Market overview

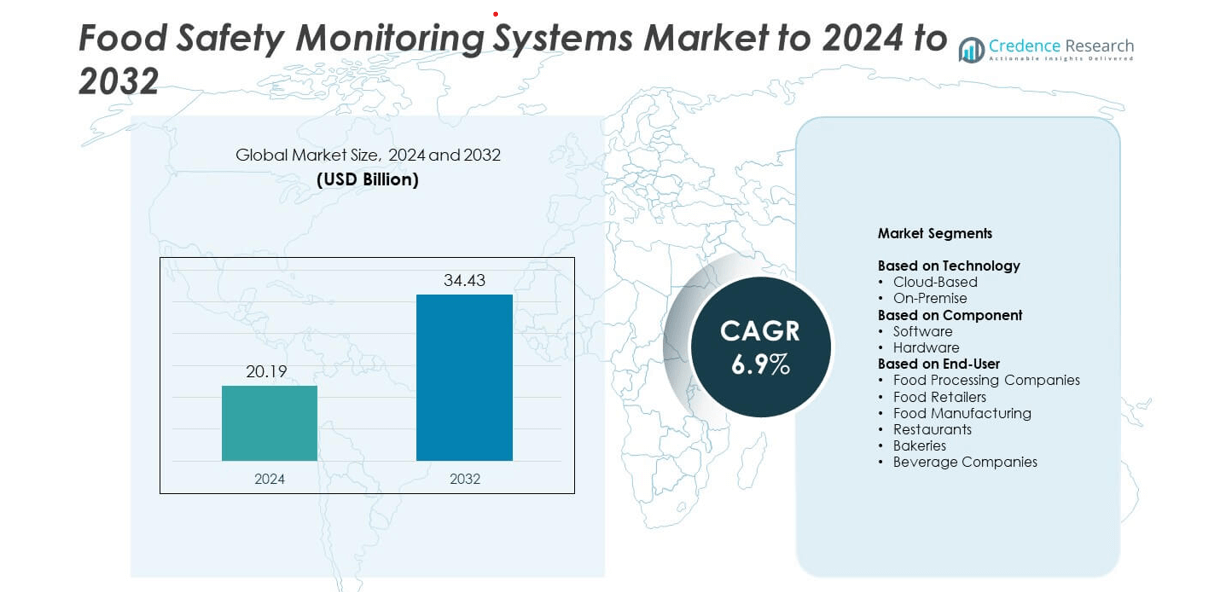

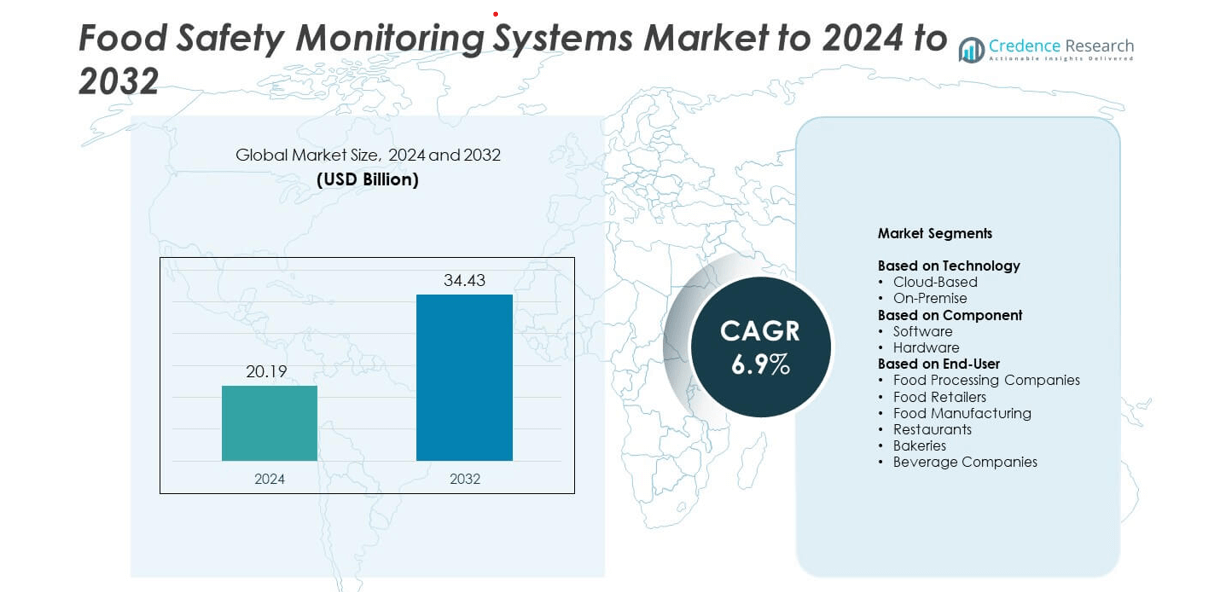

Food Safety Monitoring Systems market size was valued USD 20.19 billion in 2024 and is anticipated to reach USD 34.43 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Safety Monitoring Systems Market Size 2024 |

