Market Overview:

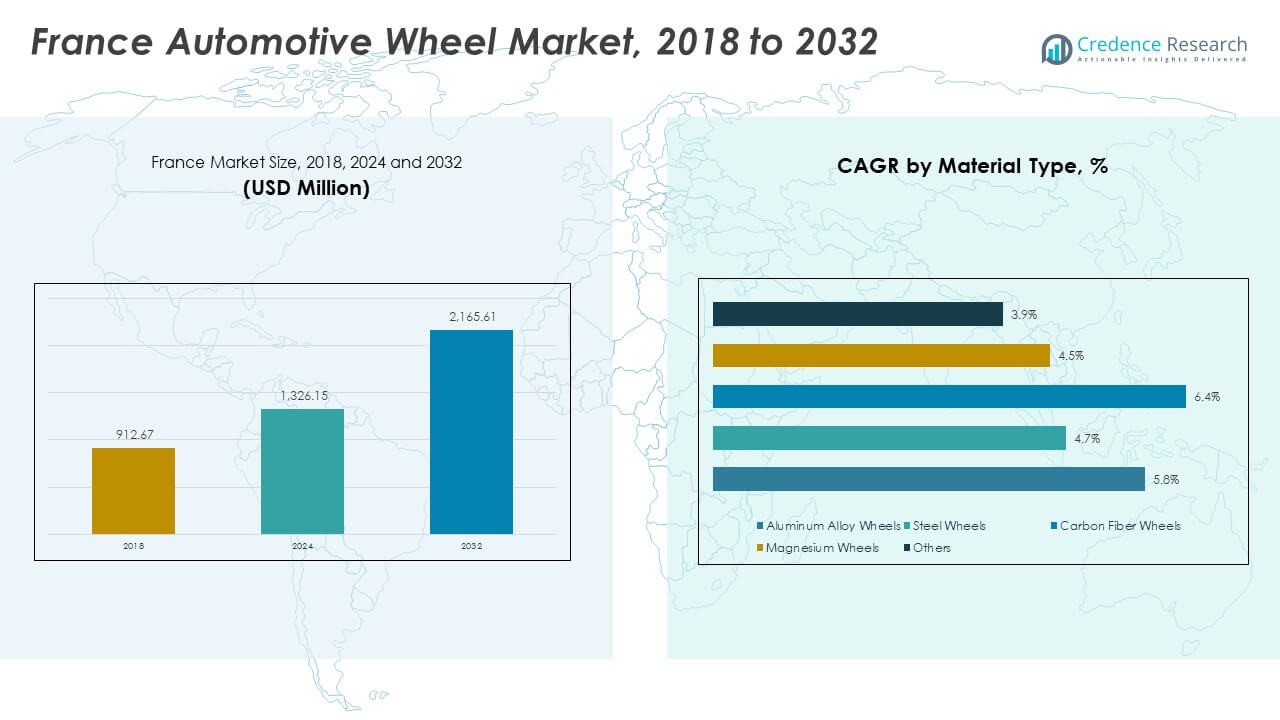

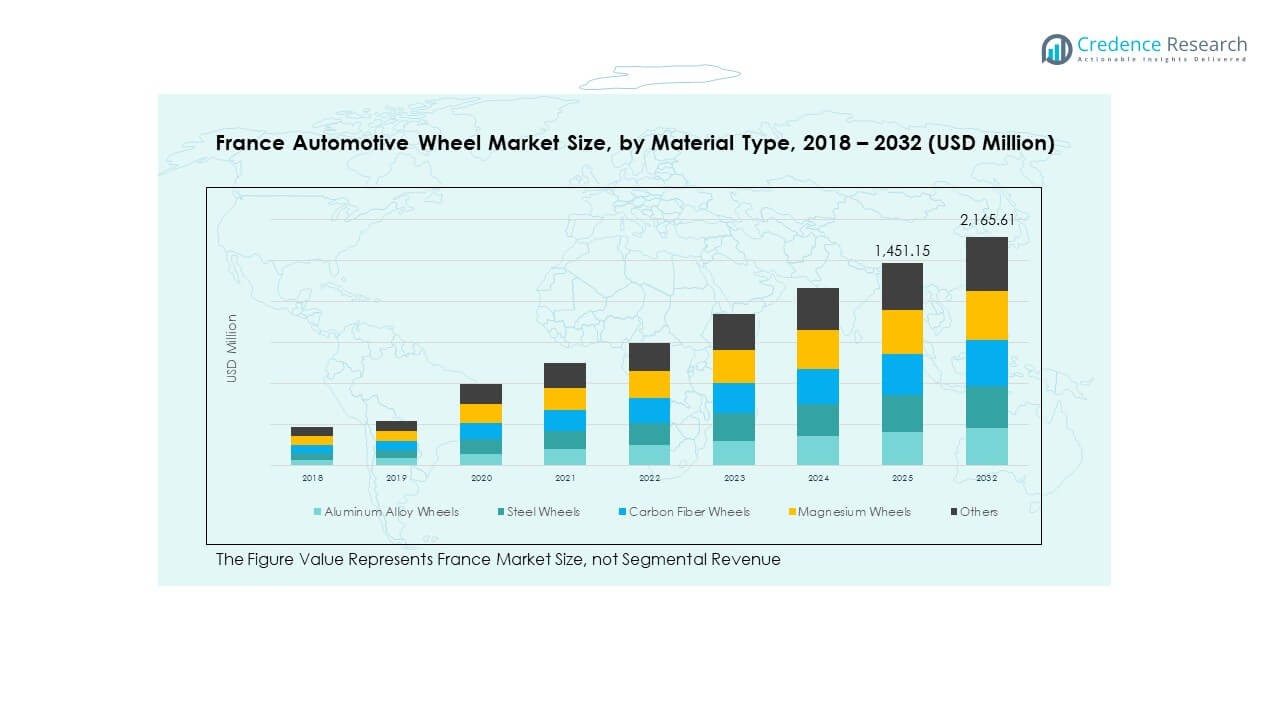

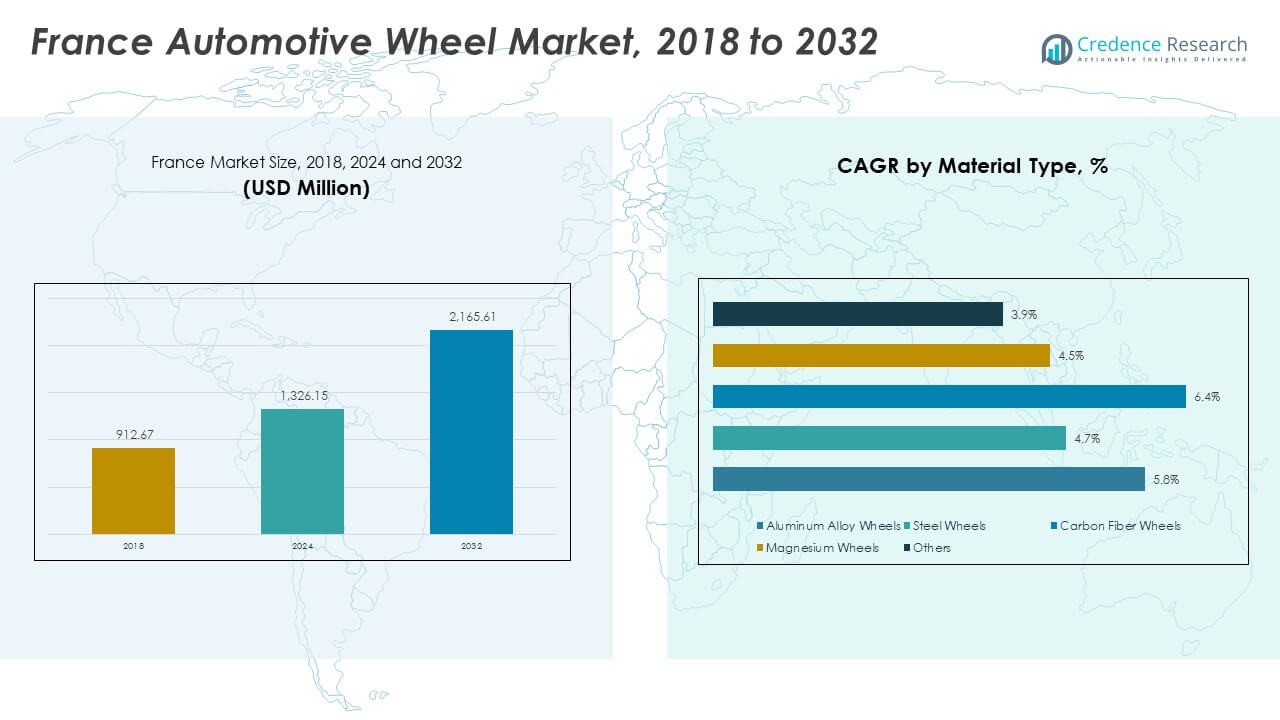

