1. Preface

1.1. Report Description

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Market Introduction

2. Executive Summary

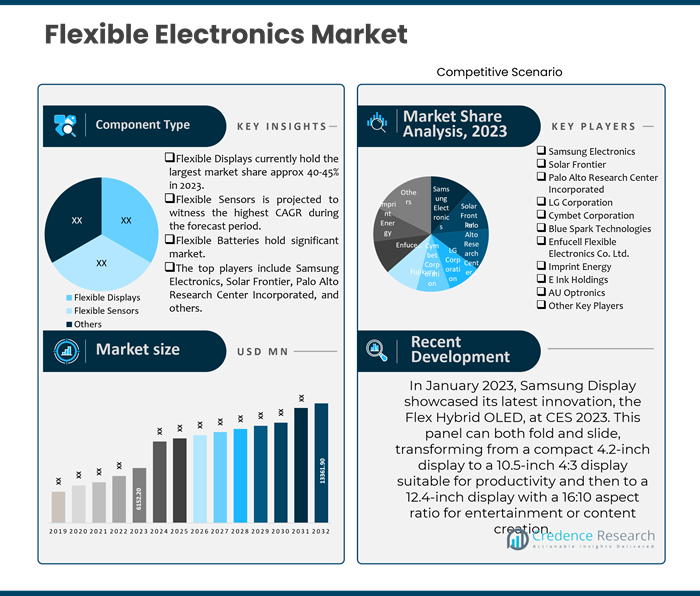

2.1. Market Snapshot: Global Flexible Electronics Market

2.1.1. Global Flexible Electronics Market, By Component Type

2.1.2. Global Flexible Electronics Market, By Application

2.1.3. Global Flexible Electronics Market, By Substrate Material

2.1.4. Global Flexible Electronics Market, By Technology

2.1.5. Global Flexible Electronics Market, By End-User Industry

2.1.6. Global Flexible Electronics Market, By Region

2.2. Insights from Primary Respondents

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. Global Flexible Electronics Market Value, 2019-2032, (US$ Mn)

