Market Overview

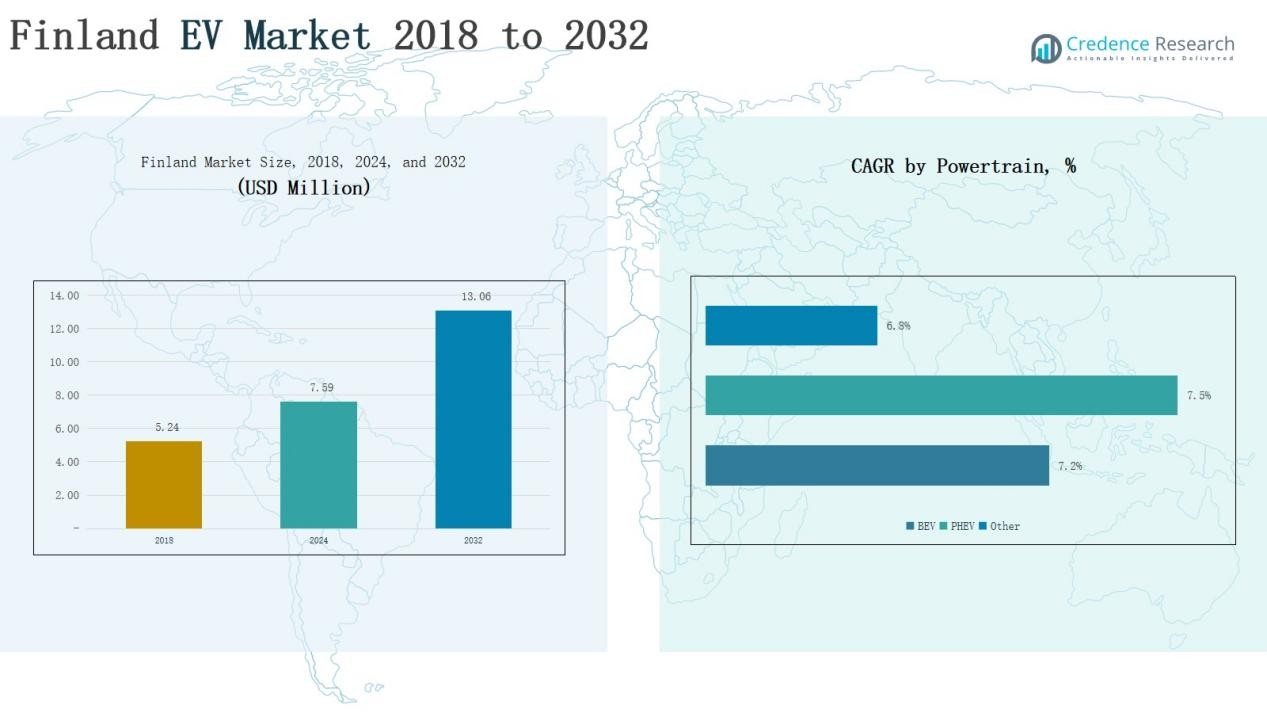

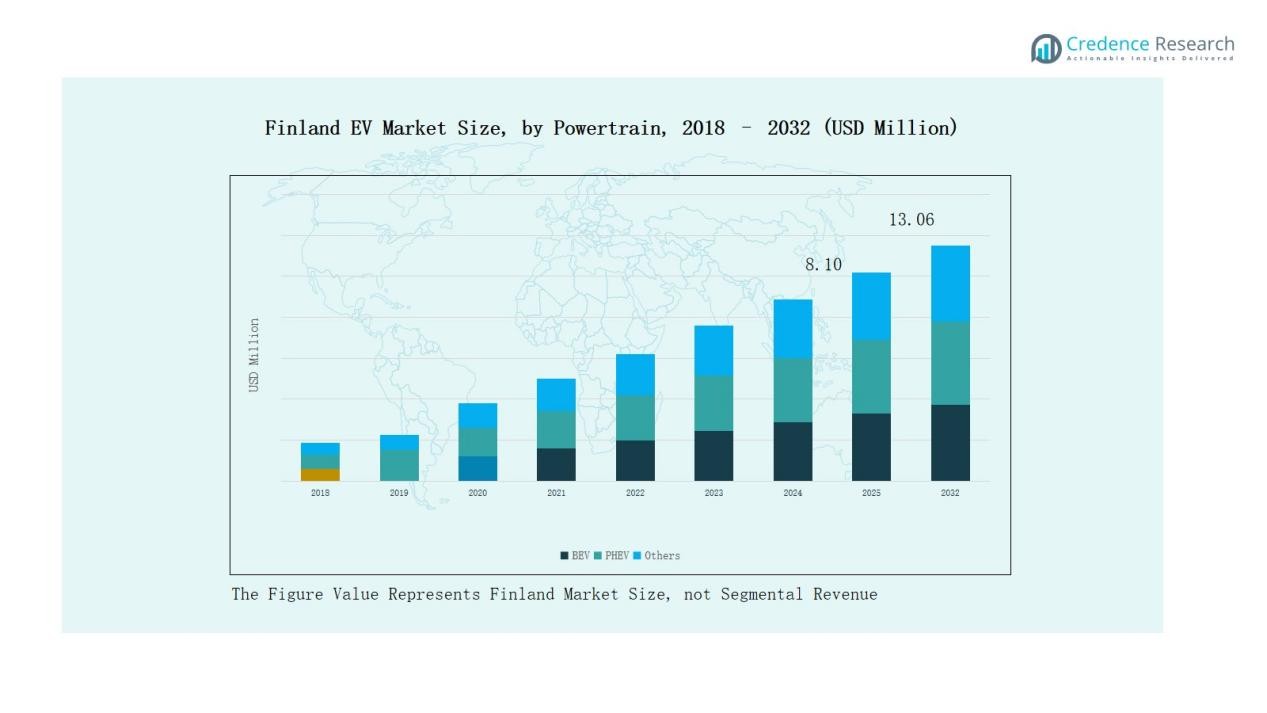

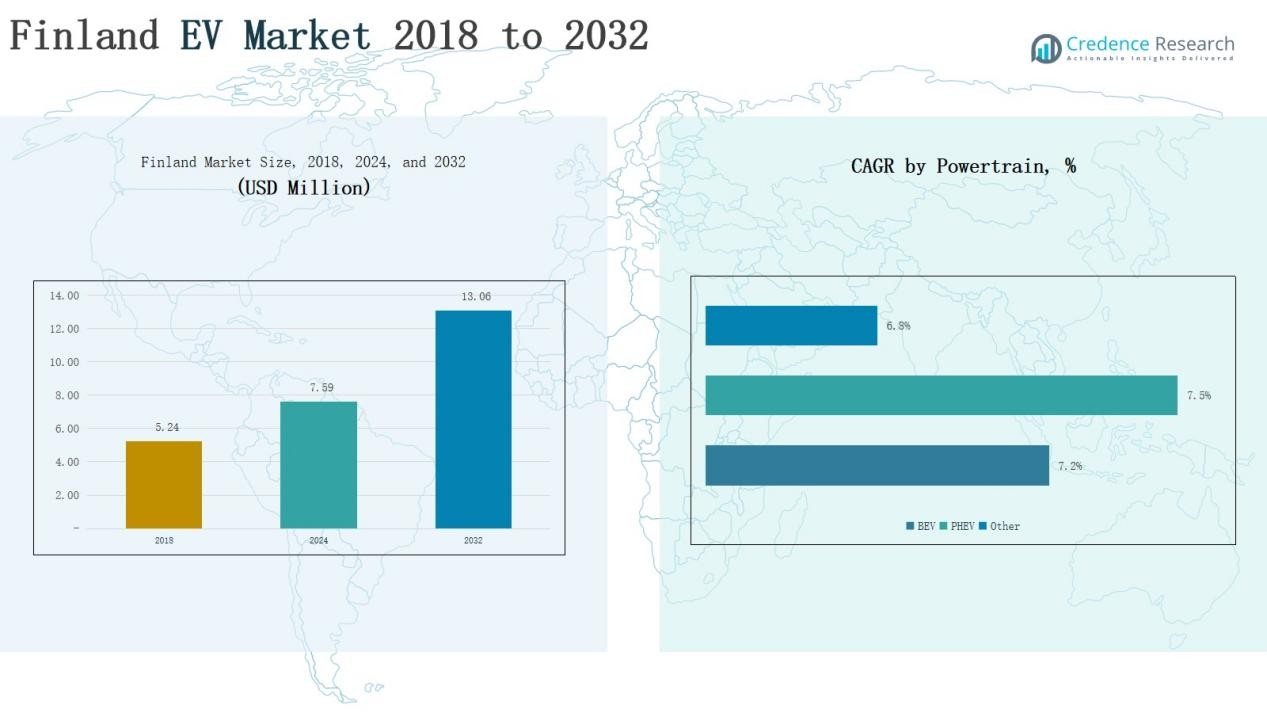

