Market Overview:

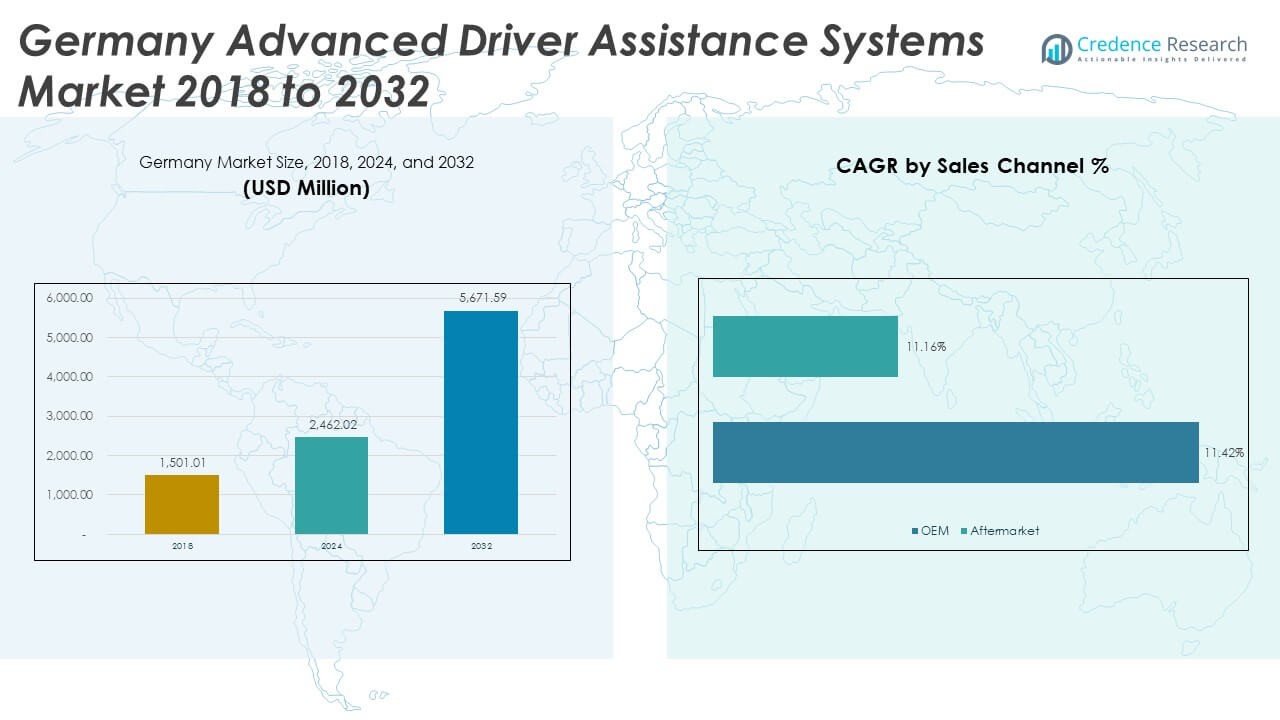

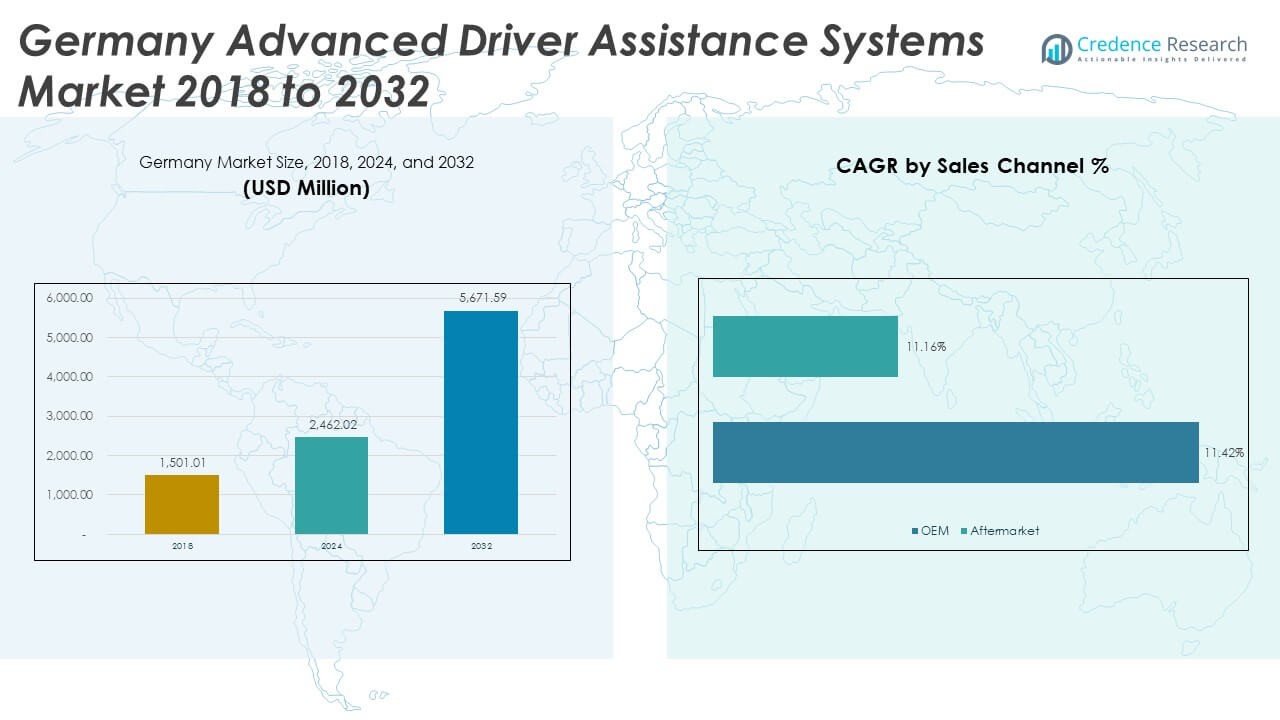

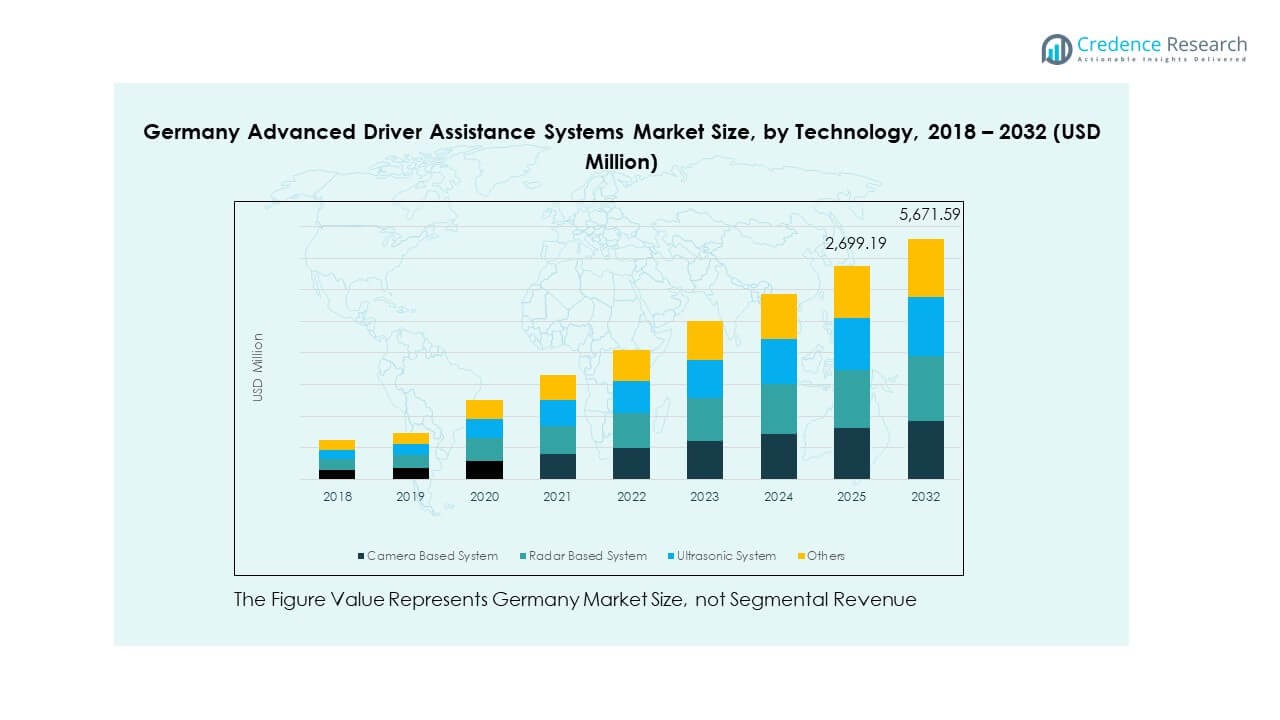

The Germany Advanced Driver Assistance Systems Market size was valued at USD 1,501.01 million in 2018 to USD 2,462.02 million in 2024 and is anticipated to reach USD 5,671.59 million by 2032, at a CAGR of 10.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Advanced Driver Assistance Systems Market Size 2024 |

