| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Automotive Smart Keys Market Size 2024 |

USD 462.42 Million |

| France Automotive Smart Keys Market, CAGR |

8.43% |

| France Automotive Smart Keys Market Size 2032 |

USD 958.41 Million |

Market Overview

France Automotive Smart Keys Market size was valued at USD 462.42 million in 2023 and is anticipated to reach USD 958.41 million by 2032, at a CAGR of 8.43% during the forecast period (2023-2032).

The France automotive smart keys market is driven by the growing consumer demand for enhanced vehicle security, convenience, and seamless connectivity. Increasing adoption of electric and premium vehicles, which typically integrate advanced keyless entry and start systems, significantly fuels market growth. Automakers are continuously investing in smart key technologies to improve user experience, reduce theft risks, and support vehicle personalization. Technological advancements such as biometric authentication, smartphone integration, and proximity sensors are reshaping the smart key landscape. Additionally, supportive government policies promoting vehicle safety standards and the rapid expansion of electric mobility contribute to the market’s momentum. Urbanization and rising disposable incomes further encourage consumers to opt for vehicles equipped with smart key systems. As digital transformation accelerates across the automotive sector, the integration of Internet of Things (IoT) and AI-powered features into smart keys is emerging as a key trend, enhancing functionality and aligning with the broader shift toward connected mobility.

The geographical analysis of the France automotive smart keys market highlights regional demand influenced by industrial concentration, urbanization, and the pace of electric vehicle adoption. Northern and Southern France lead in terms of technological integration due to strong automotive manufacturing bases and higher consumer inclination toward advanced vehicle features. Eastern France benefits from proximity to European automotive hubs, while Western France shows growing potential through urban development and emerging demand for connected mobility solutions. Key players driving innovation and competition in the market include Huf Hulsbeck & Fürst GmbH & Co., Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Hyundai Mobis, and Valeo SA. These companies are focused on developing smart key systems that enhance vehicle security, support digital connectivity, and integrate seamlessly with electric and autonomous vehicles. Strategic partnerships, R&D investments, and expanding product portfolios position these firms as critical contributors to the advancement of smart key technologies across the French automotive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France automotive smart keys market was valued at USD 462.42 million in 2023 and is expected to reach USD 958.41 million by 2032, growing at a CAGR of 8.43% during the forecast period.

- The Global Automotive Smart Keys market was valued at USD 12,499.00 million in 2023 and is projected to reach USD 26,481.41 million by 2032, growing at a CAGR of 8.70% from 2023 to 2032.

- Increasing demand for keyless entry, enhanced vehicle security, and digital convenience is driving market growth.

- Trends such as biometric authentication, smartphone integration, and cloud-based vehicle access are reshaping consumer expectations.

- Leading players like Continental AG, Valeo SA, and Hyundai Mobis are investing in advanced smart key technologies to maintain competitive advantage.

- High costs of implementation and vulnerability to cyber threats act as major restraints to market expansion.

- Northern and Southern France lead in adoption due to strong automotive presence and technological advancement, while Eastern and Western regions show gradual growth.

- The market is poised for steady expansion with the rise in electric vehicles and increasing integration of IoT and AI into smart key systems.

