Market Overview:

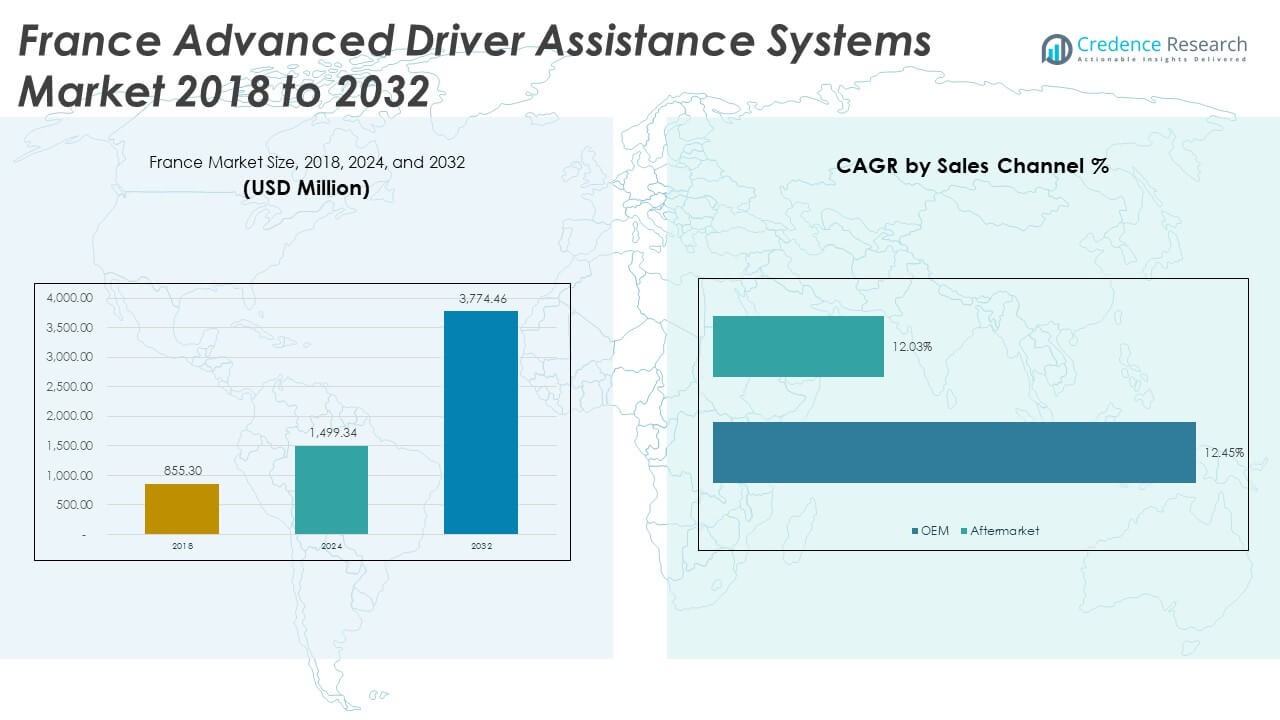

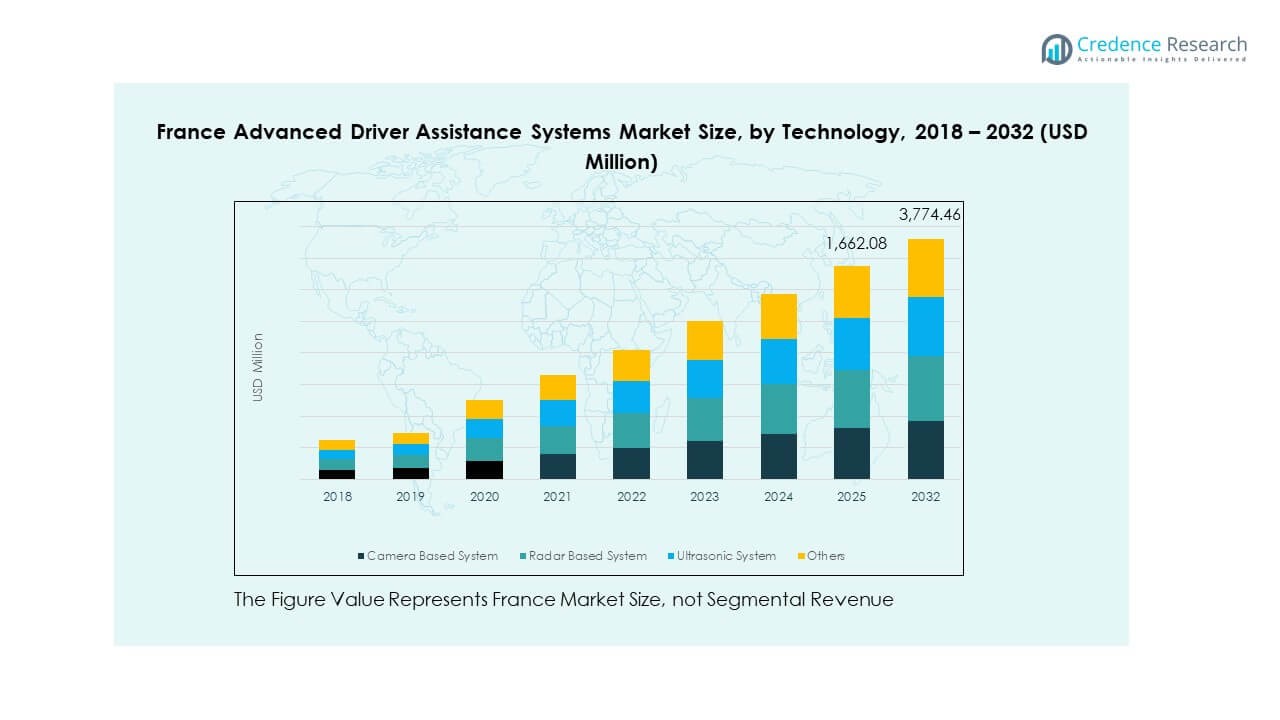

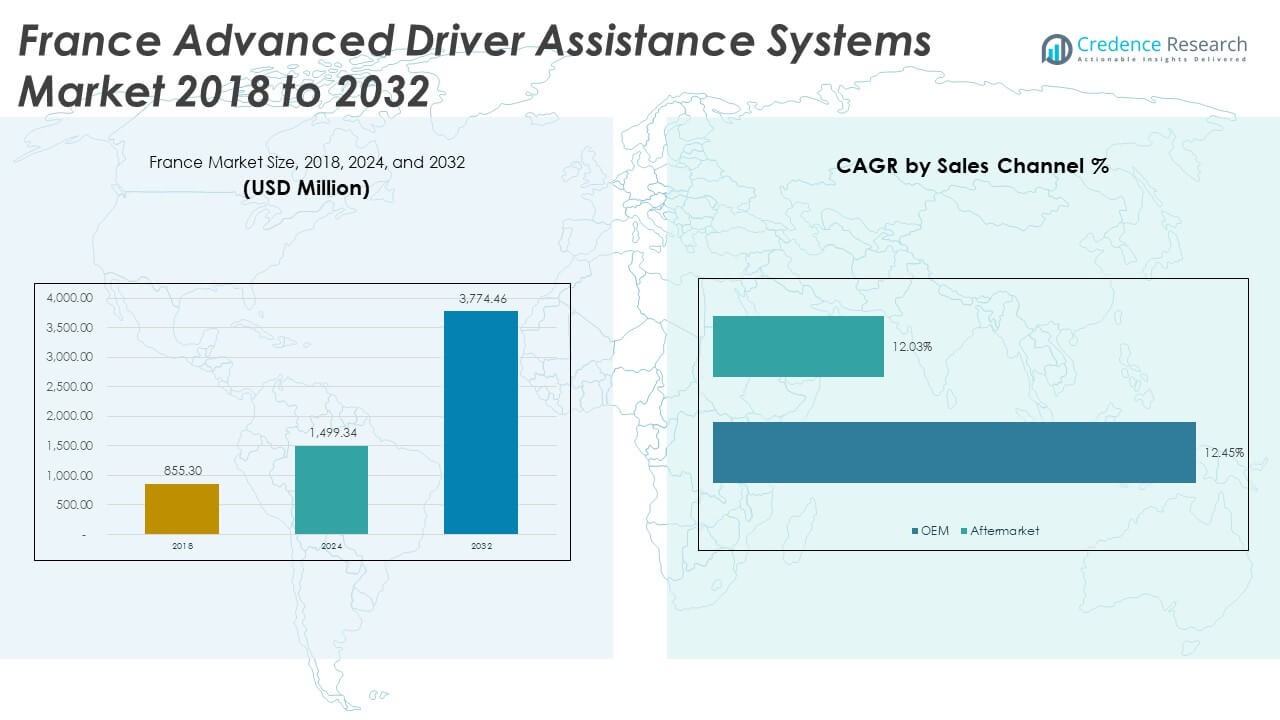

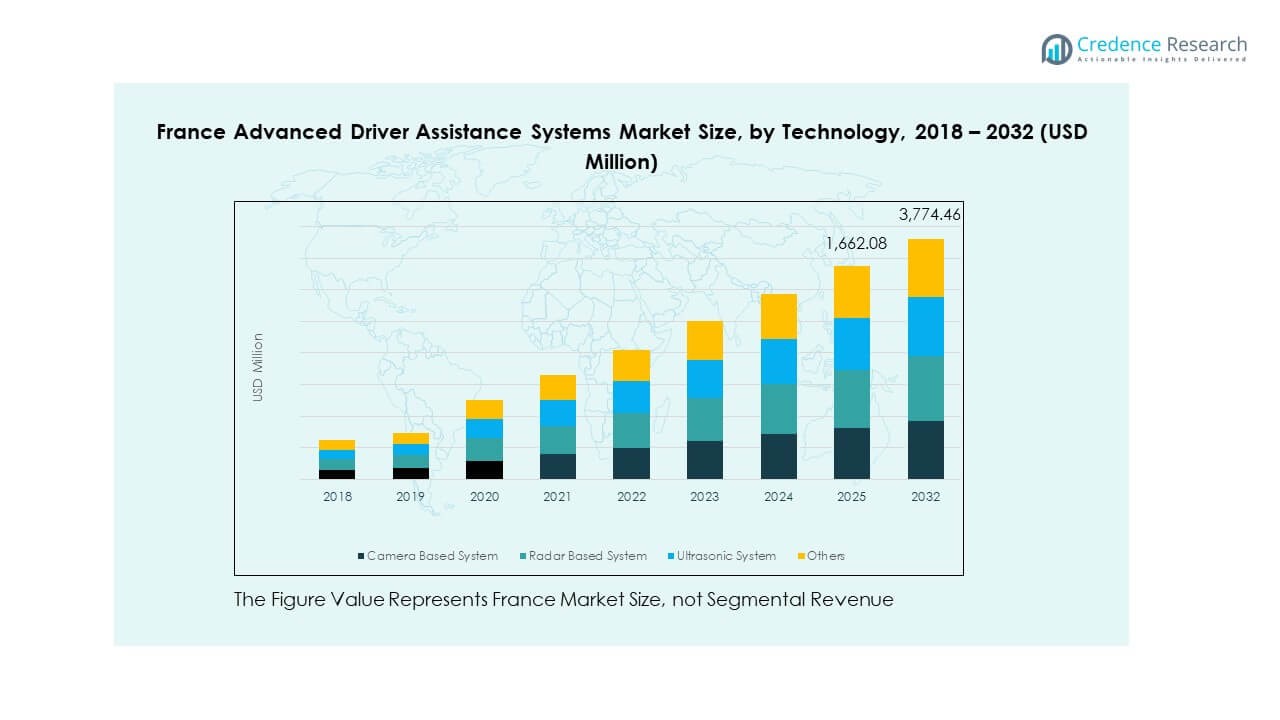

The France Advanced Driver Assistance Systems Market size was valued at USD 855.3 million in 2018 to USD 1,499.34 million in 2024 and is anticipated to reach USD 3,774.46 million by 2032, at a CAGR of 12.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Advanced Driver Assistance Systems Market Size 2024 |

USD 1,499.34 Million |

| France Advanced Driver Assistance Systems Market, CAGR |

12.23% |

| France Advanced Driver Assistance Systems Market Size 2032 |

USD 3,774.46 Million |

The France Advanced Driver Assistance Systems Market is expanding rapidly due to the rising demand for driver safety, stricter government regulations, and the integration of advanced sensor technologies. Increasing adoption of adaptive cruise control, lane-keeping assistance, and automatic emergency braking in both passenger and commercial vehicles drives market growth. Government incentives for smart mobility and the introduction of connected vehicle frameworks strengthen industry adoption. Major automakers focus on developing Level 2+ autonomous features to meet consumer expectations for enhanced driving comfort and safety.

Regionally, Northern France dominates the market due to its strong automotive manufacturing and innovation ecosystem. Western and Central regions are growing as testing and validation hubs for ADAS technologies supported by research partnerships. Southern France is emerging as a key location for autonomous and electric vehicle trials, supported by regional R&D infrastructure. Collaborative efforts among automakers, technology providers, and government institutions continue to boost the national ADAS deployment rate. The overall market momentum aligns with Europe’s long-term vision for zero-accident, fully connected transportation systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Advanced Driver Assistance Systems Market was valued at USD 855.3 million in 2018, reached USD 1,499.34 million in 2024, and is projected to hit USD 3,774.46 million by 2032, expanding at a CAGR of 12.23%.

