Market Overview:

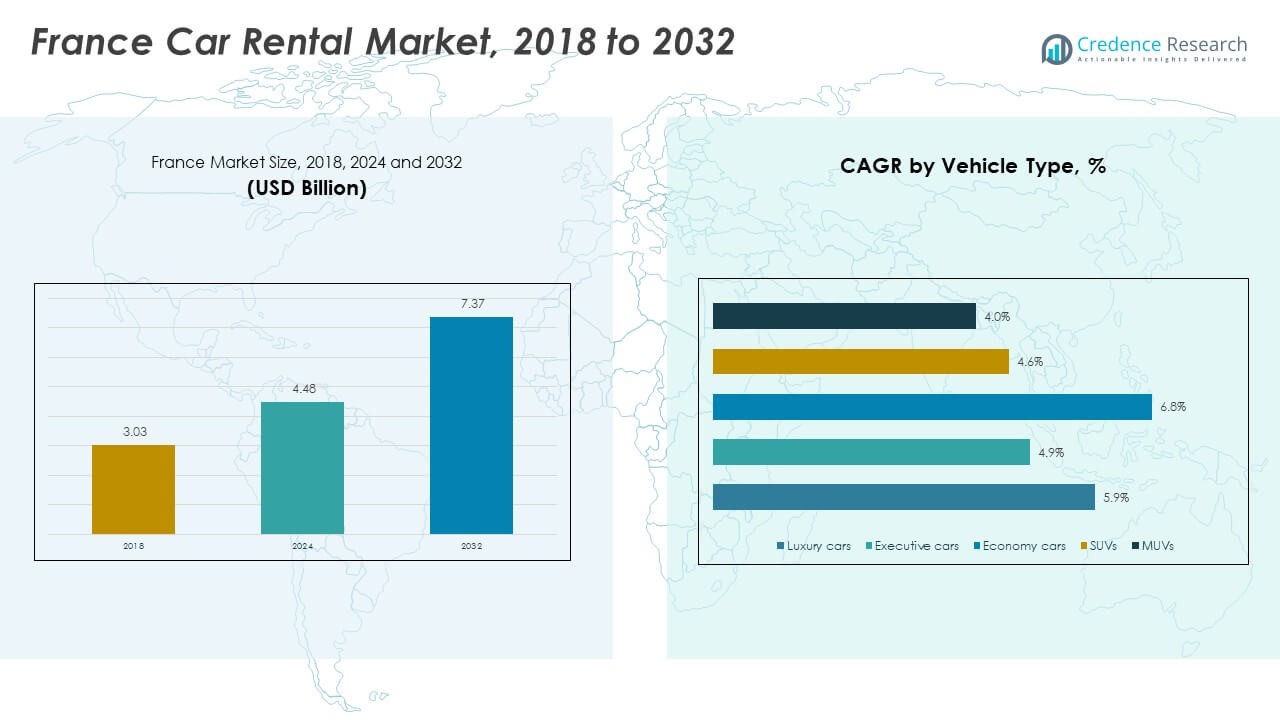

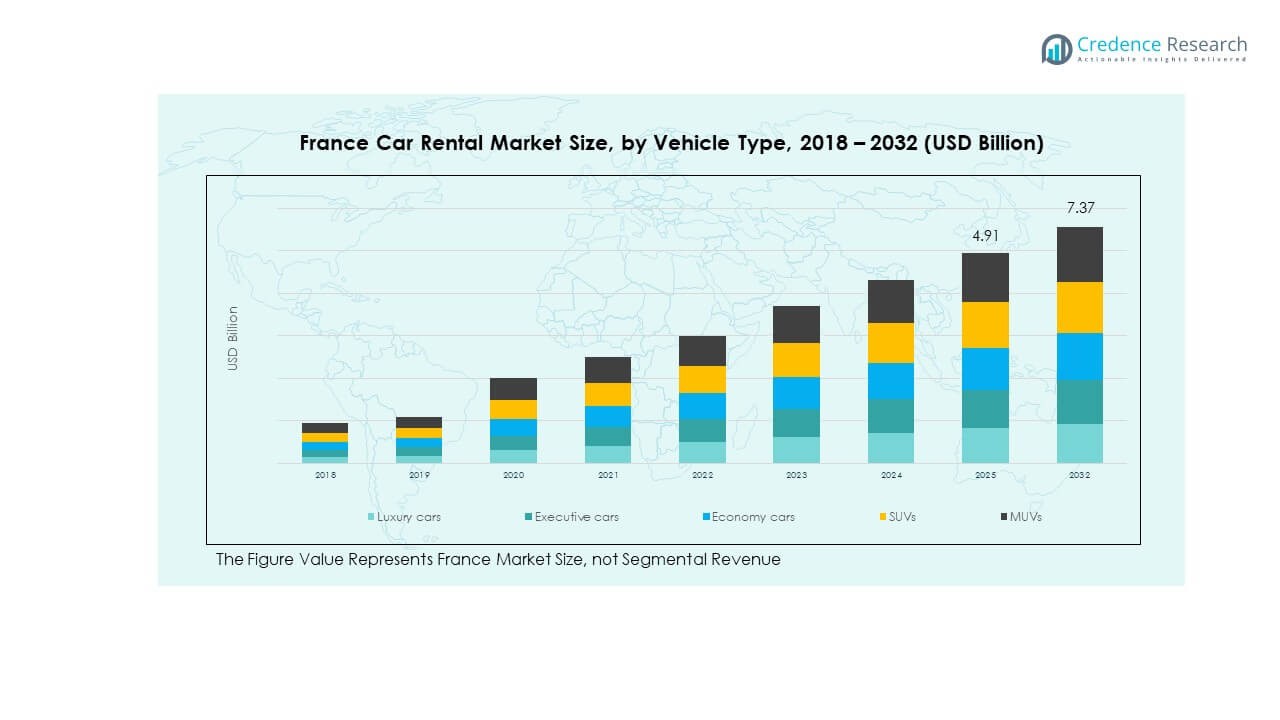

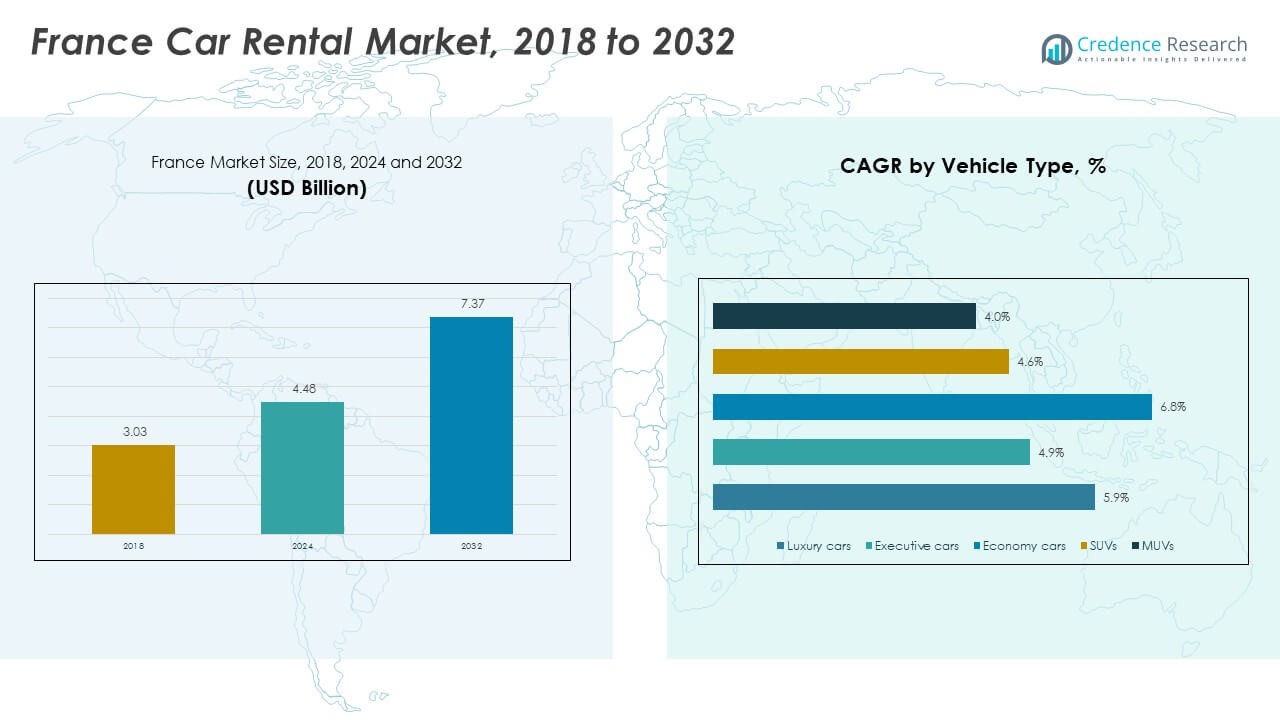

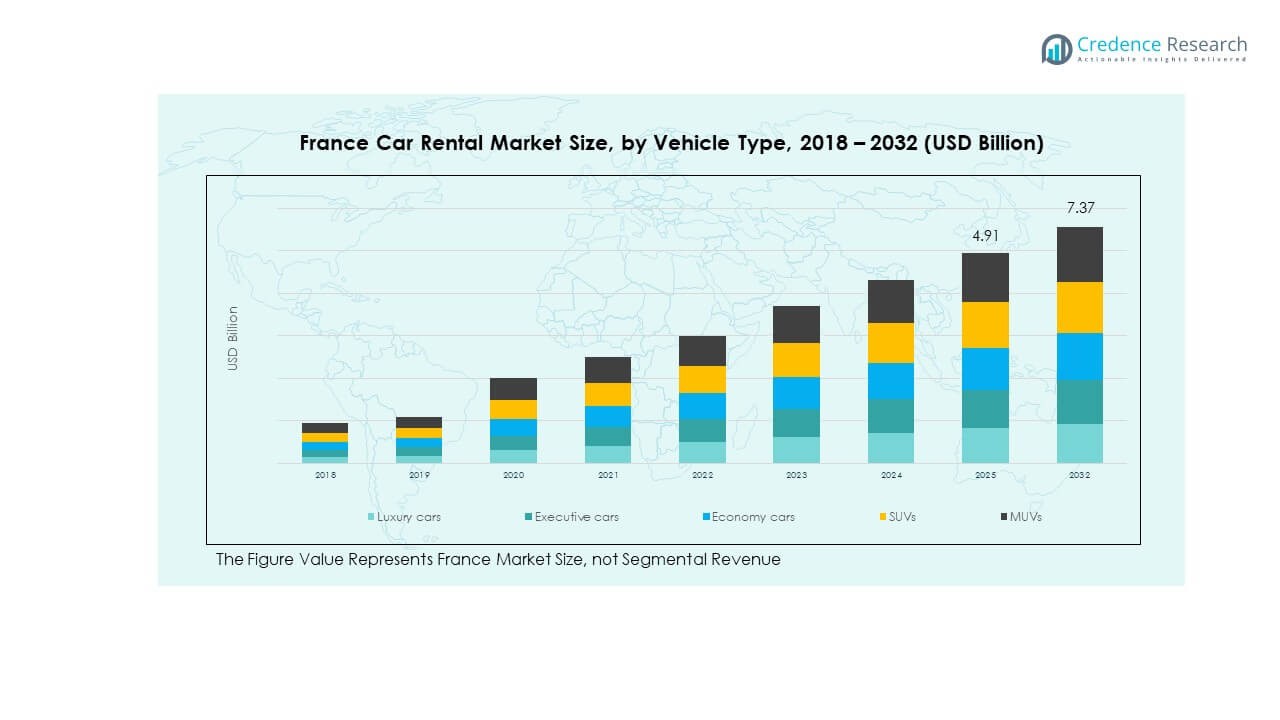

The France Car Rental Market size was valued at USD 3.03 billion in 2018, rose to USD 4.48 billion in 2024, and is anticipated to reach USD 7.37 billion by 2032, at a CAGR of 5.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Car Rental Market Size 2024 |

USD 4.48 Billion |

| France Car Rental Market, CAGR |

5.97% |

| France Car Rental Market Size 2032 |

USD 7.37 Billion |

The market is being driven by rising leisure travel and tourism as more visitors and local residents turn to rentals for flexibility and convenience. Digital booking platforms and mobile apps are streaming rental operations, making it easier for consumers to compare and book vehicles. Also, a shift towards short‑term solutions rather than ownership, especially among younger people, is increasing demand for rental services.

