| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flush Mount Photo Album Market Size 2024 |

USD 3,830.1 Million |

| Flush Mount Photo Album Market , CAGR |

3.68 % |

| Flush Mount Photo Album Market Size 2032 |

USD 5,094.3 Million |

Market Overview

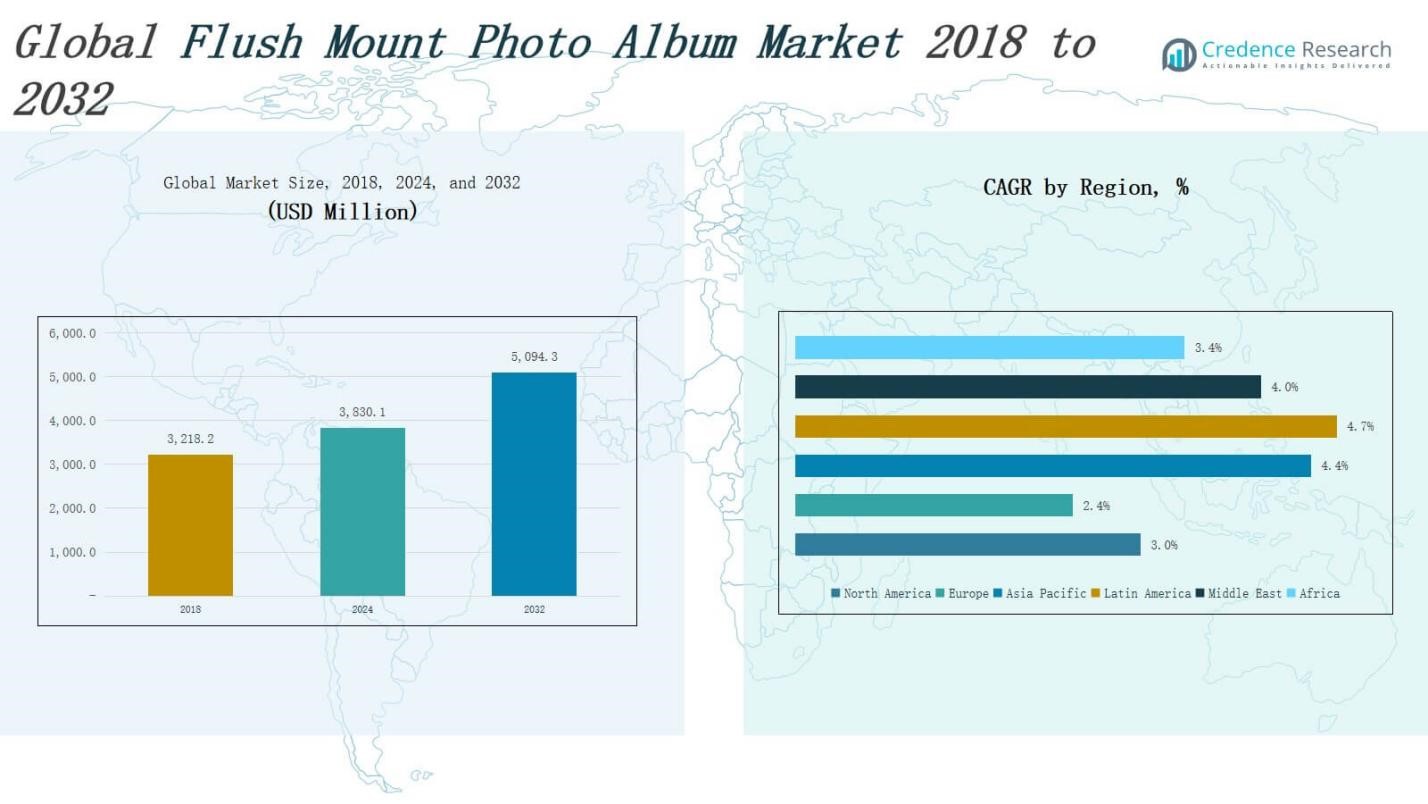

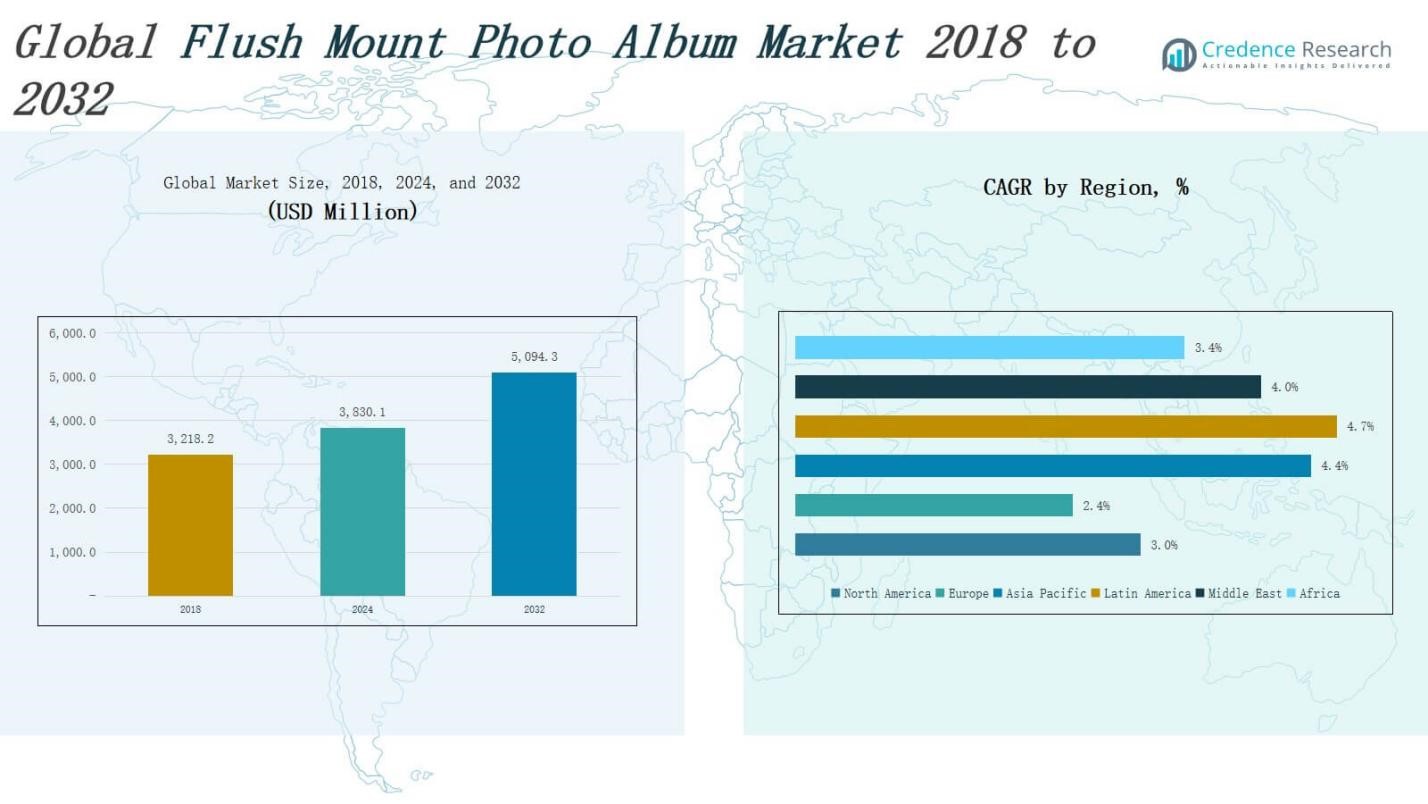

The Flush Mount Photo Album Market size was valued at USD 3,218.2 million in 2018 to USD 3,830.1 million in 2024 and is anticipated to reach USD 5,094.3 million by 2032, at a CAGR of 3.68 % during the forecast period.

The Flush Mount Photo Album Market is driven by the growing demand for premium, personalized photo storage solutions, particularly for weddings, events, and luxury gifting. Consumers are increasingly valuing tangible, high-quality keepsakes in a digital age, prompting demand for albums with superior print quality, thick pages, and elegant finishes. Advances in printing technology, including lay-flat binding and HD printing, are enhancing product appeal and customization capabilities. Market trends include rising adoption of online photo printing platforms, the emergence of eco-friendly album materials, and increased popularity of minimalist and modern design aesthetics. E-commerce platforms and social media marketing are expanding consumer reach, while professional photographers and event planners are playing a key role in driving product adoption. Regional markets such as North America and Europe lead in demand due to high disposable income and gift-oriented culture, while Asia-Pacific is experiencing rapid growth fueled by increasing wedding expenditure and digital print infrastructure.