Report Scope

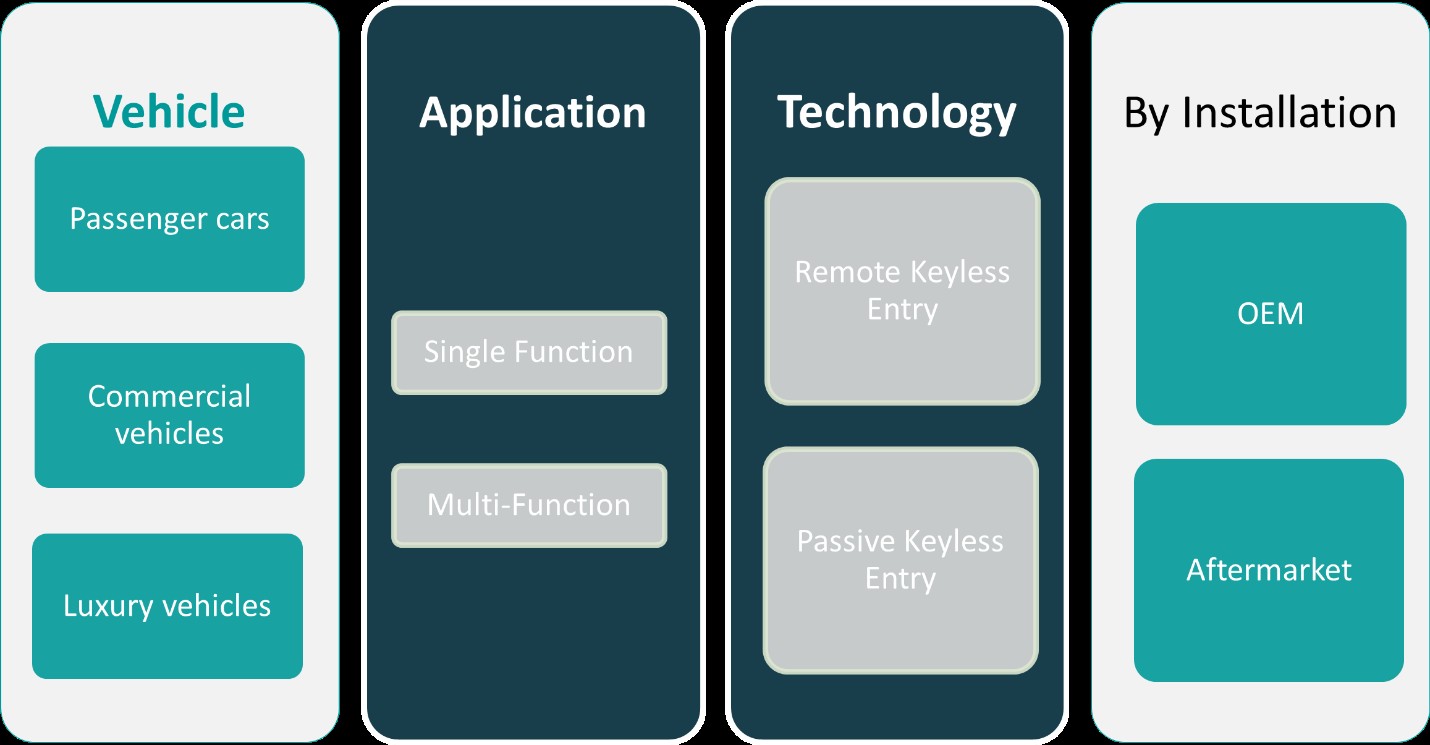

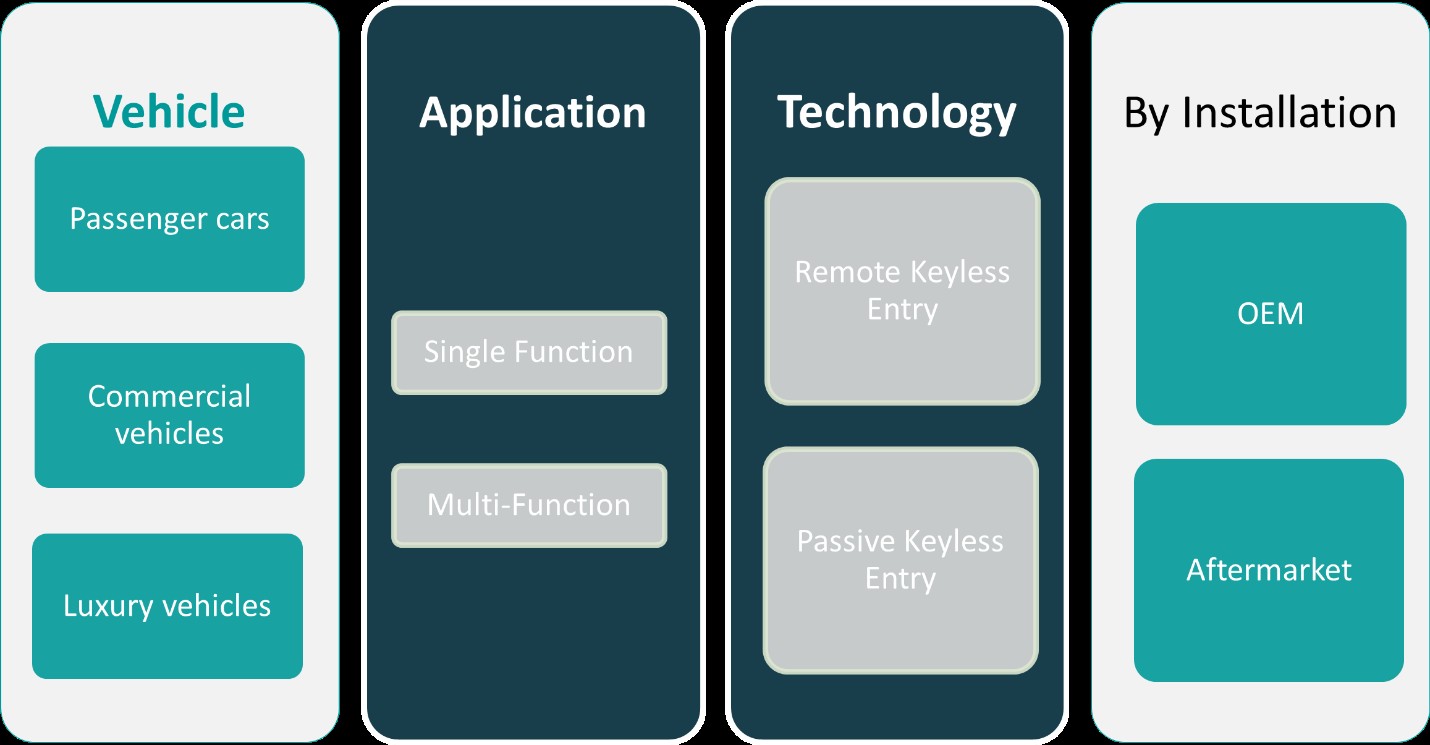

This report segments the France Automotive Smart Keys Market as follows:

Market Drivers

Rising Demand for Enhanced Vehicle Security and Convenience

One of the primary drivers of the France automotive smart keys market is the increasing demand for advanced vehicle security systems. For instance, a report by the European Union Agency for Cybersecurity (ENISA) highlights the effectiveness of keyless entry and immobilizers in reducing unauthorized access and vehicle theft. Traditional keys are becoming obsolete as consumers prioritize safety, theft prevention, and user-friendly access to their vehicles. Smart keys offer features such as keyless entry, push-button start, and immobilizers, which enhance vehicle security and convenience. These technologies significantly reduce the risk of unauthorized access and vehicle theft, making them particularly attractive to car owners in urban environments. The combination of convenience and security positions smart keys as a preferred choice in the French automotive sector.

Growing Adoption of Electric and High-End Vehicles

The accelerating shift toward electric vehicles (EVs) and luxury automobiles in France significantly contributes to the growth of the smart keys market. For instance, data from the International Energy Agency (IEA) highlights the compatibility of smart key systems with EVs, which rely heavily on advanced digital features. Electric and premium vehicles often come equipped with advanced digital features, including smart key technology as a standard or high-value option. Government incentives for EV adoption, along with stringent emissions regulations, have spurred the growth of this vehicle segment. As consumers increasingly invest in technologically advanced and environmentally friendly cars, the demand for integrated smart key systems continues to rise. Automakers are leveraging this trend by integrating more sophisticated key functionalities to differentiate their offerings in a competitive market.

