Market Overview

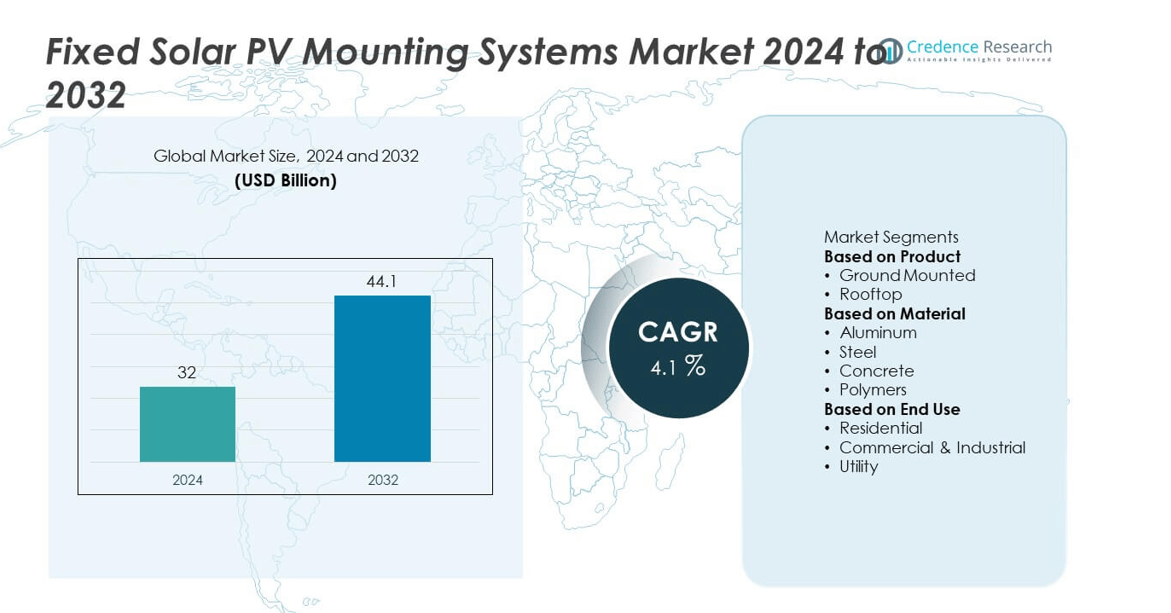

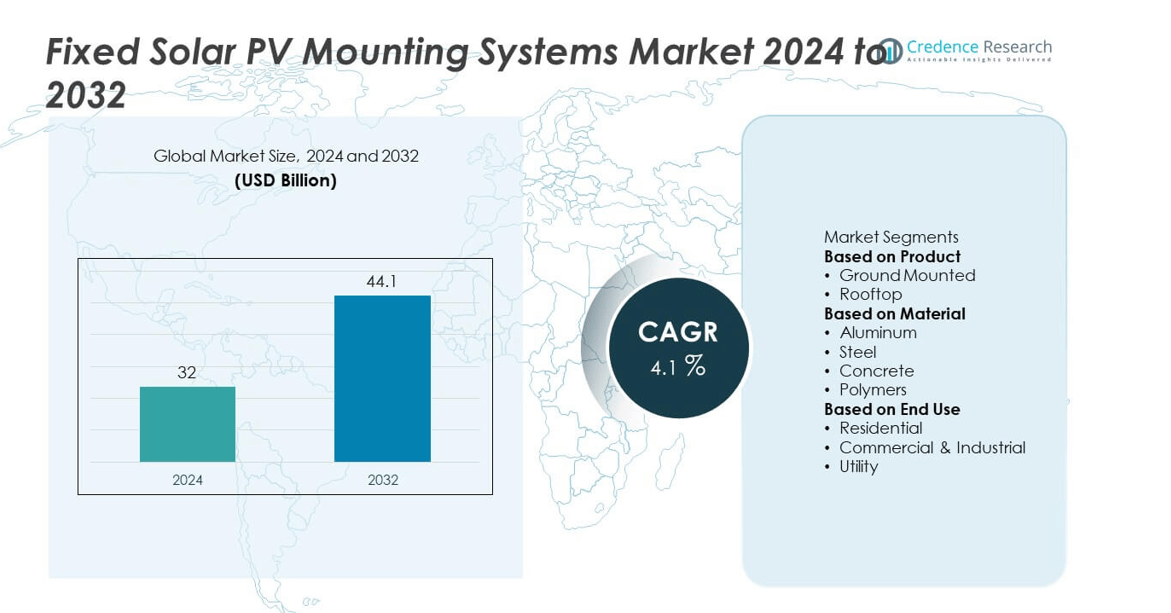

The Fixed Solar PV Mounting Systems Market was valued at USD 32 billion in 2024 and is projected to reach USD 44.1 billion by 2032, expanding at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Solar PV Mounting Systems Market Size 2024 |

USD 32 billion |

| Fixed Solar PV Mounting Systems Market, CAGR |

4.1% |

| Fixed Solar PV Mounting Systems Market Size 2032 |

USD 44.1 billion |

The Fixed Solar PV Mounting Systems Market grows with rising demand for renewable energy and supportive government policies that encourage large-scale solar adoption. Fixed mounting structures provide cost efficiency, durability, and low maintenance, making them suitable for utility-scale and rooftop projects.

The Fixed Solar PV Mounting Systems Market demonstrates strong regional presence, with North America leading adoption through large-scale solar farms supported by favorable tax incentives and robust infrastructure. Europe follows with significant demand driven by strict climate policies, renewable energy targets, and investments in rooftop and ground-mounted projects across countries such as Germany, Spain, and France. Asia-Pacific emerges as the fastest-growing region, supported by rapid expansion of solar installations in China, India, and Japan, along with rising electrification programs in Southeast Asia. Latin America and the Middle East & Africa expand gradually through rural electrification initiatives and utility-scale projects backed by private and government funding. Key players influencing this market include Aerocompact, Arctech, Schletter Group, and UNIRAC. These companies focus on introducing corrosion-resistant materials, modular and lightweight designs, and cost-efficient systems to meet global demand. It highlights a competitive environment shaped by innovation, sustainability, and rapid regional adoption.

Market Insights

