Market Overview

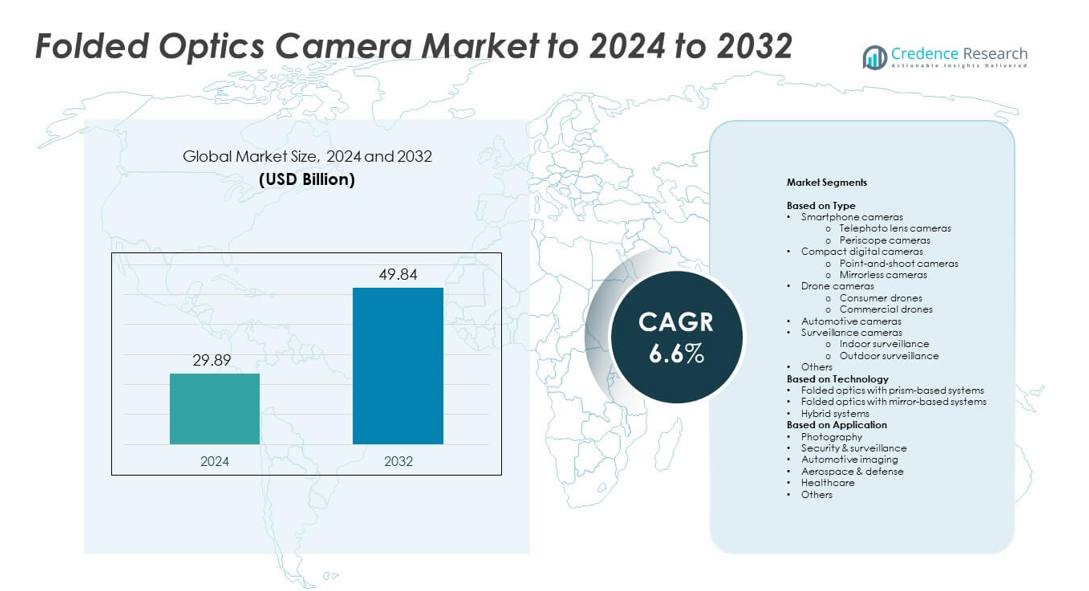

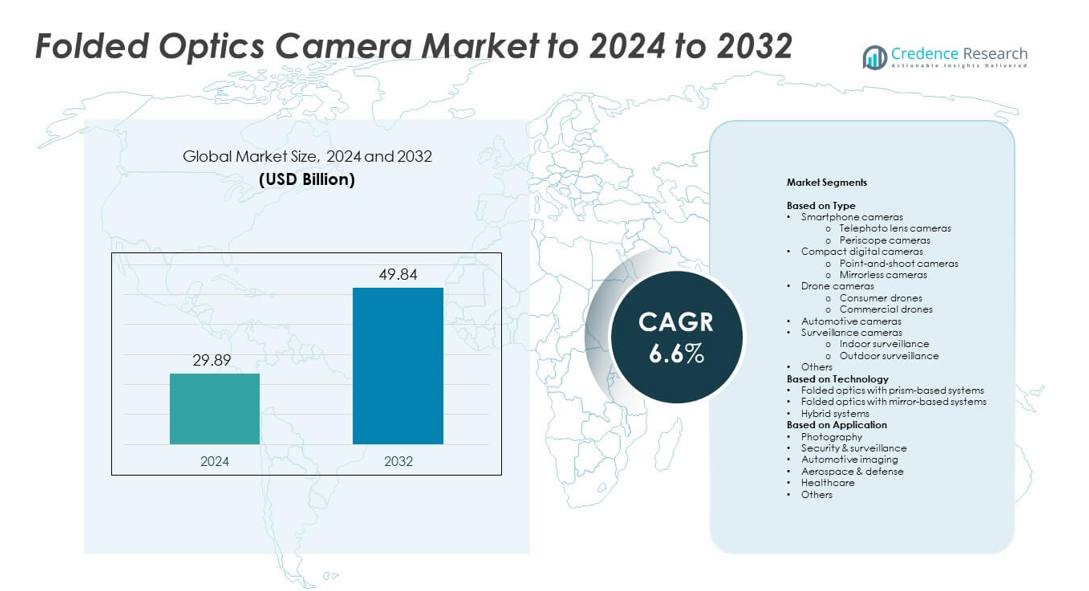

Folded Optics Camera Market size was valued USD 29.89 Billion in 2024 and is anticipated to reach USD 49.84 Billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Folded Optics Camera Market Size 2024 |

