Market Overview:

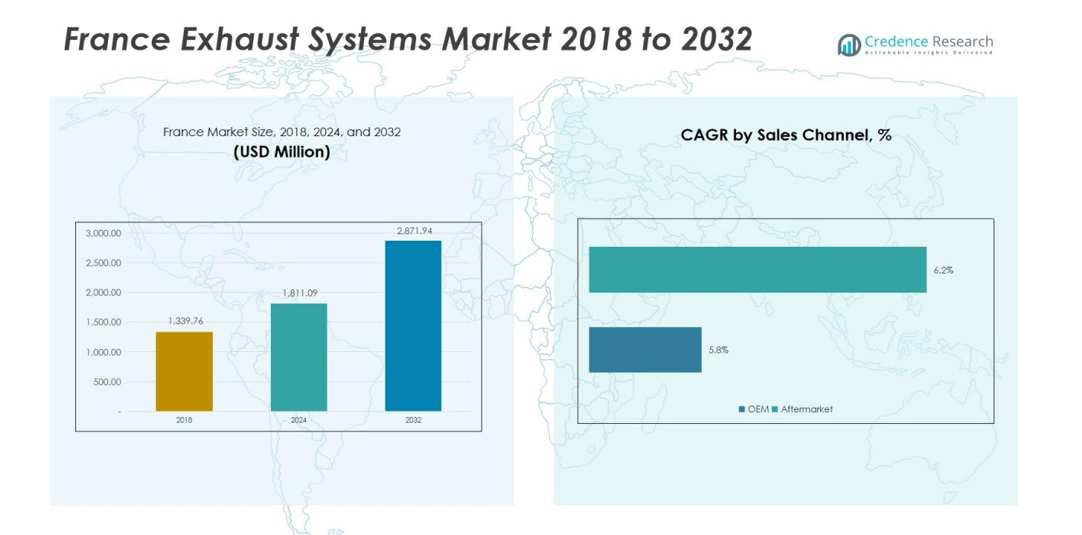

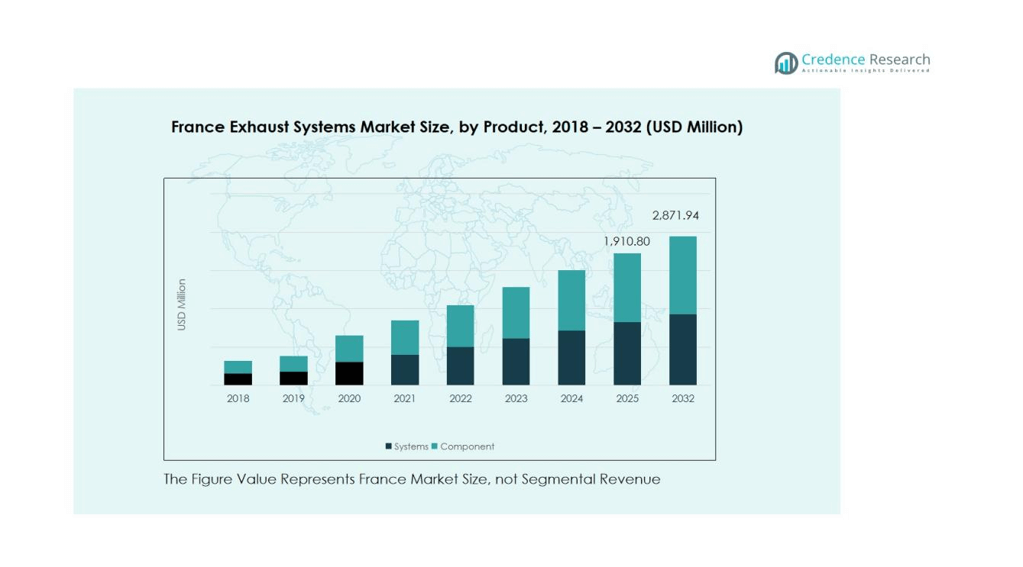

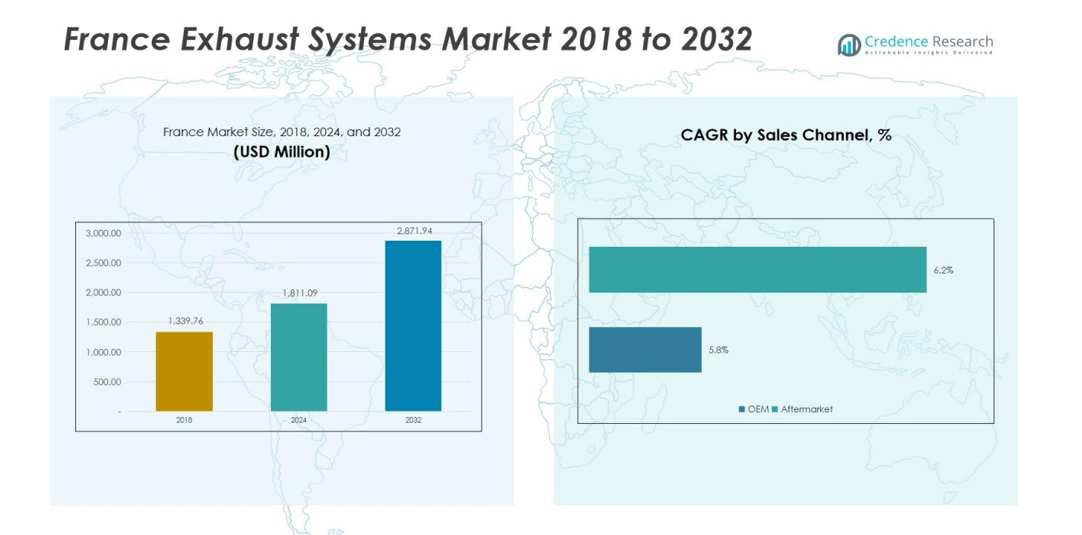

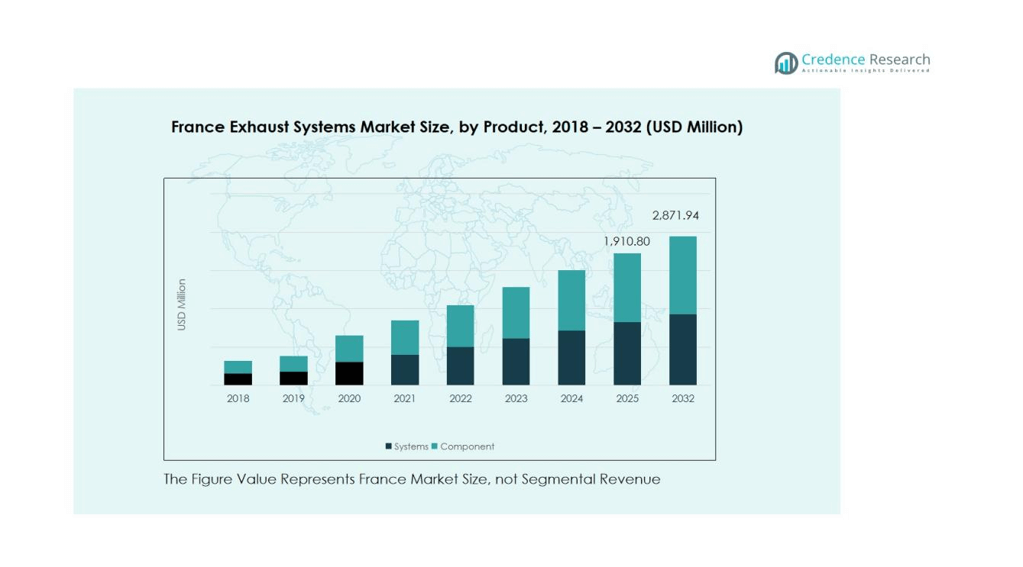

The France Exhaust Systems Market size was valued at USD 1,339.76 million in 2018 to USD 1,811.09 million in 2024 and is anticipated to reach USD 2,871.94million by 2032, at a CAGR of 5.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Exhaust Systems Market Size 2024 |

USD 1,811.09 million |

| France Exhaust Systems Market, CAGR |

5.61% |

| France Exhaust Systems Market Size 2032 |

USD 2,871.94million |

Stringent emission standards, including Euro 6 and the upcoming Euro 7 norms, are driving technological innovation in exhaust after-treatment systems. Manufacturers are focusing on advanced catalytic converters, diesel particulate filters, and lightweight materials to improve emission control and vehicle efficiency. The shift toward hybrid and plug-in hybrid vehicles further strengthens demand for optimized exhaust systems capable of reducing pollutants while maintaining engine performance and durability.

