| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Toy Market Size 2024 |

USD 84,037.51 Million |

| Europe Toy Market, CAGR |

3.52% |

| Europe Toy Market Size 2032 |

USD 1,10,836.88 Million |

Market Overview

Europe Toy Market size was valued at USD 84,037.51 million in 2024 and is anticipated to reach USD 1,10,836.88 million by 2032, at a CAGR of 3.52% during the forecast period (2024-2032).

The Europe toy market is driven by evolving consumer preferences, increasing demand for educational and STEM-based toys, and the rising popularity of licensed merchandise from movies, TV shows, and gaming franchises. Sustainability is a key trend, with manufacturers focusing on eco-friendly materials and recyclable packaging. Digital integration in traditional toys, such as augmented reality (AR) and interactive playsets, enhances engagement and learning experiences. The growing e-commerce sector and omnichannel retail strategies are further expanding market reach, offering convenience and a wider product selection. Additionally, increased parental awareness of cognitive development benefits fuels demand for innovative toys that promote creativity and problem-solving skills. Premiumization trends, including collectibles and limited-edition toys, attract both children and adult collectors. Economic factors, such as rising disposable incomes and holiday-season sales, also contribute to market growth. Overall, technological advancements and sustainability initiatives are shaping the future of the European toy industry.

The European toy market is geographically diverse, with strong demand across Western, Eastern, Northern, and Southern Europe. Western Europe, including the UK, Germany, and France, dominates due to high consumer spending and a well-developed retail sector. Eastern Europe, led by Russia and Poland, is experiencing rapid growth due to increasing disposable income and expanding e-commerce. Northern Europe, particularly Denmark and Sweden, is at the forefront of sustainable and innovative toy manufacturing. Southern Europe, including Spain and Italy, sees steady demand, driven by tourism and cultural preferences for traditional toys. Key players in the European toy market include LEGO System A/S, Ravensburger AG, Simba Dickie Group GmbH, Hasbro, and MGA Entertainment. These companies focus on innovation, digital integration, and sustainability to maintain their competitive edge. The market is also witnessing the rise of niche and eco-friendly toy brands, catering to evolving consumer preferences and regulatory demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe toy market was valued at USD 84,037.51 million in 2024 and is projected to reach USD 110,836.88 million by 2032, growing at a CAGR of 3.52% (2024-2032).

- Increasing demand for educational and STEM-based toys is driving market growth, with parents and educators focusing on cognitive development.

- Sustainability is a key trend, with rising consumer preference for eco-friendly toys made from biodegradable and recycled materials.

- ·The market is highly competitive, with major players like LEGO System A/S, Ravensburger AG, Hasbro, Simba Dickie Group GmbH, and MGA Entertainment focusing on innovation and digital integration.

- Stringent regulations and safety standards in the EU pose challenges for manufacturers, increasing compliance costs.

- Western Europe leads the market, while Eastern and Northern Europe show significant growth potential due to rising disposable income and sustainable toy adoption.

- E-commerce expansion and direct-to-consumer sales are reshaping distribution, enhancing accessibility and customer engagement.

Report Scope

This report segments the Europe Market as follows:

Market Drivers

Growing Demand for Educational and STEM Toys

The increasing focus on early childhood development and cognitive skill enhancement is a major driver of the European toy market. Parents and educators are prioritizing toys that promote learning, problem-solving, and creativity. STEM (Science, Technology, Engineering, and Mathematics) toys, such as coding kits, robotics, and construction sets, are gaining popularity as they help children develop critical thinking and technical skills. The rise of interactive and AI-powered educational toys further enhances engagement, making learning fun and effective. Additionally, government initiatives supporting educational toys in schools and childcare centers further contribute to market expansion.