USD 29.89 Billion |

| Folded Optics Camera Market, CAGR |

6.6% |

| Folded Optics Camera Market Size 2032 |

USD 49.84 Billion |

The Folded Optics Camera Market is shaped by major players such as Samsung Electronics, Apple Inc., Huawei Technologies, DJI, Sony Corporation, Xiaomi, Fujifilm, Oppo, and Nikon. These companies focus on integrating advanced folded lens systems, enhanced image sensors, and AI-driven imaging to deliver high-performance optical zoom in compact devices. Strategic investments in precision optics, hybrid lens modules, and periscope camera designs continue to strengthen their product portfolios. Asia Pacific leads the global market with 35% share, driven by large-scale smartphone manufacturing, advanced R&D capabilities, and expanding demand for miniaturized imaging solutions across consumer electronics and automotive applications.

Market Insights

- The Folded Optics Camera Market was valued at USD 29.89 Billion in 2024 and is expected to reach USD 49.84 Billion by 2032, growing at a CAGR of 6.6%.

- Rising demand for compact, high-zoom smartphone cameras and advancements in miniaturized optics are driving market growth.

- Trends such as AI-assisted image correction, hybrid folded lens systems, and increased drone and automotive applications are shaping the market outlook.

- Leading companies focus on innovation in optical design and sensor integration to enhance clarity and efficiency, intensifying competition across global brands.

- Asia Pacific leads with 35% share, followed by North America at 32% and Europe at 25%, while the smartphone camera segment dominates with 45% share due to strong consumer demand for enhanced mobile imaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Smartphone cameras dominate the Folded Optics Camera Market with nearly 45% share in 2024. Growing demand for advanced telephoto and periscope lens systems in premium smartphones drives this dominance. Folded optics enhance zoom capability without increasing device thickness, meeting consumer demand for compact yet powerful imaging. Major smartphone makers are integrating folded periscope modules to achieve optical zoom levels of 5x to 10x. Rising smartphone photography trends and social media influence continue to strengthen this segment’s leadership.

- For instance, Apple’s iPhone 15 Pro Max delivers 5× optical at 120 mm. The tetraprism telephoto is 12 MP with OIS and AF. Apple lists a 10× total optical zoom range.

By Technology

Folded optics with prism-based systems lead the market with around 48% share in 2024. These systems offer superior image alignment and minimize distortion, supporting their widespread use in smartphone and surveillance applications. Prism-based designs enable thinner camera modules while maintaining high optical performance. Manufacturers prefer these systems for better light transmission and reduced aberrations. Advancements in glass prism coatings and alignment precision have further improved optical efficiency, driving adoption in compact imaging devices and AI-based photography applications.

- For instance, Xiaomi Mi 11 Ultra includes a 120 mm periscope telephoto. Xiaomi specifies 5× optical, 10× hybrid, and 120× digital zoom. The telephoto sensor is 48 MP with OIS.

By Application

Photography holds the largest market share of nearly 38% in 2024, making it the dominant application segment. The growing use of folded optics in smartphones and compact cameras enables enhanced optical zoom and improved clarity. Consumers’ rising preference for DSLR-like results from mobile devices fuels growth. Additionally, social media, content creation, and travel photography trends are boosting adoption. Manufacturers are investing in miniaturized folded lens modules and image stabilization to meet rising demand for professional-grade photo quality in compact devices.

Key Growth Drivers

Miniaturization and Space Optimization

The rising demand for compact and slim devices is a key growth driver in the Folded Optics Camera Market. Folded optics allow manufacturers to design ultra-thin camera modules without compromising optical zoom or image quality. Smartphone makers, drone manufacturers, and surveillance system providers are adopting this design to improve form factors. The ability to fit advanced optical systems into limited space enhances device portability and aesthetics, supporting widespread integration across consumer electronics and industrial imaging applications.

- For instance, LG Innotek’s optical telephoto zoom module supports continuous 4–9× optical.

