| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Off The Road Tire Market Size 2023 |

USD 674.60 Million |

| France Off The Road Tire Market, CAGR |

4.24% |

| France Off The Road Tire Market Size 2032 |

USD 980.71 Million |

Market Overview:

France Off-the-Road Tire Market size was valued at USD 674.60 million in 2023 and is anticipated to reach USD 980.71 million by 2032, at a CAGR of 4.24% during the forecast period (2023-2032).

The growth of the France Off-the-Road (OTR) tire market is primarily driven by several key factors. The country’s ongoing industrial development, including large-scale infrastructure projects such as road construction, urbanization, and power plant development, necessitates the use of heavy-duty machinery equipped with robust OTR tires. Furthermore, the agriculture sector in France is undergoing mechanization, with a growing adoption of large tractors and harvesters, which increases the demand for OTR tires. Additionally, while France’s mining industry is not as expansive as some other European nations, it still requires specialized tires for its heavy equipment used in mineral extraction and related activities. Another significant driver is the technological advancements in tire manufacturing, which have led to the development of more durable, puncture-resistant, and eco-friendly OTR tire solutions. These innovations contribute to the longer life span and superior performance of OTR tires, making them increasingly attractive to end-users across various industries.

Regionally, the northern part of France holds the largest market share for OTR tires, largely due to its advanced industrial infrastructure and high concentration of manufacturing and construction activities. This region is home to a number of large-scale construction projects and automotive manufacturing hubs, which necessitate the use of OTR tires for heavy equipment. The proximity of northern France to other major European markets also facilitates trade, making it a central distribution point for the OTR tire industry. Additionally, regions with intensive agricultural activities, such as Normandy, contribute significantly to the demand for OTR tires, as modern farming equipment requires specialized tires to handle the rough terrain and demanding operational conditions. The growth in these regions continues to foster a robust demand for OTR tires, driving the overall market forward.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Off-the-Road (OTR) tire market was valued at USD 674.60 million in 2023 and is projected to reach USD 980.71 million by 2032, growing at a CAGR of 4.24% during the forecast period.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Key drivers include ongoing industrial development, large-scale infrastructure projects, and the mechanization of the agriculture sector, all of which increase the demand for heavy-duty machinery and specialized OTR tires.

- Technological advancements in tire manufacturing have led to the development of more durable, puncture-resistant, and eco-friendly OTR tire solutions, enhancing their performance and lifespan.

- Northern France holds the largest market share for OTR tires due to its advanced industrial infrastructure and high concentration of manufacturing and construction activities.

- The high cost of OTR tires remains a challenge, particularly for smaller businesses, despite the long-term benefits such as reduced maintenance costs and extended tire life.

- The availability of raw materials required for manufacturing OTR tires can pose a challenge to market growth, with fluctuations in supply leading to delays and increased costs.

- Competition from alternative solutions, such as retreaded tires and hybrid tires, presents challenges to the traditional OTR tire market, particularly in cost-sensitive industries.

Market Drivers:

Industrial Growth and Infrastructure Development

The industrial growth in France is one of the key drivers of the Off-the-Road (OTR) tire market. For example, the construction and industrial vehicle segment is the largest user of OTR tires in Europe, driven by the need for equipment that can operate in harsh conditions and on rough terrains. The country is witnessing significant infrastructure development projects, including the construction of roads, bridges, and power plants. These projects require heavy-duty machinery that operates in demanding environments, necessitating the use of durable and specialized tires. The demand for OTR tires is fueled by the need for equipment capable of performing optimally in harsh conditions such as rough terrains, variable weather, and heavy loads. The French government’s focus on expanding and upgrading infrastructure, coupled with investments from private enterprises, drives the consistent demand for OTR tires across the country.

Agricultural Mechanization

Agriculture in France is becoming increasingly mechanized, which is directly contributing to the growth of the OTR tire market. The shift from traditional farming practices to large-scale, modernized agricultural operations has led to an increased demand for specialized tires, particularly for tractors, harvesters, and other farming equipment. OTR tires are required to support the heavier machinery used in the farming sector, which operates on uneven, often challenging terrains. For instance, Michelin has collaborated with La Poste, the French postal service, to introduce Uptis puncture-proof tires in their delivery fleet, demonstrating the shift towards durable and maintenance-free tire solutions in both agriculture and logistics. The growth in agricultural mechanization is not only a response to the need for increased efficiency and productivity but also driven by environmental regulations and sustainability goals. This trend is expected to continue, as more farmers and agricultural businesses adopt advanced equipment to remain competitive, further fueling the demand for OTR tires.

Technological Advancements in Tire Manufacturing

Technological innovations in the manufacturing of OTR tires have played a significant role in driving market growth. Advances such as the development of puncture-resistant materials, improved tread patterns, and better load-bearing capabilities have enhanced the durability and performance of OTR tires. These technological improvements are crucial for industries such as construction, mining, and agriculture, where tires face harsh conditions that require high performance and extended life spans. Manufacturers are continuously innovating to meet the demands of their customers by introducing tires that offer better fuel efficiency, enhanced durability, and superior traction. As these innovations continue to improve the overall quality and reliability of OTR tires, their adoption is expected to rise across various sectors in France.

Sustainability and Environmental Considerations

Increasing awareness of sustainability and environmental concerns is another factor propelling the demand for OTR tires in France. As industries face greater pressure to meet environmental regulations, the focus has shifted towards adopting eco-friendly solutions. In response to this, OTR tire manufacturers are investing in producing tires that are not only more durable and efficient but also designed with sustainability in mind. The shift towards recyclable and environmentally friendly materials in tire production is becoming more prominent. Furthermore, French companies are increasingly adopting practices such as tire recycling, which contributes to reducing the environmental impact of tire disposal. The growing trend toward sustainability, alongside stringent environmental regulations, is shaping the OTR tire market and encouraging manufacturers to innovate and produce greener, more efficient products.

Market Trends:

Shift Towards Radial Tires

One of the key trends driving the France Off-the-Road (OTR) tire market is the increasing adoption of radial tires over bias tires. Radial tires offer several advantages, including improved fuel efficiency, greater durability, and better performance on uneven terrains. In France, industries such as construction, agriculture, and mining are shifting towards radial tires because of their ability to handle heavier loads and provide enhanced stability for large machines operating in harsh environments. For instance, Michelin recently announced a USD 750 million investment to expand radial earthmover tire production, underscoring the growing demand for these tires in heavy equipment markets. As tire manufacturers continue to innovate and improve the design and performance of radial tires, their adoption is expected to grow in the French OTR tire market, particularly among businesses looking to optimize their machinery and operations.

Growing Focus on Eco-Friendly Tire Solutions

Sustainability is becoming a significant focus in the French OTR tire market. Companies and industries are increasingly prioritizing eco-friendly solutions due to rising environmental concerns and stricter regulations regarding waste management and carbon emissions. For instance, companies like Pirelli have launched new agricultural OTR tires, such as the Pirelli PHP, specifically designed for the European market to deliver higher fuel savings, longer lifespan, and lower land compaction, while utilizing materials with a reduced environmental footprint. There is a notable trend toward the development and use of tires that offer better recyclability and lower environmental impact during their lifecycle. This trend is driving innovation in the OTR tire industry, with manufacturers focusing on creating tires made from sustainable materials and those that offer longer lifespans to reduce waste. The move toward greener solutions is in line with global environmental standards and the French government’s growing emphasis on sustainability in industrial practices.

Technological Advancements in Tire Monitoring Systems

The integration of advanced tire monitoring systems is another emerging trend in the France OTR tire market. These systems allow for real-time tracking of tire performance, including monitoring pressure, temperature, and wear levels. The data collected from these systems can help businesses optimize tire maintenance schedules, reduce downtime, and extend the life of tires. As industries in France, such as agriculture, construction, and mining, increasingly adopt these technologies, tire manufacturers are integrating them into their products to enhance the overall performance and reliability of OTR tires. This trend is expected to further strengthen the demand for high-tech, performance-driven OTR tires in the coming years.

Rising Demand for Retreaded Tires

An increasing demand for retreaded OTR tires is another significant trend in the French market. Retreaded tires, which are recycled and reprocessed for reuse, offer a cost-effective and environmentally friendly alternative to new tires. The cost-effectiveness of retreaded tires is particularly appealing to industries like mining and construction, where heavy machinery requires frequent tire replacements. Retreading allows companies to extend the life of tires and reduce overall operational costs. This trend aligns with the growing emphasis on sustainability and cost-efficiency in the French industrial sector, making retreaded tires a popular choice for businesses looking to balance performance with economic and environmental considerations.

Market Challenges Analysis:

High Cost of OTR Tires

One of the key restraints in the France Off-the-Road (OTR) tire market is the high cost associated with these specialized tires. OTR tires, due to their durability, advanced technology, and heavy-duty construction, come with a higher price tag compared to regular tires. This cost can be prohibitive for smaller businesses or those with limited budgets, particularly in sectors such as agriculture or small-scale construction. The high upfront cost of OTR tires can deter some companies from making the investment, especially in times of economic uncertainty. Despite the long-term benefits, such as reduced maintenance costs and extended tire life, the initial expense remains a significant challenge for market growth.

Limited Availability of Raw Materials

The availability of raw materials required for manufacturing OTR tires can also pose a challenge to market growth. Tires are made using a variety of specialized materials such as high-quality rubber, steel, and synthetic compounds. Fluctuations in the supply of these materials, whether due to global supply chain disruptions or local shortages, can lead to delays in production and increased costs for manufacturers. For instance, the European Central Bank reported a 20% increase in raw material costs in 2022 due to global supply chain bottlenecks, while the scarcity of natural rubber led to a 15% rise in production delays. In France, where strict environmental regulations govern material sourcing and production processes, manufacturers must comply with sustainable practices while ensuring a steady supply of raw materials, adding another layer of complexity to the market.

Competition from Alternative Solutions

Another challenge facing the France OTR tire market is the increasing competition from alternative tire solutions, such as retreaded tires and hybrid tires. Retreaded tires, being more cost-effective, present a viable alternative to new OTR tires, particularly in industries like mining and construction. While retreaded tires offer economic benefits, they may not always match the performance levels of brand-new tires. However, the growing acceptance of retreaded tires due to their affordability and sustainability is posing a challenge to the traditional OTR tire market in France.

Regulatory Compliance and Environmental Concerns

The increasing focus on environmental regulations presents both a restraint and challenge for the OTR tire market. France, being a leader in sustainable practices, has stringent regulations governing tire disposal, carbon emissions, and the overall environmental impact of manufacturing processes. Complying with these regulations requires significant investment in research, innovation, and eco-friendly tire production. This added cost and the need for constant adaptation to new regulations can hinder market growth, especially for smaller manufacturers or businesses seeking to minimize their operational expenses.

Market Opportunities:

The France Off-the-Road (OTR) tire market presents several lucrative opportunities driven by the ongoing growth in key industries such as construction, agriculture, and mining. The expansion of infrastructure projects, particularly in urbanization and transportation networks, is fueling the demand for heavy-duty machinery, which in turn increases the need for high-performance OTR tires. Additionally, the agricultural sector’s ongoing mechanization trend provides a significant opportunity for manufacturers to cater to the demand for specialized tires suited for advanced farming machinery. As French agricultural practices evolve to incorporate larger and more efficient equipment, the demand for OTR tires that can withstand demanding terrains is expected to grow, presenting an opportunity for tire producers to expand their offerings.

Furthermore, the growing emphasis on sustainability and eco-friendly practices in France provides manufacturers with the opportunity to innovate in the production of more sustainable OTR tires. As environmental regulations become more stringent, the demand for recyclable, energy-efficient, and eco-friendly tires is increasing. Tire manufacturers can capitalize on this trend by developing products that meet both performance and sustainability standards. With advancements in tire technology, including the development of longer-lasting and more efficient tires, there is a growing opportunity for manufacturers to cater to the market’s need for higher durability and lower maintenance costs, which can significantly drive the growth of the OTR tire market in France.

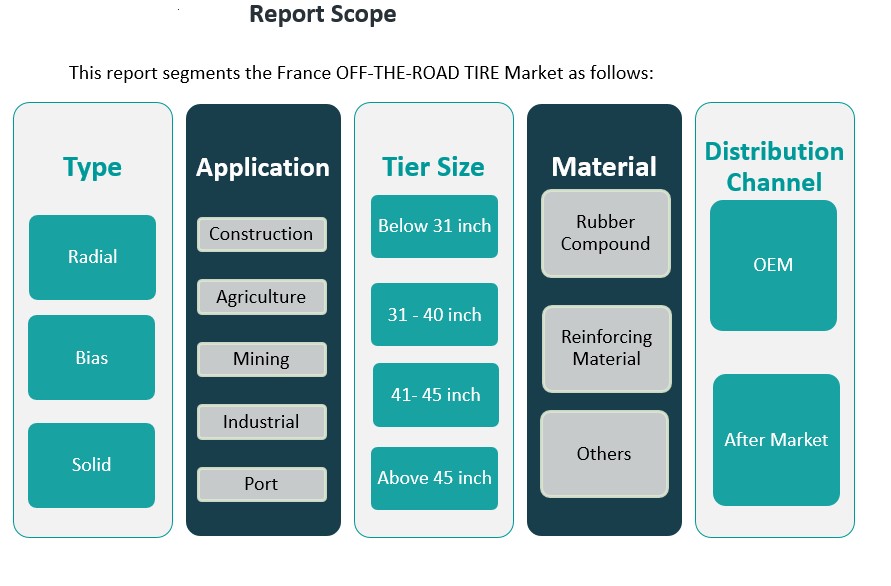

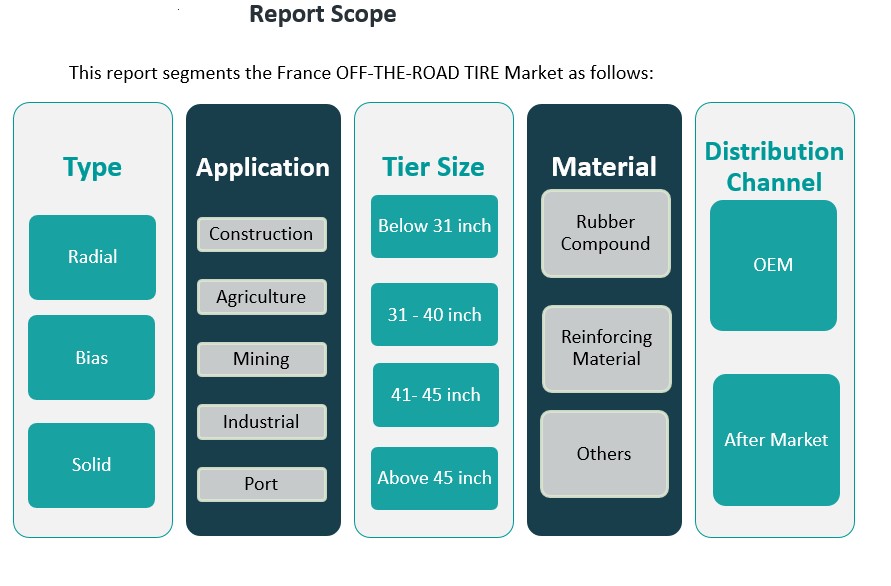

Market Segmentation Analysis:

The France Off-the-Road (OTR) tire market is categorized into several key segments, each with its distinct characteristics and growth drivers.

By Type Segment

The OTR tire market in France is primarily segmented by type, with radial, bias, and solid tires being the most common. Radial tires dominate the market due to their superior performance, fuel efficiency, and longer lifespan. Bias tires are still used in certain applications due to their durability and lower initial cost, particularly in construction and mining industries. Solid tires, known for their resilience and puncture resistance, are gaining traction in industrial applications where heavy equipment operates in challenging environments.

By Application Segment

In terms of applications, the construction sector holds a significant share of the market, driven by ongoing infrastructure development in France. Agriculture follows closely, as modern farming practices increasingly require robust tires for large machinery. The mining industry also represents a critical segment, especially in regions with rich natural resources. Additionally, industrial and port applications are contributing to the demand for OTR tires, as heavy machinery in warehouses and logistics hubs needs specialized tires for optimal performance.

By Tire Size Segment

Tire size is another key factor influencing the market. Tires below 31 inches and between 31-40 inches are commonly used in agriculture and construction, while larger tires (41-45 inches and above) are predominantly employed in mining and port applications due to the heavier load-bearing requirements.

By Material Segment

Rubber compounds and reinforcing materials dominate the market, as these are critical for enhancing the performance, durability, and load-bearing capacity of OTR tires. Other materials, such as synthetic compounds, also play a role in enhancing the properties of the tires.

By Distribution Channel Segment

The distribution of OTR tires is divided into OEM (Original Equipment Manufacturer) and aftermarket channels. The OEM segment holds a larger share, driven by the direct demand from heavy machinery manufacturers. The aftermarket segment is growing steadily as industries increasingly replace tires to maintain optimal machinery performance.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The France Off-the-Road (OTR) tire market is primarily driven by key regions with distinct industrial activities, each contributing to the overall demand for specialized tires. These regions include northern, southern, and central France, each characterized by its specific industrial and agricultural focus. Understanding these regional dynamics is crucial for assessing market opportunities and growth potential.

Northern France

Northern France, particularly regions such as Île-de-France, Hauts-de-France, and Normandy, holds a significant share of the OTR tire market. This area is home to a large concentration of industrial activities, including heavy manufacturing, construction, and infrastructure development. As one of the most industrialized regions, the demand for OTR tires in the construction and mining sectors is robust, with a strong reliance on heavy machinery that requires durable and high-performance tires. The northern region also benefits from its proximity to other European markets, making it a key distribution hub for OTR tires in France. The market share in this region is estimated to account for over 40% of the total OTR tire market in France.

Southern France

Southern France, particularly in areas such as Provence-Alpes-Côte d’Azur and Languedoc-Roussillon, is seeing significant growth in the agriculture and port sectors. Agriculture, which is central to this region, requires specialized OTR tires for tractors and other machinery operating on diverse terrains. Additionally, the southern coastal regions have major ports, such as the Port of Marseille, driving demand for OTR tires used in industrial and logistics applications. This region’s market share is growing steadily and is estimated to represent around 30% of the French OTR tire market. The ongoing expansion of agricultural mechanization and port activities contributes to the rising demand for tires designed to withstand the unique challenges of these sectors.

Central and Eastern France

Central and eastern France, including regions like Rhône-Alpes and Alsace, have a mix of agricultural, industrial, and mining activities. While these areas are less densely industrialized compared to the north, the presence of mining operations and smaller-scale manufacturing contributes to the OTR tire demand. The mining sector, particularly in regions like Lorraine, requires robust OTR tires for equipment used in mineral extraction. This region’s market share is approximately 20%, with potential for growth as mining activities intensify and industrial sectors continue to evolve.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Hankook Tire

Competitive Analysis:

The France Off-the-Road (OTR) tire market is characterized by intense competition among both global and regional players. Key international tire manufacturers such as Michelin, Bridgestone, and Goodyear dominate the market due to their established presence, extensive product portfolios, and strong distribution networks. Michelin, with its headquarters in France, has a significant advantage in the domestic market, offering a wide range of high-performance OTR tires catering to construction, mining, and agricultural sectors. Regional players like Trelleborg and Pirelli also contribute to the competitive landscape by offering specialized products tailored to specific industries, such as agriculture and port operations. These manufacturers focus on technological innovation, producing tires with improved durability, eco-friendly features, and enhanced fuel efficiency. The competitive dynamics in the French OTR tire market are driven by product differentiation, technological advancements, and strong customer relationships, with a focus on meeting the diverse needs of various industrial sectors.

Recent Developments:

- In July 2023, Nokian Tyres entered into a new distribution agreement with the French company Heuver Tyres. This partnership is set to enhance the availability of Nokian Tyres’ products across France, especially in the agricultural and industrial segments. Heuver, already a well-established distributor in the region, has strengthened its resources to support this collaboration, which is expected to bolster Nokian Tyres’ position in the French market and facilitate their international expansion.

- In March 2024, Goodyear, a leading US-based tire manufacturer, launched the RL-5K OTR (Off-the-Road) tire, which features a three-star load capacity rating. This new product is designed for heavy-duty loaders and wheel dozers, offering enhanced durability and performance for demanding industrial operations. The RL-5K tire represents a significant technological advancement in OTR tire design, with a focus on efficiency, durability, and operational performance.

- In February 2025, The Goodyear Tire & Rubber Company completed the divestiture of its global Off-The-Road (OTR) tire business to The Yokohama Rubber Company, Limited, for approximately $905 million. This move is a major milestone in Goodyear’s transformation plan, allowing the company to streamline its portfolio and focus on core products and services. The proceeds from the sale are being used to reduce leverage and fund strategic initiatives under the Goodyear Forward transformation plan

Market Concentration & Characteristics:

The France Off-the-Road (OTR) tire market exhibits a moderately concentrated structure, with a few key global players dominating the market, including Michelin, Bridgestone, and Goodyear. Michelin, as a French-based leader, holds a significant market share, benefiting from its local presence and strong brand recognition. Other international tire manufacturers also maintain a solid foothold, contributing to healthy competition. The market is characterized by high product differentiation, with manufacturers offering specialized tires designed for construction, mining, agriculture, and industrial applications. Companies focus on technological innovation, emphasizing factors such as tire durability, fuel efficiency, and eco-friendly solutions. The market is also shaped by the increasing demand for sustainable and cost-effective tire solutions, with the growth of retreaded tires and eco-friendly materials gaining traction. As a result, while large multinational corporations dominate, regional players are finding opportunities by catering to niche sectors with tailored products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Off-the-Road (OTR) tires in France will grow due to ongoing infrastructure and construction projects across the country.

- Agricultural mechanization will continue to drive the need for specialized OTR tires, particularly in rural areas.

- The mining sector’s expansion in France, though limited, will contribute to sustained growth in the OTR tire market.

- Technological advancements in tire design, focusing on improved durability and performance, will enhance market appeal.

- Eco-friendly and sustainable tire solutions will become more important, as regulations tighten and environmental concerns grow.

- Retreaded OTR tires will gain traction due to their cost-effectiveness and environmental benefits, particularly in the mining and construction sectors.

- The shift towards radial tires will increase as industries seek higher performance and longer tire life.

- Regional demand variations will persist, with northern France leading in industrial and construction applications.

- The aftermarket segment will expand as businesses increasingly focus on tire replacements and maintenance to optimize machinery performance.

- Competitive pressures will intensify, with both global and regional players innovating to meet evolving market demands.