Technological Advancements and Digital Integration

Rapid innovation in automotive electronics is another crucial factor driving market growth. The integration of smart keys with smartphone applications, biometric verification, and proximity sensors reflects the broader trend toward vehicle digitalization. Consumers expect seamless interaction with their vehicles, and smart keys are evolving to meet this demand. Manufacturers are investing in R&D to develop keys that not only offer access control but also support remote diagnostics, vehicle tracking, and personalized driver settings. These advancements align with the broader connected vehicle ecosystem, enabling enhanced user experiences and contributing to brand loyalty and customer satisfaction.

Supportive Regulatory Environment and Urban Mobility Trends

France’s regulatory framework and urban mobility initiatives also support the expansion of the automotive smart keys market. The government’s push for enhanced road safety standards and digital infrastructure encourages the adoption of intelligent vehicle technologies. Additionally, urbanization and changing consumer lifestyles—particularly among younger, tech-savvy populations—are shaping preferences toward modern vehicles equipped with smart access systems. Car-sharing services, rental fleets, and corporate mobility programs are increasingly adopting smart keys to streamline operations and enhance user convenience. This institutional adoption, combined with consumer demand, reinforces the market’s growth trajectory and highlights the growing importance of digital access solutions in modern transportation.

Market Trends

Integration of Biometric Authentication Enhances Vehicle Security

The incorporation of biometric authentication into smart key systems is significantly enhancing vehicle security. By utilizing technologies such as fingerprint scanning and facial recognition, manufacturers ensure that only authorized individuals can access and operate vehicles. This advancement addresses increasing consumer concerns regarding vehicle theft and unauthorized use, providing a personalized and secure user experience. The adoption of biometric features aligns with the broader trend of integrating advanced security measures into automotive design, reflecting a commitment to both safety and innovation.

Collaboration with Cloud Service Providers for Enhanced Connectivity

Manufacturers are increasingly collaborating with cloud service providers to enhance the functionality and security of smart key systems. For instance, a report by the National Informatics Centre (NIC) emphasizes the role of cloud connectivity in enabling features like remote diagnostics, vehicle tracking, and personalized user settings. These partnerships facilitate features such as remote diagnostics, vehicle tracking, and personalized user settings, aligning with the broader trend of vehicle digitalization. By leveraging cloud connectivity, smart keys are evolving into integral components of the connected car ecosystem, offering users a seamless and enriched driving experience.

Expansion of Remote Keyless Entry Systems Across Vehicle Segments

Remote Keyless Entry (RKE) systems are becoming increasingly prevalent across various vehicle segments, including mid-range and entry-level models. For instance, data from the National Data and Analytics Platform (NDAP) highlights the increasing adoption of RKE systems in mid-range vehicles, driven by their cost-effectiveness and reliability. Their straightforward design enhances reliability and reduces maintenance costs, appealing to both consumers and manufacturers. This widespread adoption reflects a market shift towards enhancing vehicle accessibility and convenience without compromising on security.

Emphasis on Advanced Security Features to Mitigate Theft Risks

Despite the convenience offered by smart keys, there is a growing emphasis on addressing security vulnerabilities associated with keyless entry systems. Instances of relay attacks, where thieves capture signals from key fobs to gain unauthorized access, have raised concerns. In response, manufacturers are investing in advanced security features, such as ultra-wideband technology and encrypted communication, to mitigate these risks and enhance consumer confidence in smart key systems.

