Market Overview

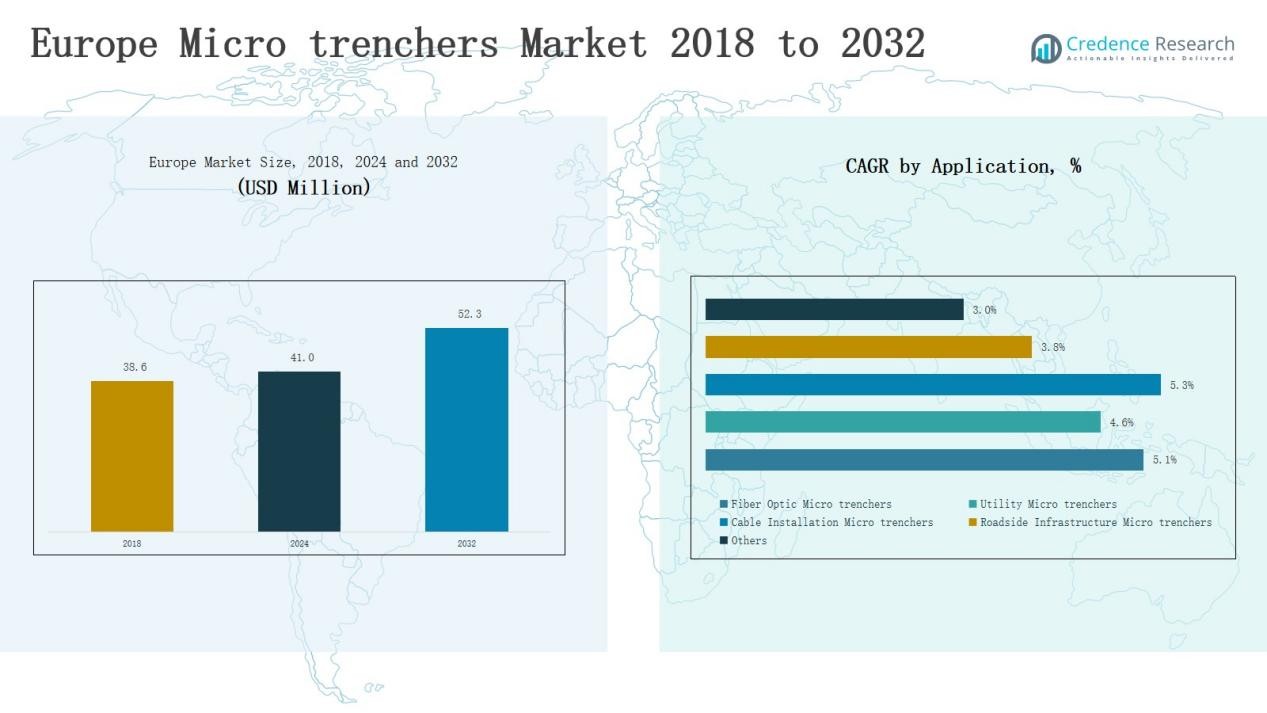

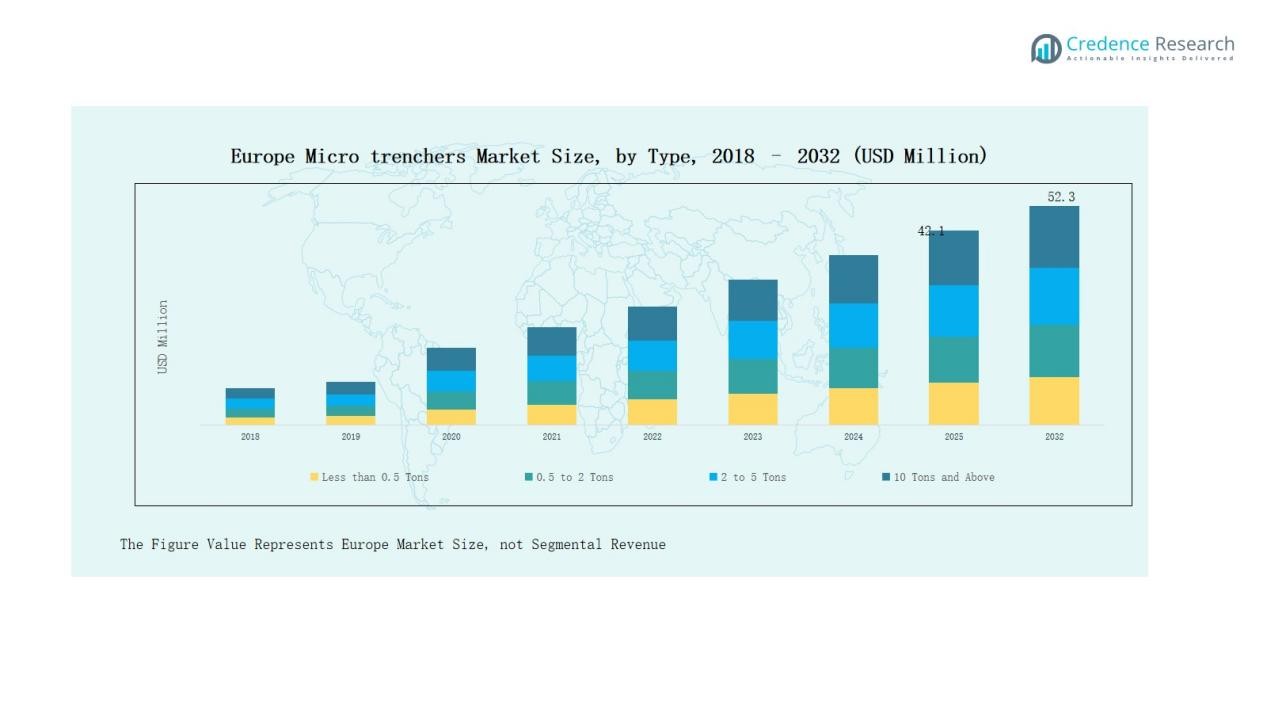

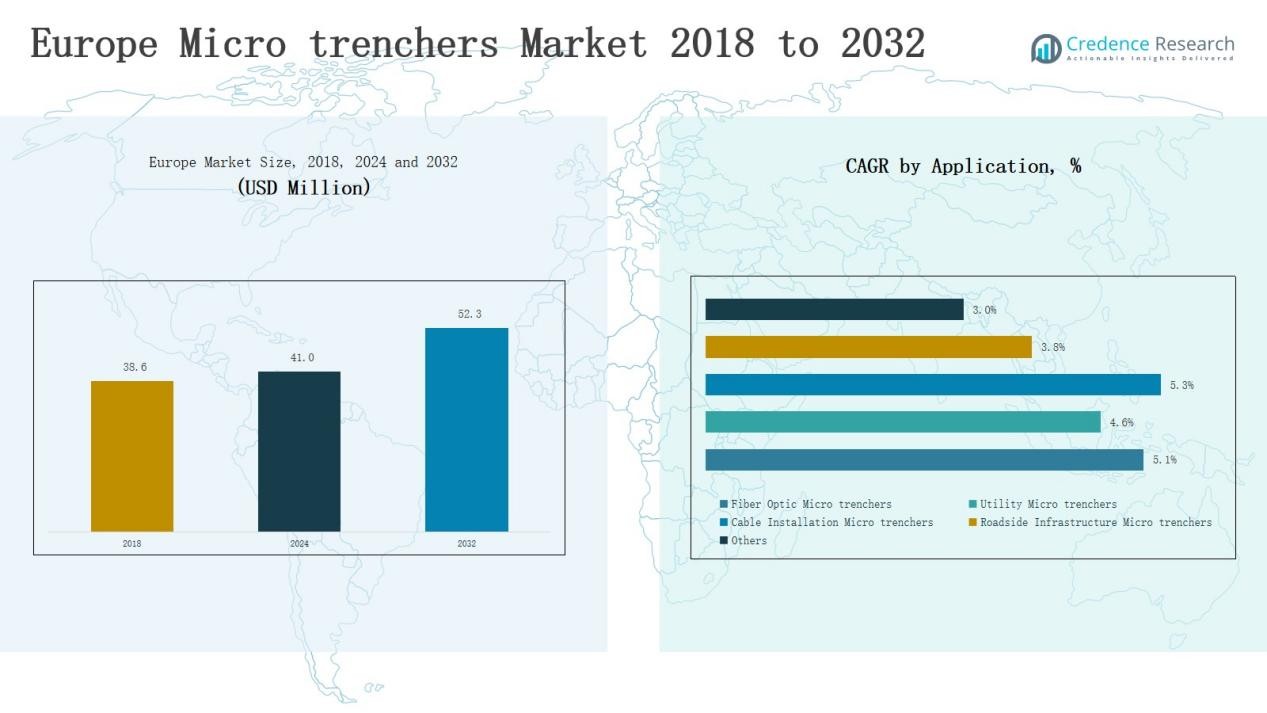

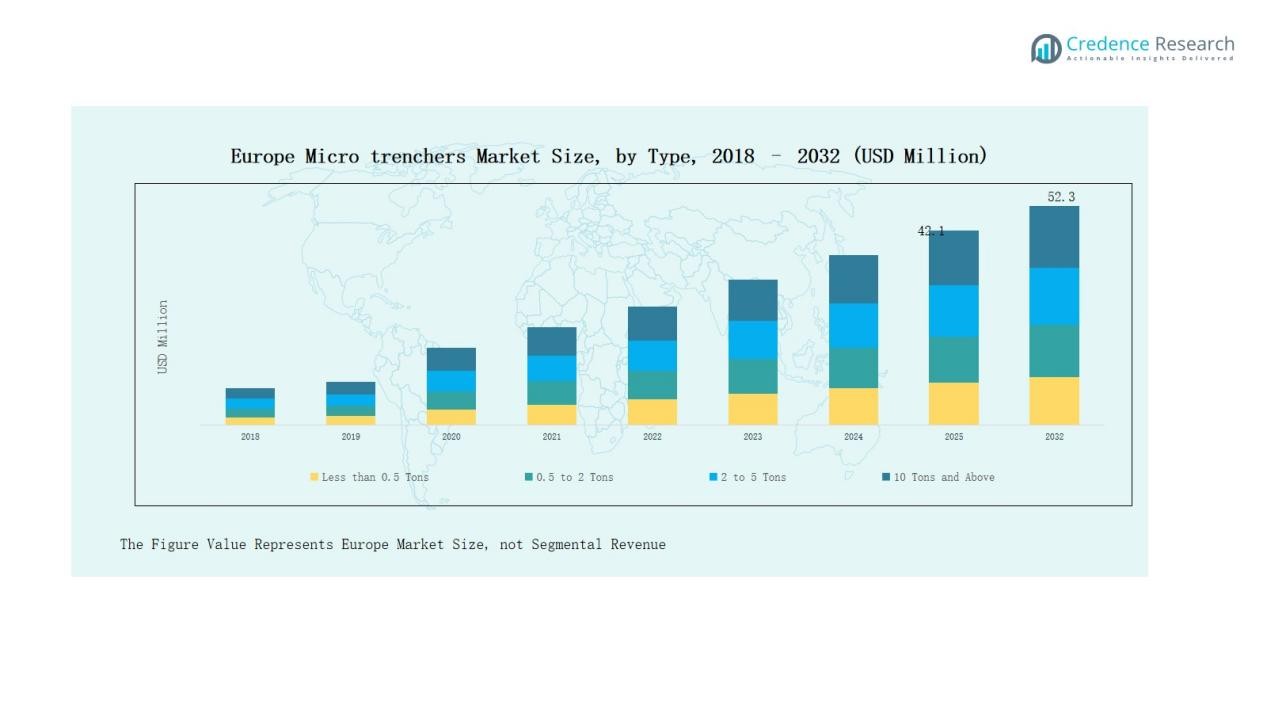

Europe Trencher Market size was valued at USD 161.5 million in 2018 to USD 172.0 million in 2024 and is anticipated to reach USD 219.0 million by 2032, at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Trencher Market Size 2024 |

USD 172.0 Million |

| Europe Trencher Market , CAGR |

3.1% |

| Europe Trencher Market Size 2032 |

USD 219.0 Million |

The Europe Trencher Market features strong competition from global and regional manufacturers, each focusing on technology, efficiency, and service support. Key players include Ditch Witch, Tesmec S.p.A., Soil Machine Dynamics Ltd. (UK), Royal IHC (Netherlands), DeepOcean Group (Norway), Osbit Ltd. (UK), Global Marine (UK), Port Industries, UNAC SAS, and Cleveland Trencher Company, Inc. These companies strengthen their positions through advanced product portfolios, automation, eco-friendly models, and robust dealer networks. Among regional markets, the UK leads with a 21% share in 2024, driven by heavy investments in fiber optic networks, 5G expansion, and municipal utility projects that continue to boost trencher demand across both urban and rural applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Trencher Market grew from USD 161.5 million in 2018 to USD 172.0 million in 2024 and is projected to reach USD 219.0 million by 2032 at 3.1% CAGR.