USD 2,462.02 Million |

| Germany Advanced Driver Assistance Systems Market, CAGR |

10.99% |

| Germany Advanced Driver Assistance Systems Market Size 2032 |

USD 5,671.59 Million |

The growth of the Germany Advanced Driver Assistance Systems Market is driven by the increasing demand for vehicle safety technologies and rising government regulations for advanced safety systems. Consumers’ preference for enhanced driving comfort and safety is prompting automakers to integrate more advanced systems such as lane departure warning, adaptive cruise control, and automatic emergency braking into their vehicles. The growing adoption of electric and autonomous vehicles also supports the market, as these vehicles rely heavily on ADAS technologies for improved driving performance and safety.

Western Europe, particularly Germany, leads the market due to its strong automotive industry presence and technological advancements. Germany’s major automobile manufacturers, such as BMW, Mercedes-Benz, and Audi, are at the forefront of incorporating ADAS into their models, driving market growth. Other European regions, like Central and Eastern Europe, are emerging as strong markets for ADAS due to increasing automotive production and adoption of advanced safety systems. These regions are likely to witness growing demand for ADAS technologies as vehicle safety standards continue to tighten.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Advanced Driver Assistance Systems Market was valued at USD 1,501.01 million in 2018 and is projected to reach USD 5,671.59 million by 2032, growing at a CAGR of 10.99% from 2024 to 2032.

- Western Europe leads the market with a share of 45%, driven by major automotive manufacturers and stringent safety regulations. Central and Eastern Europe follows with 25% share, as emerging markets increase ADAS adoption, while Southern Europe holds 15% due to growing safety awareness and vehicle technology demand.

- The fastest-growing region is Central and Eastern Europe, with increasing vehicle production and demand for advanced safety features. Market growth is supported by rising government incentives and consumer adoption of ADAS technologies.