- Northern France leads with 41% share due to strong automotive manufacturing and advanced R&D infrastructure; Western and Central France follow with 33% share, supported by testing facilities and technology collaborations.

- Southern France holds 26% share and represents the fastest-growing region, driven by autonomous vehicle testing, electric mobility programs, and strong government innovation support.

- Radar-based systems account for 42% of the market share, supported by their reliability under varying weather conditions and widespread OEM adoption.

- Camera-based systems capture 38% of the share, driven by increasing integration in passenger cars for lane detection, pedestrian monitoring, and traffic recognition functions.

Market Drivers

Growing Demand for Vehicle Safety and Regulatory Support

Government initiatives and European Union regulations are strengthening vehicle safety standards across the region. The France Advanced Driver Assistance Systems Market benefits from these regulations that require integration of advanced safety systems such as lane departure warning and adaptive cruise control. Automakers are prioritizing driver safety to meet consumer expectations and compliance norms. The growing frequency of road accidents drives the adoption of collision prevention features. Consumers prefer vehicles equipped with semi-autonomous functions that minimize human error. It encourages OEMs to expand ADAS portfolios across vehicle classes. Technological innovation, combined with stricter Euro NCAP ratings, reinforces demand for high-performance systems.

Increasing Integration of Automation and Smart Mobility Solutions

Rapid urbanization and the shift toward connected mobility have accelerated demand for intelligent driving technologies. Automakers integrate ADAS to improve vehicle handling and road awareness. The market benefits from government support for intelligent transportation systems that enhance traffic flow and safety. Growing investment in 5G connectivity supports faster data transmission between sensors and control units. Vehicle-to-everything (V2X) communication strengthens ADAS reliability. It helps automakers optimize vehicle functions through real-time updates. Demand from both electric and hybrid segments continues to rise due to advanced software integration capabilities.

- For example, PSA Groupe, now part of Stellantis, partnered with Orange and Ericsson to conduct a live 5G-V2X connectivity trial in France. The project demonstrated real-time vehicle-to-everything communication for cooperative intelligent transport systems supporting advanced driver assistance features.

Rising Consumer Awareness and Premium Vehicle Adoption

Consumers are increasingly aware of the benefits of ADAS features that ensure safer driving experiences. The France Advanced Driver Assistance Systems Market witnesses high adoption in luxury and mid-segment vehicles. Leading carmakers integrate adaptive headlights, automated braking, and blind-spot detection to improve comfort and protection. Rising disposable incomes encourage the purchase of premium models with advanced automation features. It allows brands to differentiate through enhanced safety and convenience. Widespread awareness campaigns and showroom demonstrations help consumers experience these technologies firsthand. Increasing online reviews and influencer marketing further strengthen brand trust.

Expanding Collaboration Between OEMs and Technology Providers

Automotive manufacturers are collaborating with software and semiconductor firms to improve ADAS efficiency. These partnerships enable the integration of sensors, radars, and AI-based analytics. The France Advanced Driver Assistance Systems Market gains from co-development programs that improve calibration accuracy and reduce production costs. Companies focus on cloud-based simulation platforms to refine algorithms before deployment. It allows faster product testing and compliance validation. OEMs benefit from shared R&D resources that accelerate product launches. Partnerships also ensure compatibility with evolving autonomous driving frameworks. Such alliances enhance scalability and ensure continuous innovation.

- For example, in 2023, Valeo and Mobileye partnered to develop next-generation imaging radars that combine Mobileye’s AI-driven radar chipset with Valeo’s automotive hardware expertise. These radars deliver 4D environmental mapping with up to 300 meters range and a 170-degree field of view, meeting advanced European ADAS safety standards.

Market Trends

Adoption of AI and Deep Learning for Real-Time Decision Making

AI-driven analytics are transforming the capability of ADAS systems by enhancing real-time response and prediction accuracy. Manufacturers are deploying neural networks that recognize road conditions and adjust vehicle performance instantly. The France Advanced Driver Assistance Systems Market benefits from AI-powered data processing for adaptive control. It enables vehicles to detect pedestrians, lane markers, and traffic signals with improved precision. Deep learning algorithms allow systems to self-improve through continuous data collection. Automakers integrate these models into ECU units for faster decision execution. The inclusion of AI ensures a safer and more autonomous driving environment.

- For instance, Valeo’s SCALA 3 LiDAR enables object classification and detection at distances over 200 meters, providing perception capabilities for Level 3-4 automated driving functions and delivering up to 12.5 million points per echo per second.