Regionally, Northern and Western France dominate the market due to strong automotive manufacturing hubs in Île-de-France, Hauts-de-France, and Grand Est. These regions benefit from robust R&D infrastructure and the presence of major OEMs and Tier-1 suppliers. Southern France is emerging as a growth area driven by expanding EV-hybrid production facilities and government incentives promoting sustainable automotive technologies.

Market Insights:

- The France Exhaust Systems Market was valued at USD 1,339.76 million in 2018, reached USD 1,811.09 million in 2024, and is projected to attain USD 2,871.94 million by 2032, growing at a CAGR of 5.61% during the forecast period.

- Northern France holds 38% of the market share, driven by established OEMs and Tier-1 suppliers in Île-de-France and Hauts-de-France. Western France accounts for 31%, supported by advanced manufacturing and export capacity, while Central France represents 18%, strengthened by strong supply chain networks.

- Southern France is the fastest-growing region with nearly 13% share, supported by expanding EV and hybrid assembly facilities and favorable government incentives for green mobility.

- By product type, catalytic converters lead with around 42% share, followed by mufflers and exhaust pipes with a combined 37%, supported by demand for better emission control and acoustic performance.

- By vehicle type, passenger vehicles dominate with nearly 68% share due to high production volumes and rising adoption of hybrid models, while commercial vehicles hold about 22%, driven by logistics and public transport demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Regulations Driving Technological Advancements

The France Exhaust Systems Market is primarily driven by stringent emission norms aligned with European Union directives. Regulations under Euro 6 and the upcoming Euro 7 standards push manufacturers to develop advanced exhaust after-treatment solutions. Companies are investing in catalytic converters, diesel particulate filters, and selective catalytic reduction systems to reduce carbon and nitrogen oxide emissions. It fosters continuous innovation and adoption of lightweight, corrosion-resistant materials for better efficiency and durability.

- For Instance, Forvia (Faurecia) developed its Electrically Heated Catalyst (EHC) technology, which significantly contributes to reducing emissions during cold starts, by as much as 85%. This technology, along with other advanced emission-control solutions from Forvia, helps vehicles align with ambitious emissions targets, including those for Euro 7 compliance.

Growing Adoption of Hybrid and Plug-In Hybrid Vehicles Stimulating Demand

Hybrid and plug-in hybrid vehicles are gaining traction across France, influencing demand for optimized exhaust systems. These vehicles require advanced systems for thermal management and pollutant control, even under variable engine loads. The France Exhaust Systems Market benefits from this trend as automakers design flexible exhaust architectures compatible with hybrid technologies. Government incentives promoting low-emission mobility accelerate this adoption.

- For instance, in France alone, the Renault 5 E-Tech, which was launched in late 2024, was the best-selling electric B-segment city car in November and December of that year, contributing to the overall rise in BEV adoption across Europe.

Increased Focus on Lightweight Materials Enhancing Fuel Efficiency

Automotive manufacturers are increasingly using stainless steel, titanium, and composite alloys to develop lightweight exhaust systems. These materials improve heat resistance, reduce overall vehicle weight, and enhance fuel efficiency. It helps meet environmental targets while improving vehicle performance and reliability. The shift toward lightweight construction supports both cost savings and sustainability goals within the French automotive industry.

Strong R&D Investment Supporting Sustainable Mobility Goals

France maintains a robust automotive research ecosystem supported by major OEMs and Tier-1 suppliers. Continuous R&D efforts focus on cleaner exhaust solutions and integration with electric and hybrid platforms. The France Exhaust Systems Market gains from this collaboration between industry and government to achieve carbon neutrality targets by 2050. Strategic investment in innovation and sustainable mobility technologies reinforces long-term market growth.

Market Trends:

Rising Integration of Advanced After-Treatment Technologies Across Vehicle Platforms

The France Exhaust Systems Market is witnessing rapid integration of selective catalytic reduction (SCR), gasoline particulate filters (GPF), and diesel oxidation catalysts (DOC). Automakers are prioritizing these technologies to comply with tightening emission limits under Euro 7 regulations. It improves fuel efficiency and reduces nitrogen oxide and carbon emissions across passenger and commercial vehicles. Manufacturers are also focusing on modular exhaust designs that simplify maintenance and lower production costs. The trend is reinforced by France’s strong regulatory framework promoting sustainable mobility and decarbonization of the transport sector. Leading OEMs and suppliers are aligning R&D toward compact, high-performance exhaust systems compatible with hybrid and plug-in hybrid vehicles.

- For Instance, FORVIA reported that it was on track to achieve an 80% cut in company-wide Scope 1 and 2 emissions by the end of 2025, compared to 2019 levels.