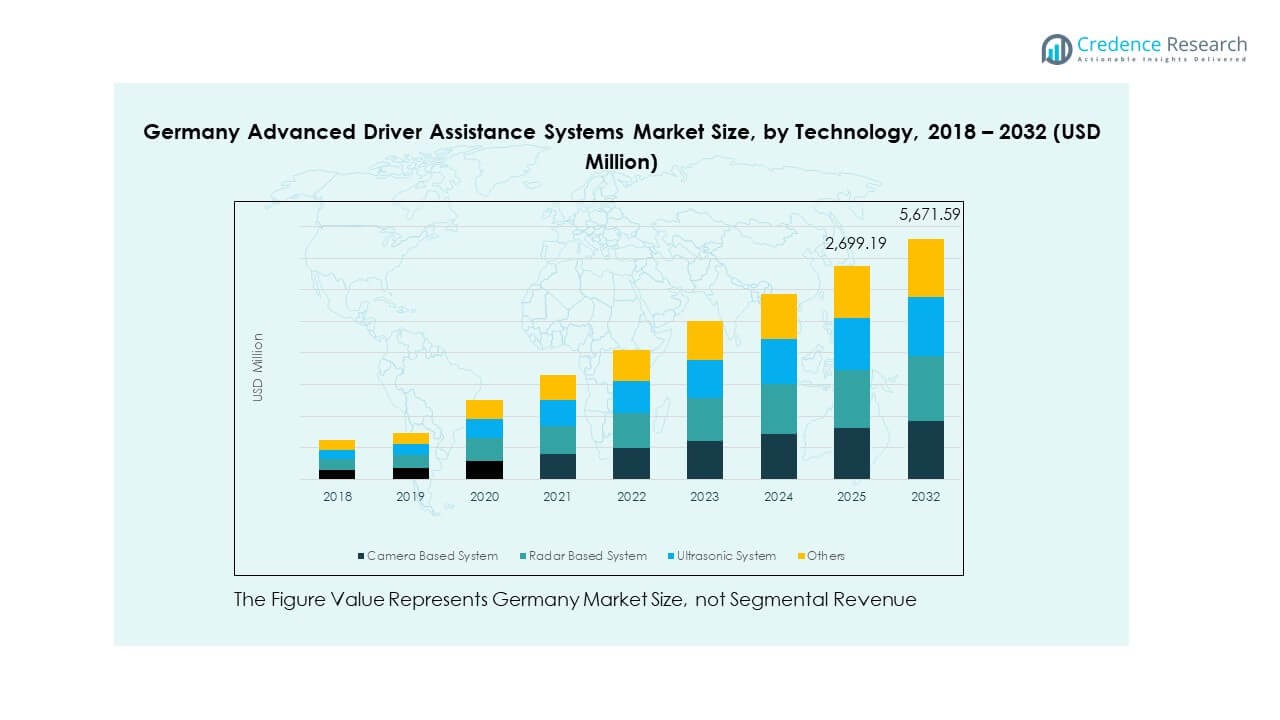

- Camera-based systems hold the largest share, contributing a significant portion to the market, followed by radar-based systems and ultrasonic systems in the Germany Advanced Driver Assistance Systems Market.

- Radar-based systems and ultrasonic systems are seeing steady growth, with radar-based systems making up a major share, as they are essential for adaptive cruise control and collision prevention technologies.

Market Drivers:

Increasing Demand for Vehicle Safety and Driver Assistance Features

The Germany Advanced Driver Assistance Systems Market has witnessed significant growth due to the increasing demand for vehicle safety and driver assistance features. Consumers are seeking advanced systems that improve safety while driving, such as lane-keeping assistance and automatic emergency braking. These systems are designed to reduce the likelihood of accidents, enhancing both driver and passenger safety. As traffic congestion rises, there is also greater emphasis on systems that assist in reducing collision risks, such as forward collision warning and blind spot detection. The focus on reducing fatalities and injuries in road accidents is pushing the demand for ADAS.

- BMW and MINI vehicles equipped with forward collision warning and automatic emergency braking showed a 13% reduction in property damage liability claims for 2013-17 models. Vehicles with Adaptive Cruise Control (ACC) showed a 25% reduction in such claims, according to data from the Insurance Institute for Highway Safety (IIHS) and the Highway Loss Data Institute (HLDI).

Government Regulations and Safety Standards

Government regulations play a key role in driving the growth of the Germany Advanced Driver Assistance Systems Market. Regulations such as mandatory installation of certain ADAS technologies, including automatic emergency braking and lane-keeping assist, have been enforced by the European Union. These regulations are aimed at improving road safety across the region, encouraging automakers to integrate more advanced technologies into their vehicle models. The influence of these policies has significantly impacted the adoption rate of ADAS across Germany.

- For example, in 2024, Mercedes-Benz’s E-Class achieved top safety ratings in Euro NCAP’s Year in Numbers report, meeting all updated criteria and the European General Safety Regulation (GSR). Additionally, Mercedes-Benz’s DRIVE PILOT system was authorized in Germany for conditionally automated driving at speeds up to 95 km/h.

Technological Advancements in Sensor and Camera Systems

Technological advancements in sensors and camera systems have been pivotal in the expansion of the Germany Advanced Driver Assistance Systems Market. The development of high-resolution cameras, radar sensors, and LIDAR technologies is making it easier to integrate ADAS features into vehicles. These innovations help to enhance the accuracy of systems such as pedestrian detection and night vision, offering a more reliable driving experience. The continuous improvement of sensor technology supports the growth of ADAS, as it ensures higher performance and reduced errors in real-time driving conditions.

Growing Popularity of Autonomous Vehicles

The growing interest in autonomous vehicles has also influenced the market for advanced driver assistance systems in Germany. With companies and governments focusing on self-driving technology, ADAS is becoming increasingly integral to the development of fully autonomous vehicles. Features such as adaptive cruise control, traffic jam assist, and intelligent park assist are essential for the seamless operation of autonomous vehicles. The demand for these systems is expected to rise as advancements in autonomous driving technologies continue.

Market Trends:

Shift Toward Integration of AI and Machine Learning in ADAS

In the Germany Advanced Driver Assistance Systems Market, the integration of artificial intelligence (AI) and machine learning is gaining momentum. Manufacturers are increasingly incorporating AI algorithms to enhance the decision-making processes within ADAS. These technologies allow systems to learn from driving patterns, improving their accuracy over time. AI-driven systems can optimize driving assistance, adapt to various driving conditions, and even predict driver behavior, leading to a more personalized and effective experience. This trend is expected to propel the market as the focus shifts toward intelligent systems.