3.1.2. Y-o-Y Growth Trend Analysis

3.2. Market Dynamics

3.2.1. Wired Drivers

3.2.2. Flexible Electronics Market Restraints

3.2.3. Flexible Electronics Market Opportunities

3.2.4. Major Flexible Electronics Industry Challenges

3.3. Growth and Development Patterns

3.4. Investment Feasibility Analysis

3.5. Market Opportunity Analysis

3.5.1. Component Type

3.5.2. Application

3.5.3. Substrate Material

3.5.4. Technology

3.5.5. End-User Industry

3.5.6. Geography

4. Market Competitive Landscape Analysis

4.1. Company Market Share Analysis, 2023

4.1.1. Global Flexible Electronics Market: Company Market Share, Value 2023

4.1.2. Global Flexible Electronics Market: Top 6 Company Market Share, Value 2023

4.1.3. Global Flexible Electronics Market: Top 3 Company Market Share, Value 2023

4.2. Global Flexible Electronics Market: Company Revenue Share Analysis, 2023

4.3. Company Assessment Metrics, 2023

4.3.1. Stars

4.3.2. Emerging Leaders

4.3.3. Pervasive Players

4.3.4. Participants

4.4. Startups/ SMEs Assessment Metrics, 2023

4.4.1. Progressive Companies

4.4.2. Responsive Companies

4.4.3. Dynamic Companies

4.4.4. Starting Blocks

4.5. Strategic Development

4.5.1. Acquisition and Mergers

4.5.2. New Product Launch

4.5.3. Regional Expansion

4.5.4. Partnerships

4.6. Key Player Product Matrix

4.7. Potential for New Players in the Global Flexible Electronics Market

5. Premium Insights

5.1. STAR (Situation, Task, Action, Results) Analysis

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of New Entrants

5.2.2. Bargaining Power of Buyers/Consumers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of Substitute Types

5.2.5. Intensity of Competitive Rivalry

5.3. PESTEL Analysis

5.3.1. Political Factors

5.3.2. Economic Factors

5.3.3. Social Factors

5.3.4. Technological Factors

5.3.5. Environmental Factors

5.3.6. Legal Factors

5.4. Key Market Trends

5.4.1. Demand Side Trends

5.4.2. Supply Side Trends

5.5. Value Chain Analysis

5.6. Technology Analysis

5.6.1. Research and development in the global market

5.6.2. Patent Analysis

5.6.3. Emerging technologies and their potential disruption to the market

5.7. Consumer Behaviour Analysis

5.7.1. Consumer Preferences and Expectations

5.7.2. Factors Influencing Consumer Buying Decisions

5.7.2.1. North America

5.7.2.2. Europe

5.7.2.3. Asia Pacific

5.7.2.4. Latin America

5.7.2.5. Middle East and Africa

5.7.3. Consumer Pain Points

5.8. Analysis and Recommendations

5.9. Adjacent Market Analysis

6. Market Positioning of Key Players, 2023

6.1. Company market share of key players, 2023

6.2. Competitive Benchmarking

6.3. Market Positioning of Key Vendors

6.4. Geographical Presence Analysis

6.5. Major Strategies Adopted by Key Players

6.5.1. Key Strategies Analysis

6.5.2. Mergers and Acquisitions

6.5.3. Partnerships

6.5.4. Product Launch

6.5.5. Geographical Expansion

6.5.6. Others

7. Impact Analysis of COVID 19 and Russia – Ukraine War on Flexible Electronics Market

7.1. Ukraine-Russia War Impact

7.1.1. Uncertainty and Economic Instability

7.1.2. Supply chain disruptions

7.1.3. Regional market shifts

7.1.4. Shift in government priorities

7.2. COVID-19 Impact Analysis

7.2.1. Supply Chain Disruptions

7.2.2. Demand Fluctuations

7.2.3. Shift in Product Mix

7.2.4. Reduced Industrial Activity

7.2.5. Regional Impact Analysis

7.2.5.1. North America

7.2.5.2. Europe

7.2.5.3. Asia Pacific

7.2.5.4. Latin America

7.2.5.5. Middle East and Africa

8. Global Flexible Electronics Market, By Component Type

8.1. Global Flexible Electronics Market Overview, by Component Type

8.1.1. Global Flexible Electronics Market Revenue Share, By Component Type, 2023 Vs 2032 (in %)

8.2. Flexible Displays

8.2.1. Global Flexible Electronics Market, By Flexible Displays, By Region, 2019-2032(US$ Mn)

8.2.2. Market Dynamics for Flexible Displays

8.2.2.1. Drivers

8.2.2.2. Restraints

8.2.2.3. Opportunities

8.2.2.4. Trends

8.3. Flexible Batteries

8.3.1. Global Flexible Electronics Market, By Flexible Batteries, By Region, 2019-2032 (US$ Mn)

8.3.2. Market Dynamics for Flexible Batteries

8.3.2.1. Drivers

8.3.2.2. Restraints

8.3.2.3. Opportunities

8.3.2.4. Trends

8.4. Flexible Sensors

8.4.1. Global Flexible Electronics Market, By Flexible Sensors, By Region, 2019-2032 (US$ Mn)

8.4.2. Market Dynamics for Flexible Sensors

8.4.2.1. Drivers

8.4.2.2. Restraints

8.4.2.3. Opportunities

8.4.2.4. Trends

8.5. Flexible Circuits (Flexible Printed Circuit Boards – FPCBs)

8.5.1. Global Flexible Electronics Market, By Flexible Circuits (Flexible Printed Circuit Boards – FPCBs), By Region, 2019-2032 (US$ Mn)