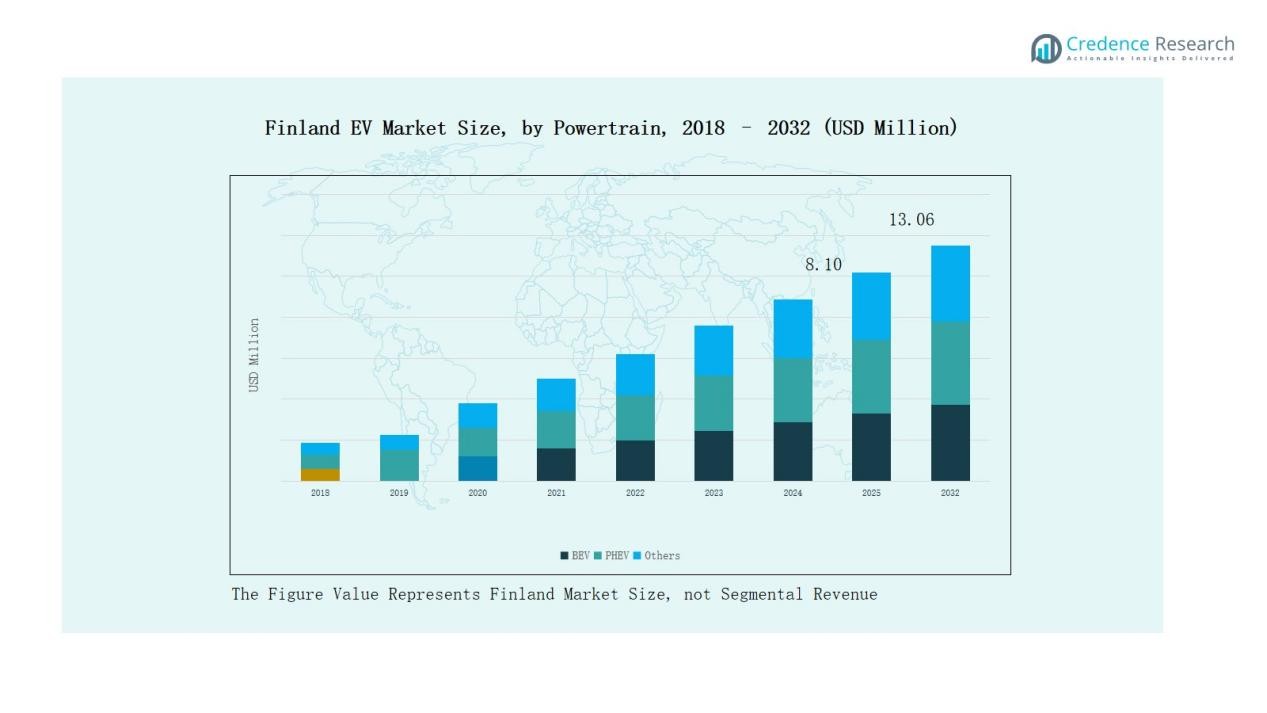

Finland Electric Vehicle (EV) Market size was valued at USD 5.24 million in 2018 to USD 7.59 million in 2024 and is anticipated to reach USD 13.06 million by 2032, at a CAGR of 7.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Finland EV Market Size 2024 |