Growing Adoption of Electric and Hybrid Vehicles with ADAS

The increasing adoption of electric and hybrid vehicles in Germany is creating new opportunities for the Advanced Driver Assistance Systems Market. Electric and hybrid vehicles often come with a greater focus on modern technologies, including ADAS. Consumers who opt for these eco-friendly vehicles are also looking for advanced safety features and smart driving systems. The need for greater integration of ADAS into electric and hybrid models is expected to continue, as these vehicles align well with the technology’s potential for enhancing safety and driving comfort.

- For instance, BMW Group became the first car manufacturer in Germany to receive regulatory approval for Level 2 “hands-off” driver assistance (Motorway Assistant) compliant with UN Regulation No. 171 for its BMW iX3 and wider i Series models in 2025. This authorization enables legally recognized, hands-free driving functions on German highways, expanding ADAS integration in electrified vehicles.

Expansion of ADAS in Commercial Vehicle Segment

The commercial vehicle segment is experiencing significant growth in the adoption of Advanced Driver Assistance Systems in Germany. Fleet operators and logistics companies are integrating ADAS into trucks and buses to improve safety, reduce operational costs, and enhance driver productivity. Systems such as lane departure warning, adaptive cruise control, and collision prevention technologies are being increasingly deployed to mitigate human errors, improve fuel efficiency, and reduce maintenance costs. This trend is anticipated to grow as logistics industries prioritize safety and cost savings.

- For instance, Mercedes‑Benz Trucks launched advanced ADAS systems such as Active Brake Assist 6 and Active Sideguard Assist 2 in its Actros and eActros models, with the Active Brake Assist 6 system offering full‑stop emergency braking for pedestrians and vehicles at speeds up to 60 km/h.

Surge in Consumer Awareness and Preference for Smart Vehicles

Consumers in Germany are becoming more aware of the benefits of smart vehicle technologies, leading to an increased preference for vehicles equipped with ADAS. This surge in consumer awareness has prompted automakers to include more advanced features in their offerings, especially in mid-range and premium segments. Features such as traffic sign recognition, pedestrian detection, and intelligent parking assist are becoming standard in many new vehicle models. The desire for smarter, safer vehicles is expected to drive future growth in the Germany Advanced Driver Assistance Systems Market.

Market Challenges Analysis:

High Costs of Advanced ADAS Technologies

One of the primary challenges in the Germany Advanced Driver Assistance Systems Market is the high cost of advanced ADAS technologies. While ADAS features are becoming more common, the cost of integrating high-end sensors, radar systems, and cameras can be prohibitive, particularly for lower-end vehicle models. This can limit the adoption of ADAS in certain market segments, particularly in budget vehicles. The cost factor also affects the aftermarket sales of ADAS components, as consumers may be hesitant to invest in these expensive upgrades. Manufacturers must focus on reducing the cost of production while maintaining high performance to drive broader adoption.

Complex Integration and Compatibility Issues

Another significant challenge in the market is the complex integration of ADAS features into existing vehicle platforms. Many older vehicle models are not equipped to handle advanced driver assistance technologies without significant modifications. This creates compatibility challenges for automakers who need to retrofit these systems into older models or offer upgrades to consumers. The integration of ADAS systems requires seamless communication between various vehicle components, and any misalignment or incompatibility can compromise system performance, raising safety concerns and hindering market growth.

Market Opportunities:

Expanding Aftermarket for ADAS Integration

The expanding aftermarket for ADAS integration presents a significant opportunity in the Germany Advanced Driver Assistance Systems Market. As consumers and fleet owners seek to upgrade older vehicles with modern safety technologies, the demand for retrofitted ADAS solutions is increasing. This creates a growing market for aftermarket parts and services, where third-party suppliers can offer sensor kits, cameras, and software packages for existing vehicles. The continued interest in vehicle upgrades provides a lucrative opportunity for ADAS suppliers to expand their reach beyond OEM sales.

Rising Demand from Emerging Markets

Emerging markets within Europe are beginning to embrace advanced driver assistance systems at an increasing rate. The demand for ADAS is expected to rise in these regions as consumers become more aware of the safety benefits. The expansion of the automotive industry in Eastern Europe and other neighboring regions will drive this growth. Manufacturers in Germany have the opportunity to tap into these emerging markets by offering tailored solutions that meet the specific needs of these consumers while capitalizing on their growing interest in ADAS technologies.