8.5.2. Market Dynamics for Flexible Circuits (Flexible Printed Circuit Boards – FPCBs)

8.5.2.1. Drivers

8.5.2.2. Restraints

8.5.2.3. Opportunities

8.5.2.4. Trends

8.6. Flexible Memory Devices

8.6.1. Global Flexible Electronics Market, By Flexible Memory Devices, By Region, 2019-2032 (US$ Mn)

8.6.2. Market Dynamics for Flexible Memory Devices

8.6.2.1. Drivers

8.6.2.2. Restraints

8.6.2.3. Opportunities

8.6.2.4. Trends

8.7. Photovoltaics (Flexible Solar Cells)

8.7.1. Global Flexible Electronics Market, By Photovoltaics (Flexible Solar Cells), By Region, 2019-2032 (US$ Mn)

8.7.2. Market Dynamics for Photovoltaics (Flexible Solar Cells)

8.7.2.1. Drivers

8.7.2.2. Restraints

8.7.2.3. Opportunities

8.7.2.4. Trends

8.8. Other Components

8.8.1. Global Flexible Electronics Market, By Other Components, By Region, 2019-2032 (US$ Mn)

8.8.2. Market Dynamics for Other Components

8.8.2.1. Drivers

8.8.2.2. Restraints

8.8.2.3. Opportunities

8.8.2.4. Trends

9. Global Flexible Electronics Market, By Application

9.1. Global Flexible Electronics Market Overview, by Application

9.1.1. Global Flexible Electronics Market Revenue Share, By Application, 2023 Vs 2032 (in %)

9.2. Consumer Electronics

9.2.1. Global Flexible Electronics Market, By Consumer Electronics, By Region, 2019-2032 (US$ Mn)

9.2.2. Market Dynamics for Consumer Electronics

9.2.2.1. Drivers

9.2.2.2. Restraints

9.2.2.3. Opportunities

9.2.2.4. Trends

9.3. Healthcare

9.3.1. Global Flexible Electronics Market, By Healthcare, By Region, 2019-2032 (US$ Mn)

9.3.2. Market Dynamics for Healthcare

9.3.2.1. Drivers

9.3.2.2. Restraints

9.3.2.3. Opportunities

9.3.2.4. Trends

9.4. Automotive

9.4.1. Global Flexible Electronics Market, By Automotive, By Region, 2019-2032 (US$ Mn)

9.4.2. Market Dynamics for Automotive

9.4.2.1. Drivers

9.4.2.2. Restraints

9.4.2.3. Opportunities

9.4.2.4. Trends

9.5. Aerospace and Defense

9.5.1. Global Flexible Electronics Market, By Aerospace and Defense, By Region, 2019-2032 (US$ Mn)

9.5.2. Market Dynamics for Aerospace and Defense

9.5.2.1. Drivers

9.5.2.2. Restraints

9.5.2.3. Opportunities

9.5.2.4. Trends

9.6. Industrial

9.6.1. Global Flexible Electronics Market, By Industrial, By Region, 2019-2032 (US$ Mn)

9.6.2. Market Dynamics for Industrial

9.6.2.1. Drivers

9.6.2.2. Restraints

9.6.2.3. Opportunities

9.6.2.4. Trends

9.7. Energy

9.7.1. Global Flexible Electronics Market, By Energy, By Region, 2019-2032 (US$ Mn)

9.7.2. Market Dynamics for Energy

9.7.2.1. Drivers

9.7.2.2. Restraints

9.7.2.3. Opportunities

9.7.2.4. Trends

9.8. Others

9.8.1. Global Flexible Electronics Market, By Others, By Region, 2019-2032 (US$ Mn)

9.8.2. Market Dynamics for Others

9.8.2.1. Drivers

9.8.2.2. Restraints

9.8.2.3. Opportunities

9.8.2.4. Trends

10. Global Flexible Electronics Market, By Substrate Material

10.1. Global Flexible Electronics Market Overview, by Substrate Material

10.1.1. Global Flexible Electronics Market Revenue Share, By Substrate Material, 2023 Vs 2032 (in %)

10.2. Plastic

10.2.1. Global Flexible Electronics Market, By Plastic, By Region, 2019-2032 (US$ Mn)

10.2.2. Market Dynamics for Plastic

10.2.2.1. Drivers

10.2.2.2. Restraints

10.2.2.3. Opportunities

10.2.2.4. Trends

10.3. Paper

10.3.1. Global Flexible Electronics Market, By Paper, By Region, 2019-2032 (US$ Mn)

10.3.2. Market Dynamics for Paper

10.3.2.1. Drivers

10.3.2.2. Restraints

10.3.2.3. Opportunities

10.3.2.4. Trends

10.4. Metal Foil

10.4.1. Global Flexible Electronics Market, By Metal Foil, By Region, 2019-2032 (US$ Mn)

10.4.2. Market Dynamics for Metal Foil

10.4.2.1. Drivers

10.4.2.2. Restraints

10.4.2.3. Opportunities

10.4.2.4. Trends

10.5. Glass

10.5.1. Global Flexible Electronics Market, By Glass, By Region, 2019-2032 (US$ Mn)

10.5.2. Market Dynamics for Glass

10.5.2.1. Drivers

10.5.2.2. Restraints

10.5.2.3. Opportunities

10.5.2.4. Trends

10.6. Others

10.6.1. Global Flexible Electronics Market, By Others, By Region, 2019-2032 (US$ Mn)

10.6.2. Market Dynamics for Others

10.6.2.1. Drivers

10.6.2.2. Restraints

10.6.2.3. Opportunities

10.6.2.4. Trends

11. Global Flexible Electronics Market, By Technology

11.1. Global Flexible Electronics Market Overview, by Technology

11.1.1. Global Flexible Electronics Market Revenue Share, By Technology, 2023 Vs 2032 (in %)

11.2. Organic Thin-film Transistors (OTFT)

11.2.1. Global Flexible Electronics Market, By Organic Thin-film Transistors (OTFT), By Region, 2019-2032 (US$ Mn)

11.2.2. Market Dynamics for Organic Thin-film Transistors (OTFT)

11.2.2.1. Drivers

11.2.2.2. Restraints

11.2.2.3. Opportunities

11.2.2.4. Trends

11.3. Inorganic Thin-film Transistors (ITFT)

11.3.1. Global Flexible Electronics Market, By Inorganic Thin-film Transistors (ITFT), By Region, 2019-2032 (US$ Mn)

11.3.2. Market Dynamics for Inorganic Thin-film Transistors (ITFT)

11.3.2.1. Drivers

11.3.2.2. Restraints

11.3.2.3. Opportunities

11.3.2.4. Trends

11.4. Organic Light Emitting Diodes (OLED)

11.4.1. Global Flexible Electronics Market, By Organic Light Emitting Diodes (OLED), By Region, 2019-2032 (US$ Mn)

11.4.2. Market Dynamics for Organic Light Emitting Diodes (OLED)

11.4.2.1. Drivers

11.4.2.2. Restraints

11.4.2.3. Opportunities

11.4.2.4. Trends

11.5. Organic Photovoltaics (OPV)

11.5.1. Global Flexible Electronics Market, By Organic Photovoltaics (OPV), By Region, 2019-2032 (US$ Mn)

11.5.2. Market Dynamics for Organic Photovoltaics (OPV)

11.5.2.1. Drivers

11.5.2.2. Restraints

11.5.2.3. Opportunities

11.5.2.4. Trends

11.6. Hybrid Materials

11.6.1. Global Flexible Electronics Market, By Hybrid Materials, By Region, 2019-2032 (US$ Mn)

11.6.2. Market Dynamics for Hybrid Materials

11.6.2.1. Drivers

11.6.2.2. Restraints

11.6.2.3. Opportunities

11.6.2.4. Trends

11.7. Others

11.7.1. Global Flexible Electronics Market, By Others, By Region, 2019-2032 (US$ Mn)

11.7.2. Market Dynamics for Others

11.7.2.1. Drivers

11.7.2.2. Restraints

11.7.2.3. Opportunities

11.7.2.4. Trends

12. Global Flexible Electronics Market, By End-User Industry

12.1. Global Flexible Electronics Market Overview, by End-User Industry

12.1.1. Global Flexible Electronics Market Revenue Share, By End-User Industry, 2023 Vs 2032 (in %)