Integration of Advanced Sensors and Multifunctional Cameras

Modern vehicles rely on a blend of radar, LiDAR, and camera sensors to create a complete environmental view. Automakers in France are using high-resolution cameras for lane tracking and collision avoidance. The France Advanced Driver Assistance Systems Market experiences growth due to rapid sensor miniaturization and lower component costs. It supports improved detection ranges under various weather and lighting conditions. Integration of infrared and ultrasonic sensors enables night and close-range visibility. OEMs continue to enhance calibration techniques for improved reliability. Sensor fusion improves system redundancy and ensures accurate decision-making on complex roads.

Rise of Electric and Connected Vehicle Platforms

Electrification and digitalization of vehicles are driving new applications for ADAS integration. Automakers are embedding smart control systems into electric and hybrid vehicles to optimize power usage and safety. The France Advanced Driver Assistance Systems Market gains from software-defined architectures that simplify system upgrades. It supports over-the-air updates for continuous performance enhancement. Connectivity features link vehicles with infrastructure and cloud-based data systems. Manufacturers utilize predictive analytics to maintain consistent system reliability. Increasing EV adoption strengthens the ecosystem for advanced safety solutions.

- For example, the 2024 Peugeot e-208 offers a new 51 kWh battery and 154 hp motor, providing up to 268 miles (WLTP) of range and 100 kW fast charging capability, while earlier models featured a 50 kWh battery and 136 hp motor.

Emergence of Autonomous Driving and Pilot Assistance Features

The development of semi-autonomous and self-driving vehicles has accelerated the need for enhanced driver assistance systems. Automakers are introducing features like traffic jam assist and automated parking across new models. The France Advanced Driver Assistance Systems Market benefits from national investments in smart mobility infrastructure. It ensures vehicle compatibility with evolving autonomy levels. Integration of radar and lidar systems offers redundancy that improves operational safety. The trend aligns with consumer preference for comfort and reduced driving fatigue. Continuous algorithm refinement makes partial automation more efficient and affordable.

Market Challenges Analysis

High Implementation Cost and Complex Integration of ADAS Components

The installation of ADAS technologies requires costly sensors, radar modules, and high-performance chips. OEMs face challenges in balancing affordability with technological advancement. The France Advanced Driver Assistance Systems Market encounters higher production costs due to precision calibration needs. Smaller manufacturers struggle to integrate multi-sensor systems into compact models. It affects pricing strategies and consumer accessibility. Complex electronic control units demand specialized maintenance, increasing ownership cost. Compatibility issues across suppliers complicate system standardization. High investment requirements in software validation extend product development cycles.

Regulatory Compliance, Cybersecurity Risks, and Limited Infrastructure Readiness

Automotive suppliers must comply with strict safety and cybersecurity regulations that evolve with each technological generation. Maintaining consistent standards across software updates remains difficult. The France Advanced Driver Assistance Systems Market faces risks linked to data breaches and unauthorized access. It requires robust encryption and secure communication networks. The lack of harmonized testing protocols delays certification timelines. Limited adoption of intelligent road infrastructure restricts system functionality in rural zones. OEMs must ensure consistent performance across regions despite inconsistent digital readiness. Slow consumer education also restricts complete adoption in lower-tier cities.

Market Opportunities

Expansion of Connected Mobility and 5G-Based ADAS Systems

5G technology is transforming data transmission speed and communication reliability across smart vehicles. The France Advanced Driver Assistance Systems Market stands to benefit from improved real-time coordination between vehicles and infrastructure. It helps automakers deploy V2X applications for safer intersections and dynamic traffic control. Telecom providers collaborate with OEMs to enhance latency-sensitive operations. Growth in smart city projects boosts adoption of network-based safety functions. The expansion of vehicle connectivity services supports predictive driving systems. Integration of cloud-based diagnostics opens new business opportunities for software updates.

Emerging Aftermarket Demand and Retrofitting Solutions

Consumers owning older vehicles increasingly prefer upgrading with affordable ADAS kits. The France Advanced Driver Assistance Systems Market experiences rising demand for retrofitting systems that offer essential safety functions. It creates opportunities for local suppliers to deliver compact, plug-and-play modules. Insurance companies also promote aftermarket solutions to reduce accident claims. Independent workshops benefit from partnerships with component manufacturers. It allows a wider distribution network for maintenance and installation. Rising awareness of cost-effective upgrades supports long-term aftermarket expansion.

