Market Overview

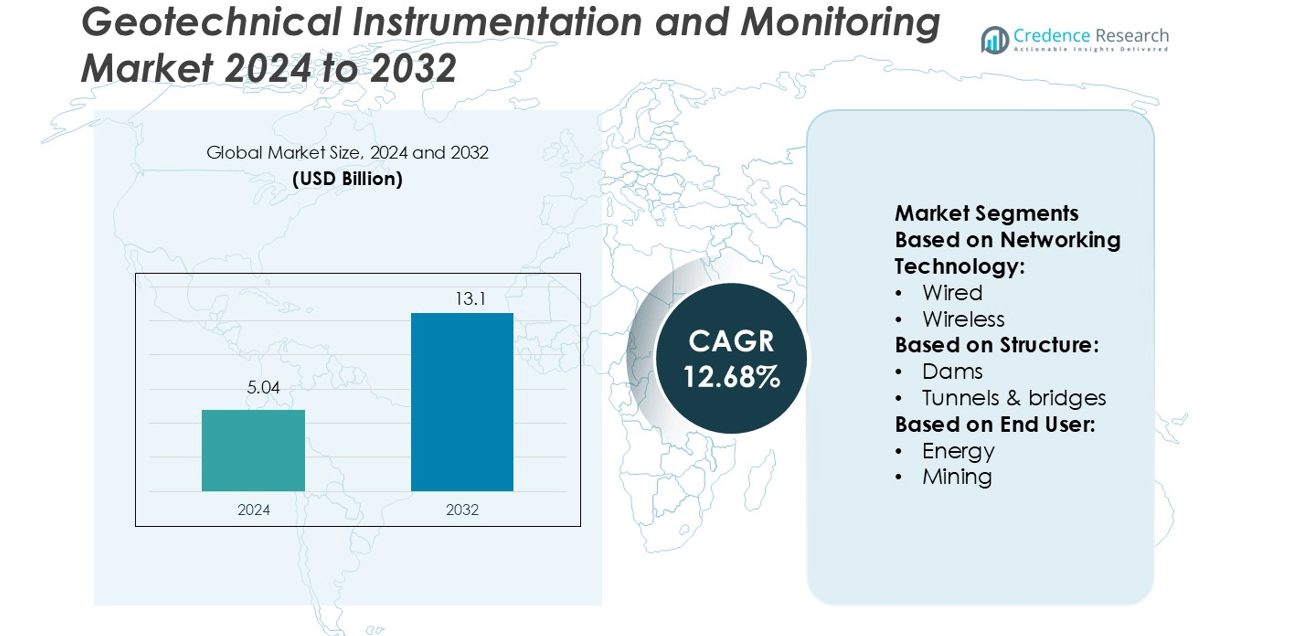

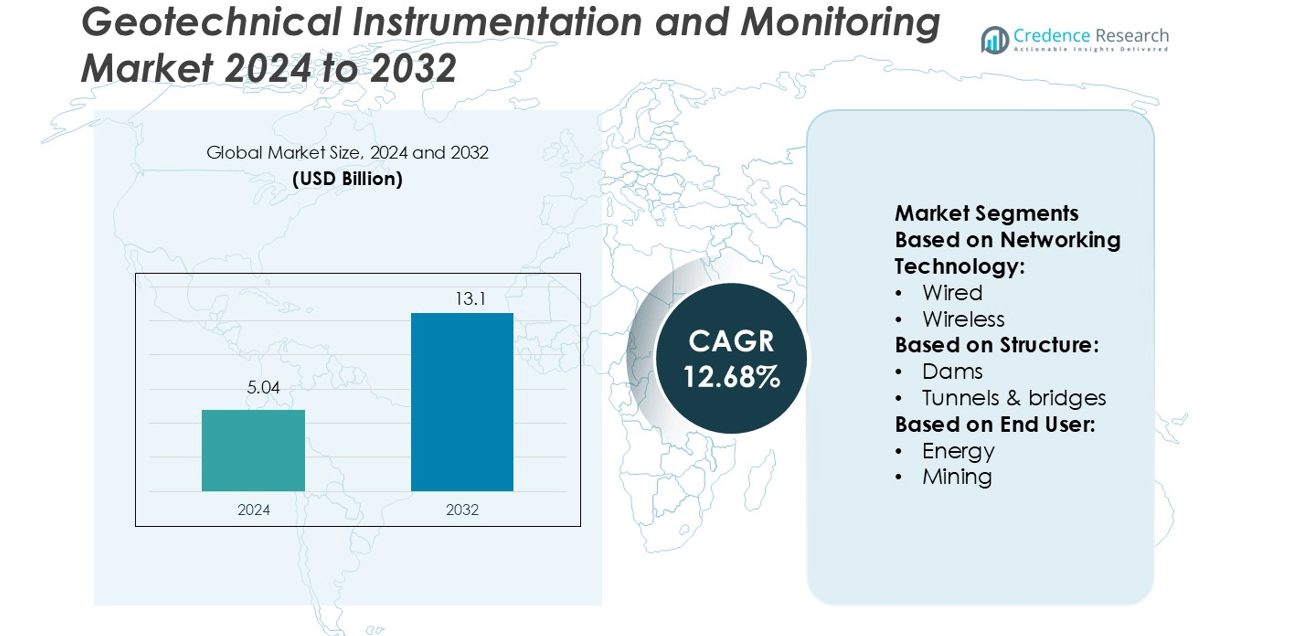

Geotechnical Instrumentation and Monitoring Market size was valued USD 5.04 billion in 2024 and is anticipated to reach USD 13.1 billion by 2032, at a CAGR of 12.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geotechnical Instrumentation and Monitoring Market Size 2024 |

USD 5.04 billion |

| Geotechnical Instrumentation and Monitoring Market, CAGR |

12.68% |

| Geotechnical Instrumentation and Monitoring Market Size 2032 |

USD 13.1 billion |

The Geotechnical Instrumentation and Monitoring Market is driven by top players such as Terracon, G3SoilWorks, Inc., MRCE, Airef Engineers, Applus+, Keller Group plc, W. Cole Engineering, Inc., Haley & Aldrich, HMA Group, and Encardio Rite. These companies focus on advanced instrumentation, automated monitoring systems, and digital platforms to enhance project safety and structural reliability. Strategic investments in wireless technologies and predictive analytics strengthen their market positions. North America leads the global market with a 36.4% share, supported by extensive infrastructure development, stringent safety regulations, and the early adoption of digital monitoring solutions. Strong investment in smart transportation and construction projects further drives regional dominance, giving key players opportunities to expand their service offerings and technical

Market Insights

- The Geotechnical Instrumentation and Monitoring Market was valued at USD 5.04 billion in 2024 and is expected to reach USD 13.1 billion by 2032, growing at a CAGR of 12.68%.

- Growing demand for real-time data, infrastructure expansion, and strict safety regulations are key drivers boosting market growth across multiple industries.

- Increasing adoption of IoT, predictive analytics, and automated sensor systems is shaping new market trends and enhancing operational efficiency.

- High installation costs, complex integration with existing infrastructure, and maintenance challenges are key restraints limiting wider adoption.

- North America holds a 36.4% share, leading due to advanced infrastructure projects and early technology adoption, while the construction and tunneling segments contribute the largest share, supported by strong regulatory frameworks and investments in monitoring solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Networking Technology

Wired networking dominates the Geotechnical Instrumentation and Monitoring Market with the largest market share. Its leadership is driven by high reliability, stable data transmission, and low maintenance costs. Wired systems are widely used in long-term structural monitoring where uninterrupted data is critical. These systems support real-time performance tracking in complex infrastructure, reducing the risk of measurement errors. Their robust installation in tunnels, bridges, and dams enhances operational efficiency and minimizes downtime, making them the preferred choice for major infrastructure projects.