12.2. Consumer Electronics

12.2.1. Global Flexible Electronics Market, By Consumer Electronics, By Region, 2019-2032 (US$ Mn)

12.2.2. Market Dynamics for Consumer Electronics

12.2.2.1. Drivers

12.2.2.2. Restraints

12.2.2.3. Opportunities

12.2.2.4. Trends

12.3. Healthcare

12.3.1. Global Flexible Electronics Market, By Healthcare, By Region, 2019-2032 (US$ Mn)

12.3.2. Market Dynamics for Healthcare

12.3.2.1. Drivers

12.3.2.2. Restraints

12.3.2.3. Opportunities

12.3.2.4. Trends

12.4. Automotive

12.4.1. Global Flexible Electronics Market, By Automotive, By Region, 2019-2032 (US$ Mn)

12.4.2. Market Dynamics for Automotive

12.4.2.1. Drivers

12.4.2.2. Restraints

12.4.2.3. Opportunities

12.4.2.4. Trends

12.5. Aerospace and Defense

12.5.1. Global Flexible Electronics Market, By Aerospace and Defense, By Region, 2019-2032 (US$ Mn)

12.5.2. Market Dynamics for Aerospace and Defense

12.5.2.1. Drivers

12.5.2.2. Restraints

12.5.2.3. Opportunities

12.5.2.4. Trends

12.6. Industrial

12.6.1. Global Flexible Electronics Market, By Industrial, By Region, 2019-2032 (US$ Mn)

12.6.2. Market Dynamics for Industrial

12.6.2.1. Drivers

12.6.2.2. Restraints

12.6.2.3. Opportunities

12.6.2.4. Trends

12.7. Energy

12.7.1. Global Flexible Electronics Market, By Energy, By Region, 2019-2032 (US$ Mn)

12.7.2. Market Dynamics for Energy

12.7.2.1. Drivers

12.7.2.2. Restraints

12.7.2.3. Opportunities

12.7.2.4. Trends

12.8. Others

12.8.1. Global Flexible Electronics Market, By Others, By Region, 2019-2032 (US$ Mn)

12.8.2. Market Dynamics for Others

12.8.2.1. Drivers

12.8.2.2. Restraints

12.8.2.3. Opportunities

12.8.2.4. Trends

13. Global Flexible Electronics Market, By Region

13.1. Global Flexible Electronics Market Overview, by Region

13.1.1. Global Flexible Electronics Market, By Region, 2023 vs 2032 (in%)

13.2. Component Type

13.2.1. Global Flexible Electronics Market, By Component Type, 2019-2032 (US$ Mn)

13.3. Application

13.3.1. Global Flexible Electronics Market, By Application, 2019-2032 (US$ Mn)

13.4. Substrate Material

13.4.1. Global Flexible Electronics Market, By Substrate Material, 2019-2032 (US$ Mn)

13.5. Technology

13.5.1. Global Flexible Electronics Market, By Technology, 2019-2032 (US$ Mn)

13.6. End-User Industry

13.6.1. Global Flexible Electronics Market, By End-User Industry, 2019-2032 (US$ Mn)

14. North America Flexible Electronics Market Analysis

14.1. Overview

14.1.1. Market Dynamics for North America

14.1.1.1. Drivers

14.1.1.2. Restraints

14.1.1.3. Opportunities

14.1.1.4. Trends

14.2. North America Flexible Electronics Market, by Component Type, 2019-2032(US$ Mn)

14.2.1. Overview

14.2.2. SRC Analysis

14.3. North America Flexible Electronics Market, by Application, 2019-2032(US$ Mn)

14.3.1. Overview

14.3.2. SRC Analysis

14.4. North America Flexible Electronics Market, by Substrate Material, 2019-2032(US$ Mn)

14.4.1. Overview

14.4.2. SRC Analysis

14.5. North America Flexible Electronics Market, by Technology, 2019-2032(US$ Mn)

14.5.1. Overview

14.5.2. SRC Analysis

14.6. North America Flexible Electronics Market, by End-User Industry, 2019-2032(US$ Mn)

14.6.1. Overview

14.6.2. SRC Analysis

14.7. North America Flexible Electronics Market, by Country, 2019-2032(US$ Mn)

14.7.1. North America Flexible Electronics Market, by Country, 2023 Vs 2032 (in%)

14.7.2. U.S.

14.7.3. Canada

14.7.4. Mexico

15. Europe Flexible Electronics Market Analysis

15.1. Overview

15.1.1. Market Dynamics for North America

15.1.1.1. Drivers

15.1.1.2. Restraints

15.1.1.3. Opportunities

15.1.1.4. Trends

15.2. Europe Flexible Electronics Market, by Component Type, 2019-2032(US$ Mn)

15.2.1. Overview

15.2.2. SRC Analysis

15.3. Europe Flexible Electronics Market, by Application, 2019-2032(US$ Mn)

15.3.1. Overview

15.3.2. SRC Analysis

15.4. Europe Flexible Electronics Market, by Substrate Material, 2019-2032(US$ Mn)

15.4.1. Overview

15.4.2. SRC Analysis

15.5. Europe Flexible Electronics Market, by Technology, 2019-2032(US$ Mn)

15.5.1. Overview

15.5.2. SRC Analysis

15.6. Europe Flexible Electronics Market, by End-User Industry, 2019-2032(US$ Mn)

15.6.1. Overview

15.6.2. SRC Analysis

15.7. Europe Flexible Electronics Market, by Country, 2019-2032 (US$ Mn)

15.7.1. Europe Flexible Electronics Market, by Country, 2023 Vs 2032 (in%)

15.7.2. UK

15.7.3. France

15.7.4. Germany

15.7.5. Italy

15.7.6. Spain

15.7.7. Benelux

15.7.8. Russia

15.7.9. Rest of Europe

16. Asia Pacific Flexible Electronics Market Analysis

16.1. Overview

16.1.1. Market Dynamics for North America

16.1.1.1. Drivers

16.1.1.2. Restraints

16.1.1.3. Opportunities

16.1.1.4. Trends

16.2. Asia Pacific Flexible Electronics Market, by Component Type, 2019-2032(US$ Mn)

16.2.1. Overview

16.2.2. SRC Analysis

16.3. Asia Pacific Flexible Electronics Market, by Application, 2019-2032(US$ Mn)

16.3.1. Overview

16.3.2. SRC Analysis

16.4. Asia Pacific Flexible Electronics Market, by Substrate Material, 2019-2032(US$ Mn)

16.4.1. Overview

16.4.2. SRC Analysis

16.5. Asia Pacific Flexible Electronics Market, by Technology, 2019-2032(US$ Mn)

16.5.1. Overview

16.5.2. SRC Analysis

16.6. Asia Pacific Flexible Electronics Market, by End-User Industry, 2019-2032(US$ Mn)

16.6.1. Overview

16.6.2. SRC Analysis

16.7. Asia Pacific Flexible Electronics Market, by Country, 2019-2032 (US$ Mn)

16.7.1. Asia Pacific Flexible Electronics Market, by Country, 2023 Vs 2032 (in%)

16.7.2. China

16.7.3. Japan

16.7.4. India

16.7.5. South Korea

16.7.6. South East Asia

16.7.7. Rest of Asia Pacific

17. Latin America Flexible Electronics Market Analysis

17.1. Overview

17.1.1. Market Dynamics for North America

17.1.1.1. Drivers

17.1.1.2. Restraints

17.1.1.3. Opportunities

17.1.1.4. Trends

17.2. Latin America Flexible Electronics Market, by Component Type, 2019-2032(US$ Mn)

17.2.1. Overview

17.2.2. SRC Analysis

17.3. Latin America Flexible Electronics Market, by Application, 2019-2032(US$ Mn)

17.3.1. Overview

17.3.2. SRC Analysis

17.4. Latin America Flexible Electronics Market, by Substrate Material, 2019-2032(US$ Mn)

17.4.1. Overview

17.4.2. SRC Analysis