- The Fixed Solar PV Mounting Systems Market was valued at USD 32 billion in 2024 and is projected to reach USD 44.1 billion by 2032, expanding at a CAGR of 4.1% during the forecast period.

- Rising global demand for renewable energy and government-backed policies supporting clean energy adoption drive the market, with fixed mounting structures offering cost efficiency and reliability for large and small projects.

- Advances in corrosion-resistant materials, modular frameworks, and pre-assembled designs improve durability, reduce installation time, and make systems suitable for diverse climates and terrains.

- Competitive activity remains strong with players such as Aerocompact, Arctech, Schletter Group, and UNIRAC focusing on innovation, partnerships, and expanding presence in emerging markets.

- High land requirements, weather-related risks, and lack of flexibility compared to solar tracking systems act as restraints, particularly for regions with variable sunlight conditions or limited land availability.

- North America leads adoption with widespread utility-scale deployment and favorable incentives, while Europe expands rapidly under strict climate goals and strong rooftop solar programs.

- Asia-Pacific shows the fastest growth, supported by rising installations in China, India, and Japan, while Latin America and the Middle East & Africa expand steadily through rural electrification projects and increasing solar infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Demand for Renewable Energy and Solar Power Expansion

The Fixed Solar PV Mounting Systems Market benefits from the growing adoption of renewable energy worldwide. Governments set ambitious targets to reduce carbon emissions and expand solar capacity. Fixed systems remain a preferred choice due to their durability and ease of installation for utility-scale projects. It supports long-term solar expansion by offering reliable structural solutions at competitive costs. Increasing energy demand across developing nations further drives large-scale solar deployments. Strong policy frameworks continue to accelerate solar adoption globally.

