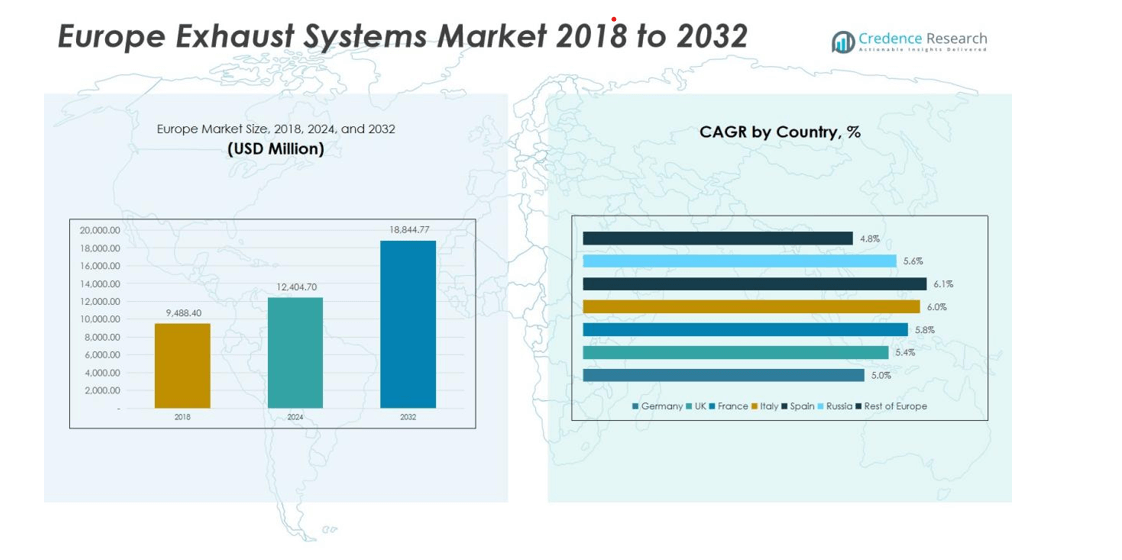

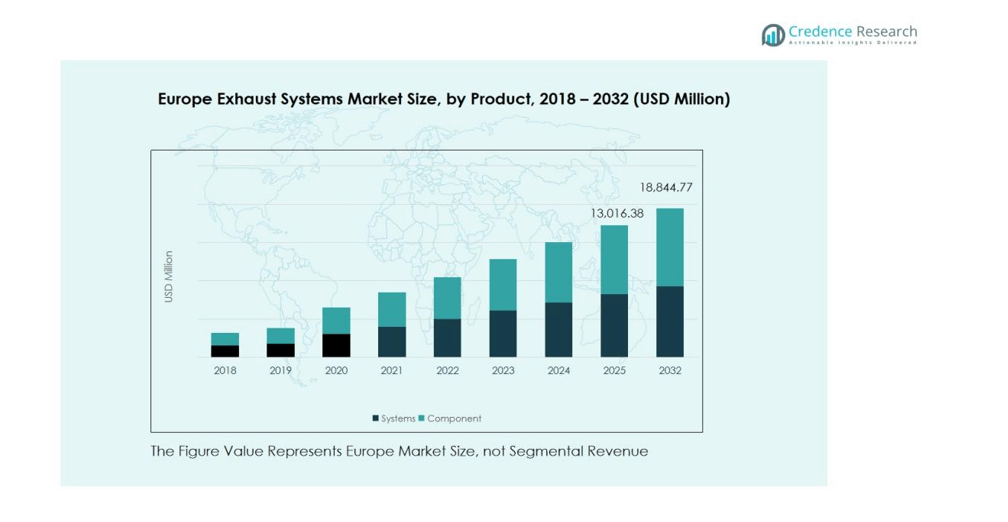

The Europe Exhaust Systems Market size was valued at USD 9,488.40 million in 2018 to USD 12,404.70 million in 2024 and is anticipated to reach USD 18,844.77 million by 2032, at a CAGR of 5.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Exhaust Systems Market Size 2024 |