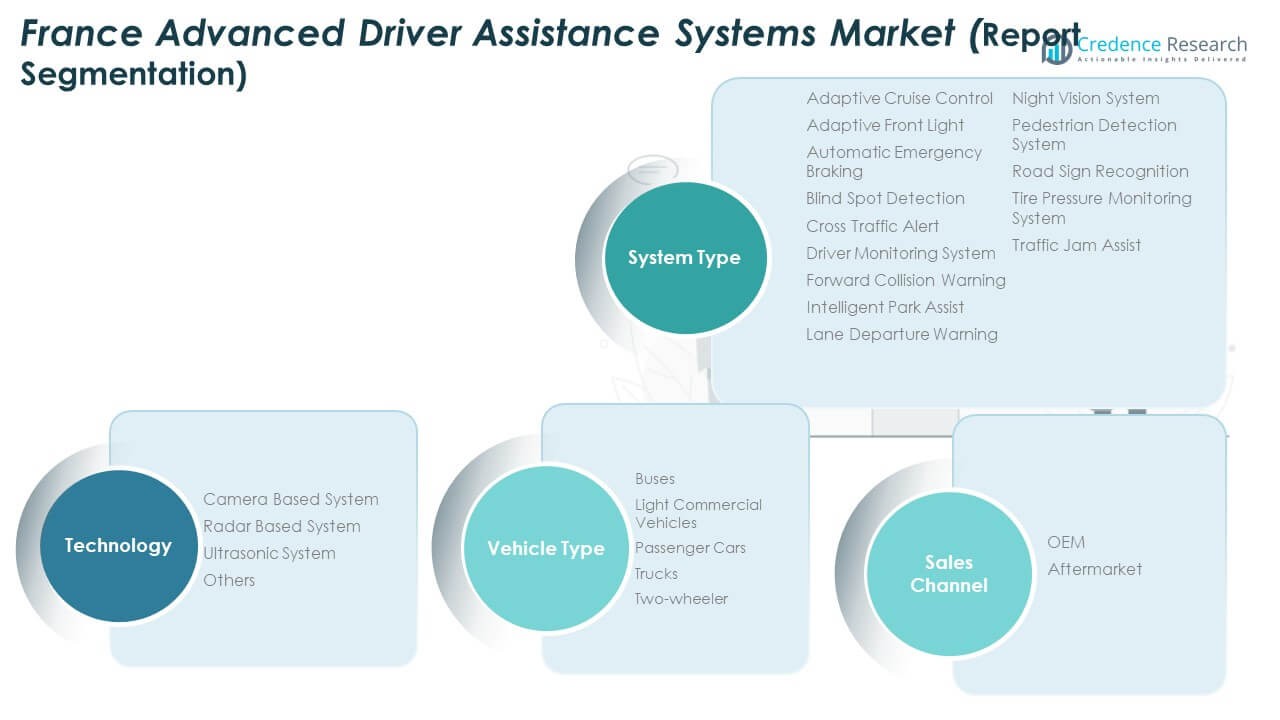

Market Segmentation Analysis

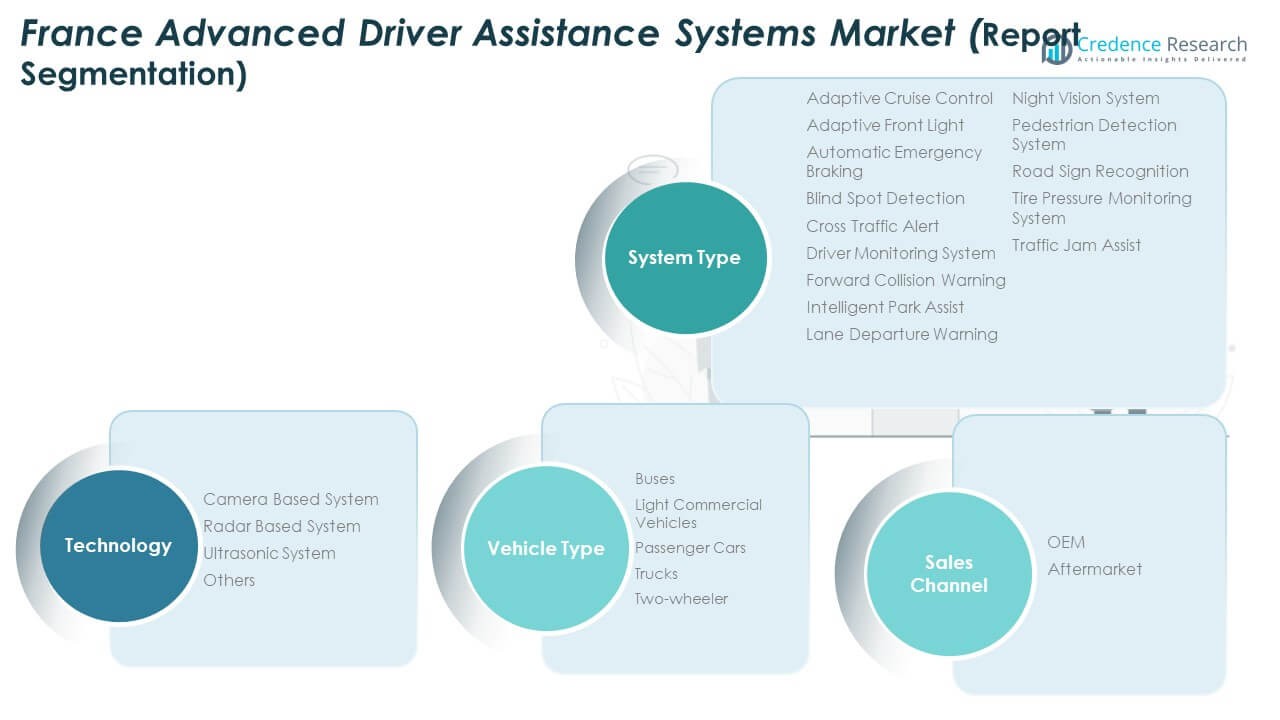

By System Type

Adaptive Cruise Control and Automatic Emergency Braking systems hold the dominant market share due to their integration into mid and high-end vehicles. The France Advanced Driver Assistance Systems Market benefits from consumer preference for comfort and safety in long-distance travel. Lane departure warning, blind spot detection, and cross-traffic alert systems are rapidly expanding among compact cars. Intelligent park assist and pedestrian detection systems enhance urban driving safety. Road sign recognition and tire pressure monitoring systems continue to improve vehicle efficiency. Growth in premium vehicles supports the expansion of multi-feature ADAS packages.

- For instance, a study by MITRE analyzing real-world effectiveness found that vehicles equipped with Automatic Emergency Braking (AEB), such as those offered by Toyota and Honda, exhibited a 49% reduction in front-to-rear crashes between 2015 and 2023 model years.

By Technology

Radar-based systems lead the technology segment due to their high precision under all weather conditions. The France Advanced Driver Assistance Systems Market shows strong adoption of camera-based systems in detecting pedestrians and lane markings. Ultrasonic sensors support short-range applications, particularly in parking assistance. The introduction of hybrid sensor fusion combining radar, cameras, and ultrasonic modules enhances detection accuracy. Advanced software integration allows real-time interpretation of road scenarios. It ensures reliable functioning across varied terrains. Continuous R&D investment aims to reduce production cost and improve adaptability.

By Vehicle Type

Passenger cars dominate due to the high inclusion rate of ADAS in luxury and premium segments. The France Advanced Driver Assistance Systems Market also finds growing adoption in light commercial vehicles for fleet management efficiency. Trucks and buses integrate ADAS to reduce collision risks and improve driver assistance during long hauls. The demand for two-wheeler systems remains emerging, primarily in high-end models. It demonstrates gradual innovation toward compact sensor design and stability enhancement. Expanding logistics and ride-sharing sectors further strengthen multi-vehicle ADAS integration.