The Flush Mount Photo Album Market exhibits a strong global footprint, with Asia Pacific leading in revenue share due to rising wedding expenditures and a growing middle-class population in countries like China and India. North America and Europe follow, driven by established photography services, high consumer spending, and demand for personalized keepsakes. Latin America shows steady growth supported by cultural emphasis on celebration photography, while the Middle East experiences rising demand for luxury albums, especially in GCC countries. Africa presents emerging opportunities fueled by urbanization and expanding print access. Key players operating across these regions include MILK Tailor Made Books Ltd, ASUKANET, Advance Photo Lab Inc., Zno Inc., Shutterfly, Inc., Printique LLC, Photobook Worldwide, and PikPerfect. These companies compete on quality, customization, and digital platform integration to capture demand from both professional and personal photo album segments globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Flush Mount Photo Album Market was valued at USD 3,830.1 million in 2024 and is projected to reach USD 5,094.3 million by 2032, growing at a CAGR of 3.68%.

- Rising demand for premium, personalized keepsakes for weddings, family events, and luxury gifting continues to drive market expansion.

- Advances in lay-flat binding, high-definition printing, and material customization enhance product value and consumer satisfaction.

- Online photo printing platforms and mobile apps are boosting accessibility, while e-commerce drives global product availability.

- Asia Pacific leads the market with 35.7% share in 2024, followed by Europe (22.1%) and North America (17.9%), with strong demand across weddings and gifting applications.

- Challenges include high production costs, limited scalability for customization, and growing competition from digital alternatives like cloud photo storage.

- Key players such as MILK Tailor Made Books Ltd, Shutterfly, Zno Inc., ASUKANET, and Photobook Worldwide compete on quality, design, and digital integration to meet global demand.

Market Drivers

Rising Demand for Premium and Personalized Keepsakes

The Flush Mount Photo Album Market is fueled by increasing consumer preference for premium, durable, and personalized memory preservation solutions. Customers, especially in weddings, baby photography, and milestone events, seek high-end albums with professional-grade materials. It offers thick, lay-flat pages and vibrant, full-spread images that enhance visual appeal. Emotional value and the desire for lasting physical keepsakes drive repeat purchases. Gifting trends and social rituals further support this demand across developed and emerging economies.

Advancements in Digital Printing and Binding Technologies

The Flush Mount Photo Album Market benefits from significant improvements in digital imaging, photo editing, and binding technologies. High-definition inkjet and laser printing enable superior photo reproduction with long-lasting clarity. Lay-flat binding techniques offer seamless panoramic layouts, appealing to professional photographers and design-savvy consumers. It enables greater customization through templates, cover materials, and text embossing. These technological innovations elevate product value and expand application across various event documentation purposes.

- For instance, ASUKANET collaborated with Holo Industries in June 2021 to integrate ASKA3D holographic plates and sensors into photo album displays, resulting in clear holographic images with a rapid 50-millisecond response time, expanding both digital and tactile user experiences.

Growth of Online Photo Printing Services and E-Commerce

The Flush Mount Photo Album Market is gaining traction through the rise of online photo printing platforms and direct-to-consumer e-commerce channels. These platforms allow easy upload, customization, and ordering of albums, broadening accessibility for consumers globally. It reduces reliance on traditional studio setups and makes premium products available to mass users. E-commerce adoption also allows manufacturers to offer discounts, bundles, and personalized services. Integration with mobile apps and social media accelerates user engagement and sales conversion.

- For instance, Bay Photo Lab and Mpix have partnered with ROES, an online platform that lets customers design personalized album layouts, graphics, and text, then place orders directly through the app.

Expanding Influence of Professional Photography and Events Industry

The Flush Mount Photo Album Market continues to grow with rising demand from professional photographers and event planners. Wedding, maternity, graduation, and corporate event segments actively seek high-quality printed deliverables. It supports premium album formats to enhance service offerings and client satisfaction. Increased disposable income and cultural emphasis on event documentation elevate product relevance. Partnerships between album manufacturers and professional service providers strengthen market penetration across urban and semi-urban regions.

Market Trends

Shift Toward Minimalist and Contemporary Album Designs

The Flush Mount Photo Album Market is witnessing a strong trend toward minimalist aesthetics and modern layouts. Consumers increasingly prefer clean, elegant designs with subtle color palettes, matte finishes, and streamlined typography. It aligns with global interior design trends that favor simplicity and sophistication. Wedding and lifestyle photographers are curating albums with curated storytelling formats and fewer images per spread. Premium covers made of linen, leather, or recycled materials further complement this contemporary visual appeal.