Sustainability and Eco-Friendly Toy Innovations

The shift towards sustainable and eco-conscious consumerism is shaping the European toy industry. Parents are increasingly seeking environmentally friendly alternatives, prompting manufacturers to adopt biodegradable materials, recycled plastics, and non-toxic dyes. For instance, some companies have partnered with environmental organizations to certify their products as eco-friendly, while others have introduced wooden toys and organic fabric dolls made from sustainably sourced materials. European regulations, such as the EU’s directive on reducing single-use plastics, have also encouraged manufacturers to innovate with upcycled materials and reduce plastic packaging.

Digital Integration and Smart Toys

Technology-driven toys are revolutionizing the market, with digital integration enhancing play experiences. For instance, several European startups have developed Augmented Reality (AR) and Virtual Reality (VR) toys that combine physical play with immersive digital experiences. IoT-enabled toys, such as interactive robots and app-connected board games, are gaining traction among tech-savvy consumers. These innovations cater to modern children who are accustomed to digital interactions while also meeting parental expectations for educational value. The fusion of physical and digital play elements is creating a new segment of hybrid toys, further driving market growth.

E-Commerce Expansion and Omnichannel Strategies

The rapid growth of e-commerce platforms and omnichannel retailing is significantly influencing the European toy market. Online marketplaces provide consumers with a wider product selection, competitive pricing, and convenience, leading to increased sales. Major toy brands and retailers are leveraging digital marketing strategies, personalized recommendations, and subscription-based models to enhance customer engagement. The integration of AI-powered chatbots and virtual try-on experiences further improves online shopping. Additionally, the growing trend of direct-to-consumer (DTC) sales allows manufacturers to establish stronger brand loyalty and gather valuable consumer insights. As e-commerce continues to evolve, it remains a key driver of market expansion.

Market Trends

Rise of Sustainable and Eco-Friendly Toys

Sustainability is a defining trend in the European toy market, driven by increasing consumer awareness of environmental issues. Parents and caregivers prefer toys made from biodegradable materials, recycled plastics, and sustainably sourced wood. Leading manufacturers are incorporating eco-friendly practices, such as reducing single-use plastic packaging and using plant-based dyes. For instance, 69% of toy companies believe they can make a difference in the sustainability industry, with major brands developing environmental strategies to gain a competitive advantage. Regulatory policies across Europe, including the EU Green Deal, further encourage sustainable innovation in toy production. As environmental consciousness grows, brands emphasizing ethical sourcing and circular economy principles are gaining a competitive advantage.

Increasing Popularity of Educational and STEM Toys

Educational toys continue to dominate the European market, with a strong emphasis on STEM-based products. Parents and educators seek toys that enhance problem-solving skills, creativity, and cognitive development. Robotics kits, coding games, and science experiment sets are in high demand, aligning with the growing interest in early childhood education. For instance, the educational toys market in Europe generated significant revenue in 2023, with STEM toys being the most lucrative and fastest-growing product segment during the forecast period. Additionally, toys incorporating artificial intelligence (AI) and interactive learning elements are reshaping how children engage with educational content. The emphasis on learning through play supports long-term market growth and encourages continuous innovation in toy design.

Digital and Smart Toy Integration

The fusion of technology and traditional toys is transforming the market, with smart toys offering interactive and immersive experiences. Augmented Reality (AR), Virtual Reality (VR), and app-connected playsets enhance engagement, catering to a tech-savvy generation. Internet of Things (IoT)-enabled toys, such as voice-activated dolls and AI-powered robots, provide personalized play experiences. This trend is further fueled by the increasing use of tablets and smartphones among children, making digital integration a key differentiator in the competitive toy industry. As technology advances, smart toys will continue to shape the future of play.

Growth of E-Commerce and Direct-to-Consumer Sales

The rapid expansion of e-commerce is reshaping toy distribution, with online marketplaces becoming a dominant sales channel. Consumers benefit from wider product availability, personalized recommendations, and competitive pricing through digital platforms. Leading toy brands are adopting direct-to-consumer (DTC) strategies, allowing them to build strong brand loyalty and gather valuable customer insights. Subscription-based toy services and online-exclusive product launches further drive online sales. Additionally, social media marketing and influencer partnerships play a crucial role in promoting new toys and engaging with target audiences. As digital commerce continues to grow, brands are focusing on seamless omnichannel experiences to meet evolving consumer expectations.