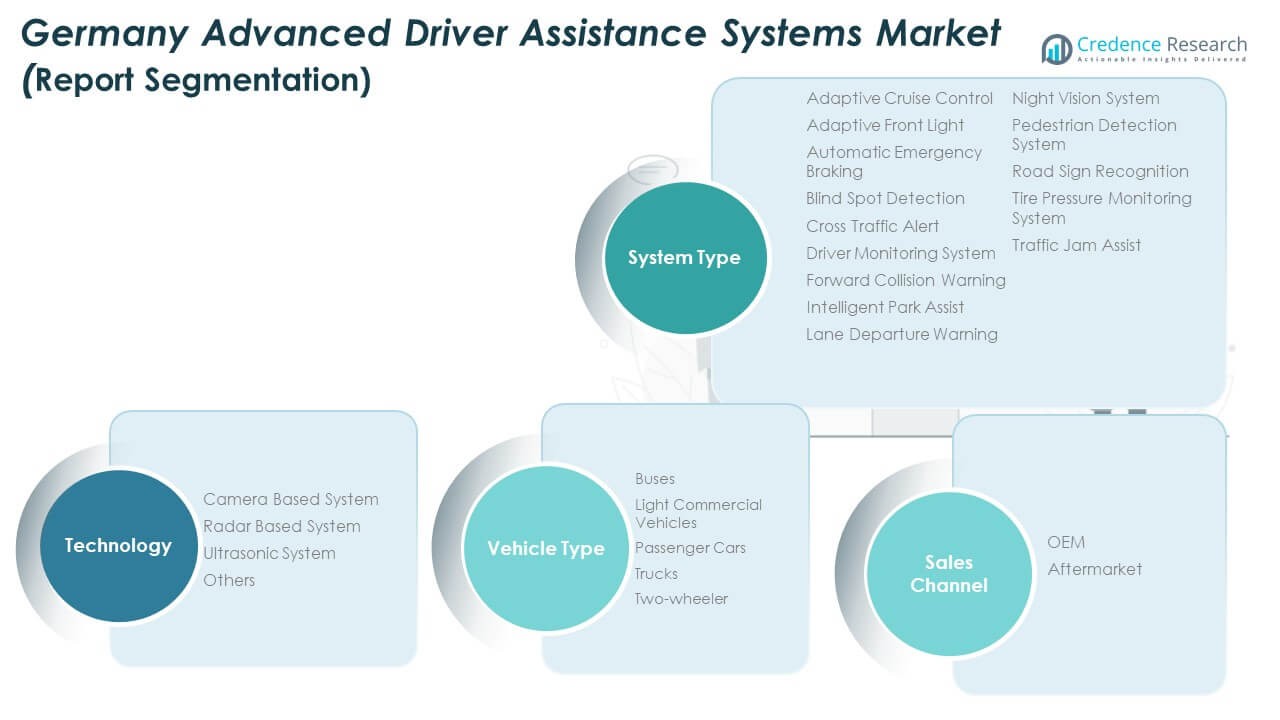

Market Segmentation Analysis:

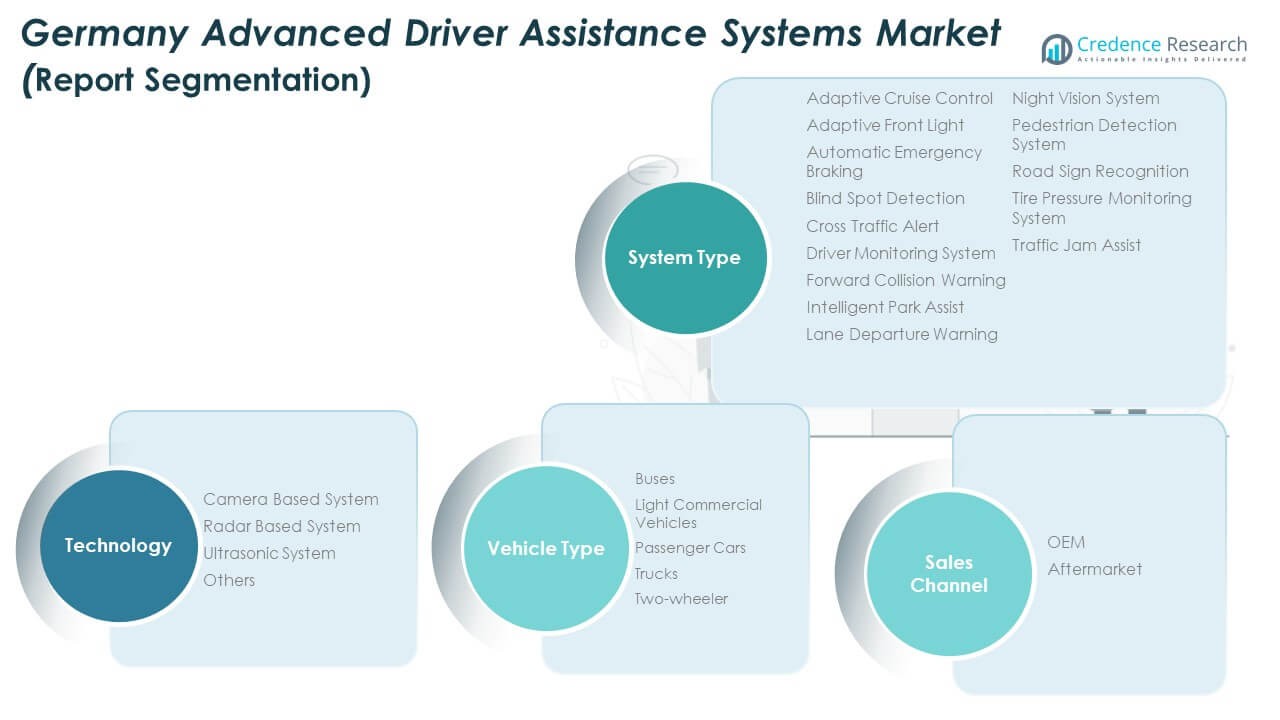

By System Type

The Germany Advanced Driver Assistance Systems Market is segmented by system type, with several key technologies making up the market. Adaptive cruise control, automatic emergency braking, and lane departure warning systems are leading the market, providing key safety and convenience features. These systems help reduce collisions and enhance the driving experience. The continued integration of advanced systems, such as intelligent park assist and pedestrian detection systems, further fuels the market growth. These technologies are being adopted across both passenger cars and commercial vehicles, driving the demand for ADAS in various segments.

By Technology

In terms of technology, the Germany Advanced Driver Assistance Systems Market is primarily segmented into camera-based, radar-based, ultrasonic, and other systems. Camera-based systems are widely used for applications such as lane detection and traffic sign recognition. Radar-based systems support adaptive cruise control and collision avoidance, while ultrasonic systems are typically used for parking assistance and proximity detection. As sensor technologies evolve, the demand for radar-based and camera-based systems is expected to grow, as they provide the accuracy needed for advanced driving functions.

- For instance, the Continental ARS 4-B radar sensor, supplied to European automakers, features a far-range scan capability up to 170 meters with ±4° scanning angles and a short-range operation up to 55 meters with a wide ±45° azimuth field of view. It operates on a 76-77 GHz band for advanced radar functionality.

By Vehicle Type

The market is also segmented by vehicle type, including passenger cars, light commercial vehicles, trucks, buses, and two-wheelers. Passenger cars dominate the market, with a high adoption rate of advanced safety features. Light commercial vehicles and trucks are also increasingly integrating ADAS to enhance fleet safety and operational efficiency. In the commercial vehicle segment, systems like lane departure warning and automatic emergency braking are crucial for improving driver safety. Two-wheelers, though a smaller segment, are seeing growing interest in ADAS features such as collision avoidance and blind spot detection.

- For instance, MAN’s Lane Departure Warning (LDW) system, available in TGX and TGS trucks, issues an acoustic alert when unintentional lane departure is detected at speeds from 60 km/h. In combination with the Lane Return Assist (LRA), it can actively steer the vehicle back into its lane, enhancing safety on long highway drives.

By Sales Channel

The sales channel segmentation in the Germany Advanced Driver Assistance Systems Market includes OEM (Original Equipment Manufacturer) and aftermarket sales. OEM sales dominate the market as automakers are increasingly offering ADAS as standard or optional features in new vehicles. Aftermarket sales are also growing as consumers seek to retrofit ADAS technologies into older vehicles. This segment provides an opportunity for companies offering ADAS systems for integration into a wide variety of vehicle models, allowing consumers to upgrade their vehicles without purchasing new ones.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis

Western Europe

The Germany Advanced Driver Assistance Systems Market is predominantly driven by Western Europe, where it holds a significant market share of approximately 45%. The region is home to major automotive manufacturers, including BMW, Mercedes-Benz, and Audi, who are continually integrating ADAS technologies into their vehicle models. The demand for advanced safety features is fueled by strict regulatory requirements and an increasing focus on reducing road accidents. The presence of key technological players, along with consumer preference for enhanced safety features, drives the market growth in this subregion. Furthermore, the adoption of electric and autonomous vehicles further propels the demand for ADAS solutions.