- For instance, PikPerfect, a global photo book manufacturer, documents that their Minimalist wedding albums feature fewer images per spread and often use premium materials like linen and leather for covers, catering to couples wanting curated, sophisticated storytelling in their album layouts.

Increased Integration of Eco-Friendly Materials and Practices

Sustainability has become a central trend shaping the Flush Mount Photo Album Market. Manufacturers are using recycled paper, vegetable-based inks, and biodegradable adhesives to meet growing environmental expectations. It reflects consumers’ rising preference for ethical and eco-conscious purchases. Eco-friendly packaging and carbon-neutral shipping are gaining traction across online distribution channels. Brands actively market these initiatives to differentiate themselves and build long-term customer loyalty. This trend is particularly pronounced in North America and Europe.

- For instance, Milk Books offers photo albums crafted with sustainably sourced papers and features options for premium albums bound with biodegradable adhesives, responding directly to consumer demand for ethical products.

Expansion of Mobile-Based Album Customization Platforms

The adoption of mobile-first platforms for album customization is reshaping consumer engagement in the Flush Mount Photo Album Market. Users can now create, preview, and order flush mount albums directly through mobile apps integrated with photo galleries and social media accounts. It reduces design time and enhances convenience for tech-savvy consumers. Real-time editing features and drag-and-drop functionality improve the design experience. Mobile platforms also enable notifications, upsell options, and customer support in-app.

Rising Influence of Social Media and Influencer Marketing

The Flush Mount Photo Album Market is increasingly shaped by social media content and influencer endorsements. Professional photographers and lifestyle influencers showcase flush mount albums in unboxing videos, tutorials, and event recaps, elevating brand visibility. It inspires aspirational buying behavior among followers, especially in the wedding and luxury gifting segments. User-generated content and customer reviews add credibility to product claims. Social commerce and platform-integrated shopping links drive direct conversions.

Market Challenges Analysis

High Production Costs and Limited Scalability for Customization

The Flush Mount Photo Album Market faces significant challenges due to high production costs linked to premium materials, manual craftsmanship, and advanced printing techniques. Each album often requires tailored layouts, cover treatments, and quality checks, which limit economies of scale. It makes large-scale production difficult and affects pricing flexibility, especially for price-sensitive markets. Rising raw material costs further strain profit margins for small and mid-sized vendors. Custom orders can also extend lead times, affecting delivery commitments and customer satisfaction.

Competition from Digital Alternatives and Changing Consumer Preferences

The Flush Mount Photo Album Market contends with growing competition from digital photo storage and sharing platforms. Cloud-based albums, digital frames, and mobile galleries offer instant access, easy sharing, and zero physical storage needs. It challenges the relevance of printed albums, particularly among younger consumers with limited interest in physical media. Declining attention spans and preference for short-form content also reduce demand for elaborate printed collections. Companies must constantly innovate to maintain product appeal in this evolving landscape.

Market Opportunities

Growing Demand in Emerging Economies with Rising Disposable Income

The Flush Mount Photo Album Market holds strong potential in emerging economies where rising disposable income and urbanization are fueling consumer interest in premium lifestyle products. Expanding middle-class segments in countries like India, Brazil, and Indonesia are investing more in professional photography for weddings, family events, and travel. It creates a growing customer base for personalized albums. As awareness of premium print products spreads through social media and e-commerce platforms, new entrants can capture untapped market segments. Localized design options and regional language support can further enhance adoption rates.

Expansion of B2B Partnerships with Photographers and Event Planners

Collaborations with professional photographers, studios, and event planners present scalable growth opportunities in the Flush Mount Photo Album Market. These partnerships allow manufacturers to secure recurring business and offer bundled services directly to end clients. It helps streamline product distribution while enhancing customer experience through expert-led customization. Album providers can integrate order systems into studio workflows, reducing turnaround time and increasing order volumes. Loyalty programs and white-label solutions can strengthen relationships and expand market penetration.

Market Segmentation Analysis:

By Product Type

The Flush Mount Photo Album Market is segmented into professional and personal categories. Professional albums dominate the market, driven by demand from photographers and studios offering high-end wedding, portrait, and event packages. These albums prioritize quality, durability, and customization. Personal albums are gaining popularity with consumers creating travel, baby, and family memory books through online platforms. It reflects growing interest in personalized lifestyle products among general consumers.