USD 12,404.70 million |

| Europe Exhaust Systems Market, CAGR |

5.04% |

| Europe Exhaust Systems Market Size 2032 |

USD 18,844.77 million |

Stringent European Union emission standards continue to drive innovation in exhaust treatment and lightweight materials. Automakers are adopting selective catalytic reduction (SCR) and gasoline particulate filter (GPF) systems to reduce harmful emissions and enhance fuel efficiency. The market also benefits from rising sales of hybrid and plug-in hybrid vehicles, which require advanced exhaust systems for optimized thermal management and reduced noise.

Germany dominates the regional market, supported by a strong automotive manufacturing base and leading OEMs. France, Italy, and the United Kingdom also contribute significantly due to their growing focus on low-emission technologies and environmental sustainability initiatives. Eastern European countries are witnessing rapid growth driven by expanding production facilities, foreign investments, and supportive government regulations promoting eco-friendly automotive technologies.

Market Insights:

- The Europe Exhaust Systems Market was valued at USD 9,488.40 million in 2018, reached USD 12,404.70 million in 2024, and is projected to hit USD 18,844.77 million by 2032, registering a CAGR of 5.04% during the forecast period.

- Western Europe holds the largest share of 55%, supported by Germany, France, and the United Kingdom’s strong automotive base and innovation in emission technologies.

- Central and Eastern Europe account for 28% of the market, benefitting from cost-efficient manufacturing, growing investments, and supply chain integration.

- Southern Europe contributes 17% and shows steady aftermarket expansion driven by vehicle replacement demand and sustainability-focused upgrades.

- Central and Eastern Europe remain the fastest-growing subregion with a 6.2% CAGR, driven by favorable policies, skilled labor, and expanding production capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Regulations Driving Technology Adoption

The Europe Exhaust Systems Market experiences strong growth due to strict emission standards set by the European Union. These regulations aim to reduce nitrogen oxide (NOx), carbon monoxide (CO), and particulate emissions from vehicles. Automakers are investing in advanced exhaust after-treatment systems, such as catalytic converters and diesel particulate filters (DPF), to meet these requirements. It encourages continuous innovation and accelerates the shift toward efficient and sustainable exhaust technologies.

- For Instance, Faurecia (now part of the FORVIA group) is a leading global supplier of advanced Selective Catalytic Reduction (SCR) systems to meet strict European emissions standards like Euro 6d.

Rising Production of Passenger and Commercial Vehicles

Growing demand for passenger cars and light commercial vehicles boosts the adoption of advanced exhaust systems across Europe. Manufacturers integrate lightweight materials and optimized designs to enhance fuel efficiency and minimize emissions. The recovery of the European automotive industry after recent economic slowdowns strengthens market expansion. It benefits from the region’s robust automotive supply chain and increasing export activities.

- For Instance, Spain’s automotive production reached 2.38 million vehicles in 2024, representing a 3% year-on-year decrease, but it maintained its position as Europe’s second-largest car manufacturer, behind Germany.

Growing Preference for Hybrid and Plug-in Hybrid Vehicles

Hybrid and plug-in hybrid vehicles require specialized exhaust configurations to maintain engine efficiency during variable operation modes. The integration of selective catalytic reduction (SCR) and gasoline particulate filters (GPF) supports emission control and performance. Rising consumer preference for eco-friendly mobility solutions accelerates the adoption of such technologies. It positions exhaust system manufacturers to diversify their product portfolios for low-emission vehicle applications.

Ongoing Advancements in Lightweight and Heat-Resistant Materials

Material innovation plays a key role in enhancing the performance and durability of exhaust components. European manufacturers are using stainless steel, titanium, and composite alloys to reduce vehicle weight and improve thermal resistance. These developments help extend product life and optimize exhaust flow under extreme conditions. It drives cost efficiency and supports compliance with evolving environmental standards across the region.