- For instance, Schletter Korea delivered the mounting system for a 100 MWp coastal solar project in Dangjin, South Korea in June 2025, ensuring stability for large-scale, utility-grade fixed installations.

Cost-Effectiveness and Reliability of Fixed Mounting Structures

Affordability and reliability remain critical factors driving demand for fixed mounting systems. The Fixed Solar PV Mounting Systems Market grows as developers seek stable designs that reduce operational costs. Fixed structures provide simple installation, low maintenance, and long service life. It makes them suitable for diverse geographic conditions, from deserts to rural farmlands. Cost efficiency compared to tracking systems positions fixed mounts as attractive for price-sensitive projects. This driver ensures consistent deployment across both commercial and utility applications.

- For instance, In September 2024, a 32 kW standalone solar project on Mount Owen in Tasmania was completed for BAI Communications. Clenergy customized its fixed-tilt SolarTerrace II-A mounting system for the project, integrating it with the Mega Anchor ground screw system to overcome the site’s difficult, remote location.

Government Incentives and Supportive Policy Frameworks

Incentives and subsidies strengthen adoption across multiple regions. The Fixed Solar PV Mounting Systems Market benefits from tax credits, feed-in tariffs, and renewable portfolio standards. Governments invest in solar infrastructure to meet climate goals and enhance energy security. It encourages widespread adoption of fixed mounting systems due to their reliability and affordability. Supportive policies reduce financial risks for investors and developers. Growing international collaborations on clean energy transition further reinforce market growth.

Expanding Utility-Scale and Rural Electrification Projects

Large solar farms and rural electrification initiatives create significant demand for fixed mounting systems. The Fixed Solar PV Mounting Systems Market benefits from widespread adoption in off-grid and grid-connected projects. Utility companies prefer fixed mounts for stability and lower costs in high-capacity installations. It also supports rural electrification programs in emerging economies where access to reliable energy remains limited. Expansion of such projects increases demand for robust and easy-to-deploy mounting structures. The growth of global solar capacity ensures sustained momentum for this market driver.

Market Trends

Growing Adoption in Utility-Scale Solar Projects

The Fixed Solar PV Mounting Systems Market demonstrates strong adoption in large utility-scale solar farms. Developers favor fixed structures for their ability to support high-capacity installations with long service life. It ensures stability under diverse environmental conditions, from deserts to coastal regions. Utility providers rely on fixed systems for predictable energy output and lower operational risks. Global expansion of large-scale solar farms continues to reinforce demand. This trend aligns with increasing investment in renewable infrastructure worldwide.

Rising Use of Corrosion-Resistant and Durable Materials

Material innovation shapes the direction of the Fixed Solar PV Mounting Systems Market. Manufacturers incorporate galvanized steel, aluminum alloys, and anti-corrosion coatings to extend product life. These upgrades help systems withstand extreme weather conditions while reducing maintenance needs. It improves project returns by minimizing long-term operational costs. Demand for durable mounting solutions rises in regions with harsh climates. The trend strengthens confidence among investors and project developers.

Focus on Simplified Installation and Standardized Designs

The market experiences growing preference for designs that reduce installation time and labor costs. The Fixed Solar PV Mounting Systems Market benefits from pre-assembled structures and modular frameworks. It enables faster deployment across residential, commercial, and utility projects. Standardization of components also enhances scalability and ease of logistics. Contractors and developers value systems that shorten construction schedules. This trend supports efficient project execution and faster return on investment.