17.5. Latin America Flexible Electronics Market, by Technology, 2019-2032(US$ Mn)

17.5.1. Overview

17.5.2. SRC Analysis

17.6. Latin America Flexible Electronics Market, by End-User Industry, 2019-2032(US$ Mn)

17.6.1. Overview

17.6.2. SRC Analysis

17.7. Latin America Flexible Electronics Market, by Country, 2019-2032 (US$ Mn)

17.7.1. Latin America Flexible Electronics Market, by Country, 2023 Vs 2032 (in%)

17.7.2. Brazil

17.7.3. Argentina

17.7.4. Rest of Latin America

18. Middle East Flexible Electronics Market Analysis

18.1. Overview

18.1.1. Market Dynamics for North America

18.1.1.1. Drivers

18.1.1.2. Restraints

18.1.1.3. Opportunities

18.1.1.4. Trends

18.2. Middle East Flexible Electronics Market, by Component Type, 2019-2032(US$ Mn)

18.2.1. Overview

18.2.2. SRC Analysis

18.3. Middle East Flexible Electronics Market, by Application, 2019-2032(US$ Mn)

18.3.1. Overview

18.3.2. SRC Analysis

18.4. Middle East Flexible Electronics Market, by Substrate Material, 2019-2032(US$ Mn)

18.4.1. Overview

18.4.2. SRC Analysis

18.5. Middle East Flexible Electronics Market, by Technology, 2019-2032(US$ Mn)

18.5.1. Overview

18.5.2. SRC Analysis

18.6. Middle East Flexible Electronics Market, by End-User Industry, 2019-2032(US$ Mn)

18.6.1. Overview

18.6.2. SRC Analysis

18.7. Middle East Flexible Electronics Market, by Country, 2019-2032 (US$ Mn)

18.7.1. Middle East Flexible Electronics Market, by Country, 2023 Vs 2032 (in%)

18.7.2. UAE

18.7.3. Saudi Arabia

18.7.4. Rest of Middle East

19. Africa Flexible Electronics Market Analysis

19.1. Overview

19.1.1. Market Dynamics for North America

19.1.1.1. Drivers

19.1.1.2. Restraints

19.1.1.3. Opportunities

19.1.1.4. Trends

19.2. Africa Flexible Electronics Market, by Component Type, 2019-2032(US$ Mn)

19.2.1. Overview

19.2.2. SRC Analysis

19.3. Africa Flexible Electronics Market, by Application, 2019-2032(US$ Mn)

19.3.1. Overview

19.3.2. SRC Analysis

19.4. Africa Flexible Electronics Market, by Substrate Material, 2019-2032(US$ Mn)

19.4.1. Overview

19.4.2. SRC Analysis

19.5. Africa Flexible Electronics Market, by Technology, 2019-2032(US$ Mn)

19.5.1. Overview

19.5.2. SRC Analysis

19.6. Africa Flexible Electronics Market, by End-User Industry, 2019-2032(US$ Mn)

19.6.1. Overview

19.6.2. SRC Analysis

19.7. Africa Flexible Electronics Market, by Country, 2019-2032 (US$ Mn)

19.7.1. Middle East Flexible Electronics Market, by Country, 2023 Vs 2032 (in%)

19.7.2. South Africa

19.7.3. Egypt

19.7.4. Rest of Africa

20. Company Profiles

20.1. Samsung Electronics

20.1.1. Company Overview

20.1.2. Products/Services Portfolio

20.1.3. Geographical Presence

20.1.4. SWOT Analysis

20.1.5. Financial Summary

20.1.5.1. Market Revenue and Net Profit (2019-2023)

20.1.5.2. Business Segment Revenue Analysis

20.1.5.3. Geographical Revenue Analysis

20.2. Solar Frontier

20.3. Palo Alto Research Center Incorporated

20.4. LG Corporation

20.5. Cymbet Corporation

20.6. Blue Spark Technologies

20.7. Enfucell Flexible Electronics Co. Ltd.

20.8. Imprint Energy

20.9. E Ink Holdings

20.10. AU Optronics

20.11. Others

21. Research Methodology

21.1. Research Methodology

21.2. Phase I – Secondary Research

21.3. Phase II – Data Modelling

21.3.1. Company Share Analysis Model

21.3.2. Revenue Based Modelling

21.4. Phase III – Primary Research

21.5. Research Limitations

21.5.1. Assumptions

List of Figures

FIG. 1 Global Flexible Electronics Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 Global Flexible Electronics Market Segmentation

FIG. 4 Global Flexible Electronics Market, by Component Type, 2023 (US$ Mn)

FIG. 5 Global Flexible Electronics Market, by Application, 2023 (US$ Mn)

FIG. 6 Global Flexible Electronics Market, by Substrate Material, 2023 (US$ Mn)

FIG. 7 Global Flexible Electronics Market, by Technology, 2023 (US$ Mn)

FIG. 8 Global Flexible Electronics Market, by End-User Industry, 2023 (US$ Mn)

FIG. 9 Global Flexible Electronics Market, by Geography, 2023 (US$ Mn)

FIG. 10 Attractive Investment Proposition, by Component Type, 2023

FIG. 11 Attractive Investment Proposition, by Application, 2023

FIG. 12 Attractive Investment Proposition, by Substrate Material, 2023

FIG. 13 Attractive Investment Proposition, by Technology, 2023

FIG. 14 Attractive Investment Proposition, by End-User Industry, 2023

FIG. 15 Attractive Investment Proposition, by Geography, 2023

FIG. 16 Global Market Share Analysis of Key Flexible Electronics Market Manufacturers, 2023

FIG. 17 Global Market Positioning of Key Flexible Electronics Market Manufacturers, 2023

FIG. 18 Global Flexible Electronics Market Value Contribution, By Component Type, 2023&2032 (Value %)

FIG. 19 Global Flexible Electronics Market, by Flexible Displays, By Region, 2019-2023 (US$ Mn)

FIG. 20 Global Flexible Electronics Market, by Flexible Batteries, By Region, 2019-2023 (US$ Mn)

FIG. 21 Global Flexible Electronics Market, by Flexible Sensors, By Region, 2019-2023 (US$ Mn)

FIG. 22 Global Flexible Electronics Market, by Flexible Circuits (Flexible Printed Circuit Boards – FPCBs), By Region, 2019-2023 (US$ Mn)

FIG. 23 Global Flexible Electronics Market, by Flexible Memory Devices, By Region, 2019-2023 (US$ Mn)

FIG. 24 Global Flexible Electronics Market, by Photovoltaics (Flexible Solar Cells), By Region, 2019-2023 (US$ Mn)

FIG. 25 Global Flexible Electronics Market, by Other Components, By Region, 2019-2023 (US$ Mn)

FIG. 26 Global Flexible Electronics Market Value Contribution, By Application, 2023&2032 (Value %)

FIG. 27 Global Flexible Electronics Market, by Consumer Electronics, By Region, 2019-2023 (US$ Mn)

FIG. 28 Global Flexible Electronics Market, by Healthcare, By Region, 2019-2023 (US$ Mn)

FIG. 29 Global Flexible Electronics Market, by Automotive, By Region, 2019-2023 (US$ Mn)

FIG. 30 Global Flexible Electronics Market, by Aerospace and Defense, By Region, 2019-2023 (US$ Mn)

FIG. 31 Global Flexible Electronics Market, by Industrial, By Region, 2019-2023 (US$ Mn)

FIG. 32 Global Flexible Electronics Market, by Energy, By Region, 2019-2023 (US$ Mn)

FIG. 33 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

FIG. 34 Global Flexible Electronics Market Value Contribution, By Substrate Material, 2023&2032 (Value %)