- Wheel trenchers lead with 48% share in 2024, while chain trenchers hold 37% and other types account for 15%, reflecting diverse application needs across industries.

- By application, telecommunication and power cables dominate with 34% share, followed by agriculture at 27%, municipal at 19%, oil and gas at 12%, and others at 8%.

- Distribution channels command 61% share in 2024, highlighting the strong role of dealer networks, while direct channels contribute 39% through large-scale infrastructure projects and utility demand.

- Regionally, the UK leads with 21% share, followed by France at 18%, Germany at 17%, Italy at 14%, Spain at 12%, Russia at 9%, and Rest of Europe at 9%.

Market Segment Insights

By Type

In the Europe Trencher Market, wheel trenchers dominate with around 48% share in 2024. Their popularity stems from efficiency in cutting through hard soils, pavements, and rocky terrains, making them essential for urban infrastructure and pipeline projects. Chain trenchers hold a significant 37% share, supported by demand in agriculture and telecommunication due to their precision in narrow and deep trenching. Other types account for the remaining 15%, serving niche applications where specialized digging capabilities are required.

- For instance, Vermeer’s RTX1250i2 ride-on trencher, launched in Europe with an automated digging system, is widely used in city utility projects where consistent trench depth is critical.

By Application

Telecommunication and power cables lead the market with a 34% share in 2024, driven by widespread fiber optic deployment and grid modernization across Europe. Agriculture follows with 27%, as trenchers support irrigation and drainage activities. The municipal segment secures 19% share, supported by rising investments in water, sewage, and urban utilities. Oil and gas contributes 12%, as trenchers assist in pipeline installations, while other applications cover 8%, addressing smaller-scale or custom trenching needs.

- For instance, in February 2023, Thames Water announced a £1.6 billion investment to be spent over the next two years on upgrading its wastewater treatment works and sewer networks across its entire region.

By Sales Channel

The distribution channel dominates with a 61% share in 2024, reflecting the strong role of dealer networks and partnerships in reaching diverse end users across Europe. Contractors and municipal bodies prefer distribution channels for access to aftersales service, financing, and product variety. The direct channel holds 39%, supported by large-scale infrastructure and utility projects where manufacturers directly supply equipment to clients, ensuring customization and better service integration.

Key Growth Drivers

Infrastructure Modernization Across Europe

The Europe Trencher Market grows steadily with strong investments in infrastructure modernization. Governments across the region focus on upgrading road networks, pipelines, and smart city projects. Wheel and chain trenchers are vital for rapid and precise digging, making them preferred equipment for large projects. Increasing demand for fiber optic and utility installations also adds momentum. This modernization push supports long-term adoption of trenchers, particularly in urban and semi-urban areas where efficient trenching solutions are essential.

- For instance, Germany is advancing its transportation networks supported by government initiatives like the Bundesverkehrswegeplan 2030 and climate targets from programs like the Klimaschutzprogramm 2030, with contractors increasingly adopting modern, digitally-enabled equipment for efficiency and sustainability.

Expansion of Telecommunication Networks

Fiber optic rollout and 5G expansion drive the demand for trenchers across Europe. Telecom operators invest heavily in laying underground cables to strengthen connectivity and reduce service gaps. Trenchers ensure faster, cost-effective, and less disruptive installation compared to traditional excavation. Countries like Germany, the UK, and France lead in this expansion, boosting market potential. Compact and specialized trenchers are especially sought after for urban deployment, where space constraints require precise trenching. This connectivity growth secures strong opportunities for trenching equipment manufacturers.

- For instance, Deutsche Telekom had enabled over 2.5 million new fiber optic connections that year, bringing the total number of households able to book a fiber line to 8 million.

Agricultural Mechanization and Irrigation Demand

Agricultural modernization contributes significantly to trencher adoption in Europe. Farmers increasingly use trenchers for irrigation systems, drainage, and soil management. The rising demand for sustainable farming and water-efficient practices drives mechanization in agricultural operations. Countries with large farming bases, such as France, Spain, and Italy, emphasize efficiency to boost yields and reduce costs. Trenchers improve productivity by reducing labor needs and speeding up land preparation. This growing agricultural mechanization trend ensures steady demand for trenching equipment in rural markets.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Automated Trenchers

Manufacturers in the Europe Trencher Market emphasize eco-friendly and automated designs to meet environmental and efficiency standards. Electric-powered trenchers, hybrid models, and advanced control systems reduce emissions and improve precision. Automation reduces operational errors while enhancing productivity in large-scale projects. The adoption of GPS-based guidance and telematics further improves trenching accuracy and maintenance monitoring. These innovations position trenchers as sustainable and high-performance tools, unlocking opportunities with contractors seeking greener solutions and compliance with strict European emission policies.