- For instance, Nations Photo Lab provides flush mount albums tailored for professional use, featuring thick lay-flat pages and archival-quality materials to meet clients’ needs for durability and presentation.

By Occasion

The Flush Mount Photo Album Market caters to various occasions such as weddings, birthdays, anniversaries, and others. Wedding albums hold the largest market share due to strong cultural and emotional value attached to marriage documentation. Birthdays and anniversaries contribute steady demand, particularly in the personal segment. Albums created for holidays, graduations, and baby showers fall under the “others” category, which is expanding with lifestyle-focused buyers seeking tangible keepsakes.

- For instance, Bay Photo Lab has partnered with the ROES platform, enabling customers to create highly personalized wedding albums with custom layouts, graphics, and finishes, reflecting the increasing demand for unique, theme-based wedding documentation.

By Distribution Channel

The Flush Mount Photo Album Market reaches consumers through hypermarkets and supermarkets, retail stores, specialty gift stores, and online stores. Online stores lead the segment, supported by growing digital adoption and easy customization tools. Specialty gift stores attract premium buyers seeking curated and occasion-specific albums. Retail stores and hypermarkets hold a smaller share but maintain relevance in markets where in-store browsing remains preferred. It shows strong performance where physical retail continues to influence gifting behavior.

Segments:

Based on Product Type

Based on Occasion

- Wedding

- Birthdays

- Anniversary

- Others

Based on Distribution Channel

- Hypermarkets and Supermarkets

- Retail Stores

- Specialty Gift Stores

- Online Stores

Based on Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis

North America

The North America Flush Mount Photo Album Market size was valued at USD 600.85 million in 2018 to USD 687.66 million in 2024 and is anticipated to reach USD 866.04 million by 2032, at a CAGR of 3.0% during the forecast period. The region accounts for 17.9% of the global market share in 2024. It benefits from strong consumer spending on premium photo products and well-established photography service providers. The U.S. leads regional demand, supported by a high number of weddings, professional studios, and digital printing platforms. Consumers in North America value customized, high-quality albums for personal milestones and gifting purposes. Retailers and online platforms offer a wide range of design options and same-day printing services, enhancing buyer convenience and repeat purchases.

Europe

The Europe Flush Mount Photo Album Market size was valued at USD 761.76 million in 2018 to USD 846.34 million in 2024 and is anticipated to reach USD 1,018.86 million by 2032, at a CAGR of 2.4% during the forecast period. Europe holds 22.1% of the global market share in 2024. It reflects strong cultural importance of preserving printed memories and growing popularity of minimalistic, sustainable album designs. Countries such as Germany, France, and the UK lead consumption, with demand from both consumers and event photographers. Manufacturers in the region prioritize high-end materials and environmental compliance. The region’s e-commerce infrastructure and photography-centric gifting culture further contribute to market expansion.

Asia Pacific

The Asia Pacific Flush Mount Photo Album Market size was valued at USD 1,097.74 million in 2018 to USD 1,368.48 million in 2024 and is anticipated to reach USD 1,930.24 million by 2032, at a CAGR of 4.4% during the forecast period. It commands 35.7% of the global market share in 2024, making it the largest regional segment. The market benefits from a rapidly growing middle class, increasing wedding expenditure, and expanding digital printing capabilities. Countries such as China, India, and Japan show strong demand for personalized wedding albums and baby photo books. Online customization platforms are becoming popular across urban centers. Local vendors often partner with photographers to offer bundled packages for mass adoption.

Latin America

The Latin America Flush Mount Photo Album Market size was valued at USD 364.95 million in 2018 to USD 461.58 million in 2024 and is anticipated to reach USD 662.26 million by 2032, at a CAGR of 4.7% during the forecast period. The region holds 12.0% of the global market share in 2024. It is experiencing rising demand for flush mount albums due to cultural emphasis on event celebrations and photo preservation. Brazil and Mexico are key markets, supported by growing wedding photography and lifestyle gifting trends. Local printing labs and boutique stores offer custom albums tailored to regional preferences. Improved internet penetration and mobile app-based services are making album ordering accessible to a broader demographic.