FIG. 35 Global Flexible Electronics Market, by Plastic, By Region, 2019-2023 (US$ Mn)

FIG. 36 Global Flexible Electronics Market, by Paper, By Region, 2019-2023 (US$ Mn)

FIG. 37 Global Flexible Electronics Market, by Metal Foil, By Region, 2019-2023 (US$ Mn)

FIG. 38 Global Flexible Electronics Market, by Glass, By Region, 2019-2023 (US$ Mn)

FIG. 39 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

FIG. 40 Global Flexible Electronics Market Value Contribution, By Technology, 2023&2032 (Value %)

FIG. 41 Global Flexible Electronics Market, by Organic Thin-film Transistors (OTFT), By Region, 2019-2023 (US$ Mn)

FIG. 42 Global Flexible Electronics Market, by Inorganic Thin-film Transistors (ITFT), By Region, 2019-2023 (US$ Mn)

FIG. 43 Global Flexible Electronics Market, by Organic Light Emitting Diodes (OLED), By Region, 2019-2023 (US$ Mn)

FIG. 44 Global Flexible Electronics Market, by Organic Photovoltaics (OPV), By Region, 2019-2023 (US$ Mn)

FIG. 45 Global Flexible Electronics Market, by Hybrid Materials, By Region, 2019-2023 (US$ Mn)

FIG. 46 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

FIG. 47 Global Flexible Electronics Market Value Contribution, By End-User Industry, 2023&2032 (Value %)

FIG. 48 Global Flexible Electronics Market, by Consumer Electronics, By Region, 2019-2023 (US$ Mn)

FIG. 49 Global Flexible Electronics Market, by Healthcare, By Region, 2019-2023 (US$ Mn)

FIG. 50 Global Flexible Electronics Market, by Automotive, By Region, 2019-2023 (US$ Mn)

FIG. 51 Global Flexible Electronics Market, by Aerospace and Defense, By Region, 2019-2023 (US$ Mn)

FIG. 52 Global Flexible Electronics Market, by Industrial, By Region, 2019-2023 (US$ Mn)

FIG. 53 Global Flexible Electronics Market, by Energy, By Region, 2019-2023 (US$ Mn)

FIG. 54 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

FIG. 55 North America Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 56 U.S. Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 57 Canada Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 58 Mexico Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 59 Europe Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 60 Germany Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 61 France Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 62 U.K. Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 63 Italy Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 64 Spain Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 65 Benelux Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 66 Russia Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 67 Rest of Europe Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 68 Asia Pacific Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 69 China Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 70 Japan Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 71 India Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 72 South Korea Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 73 South-East Asia Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 74 Rest of Asia Pacific Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 75 Latin America Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 76 Brazil Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 77 Argentina Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 78 Rest of Latin America Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 79 Middle East Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 80 UAE Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 81 Saudi Arabia Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 82 Rest of Middle East Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 83 Africa Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 84 South Africa Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 85 Egypt Flexible Electronics Market, 2019-2032 (US$ Mn)

FIG. 86 Rest of Africa Flexible Electronics Market, 2019-2032 (US$ Mn)

List of Tables

TABLE 1 Market Snapshot: Global Flexible Electronics Market

TABLE 2 Global Flexible Electronics Market: Market Drivers Impact Analysis

TABLE 3 Global Flexible Electronics Market: Market Restraints Impact Analysis

TABLE 4 Global Flexible Electronics Market, by Competitive Benchmarking, 2023

TABLE 5 Global Flexible Electronics Market, by Geographical Presence Analysis, 2023

TABLE 6 Global Flexible Electronics Market, by Key Strategies Analysis, 2023

TABLE 7 Global Flexible Electronics Market, by Flexible Displays, By Region, 2019-2023 (US$ Mn)

TABLE 8 Global Flexible Electronics Market, by Flexible Displays, By Region, 2024-2032 (US$ Mn)

TABLE 9 Global Flexible Electronics Market, by Flexible Batteries, By Region, 2019-2023 (US$ Mn)

TABLE 10 Global Flexible Electronics Market, by Flexible Batteries, By Region, 2019-2023 (US$ Mn)

TABLE 11 Global Flexible Electronics Market, by Flexible Sensors, By Region, 2019-2023 (US$ Mn)

TABLE 12 Global Flexible Electronics Market, by Flexible Sensors, By Region, 2019-2023 (US$ Mn)

TABLE 13 Global Flexible Electronics Market, by Flexible Circuits (Flexible Printed Circuit Boards – FPCBs), By Region, 2019-2023 (US$ Mn)

TABLE 14 Global Flexible Electronics Market, by Flexible Circuits (Flexible Printed Circuit Boards – FPCBs), By Region, 2019-2023 (US$ Mn)

TABLE 15 Global Flexible Electronics Market, by Flexible Memory Devices, By Region, 2019-2023 (US$ Mn)

TABLE 16 Global Flexible Electronics Market, by Flexible Memory Devices, By Region, 2019-2023 (US$ Mn)

TABLE 17 Global Flexible Electronics Market, by Photovoltaics (Flexible Solar Cells), By Region, 2019-2023 (US$ Mn)

TABLE 18 Global Flexible Electronics Market, by Photovoltaics (Flexible Solar Cells), By Region, 2019-2023 (US$ Mn)

TABLE 19 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 20 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 21 Global Flexible Electronics Market, by Consumer Electronics, By Region, 2019-2023 (US$ Mn)

TABLE 22 Global Flexible Electronics Market, by Consumer Electronics, By Region, 2019-2023 (US$ Mn)

TABLE 23 Global Flexible Electronics Market, by Healthcare, By Region, 2019-2023 (US$ Mn)

TABLE 24 Global Flexible Electronics Market, by Healthcare, By Region, 2019-2023 (US$ Mn)

TABLE 25 Global Flexible Electronics Market, by Automotive, By Region, 2019-2023 (US$ Mn)

TABLE 26 Global Flexible Electronics Market, by Automotive, By Region, 2019-2023 (US$ Mn)

TABLE 27 Global Flexible Electronics Market, by Aerospace and Defense, By Region, 2019-2023 (US$ Mn)

TABLE 28 Global Flexible Electronics Market, by Aerospace and Defense, By Region, 2019-2023 (US$ Mn)

TABLE 29 Global Flexible Electronics Market, by Industrial, By Region, 2019-2023 (US$ Mn)