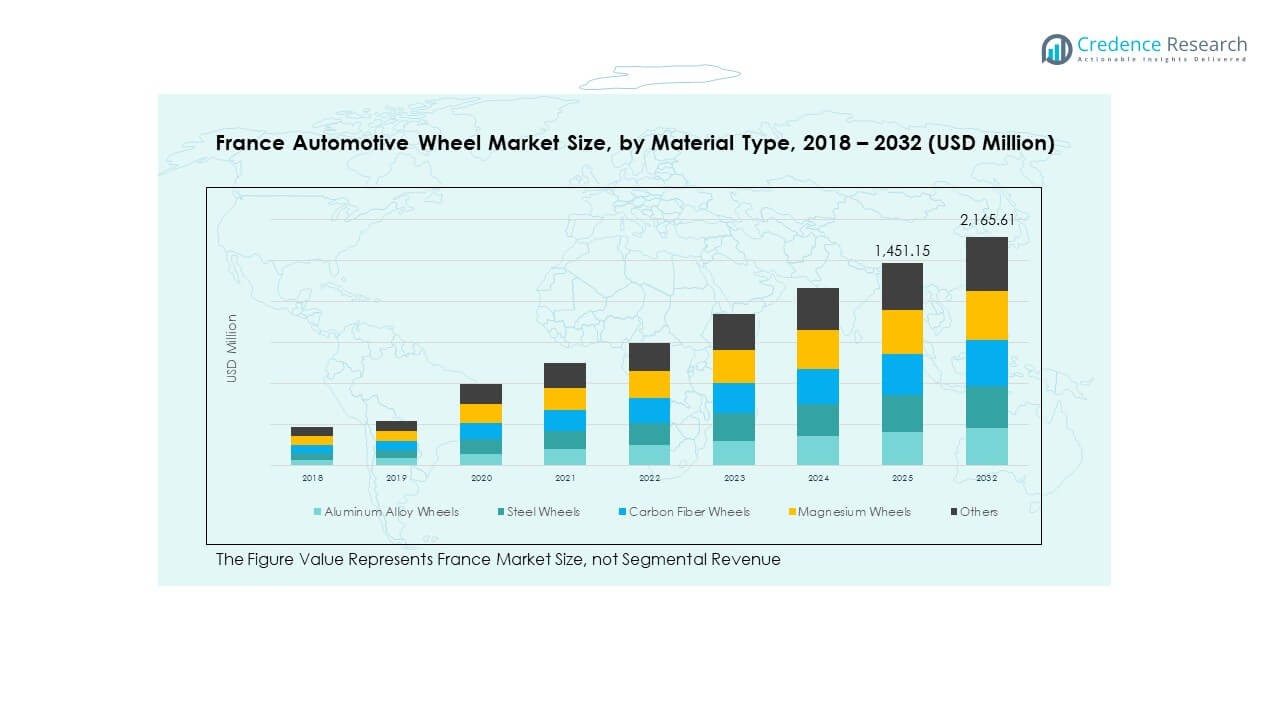

The France Automotive Wheel Market size was valued at USD 912.67 million in 2018, rose to USD 1,326.15 million in 2024, and is anticipated to reach USD 2,165.61 million by 2032, at a CAGR of 5.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Automotive Wheel Market Size 2024 |