Market Trends:

Integration of Advanced Emission Control and Thermal Management Technologies

The Europe Exhaust Systems Market is witnessing a strong shift toward advanced emission reduction and thermal control technologies. Automakers are increasingly integrating selective catalytic reduction (SCR), diesel oxidation catalysts (DOC), and gasoline particulate filters (GPF) to meet Euro 6 and upcoming Euro 7 standards. These systems enhance fuel efficiency and reduce nitrogen oxide emissions across passenger and commercial fleets. Manufacturers are also focusing on thermal insulation and active temperature management to optimize catalytic performance during cold starts. It supports cleaner combustion and reduces overall energy loss in hybrid and internal combustion engines. Continuous R&D investments in compact, modular exhaust designs are improving efficiency and sustainability across the regional automotive industry.

- For Instance, Automakers are increasingly integrating selective catalytic reduction (SCR), diesel oxidation catalysts (DOC), and gasoline particulate filters (GPF) to meet Euro 6 and upcoming Euro 7 standards.

Adoption of Lightweight Materials and Electrification-Compatible Exhaust Designs

Material innovation is a defining trend in the regional market, driven by the need for weight reduction and improved corrosion resistance. Leading manufacturers are adopting stainless steel, titanium, and composite alloys to enhance exhaust system strength and heat tolerance. The growing transition toward electric and hybrid mobility is pushing suppliers to redesign exhaust systems compatible with partial or intermittent engine operation. It encourages modular architectures that integrate sensors, actuators, and electronic controls for better emission tracking. The use of digital simulations in exhaust design supports precision manufacturing and performance optimization. The trend highlights a steady move toward efficient, intelligent, and environmentally compliant exhaust solutions across Europe.

- For Instance, Eberspächer has introduced new emission control products for Euro 6 and Euro 7 standards, achieving high NOx conversion rates in specific applications, but has not claimed a generalized “up to 15% higher conversion efficiency”

Market Challenges Analysis:

High Cost and Complexity of Advanced Exhaust Technologies

The Europe Exhaust Systems Market faces challenges due to the high cost of advanced emission control systems. Technologies such as SCR, GPF, and DPF require expensive materials like platinum and palladium, increasing production costs. Manufacturers must also meet evolving design and regulatory standards, which demand continuous R&D spending. It pressures small and mid-sized suppliers with limited technical and financial capacity. The complexity of integrating multiple after-treatment systems in compact vehicle designs further increases production time and cost. These factors collectively limit price competitiveness in cost-sensitive vehicle segments.

Rising Electric Vehicle Adoption Reducing Exhaust System Demand

The growing adoption of electric vehicles across Europe presents a major challenge to exhaust system manufacturers. Electric vehicles do not require traditional exhaust systems, reducing demand across OEM and aftermarket channels. Governments are providing incentives for EV adoption, which accelerates this shift. It forces exhaust system manufacturers to diversify into hybrid and alternative propulsion technologies to remain relevant. The transition impacts long-term growth potential in conventional vehicle segments. Strategic innovation and material adaptation remain essential for maintaining competitiveness in the evolving European mobility landscape.

Market Opportunities:

Expansion of Hybrid and Plug-in Hybrid Vehicle Segment

The Europe Exhaust Systems Market is set to benefit from the rapid growth of hybrid and plug-in hybrid vehicles. These vehicles require specialized exhaust solutions to handle variable engine loads and optimize emission control. Manufacturers can develop compact, heat-efficient systems tailored for hybrid powertrains to capture this demand. It creates opportunities for integrating intelligent sensors and catalytic materials to improve performance and durability. The growing preference for low-emission mobility in Europe strengthens the market potential for customized exhaust technologies. Partnerships with OEMs developing hybrid platforms can enhance market reach and innovation capabilities.

Rising Demand for Lightweight and Recyclable Materials

Lightweight and sustainable materials present significant growth opportunities for European exhaust system manufacturers. The shift toward stainless steel, titanium, and composite materials supports both emission reduction and fuel efficiency targets. It allows manufacturers to meet environmental goals while reducing vehicle weight and improving performance. Recyclable materials also align with the European Green Deal and circular economy principles. Investments in advanced forming and coating technologies can help achieve higher corrosion resistance and longer component life. This trend positions the region’s suppliers to lead in sustainable exhaust manufacturing and global exports.