Middle East

The Middle East Flush Mount Photo Album Market size was valued at USD 153.83 million in 2018 to USD 186.69 million in 2024 and is anticipated to reach USD 254.72 million by 2032, at a CAGR of 4.0% during the forecast period. It captures 4.9% of the global market share in 2024. The region sees growing demand for luxury wedding and family albums, especially in the GCC countries where photo documentation is culturally significant. Consumers favor premium leather-bound and gold-embossed albums. The presence of high-income populations and event planning businesses further fuels growth. Online retailers and print service providers are expanding their product offerings to match local preferences and premium expectations.

Africa

The Africa Flush Mount Photo Album Market size was valued at USD 239.12 million in 2018 to USD 279.32 million in 2024 and is anticipated to reach USD 362.21 million by 2032, at a CAGR of 3.4% during the forecast period. The region accounts for 7.3% of the global market share in 2024. It shows gradual growth driven by urbanization, expanding wedding photography businesses, and increasing disposable income in countries such as South Africa, Nigeria, and Egypt. Small studios and print shops cater to local demand for wedding and birthday albums. It presents long-term opportunities as mobile usage and internet connectivity improve, enabling broader access to online design and ordering platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MILK Tailor Made Books Ltd

- ASUKANET

- Advance Photo Lab Inc.

- Zno Inc.

- Shutterfly, Inc.

- Printique LLC

- Photobook Worldwide

- PikPerfect

- Other Key Players

Competitive Analysis

The Flush Mount Photo Album Market features a competitive landscape marked by strong brand positioning, design innovation, and service differentiation. Leading players such as Shutterfly, Zno Inc., and MILK Tailor Made Books Ltd compete by offering premium materials, personalized layouts, and seamless online ordering experiences. It encourages continuous investment in digital platforms, sustainable production methods, and mobile-first customization tools. Companies like Printique LLC and PikPerfect focus on serving professional photographers through white-label solutions and B2B partnerships. Regional players and niche brands target specific customer segments with curated themes and localized services. The market favors players with efficient logistics, high-quality printing infrastructure, and global distribution capabilities. Strategic collaborations with studios, wedding planners, and event organizers expand market reach and enhance brand loyalty. Innovation in packaging, eco-friendly offerings, and limited-edition collections supports brand distinction. Pricing flexibility and customer experience remain critical to gaining a competitive edge in this evolving market.

Recent Developments

- In February 2025, Zno launched a Raised Varnishing feature for its flush mount albums, allowing tactile texture on lustre and matte velvet pages sized 8×8 and above.

- In 2025, MILK Tailor Made Books updated its Design Studio with drag‑and‑drop support for professional-grade flush mount album creation via desktop and mobile input.

- In early 2025, MILK Tailor Made Books updated its Design Studio with drag‑and‑drop support for professional-grade flush mount album creation via desktop and mobile input.

Market Concentration & Characteristics

The Flush Mount Photo Album Market exhibits moderate market concentration, with a mix of established global players and regional specialists competing across digital and physical channels. It is characterized by strong product differentiation based on material quality, design aesthetics, customization options, and binding techniques. Leading companies focus on high-end offerings tailored for weddings, milestone events, and luxury gifting, while niche players serve personal memory preservation needs with localized themes. The market favors firms with advanced digital printing infrastructure, efficient e-commerce platforms, and partnerships with professional photographers and studios. It relies heavily on seasonal demand, especially in wedding and holiday periods, and is driven by consumer preference for tangible keepsakes in an increasingly digital world. Companies offering seamless design interfaces, mobile integration, and fast turnaround times gain a competitive advantage. Sustainability, eco-friendly packaging, and premium craftsmanship are emerging as critical purchase factors, shaping both consumer behavior and brand positioning in this evolving market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Occasion, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized and luxury photo albums will continue to grow across weddings, travel, and milestone events.

- Online platforms and mobile apps will dominate album customization and ordering processes.

- Professional photographers will strengthen their role as key distribution partners for premium album products.

- Eco-friendly materials and sustainable production methods will gain traction among environmentally conscious consumers.

- Minimalist design trends will shape future product offerings in both personal and professional segments.

- Expansion in emerging markets will accelerate, driven by rising disposable incomes and wedding expenditures.

- Integration of AI tools for layout suggestions and image selection will enhance user experience.

- Retailers will offer more bundled services with albums, including packaging, video integration, and gift sets.

- Companies will invest in faster delivery networks and real-time design-to-print systems.

- Market competition will intensify with regional brands entering global e-commerce platforms.