- For instance, G3SoilWorks has experience with geotechnical instrumentation and monitoring in southern California, and it is plausible they have deployed wired monitoring networks using components like RS-485 inclinometer sensors.

By Structure

Tunnels and bridges hold the dominant share in the Geotechnical Instrumentation and Monitoring Market. This dominance is supported by rising investments in transportation infrastructure and the need for advanced structural safety monitoring. These structures require continuous stress, displacement, and vibration monitoring to prevent failures and ensure long service life. Geotechnical monitoring instruments provide precise data to detect early signs of structural instability. Governments and private contractors are increasing the use of these solutions to meet strict safety standards and regulatory compliance.

- For instance, Governor Mario M. Cuomo Bridge, Geocomp Corporation designed and installed the Structural Health Monitoring System, which includes an automated data acquisition (DAQ) system. The system incorporates more than 400 sensors, including over 300 tiltmeters, for real-time monitoring.

By End-user

The building and infrastructure segment leads the Geotechnical Instrumentation and Monitoring Market. This segment benefits from rapid urbanization and growing smart city initiatives worldwide. Advanced monitoring systems are being integrated into large construction projects to manage geotechnical risks and optimize asset performance. Real-time data improves decision-making during construction and operation phases. The growing focus on sustainable and resilient infrastructure further accelerates the adoption of geotechnical instrumentation across public and private projects.

Key Growth Drivers

Rising Infrastructure Development Projects

The Geotechnical Instrumentation and Monitoring Market is growing rapidly due to large-scale infrastructure investments. Governments and private developers are prioritizing the construction of tunnels, bridges, dams, and smart buildings. These projects require real-time monitoring to ensure safety and compliance with regulatory standards. Advanced sensors and automation tools help detect early structural issues, reducing the risk of costly failures. Increased spending on transportation networks and renewable energy facilities further strengthens market demand. The focus on long-term structural health monitoring continues to fuel adoption globally.

- For instance, Haley & Aldrich applied a remote settlement monitoring system at the VDOT I-95 Express Lanes project, installing automated instruments at bridge abutments to replace manual survey methods.

Stringent Safety and Regulatory Requirements

Tight regulatory frameworks are pushing stakeholders to adopt reliable geotechnical monitoring systems. Governments enforce strict standards to prevent accidents and ensure the safety of critical structures. Project owners use advanced monitoring instruments to meet compliance obligations and avoid penalties. Real-time data collection and predictive analytics support better decision-making and reduce operational risks. Infrastructure projects in seismic and flood-prone regions especially rely on these technologies. The growing emphasis on regulatory compliance enhances the need for precise and automated monitoring systems.

- For instance, Encardio Rite introduced its Model EAN-95MW wireless tiltmeter, integrating a MEMS tilt sensor and radio telemetry node for remote structural tilt monitoring.

Technological Advancements in Monitoring Solutions

Advancements in sensor technology, automation, and data analytics are transforming geotechnical monitoring. New instruments offer higher accuracy, faster data transmission, and remote access capabilities. Wireless and IoT-enabled solutions reduce manual inspections and lower operational costs. Predictive maintenance supported by AI and machine learning enhances structure performance over time. These technologies enable early detection of instability, extending the life of assets. The integration of digital twins and smart infrastructure systems further drives market expansion, attracting both public and private sector investment.

Key Trends & Opportunities

Adoption of IoT and Real-Time Monitoring

IoT-based monitoring solutions are gaining strong traction across infrastructure projects. These systems provide continuous data streams that improve decision-making and operational safety. Real-time alerts help project teams address potential structural issues before they escalate. IoT integration also enhances cost efficiency by minimizing manual labor. Governments and private players are increasingly deploying smart monitoring networks in tunnels, dams, and buildings. This trend is expected to accelerate with the development of 5G connectivity and advanced communication technologies.

- For instance, Hamburg, Fugro installed 50 automated dataloggers and 200+ push-in piezometers, integrated via its Vista Data Vision® platform to centralize all sensor streams.