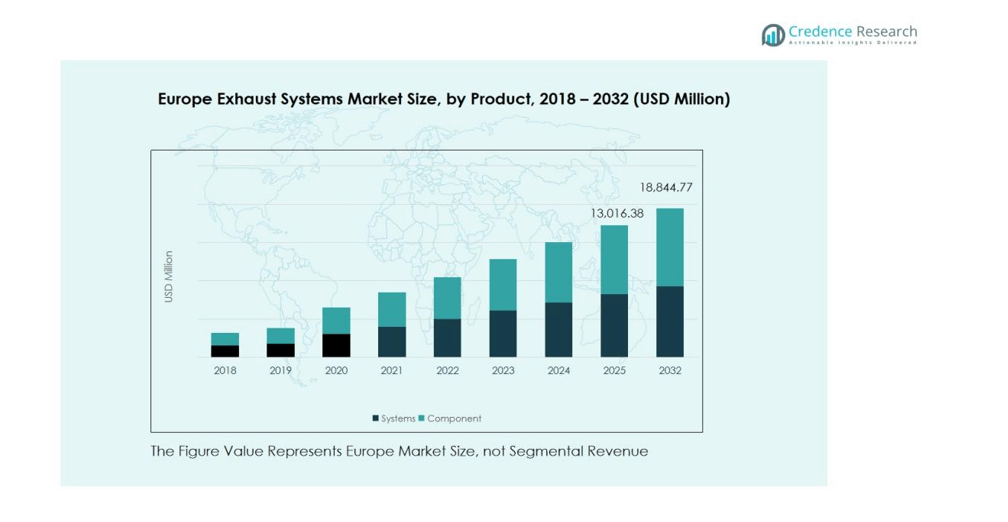

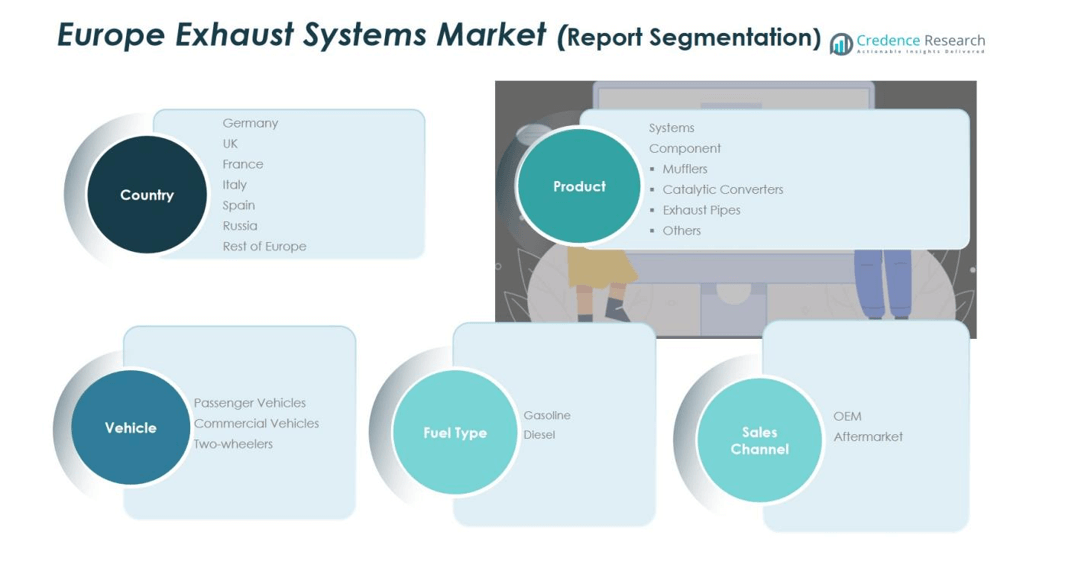

Market Segmentation Analysis:

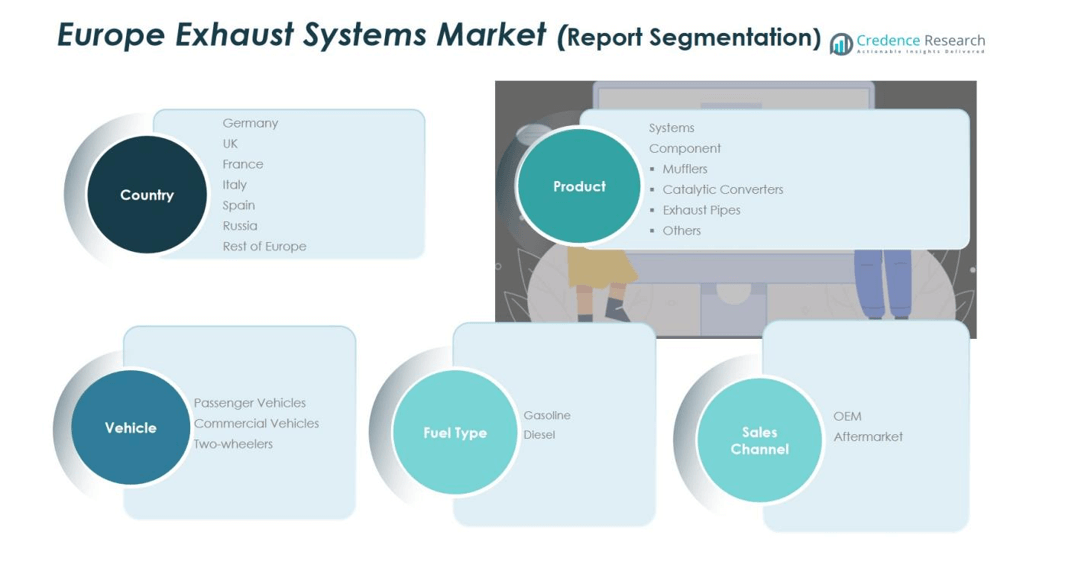

By Product Type

The Europe Exhaust Systems Market is segmented into systems and components, including mufflers, catalytic converters, exhaust pipes, and others. Catalytic converters hold the largest share due to their essential role in emission reduction and compliance with Euro standards. Mufflers and exhaust pipes are witnessing steady demand, driven by the growing preference for lightweight and corrosion-resistant materials. It benefits from continuous R&D in compact designs and advanced filtration systems. The shift toward modular and high-efficiency exhaust assemblies enhances performance while reducing vehicle weight and noise.

- For instance, Tenneco’s fabricated manifolds deliver weight reduction of up to 50 percent compared with traditional cast manifolds, while achieving temperature benefits of up to 50 degrees Celsius for faster catalyst light-off and improved overall catalyst efficiency.

By Vehicle Type

The market covers passenger vehicles, commercial vehicles, and two-wheelers, with passenger vehicles accounting for a dominant share. High production volumes of cars in Germany, France, and the UK strengthen this segment. Commercial vehicles contribute significantly due to stricter emission norms and the need for durable exhaust systems. It gains momentum from logistics expansion and infrastructure projects across Europe. The two-wheeler segment also shows steady adoption of emission-compliant exhaust designs, supporting sustainability goals.

- For Instance, In Germany’s passenger car market during the first quarter of 2025, Volkswagen sold 138,353 units, capturing a leading market share of 20.8%.

By Fuel Type

Based on fuel type, the market is classified into gasoline and diesel. Gasoline vehicles dominate due to their widespread use and improved fuel economy technologies. Diesel vehicles maintain relevance in heavy-duty and commercial applications requiring high torque performance. It benefits from advancements in diesel particulate filters and selective catalytic reduction systems that reduce harmful emissions. Growing preference for cleaner fuels supports innovation in both segments across Europe.