- For instance, Tesmec offers full electric trenching machines that produce zero emissions and reduce noise pollution, supporting green initiatives in trenching operations

Rising Demand from Utility and Municipal Projects

Utility and municipal projects present a growing opportunity for trenchers in Europe. Governments increase spending on underground cabling, sewage, and water management systems to support urban population growth. Municipal trenching projects often require compact equipment with minimal surface disruption, driving demand for advanced wheel and chain trenchers. The growing need for efficient underground utility placement aligns with smart city initiatives across the region. This consistent investment cycle creates long-term opportunities for manufacturers and distributors targeting the municipal and public sector markets.

- For instance, Mastenbroek Limited launched the Bulldog utility trencher in 2023, designed specifically for urban municipal projects that require compact equipment to minimize surface disruption, featuring an 8-liter Volvo engine suitable for precise utility cable installation.

Key Challenges

High Equipment and Maintenance Costs

One of the major challenges in the Europe Trencher Market is the high cost of acquisition and maintenance. Trenchers require significant upfront investment, which limits adoption among small contractors and farmers. Regular maintenance, spare parts, and technical support further increase ownership costs. These financial constraints make rental services or second-hand equipment more attractive, slowing down the purchase of new machines. Market growth depends heavily on offering cost-effective models and financing solutions to widen access for smaller end users.

Stringent Environmental and Safety Regulations

The regulatory environment in Europe poses challenges for trencher manufacturers. Strict emission standards and safety requirements increase compliance costs and extend product development timelines. Meeting EU carbon targets forces companies to redesign machines, often raising production expenses. Additionally, workplace safety regulations demand advanced protective features, increasing design complexity. These constraints can delay product launches and reduce profitability. Smaller manufacturers, in particular, face difficulties in keeping pace with evolving regulations, making it harder to compete with global players.

Seasonal Dependence and Demand Fluctuations

The market faces challenges from seasonal demand fluctuations, particularly in agriculture and construction. Harsh winters in Northern and Eastern Europe limit trenching activities, reducing equipment utilization rates. Demand also fluctuates with government budgets and project funding cycles, creating uncertainty for manufacturers and dealers. Seasonal slowdowns affect revenue stability, forcing companies to rely on diverse applications and rental services. Addressing this challenge requires manufacturers to expand into regions or applications with year-round activity to maintain consistent sales performance.

Regional Analysis

UK

The UK holds 21% share of the Europe Trencher Market in 2024. Strong investments in fiber optic networks and 5G rollout drive equipment demand. Municipal bodies focus on underground utility placement to support urban growth, which strengthens adoption of wheel trenchers. Agriculture also contributes through irrigation and drainage requirements in rural regions. Domestic manufacturers and service providers support local supply and aftersales services. The market benefits from both public and private sector infrastructure upgrades. It remains one of the leading regional contributors in Europe.

France

France accounts for 18% share of the Europe Trencher Market in 2024. Infrastructure modernization and renewable energy projects boost demand for trenching equipment. Agriculture plays a key role, with extensive farming bases requiring efficient land preparation and irrigation. Government investment in rural connectivity through underground cabling further drives demand. Wheel and chain trenchers are widely used in mixed applications. The market maintains steady growth with strong domestic consumption. It continues to balance demand from both urban and rural sectors.

Germany

Germany represents 17% share of the Europe Trencher Market in 2024. Its industrial strength and ongoing broadband expansion create strong opportunities for trenching machines. The construction and utility sectors rely on trenchers for underground networks and smart city initiatives. Farmers adopt trenchers for large-scale irrigation and drainage. High-quality standards encourage adoption of technologically advanced models. The presence of global manufacturers and established distribution networks supports market stability. It plays a critical role in regional demand with diversified applications.