- For example, Volvo Trucks equips its vehicles with advanced ADAS features such as Collision Warning with Emergency Brake, combining radar and camera sensors to help prevent rear-end collisions. The system supports safer driving in dense traffic by automatically alerting the driver and applying brakes when a collision risk is detected.

By Sales Channel

OEMs dominate sales as manufacturers embed ADAS during production to meet safety regulations. The France Advanced Driver Assistance Systems Market gains from partnerships between automakers and technology firms for mass adoption. The aftermarket segment is witnessing growth due to affordable sensor kits and driver assistance accessories. It provides cost-efficient options for vehicle owners without factory-installed systems. Local workshops and online distributors cater to growing retrofit demand. OEM innovation combined with aftermarket affordability ensures widespread system penetration across vehicle categories.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis

Northern France – Automotive and Industrial Innovation Hub (41% Market Share)

Northern France holds the leading share of 41% in the France Advanced Driver Assistance Systems Market, driven by its strong automotive manufacturing and R&D base. The region hosts major OEMs and component suppliers developing advanced radar, sensor, and vision systems. Lille and Amiens have become centers for smart mobility innovation, supported by public-private partnerships in connected vehicle technologies. Government-backed research programs strengthen autonomous vehicle testing in controlled environments. It benefits from a mature infrastructure network and access to skilled engineering talent. Expanding electric and hybrid vehicle production enhances the integration of ADAS technologies across multiple vehicle segments.