In terms of geography, western France including Paris and the Mediterranean coast remains a stronghold due to tourist influx and airport rental hubs. Emerging growth is seen in smaller urban centres and rural regions as mobility preferences change and car sharing gains traction. Meanwhile, neighbouring countries’ markets such as Germany and Spain influence cross‑border rental demand, so France benefits from its central location in Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Car Rental Market was valued at USD 3.03 billion in 2018, with projections to reach USD 4.91 billion in 2024 and USD 7.37 billion by 2032, growing at a CAGR of 5.97% from 2024 to 2032.

- The Île-de-France region, including Paris, holds the largest market share, accounting for approximately 30%, driven by high tourist traffic and business travel. The Provence-Alpes-Côte d’Azur region follows with 20%, benefiting from strong tourism. The third-largest market share is in the Auvergne-Rhône-Alpes region, at 15%, with growing demand for both leisure and business rentals.

- The fastest-growing region is Grand Est, with an expected growth rate of 6.5% annually, driven by increased regional mobility and an expanding rental infrastructure.

- Luxury cars make up 20% of the total rental market, while executive cars account for 25% of the fleet. Economy cars dominate at 45%, representing the most popular choice among customers due to their affordability and practicality.

- SUV and MUV rentals are gaining traction, accounting for 10% and 15% of the market share, respectively, reflecting increasing demand for vehicles with higher capacity and off-road capabilities.

Market Drivers:

Increasing Tourism and Business Travel

The France Car Rental Market is experiencing growth due to the rising number of international and domestic tourists. France remains one of the most visited countries globally, with major tourist destinations like Paris, Nice, and Lyon. Rental cars offer tourists flexibility and convenience, especially for exploring regions outside urban centres. Business travel also contributes significantly as corporate clients increasingly opt for rental cars to attend meetings and conferences. This growing influx of tourists and business professionals ensures a steady demand for car rental services.

- For instance, Europcar Mobility Group reported a fleet size of approximately 267,000 vehicles in the first half of 2024, up from 251,000 the previous period, reflecting the increased demand for vehicle rentals in France and abroad.

Shifts in Consumer Mobility Preferences

Consumers are increasingly opting for rental vehicles over car ownership. The growing trend toward shared mobility solutions is transforming the market. Younger generations, in particular, are showing preference for renting vehicles due to the high cost of car ownership and maintenance. Short-term car rental solutions provide better flexibility and lower financial commitment. This shift in consumer preferences is creating a more dynamic market, with rental providers offering tailored packages and services to meet the needs of various customer segments.

- For instance, Europcar’s subsidiary Ubeeqo (re‑branded as Europcar On Demand in 2024) secured 851 parking locations out of 1,213 in Paris by May 2019, showing how rental and shared mobility services are expanding in urban France.

Technological Advancements in Car Rentals

Technological innovations are shaping the France Car Rental Market, with digital platforms and mobile applications enhancing customer experience. Mobile apps enable customers to easily book and manage rentals, driving convenience and efficiency. Online comparison platforms allow users to evaluate options based on price, vehicle type, and location. Moreover, advanced vehicle tracking and GPS technology improve the rental experience by offering added security and location-based services. The increasing reliance on digital tools and the integration of AI further streamline the booking and fleet management process.

Government Support for Sustainable Transport

Government regulations promoting sustainable transport also support the growth of the France Car Rental Market. Policies aimed at reducing carbon emissions are encouraging the adoption of eco-friendly vehicles within rental fleets. The French government has introduced incentives for the adoption of electric vehicles (EVs), boosting demand for electric car rentals. With rising environmental consciousness, car rental companies are investing in cleaner vehicle options to meet regulatory requirements and consumer preferences for greener alternatives.

Market Trends:

Growth of Electric and Hybrid Vehicle Fleets

The France Car Rental Market is seeing a steady rise in the adoption of electric and hybrid vehicles. Car rental companies are responding to environmental concerns and shifting consumer demands by integrating more eco-friendly vehicles into their fleets. As the French government promotes the adoption of electric vehicles through subsidies and tax incentives, rental services are expanding their electric vehicle (EV) offerings. Consumers increasingly seek out EVs for their reduced environmental impact, lower fuel costs, and government rebates, aligning with broader trends toward sustainability.