Market Challenges Analysis

Stringent Regulations and Safety Compliance

The European toy market faces significant challenges due to strict regulations and safety standards. The European Union enforces rigorous toy safety directives, including EN 71 and REACH regulations, which require manufacturers to comply with stringent quality control measures. For instance, the EU Toy Safety Directive mandates mechanical safety testing and the use of non-toxic materials, ensuring toys meet high safety standards. Frequent regulatory updates demand continuous compliance, which can be financially and logistically challenging, particularly for small and medium-sized enterprises (SMEs). Additionally, the growing emphasis on sustainability adds another layer of compliance, as companies must adopt eco-friendly materials while meeting safety requirements. Failure to comply with these regulations can result in recalls, legal penalties, and reputational damage, making regulatory adherence a critical challenge for the industry.

Rising Production Costs and Supply Chain Disruptions

Increasing raw material costs, labor expenses, and supply chain disruptions present ongoing challenges for the European toy market. The rising prices of plastics, metals, and electronic components significantly impact manufacturing costs, forcing companies to either absorb the expenses or pass them on to consumers. Additionally, global supply chain disruptions, including shipping delays, container shortages, and geopolitical tensions, have strained toy distribution networks. Many toy companies rely on production facilities in Asia, making them vulnerable to supply chain vulnerabilities and fluctuating tariffs. Inflationary pressures further impact consumer purchasing power, potentially reducing discretionary spending on toys. To mitigate these challenges, companies are exploring nearshoring, localized production, and sustainable material sourcing, but these strategies require long-term investment and adaptation.

Market Opportunities

The European toy market presents significant growth opportunities driven by the increasing demand for sustainable and educational toys. As environmental awareness rises, consumers seek eco-friendly alternatives, creating opportunities for manufacturers to develop biodegradable, recycled, and ethically sourced toys. Companies that prioritize sustainability through innovative materials and reduced carbon footprints can differentiate themselves and attract environmentally conscious buyers. Additionally, the demand for educational and STEM-based toys continues to grow as parents and educators emphasize early learning. Toys that promote cognitive development, creativity, and problem-solving skills—such as robotics kits, coding games, and interactive learning tools—are gaining popularity. This shift towards educational play provides opportunities for brands to develop engaging and technology-integrated products that support both entertainment and learning objectives.

Digital transformation in the toy industry also opens new avenues for market expansion. The rise of e-commerce and direct-to-consumer (DTC) sales allows manufacturers to reach broader audiences with personalized marketing strategies. Online marketplaces offer enhanced visibility, while subscription-based models create recurring revenue streams and customer loyalty. The integration of smart technology, such as augmented reality (AR), artificial intelligence (AI), and app-connected toys, presents opportunities for companies to innovate and cater to tech-savvy consumers. Additionally, the resurgence of collectible toys and nostalgia-driven purchases among adults further expands the market, allowing brands to tap into multi-generational appeal. By leveraging digital advancements, sustainable practices, and educational trends, toy manufacturers can capitalize on evolving consumer preferences and drive long-term growth in the European toy market.