Advancements in Lens and Sensor Integration

Continuous improvement in lens precision and image sensor alignment is boosting folded optics adoption. Integration of multi-element lens systems with advanced CMOS sensors enhances image resolution and low-light performance. These innovations enable greater optical zoom ranges while maintaining compact size. Leading manufacturers are focusing on precision manufacturing and adaptive focusing technologies to optimize image quality. This synergy between optics and sensors supports the market’s growth in high-performance smartphone cameras and compact imaging systems.

- For instance, Sony’s 2-Layer Transistor Pixel doubles saturation signal level.

Rising Demand for High-Performance Smartphone Cameras

The expanding smartphone market, driven by consumer preference for professional-grade photography, is fueling growth. Folded optics enable enhanced optical zoom and superior image clarity within slim smartphone designs. Brands are increasingly integrating periscope modules to offer advanced zoom capabilities up to 10x. Growing popularity of mobile photography and content creation across social media platforms further accelerates adoption. This trend reinforces smartphones as the largest revenue-generating segment within the folded optics camera ecosystem.

Key Trends and Opportunities

Adoption of AI-Enhanced Imaging Technologies

AI-driven enhancements in autofocus, stabilization, and image correction are reshaping the folded optics camera landscape. Manufacturers are incorporating AI algorithms to optimize image sharpness, exposure balance, and scene recognition. These capabilities enhance user experience while improving performance in challenging lighting conditions. Integration of AI with folded optics expands opportunities in autonomous vehicles, surveillance systems, and consumer electronics. The synergy between intelligent imaging and compact optics design positions this as a major opportunity for market expansion.

- For instance, Qualcomm’s Snapdragon 8 Gen 3 features a Cognitive ISP. Qualcomm specifies triple 18-bit ISPs and 12-layer segmentation. These enable advanced real-time image optimization.

Growth in Automotive and Drone Imaging Applications

Folded optics systems are gaining momentum in emerging automotive and drone imaging markets. In vehicles, they enable compact high-resolution cameras for driver assistance and 360° monitoring systems. In drones, folded lenses reduce payload weight while extending optical zoom and focus capabilities. Increasing adoption in commercial drones and autonomous vehicles drives new revenue streams. The technology’s adaptability to space-constrained environments creates strong opportunities for expansion across mobility and industrial sectors.

- For instance, DJI Mavic 3 Pro carries a 166 mm tele camera. DJI lists a triple-camera system with 70 mm and 166 mm teles. The drone’s takeoff weight is 958 g.

Key Challenges

Complex Manufacturing and Alignment Processes

Manufacturing folded optics modules involves intricate design and assembly steps that demand high precision. The alignment of multiple lenses and prisms within confined spaces increases production complexity and cost. Any minor misalignment can degrade image quality or optical performance. This challenge often limits scalability and raises barriers for new market entrants. To overcome these issues, companies are investing in precision robotics, advanced optical coatings, and automated inspection technologies.

High Cost of Advanced Materials and Components

The reliance on specialized prisms, high-index glass, and precision mirrors significantly raises component costs. Developing durable and miniaturized folded optics requires expensive tooling and advanced fabrication equipment. This cost structure restricts adoption in entry-level and mid-range products. Manufacturers are exploring hybrid materials and cost-efficient production techniques to mitigate expenses. However, balancing affordability with optical performance remains a persistent challenge in achieving mass-market penetration.

Regional Analysis

North America

North America holds around 32% share of the folded optics camera market in 2024. Strong demand for advanced smartphone photography, drone imaging, and automotive cameras drives regional growth. The United States leads adoption due to high penetration of flagship smartphones with periscope and telephoto lenses. Expanding drone usage in surveillance and industrial inspection further supports adoption. Major technology companies and imaging system manufacturers in the region continue investing in lens miniaturization and AI-assisted optics, strengthening their competitive edge in premium imaging products.

Europe

Europe accounts for nearly 25% share of the global folded optics camera market. The region’s strong presence of automotive manufacturers and increasing demand for high-performance vehicle cameras boost market growth. Countries such as Germany, France, and the United Kingdom are witnessing rising integration of folded optics in advanced driver-assistance systems and security cameras. Growing smartphone replacement rates and premium mobile sales add further momentum. Stringent imaging quality standards and R&D investments in precision optics also encourage technological advancements across the region.