Integration with Hybrid and Off-Grid Energy Projects

The Fixed Solar PV Mounting Systems Market gains traction through its role in hybrid and off-grid energy solutions. Growing demand for rural electrification and backup power drives adoption of fixed systems in standalone projects. It provides affordable structural solutions where energy demand is rising but infrastructure is limited. Fixed mounting structures also complement hybrid systems combining solar with wind or storage. Their reliability and cost efficiency make them a preferred choice in such projects. This trend highlights the adaptability of fixed mounts across diverse energy applications.

Market Challenges Analysis

Land Use Constraints and Site Limitations for Deployment

The Fixed Solar PV Mounting Systems Market faces challenges related to land availability and site suitability. Large-scale solar projects often require extensive land, creating conflicts with agriculture, urban development, or conservation priorities. Uneven terrain or poor soil conditions increase installation complexity and costs. It restricts adoption in regions where land competition is high or where environmental regulations are strict. Developers must balance energy goals with land use policies, which slows project execution. These constraints limit the scalability of fixed systems in certain regions.

High Exposure to Weather Risks and Limited Flexibility

The Fixed Solar PV Mounting Systems Market also struggles with performance limitations linked to fixed structures. Unlike tracking systems, fixed mounts cannot adjust angles to maximize energy capture throughout the day. It reduces efficiency in regions with variable sunlight exposure. Harsh weather conditions such as storms, snow, or high winds create risks of structural damage, raising maintenance and insurance costs. These risks discourage adoption in areas with extreme climates. The lack of flexibility compared to advanced alternatives makes fixed mounts less attractive for some high-efficiency projects.

Market Opportunities

Expansion of Solar Capacity in Emerging Economies

The Fixed Solar PV Mounting Systems Market presents strong opportunities in emerging regions where solar energy adoption is accelerating. Countries in Asia-Pacific, Latin America, and Africa are expanding renewable capacity to meet rising electricity demand and reduce dependence on fossil fuels. Governments introduce favorable policies and subsidies that encourage large-scale solar deployment. It creates demand for cost-effective, durable, and easy-to-install fixed mounting systems suitable for diverse terrains. Growing investment in rural electrification and utility-scale projects strengthens prospects in underserved regions. The long-term push toward sustainable power ensures steady opportunities for manufacturers and developers.

Innovation in Materials and Integration with Hybrid Energy Systems

Material advancements and hybrid applications open new growth avenues for the Fixed Solar PV Mounting Systems Market. Manufacturers are investing in lightweight, corrosion-resistant, and recyclable materials to enhance durability and sustainability. It improves system performance while aligning with global environmental goals. Fixed mounts also integrate effectively with hybrid projects that combine solar with storage or wind energy. This adaptability provides solutions for off-grid, backup, and microgrid applications across residential and industrial sectors. Rising demand for sustainable and flexible renewable infrastructure creates strong potential for innovation-driven players in the market.

Market Segmentation Analysis:

By Product

The Fixed Solar PV Mounting Systems Market is divided into ground-mounted and rooftop-mounted systems. Ground-mounted structures dominate due to their suitability for large-scale solar farms and utility projects. They provide high stability and efficient alignment, making them the preferred choice for developers targeting maximum energy generation. Rooftop-mounted systems contribute steadily, driven by adoption across residential and commercial sectors where space utilization is critical. It supports energy self-sufficiency for businesses and households while reducing reliance on grid electricity. Growing focus on distributed energy solutions ensures consistent demand for rooftop installations alongside ground-mounted projects.

- For instance, Schletter Korea supplied ground-mounted systems for a 100 MWp coastal solar farm in Dangjin in June 2025, while K2 Systems launched its rooftop InsertionRail 2.0 in July 2025, measuring 5.7 m in length and weighing 6.498 kg per rail to support high-load residential installations.

By Material

Material selection plays a vital role in the performance and durability of mounting systems. The Fixed Solar PV Mounting Systems Market widely uses galvanized steel and aluminum as the primary materials. Galvanized steel provides robustness and affordability, making it popular in large-scale installations. Aluminum offers lightweight, corrosion-resistant properties that extend system life in coastal and harsh climates. It also reduces maintenance needs, ensuring cost efficiency over long project lifecycles. Increasing innovation in recyclable and eco-friendly materials supports sustainability goals and aligns with global clean energy transitions. The combination of strength, durability, and environmental compatibility defines material choice in this segment.