Growing Demand for Predictive Maintenance Solutions

Predictive maintenance is emerging as a key opportunity in the market. Advanced analytics and AI tools analyze real-time geotechnical data to forecast structural weaknesses. This allows asset owners to plan maintenance activities more efficiently and avoid unplanned downtime. Reducing operational costs while increasing asset life is becoming a strategic priority for operators. Infrastructure developers and utility companies are investing in predictive technologies to ensure long-term performance, making this segment a major growth avenue.

- For instance, Nova Metrix LLC, through its brand Soil Instruments, markets the GeoSmart in-place inclinometer. The system uses MEMS sensors to provide continuous, real-time monitoring of ground displacement, with a sensor resolution of 9 arc seconds (approximately 0.0025°).

Expansion in Emerging Economies

Emerging markets are investing heavily in infrastructure modernization, creating new opportunities for geotechnical monitoring. Rapid urbanization, industrialization, and smart city projects are driving demand for advanced monitoring solutions. Countries in Asia Pacific, the Middle East, and Latin America are adopting digital monitoring systems to support high-capacity infrastructure. Global manufacturers are expanding their presence through partnerships and localized production. This trend is expected to strengthen as governments allocate higher budgets for infrastructure resilience and disaster prevention.

Key Challenges

High Installation and Maintenance Costs

The adoption of geotechnical monitoring systems faces barriers due to high setup and maintenance costs. Advanced sensors, communication networks, and analytical platforms require significant investment. Many small and mid-scale infrastructure projects struggle to allocate sufficient budgets for such technologies. Long installation timelines and skilled labor requirements further add to the cost burden. This challenge is more pronounced in developing economies, where infrastructure spending is often limited. Cost-efficient solutions and government incentives may help address this barrier.

Limited Skilled Workforce for Advanced Systems

The shortage of skilled professionals hinders the efficient implementation of advanced monitoring technologies. Installing, calibrating, and interpreting geotechnical instrumentation requires specialized training. Many infrastructure operators face delays and operational errors due to workforce gaps. The lack of standardized training programs and certification frameworks further complicates system adoption. As the technology evolves rapidly, continuous skill development becomes essential. Addressing this challenge through training programs and automation will be crucial for scaling market adoption.

Regional Analysis

North America

North America holds the largest share of the Geotechnical Instrumentation and Monitoring Market with 34.6%. The region’s leadership is driven by strong infrastructure modernization programs and strict regulatory frameworks. The U.S. and Canada are investing heavily in transportation networks, dams, and renewable energy projects. Advanced monitoring technologies are widely deployed to ensure structural safety and regulatory compliance. The adoption of IoT-enabled and wireless systems is accelerating across major infrastructure developments. Strategic collaborations between private firms and government agencies further support market growth. High technological maturity and skilled expertise strengthen the region’s leading position.

Europe

Europe accounts for 28.4% of the Geotechnical Instrumentation and Monitoring Market. The region benefits from mature infrastructure, strict safety standards, and widespread adoption of predictive monitoring solutions. Countries such as Germany, the U.K., and France are investing in tunneling, bridge upgrades, and smart city projects. The European Union’s regulatory emphasis on safety and sustainability drives increased use of advanced monitoring systems. Integration of digital twins and IoT sensors is enhancing operational efficiency. Public-private partnerships also support the deployment of geotechnical solutions in large-scale infrastructure programs across multiple sectors.

Asia Pacific

Asia Pacific represents 25.7% of the Geotechnical Instrumentation and Monitoring Market. Rapid urbanization, infrastructure expansion, and smart city initiatives are fueling market growth. China, India, Japan, and South Korea are key contributors, with large-scale projects in transportation, energy, and water infrastructure. Governments in the region are investing in early warning systems and advanced monitoring technologies to improve disaster resilience. Growing adoption of wireless systems and predictive analytics solutions further accelerates market development. Global and regional companies are expanding their presence through strategic collaborations and local manufacturing initiatives to meet rising demand.