USD 1,326.15 Million |

| France Automotive Wheel Market, CAGR |

5.89% |

| France Automotive Wheel Market Size 2032 |

USD 2,165.61 Million |

The market growth is being propelled by rising passenger vehicle production in France and enhanced demand for lightweight alloy wheels to meet fuel‐efficiency standards. Manufacturers are actively introducing advanced materials and designs that enable better vehicle dynamics and reduced weight, thereby attracting both OEMs and aftermarket players. Furthermore, increasing spending on vehicle upgrades and customisation is supporting stronger demand for premium wheel offerings across segments in France.

In geographic terms, France remains part of the leading European wheel market, with Germany and Italy also holding significant volumes due to large vehicle manufacturing bases. Southern and Eastern European countries are emerging as growth areas, driven by rising vehicle ownership and aftermarket activity. Meanwhile, France benefits from its mature automotive supply chain, established OEM presence and strong aftermarket infrastructure, which positions the country favourably in the regional competitive landscape.

Market Insights:

Market Insights:

- The France Automotive Wheel Market was valued at USD 912.67 million in 2018 and is projected to grow to USD 2,165.61 million by 2032, with a CAGR of 5.89% between 2024 and 2032.

- The top three regional shares contributing to the market include Western Europe (30%), Eastern & Central Europe (18%), and the Rest of Europe (14%), with France leading due to its strong OEM presence, production capacity, and robust automotive sector.

- The fastest-growing region is Eastern & Central Europe, which accounts for 18% of the market share. This growth is driven by expanding vehicle production hubs and increasing foreign investment in automotive manufacturing.

- In the material type segment, aluminium alloy wheels dominate the market with a substantial share, followed by steel wheels and carbon fiber wheels, which have a growing presence in high-performance vehicles.

- The segment distribution of the France Automotive Wheel Market includes Aluminium Alloy Wheels at 45%, Steel Wheels at 35%, and Carbon Fiber Wheels at 10%, while the remaining categories, including Magnesium Wheels, hold the smallest share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Lightweight Wheels

The France Automotive Wheel Market benefits from the growing demand for lightweight alloys such as aluminum and magnesium. These materials are being used to reduce vehicle weight, improve fuel efficiency, and comply with environmental regulations. Automakers are increasingly adopting lightweight materials to meet the carbon emission targets, boosting the need for advanced wheel technologies. The demand for lightweight wheels is particularly high in the electric vehicle (EV) segment, where reducing vehicle weight directly impacts energy efficiency and range. This shift is expected to continue as the automotive sector moves towards more sustainable practices.

- For instance, a study of magnesium alloy wheels reported a weight reduction of approximately 32.3% over traditional aluminium wheels. Automakers are increasingly using lightweight materials to meet carbon-emission targets, which boosts the need for advanced wheel technologies. The demand for lightweight wheels is particularly high in EVs, where reducing vehicle weight directly impacts energy efficiency and driving range.

Technological Advancements in Wheel Manufacturing

Advancements in wheel manufacturing technology have also contributed to the growth of the France Automotive Wheel Market. Innovations such as 3D printing and automated production processes are allowing for the creation of more complex wheel designs with higher precision. These technologies enable manufacturers to optimize wheel performance, durability, and aesthetics while reducing production costs. The ability to create customized wheel designs is also appealing to both automakers and consumers. As these technologies improve, the market is likely to see further advancements in the materials and designs used in automotive wheels.

- For instance, Renault Group, together with CEA, developed a 3D-printed component architecture that enabled parts to become “around 30% lighter” using a novel lattice structure and additive manufacturing.