TABLE 30 Global Flexible Electronics Market, by Industrial, By Region, 2019-2023 (US$ Mn)

TABLE 31 Global Flexible Electronics Market, by Energy, By Region, 2019-2023 (US$ Mn)

TABLE 32 Global Flexible Electronics Market, by Energy, By Region, 2019-2023 (US$ Mn)

TABLE 33 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 34 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 35 Global Flexible Electronics Market, by Plastic, By Region, 2019-2023 (US$ Mn)

TABLE 36 Global Flexible Electronics Market, by Plastic, By Region, 2019-2023 (US$ Mn)

TABLE 37 Global Flexible Electronics Market, by Paper, By Region, 2019-2023 (US$ Mn)

TABLE 38 Global Flexible Electronics Market, by Paper, By Region, 2019-2023 (US$ Mn)

TABLE 39 Global Flexible Electronics Market, by Metal Foil, By Region, 2019-2023 (US$ Mn)

TABLE 40 Global Flexible Electronics Market, by Metal Foil, By Region, 2019-2023 (US$ Mn)

TABLE 41 Global Flexible Electronics Market, by Glass, By Region, 2019-2023 (US$ Mn)

TABLE 42 Global Flexible Electronics Market, by Glass, By Region, 2019-2023 (US$ Mn)

TABLE 43 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 44 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 45 Global Flexible Electronics Market, by Organic Thin-film Transistors (OTFT), By Region, 2019-2023 (US$ Mn)

TABLE 46 Global Flexible Electronics Market, by Organic Thin-film Transistors (OTFT), By Region, 2019-2023 (US$ Mn)

TABLE 47 Global Flexible Electronics Market, by Inorganic Thin-film Transistors (ITFT), By Region, 2019-2023 (US$ Mn)

TABLE 48 Global Flexible Electronics Market, by Inorganic Thin-film Transistors (ITFT), By Region, 2019-2023 (US$ Mn)

TABLE 49 Global Flexible Electronics Market, by Organic Light Emitting Diodes (OLED), By Region, 2019-2023 (US$ Mn)

TABLE 50 Global Flexible Electronics Market, by Organic Light Emitting Diodes (OLED), By Region, 2019-2023 (US$ Mn)

TABLE 51 Global Flexible Electronics Market, by Organic Photovoltaics (OPV), By Region, 2019-2023 (US$ Mn)

TABLE 52 Global Flexible Electronics Market, by Organic Photovoltaics (OPV), By Region, 2019-2023 (US$ Mn)

TABLE 53 Global Flexible Electronics Market, by Hybrid Materials, By Region, 2019-2023 (US$ Mn)

TABLE 54 Global Flexible Electronics Market, by Hybrid Materials, By Region, 2019-2023 (US$ Mn)

TABLE 55 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 56 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 57 Global Flexible Electronics Market, by Consumer Electronics, By Region, 2019-2023 (US$ Mn)

TABLE 58 Global Flexible Electronics Market, by Consumer Electronics, By Region, 2019-2023 (US$ Mn)

TABLE 59 Global Flexible Electronics Market, by Healthcare, By Region, 2019-2023 (US$ Mn)

TABLE 60 Global Flexible Electronics Market, by Healthcare, By Region, 2019-2023 (US$ Mn)

TABLE 61 Global Flexible Electronics Market, by Automotive, By Region, 2019-2023 (US$ Mn)

TABLE 62 Global Flexible Electronics Market, by Automotive, By Region, 2019-2023 (US$ Mn)

TABLE 63 Global Flexible Electronics Market, by Aerospace and Defense, By Region, 2019-2023 (US$ Mn)

TABLE 64 Global Flexible Electronics Market, by Aerospace and Defense, By Region, 2019-2023 (US$ Mn)

TABLE 65 Global Flexible Electronics Market, by Industrial, By Region, 2019-2023 (US$ Mn)

TABLE 66 Global Flexible Electronics Market, by Industrial, By Region, 2019-2023 (US$ Mn)

TABLE 67 Global Flexible Electronics Market, by Energy, By Region, 2019-2023 (US$ Mn)

TABLE 68 Global Flexible Electronics Market, by Energy, By Region, 2019-2023 (US$ Mn)

TABLE 69 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 70 Global Flexible Electronics Market, by Others, By Region, 2019-2023 (US$ Mn)

TABLE 71 Global Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 72 Global Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 73 Global Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 74 Global Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 75 Global Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 76 Global Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 77 Global Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 78 Global Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 79 Global Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 80 Global Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 81 Global Flexible Electronics Market, by Region, 2019-2023 (US$ Mn)

TABLE 82 Global Flexible Electronics Market, by Region, 2024-2032 (US$ Mn)

TABLE 83 North America Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 84 North America Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 85 North America Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 86 North America Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 87 North America Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 88 North America Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 89 North America Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 90 North America Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 91 North America Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 92 North America Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 93 North America Flexible Electronics Market, by Country, 2019-2023 (US$ Mn)

TABLE 94 North America Flexible Electronics Market, by Country, 2024-2032 (US$ Mn)

TABLE 95 United States Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 96 United States Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 97 United States Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 98 United States Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 99 United States Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 100 United States Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 101 United States Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 102 United States Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 103 United States Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 104 United States Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 105 Canada Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 106 Canada Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 107 Canada Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 108 Canada Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 109 Canada Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 110 Canada Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 111 Canada Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 112 Canada Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 113 Canada ca Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 114 Canada Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 115 Mexico Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 116 Mexico Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 117 Mexico Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 118 Mexico Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 119 Mexico Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 120 Mexico Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 121 Mexico Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 122 Mexico Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 123 Mexico Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 124 Mexico Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 125 Europe Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 126 Europe Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 127 Europe Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 128 Europe Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 129 Europe Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 130 Europe Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 131 Europe Flexible Electronics Market, by Country, 2019-2023 (US$ Mn)

TABLE 132 Europe Flexible Electronics Market, by Country, 2024-2032 (US$ Mn)