Shift Toward Electrified Powertrains and Lightweight Construction Materials

The ongoing transition toward electric and hybrid vehicles is influencing the structural design of exhaust systems in France. The France Exhaust Systems Market benefits from the need for thermal and acoustic management components in hybrid models, even when full EV demand grows. Lightweight alloys such as stainless steel, titanium, and aluminum composites are replacing traditional materials to improve durability and reduce vehicle weight. It enables automakers to achieve better fuel efficiency and extend vehicle lifespan. The focus on recyclability and material efficiency supports national sustainability goals. Manufacturers are investing in material science and advanced manufacturing methods, including 3D printing and robotic welding, to achieve higher precision and reduced emissions throughout production.

- For Instance, FORVIA, headquartered in Nanterre, operates 78 R&D centers worldwide. The company has developed innovative lightweight exhaust systems, such as its award-winning “Resonance Free Pipe,” which offers up to 3kg in weight savings.

Market Challenges Analysis:

Stringent Emission Norms Increasing Compliance and Production Costs

The France Exhaust Systems Market faces challenges from strict emission regulations that require advanced and costly technologies. Compliance with Euro 6 and Euro 7 standards drives up R&D and material expenses for manufacturers. It increases the financial burden on small and mid-sized suppliers with limited technical capabilities. Complex testing, certification, and continuous upgrades to meet evolving environmental rules extend development timelines. These high costs pressure profit margins and create uncertainty for long-term investment planning.

Growing Electric Vehicle Adoption Reducing Demand for Traditional Exhaust Systems

The rising shift toward electric vehicles presents a major challenge for conventional exhaust system manufacturers in France. The France Exhaust Systems Market is under pressure as EVs do not require combustion-based emission components. It forces established players to diversify portfolios toward hybrid-compatible or alternative propulsion technologies. Market demand is gradually shifting toward heat recovery and acoustic components instead of full exhaust assemblies. The declining share of internal combustion vehicles may restrain future revenue growth. Manufacturers must adapt through innovation and partnerships to remain competitive in a changing mobility landscape.

Market Opportunities:

Expansion of Hybrid Vehicle Segment Creating Product Development Opportunities

The growing shift toward hybrid and plug-in hybrid vehicles presents new opportunities for exhaust system manufacturers in France. The France Exhaust Systems Market benefits from hybrid models that still rely on efficient emission control during engine operation. It allows companies to develop compact, adaptive exhaust designs for dual powertrains. Advanced systems capable of managing variable heat loads and emissions offer a competitive edge. The transition encourages OEMs and suppliers to collaborate on flexible exhaust architectures suited for hybrid platforms. Manufacturers investing in hybrid-specific exhaust solutions can strengthen their market share in a rapidly transforming automotive environment.

Innovation in Lightweight and Sustainable Materials Supporting Market Growth

The focus on reducing vehicle weight and carbon footprint opens opportunities for advanced material adoption. The France Exhaust Systems Market gains from the use of stainless steel, titanium, and aluminum alloys that enhance durability and performance. It drives demand for materials that balance cost efficiency with recyclability. Ongoing innovation in 3D printing and precision welding further improves manufacturing efficiency and system reliability. France’s strong sustainability policies and support for eco-friendly manufacturing strengthen this opportunity. Companies that integrate green production methods and lightweight materials can achieve higher efficiency while aligning with national environmental objectives.