Segmentations:

By Product Type

- Systems

- Component

- Mufflers

- Catalytic Converters

- Exhaust Pipes

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-wheelers

By Fuel Type

By Sales Channel

By Country

- United Kingdom

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Dominating Through Strong Automotive Manufacturing and Innovation

The Europe Exhaust Systems Market is primarily led by Western Europe, driven by Germany, France, and the United Kingdom. Germany remains the leading contributor due to its advanced engineering expertise, high production capacity, and strong presence of OEMs such as Volkswagen, BMW, and Mercedes-Benz. France and the UK focus on sustainable vehicle technologies and emission compliance, boosting the adoption of efficient exhaust systems. It benefits from advanced R&D centers and strict environmental regulations that push innovation in catalytic and filtration technologies. Western Europe’s robust export base and integration of automation in manufacturing further enhance its market strength.

Central and Eastern Europe Strengthening Supply Chain and Production Capacity

Central and Eastern Europe are emerging as major production hubs due to favorable manufacturing costs and expanding automotive supply chains. Countries such as Poland, Hungary, and the Czech Republic attract foreign investments for exhaust component manufacturing. The availability of skilled labor and improved infrastructure supports large-scale production and assembly operations. It gains from government incentives promoting clean and sustainable vehicle technologies. These developments help regional suppliers establish strong partnerships with Western European automakers. The region’s cost advantage positions it as a strategic contributor to Europe’s overall exhaust system production network.

Southern Europe Advancing Through Aftermarket Growth and Sustainable Upgrades

Southern Europe, led by Italy and Spain, is experiencing steady expansion driven by aftermarket demand and replacement needs. The aging vehicle fleet across these countries boosts sales of upgraded exhaust components. It benefits from local manufacturing firms focusing on lightweight alloys and eco-friendly designs that meet EU emission norms. Italy’s strong engineering base and Spain’s growing vehicle production contribute to regional competitiveness. The trend toward sustainable mobility solutions supports continued innovation in exhaust system performance. This balance of aftermarket growth and sustainability focus strengthens Southern Europe’s role in the regional market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Exhaust Systems Market features strong competition among global and regional manufacturers focused on innovation, cost efficiency, and regulatory compliance. Major players such as Continental AG, Futaba Industrial Co., Ltd., Sango Co., Ltd., RTA Entwicklung GmbH, Eberspächer, and Forvia dominate through advanced product development and strategic partnerships with OEMs. The market structure is moderately consolidated, with companies emphasizing lightweight materials, catalytic efficiency, and modular designs to meet Euro 6 and Euro 7 standards. It benefits from ongoing R&D in hybrid-compatible and recyclable exhaust technologies. Firms are also expanding production across Central and Eastern Europe to leverage cost advantages and growing vehicle assembly operations. Competition continues to center on technology differentiation, sustainable manufacturing practices, and adaptability to evolving emission norms.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In September 2025, Purem by Eberspächer developed Direct Air Capture Technology designed to remove CO₂ from the atmosphere, expanding the company’s expertise beyond traditional exhaust systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle Type, Fuel Type, Sales Channel and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Exhaust Systems Market will continue evolving toward low-emission and lightweight technologies in the coming years.

- Manufacturers will prioritize materials that enhance corrosion resistance and durability while reducing overall system weight.

- Integration of smart sensors and digital monitoring systems will improve emission tracking and system performance.

- Hybrid and plug-in hybrid vehicles will generate new design opportunities for adaptive and heat-efficient exhaust systems.

- OEM collaborations will strengthen innovation in modular exhaust architectures suitable for next-generation vehicles.

- Regulatory tightening across the EU will accelerate R&D spending in catalytic and filtration technologies.

- The aftermarket segment will expand due to the aging vehicle fleet and higher demand for compliant replacement parts.

- Automation and advanced manufacturing methods will help reduce production costs and improve consistency.

- Sustainability initiatives will encourage the adoption of recyclable and reusable materials in exhaust components.

- The regional market will maintain steady growth supported by industrial expansion in Central and Eastern Europe.