USD 20.19 billion |

| Food Safety Monitoring Systems Market, CAGR |

6.9% |

| Food Safety Monitoring Systems Market Size 2032 |

USD 34.43 billion |

The food safety monitoring systems market is led by major players such as SGS SA, DuPont, Bureau Veritas SA, SAP, Intertek Group plc, RJ Hill Laboratories Ltd, BioMérieux, AsureQuality Ltd, Gold Standard Diagnostics Horsham, IBM, SecureMetric Technology, and Danaher Corporation. These companies focus on developing AI-driven, cloud-based, and IoT-integrated platforms to enhance food traceability, contamination detection, and regulatory compliance. Strategic alliances, digital innovation, and laboratory automation strengthen their competitive positions. Regionally, North America leads the market with a 38% share in 2024, supported by strict FDA regulations and high adoption of digital safety systems, while Europe and Asia-Pacific follow with strong growth momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The food safety monitoring systems market was valued at USD 20.19 billion in 2024 and is projected to reach USD 34.43 billion by 2032, growing at a CAGR of 6.9%.

- Growth is driven by stringent food safety regulations, increased foodborne illness cases, and the rising use of automated digital monitoring technologies.

- Emerging trends include wider adoption of AI, IoT, and blockchain-based traceability systems, along with a shift toward predictive analytics and cloud-based platforms that held 63% share in 2024.

- The market is moderately consolidated, with leading players focusing on innovation, product integration, and global service expansion to strengthen competitive advantage.

- North America led with 38% share in 2024, followed by Europe at 28% and Asia-Pacific at 23%, while Latin America and the Middle East & Africa accounted for 7% and 4% respectively, reflecting steady regional diversification and regulatory adoption.

Market Segmentation Analysis:

By Technology

Cloud-based systems dominated the food safety monitoring systems market with nearly 63% share in 2024. The segment’s growth is driven by scalability, remote accessibility, and real-time analytics that enhance food traceability and contamination prevention. These platforms allow centralized data storage and integration with IoT-enabled sensors for faster compliance reporting. Rising adoption among global food manufacturers to meet FSMA and ISO 22000 standards further boosts demand. In contrast, on-premise systems continue to serve legacy users prioritizing data ownership and localized control in regulated environments.

- For instance, Walmart’s IBM Food Trust pilot traced mango origin in 2.2 seconds, down from days, across multiple suppliers and products.

By Component

Software held the dominant 58% share in 2024, supported by the rising demand for automated reporting, predictive analytics, and risk management tools. Modern software platforms help identify critical control points and monitor parameters such as temperature, humidity, and contamination risk across facilities. Integration with AI and blockchain enhances transparency and recall traceability across supply chains. Hardware components, including RFID tags, sensors, and data loggers, complement these systems by providing real-time input for quality assurance and compliance validation in high-volume processing environments.

- For instance, a Domino’s franchise in Springfield conducted a pilot program using an IoT solution where 6 wireless temperature sensors provided readings every 15 minutes to a cloud platform for monitoring coolers and food preparation lines.

By End-User

Food processing companies accounted for around 39% of the market share in 2024, making them the leading end-user segment. Their dominance stems from stringent quality assurance protocols and regulatory compliance requirements for microbial testing and allergen control. These firms increasingly deploy cloud-based systems to automate audits and track hygiene performance across multiple plants. Food retailers and restaurants are also accelerating adoption to ensure freshness, prevent spoilage, and improve consumer trust through digital traceability and integrated safety management platforms across their supply chains.

Key Growth Drivers

Stringent Food Safety Regulations and Compliance Requirements

Global enforcement of food safety standards such as HACCP, ISO 22000, and the FDA’s Food Safety Modernization Act is driving strong adoption of monitoring systems. Food manufacturers and processors are investing in automated platforms to meet traceability, contamination detection, and reporting mandates. Compliance-driven modernization across global supply chains is pushing companies to deploy digital tools that ensure continuous monitoring and real-time alerts. This regulatory emphasis has made compliance automation one of the strongest growth drivers in the market.