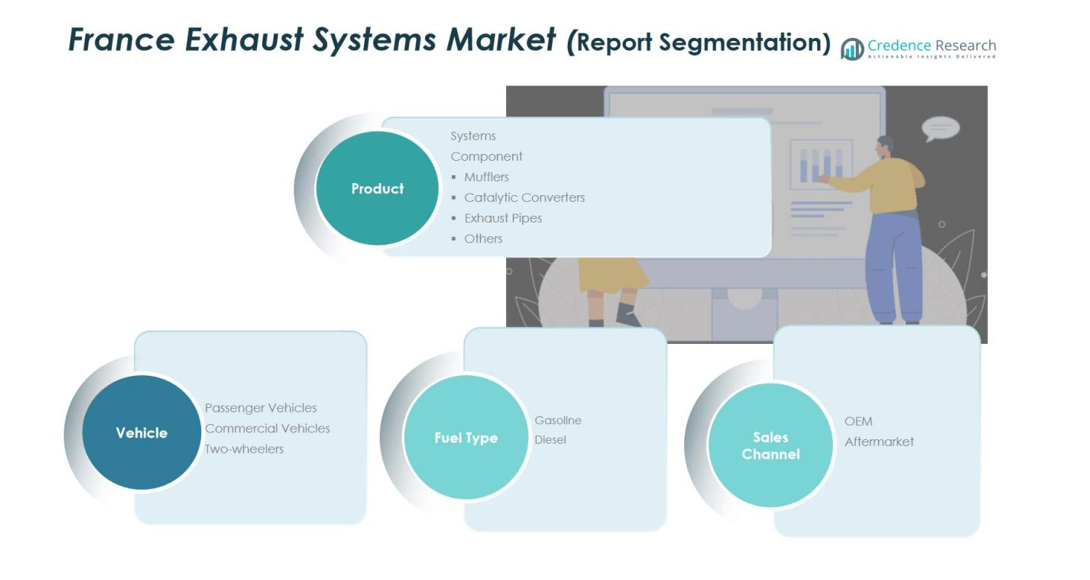

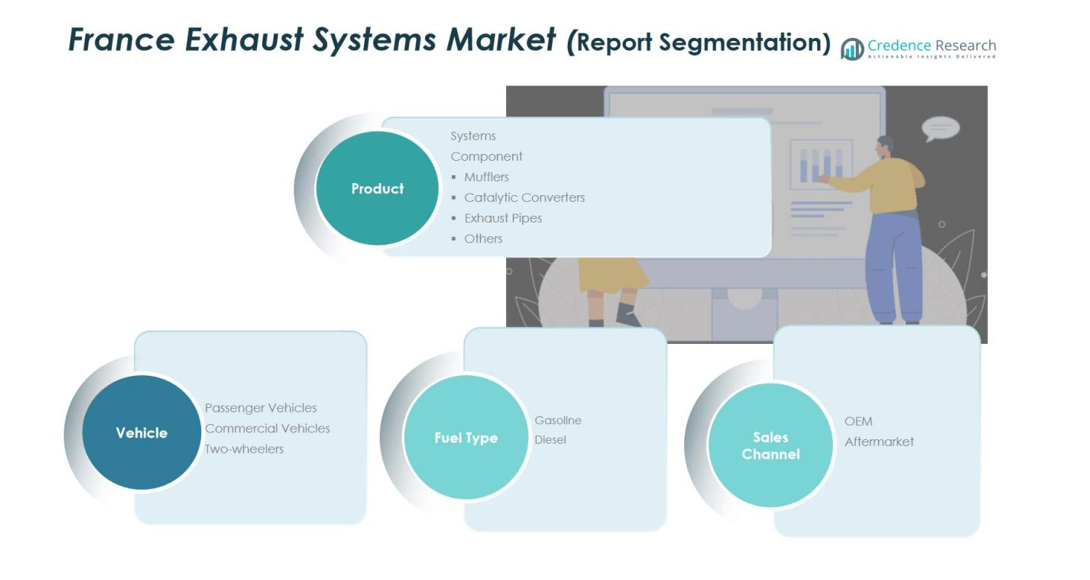

Market Segmentation Analysis:

By Product Type

The France Exhaust Systems Market includes systems and components such as mufflers, catalytic converters, exhaust pipes, and other related parts. Catalytic converters hold a major share due to their essential role in reducing nitrogen oxide and hydrocarbon emissions. Mufflers and exhaust pipes follow, driven by the demand for improved acoustic performance and thermal management. It continues to benefit from advancements in lightweight materials and compact modular designs that enhance vehicle efficiency and compliance with Euro 6 and Euro 7 standards.

- For Instance, Faurecia’s SCR BlueBox® technology is designed to improve low-temperature performance, but the 95% figure typically represents the system’s peak performance under optimal, and usually higher, exhaust conditions.

By Vehicle

Passenger vehicles account for the largest share due to high domestic production and growing hybrid adoption. The France Exhaust Systems Market also witnesses steady demand from commercial vehicles, supported by the logistics and public transport sectors. Two-wheelers contribute a smaller share but reflect steady growth due to urban mobility and emission control mandates. It gains further traction through government policies supporting low-emission transportation systems.

- For Instance, Valeo announced in October 2025 that it is expanding its aftermarket product portfolio with over 4,000 new engine management references, including 1,500 sensors and injectors, by 2026.