USD 7.59 Million |

| Finland EV Market, CAGR |

7.02% |

| Finland EV Market Size 2032 |

USD 13.06 Million |

The Finland EV Market is shaped by the presence of leading automakers including Volkswagen, BMW AG, Mercedes-Benz, Tesla, Volvo, Audi, Skoda, Nissan Motor Co., Ltd., and Geely Holding, each strengthening their positions through diverse product portfolios and targeted strategies. Tesla dominates the premium segment with advanced technology and a dedicated charging network, while Volkswagen, BMW AG, and Mercedes-Benz leverage strong brand equity and wide product ranges to attract both private and corporate buyers. Volvo and Audi focus on expanding mass-market offerings, whereas Skoda and Nissan emphasize affordability to broaden accessibility. Geely Holding strengthens its foothold by targeting fleet electrification and sustainability-driven corporate buyers. Regionally, Southern Finland emerged as the market leader in 2024 with a 48% share, supported by dense urbanization, advanced infrastructure, and higher purchasing power, making it the most significant growth hub for both BEV and PHEV adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Finland EV Market grew from USD 5.24 million in 2018 to USD 7.59 million in 2024 and is forecasted to reach USD 13.06 million by 2032.

- Battery Electric Vehicles held a 69% share in 2024, followed by Plug-in Hybrid Electric Vehicles at 26%, while other powertrains accounted for 5%.

- Private buyers led with a 72% share in 2024, while corporate buyers represented 28%, driven by fleet electrification and sustainability commitments.

- Southern Finland dominated with 48% share in 2024, followed by Western Finland at 22%, Eastern Finland at 17%, and Northern Finland at 13%.

- Key players include Volkswagen, BMW AG, Mercedes-Benz, Tesla, Volvo, Audi, Skoda, Nissan Motor Co., Ltd., and Geely Holding, focusing on innovation and accessibility.

Market Segment Insights

By Powertrain

Battery Electric Vehicles (BEVs) dominated the Finland EV Market in 2024 with a 69% share, supported by strong government incentives, growing charging infrastructure, and consumer preference for zero-emission driving. Plug-in Hybrid Electric Vehicles (PHEVs) accounted for 26% share, attracting buyers seeking flexibility for long-distance travel. Other powertrains, including fuel-cell and hybrid systems, held the remaining 5% share, driven by early-stage pilot projects and limited commercial adoption.

- For instance, Toyota launched the Prius Plug-in Hybrid in Finland, targeting consumers combining electric driving with extended range capability.

By End User

Private buyers led the Finland EV Market with a 72% share in 2024, driven by subsidies, tax exemptions, and the availability of affordable EV models from domestic and international brands. Corporate buyers captured the remaining 28% share, supported by fleet electrification programs, sustainability commitments, and financial benefits tied to lower operating costs. Growth in the corporate segment is expected to accelerate as businesses align with emission reduction policies and expand employee leasing programs.

- For instance, 48% of all new passenger car registrations in Finland in 2024 were corporate purchases, and 55.9% of those corporate-purchased cars were plug-in vehicles (BEVs or PHEVs).

Key Growth Drivers

Government Incentives and Policy Support

Government-backed subsidies, tax exemptions, and reduced registration costs remain a primary growth driver for the Finland EV Market. Policymakers encourage EV adoption by reducing the total cost of ownership and enforcing stricter emission targets across transport. These measures make EVs more affordable for households and businesses while improving consumer confidence. Long-term policies, including plans to phase out internal combustion vehicles, ensure stability in the market. This regulatory push continues to strengthen demand and attract investment from both domestic and global automakers.

Expanding Charging Infrastructure

Rapid expansion of public and private charging infrastructure significantly boosts EV adoption in Finland. Investments by utilities, municipalities, and automakers are improving coverage across urban, suburban, and highway routes. Fast-charging stations reduce range anxiety, a key barrier for buyers considering EVs. Integration of renewable energy into charging networks further enhances the sustainability profile of EV ownership. Growing interoperability and standardized payment systems make charging more user-friendly, which strengthens consumer trust. This infrastructure development creates a strong foundation for both BEV and PHEV market growth.