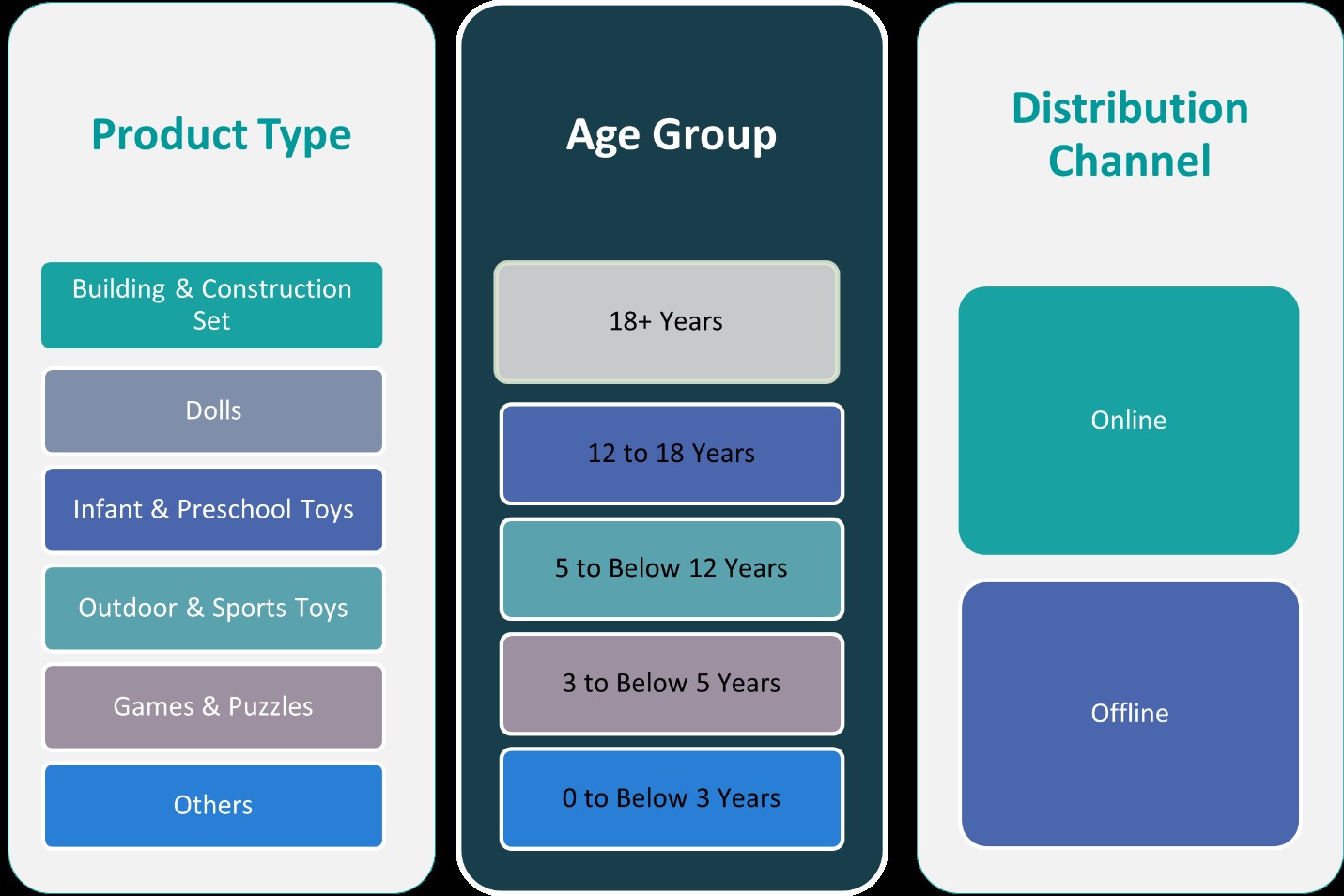

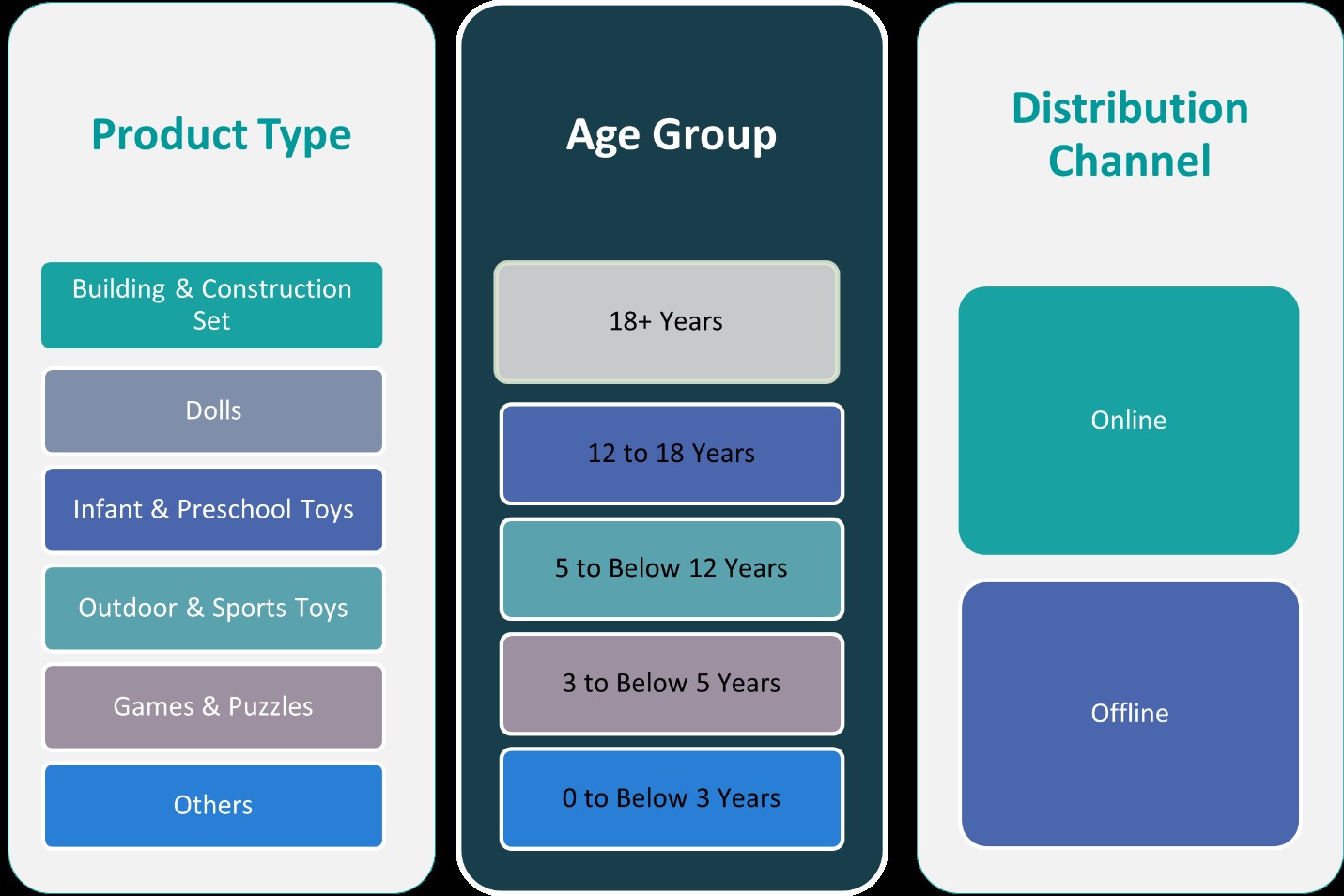

Market Segmentation Analysis:

By Product Type:

The European toy market is categorized into various product types, each catering to specific consumer preferences and developmental needs. Building and construction sets are highly popular among children and collectors, as they enhance problem-solving skills and creativity. Leading brands continuously innovate with themed sets, incorporating STEM elements to attract educational buyers. Dolls remain a strong segment, with demand fueled by movie franchises, character-based merchandise, and interactive features. The shift toward diversity and inclusivity in doll design further boosts market appeal. Infant and preschool toys emphasize sensory development, motor skills, and early learning, making them essential purchases for parents and caregivers. This segment benefits from the rising focus on cognitive development and Montessori-inspired toys. Outdoor and sports toys experience seasonal demand, driven by health-conscious parents encouraging physical activity. Bicycles, ride-ons, and sports equipment continue to be in high demand. Games and puzzles attract both children and adults, with a surge in board games, strategy-based puzzles, and digital-integrated options fostering family engagement and mental stimulation.