Asia Pacific

Asia Pacific dominates with about 35% share, making it the leading regional market. Rapid smartphone production in China, South Korea, and Japan fuels major demand for folded optics modules. Regional manufacturers benefit from large-scale production capacities and access to skilled optical component suppliers. Increasing drone manufacturing and rising use of AI-based imaging in consumer electronics accelerate adoption. Growing exports of optical components from China and lens innovations in Japan position the region as a global hub for folded optics camera technologies.

Latin America

Latin America represents around 5% share of the folded optics camera market in 2024. The region’s growth is supported by expanding smartphone adoption and increasing interest in drone photography. Brazil and Mexico lead demand due to rising consumer spending on mid-range and premium smartphones. Improving telecom networks and mobile internet penetration encourage the use of high-resolution camera technologies. However, limited local manufacturing capabilities and higher component import costs restrict faster market expansion, although ongoing digitalization efforts offer gradual growth opportunities.

Middle East and Africa

The Middle East and Africa together account for nearly 3% share of the global market. Growing adoption of surveillance and security systems across urban areas drives regional demand. Countries such as the UAE and Saudi Arabia are increasingly using folded optics cameras in smart city projects and infrastructure monitoring. The expanding luxury smartphone market further supports uptake. Despite limited local manufacturing, investments in smart technologies and government-led modernization programs are creating new opportunities for optical component suppliers and camera manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Smartphone cameras

- Telephoto lens cameras

- Periscope cameras

- Compact digital cameras

- Point-and-shoot cameras

- Mirrorless cameras

- Drone cameras

- Consumer drones

- Commercial drones

- Automotive cameras

- Surveillance cameras

- Indoor surveillance

- Outdoor surveillance

- Others

By Technology

- Folded optics with prism-based systems

- Folded optics with mirror-based systems

- Hybrid systems

By Application

- Photography

- Security & surveillance

- Automotive imaging

- Aerospace & defense

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major companies such as Samsung Electronics, Apple Inc., Huawei Technologies, DJI, Sony Corporation, Xiaomi, Fujifilm, Oppo, and Nikon play a vital role in shaping the folded optics camera market. These firms focus on advanced optical design, sensor precision, and compact module integration to enhance imaging performance. Many are investing heavily in periscope and telephoto lens systems to achieve higher optical zoom without increasing device thickness. Strategic partnerships with lens and semiconductor manufacturers are improving quality and production efficiency. Continuous innovation in image stabilization, AI-driven processing, and hybrid folded optics systems supports product differentiation. Companies are also expanding manufacturing capacity and developing new materials to reduce weight and improve light transmission. Intense competition drives advancements in miniaturization and image clarity, while sustained R&D investments ensure alignment with emerging applications such as automotive vision, drones, and smart surveillance systems.

Key Player Analysis

Recent Developments

- In 2023, Samsung Electronics Introduced the Galaxy S23 Ultra, featuring a folded optics periscope camera with 10x optical zoom for enhanced long-range photography. It was the premium option in Samsung’s flagship line.

- In 2023, Apple Launched the iPhone 15 Pro Max, which for the first time included a folded optics tetraprism telephoto lens system.

- In 2023, Sony Released the Xperia 1 V, featuring a variable telephoto lens with folded optics, allowing for multiple optical zoom levels (85-125mm) without compromising image quality.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rapid adoption in smartphones with advanced periscope zoom capabilities.

- AI-powered image processing will enhance autofocus and low-light performance in compact cameras.

- Automotive imaging applications will expand with integration into autonomous and driver-assistance systems.

- Drone manufacturers will increasingly use folded optics to reduce payload and improve aerial imaging range.

- Hybrid folded optics combining prism and mirror systems will gain traction for multi-zoom functionality.

- Advances in nanofabrication will reduce production complexity and improve alignment precision.

- Demand for ultra-slim camera modules will rise across wearable and portable devices.

- The healthcare sector will adopt folded optics in endoscopic and diagnostic imaging tools.

- Collaborations between lens manufacturers and smartphone brands will accelerate innovation in optical design.

- Asia Pacific will remain the primary production hub due to strong manufacturing and R&D capabilities.