- For instance, Arctech possesses a total annual manufacturing capacity exceeding 30 GW, encompassing both solar trackers and fixed-tilt structures, demonstrating a strong global production scale for heavy deployment needs.

By End Use

End-use segmentation highlights adoption across residential, commercial, and utility sectors. The Fixed Solar PV Mounting Systems Market records strong demand from utility-scale projects, which account for the largest share due to widespread deployment of solar farms. Commercial installations grow steadily as businesses invest in renewable energy to lower operational costs and achieve sustainability targets. Residential adoption expands with rising rooftop solar programs and supportive government incentives for households. It reflects the broad appeal of fixed mounting systems across diverse applications. The segment’s growth is reinforced by rising electricity demand and global commitments to increase renewable energy capacity across all sectors.

Segments:

Based on Product

Based on Material

- Aluminum

- Steel

- Concrete

- Polymers

Based on End Use

- Residential

- Commercial & Industrial

- Utility

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share of the Fixed Solar PV Mounting Systems Market at 34% in 2024. The region benefits from large-scale solar installations, favorable tax incentives, and increasing commitments to renewable energy targets. The United States leads with widespread deployment of ground-mounted systems across utility-scale projects in states such as California, Texas, and Arizona. Canada contributes steadily with investments in renewable infrastructure and rooftop solar adoption in urban regions. Mexico is expanding solar capacity through government initiatives and private sector participation. It benefits from a strong regulatory framework, advanced engineering capabilities, and rising demand for clean energy among both residential and commercial sectors. With supportive policies and high energy transition goals, North America is expected to maintain its leadership during the forecast period.

Europe

Europe holds 30% of the Fixed Solar PV Mounting Systems Market in 2024, driven by stringent climate policies and renewable energy mandates under the European Green Deal. Countries such as Germany, Spain, and France lead adoption with large-scale utility projects and strong support for rooftop solar in residential and commercial sectors. The UK, Italy, and the Netherlands are also expanding investments in solar infrastructure to meet carbon neutrality goals. It benefits from mature renewable energy frameworks and significant investment in grid modernization. Use of aluminum and corrosion-resistant steel in mounting structures is common across Europe due to diverse climate conditions. The region’s strong focus on sustainability and circular economy principles further encourages adoption of recyclable materials in fixed mounting solutions.

Asia-Pacific

Asia-Pacific represents 27% of the Fixed Solar PV Mounting Systems Market in 2024, making it the fastest-growing region. China leads with massive utility-scale projects supported by state-backed initiatives and cost-effective production of solar equipment. India shows rapid growth with expanding rural electrification programs and government-backed solar energy targets. Japan contributes with rooftop solar installations driven by limited land availability and supportive subsidies for households. It benefits from a growing middle class, increasing electricity demand, and government policies promoting renewable adoption. Southeast Asian nations including Vietnam, Thailand, and Indonesia are also expanding solar capacity, creating strong opportunities for fixed mounting system providers. With expanding energy demand and rising investments, Asia-Pacific is set to play a critical role in driving global growth.

Latin America

Latin America holds 6% of the Fixed Solar PV Mounting Systems Market in 2024, with Brazil and Mexico leading regional adoption. Brazil’s utility-scale solar farms continue to expand, supported by abundant sunlight and favorable policies. Mexico benefits from private investment in renewable energy and cross-border partnerships with North American firms. Chile and Argentina contribute through solar projects focused on reducing dependency on fossil fuels. It faces challenges such as uneven policy frameworks and financing hurdles in some markets, but growing urban demand and favorable geographic conditions support expansion. Latin America’s solar growth reflects both government commitment and private sector interest in building resilient renewable infrastructure.