TABLE 133 Europe Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 134 Europe Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 135 Europe Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 136 Europe Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 137 Germany Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 138 Germany Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 139 Germany Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 140 Germany Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 141 Germany Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 142 Germany Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 143 Germany Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 144 Germany Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 145 Germany Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 146 France Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 147 France Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 148 France Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 149 France Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 150 France Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 151 France Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 152 France Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 153 France Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 154 France Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 155 France Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 156 United Kingdom Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 157 United Kingdom Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 158 United Kingdom Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 159 United Kingdom Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 160 United Kingdom Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 161 United Kingdom Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 162 United Kingdom Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 163 United Kingdom Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 164 United Kingdom Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 165 United Kingdom Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 166 Italy Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 167 Italy Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 168 Italy Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 169 Italy Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 170 Italy Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 171 Italy Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 172 Italy Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 173 Italy Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 174 Italy Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 175 Italy Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 176 Spain Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 177 Spain Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 178 Spain Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 179 Spain Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 180 Spain Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 181 Spain Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 182 Spain Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 183 Spain Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 184 Spain Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 185 Spain Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 186 Benelux Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 187 Benelux Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 188 Benelux Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 189 Benelux Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 190 Benelux Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 191 Benelux Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 192 Benelux Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 193 Benelux Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 194 Benelux Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 195 Benelux Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 196 Russia Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 197 Russia Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 198 Russia Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 199 Russia Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 200 Russia Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 201 Russia Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 202 Russia Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 203 Russia Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 204 Russia Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 205 Russia Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 206 Rest of Europe Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 207 Rest of Europe Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 208 Rest of Europe Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 209 Rest of Europe Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 210 Rest of Europe Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 211 Rest of Europe Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 212 Rest of Europe Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 213 Rest of Europe Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 214 Rest of Europe Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 215 Rest of Europe Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 216 Asia Pacific Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 217 Asia Pacific Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 218 Asia Pacific Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 219 Asia Pacific Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 220 Asia Pacific Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 221 Asia Pacific Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 222 Asia Pacific Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 223 Asia Pacific Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 224 Asia Pacific Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 225 Asia Pacific Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 226 China Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 227 China Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 228 China Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 229 China Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 230 China Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 231 China Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 232 China Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 233 China Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 234 China Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 235 China Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 236 Japan Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 237 Japan Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 238 Japan Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 239 Japan Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 240 Japan Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 241 Japan Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 242 Japan Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 243 Japan Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 244 Japan Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 245 Japan Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 246 India Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 247 India Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 248 India Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 249 India Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 250 India Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 251 India Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 252 India Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 253 India Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 254 India Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 255 India Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 256 South Korea Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 257 South Korea Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 258 South Korea Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 259 South Korea Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 260 South Korea Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 261 South Korea Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 262 South Korea Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 263 South Korea Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 264 South Korea Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 265 South Korea Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 266 South-East Asia Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 267 South-East Asia Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 268 South-East Asia Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 269 South-East Asia Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 270 South-East Asia Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 271 South-East Asia Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 272 South-East Asia Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 273 South-East Asia Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 274 South-East Asia Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 275 South-East Asia Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 276 Rest of Asia Pacific Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 277 Rest of Asia Pacific Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 278 Rest of Asia Pacific Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 279 Rest of Asia Pacific Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 280 Rest of Asia Pacific Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 281 Rest of Asia Pacific Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 282 Rest of Asia Pacific Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 283 Rest of Asia Pacific Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 284 Rest of Asia Pacific Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 285 Rest of Asia Pacific Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 286 Latin America Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 287 Latin America Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 288 Latin America Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 289 Latin America Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 290 Latin America Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 291 Latin America Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 292 Latin America Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 293 Latin America Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 294 Latin America Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 295 Latin America Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 296 Brazil Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 297 Brazil Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 298 Brazil Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 299 Brazil Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 300 Brazil Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 301 Brazil Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 302 Brazil Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 303 Brazil Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 304 Brazil Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 305 Brazil Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 306 Argentina Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 307 Argentina Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 308 Argentina Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 309 Argentina Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 310 Argentina Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 311 Argentina Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 312 Argentina Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 313 Argentina Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 314 Argentina Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 315 Argentina Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 316 Rest of Latin America Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 317 Rest of Latin America Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 318 Rest of Latin America Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 319 Rest of Latin America Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 320 Rest of Latin America Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 321 Rest of Latin America Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 322 Rest of Latin America Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 323 Rest of Latin America Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 324 Rest of Latin America Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 325 Rest of Latin America Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 326 Middle East Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 327 Middle East Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 328 Middle East Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 329 Middle East Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 330 Middle East Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 331 Middle East Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 332 Middle East Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 333 Middle East Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 334 Middle East rica Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 335 Middle East Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 336 UAE Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 337 UAE Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 338 UAE Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 339 UAE Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 340 UAE Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 341 UAE Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 342 UAE Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 343 UAE Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 344 UAE Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 345 UAE Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 346 Saudi Arabia Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 347 Saudi Arabia Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 348 Saudi Arabia Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 349 Saudi Arabia Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 350 Saudi Arabia Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 351 Saudi Arabia Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 352 Saudi Arabia Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 353 Saudi Arabia Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 354 Saudi Arabia Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 355 Saudi Arabia Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 356 Rest of Middle East Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 357 Rest of Middle East Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 358 Rest of Middle East Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 359 Rest of Middle East Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 360 Rest of Middle East Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 361 Rest of Middle East Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 362 Rest of Middle East Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 363 Rest of Middle East Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 364 Rest of Middle East Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 365 Rest of Middle East Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 366 Africa Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 367 Africa Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 368 Africa Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 369 Africa Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 370 Africa Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 371 Africa Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 372 Africa Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 373 Africa Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 374 Africa Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 375 Africa Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 376 South Africa Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 377 South Africa Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 378 South Africa Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 379 South Africa Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 380 South Africa Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 381 South Africa Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 382 South Africa Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 383 South Africa Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 384 South Africa Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 385 South Africa Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 386 Egypt Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 387 Egypt Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 388 Egypt Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 389 Egypt Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 390 Egypt Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 391 Egypt Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 392 Egypt Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 393 Egypt Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 394 Egypt Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 395 Egypt Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)

TABLE 396 Rest of Africa Flexible Electronics Market, by Component Type, 2019-2023 (US$ Mn)

TABLE 397 Rest of Africa Flexible Electronics Market, by Component Type, 2024-2032 (US$ Mn)

TABLE 398 Rest of Africa Flexible Electronics Market, by Application, 2019-2023 (US$ Mn)

TABLE 399 Rest of Africa Flexible Electronics Market, by Application, 2024-2032 (US$ Mn)

TABLE 400 Rest of Africa Flexible Electronics Market, by Substrate Material, 2019-2023 (US$ Mn)

TABLE 401 Rest of Africa Flexible Electronics Market, by Substrate Material, 2024-2032 (US$ Mn)

TABLE 402 Rest of Africa Flexible Electronics Market, by Technology, 2019-2023 (US$ Mn)

TABLE 403 Rest of Africa Flexible Electronics Market, by Technology, 2024-2032 (US$ Mn)

TABLE 404 Rest of Africa Flexible Electronics Market, by End-User Industry, 2019-2023 (US$ Mn)

TABLE 405 Rest of Africa Flexible Electronics Market, by End-User Industry, 2024-2032 (US$ Mn)