Western and Central France – Expanding Supply Chain and Testing Ecosystem (33% Market Share)

Western and Central France contribute 33% of market share, supported by growing automotive logistics, system calibration centers, and advanced component suppliers. The France Advanced Driver Assistance Systems Market gains momentum here through regional collaborations between automakers, start-ups, and digital solution providers. Nantes and Tours are developing testing facilities for camera-based driver assistance technologies. Local universities and research institutions actively contribute to AI model training and software validation. It benefits from favorable tax incentives for innovation and strong industrial connectivity. The supply chain infrastructure for sensor manufacturing continues to strengthen, improving production efficiency and export capability.

Southern France – Emerging Mobility and Autonomous Testing Region (26% Market Share)

Southern France holds 26% of the market share, characterized by its growing focus on electric mobility and autonomous vehicle pilot projects. Toulouse and Marseille play key roles in developing communication technologies that enhance vehicle-to-infrastructure interaction. The France Advanced Driver Assistance Systems Market is expanding through collaborations between automotive and aerospace sectors for sensor fusion applications. The presence of technology parks supports local innovation in optical detection and simulation tools. It leverages the region’s research excellence and access to advanced digital infrastructure. The steady adoption of intelligent transport systems positions Southern France as a future hotspot for ADAS deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Astemo, Ltd.

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- JLR Corporate

- ZF Friedrichshafen AG

- Kopernikus Automotive

- Valeo SA

- Mobileye

- Allegro MicroSystems

- Renault

- Other Key Players

Competitive Analysis

The France Advanced Driver Assistance Systems Market features strong competition among global and domestic players focusing on technological innovation, safety compliance, and system integration. Key participants include Valeo SA, Continental AG, Robert Bosch GmbH, Aptiv PLC, and Denso Corporation. These companies prioritize sensor precision, radar range improvement, and AI-driven perception algorithms. It benefits from continuous collaboration between OEMs and technology firms for product development and cost optimization. Valeo leads through radar and vision systems produced domestically, while Continental and Bosch expand through partnerships with electric vehicle manufacturers. Start-ups specializing in simulation software and embedded analytics add dynamism to the ecosystem. Strategic mergers and R&D centers in France strengthen the market’s innovation pipeline. Leading firms invest heavily in testing facilities and software calibration tools, enhancing accuracy and reliability across autonomous functions.

Recent Developments

- In September 2025, Valeo formed a strategic collaboration with Capgemini to test and validate a newly developed ADAS system capable of up to Level 2+ autonomy. Shortly after, Valeo signed a global partnership agreement with Momenta, a leading autonomous driving firm, to co-develop advanced intelligent driving solutions, integrating cutting-edge sensor, software, and hardware expertise for OEMs in France, China, and beyond.

- In August 2025, Bosch launched its new ADAS product family, which integrates advanced radar and camera sensors, inertial units, and a proprietary system-on-chip (SoC) for enhanced computing power and efficiency. These solutions enable scalable assisted and automated driving functions, catering to vehicles from compact cars to premium segments, and support faster market deployment of driver assistance features.

- In June 2025, ZF announced enhanced global turnkey ADAS solutions with the latest Smart Camera 6 offering a 120-degree field of view and high image resolution. The company highlighted its world leadership, exceeding 75 million smart cameras sold, and detailed new stand-alone software-ready systems to empower software-defined vehicles and meet new EU regulatory requirements for ADAS features in all new vehicles from July 2024.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of AI-driven ADAS platforms will strengthen automation, safety precision, and real-time navigation capabilities.

- Demand for radar and camera-based systems will rise due to improved detection accuracy and reduced component costs.

- Electric and hybrid vehicles will increasingly integrate advanced assistance systems to support energy efficiency and intelligent mobility.

- Regulatory policies enforcing higher safety standards will accelerate system installation across all vehicle categories.

- Partnerships between automakers and semiconductor firms will boost sensor performance and reduce system latency.

- Aftermarket expansion will provide cost-effective upgrades for older vehicles, improving market accessibility and penetration.

- Local manufacturing initiatives and government funding will enhance innovation capacity and reduce import dependency.

- The emergence of 5G connectivity will drive the development of faster vehicle-to-infrastructure communication networks.

- Autonomous driving pilots across urban centers will encourage early adoption of adaptive and predictive safety features.

- Sustainable system designs focusing on lightweight components and recyclable materials will shape future product development.