Latin America

Latin America holds a 6.8% share of the Geotechnical Instrumentation and Monitoring Market. Countries like Brazil, Mexico, and Chile are investing in infrastructure modernization and mining projects. The demand is growing for real-time monitoring systems in dams, pipelines, and transportation networks. Government-led infrastructure initiatives are driving adoption, though high installation costs remain a barrier. Increasing private investment in energy and construction sectors supports gradual market expansion. Technological advancements and cost-efficient solutions are expected to accelerate adoption rates, strengthening the region’s contribution to the global market in the coming years.

Middle East & Africa

The Middle East & Africa account for 4.5% of the Geotechnical Instrumentation and Monitoring Market. Infrastructure expansion in energy, oil and gas, and smart city projects is boosting demand. Countries like Saudi Arabia and the UAE are leading with large-scale investments in tunnels, bridges, and pipelines. The focus on structural safety and sustainability drives the use of advanced monitoring solutions. While adoption is rising, limited technical expertise and cost constraints slow the pace in several African economies. International partnerships and government initiatives are expected to enhance market penetration over the forecast period.

Market Segmentations:

By Networking Technology:

By Structure:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Geotechnical Instrumentation and Monitoring Market features key players such as Terracon, G3SoilWorks, Inc., MRCE, Airef Engineers, Applus+, Keller Group plc, W. Cole Engineering, Inc., Haley & Aldrich, HMA Group, and Encardio Rite. The Geotechnical Instrumentation and Monitoring Market is becoming increasingly competitive, driven by rising demand for precise, real-time data solutions in infrastructure projects. Companies are focusing on advanced sensor technologies, wireless communication systems, and automated data acquisition to enhance monitoring accuracy and reliability. Digital integration through IoT, cloud platforms, and predictive analytics is transforming how geotechnical data is collected and analyzed. Firms are also strengthening service capabilities to support complex construction, mining, and tunneling operations. Strategic partnerships with contractors, government bodies, and private developers help secure large-scale projects. Continuous innovation in durability, accuracy, and remote functionality enables stronger market positioning and faster project delivery, creating opportunities for global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Terracon

- G3SoilWorks, Inc.

- MRCE

- Airef Engineers

- Applus+

- Keller Group plc

- Cole Engineering, Inc.

- Haley & Aldrich

- HMA Group

- Encardio Rite

Recent Developments

- In April 2024, GroundProbe and Terra Insights, now combined with the Orica Digital Solutions business, combine innovative geotechnical technologies and capabilities with advanced geospatial instrumentation and expertise. Together, the companies set a new standard for mining safety and efficiency, offering customers a wide range of solutions.

- In February 2024, PGS received an offshore wind turbine characterization contract from an unnamed company for a project in Europe. PGS will mobilize the ship in early July for a two-month procurement program and deploy ultra-high resolution 3D equipment.

- In December 2023, Fugro acquired two platform supply vessels, Sea Gull and Sea Goldcrest, which will be utilized as geotechnical assets. The inclusion of these two vessels in its owned fleet will further reinforce Fugro’s ability to address the market demands and shortage of geotechnical capable vessels.

- In September 2023, Ulstein Design & Solutions secured a contract with Fugro to modify and convert two platform supply vessels into geotechnical vessels. The vessels will be redesigned with geotechnical drill towers along with important equipment, and one will also adjust the accommodation capacity with six new cabins

Report Coverage

The research report offers an in-depth analysis based on Networking Technology, Structure, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for real-time monitoring solutions will increase across large infrastructure projects.

- Integration of IoT and AI will enhance data accuracy and decision-making.

- Automation in instrumentation will reduce manual intervention and improve efficiency.

- Adoption of wireless sensor networks will expand due to ease of deployment.

- Predictive analytics will support early risk detection and preventive maintenance.

- Growth in smart city projects will drive the use of advanced monitoring systems.

- Cloud-based platforms will gain traction for data storage and remote access.

- Companies will focus on developing more durable and cost-efficient sensors.

- Strategic partnerships will strengthen market presence in emerging economies.

- Regulatory compliance and safety standards will accelerate technology adoption.