By Fuel Type

Gasoline vehicles dominate the market due to France’s strong preference for small and mid-size passenger cars. Diesel vehicles, once prevalent, now face a gradual decline owing to stricter emission norms and consumer shift toward hybrid options. It presents opportunities for innovation in gasoline particulate filters and hybrid-compatible exhaust systems. The ongoing transition toward cleaner fuels continues to redefine design priorities and performance standards for manufacturers.

Segmentations:

By Product Type Segment

- Systems

- Components

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Segment

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Fuel Type Segment

By Sales Channel Segment

Regional Analysis:

Northern and Western France Leading Production and Technological Development

Northern and Western regions dominate the France Exhaust Systems Market, driven by their strong industrial base and concentration of automotive manufacturers. Areas such as Île-de-France, Hauts-de-France, and Grand Est host major OEMs, Tier-1 suppliers, and research centers specializing in emission control technologies. It benefits from advanced infrastructure, skilled labor, and robust supply networks that support high-volume manufacturing and innovation. The proximity to major European automotive hubs strengthens export potential and integration with regional supply chains. Continuous investment in R&D and adoption of digital manufacturing techniques further reinforce the market’s growth in these regions.

Southern France Emerging as a Center for Sustainable Mobility Solutions

Southern France is gradually emerging as a key growth zone supported by regional investment incentives and expanding hybrid and EV assembly lines. The France Exhaust Systems Market in this area benefits from government-backed programs promoting green mobility and energy-efficient manufacturing. It attracts both domestic and international suppliers aiming to align with France’s carbon neutrality goals. The rise of specialized production facilities in Occitanie and Provence-Alpes-Côte d’Azur improves regional competitiveness. Collaboration between local startups and global automotive players strengthens innovation in hybrid-compatible exhaust designs.

Central and Eastern Regions Supporting Market Expansion Through Supply Chain Development

Central and Eastern regions, including Bourgogne-Franche-Comté and Auvergne-Rhône-Alpes, play a growing role in component manufacturing and distribution. The France Exhaust Systems Market gains from the expansion of small and medium enterprises supplying catalytic converters, pipes, and mufflers. It benefits from strong logistics connectivity and industrial clusters that link suppliers with national and European OEMs. Regional policies supporting industrial modernization and workforce training enhance production capacity. These regions are expected to record consistent growth due to their strategic location and supportive regulatory environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Forvia

- Futaba Industrial Co., Ltd.

- MagnaFlow

- ATJ Automotive GmbH

- Eberspächer

- The Axces Group

- BOSAL

- Sejong Industrial Co., Ltd.

- Vanstar

- Continental AG

Competitive Analysis:

The France Exhaust Systems Market is highly competitive, with strong participation from global and domestic manufacturers. Major companies include Forvia, Futaba Industrial Co., Ltd., MagnaFlow, ATJ Automotive GmbH, Eberspächer, The Axces Group, and BOSAL, each focusing on technology upgrades and sustainability. It emphasizes innovation in catalytic converters, mufflers, and lightweight exhaust assemblies to meet stringent Euro 6 and Euro 7 standards. Forvia and Eberspächer maintain leadership through integrated exhaust and emission control systems, supported by extensive R&D investment. BOSAL and MagnaFlow expand their market reach through partnerships with local distributors and OEMs. Competitive strategies center on product differentiation, regional manufacturing efficiency, and cost optimization to capture long-term growth opportunities in France’s evolving automotive landscape.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In September 2025, Purem by Eberspächer developed Direct Air Capture Technology designed to remove CO₂ from the atmosphere, expanding the company’s expertise beyond traditional exhaust systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle, Fuel Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Exhaust Systems Market is expected to evolve with growing emphasis on hybrid and plug-in hybrid compatibility.

- Manufacturers will continue investing in advanced catalytic converters and particulate filters to meet Euro 7 norms.

- Lightweight materials such as stainless steel, titanium, and aluminum alloys will gain higher adoption to improve fuel efficiency.

- Integration of digital design tools and automated manufacturing will enhance system precision and reduce costs.

- Hybrid-specific exhaust technologies will create new business opportunities for Tier-1 and Tier-2 suppliers.

- Rising environmental awareness will push OEMs toward recyclable and eco-friendly exhaust materials.

- Government policies supporting clean mobility will accelerate R&D in low-emission exhaust technologies.

- Local production in northern and western regions will strengthen to support domestic and export demand.

- Strategic collaborations among global players and French manufacturers will enhance innovation capacity.

- The long-term market focus will shift toward sustainable mobility solutions aligned with France’s carbon neutrality goals.