Increasing Vehicle Production and Customization

The growing vehicle production in France is driving the demand for automotive wheels. Manufacturers are ramping up production to meet the rising demand for both passenger cars and commercial vehicles. Customization has become a key trend, as consumers increasingly seek personalized wheels to enhance the aesthetic appeal of their vehicles. As vehicle manufacturers invest in producing vehicles with unique designs, they are turning to innovative wheel solutions to meet these needs. The rise in demand for aftermarket wheels is another factor boosting market growth.

Government Regulations Promoting Sustainability

Government regulations focused on reducing the environmental impact of vehicles are also driving the France Automotive Wheel Market. Stricter fuel efficiency standards and emissions regulations are encouraging automakers to adopt lighter and more efficient materials, including advanced alloys for wheels. The European Union’s push for carbon neutrality and reduced CO2 emissions from the automotive sector is influencing these changes. As such, there is a greater emphasis on sustainability in wheel manufacturing, which is creating significant opportunities for companies focused on eco-friendly and energy-efficient solutions.

Market Trends:

Shift Towards Alloy and Carbon Fiber Wheels

The demand for alloy and carbon fiber wheels is rising in the France Automotive Wheel Market. Alloy wheels, known for their light weight and durability, are preferred in both the OEM and aftermarket segments. Carbon fiber wheels, with their superior strength-to-weight ratio, are gaining popularity in the luxury and high-performance vehicle segments. The trend towards these advanced materials is driven by consumer desire for both aesthetic appeal and improved vehicle performance. As automakers move towards more sustainable and high-performance solutions, these materials are expected to dominate the wheel market in the coming years.

- For instance, BMW reported that its carbon-fibre wheel option can be up to 35% lighter than a standard aluminium wheel. Alloy wheels, known for their lightweight and durability, are preferred in both OEM and aftermarket segments. Carbon-fibre wheels, with their superior strength-to-weight ratio, are gaining popularity in luxury and high-performance vehicle segments. This trend is driven by consumer desire for both aesthetic appeal and improved vehicle performance.

Emergence of Smart Wheels with Integrated Sensors

Smart wheels that integrate sensor technologies are emerging as a key trend in the France Automotive Wheel Market. These wheels are equipped with sensors to monitor tire pressure, temperature, and even road conditions in real-time. The data collected by these sensors is used to optimize vehicle performance, enhance safety, and improve fuel efficiency. This trend aligns with the growing demand for connected and autonomous vehicles. With the automotive industry focusing on the development of self-driving technologies, smart wheels are becoming a vital part of the future of mobility.

- or instance, Continental AG offers direct-measurement tyre-pressure and temperature sensors mounted on the wheel, which monitor inflation in real time. These wheels are equipped with sensors to monitor tyre pressure, temperature, and even tread depth, in real time.

Focus on Sustainable Manufacturing Practices

Sustainability continues to be a significant trend within the France Automotive Wheel Market. Manufacturers are adopting more eco-friendly production methods to reduce waste and minimize the environmental impact of wheel manufacturing. This includes the use of recycled materials, energy-efficient manufacturing processes, and reducing the carbon footprint of production. Additionally, companies are focusing on designing wheels that are easier to recycle, contributing to the circular economy. As environmental regulations tighten, the industry’s shift towards sustainable practices is expected to grow.

Increased Demand for Customization and Personalization

Consumers are increasingly seeking personalized and unique wheel designs to distinguish their vehicles. The France Automotive Wheel Market is witnessing a rise in demand for customized wheels that cater to specific aesthetic preferences and functional requirements. This trend is being driven by the growing popularity of high-end, luxury, and performance vehicles where customization is a key selling point. The market is expected to see more innovations in custom wheel designs, with manufacturers offering a wide range of options in terms of finishes, colors, and styles.

Market Challenges Analysis:

Rising Raw Material Costs

One of the significant challenges facing the France Automotive Wheel Market is the increasing cost of raw materials. The prices of key materials like aluminum and steel have been volatile in recent years, making it difficult for manufacturers to manage production costs effectively. The rising costs of raw materials put pressure on profit margins and could lead to higher prices for end consumers. Manufacturers are being forced to find ways to mitigate these cost increases while maintaining the quality of their products. The fluctuation in raw material prices remains a major challenge for the entire industry.