Italy

Italy holds 14% share of the Europe Trencher Market in 2024. Demand is influenced by agricultural mechanization, particularly in irrigation and vineyard management. Municipal projects focused on water and sewage systems also support adoption. Infrastructure upgrades in southern regions create further opportunities for trenchers. Domestic contractors increasingly use trenchers for road and utility projects. The market benefits from strong distribution channels that provide accessibility across rural and urban zones. It sustains balanced demand across multiple applications.

Spain

Spain secures 12% share of the Europe Trencher Market in 2024. The agricultural sector is a major driver, with widespread adoption in irrigation and land preparation. Telecommunications expansion through fiber optic networks supports urban demand. Municipalities invest in sewage and water projects that require efficient trenching solutions. Domestic service providers ensure access to equipment and rentals. Growth is steady with contributions from both public and private investments. It demonstrates resilience through diversified end-user adoption.

Russia

Russia accounts for 9% share of the Europe Trencher Market in 2024. Large-scale oil and gas projects drive demand for heavy-duty trenchers. Municipal and utility expansion in major cities supports additional equipment use. The agricultural sector contributes through mechanization in drainage and irrigation systems. Harsh winters limit operations seasonally but demand remains strong in warmer months. International partnerships play a role in supplying advanced trenchers to Russian contractors. It continues to represent a key market for large infrastructure projects.

Rest of Europe

The Rest of Europe contributes 9% share of the Europe Trencher Market in 2024. Countries in Eastern and Northern Europe show rising adoption supported by utility projects and broadband expansion. Agriculture contributes through modernization of irrigation practices in developing rural regions. Municipalities invest in trenchers to improve water and sewage systems. Distribution networks strengthen availability of equipment across smaller economies. Seasonal weather patterns influence demand cycles but long-term growth remains positive. It provides a stable but growing share within the regional landscape.

Market Segmentations:

By Type

- Wheel Trencher

- Chain Trencher

- Other Types

By Application

- Agriculture

- Oil & Gas

- Telecommunication & Power Cables

- Municipal

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe Trencher Market is shaped by a mix of global leaders and regional players focusing on innovation, efficiency, and service support. Key companies such as Ditch Witch, Tesmec S.p.A., Soil Machine Dynamics, Royal IHC, DeepOcean Group, Osbit Ltd., Global Marine, Port Industries, UNAC SAS, and Cleveland Trencher Company compete through advanced product portfolios and strong dealer networks. Global manufacturers emphasize automation, eco-friendly designs, and partnerships with telecom and utility providers to strengthen market penetration. Regional players leverage cost-effective solutions and localized support to address smaller contractors and municipal clients. The presence of established service networks and rental offerings increases accessibility across both urban and rural markets. Intense competition drives continuous investment in research and development, while strategic collaborations with government projects and private operators ensure consistent demand. The market remains highly dynamic, with differentiation based on technology adoption, aftersales service quality, and price competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Ditch Witch

- Soil Machine Dynamics Ltd. (UK)

- Royal IHC (Netherlands)

- DeepOcean Group (Norway)

- Osbit Ltd. (UK)

- Global Marine (UK)

- Tesmec S.p.A.

- Port Industries

- UNAC SAS

- Cleveland Trencher Company, Inc.

Recent Developments

- In July 2025, NKT partnered with UK-based Helix Robotics Solutions Ltd to operate its new T3600 subsea trencher, considered the world’s most powerful. The trencher is expected to be fully operational by 2027 for offshore trenching projects.

- In April 2025, Mastenbroek introduced the Bulldog Compact Trencher at Bauma 2025. This compact machine impressed contractors with its speed, precision, and versatile conveyor system.

- In February 2025, Barreto Manufacturing expanded its product lineup by unveiling four new trenchers, including the 30RTK Track, strengthening its presence in the trenchers market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for trenchers will rise with large-scale fiber optic network expansion across Europe.

- Municipal projects will continue to drive adoption through investments in sewage and water systems.

- Agricultural modernization will support steady demand for irrigation and drainage trenching.

- Rental and leasing services will expand as contractors seek cost-effective equipment options.

- Eco-friendly and electric-powered trenchers will gain traction under stricter emission regulations.

- Automation and GPS-enabled machines will become more common in urban infrastructure projects.

- Distribution networks will strengthen to ensure wider access across developing European regions.

- Oil and gas pipeline projects will maintain demand for heavy-duty trenchers in select markets.

- Seasonal fluctuations will encourage diversification into year-round applications for stable growth.

- Strategic partnerships between manufacturers and utility providers will enhance market penetration.