- For instance, the Helsinki-Uusimaa region led Finland with the densest charging station network, demonstrating successful infrastructure expansion driving EV uptake across urban and highway routes

Growing Consumer Environmental Awareness

Rising environmental awareness and the desire for sustainable mobility strongly influence EV purchases in Finland. Consumers increasingly prioritize low-emission alternatives as awareness of climate change intensifies. EVs align with the country’s commitment to reducing carbon footprints and promoting renewable energy adoption. Marketing campaigns by automakers highlight EVs’ ecological benefits, reinforcing their appeal to eco-conscious buyers. Younger demographics, in particular, view EV ownership as both practical and socially responsible. This cultural shift supports demand growth and strengthens the long-term outlook for the EV industry in Finland.

- For instance, in December 2023, Mercedes-Benz introduced its EQE SUV in the Finnish market with manufacturer’s promotion highlighting lifecycle CO₂ reductions achieved through recycled materials.

Key Trends & Opportunities

Integration of Renewable Energy with EV Ecosystem

The integration of solar and wind energy into EV charging systems is emerging as a major trend in Finland. Energy companies and automakers are partnering to enable clean charging solutions, reducing lifecycle emissions. Vehicle-to-grid (V2G) technologies provide additional opportunities by stabilizing electricity networks and offering new revenue streams for owners. This trend not only enhances EV sustainability but also positions the market at the center of Finland’s clean energy transition. It creates strong potential for growth in smart grid-enabled solutions and services.

- For instance, in June 2025, SolaX Power launched a collaboration with CheckWatt to integrate its residential energy storage solution with a virtual power plant in Finland, enabling households to participate in grid frequency regulation and earn extra income through clean energy use. Their system includes the X3-G4 three-phase hybrid inverter and T30 expandable battery system.

Rising Corporate Fleet Electrification

Corporate buyers increasingly view fleet electrification as a cost-saving and branding opportunity. Businesses adopt EVs to reduce fuel expenses, meet sustainability targets, and comply with EU emission regulations. Leasing companies and mobility service providers actively expand EV offerings, making access easier for enterprises. Incentives further lower upfront investment for corporate buyers, accelerating adoption in logistics and employee mobility. This trend creates opportunities for partnerships between automakers, leasing firms, and charging providers, solidifying the corporate sector as a growing contributor to market expansion.

- For instance, PowerFlex documented that EV owners saved $4,700 or more on fuel costs over seven years due to lower and more predictable electricity costs, reinforcing fleet electrification as a serious cost-saving strategy for businesses.

Key Challenges

High Upfront Purchase Costs

Despite subsidies, the upfront cost of EVs remains a barrier for many Finnish households. Affordable options are limited compared to conventional vehicles, making mass adoption slower than anticipated. While operational savings exist, initial investment continues to discourage middle-income buyers. Automakers must address this challenge by expanding low-cost EV portfolios and local production strategies. Without affordable alternatives, demand growth risks becoming concentrated among higher-income groups, reducing inclusivity in adoption. This challenge emphasizes the importance of financing models and competitive pricing strategies.

Limited Availability of Charging Infrastructure in Rural Areas

Urban regions enjoy fast growth in charging infrastructure, but rural Finland faces limited coverage. Long travel distances and harsh weather conditions increase reliance on accessible charging, yet many areas remain underserved. This gap restricts adoption outside metropolitan centers, limiting nationwide EV penetration. Addressing rural charging needs requires collaboration between government, utilities, and private investors. Without this expansion, adoption could stagnate in less populated regions. Closing the rural-urban divide is essential for achieving balanced growth across the entire Finnish EV market.

Supply Chain Constraints and Battery Dependency

Global supply chain disruptions and reliance on imported battery materials present risks for the Finnish EV Market. Lithium, cobalt, and nickel availability strongly impact pricing and production timelines. Fluctuations in supply increase costs for automakers and slow deliveries to buyers. Dependence on international suppliers also exposes Finland to geopolitical risks and trade restrictions. Developing recycling technologies and exploring alternative chemistries could help reduce dependency. Without addressing these challenges, growth in EV adoption risks being undermined by external supply uncertainties.