- For instance, data shows that as of 2021, France had registered a total of 786,274 light‑duty plug‑in electric vehicles (512,178 all‑electric plus 274,096 plug‑in hybrids).

Enhanced Digitalization and Contactless Services

The trend of digitalization is transforming the car rental industry in France. Customers now prefer booking rental cars via mobile apps or websites, driving the rise of online rental services. Contactless check-ins and keyless car entry are becoming more common, allowing for a smoother, safer rental process. The rise of contactless services is especially notable in the wake of the COVID-19 pandemic, as consumers continue to prioritize health and safety. Rental companies are leveraging digital tools to enhance customer experience, improve operational efficiency, and increase revenue.

- For instance, Avis Budget Group announced the installation of 50,000 Unified Telematics Platform devices to convert that many vehicles into connected cars, more than doubling its connected fleet and enhancing the rental customer experience through app‑based control.

Shift Toward Peer-to-Peer Car Rental Services

A significant trend in the France Car Rental Market is the emergence of peer-to-peer (P2P) car rental platforms. These services allow individuals to rent their personal vehicles to others, expanding rental options and increasing fleet diversity. P2P rental models are becoming popular due to their affordability and convenience for both vehicle owners and renters. These platforms often operate via user-friendly apps, providing seamless rental transactions. This growing segment is reshaping the traditional rental model by providing consumers with more options and competitive pricing.

Increased Focus on User-Centric Services

Rental companies in France are increasingly focusing on user-centric services to enhance customer satisfaction. This includes flexible rental durations, home delivery of rental vehicles, and personalized services based on customer preferences. The ability to rent a car for specific needs, such as vacation, business trips, or one-way rentals, is gaining traction. Many companies are also offering premium services like luxury car rentals, tailored to high-end clientele seeking exclusive options. By prioritizing customer preferences, the France Car Rental Market is positioning itself for continued growth.

Market Challenges Analysis:

High Competition and Market Fragmentation

One of the main challenges facing the France Car Rental Market is the high level of competition among rental companies. The market is fragmented with several players competing for market share, which limits profitability. Smaller companies struggle to match the extensive fleets and technological advancements of large rental chains, creating challenges in customer retention and brand differentiation. This intensifying competition is forcing rental companies to continuously innovate in pricing strategies, services, and fleet offerings to stay ahead.

Rising Operational Costs and Fleet Management Issues

Rising operational costs are another challenge for the France Car Rental Market. Managing a fleet of vehicles requires substantial investment in maintenance, insurance, and operational overheads, which can significantly impact margins. Additionally, fluctuating fuel prices and vehicle depreciation further complicate cost management. Rental companies must efficiently manage their fleet to reduce downtime and maintenance costs, which requires sophisticated logistics and management systems. The need to optimize operations while maintaining competitive pricing pressures rental companies to adapt quickly.

Market Opportunities:

Expansion of Car Sharing and Ride-Hailing Services

The growing popularity of car-sharing and ride-hailing services presents significant opportunities for the France Car Rental Market. Consumers increasingly prefer flexible mobility solutions over traditional car ownership, especially in urban areas. Car-sharing platforms, which allow users to rent vehicles for short durations, are expanding rapidly in major French cities. This growing demand for shared mobility solutions opens new avenues for rental companies to diversify their service offerings and cater to a broader customer base.

Integration of Autonomous Vehicles into Fleets

Another promising opportunity in the France Car Rental Market is the integration of autonomous vehicles into rental fleets. With advancements in self-driving technology, rental companies are exploring the potential for offering autonomous cars for rent. Autonomous vehicles have the potential to enhance the convenience and safety of car rentals, attracting consumers seeking innovative travel solutions. As autonomous technology continues to evolve, car rental companies in France are positioning themselves to lead in the emerging market of self-driving rentals.