- For instance, McDonald’s Egypt adheres to a robust food safety and quality control system throughout its operations, which is informed by global best practices. This system ensures high food quality and safety, aligning with the principles of internationally recognized food safety management standards, such as those within the ISO 22000 family.

Rising Incidences of Foodborne Illnesses and Contamination

Increasing cases of foodborne diseases are compelling industries to adopt advanced monitoring technologies for contamination detection. Sensors and data-driven systems are used to track temperature, moisture, and microbial levels at every production stage. These technologies help prevent recalls and strengthen brand trust among consumers. The growing awareness of food hygiene among consumers and regulatory authorities has reinforced the role of automated safety solutions, positioning health risk mitigation as a key driver of market expansion.

- For instance, Yum China’s iQA reached 200+ supplier plants and added real-time cold-chain monitoring in logistics.

Integration of IoT, AI, and Blockchain Technologies

The adoption of digital technologies is revolutionizing the food safety landscape. IoT-enabled sensors, AI-driven predictive analytics, and blockchain-based traceability are helping firms achieve real-time visibility across production and logistics. These technologies enhance transparency, reduce human error, and improve decision-making through data analytics. Smart monitoring systems also help predict potential hazards before contamination occurs, improving preventive control strategies. The rise of connected, intelligent systems has emerged as a major driver of long-term market transformation.

Key Trends & Opportunities

Growth of Cloud-Based Food Safety Platforms

Cloud-based platforms are becoming central to digital transformation in food monitoring. These systems enable real-time tracking, centralized reporting, and easy compliance management across multiple facilities. Their scalability and ability to integrate with IoT devices allow seamless data collection and risk assessment. Cloud adoption is creating opportunities for small and medium-sized enterprises to access advanced food safety tools at lower costs, expanding the market’s reach and supporting broader digital adoption across industries.

- For instance, Chipotle deployed Zenput across its restaurants to digitize food-safety tasks chain-wide. The initial rollout was to over 2,450 restaurants in 2018, and the system has since been expanded to cover all of the company’s more than 3,400 locations.

Rising Demand for Predictive and Preventive Analytics

Predictive analytics is emerging as a transformative trend in food safety monitoring. AI-powered platforms can analyze patterns and forecast contamination risks, enabling proactive decision-making. This shift from reactive to preventive systems reduces product recalls and enhances quality control. The growing use of data visualization tools and machine learning in detecting anomalies creates opportunities for companies to improve operational efficiency while maintaining global safety compliance across diverse food categories.

- For instance, Bühler’s SORTEX A LumoVision is an optical sorter that processes maize and can achieve a significant reduction in specific mycotoxins, such as aflatoxin, by up to 90%, with less than 5% yield loss.

Key Challenges

High Implementation and Maintenance Costs

Despite technological progress, high initial investment remains a major challenge for small and medium enterprises. Integrating advanced monitoring systems with existing production infrastructure requires capital expenditure on hardware, software, and employee training. Ongoing maintenance and calibration of sensors further increase costs. The lack of affordable solutions in developing regions limits adoption among local manufacturers, slowing digital transformation in food safety management. Cost-sensitive businesses often rely on manual or semi-automated methods, hindering overall market penetration.

Data Integration and Cybersecurity Concerns

As monitoring systems become more connected, data management and security risks are growing concerns. The integration of cloud-based and IoT-enabled tools generates large data volumes that must be securely stored and analyzed. Breaches or unauthorized access to safety data can disrupt operations and damage brand reputation. Ensuring end-to-end encryption and regulatory compliance with data privacy laws presents an ongoing challenge for vendors and users. Addressing cybersecurity vulnerabilities remains essential for building trust and sustaining digital adoption.

Regional Analysis

North America

North America dominated the food safety monitoring systems market with a 38% share in 2024. The region’s leadership is driven by strict regulatory frameworks such as the FDA’s Food Safety Modernization Act and strong adoption of digital compliance tools. Food manufacturers and retailers in the United States and Canada increasingly deploy AI-integrated monitoring platforms for real-time contamination tracking. Widespread use of IoT-enabled sensors in processing and packaging facilities supports transparency and traceability. Continuous technological upgrades and the presence of key players reinforce North America’s role as the global innovation hub for food safety management.

Europe

Europe accounted for 28% of the market share in 2024, supported by well-established food safety laws under the European Food Safety Authority (EFSA) and stringent labeling regulations. The region emphasizes traceability, allergen detection, and microbial monitoring to maintain product integrity across borders. Leading nations such as Germany, France, and the UK are investing in smart sensor networks and cloud-based analytics to meet HACCP and ISO 22000 standards. The rise of clean-label and organic food production further drives system adoption across both large manufacturers and small-scale processors.

Asia-Pacific

Asia-Pacific held a 23% market share in 2024, reflecting rapid digitalization in the food manufacturing and retail sectors. The growing middle-class population and urbanization have intensified focus on food quality and contamination prevention. Countries such as China, Japan, and India are adopting cloud-based monitoring and blockchain solutions for better traceability. Government initiatives promoting food safety modernization, such as China’s Food Safety Law reforms, are accelerating adoption. Rising exports of packaged food products also compel manufacturers to comply with international safety standards, fueling sustained regional market growth.

Latin America

Latin America represented a 7% share of the food safety monitoring systems market in 2024. The region’s adoption is led by Brazil, Mexico, and Argentina, where export-oriented food processing industries demand advanced monitoring tools. Governments are strengthening inspection and certification systems to align with global food safety norms. Investment in temperature monitoring and pathogen detection systems is increasing, particularly in meat and dairy sectors. However, inconsistent enforcement and limited digital infrastructure still restrict widespread adoption, creating growth opportunities for low-cost cloud-based solutions.

Middle East & Africa

The Middle East & Africa accounted for a 4% market share in 2024, with growing awareness of food hygiene and contamination control. Gulf nations such as the UAE and Saudi Arabia are modernizing food testing and inspection frameworks to enhance compliance in hospitality and retail sectors. Adoption of automated safety monitoring is expanding in dairy, meat, and bakery industries. Regional initiatives to reduce foodborne illness and improve import quality standards are encouraging technology investments. However, fragmented regulatory systems and limited skilled workforce continue to hinder full-scale implementation across emerging markets.

Market Segmentations:

By Technology

By Component

By End-User

- Food Processing Companies

- Food Retailers

- Food Manufacturing

- Restaurants

- Bakeries

- Beverage Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food safety monitoring systems market features strong competition among leading players such as SGS SA, DuPont, Bureau Veritas SA, SAP, Intertek Group plc, RJ Hill Laboratories Ltd, BioMérieux, AsureQuality Ltd, Gold Standard Diagnostics Horsham, IBM, SecureMetric Technology, and Danaher Corporation. The market is characterized by continuous technological innovation, with companies focusing on digital transformation through AI, IoT, and blockchain integration to improve traceability and compliance efficiency. Vendors are expanding service portfolios with automated testing, cloud-based platforms, and data-driven risk assessment tools. Strategic collaborations between software developers and testing laboratories are enhancing global reach and operational reliability. Many firms are prioritizing end-to-end monitoring systems that connect supply chains from production to retail, ensuring transparency and faster incident response. Additionally, increased emphasis on sustainability, smart sensors, and predictive analytics is reshaping competitive differentiation, driving the industry toward intelligent, automated, and regulation-ready food safety ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SGS SA

- DuPont

- Bureau Veritas SA

- SAP

- Intertek Group plc

- RJ Hill Laboratories Ltd

- BioMérieux

- AsureQuality Ltd

- Gold Standard Diagnostics Horsham

- IBM

- SecureMetric Technology

- Danaher Corporation

Recent Developments

- In 2025, Gold Standard Diagnostics Horsham, launched the new ABRAXIS Dicamba ELISA Plate Test Kit, used to assess water, durum wheat, and soil samples.

- In 2024, BioMérieux Collaborated with the Center for Food Safety and Applied Nutrition (CFSAN) of the U.S. Food and Drug Administration (FDA) to develop innovative tools to identify and combat foodborne pathogens.

- In 2023, SGS SA Entered into a partnership with Eezytrace to strengthen its inspection and certification services and acquired Asmecruz Laboratory to enhance its seafood testing capabilities.

Report Coverage

The research report offers an in-depth analysis based on Technology, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of AI and IoT technologies will enhance real-time food safety monitoring.

- Cloud-based platforms will continue expanding due to scalability and lower deployment costs.

- Predictive analytics will gain importance in preventing contamination and product recalls.

- Blockchain integration will strengthen traceability across global food supply chains.

- Demand from small and medium enterprises will rise with affordable digital solutions.

- Regulatory compliance will drive continuous investment in automation and reporting tools.

- Smart sensors will become standard for temperature, humidity, and pathogen detection.

- Partnerships between technology firms and food producers will boost innovation.

- Increased focus on sustainability will promote energy-efficient monitoring systems.

- Expansion in emerging markets will accelerate with improved digital infrastructure and safety awareness.