Regional Analysis

Southern Finland

Southern Finland held the largest share of the Finland EV Market in 2024 with 48%. Strong urbanization, dense population, and advanced infrastructure support widespread adoption of EVs in this region. Charging networks are well-developed, covering highways and metropolitan areas, which reduces range anxiety. Government incentives for households and businesses further strengthen demand. Automakers focus their sales strategies here due to higher consumer purchasing power. It remains the core growth hub, driving both BEV and PHEV sales in the country.

Western Finland

Western Finland accounted for 22% share in 2024, driven by active industrial bases and corporate fleet adoption. The presence of logistics hubs and port operations creates demand for sustainable transportation. Local authorities encourage the shift to EVs through supportive policies and infrastructure investments. Rural charging access is improving, though gaps still exist compared to the south. Corporate buyers contribute significantly as businesses align with emission targets. It continues to benefit from economic activity and expansion of renewable energy integration.

Eastern Finland

Eastern Finland secured 17% share of the market in 2024, with growth supported by increasing consumer awareness. Adoption levels are moderate due to fewer urban centers and limited charging density. Government programs target this region with incentives to close the adoption gap. Local dealerships expand EV availability, which strengthens consumer access. Households adopt EVs gradually as infrastructure expands into secondary towns. It is steadily building its position in the overall EV landscape.

Northern Finland

Northern Finland represented 13% share of the market in 2024, shaped by unique geographic and climatic conditions. Harsh winters demand vehicles with reliable performance and strong battery durability. Charging infrastructure remains limited but is expanding along major routes and tourism corridors. Subsidies for rural buyers support demand but adoption lags behind other regions. Corporate fleets, especially in logistics and tourism, drive some of the demand. It plays a smaller role but holds potential as infrastructure and awareness improve.

Market Segmentations:

By Powertrain

- BEV (Battery Electric Vehicles)

- PHEV (Plug-in Hybrid Electric Vehicles)

- Other powertrains

By End User

- Private Buyers

- Corporate Buyers

By region

- Southern Finland

- Western Finland

- Eastern Finland

- Northern Finland

Competitive Landscape

The Finland EV Market is characterized by strong competition among global and regional automakers, each leveraging distinct strategies to secure market presence. Volkswagen, BMW AG, and Mercedes-Benz dominate through diversified product portfolios and established brand equity, while Tesla strengthens its position in the premium segment with advanced technology and a dedicated charging network. Volvo and Audi expand mass-market offerings, supported by partnerships in charging infrastructure and after-sales services. Skoda and Nissan Motor Co., Ltd. focus on affordability, appealing to private buyers with cost-efficient models. Geely Holding targets fleet and corporate segments, aligning with sustainability mandates. Competition centers on expanding product ranges, improving charging solutions, and enhancing financing options to attract buyers. Recent developments such as fleet electrification partnerships, renewable energy integration, and localized marketing campaigns intensify the rivalry. The market remains dynamic, with companies adapting to regulatory frameworks and consumer preferences to secure long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In August 2025, BYD partnered with Veho Group to expand its sales and service network in Finland. Billings will include new retail outlets in Helsinki, Espoo, Tampere, and Turku.

- In July 2025, Mercedes-Benz announced a new dealership in Finland in collaboration with Wetteri and Veho. It will offer EVs, light-duty vehicles, and mobility services.

- In February 2025, XPENG entered the Finnish market by launching its G9 SUV through a partnership with Inchcape.

Report Coverage

The research report offers an in-depth analysis based on Powertrain, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Government policies will continue to support EV adoption through subsidies and tax exemptions.

- BEVs will strengthen their dominance as charging infrastructure expands nationwide.

- Corporate fleet electrification will accelerate due to stricter emission targets and cost benefits.

- Rural charging networks will expand, reducing adoption gaps between urban and remote areas.

- Automakers will introduce more affordable EV models to reach middle-income households.

- Renewable energy integration will increase the sustainability of EV charging systems.

- Battery recycling initiatives will gain traction to reduce reliance on imported raw materials.

- Partnerships between automakers and energy companies will enhance charging accessibility.

- Consumer demand for eco-friendly mobility will rise as environmental awareness strengthens.

- International players will expand presence, intensifying competition with domestic brands.