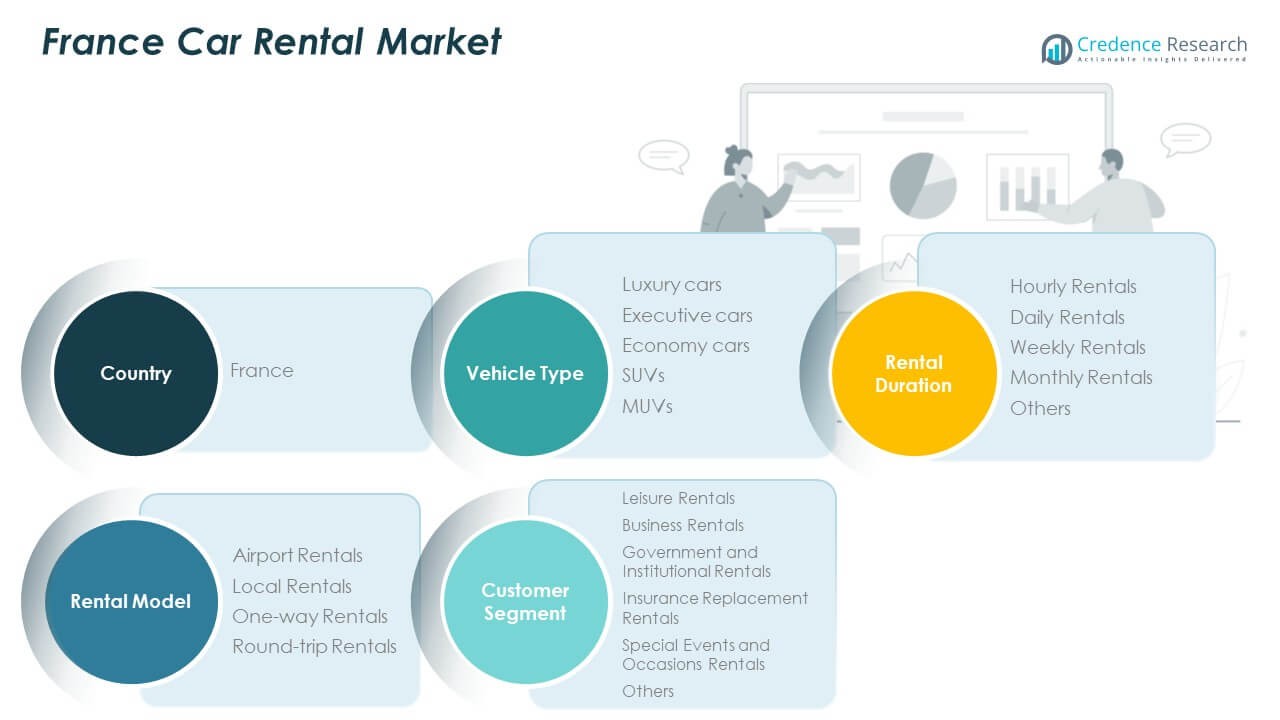

Market Segmentation Analysis:

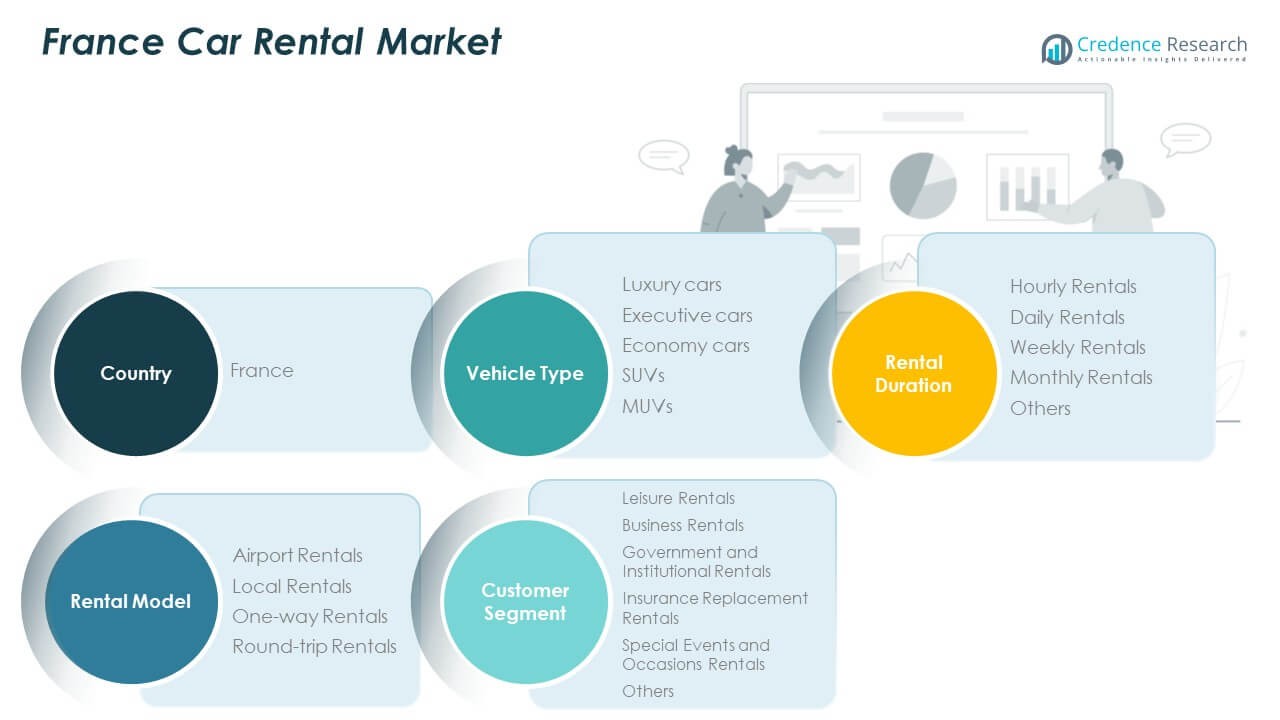

By Vehicle Type

The France Car Rental Market offers a diverse range of vehicles to meet various customer needs. Luxury cars cater to high-end clients seeking premium experiences, especially for business trips and special events. Executive cars are popular among professionals for their comfort and status, while economy cars dominate the market due to their affordability and practicality. SUVs and MUVs have gained traction for their versatility, appealing to customers requiring extra space and those traveling to regions with challenging terrains.

- For instance, SIXT’s France webpage highlights a dedicated SUV rental category equipped with high‑grade safety features such as anti‑lock disc brakes, to cater to customers seeking versatile vehicles for various conditions.

By Rental Duration

Rental duration in the France Car Rental Market spans from hourly rentals to monthly leases. Hourly rentals cater to short-term needs, often for local travel or specific tasks. Daily rentals are the most common choice, with customers opting for a full day’s usage. Weekly and monthly rentals serve customers needing extended use, often for business or relocation purposes. The “Others” segment includes unique rental durations such as weekend or event-specific rentals, offering flexibility for various scenarios.

- For instance, SIXT’s business mobility solutions allow for short‑term rentals tailored to business trips between airport or train‑station pickup and hotel or conference locations.

By Rental Model

The France Car Rental Market includes several rental models such as airport rentals, which are highly popular for tourists and business travelers. Local rentals are commonly used by residents and visitors for city-based travel. One-way rentals allow for flexible pick-up and drop-off locations, while round-trip rentals are preferred by customers planning to return to the original pickup point. These models provide diverse options for different customer needs, from leisure to business travel.

By Customer Segment

Leisure rentals dominate the France Car Rental Market, driven by tourists exploring the country. Business rentals are also a significant segment, with corporate clients relying on rental cars for meetings and events. Government and institutional rentals cater to public sector demands, while insurance replacement rentals serve clients whose vehicles are temporarily out of use. Special events and occasions rentals provide luxury and convenience for specific celebrations, further expanding the market’s reach.

Segmentation:

By Vehicle Type

- Luxury Cars

- Executive Cars

- Economy Cars

- SUVs

- MUVs

By Rental Duration

- Hourly Rentals

- Daily Rentals

- Weekly Rentals

- Monthly Rentals

- Others

By Rental Model

- Airport Rentals

- Local Rentals

- One-way Rentals

- Round-trip Rentals

By Customer Segment

- Leisure Rentals

- Business Rentals

- Government and Institutional Rentals

- Insurance Replacement Rentals

- Special Events and Occasions Rentals

- Others

By Country

- France Car Rental Market Volume By Country

- France Car Rental Market Revenue By Country

Regional Analysis:

Major West‑Coastal & Paris‑Gateway Region

The Île‑de‑France region, which includes Paris and surrounding suburbs, accounts for approximately 30% of the France Car Rental Market. It benefits from high tourist foot‑traffic and major airport hubs that support large rental volumes. Corporate travel and luxury rentals are especially strong here because many multinational firms and premium travellers operate in this area. Rental fleet turnover is higher due to frequent airport pickups and drop‑offs. Rental companies concentrate on digital‑first services and premium vehicle types to serve this corridor. The dense infrastructure and high disposable income support sustained demand for rental vehicles across categories.