Central and Eastern Europe

Central and Eastern Europe (CEE) accounts for around 25% of the Germany Advanced Driver Assistance Systems Market. While this region is not as dominant as Western Europe, it is rapidly gaining momentum due to increasing automotive production and a rising interest in vehicle safety. In countries like Poland, Czech Republic, and Hungary, both local and international vehicle manufacturers are incorporating ADAS technologies into their product offerings. Government incentives promoting vehicle safety and the growing middle-class consumer base are contributing to the region’s market expansion. The demand is particularly strong in commercial vehicle segments, where ADAS helps to reduce fleet operating costs and improve safety.

Southern Europe

Southern Europe, including countries like Spain, Italy, and Greece, holds around 15% of the Germany Advanced Driver Assistance Systems Market. This region benefits from a rising awareness of road safety and growing consumer demand for advanced vehicle technologies. The Italian and Spanish automotive industries are increasingly adopting ADAS features, particularly in premium and mid-range vehicle segments. Government initiatives encouraging the adoption of safety technologies are also fostering growth. Despite economic challenges, the demand for advanced systems is expected to rise, with significant opportunities in the fleet management and commercial vehicle segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Altera Corporation

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- JLR Corporate

- ZF Friedrichshafen AG

- Kopernikus Automotive

- Valeo SA

- Mobileye

- Allegro MicroSystems

- Renault

- Other Key Players

Competitive Analysis

The Germany Advanced Driver Assistance Systems Market is highly competitive, with several key players dominating the landscape. Robert Bosch GmbH, Continental AG, and Valeo SA are among the leading companies in this market. These players are leveraging their expertise in automotive electronics, sensor technology, and software development to advance their ADAS offerings. They continuously innovate to deliver enhanced safety features, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking, which have become standard in many vehicle models. Robert Bosch GmbH leads the market by providing a wide range of ADAS solutions, including radar sensors, cameras, and control units. Continental AG focuses on providing integrated solutions and enhancing its presence in both the passenger car and commercial vehicle segments. Valeo SA, with its strong presence in the automotive industry, offers cutting-edge technologies, including sensor fusion and artificial intelligence, to support the development of autonomous driving systems. The competition is also intensifying due to the entry of new players like Mobileye, Allegro MicroSystems, and ZF Friedrichshafen AG. These companies are driving innovation in the sensor and camera technologies used in ADAS.

Recent Developments

- In June 2025, Bosch deepened its strategic AI collaboration with CARIAD within the Automated Driving Alliance, focusing on developing scalable software platforms and cost-effective Level 2 and Level 3 driving functions for future Volkswagen Group vehicles. These software solutions, integrating the latest AI technologies, are currently being deployed in test vehicles and validated across Europe, including Germany.

- In June 2025, ZF Friedrichshafen AG advanced its ADAS competencies with a focus on turnkey solutions, including industry-leading smart cameras and software-defined driving functions adaptable to central and domain computers.

- In April 2025, DENSO Corporation entered into a strategic partnership with Horizon Robotics to co-develop advanced integrated driving assistance solutions. This collaboration marks a milestone for DENSO in expanding its ADAS product and technology portfolio, targeting safer and smarter vehicle mobility across global markets, including Germany.

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for ADAS in Germany is expected to grow as more consumers seek enhanced vehicle safety features.

- Regulatory requirements will continue to drive the adoption of ADAS technologies across various vehicle segments.

- Autonomous driving technologies will evolve, pushing the integration of more sophisticated ADAS features.

- Electric vehicles will increasingly feature ADAS as a key component, due to their reliance on smart technologies.

- The commercial vehicle segment will experience significant growth as fleets adopt ADAS to improve safety and reduce operational costs.

- Technological advancements in sensor, radar, and camera systems will further enhance the performance and reliability of ADAS.

- Consumer demand for seamless integration of ADAS in mid-range vehicles will push automakers to offer these features in a broader range of models.

- The expansion of ADAS into emerging regions, particularly in Central and Eastern Europe, will contribute to market growth.

- Aftermarket ADAS solutions will continue to grow as consumers retrofit older vehicles with advanced safety technologies.

- Competition in the market will intensify, with companies focusing on reducing costs while enhancing system capabilities to maintain their market share.