Middle East & Africa

The Middle East & Africa account for 3% of the Fixed Solar PV Mounting Systems Market in 2024, but the region shows steady growth potential. Gulf countries such as Saudi Arabia and the United Arab Emirates invest heavily in large-scale solar farms to diversify energy portfolios and reduce reliance on oil. South Africa drives adoption across Africa with growing utility projects and efforts to expand electrification. It benefits from abundant solar resources but faces challenges with infrastructure and financing in several African nations. International collaborations and foreign investments are helping accelerate solar deployment. While the region’s market share is smaller compared to others, ambitious renewable energy targets ensure a steady rise in fixed solar PV mounting demand over the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mounting Systems

- Esdec

- Versolsolar Hangzhou Co., Ltd.

- Schletter Group

- Clenergy

- UNIRAC

- Aerocompact

- Convert Italia SPA

- Arctech

- K2 Systems GmbH

Competitive Analysis

Competitive landscape of the Fixed Solar PV Mounting Systems Market is defined by key players including Aerocompact, Arctech, Clenergy, Convert Italia SPA, Esdec, K2 Systems GmbH, Mounting Systems, Schletter Group, UNIRAC, and Versolsolar Hangzhou Co., Ltd. These companies drive market growth by focusing on innovation in materials, streamlined designs, and cost-effective solutions for large-scale and rooftop solar projects. Many invest in corrosion-resistant steel and aluminum structures to extend durability and reduce lifecycle costs, aligning with global sustainability goals. Partnerships with developers and utility companies strengthen their global presence and enable penetration into emerging markets with rising solar capacity. Competition is marked by efforts to simplify installation, reduce labor requirements, and enhance performance across varied terrains and climates. Players also expand product portfolios to cater to utility, commercial, and residential needs while integrating eco-friendly and recyclable materials. The market reflects a balance between established multinational leaders and regional manufacturers, with ongoing emphasis on efficiency, scalability, and sustainability to capture future demand in global solar infrastructure.

Recent Developments

- In July 2025, K2 Systems launched two new pitched-roof mounting components, the SingleHook 3S Light-a low-profile roof hook with an arm height of 6 mm, weighing 0.531 kg per unit (30 hooks per box)-and the InsertionRail 2.0 rail measuring 53 mm in height, 63 mm in width, and 5.7 m in length, weighing 6.498 kg, both already integrated into the K2 Base planning software.

- In June 2024, Clenergy’s fixed-tilt mounting system was deployed in a 32 kW stand-alone solar project in Tasmania, featuring Mega Anchor supports engineered to withstand wind speeds up to 141 km/h.

- In May 2025, At Intersolar Europe 2025, Enstall showcased the full portfolio of its mounting brands—including Esdec, PanelClaw, Blubase, Sunfer, and the newly acquired Schletter—for the first time in a unified booth.

- In 2025, At Intersolar Europe 2025, K2 presented updates in aluminum-based flat-roof systems, including ballast-reduced, double-sided designs and pre-assembled connectors to enhance recyclability, reduce weight, and speed installation

Report Coverage

The research report offers an in-depth analysis based on Product, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fixed solar mounting systems will grow with global renewable energy expansion.

- Ground-mounted systems will remain dominant in large utility-scale solar farms.

- Rooftop installations will expand with rising adoption in residential and commercial projects.

- Use of corrosion-resistant and recyclable materials will strengthen product durability and sustainability.

- Modular and pre-assembled designs will gain traction for reducing installation time and labor costs.

- Emerging economies will drive growth through electrification programs and large-scale solar projects.

- Government policies and renewable energy targets will continue to support strong adoption.

- Competition will intensify as companies focus on affordability, scalability, and product innovation.

- Hybrid and off-grid projects will expand opportunities for fixed mounting applications.

- Focus on long-term system reliability will shape investment decisions and project planning.