Southern Tourism & Leisure Region

The Provence‑Alpes‑Côte d’Azur region and the French Riviera contribute about 20% of the total market share. It attracts both domestic and international tourists, generating strong demand for short‑term rentals, SUVs and luxury vehicles for scenic travel. Tourism seasonality strongly influences rental volumes here, with spikes in summer months and slower demand in off‑peak periods. Rental firms focus on one‑way and daily rentals in this region to accommodate holiday makers. Vehicle fleets there skew toward leisure‑friendly types with extra cargo space and comfort. This region presents a lucrative niche for premium rentals and tailored services.

Emerging Secondary & Rural Regions

Regions such as Auvergne‑Rhône‑Alpes and Grand Est together represent roughly 50% of the France Car Rental Market. They currently have lower penetration of premium and business travel segments but show strong growth potential. Local mobility needs, rural tourism, and regional airport expansion drive rental service adoption here. Economy and mid‑range vehicle types dominate usage, while rental duration tends to lean toward weekly and monthly models. Rental companies expanding into these regions tap an underserved market, offering competitive pricing and convenient pickup/drop‑off services. It presents a strategic growth front for firms looking to scale beyond major urban centres.

Key Player Analysis:

- Europcar France

- Hertz France

- Sixt France

- Avis France

- Rent A Car Group

- ADA Rent A Car

- Ucar

- National Citer

- Budget France

- Avis Budget Group

Competitive Analysis:

The France Car Rental Market is highly competitive, with several key players vying for market share. Major rental agencies such as Europcar France, Hertz France, and Sixt France dominate the market, while smaller players like Rent A Car Group and ADA Rent A Car cater to niche segments. These companies compete on factors such as fleet diversity, pricing models, and customer service. The market is also characterized by the increasing presence of digital platforms, offering customers ease of booking and comparison. To maintain an edge, companies are expanding their offerings, enhancing fleet capabilities, and focusing on customer convenience, particularly in high-traffic regions like Paris and the French Riviera.

Recent Developments:

- In September 2025, Hertz Global unveiled a comprehensive transformation of its retail operations by launching a fully online car-buying marketplace at HertzCarSales.com, representing a major milestone in the company’s digital evolution.

- In January 2024, Sixt and Stellantis reached a landmark multi-billion euro agreement under which Sixt committed to purchasing up to 250,000 vehicles for its rental fleet across Europe and North America over three years, running through 2026.

- In July 2025, Avis Budget Group announced a transformative multi-year strategic partnership with Waymo, the autonomous driving technology leader, to launch and scale a fully autonomous ride-hailing service in Dallas.

- In October 2025, Avis Budget Group launched Avis First, an innovative premium concierge-style car rental service designed to revolutionize the airport arrival experience for discerning travelers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on by vehicle type, rental duration, rental model, and customer type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for electric vehicles in the France Car Rental Market will continue to rise as environmental regulations tighten.

- Digital platforms will play a larger role in shaping customer experiences, making car rental more convenient and accessible.

- Emerging regions, especially rural and secondary cities, will see increased market penetration as rental options expand.

- Business rentals will experience growth due to the rise in corporate travel and the need for flexible mobility solutions.

- The demand for luxury vehicles will grow as tourism and high-net-worth individuals increase.

- Companies will increasingly focus on offering short-term, flexible rental models to meet evolving consumer preferences.

- The introduction of autonomous vehicles in rental fleets will disrupt the market, attracting tech-savvy customers.

- Partnerships between car rental companies and ride-sharing platforms will become more common to offer integrated services.

- Increased investment in AI and data analytics will enhance fleet management and operational efficiency.

- Regional competition will intensify as players seek to capture more market share in high-growth areas.