By Age Group:

The European toy market is also segmented by age group, catering to different developmental stages and entertainment needs. The 0 to below 3 years category primarily consists of sensory-stimulating, soft, and interactive toys designed for early motor skill development. Safety is a critical factor in this segment, influencing material choices and product designs. The 3 to below 5 years age group benefits from toys that enhance creativity and problem-solving, including educational games, building sets, and role-playing toys. The 5 to below 12 years segment represents a significant market share, with strong demand for action figures, construction sets, and technology-integrated toys. This age group is highly influenced by movie franchises, gaming culture, and STEM-based learning trends. The 12 to 18 years category sees increased interest in collectibles, strategy games, and interactive entertainment, with a focus on gaming-related merchandise and hobby-based toys. Lastly, the 18+ years group is growing due to nostalgia-driven purchases, high-end collectibles, and adult board games, highlighting the expansion of the toy market beyond children.

Segments:

Based on Product Type:

- Building & Construction Set

- Dolls

- Infant & Preschool Toys

- Outdoor & Sports Toys

- Games & Puzzles

Based on Age Group:

- 18+ Years

- 12 to 18 Years

- 5 to Below 12 Years

- 3 to Below 5 Years

- 0 to Below 3 Years

Based on Distribution Channel:

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

Western Europe

Western Europe holds the largest market share in the European toy industry, accounting for approximately 40% of total revenue. The United Kingdom, France, Germany, and Italy are key contributors to this region’s dominance. Strong consumer spending, high disposable incomes, and well-established retail infrastructure drive market growth. The UK leads in toy sales, driven by strong demand for licensed merchandise and educational toys. Germany follows closely, benefiting from a strong tradition of high-quality, STEM-focused toys and sustainable production practices. France and Italy also play crucial roles, with an increasing preference for eco-friendly and innovative toy offerings. Western Europe is a hub for premium and branded toys, with consumers willing to invest in high-quality products, making it a key market for international manufacturers.

Eastern Europe

Eastern Europe represents a growing segment of the toy market, holding approximately 20% of total market share. Russia, Poland, and other emerging economies contribute to the expansion of this region, driven by rising urbanization and increasing disposable incomes. Russia remains the largest market in Eastern Europe, with a strong preference for educational and digital toys. Poland follows as an important player, experiencing rapid growth in e-commerce sales and international toy brand penetration. While price sensitivity remains a factor in this region, demand for premium and STEM-based toys is increasing. Economic improvements and a growing middle class are expected to further boost toy sales, creating opportunities for manufacturers to expand their presence.

Northern Europe

Northern Europe holds a 15% market share, with Sweden, Denmark, and Switzerland leading in innovation and sustainability-driven toy production. Scandinavian countries are at the forefront of eco-friendly toy development, with strong consumer preferences for wooden toys, biodegradable materials, and minimalistic designs. Denmark, home to LEGO, is a major contributor to the toy industry, driving the market through continuous innovation and global brand influence. Sweden and Switzerland also see strong demand for premium and high-quality toys, as well as digital-integrated play solutions. The Northern European market is characterized by environmentally conscious consumers, making it an attractive region for companies focusing on sustainable toy manufacturing.

Southern and Rest of Europe

Southern Europe and the rest of Europe collectively account for 25% of the market share, with Spain, Belgium, the Netherlands, Austria, and other regions contributing to steady growth. Spain is a significant market, benefiting from high tourism-driven toy sales and a strong preference for traditional and outdoor toys. Belgium and the Netherlands are well-developed toy markets with a strong retail presence and e-commerce adoption. Austria is witnessing increased demand for STEM-based and collectible toys. The rest of Europe, including smaller markets, continues to expand as e-commerce and cross-border trade make international toy brands more accessible. With rising consumer demand and retail expansion, this region is expected to see consistent market growth.

Key Player Analysis

- Ravensburger AG

- Simba Dickie Group GmbH

- LEGO System A/S

- Hasbro

- MGA Entertainment

Competitive Analysis

The European toy market is highly competitive, with major players focusing on innovation, sustainability, and digital integration to maintain market leadership. LEGO System A/S, Ravensburger AG, Hasbro, Simba Dickie Group GmbH, and MGA Entertainment are the key industry leaders, each leveraging their brand strength and product innovation to capture market share. The industry is driven by continuous product development, licensing agreements with popular entertainment franchises, and the integration of smart technology into traditional toys. Companies are investing in STEM-based and educational toys to meet growing consumer demand for learning-focused play. Additionally, sustainability has become a major differentiator, with brands incorporating eco-friendly materials and recyclable packaging to align with regulatory standards and consumer preferences. E-commerce expansion and direct-to-consumer strategies are reshaping the competitive landscape, allowing brands to strengthen customer engagement and personalize marketing efforts. The market is also witnessing increased competition from emerging brands specializing in niche segments, such as sustainable wooden toys and digital-interactive games. As competition intensifies, companies are leveraging strategic partnerships, acquisitions, and digital innovations to enhance their product offerings and maintain a strong market position.

Recent Developments

- In March 2025, the LEGO Group launched a wide range of new sets, including LEGO Architecture, LEGO Art, and LEGO Formula 1, with over 40 sets released on March 1st, including the Trevi Fountain and several Formula 1 Speed Champions sets.

- In March 2025, MGA Entertainment’s Little Tikes brand announced a partnership with BBC Studios to launch a line of Bluey-inspired toys, including the Bluey Grannies Car Coupe, Bluey Bushland Adventures Splash Pad, Bluey Beach Day Sand Box, and Bluey Beach Water Table.

- In March 2025, the LEGO Group announced a new multi-year partnership with The Pokémon Company International to bring LEGO Pokémon sets starting in 2026.

- In March 2025, Spin Master announced the renewal of its global master toy licensee agreement with DreamWorks Animation for Gabby’s Dollhouse.

- In March 2025, Hasbro participated in the North American International Toy Fair, showcasing new products and collaborations, including a PLAY-DOH Barbie line and Marvel’s Iron Man toys.

- In March 2025, Mattel renewed its multi-year global licensing agreement with Disney for Toy Story, planning new products for the franchise’s 30th anniversary and Toy Story 5.

Market Concentration & Characteristics

The European toy market is moderately concentrated, with a mix of established global brands and emerging niche players competing for market share. Leading companies dominate the industry through strong brand recognition, extensive distribution networks, and continuous product innovation. The market is characterized by a high degree of product diversification, ranging from traditional toys and board games to tech-integrated and STEM-based educational toys. Sustainability has become a defining characteristic, with manufacturers increasingly adopting eco-friendly materials and ethical production practices. Regulatory compliance, particularly in safety and environmental standards, plays a crucial role in shaping the competitive landscape. The rise of e-commerce and direct-to-consumer strategies has also influenced market dynamics, enabling smaller players to gain visibility and reach a broader audience. Despite intense competition, opportunities for growth exist in digital transformation, sustainable product development, and expanding consumer segments, making the European toy market a dynamic and evolving industry.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The European toy market will continue to grow steadily, driven by rising demand for educational and STEM-based toys.

- Sustainability will remain a key focus, with increased adoption of eco-friendly materials and recyclable packaging.

- Digital and smart toys will gain popularity, integrating augmented reality (AR), artificial intelligence (AI), and app-connected features.

- E-commerce and direct-to-consumer strategies will expand, reshaping distribution channels and enhancing customer engagement.

- Regulatory compliance will become more stringent, pushing manufacturers to invest in safer and more sustainable production processes.

- The demand for collectibles and nostalgia-driven toys will rise, attracting both children and adult consumers.

- Licensing and entertainment-based toys will continue to drive sales, influenced by movies, streaming platforms, and gaming franchises.

- Emerging markets in Eastern and Northern Europe will provide growth opportunities, supported by rising disposable income.

- Companies will invest in personalization and interactive play experiences to cater to evolving consumer preferences.

- Strategic partnerships, mergers, and acquisitions will shape the competitive landscape, fostering innovation and market expansion.