Regulatory and Compliance Issues

The France Automotive Wheel Market faces challenges due to strict regulatory requirements in the automotive industry. These regulations cover a range of aspects, including safety standards, emissions control, and recycling. Compliance with these standards can be costly and time-consuming for manufacturers, especially as regulations become more stringent. For instance, manufacturers need to ensure that their wheels meet both performance and environmental standards, which requires significant investment in research and development. As regulations evolve, the market must adapt to these changes, which could lead to increased production costs and supply chain disruptions.

Market Opportunities:

Expansion of Electric Vehicle Market

The rise in the electric vehicle (EV) market presents significant opportunities for the France Automotive Wheel Market. As EV adoption grows, there is an increasing demand for lightweight and energy-efficient wheels that can enhance vehicle performance and range. This trend opens up new avenues for wheel manufacturers to develop specialized products for electric vehicles, including wheels with enhanced aerodynamics and materials that reduce weight. As France and the European Union push towards carbon neutrality, the EV market will continue to be a key driver for the automotive wheel industry.

Growth of the Aftermarket Segment

The aftermarket segment presents lucrative opportunities for growth within the France Automotive Wheel Market. Consumers continue to invest in aftermarket wheels for both aesthetic and performance upgrades, contributing to a growing demand for specialized and custom wheel options. As the trend towards vehicle personalization increases, the demand for unique and high-performance wheels in the aftermarket space is expected to rise. This trend offers significant potential for wheel manufacturers to expand their product offerings and cater to a wider range of consumer preferences.

Market Segmentation Analysis:

Material Type

The France Automotive Wheel Market is segmented by material type into aluminium alloy, steel, carbon fiber, magnesium, and others. Aluminium alloy wheels dominate the market due to their lightweight nature and high resistance to corrosion, which make them ideal for improving vehicle fuel efficiency. Steel wheels, known for their strength and cost-effectiveness, hold a significant market share in the budget segment. Carbon fiber wheels, although more expensive, are gaining traction in high-performance and luxury vehicles due to their superior strength-to-weight ratio. Magnesium wheels are also emerging in performance vehicles, offering a lighter alternative to aluminium, while the “others” category includes composite and specialized alloys, catering to specific vehicle requirements.

- For instance, in the concept vehicle Renault Emblème, the alloy wheels weighed just 16.5 kg each (plus 0.88 kg add-on) and were made from aluminium with 70% recycled content. Aluminium-alloy wheels dominate due to their lightweight nature and high corrosion resistance.

Vehicle Type

The market is further segmented by vehicle type into passenger vehicles, commercial vehicles, and off-highway vehicles. Passenger vehicles hold the largest share of the France Automotive Wheel Market due to the high demand for wheels in both standard and premium segments. Commercial vehicles, including trucks and vans, are driving the demand for durable and cost-efficient wheels. Off-highway vehicles, used in construction and agricultural applications, require heavy-duty wheels designed to withstand harsh conditions.

End-User

End-users of the France Automotive Wheel Market are primarily categorized into OEM and aftermarket. OEMs dominate the market as they supply wheels for new vehicle manufacturing. However, the aftermarket segment is growing steadily, fueled by consumer demand for replacement wheels, customized designs, and performance enhancements.

Rim Size / Wheel Size

The rim size or wheel size segment is diverse, encompassing various diameter categories that cater to different vehicle requirements. Smaller wheels are used in compact cars, while larger wheels are prevalent in performance and luxury vehicles. The demand for specific rim sizes continues to evolve with consumer preferences for aesthetics and functionality.

Segmentation:

Segmentation:

Material Type

- Aluminium Alloy

- Steel

- Carbon Fiber

- Magnesium

- Others

Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Off‑Highway Vehicles

End‑User

- OEM (Original Equipment Manufacturer)

- Aftermarket

Rim Size / Wheel Size

- Various diameter categories

Geography / Country‑Wise Analysis

- France

- Key European Markets (Germany, Italy, UK, etc.)