Market Challenges Analysis

Security Vulnerabilities and Risk of Cyberattacks

One of the most pressing challenges in the France automotive smart keys market is the vulnerability of these systems to security breaches and cyberattacks. For instance, a report by the European Union Agency for Cybersecurity (ENISA) highlights the prevalence of relay attacks and signal jamming incidents, emphasizing the need for enhanced encryption and ultra-wideband (UWB) technology to mitigate these risks. As smart keys operate using wireless communication, they are susceptible to relay attacks, signal jamming, and hacking attempts. Thieves can exploit these weaknesses by intercepting signals from key fobs to gain unauthorized access to vehicles, often without leaving any trace. Maintaining consumer trust in smart key technology requires ongoing innovation in cybersecurity and consistent regulatory support to enforce robust safety standards.

High Cost of Advanced Technology and Limited Aftermarket Support

The high cost associated with smart key systems remains a significant barrier to wider adoption, especially in the mid-range and budget vehicle segments. Integrating features such as proximity sensors, remote start, biometric access, and smartphone connectivity requires substantial investment in both hardware and software development. This often results in increased vehicle prices, making these systems more accessible to premium and luxury car owners. Additionally, aftermarket support for smart key replacements or repairs is relatively limited and expensive, posing inconvenience to users and raising total cost of ownership. Small-scale manufacturers and repair service providers face technical limitations and licensing issues when working with proprietary smart key technologies, further slowing the system’s broader market penetration. As cost-efficiency and serviceability remain critical to consumers, addressing these concerns will be vital to achieving sustained market growth.

Market Opportunities

The France automotive smart keys market presents significant opportunities driven by the rapid digital transformation of the automotive industry and increasing consumer preference for connected vehicles. As demand for electric and hybrid vehicles rises—encouraged by government incentives and stricter emissions regulations—automakers are integrating smart key systems as a standard feature to enhance convenience, safety, and brand appeal. This growing adoption of EVs and high-end models provides fertile ground for smart key manufacturers to expand their footprint in France. Moreover, urbanization and lifestyle changes among younger, tech-savvy consumers are creating a shift toward vehicles equipped with digital access features, encouraging the development of more personalized, secure, and user-friendly smart key solutions.

Another promising opportunity lies in the integration of smart keys with emerging technologies such as the Internet of Things (IoT), cloud connectivity, and artificial intelligence. These innovations enable smart keys to evolve beyond simple access devices, offering advanced functionalities like remote diagnostics, driver behavior tracking, personalized vehicle settings, and enhanced anti-theft features. Additionally, the growing popularity of car-sharing platforms, subscription-based mobility services, and fleet management solutions presents new use cases for smart keys, particularly those supporting remote and contactless access. OEMs and tech providers that capitalize on these trends can unlock long-term value by developing scalable, interoperable smart key solutions tailored to both individual consumers and business fleets. As France continues to position itself as a hub for sustainable and smart mobility, the market for automotive smart keys stands poised to benefit from a surge in innovation and investment.

Market Segmentation Analysis:

By Vehicle:

The France automotive smart keys market, when segmented by vehicle type, reflects distinct growth dynamics across passenger cars, commercial vehicles, and luxury vehicles. Passenger cars represent the largest segment due to their high production volume and increasing consumer preference for enhanced vehicle convenience and safety features. As keyless entry and push-start systems become more common in mid-range models, smart keys are witnessing widespread adoption among general consumers. The commercial vehicle segment, while comparatively smaller, is gaining traction as fleet operators seek solutions that enhance operational efficiency and security. Smart keys in commercial fleets enable controlled access, vehicle usage monitoring, and reduced risks of unauthorized entry. However, the luxury vehicle segment leads in terms of innovation and adoption of high-end smart key functionalities. These vehicles often integrate advanced technologies like biometric authentication, proximity sensors, and remote control via smartphones. With growing demand for premium vehicles in France, luxury automakers continue to push the boundaries of smart key integration, setting benchmarks for innovation across the industry.

By Application:

Based on application, the smart key market in France can be segmented into single function and multi-function systems. Single-function smart keys, typically limited to remote locking and unlocking, continue to be used in entry-level models and budget-conscious vehicle categories. These systems offer basic convenience and security but lack the flexibility and technological sophistication demanded by modern consumers. On the other hand, multi-function smart keys are rapidly gaining market share, especially among electric and connected vehicles. These keys enable a wide range of features such as push-button ignition, personalized driver profiles, remote vehicle monitoring, and integration with mobile apps. The growing popularity of multi-function keys reflects a broader industry trend toward connected mobility and seamless digital experiences. Automakers are increasingly investing in multi-functional key technology to cater to evolving consumer expectations and differentiate their offerings in a competitive landscape. As user demand continues to favor smarter, more intuitive access solutions, the multi-function segment is expected to dominate market growth in the coming years.

Segments:

Based on Vehicle:

- Passenger cars

- Commercial vehicles

- Luxury vehicles

Based on Application:

- Single Function

- Multi-Function

Based on Technology:

- Remote Keyless Entry

- Passive Keyless Entry

Based on Distribution Channel:

Based on the Geography:

- Northern France

- Southern France

- Eastern France

- Western France

Regional Analysis

Northern France

Northern France holds the largest share in the country’s automotive smart keys market, accounting for approximately 34% of the total revenue. This dominance can be attributed to the presence of major automotive manufacturing hubs and research centers, especially around cities like Lille and Amiens. The region is home to key production facilities of both domestic and international automakers, which fuels strong demand for smart key technologies across new vehicle platforms. Additionally, Northern France benefits from well-developed infrastructure, high vehicle ownership rates, and early adoption of electric vehicles, all of which support the integration of advanced digital access systems. The regional focus on innovation and smart mobility solutions further reinforces the market’s growth trajectory in this part of the country.

Southern France

Southern France represents around 28% of the automotive smart keys market and is an emerging hub for automotive technology and electric vehicle adoption. Cities like Toulouse, Marseille, and Nice are leading centers for smart mobility innovation, supported by favorable weather, tourism-driven transportation needs, and increasing environmental awareness. Luxury and premium vehicles are particularly popular in the southern coastal regions, contributing to higher penetration of multi-functional smart keys with advanced security and connectivity features. Furthermore, the expanding network of EV charging stations and government-backed sustainability initiatives have boosted sales of electric and hybrid vehicles, further driving demand for integrated smart key systems. The region’s growing tech-savvy population also embraces connected car features, accelerating smart key adoption.

Eastern France

Eastern France holds a 21% share in the national automotive smart keys market, supported by a strong industrial base and cross-border automotive activity with neighboring Germany and Switzerland. The region’s proximity to the European automotive corridor facilitates the transfer of advanced automotive technologies, including smart key systems. Cities such as Strasbourg and Mulhouse play a critical role in automotive supply chains, and OEMs operating here are increasingly integrating smart access features into new models. While adoption is slightly lower compared to the northern and southern regions, the consistent investment in automotive innovation and component manufacturing ensures steady market growth.

Western France

Western France accounts for approximately 17% of the automotive smart keys market. Though it holds the smallest share among the four regions, it shows promising potential due to expanding urban development and rising consumer interest in digital vehicle technologies. The presence of mid-sized automotive component manufacturers and increasing vehicle sales in cities like Nantes and Rennes contribute to steady demand. Additionally, regional investments in smart infrastructure and sustainable transport initiatives are expected to create future growth opportunities. As more mid-range and entry-level vehicles in Western France begin integrating smart key features, the region is likely to experience gradual market expansion in the coming years.

Key Player Analysis

- Huf Hulsbeck & Furst GmbH & Co

- Continental AG

- ZF Friedrichshafen AG

- HELLA GmbH & Co. KGaA

- Hyundai Mobis

- Silca Group

- Tokai Rika Co

- Denso Corporation

- ALPHA Corporation

- Valeo SA

- Robert Bosch GmbH

- Marquardt

Competitive Analysis

The France automotive smart keys market is highly competitive, with several leading players driving innovation, product development, and strategic collaborations. Key players such as Huf Hulsbeck & Fürst GmbH & Co., Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Hyundai Mobis, Silca Group, Tokai Rika Co., Denso Corporation, ALPHA Corporation, Valeo SA, Robert Bosch GmbH, and Marquardt play a crucial role in shaping the market landscape. These companies focus on delivering high-performance smart key solutions that integrate advanced security, digital connectivity, and user convenience. R&D investments remain a core strategy as players seek to enhance product offerings with technologies such as biometric access, remote diagnostics, and smartphone-based controls. As demand for smart and connected vehicles increases, competition intensifies in delivering scalable and secure solutions. Strategic mergers, product innovations, and a shift toward cloud-based and AI-powered key systems further define the market dynamics. The focus remains on balancing cutting-edge features with affordability and cybersecurity compliance in a growing digital mobility ecosystem.

Recent Developments

- In January 2025, Honda Lock, now owned by MinebeaMitsumi, expanded its product line to include advanced keyless entry systems with mobile connectivity and IoT features, aligning with the automotive industry’s trend towards electrification and automation.

- In December 2024, Hyundai Mobis announced plans to expand its card-type smart key to major Hyundai models like the Santa Fe and Tucson. This key uses UWB for enhanced functionality and wireless charging capabilities.

- In April 2024, Continental developed a smart device-based access solution for Mercedes-Benz E-Class cars. This system utilizes ultra-wideband (UWB) technology, transceivers, and intelligent software to enhance security and convenience for luxury vehicles.

- In December 2023, Huf introduced a groundbreaking smart key that combines UWB, BLE, and NFC technologies in compliance with Car Connectivity Consortium (CCC) standards. This innovation enhances anti-theft security and convenience while allowing integration with “Phone as a Key” systems.

Market Concentration & Characteristics

The France automotive smart keys market exhibits a moderately high level of market concentration, with a few dominant players controlling a significant share of the market. Established automotive component manufacturers and technology firms play a central role in driving innovation and setting industry standards. The market is characterized by continuous advancements in digital and security technologies, leading to the frequent introduction of multi-functional, connected, and biometric-enabled smart key systems. High entry barriers exist due to the technical complexity, need for strong OEM partnerships, and compliance with stringent automotive safety standards. Furthermore, the market operates within a mature automotive ecosystem that emphasizes quality, reliability, and integration with broader vehicle systems. Customization, user-centric features, and interoperability with electric and connected vehicles are key characteristics influencing purchasing decisions. As the industry moves toward smarter mobility solutions, market players are leveraging strategic alliances, localized production, and R&D capabilities to maintain competitive advantage in a rapidly evolving landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Application, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France automotive smart keys market is projected to grow steadily, driven by increasing consumer demand for convenience and advanced vehicle security features.

- Integration of biometric authentication, such as fingerprint and facial recognition, is enhancing security and personalization in smart key systems.

- The rise of electric and connected vehicles is fostering the development of smart keys with IoT connectivity, enabling features like remote diagnostics and personalized settings.

- Manufacturers are forming strategic partnerships with cloud service providers to enhance security and functionality of digital key solutions.

- The aftermarket sector is expanding as consumers seek to upgrade vehicle security features, presenting opportunities for smart key manufacturers.

- Advancements in sensor technology and artificial intelligence are making biometric smart key systems more reliable and accessible.

- European regulatory initiatives promoting vehicle safety and emission standards are encouraging the adoption of advanced access and ignition systems like smart keys.

- The market is witnessing a shift towards multi-functional smart keys that offer features beyond locking and unlocking, such as remote engine start and vehicle tracking.

- Security concerns, particularly related to relay attacks and hacking, are prompting continuous improvements in encryption and authentication technologies.

- The growing popularity of car-sharing and mobility services is increasing the demand for digital key solutions that support remote and contactless access.