- Other Emerging Regions

Regional Analysis:

Western Europe Region

The France Automotive Wheel Market is heavily influenced by the Western Europe region, which accounts for approximately 30 % of the market share. France contributes significantly due to its strong‐OEM base and high aftermarket penetration. Manufacturers in Germany, Italy and France maintain large production capacities and robust supply chains that support wheel volume and value growth. Consumer demand in luxury and premium vehicles elevates demand for advanced wheels, increasing regional share. Regulatory pressures on CO₂ and weight reduction standards further drive adoption of lightweight materials, boosting local wheel market expansion. The region’s mature automotive ecosystem gives it a strategic edge in both OEM and aftermarket segments.

Eastern & Central Europe Region

Eastern and Central Europe represent roughly 18 % of the market share for the France Automotive Wheel Market when considering cross‑border supply and parts exports. Emerging vehicle production hubs in Poland, Czech Republic and Hungary stimulate demand for wheels and wheel assemblies. Lower labour costs and increasing foreign investment in vehicle manufacturing strengthen this regional presence. Manufacturers often use Eastern European plants to serve both local demand and export into Western Europe. The region also benefits from growth in commercial vehicle production, which increases demand for steel‑based and standard wheels. The growth rate in this region tends to exceed that in Western Europe due to investment momentum and capacity expansion.

Rest of Europe & Global Export Markets

The rest of Europe combined with export markets for components held about 14 % of the market share for the France Automotive Wheel Market. Countries such as Spain, Portugal and Turkey serve as both manufacturing bases and export platforms. Export demand into regions outside Europe further supports wheel manufacturers in France and its partner countries. This region offers growth potential thanks to rising vehicle ownership in Eastern Europe and North Africa, and increased demand for aftermarket wheels. Wheel producers in France tap into these markets to balance OEM volumes with export and aftermarket supply. Export logistics, trade regulations and regional market dynamics play a key role in shaping growth in this segment.

Key Player Analysis:

Competitive Analysis:

The France Automotive Wheel Market is highly competitive, with several global and regional players operating in the space. Key manufacturers focus on producing a variety of wheels for both OEMs and the aftermarket segment. Players such as Ronal Group, Enkei Corporation, and CITIC Dicastal dominate the market with advanced manufacturing capabilities, strong supply chain networks, and innovation in wheel design. These companies are increasingly investing in new technologies, such as lightweight alloy wheels and carbon fiber wheels, to meet the growing demand for high-performance and fuel-efficient products. Intense competition has also led to mergers, acquisitions, and strategic partnerships to enhance market share and expand product portfolios. The market is also witnessing consolidation as larger players aim to capture a higher portion of the growing demand for eco-friendly wheels.

Recent Developments:

- In August 2024, Borbet GmbH expanded its product portfolio through a strategic acquisition. The German light alloy wheel manufacturer acquired Dymag Technologies Limited, a UK-based specialist in carbon and magnesium automotive and motorcycle wheels.

- In January 2025, CITIC Dicastal achieved a significant milestone when its Morocco plant was recognized as Africa’s first “Lighthouse Factory” by the World Economic Forum. Located in the Atlantic Free Zone, the facility spans 25.33 hectares and comprises three phases dedicated to producing aluminum wheels and castings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on material types, vehicle types, and end-users. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for lightweight materials, including carbon fiber and aluminum alloys, will continue to drive growth.

- Electric vehicle production will further boost the adoption of advanced, energy-efficient wheels.

- Market players will focus on technological innovations like smart wheels and integrated sensors.

- The aftermarket segment is expected to see significant expansion as consumer vehicle customization increases.

- Sustainability will be a major focus, with companies investing in eco-friendly materials and production methods.

- New entrants will face intense competition from established players with strong brand loyalty.

- Price fluctuations in raw materials will affect manufacturing costs and consumer prices.

- Expansion into emerging markets will provide new growth opportunities.

- Regulatory pressures on CO₂ emissions will continue to influence product development.

- Ongoing research in wheel durability and performance will lead to the development of more resilient products.

Market Insights:

Market Insights:

Segmentation:

Segmentation: